Global manufacturing recovery underway, can it last? – Richard Mills

2024.04.17

Assembly lines are humming again after a years-long manufacturing slump, although the uptick isn’t happening everywhere.

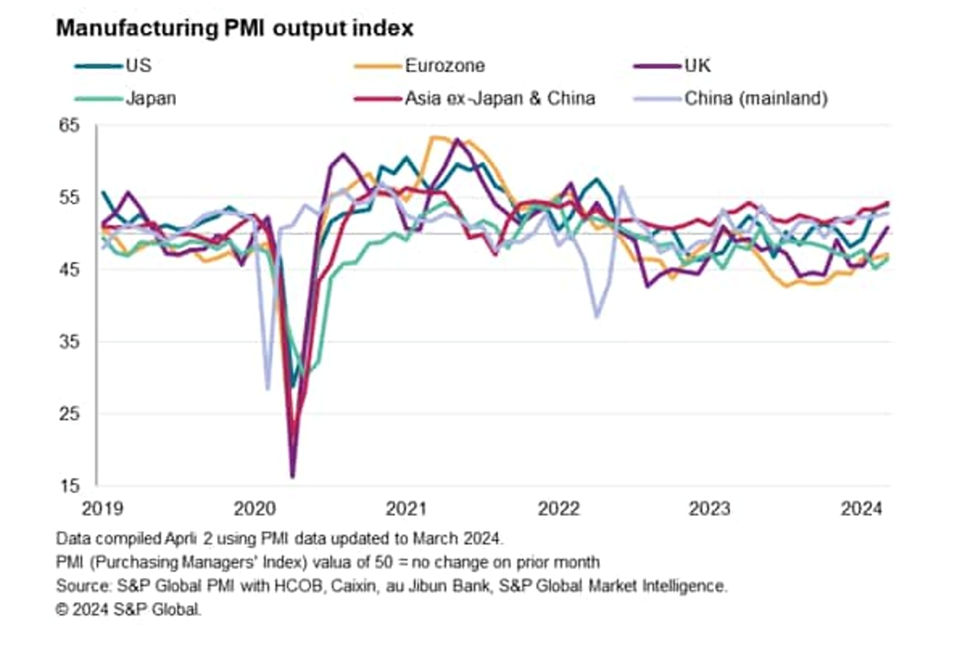

The nascent economic recovery is being led by China and the United States, with Australia, Japan and parts of the Eurozone still struggling.

Let’s start by taking a look at the global purchasing managers’ indexes, better known as PMIs.

