Getchell Gold reports 17.7 g/t Au over 9.9m within a broader mineralized interval grading 5.4 g/t over 51.9 m

2021.07.28

Getchell Gold (CSE:GTCH, OTCQB:GGLDF) continues to post impressive results from its 2022 drill program at Fondaway Canyon, Nevada.

In reporting the remaining drill results from hole FCGC22-17, that targeted the high-grade North Fork Zone, Getchell said the drill encountered gold mineralization at a relatively shallow depth.

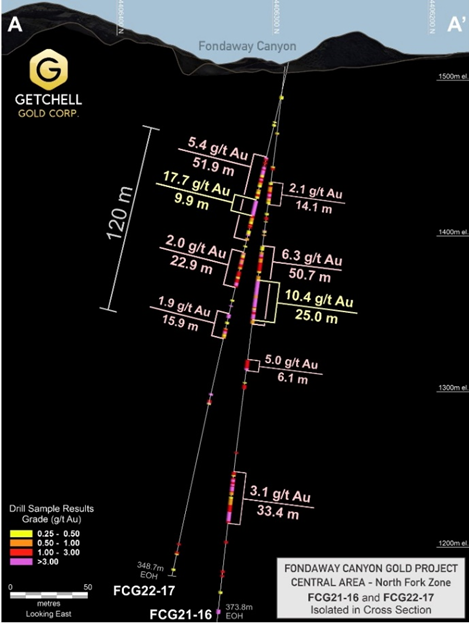

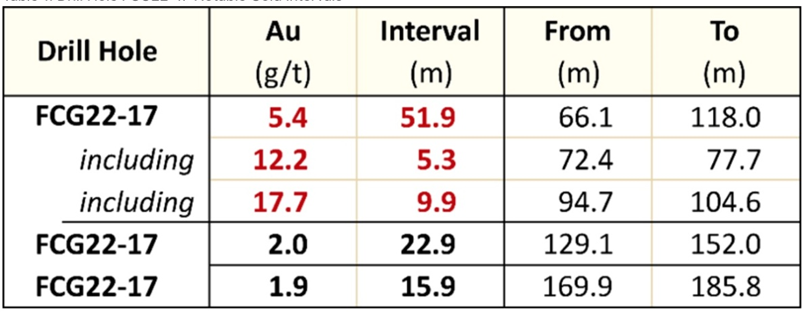

A best-grade 17.7 grams per tonne gold over 9.9 meters was found within a broader mineralized interval grading 5.4 g/t over 51.9 m. The mineralization starts at 66.1m downhole and continues for 120m. Two more intervals graded 2.0 g/t over 22.9m and 1.9 g/t over 15.9m.

“Drill hole FCG22-17 reaffirms the high-grade, high-concentration, and broad-expanse of gold mineralization at the North Fork zone,” said Getchell Gold’s President Mike Sieb, in the July 26 news release. “Every drill hole continues to contribute to our understanding and modelling, as well as continues to push the boundaries of the mineralizing system at Fondaway Canyon.”

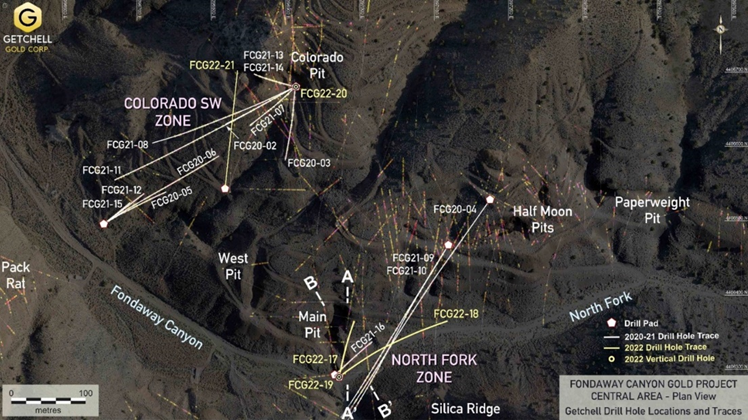

The first hole of the 2022 program, FCG22-17, was collared on the canyon floor on the same drill pad as hole FCG21-16, the last hole Getchell drilled in 2021. It was designed as a 25-meter step-out to the northwest, from the high-grade intercept encountered in FCG21-16.

Stationed on the canyon floor at the junction of Fondaway Canyon and North Fork, FCG21-16 was drilled steeply to the northeast as a step-out from three previously completed holes.

The FCG21-16 interval had the greatest “gold grade x thickness” value in the 40+ year history of gold exploration and mining on the property, and likely represents a major conduit for the gold mineralizing system at Fondaway Canyon. The interval graded 6.3 g/t over 50.7m at a depth of between 117.5 and 168.2m, including a higher-grade section of 10.4 g/t over 25.0m. The latter interval contained 12 samples reporting over 10 g/t, revealing consistent high-grade gold.

Last month Getchell released partial results from hole FCG22-17, which hit shallow mineralization starting at 66.1 meters downhole. Results were received for the upper 119.5m. The intercept highlighted 5.4 grams per tonne gold over 51.9m, with a higher-grade interval featuring 17.7 g/t Au over 9.9m. Ten consecutive samples were >9 g/t.

