Getchell’s Gold

2019.11.30

Getchell Gold (CSE:GTCH) announced on October 17, 2019 a binding letter agreement with Canarc Resource Corp. (TSX:CCM) to acquire Fondaway Canyon and Dixie Comstock. Both Nevada properties have historical resource estimates. The greater of the two is Fondaway Canyon. A 2017 technical report denotes 409,000 oz of indicated resources grading 6.18 grams per tonne, and 660,000 oz inferred grading 6.4 g/t, for a combined 1.1 million ounces.

The high-grade resource begins near surface and is open at depth and along strike.

That alone is impressive. But what really stands out to Ahead of the Herd, is the opportunity to add significantly more ounces if the structures, and ultimately, the potential source of this gold system can be identified, mapped and drilled.

Before we get to the exploration strategy, a bit of background on Nevada is helpful to place the company and its gold targets in context.

The Golden State

GTCH couldn’t ask for a better location to hunt for the precious metal. In the Fraser Institute’s latest (2018) survey, Nevada was ranked number 1, as the most attractive jurisdiction for mining investment.

The state offers an attractive tax regime with a low net profits tax and zero income tax. Regulations and permitting processes are transparent and easy for explorers to navigate. In 2018, new legislation was introduced enabling state and local governments to issue gold and silver bonds, and for mining companies to pay their taxes in physical gold. The Nevada Gold and Silver Enabling Act “will reduce the state’s debt, shore up the pension fund, increase mining employment and profitability, and attract capital to Nevada” states a news release.

With 160 years of gold mining that dates back to the Comstock Lode discovery in 1859, Nevada has been, and still is, one of the best jurisdictions to find gold.

The United States’ primary gold producer has an impressive geological endowment. Nearly every rock type known to geologists is found within its desert geography, though silver and gold have been the most prevalent. The state owes its unique geology to the northern Great Basin which features a number of mountain ranges and valleys where the rocks below have been smashed together and pulled apart through tectonic activity dating back millions of years.

According to the US Geological Survey, if Nevada were a country, it would be among the world’s top four producers. The Nevada Bureau of Mines and Geology tallied gold reserves in 2015 at about 70 million ounces, enough to sustain gold production near current levels for 12 to 15 years.

Impressive as these numbers are, gold investors sometimes overlook Nevada, thinking that all the precious metal has been found – not so. While the western state certainly has been well-explored and mined, there is still huge exploration potential remaining for multi-million-ounce discoveries, especially around the edges and in the depths of current or past-producing gold mines.

Barrick-Newmont JV

Indeed when Barrick Gold went looking for areas thought to be prospective for adding ounces to replenish its dwindling reserves, it went straight to Nevada.

Earlier this year, the gold major acquired South Africa’s Randgold and put the latter’s CEO in charge of the merged entity. Then in July, Barrick established a new joint venture partnership with Newmont, its Nevada rival, aiming to get $7 billion in synergies over the next two decades, through cost savings realized by combining operations. Newmont has 19 mines in Nevada, many adjacent to Barrick’s.

It didn’t take long for Nevada Gold Mines to find exploration success on its home turf. In September Barrick hit a discovery hole just north of its Fourmile project. The new orebody increases the strike length of the Goldrush-Fourmile trend to 6 kilometers, and opens the potential for adding one more Tier 1 asset to the three already wrapped into the Nevada Gold Mines partnership – Goldstrike/Carlin, Cortez and Turquoise Ridge/Twin Creeks – by combining Fourmile with the nearby Goldrush development.

Majors working Nevada

The creation of Nevada Gold Mines has piqued the interest of other companies looking to discover and develop new ounces in the golden state. Major miners with new projects include AngloGold Ashanti, Coeur Mining and Kinross Gold.

South Africa-based AngloGold Ashanti plans to drill the Silicon project it optioned from RenGold in 2017, located in the Bare Mountain mining district. Coeur Mining has stepped into Nevada through the acquisition of Northern Empire Resources and its Sterling project. Kinross has a large land package on the western edge of AngloGold’s Rhyolite project from which it plans to drill epithermal targets. The Toronto-based firm made a huge investment in Nevada in 2015, when it acquired the Bald Mountain and Round Mountain mines from Barrick, for a substantial $610 million in cash.