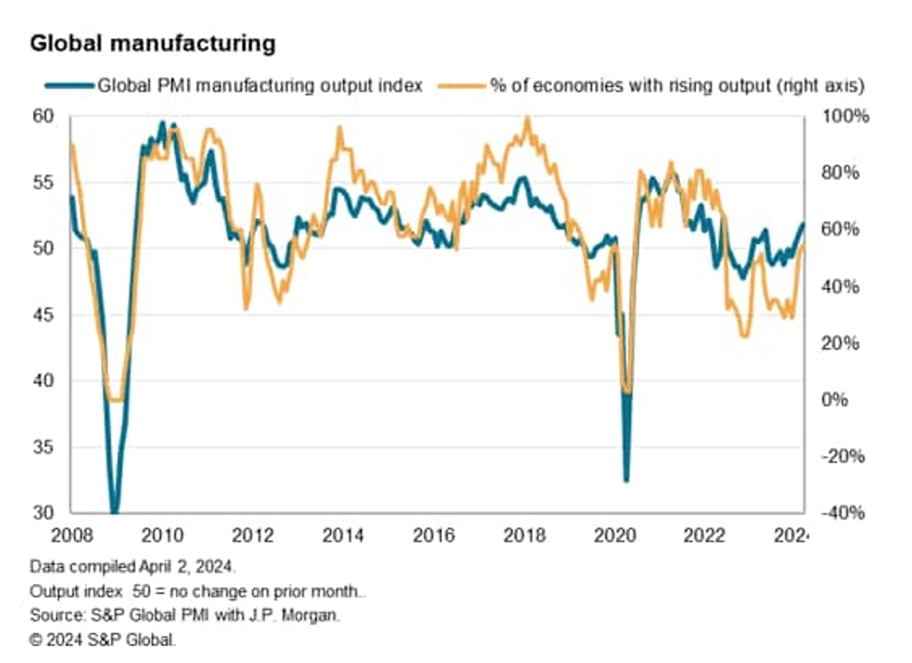

The JP Morgan Global Manufacturing PMI increased to 50.6 points in March from 50.3 in February. The average between 2013 and 2024 was 51.3.

S&P Global takes a deep dive into the data in a recent commentary.

“PMI surveys showed manufacturing business conditions improving at an increased rate in March, gaining further momentum to signal the sector’s strongest performance since the first half of 2022,” the April 2 article states.

“The upturn has also broadened out since the initial upturn seen in February, now extending to 17 of the 31 economies covered by the PMI surveys.”

Referring to the first chart, the JP Morgan Global Manufacturing PMI, S&P says the 50.6 reading in March is the highest since July 2022, with the upturn signaling “a marginal improvement in the health of the goods-producing sector for a second successive month, hinting at a nascent recovery from stagnation at the start of the year and contraction in the prior 16 months.”

The survey’s sub-index of production, which tracks factory output, expanded for a third straight month, and showed the largest increase since June 2022.

Not only did the level of manufacturing output rise globally in March, the number of economies reporting higher output increased to 55%, which is the highest proportion since June 2022.

Output rose in 17 of 31 economies tracked by the S&P Global PMI surveys in March, led by India. Strong gains were also recorded in Greece, Indonesia, Russia and Brazil.

Manufacturing expanded in the United States and China, where growth hit 22- and 21-month highs, respectively. Mexico and Spain also grew their manufacturing sectors.

The latter reported the strongest growth in the Eurozone, however S&P notes Europe was the biggest drag on global manufacturing, with steep production declines in Germany, Austria, the Czech Republic and Poland. Production also fell in Australia and Japan.

As for new orders, a reflection of rising goods demand, they rose for a second month in a row, increasing the most since May 2022.

According to S&P, the strongest upturn in new orders was for intermediate goods, “which rose for a second month after 22 months of continual decline to show the sharpest increase for just over two years.”

Intermediate goods are those used to produce final goods. Examples are wheat, crude oil, steel and sugar.

Also, “March was notable in being the first month since July 2022 that manufacturers globally did not cut their purchases of inputs.”

Consumer spending is of particular importance, since it makes up about 70% of global GDP. S&P says new orders for consumer goods climbed for a third straight month in March, following four months of decline.

New orders for investment goods like machinery and equipment continued to fall, but the decline was the smallest in a year.

Bloomberg said earlier this week that the industrial recovery is being led by the two biggest economies, the US and China, with Chinese manufacturing making a strong start to the year, and US factory activity expanding last month for the first time since September 2022.

“Manufacturing PMIs are back to expansion in key economies including China, the UK and the US,” Bloomberg quoted Janet Mui, head of market analysis at RBC Brewin Dolphin. “The synchronized nature of the recovery tends to be good signal for a cyclical upturn in global growth.”

The publication notes the manufacturing uptick “marks a departure from the slowdown that took hold globally as consumer demand pivoted to spending more on services such as travel and dining out instead of buying more goods as pandemic-era restrictions ended.”

Though S&P reported a production decline in Germany in March, Bloomberg countered that “German industrial production started the year on a two-month roll, underpinning hopes that Europe’s biggest economy may emerge from a recession. Asian export powerhouses including South Korea and Japan are also showing improvement.”

According to Bloomberg, UK manufacturing jumped 1.2% last month, the best result since July 2022. Spain and Italy both saw faster expansion in March, beating economists’ expectations.