Assays for the remainder of the hole were reported on July 26. As Getchell explains, the 51.9m interval was closely followed by two intervals grading 2.0 g/t over 22.0m and 1.9 g/t over 15.9m. Combined, the three intervals comprise a gold-mineralized zone spanning 120m downhole.

So far in 2022, five holes have been completed at Fondaway Canyon, totaling 1,867m.

FCG22-18 and 19, collared on the same pad as FCG22-17, were designed to test the immediate up-dip and down-dip extent of the mineralization encountered in FCG21-16, with FCG22-18 testing the further extent of the North Fork Zone to the northeast in an area where no drilling has been done.

Hole FCG22-21, stationed midway up the north slope of Fondaway Canyon, was designed to crosscut the Colorado SW Zone, to assist with modeling and to test the northwest extent of the mineralization.

According to Getchell, more holes are planned from this setup but due to the need to expand the drill pad and sump to accommodate additional drilling, the drill has been moved back to the canyon floor in the interim to continue to expand on the North Fork Zone.

Fondaway Canyon is an advanced-stage gold property located in Churchill County, Nevada. Since gold was first discovered there in 1977, the project has been the subject of multiple exploration campaigns along a 3.5-kilometer east-west mineralized corridor (see below), totaling over 700 reverse circulation and core drill holes, small-scale open pit mining of the oxidized zone at surface, and underground development for exploration and bulk sampling.

New resource estimate pending

A 2017 resource estimate showed 409,000 oz indicated gold resources grading 6.18 g/t Au and 660,000 oz inferred grading 6.4 g/t Au, for a combined 1.1 million oz. Up to 80% of these ounces are within the Colorado, Paperweight and Halfmoon zones, with the remainder found in parallel veins or splays off the main veins.

Getchell Gold has carried out three drill programs, in 2020, 2021 and 2022. The aim is to significantly upgrade the 2017 resource estimate into a new resource, that will combine the drill results from all three drill programs. The National Instrument 43-101-compliant resource estimate is targeted for late September.

Two consecutive years of field work have resulted in significant discoveries, expanded gold zones and consistently successful drill results. Mineralization within the Central Area’s delineated envelope has been considerably expanded; to date, it ranges 600 meters E-W along strike, 800m down-dip to the SW, and is approximately 100m thick.

Within this envelope, substantial high-grade shear vein structures with significant depth extents contribute to the potential. The drilling has yet to test the full extent of the gold mineralization, which remains open in most directions.

A compelling aspect of Fondaway Canyon is the open-pit/ high grade potential, as demonstrated by the 2021 drill results, and the results so far in 2022.

Our reasons for believing a new resource estimate will improve substantially on the previous (2017) one, are as follows:

- Getchell has discovered three new zones within the Central Area which included Colorado SW; a really high-grade zone close to surface called the Juniper Zone; and the North Fork Zone.

- Getchell’s 16 drill holes from 2020 and ‘21 all hit mineralization. New zones and higher-grade mineralization has been found, and a bigger drill program is being executed this year.

- The 2017 resource didn’t include some very significant assay results from at least seven holes drilled by Canagold Resources, so Getchell is missing some significant drill hole intercepts.

- The cut-off grade used to come up with the 1.1Moz resource was 3.4 grams per tonne. Lowering the cut-off grade would, in my opinion, add a lot of ounces.

- Most of the +700 holes drilled at Fondaway were quite shallow; a previous operator was looking for heap-leach gold oxide deposits. But there are a lot of deeper holes that have mineralization shot through them, that are in the 0.5 to 3.0 g/t range. None of those intercepts made the 3.4 g/t cut-off, so they were excluded from the 2017 resource.

- Highlights of recent intercepts that never would have been included in the previous resource, include: hole 3 last year had 2 grams (per tonne) over 49m, hole 5 had 1.8 grams over a 90-m intercept, that included 3 grams over 45m. In hole 8 this year Getchell reported 2.8 grams over 24.5m, another intercept lower in the hole had 1.4 grams over 30m. These intercepts are not only really decent grades, they’re over monster-sized widths.

- If we start to look at Fondaway Canyon from a bulk-tonnage perspective, all of the sub 3 g/t intercepts, and there are literally thousands of them, are going to play a role in delivering ounces into a new, much bigger global resource.

There are three mining probabilities: underground, open pit or both (at the same time). Getchell could chase the 2 to 10-gram material as an underground development and the deposit’s lower-grade ore would be mined as an open pit — making Fondaway a very unusual Nevada gold mine. The high-grade underground mineralization could be mixed with the “lower-grade” open-pit material. Most Nevada gold deposits are a gram per tonne or less. Fondaway Canyon has seven or eight different zones that are all carrying significant grades into a central mineralized area. That’s exciting, and makes this project truly special.

Getchell Gold Corp.

CSE:GTCH, OTCQB:GGLDF

Cdn$0.61, 2022.07.26

Shares Outstanding 105m

Market cap Cdn$61.2m

GTCH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Getchell Gold Corp. CSE:GTCH. GTCH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.