Closer to Getchell Gold’s territory, in July 2018 Newmont achieved commercial production at the underground portion of its Twin Creeks mine, located in Humboldt County. Ore mined from Twin Creeks Underground will be blended with Turquoise Ridge ore. The expansion is expected to boost gold output from

30,000-40,000 ounces per year, and extend Twin Creeks’ mine life to 2030.

As well as adding new production, Nevada is also seeing the return of junior gold explorers, after a lull in activity between 2012 and 2016. According to an industry report, exploration in Nevada increased by 15% in 2017, with 19,040 new claims. The tide has continued to turn in mining’s favor, with 198,337 active claims as of January, 2019 – 7% more than in 2018.

Fondaway Canyon

Fondaway Canyon includes 136 contiguous, unpatented mining claims, covering about 2,220 acres (898 hectares), or 3.5 square miles, on land administered by the US Bureau of Land Management (BLM) in Churchill County, Nevada.

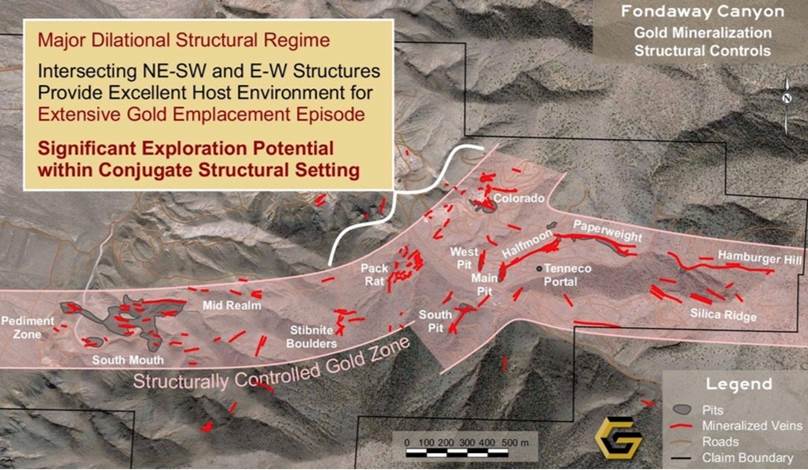

Gold mineralization is spread over 3 kilometers of east-northeast trending and steeply south dipping structures, developed within fine-grained Triassic carbonaceous siliciclastic sedimentary rocks and Jurassic limestone, cut by tertiary dikes.

The project has been extensively drilled between 1980 and 2002; records show 591 holes totaling just over 49,000 meters. Surface sampling, underground channel sampling, geological mapping and geophysical surveys have also been done.

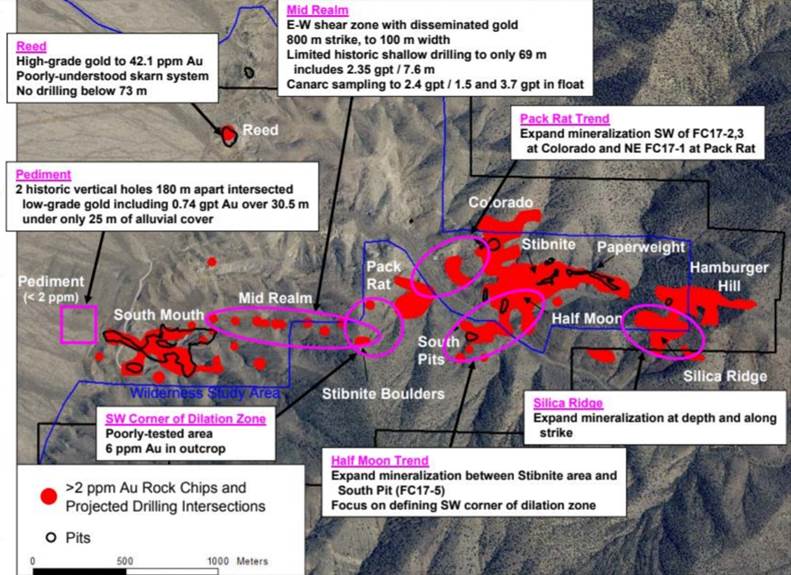

The resource covers 12 known veins, including five mineralized areas and seven untested targets.