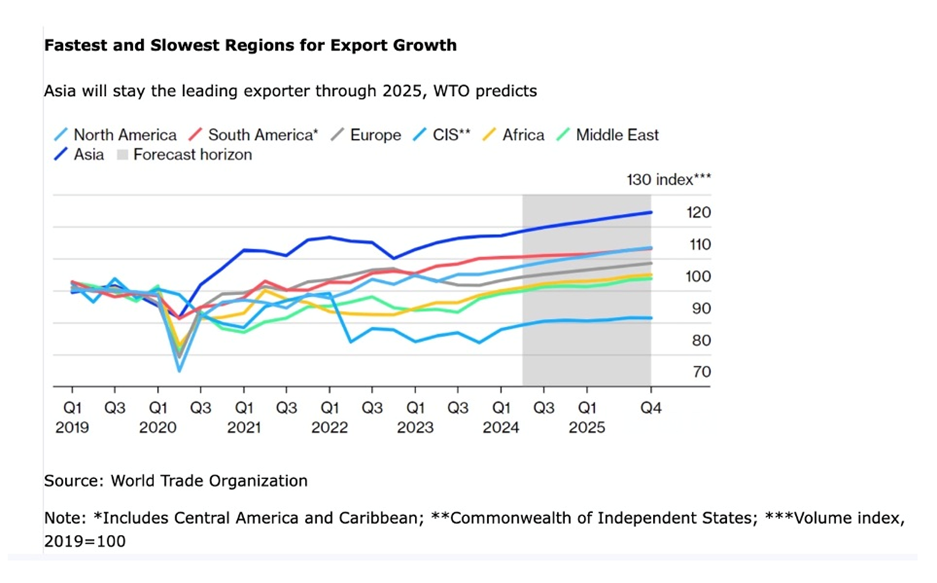

India leads the growth in South Asia, while in Southeast Asia, the Asian Development Bank expects a turnaround in merchandise exports around mid-year will drive growth in Thailand, Vietnam, the Philippines and Malaysia.

While Moody’s Analytics Chief Economist Mark Zandi says manufacturing strength will ensure the world avoids a recession, he cautions that continued high global interest rates, supply-chain disruptions and higher oil prices could weigh on manufacturing.

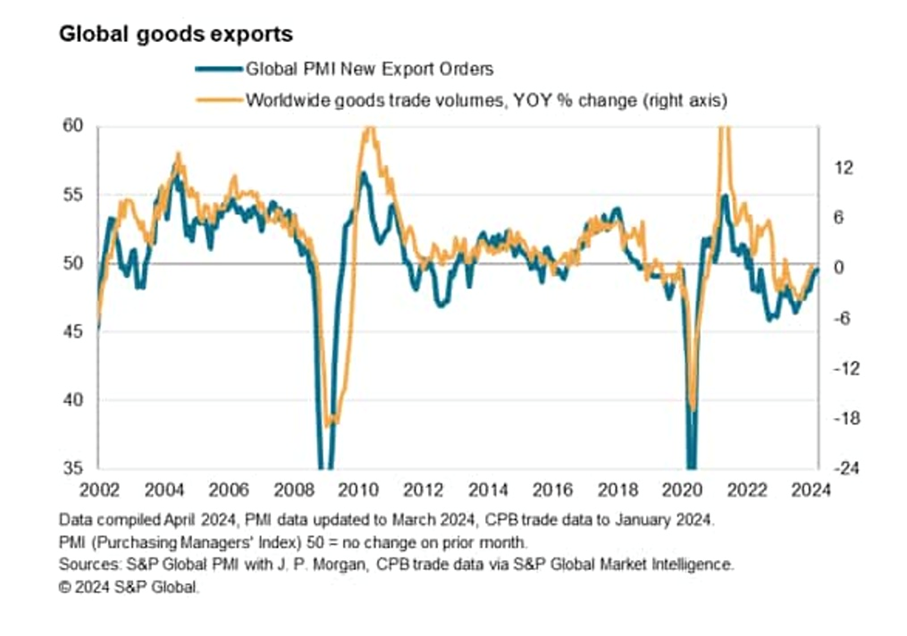

Bloomberg notes such uncertainty is why the World Trade Organization predicted this week that total goods volume will increase 2.6% in 2024, seven points lower than the 3.3% growth projection in October.

