Getchell intersects 3.4 g/t gold over 44.6m and 3.4 g/t over 31.4m at North Fork Zone, Fondaway Canyon, Nevada – Richard Mills

2023.01.11

The bounce in the gold price since January 1st could be just the beginning of a banner year for gold. That’s according to analysts who are seeing a peak in the US dollar and predicting further currency debasement going forward, as inflation continues to wreak havoc on the world’s developed economies.

While gold offers neither a dividend nor a yield, it is considered a wise investment during periods of inflation, because unlike fiat currencies, it holds its value no matter how much prices of goods and services go up.

Spot gold on Tuesday edged an eight-month high of $1,882.50 per ounce, with a strong jobs report last Friday causing drops in the dollar and US Treasury yields, but giving gold a boost. Wage growth was less than expected, an indication that inflation pressures could be weakening, potentially suggesting a pause in interest rate hikes.

More gold purchases from central banks is underpinning demand and helping to push the metal higher.

“The metal has also been buoyed by the reopening in China with pictures of very crowded gold markets seeing pre-Lunar demand and the PBoC [People’s Bank of China] announcing it bought 62 tons of gold during the last two months of the year,” Ole Hansen, head of commodity strategy at Saxo Bank, said in a note Tuesday, via CNBC.

The publication quoted analysts who believe gold will do quite well this year, on the back of continued stock market weakness, a peaking US dollar, and a fall in US real (accounting for inflation) bond yields:

- David Neuhauser, founder and chief investment officer at Livermore Partners: “I think as you look forward, you start to look around and think ‘where is the safest place for your investment in terms of assets?’ and the only place really to go as an alternative now is gold, in terms of knowing that you are not going to see that debasement of your assets.”

“I have liked gold for several years. Looking at the dollar peaking, it has gained a little bit of a lift-off here for the past several months, so I see that continuing for some time.”

- Sprott Managing Director John Hathaway said gold and related mining shares were “severely underowned” and would prove “effective antidotes to ongoing macroeconomic chaos.” “2023 will reveal that the gross mispricing of financial assets that led to the worst performance of financial markets since 2008 has been only partially resolved. We believe the bear market is far from over, even though investment sentiment is more negative than at the market lows of 2002 and 2008.”

- JPMorgan forecasts gold to average $1,860/oz in the fourth quarter of this year. The investment bank expects the Fed to hit pause, with a fall in US real yields driving a bullish outlook for gold and silver prices over the latter half of 2023. “Even with a bullish baseline gold and silver forecast, we think risk is skewed to the upside in 2023,” said Greg Shearer, head of base and precious metals strategy at JPMorgan.

“A harder-than-expected economic landing in the U.S. would not only attract additional safe haven buying, but the rally could become supercharged by more dramatic decreases in yields if the Fed more rapidly unwinds tighter fiscal policy,” Shearer added.

Getchell Gold (CSE:GTCH, OTCQB:GGLDF)

At AOTH, one of our favorite gold plays, and even more so in a rising gold price environment, is Getchell Gold’s Fondaway Canyon project in Nevada.

Getchell carried out three drill programs at Fondaway, in 2020, 2021 and 2022. Their aim was to significantly upgrade the 2017 resource estimate into a new resource, that combined the drill results from all three drill programs.

The new resource estimate, released in November, nearly doubles the previous one, of 1.1 million ounces. It is 2 million ounces, including 550,000 ounces in the indicated category grading 1.56 grams per tonne, and 1.5Moz inferred, grading 1.23 g/t. There are nine holes that haven’t been included in the resource estimate because they missed the cut-off date, and Getchell plans to do a lot more drilling in 2023. Meaning the next RE will be even bigger.