The estimation, published in a 2017 technical report for Canarc Resource Corp, relates tothe high-grade, sulfide-vein mineralization in the eastern half of the project.

The five zones comprising the 1.1 million-ounce resource are Colorado, Halfmoon, Paperweight, Silica Ridge and Hamburger Hill.

The entire project can be visualized as a vein swarm close to surface, with many veins trending east to west, shown in red in the map below.

Key to the exploration strategy at Fondaway is the area between the Colorado and South Pit zones. Historical data reveals multiple structures coming together in an east-west corridor of mineralization that looks to be open-pittable. The cross-sectional map of the Colorado to South Pit section shows the bulk of the mineralization (on the left of the map) very near surface; likely it could be mined with low strip ratio.

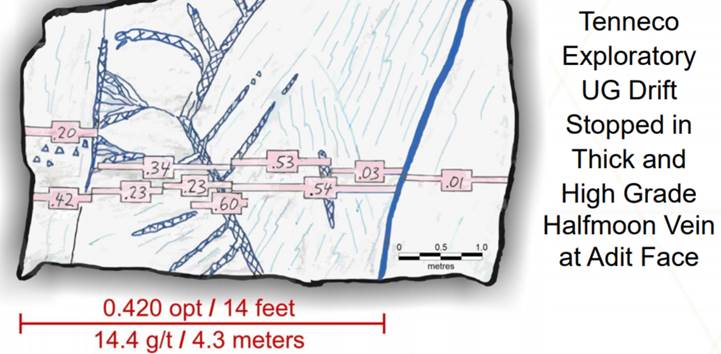

Seventy to 80% of the ounces are within Colorado, Paperweight and Halfmoon, with the remainder found in parallel veins or splays of the main veins. Previous drilling in this area only went to 300m depth, indicating how shallow the mineralization lies; however, gold mineralization was found past 1,000 feet (304m) based on drilling by NCI. The veins are typically 1.5 to 6 meters wide.

Although limited drilling has been done on the steeper slopes further west, where mineralization extends to the tops of mountain ridges, Canarc poked in a few holes yielding very promising 7 to 10 gram-per-tonne material.

Between 1986 and 1996, Tenneco Minerals drilled over 500 reverse-circulation (RC) holes totaling 40,000 meters, and took thousands of rock, soil and stream sediment samples. In the Halfmoon zone they drove an adit (entrance) 540 feet into the hillside, to take bulk samples of the Halfmoon vein; high-grade gold intersections, drilled from an exploratory drift, indicate good underground mining potential.

Tenneco also built a 1,500 tonnes-per-day heap leach pad to mine the South Mouth, Reed, and Stibnite open pits from 1989 to 1990.Fisk Mining dug a series of shallow open pits along the Paperweight and Halfmoon vein outcrops, recovering the gold using a vat leaching process.

As for adding tonnage to the 1.1Moz already identified, our opinion is: the lowest-hanging fruit could be picked by driving a portal in from the lower part of the creek bed, gaining access to Paperweight and Hamburger Hill, without sinking a shaft. There are also easy ounces available by peeling off the hillside at Silica Ridge.

Higher-grade material >6 grams per tonnes could be economically mined with a 3:1 or 4:1 strip ratio in the area between Colorado and South Pit. Even better, 10 to 14 g/t material unearthed by a previous operator could be accessed underground at Colorado.

However the most intriguing option to us at AOTH, and what could be underpinning the entire structurally-controlled gold zone all the way to Hamburger Hill, is the Pediment zone, appearing at the left edge of the map below.