“The lingering effects of high energy prices and inflation weighed especially heavily on demand for trade-intensive manufactured goods” in 2023, the WTO said in the report. “But this should recover gradually over the next two years as inflationary pressures ease and as real household incomes improve.”

Turning to the United States, Bloomberg writes, “the consumption engine for foreign goods appears to be revving up again after companies let inventories run off last year and supply chains that got knotted up during Covid look normal again.”

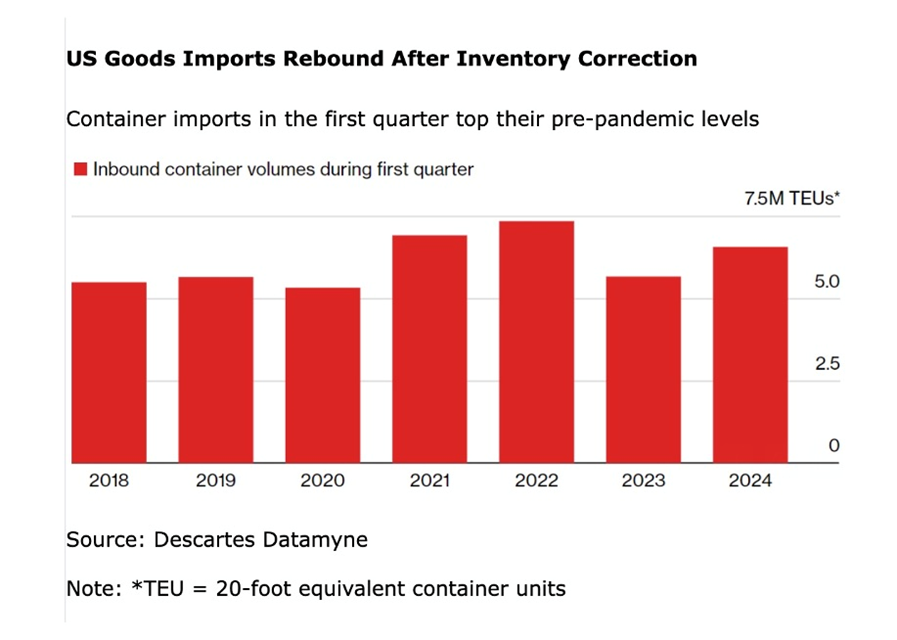

As the chart below shows, the volume of US container imports reached 6.5 million in the first quarter, up 16% from a year earlier and well above pre-pandemic levels.

The ISM Manufacturing PMI increased to 50.3 in March, up from 47.8 in February and beating market expectations of 48.4. This marked the first expansion in the manufacturing sector after 16 months of contraction, said the Institute for Supply Management.