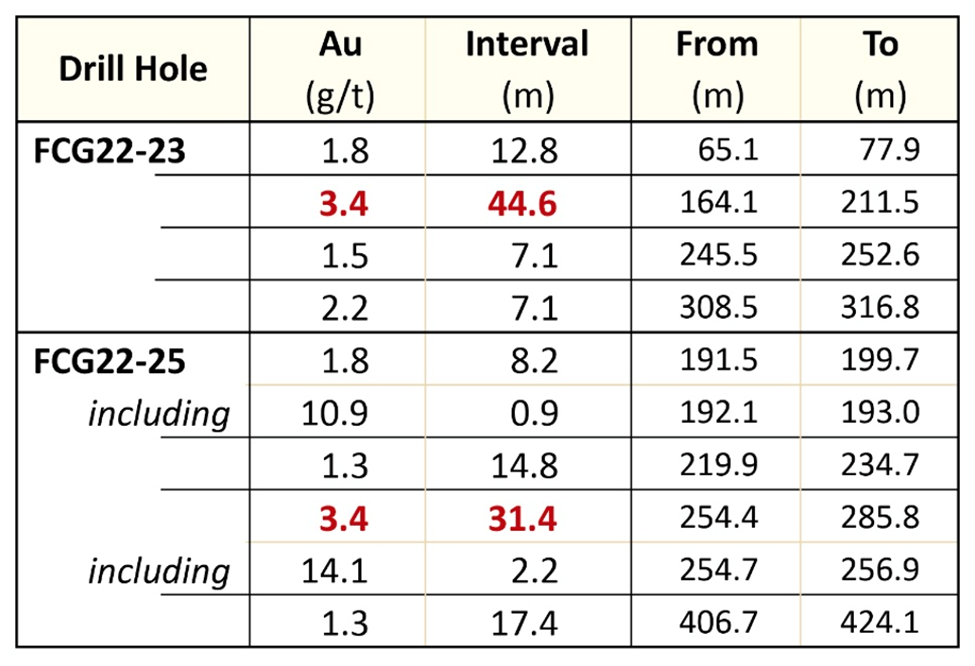

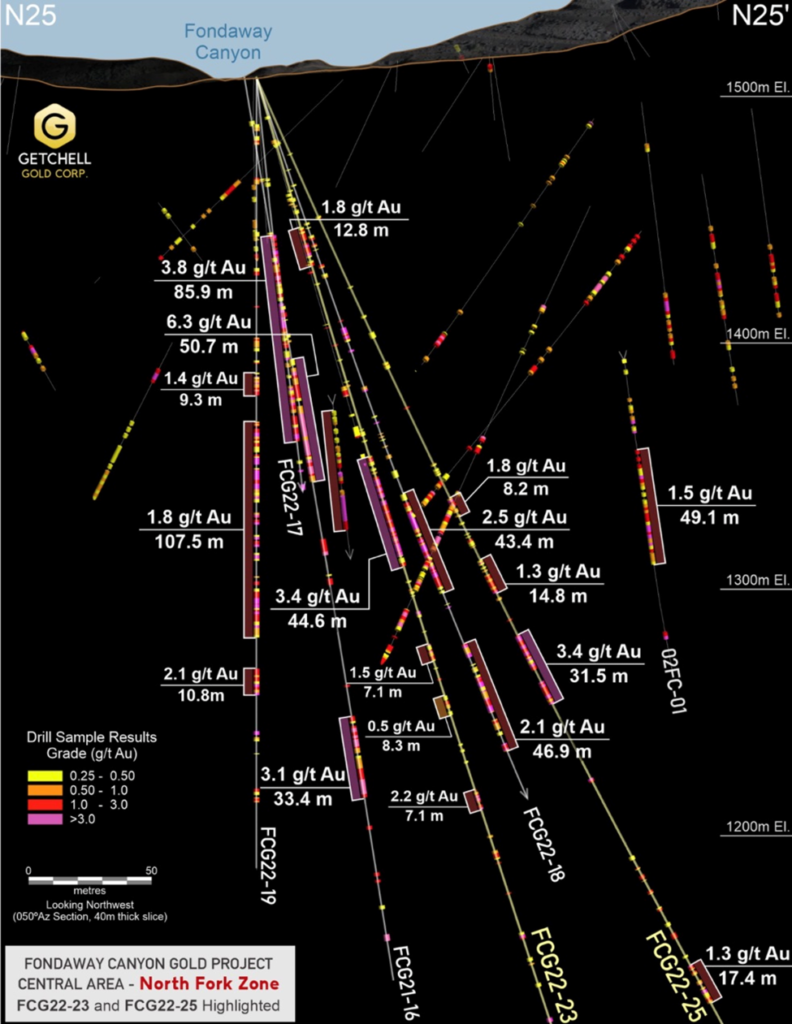

This week, the company press-released the drill results from FCG22-23 and 25, the latter being the last drill hole completed at the North Fork Zone during the 2022 drill program.