From the technical report,

Much work remains to integrate the western portion of the project area, which has a correspondingly sparse and predominantly shallow drill history, along a 1 mile corridor to the South Mouth zone, the area of previous surface mining. This corridor has detailed rock and soil geochemistry, with several areas of highly anomalous gold geochemistry suggesting continuity of gold mineralization through this zone. The South Mouth zone, where mining excavated the shallow oxide mineralization, has not been explored sufficiently to quantify the down dip extension of the sulfide mineralization to depth.

What’s really exciting is what happened when a former lease-holder, NCI, step-out drilled into the pediment – visualized as a flat plain that fronts the hills and valleys where the rest of the targets are dotted throughout.

Underlying the plain is about 25 meters of alluvial (gravel-bed) cover, making for easy overburden removal.

Two holes drilled only 800 feet (243m) apart, in the pediment west of the South Mouth pit, each pulled up significant mineralization – one hole had 0.74 grams per tonne over 30 meters; the other was 0.6 g/t. While those grades aren’t enough to energize gold investors, there is a good possibility that the deposits found in the mountains are just the “smoke” from a major gold system that originates underneath the pediment.

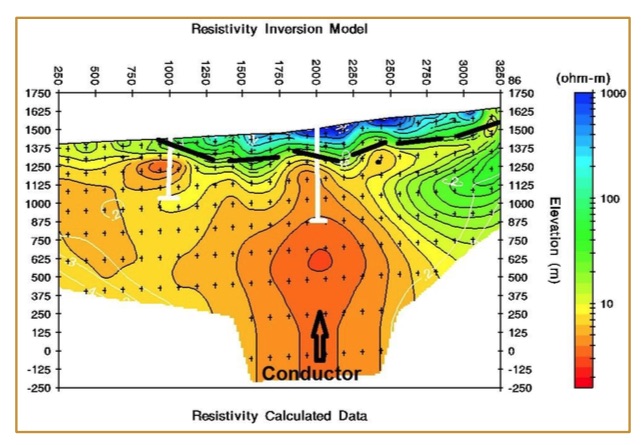

Visualize a heat source millions of years ago squeezing boiling-hot magma from west to east through the fissures and faults of the Earth’s crust, depositing gold and silver minerals all the way from the westerly range-front, several kilometers up into the mountains as far as the Hamburger Hill and Silica Ridge zones.

In Nevada this is a familiar geological model – one that led to discovery of the Pipeline and South Pipeline deposits that became the Cortez mine, mentioned above as one of three Tier 1 assets that comprise the Nevada Gold Mines’ joint venture between Barrick Gold and Newmont Mining.

Mining at Cortez currently encompasses three open pits – Pipeline, Crossroads and Cortez Hills – plus three underground zones. A 2019 report shows 8.7 million ounces of gold reserves are contained within underground and open-pit operations, graded at 1.5 grams per tonne, plus stockpiles. Another 705,000 ounces at 1.67 g/t are in measured and indicated resources.

Cortez and Barrick’s Goldstrike mine are operated as an integrated complex under Barrick Nevada. In 2018 it produced 2.1 million ounces. Goldstrike has 8.5 million ounces in gold reserves. A plan to expand the Cortez underground mine known as the Deep South Project is expected to contribute to production starting next year. Mining at Cortez is expected to last until 2031.

Deposits on the shoulders of the hills behind Cortez were mined for decades before drills pierced Pipeline. The geological model used to find Pipeline, the same theory that might apply at Fondaway, is predicated on the notion that larger deposits lie closer to the deep crustal structures, found in the basin bottoms, than in the upper parts of the geological system – like mountain ridges.

Testing that thesis would require further drilling into the pediment – looking for the engine driving the whole gold system.

The first step in finding the engine is identifying the structure – the conduit that feeds all those gold targets within the pink band, running all the way from Pediment to Hamburger Hill. At AOTH, we’d like to see Getchell drill a series of shallow, angled 75 to 100 meter holes, starting at South Mouth, into what hopefully are meaningful structures that can be followed in the direction of the pediment – eventually leading to a possible gold deposit that might be lurking underneath the plains.