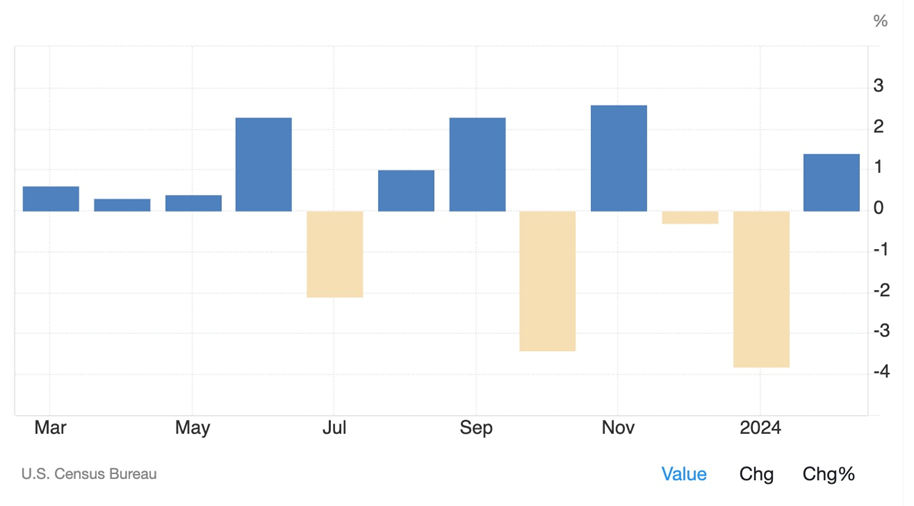

Industrial production rose by 0.4% in March compared to February.

Manufacturing output, which comprises 78% of total production, went up by half a percent, driven by a 3.1% surge in motor vehicles and parts, said the Federal Reserve. Durable manufacturing and nondurable manufacturing indexes increased by 0.3% and 0.7% respectively, while publishing and logging fell by 0.2%.

New orders for US manufactured goods rose by 1.4% to $576.8 billion in February, trimming the upwardly revised 3.8% drop in January, and above market expectations of a 1% increase to point to further resilience of the US economy. New orders expanded by 1.3% for durable goods industries, lifted by transportation equipment (3.3%), machinery (1.8%), and fabricated metal products (0.8%), the U.S. Census Bureau states.

Still, it’s not all puppies and rainbows.

According to an analysis by FX Street, the global manufacturing cycle points to further upside in the coming months, but also tentative signs of a peak during the second half.

Providing evidence for the latter, the publication states:

The growth rate in Asian exports has started to taper off and the order inventory balances have also rolled over suggesting that the lift from the inventory cycle is set to fade on a 3-6 months horizon. Finally, US goods consumption has had a weak start to the new year after a decent run in the second half of 2023. It broadly fits with our expectation that the manufacturing recovery is not the beginning of a new boom but that it will peak at a lower level than normal and probably also have a shorter duration.

Conclusion

Commodity analysts keep a close eye on economic growth and manufacturing to get an idea in which direction prices are headed.

Global purchasing managers’ indexes show that factory orders bottomed in January and are moving back up.

In December we ran a story from Wolf Street that said $18.5 billion was plowed into construction of manufacturing plants in October, $12.5B was spent in January, and the annualized amount will be $246 billion. Most of the money is coming from government, with billions being channeled into megaprojects fueled by the Biden administration’s signature pieces of legislation: the Inflation Reduction Act, the Bipartisan Infrastructure Law, and the CHIPS and Science Act.

The latter provides about $52 billion in government subsidies for US semiconductor production and an investment tax credit for chip plants estimated to be worth $24B. The legislation would also authorize more than $170 billion over five years to boost US scientific research to better compete with China, Reuters reported in July. It is expected to help fund 10 to 15 new semiconductor factories.

As for why this manufacturing renaissance is happening now, Fox News explains that covid-19, the war in Ukraine, and concerns over China’s annexation of Taiwan, a leader in semiconductors, have driven efforts to reshore manufacturing, reversing a decade-long trend of American industrial capacity moving overseas.

Behind the US manufacturing boom

Now it appears the US manufacturing boom that has been kickstarted by government, is going global.

Global PMI surveys in March signaled the sector’s strongest performance since the first half of 2022, with more than half (17) of the 31 economies covered by the surveys turning upward.

The manufacturing resurgence is being led by the two largest economies, the US and China. Other leading lights include India, Greece, Indonesia, Russia, Brazil, the UK, Mexico, Italy and Spain.

Even if manufacturing growth peaks in the second half of the year, as suggested by FX Street, we are looking at a few more months of upward momentum. The Bloomberg Commodity Index is up 4.5% year to date and at 102.83, currently, it’s the highest since Nov. 20, 2023.

A global manufacturing recovery can only be positive for commodities, including industrial metals like copper, nickel, zinc, iron and steel.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.