Among the key highlights, hole 23 intersected four significant gold-mineralized intervals, including 3.4 g/t Au over 44.6m and 1.8 g/t Au over 12.8m.

The hole was drilled as a 45-meter up-dip step out to the northeast of the high-grade gold mineralization encountered in hole FCG21-16, that graded 6.3 g/t Au over 50.7m.

FCG22-23 successfully extended the high-grade North Fork gold mineralization, reporting 3.4 g/t Au over 44.6m, and demonstrates excellent continuity and consistency of the North Fork zone (Figure 2). In addition, FCG22-23 encountered a shallow interval, 60 meters below surface, which graded 1.8 g/t Au over 12.8m and multiple additional gold intervals lower down in the drill hole, as highlighted in Table 1.

FCG22-25 also intersected four significant gold mineralized intervals, including 3.4 g/t Au over 31.4m and 1.3 g/t Au over 17.4m.

The hole was primarily designed to test the up-dip continuation of the lower series of gold intervals encountered at North Fork by hole FCG22-18, which included 2.1 g/t Au over 46.9m.

Hole 25 encountered multiple gold intervals above and below the 3.4 g/t Au over 31.4m interval, that are highlighted in Table 1.

Both holes extend North Fork mineralization by 25 meters to the north and 30 meters up-dip, respectively.

“Every hole drilled on the North Fork zone in 2022 successfully intersected and extended the gold mineralization. North Fork is shaping up to be a major center for gold mineralization that remains open in all directions and will continue to be a drill priority in 2023,” said Mike Sieb, Getchell Gold’s President, in the Jan. 10 news release. “Being able to say, ‘we have yet to test the limits of the gold mineralization’ after three drill campaigns is an excellent position to be in and highlights the overall potential of the Fondaway Canyon gold project.”

There are still three drill holes left to report assays — FCG22-26 to 28. FCG22-26 and 27, stationed near the canyon floor on the same pad as FCG21-12 and 15, were respectively designed to test the eastern extent of the Colorado SW Zone, while FCG22-28, located midway up the north slope, was designed to test the down-dip extent of the Colorado SW Zone. Assay results from all three holes are expected in the coming weeks.

In a year-end interview with AOTH, President Mike Sieb said the scenario they’re looking at for Fondaway Canyon, is an initial fairly sizeable open pit that will then transition to an underground operation, to continue following the gold trends to greater depths.

Sieb makes a great point about the mineralization remaining open: “The geological model has connected the dots for about 800 meters downdip, roughly the same on strike, and completely remains open — not only external to the drilling but also in between the areas that we’ve drilled.”

“Rick we don’t know how much gold is there. We’ve been drilling for three years and we have yet to hit the extents of the mineralization either along strike left-right or downdip, the mineralization still carries on,” he told me. “Our last deepest drill hole, downdip, is still as strong as some of the drill holes that you see at surface. As yet there is no indication that the gold mineralization is coming to any sort of truncation at Fondaway Canyon.”

Sieb says the resource estimate is just the first milestone for Getchell Gold. The next step is what he describes as “an extremely aggressive and more ambitious exploration program [in 2023],” with the goal of delivering a preliminary economic assessment by the end of the year.

Another compelling aspect of GTCH is its tight share structure, only 105 million shares outstanding, which is remarkable considering how much has been accomplished in three years. The drilling budget has been kept reasonable and a minimal amount of share dilution has occurred.

At AOTH we believe that Fondaway Canyon will become a mine and it’s only a matter of time before a share price correction occurs reflecting Getchell’s progress on the development path.

Getchell Gold Corp.

CSE:GTCH, OTCQB:GGLDF

Cdn$0.44, 2023.01.10

Shares Outstanding 105m

Market cap Cdn$46.7m

GTCH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Getchell Gold Corp. (CSE:GTCH). GTCH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.