If nothing more is found at the Pediment zone, Getchell can always go to Plan B – building an open pit between the Colorado and South Pit zones, then adding ounces by exploring nearby targets.

Buena Vista

Getchell Gold’s Buena Vista project is located 60 km southwest of Winnemucca, in Pershing County. The company has staked along 7 km of range-front that exhibits multiple types of mineralization throughout the trend.

Notable is a knob-like volcanic formation, just a few hundred meters wide, that sticks out of the pediment. Everything around the silicified, hard piece of geology has eroded. Newmont punched several holes around the structure but the intercepts were less than a gram per tonne so they walked away. There are multiple other occurrences of jasperoid formations along the range front.

Buena Vista also features a fully intact thrust plain – the contact zone between the upper plate sedimentary rock package, and the lower plate calcareous sedimentary rocks famous for hosting Nevada’s disseminated, or “Carlin-style” gold.

This thrust plain is incredibly well-mineralized. In fact, it’s possible to walk along the narrow (1-3m wide) geological feature for several miles, encountering dozens of pits, hand-mined with picks and shovels. Old-time prospectors found gold up to 3 grams per tonne, copper running 3-7% (these days anything above 1% is considered high grade) and silver grades run upwards of 200 g/t!

The intensity of the fluids in this area have not only saturated the thrust plain, but found their way to surface in jasperoid formations, sinters, and even a massive sulfide deposit just to the east of the claims.

There is clearly a big heat engine or multiple heat engines driving the mineralization.

Intuitively, it would make sense to drill the thrust plain for high-grade gold (plus silver and copper) intercepts. But doing so would not provide Getchell with much intelligence as to how the mineralization is structurally controlled.

Instead, Getchell has worked up two large scale targets, Star Point and Star South.

At Star South, a magnetic survey has been done over a very large gravity anomaly located on the range-front, sitting only a few hundred meters away from the minerals rich thrust plain.

At Star Point, an induced polarization (IP), survey identified a large magnetically defined intrusion, featuring high chargeability and resistivity. A copper-oxide mineralized structure was found at surface.

Drilling a couple of exploratory holes into each of these targets, Star Point and Star South, would be a smart strategy. It’s possible the drills could vector into something significant.

Conclusion

Getchell Gold is currently in a very good position as it mulls its next moves in Nevada. In our opinion Fondaway Canyon is a strong contender for building ounces – potentially at Paperweight, Hamburger Hill or Silica Ridge – but the real prize might be the raw potential of the Pediment zone. It is here where Getchell Gold has the chance to test the geological theory that a large pool of gold might be sitting under the range-front, that fed a highly mineralized corridor with a number of targets, into the mountains as far as Hamburger Hill.

Equally important is tracing the structures that lead to the source. A fence of shallow holes drilled west of South Mouth should reveal a structure fairly quickly, one they can vector into, in the direction of the Pediment zone.

Over at Buena Vista, there is another two excellent opportunities for finding exploration success by drilling Star Point and Star South, two targets showing excellent potential through magnetic, gravity and IP surveys.

There is little to lose. Even if the three targets we’ve outlined here – Pediment, Star Point and Star South – come up short, Getchell Gold still has its, expandable in our opinion, 1.1Moz resource at Fondaway Canyon to fall back on – ounces which are already positioned nicely for what we think is an open pit mine, or pit-underground combination.

I’m very impressed at what Getchell Gold has put together here, and I’ll be watching closely to see what the company does next to deliver the best exploration bang for the buck.

Getchell Gold Corp.

CSE:GTCH: Cdn$0.115, 2019.11.29

Shares Outstanding: 37,340,464m

Market cap: Cdn $4,294,153.00

GTCH website

Richard (Rick) Mills

subscribe to my free newsletter

aheadoftheherd.com

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions.

Richard does not own shares of Getchell Gold (CSE:GTCH). However, GTCH is an advertiser on his site and is paid by GTCH to write articles on Getchell Gold. The Management and Board of Getchell Gold Corp. does not endorse this or any article, nor do they certify the accuracy of its contents.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.