2020.09.09

Getchell Gold’s (CSE:GTCH, US OTC:GGLDF) Fondaway Canyon project is the subject of a 2,000-meter drill campaign designed to extend the known high-grade gold zones, and to test the geological model the company has been devising.

According to the Sept. 8 news release,

Over the last several months, Getchell’s technical team has conducted a comprehensive interpretation of the historic data set to develop a newly refined geological and gold mineralizing model. Stemming from this work, the Company has designed a Phase 1 drill program consisting of an initial 6 drill holes totaling 2,000 metres, performed by a coring rig, that will test various aspects of the extensive gold mineralizing system at Fondaway.

Fondaway Canyon

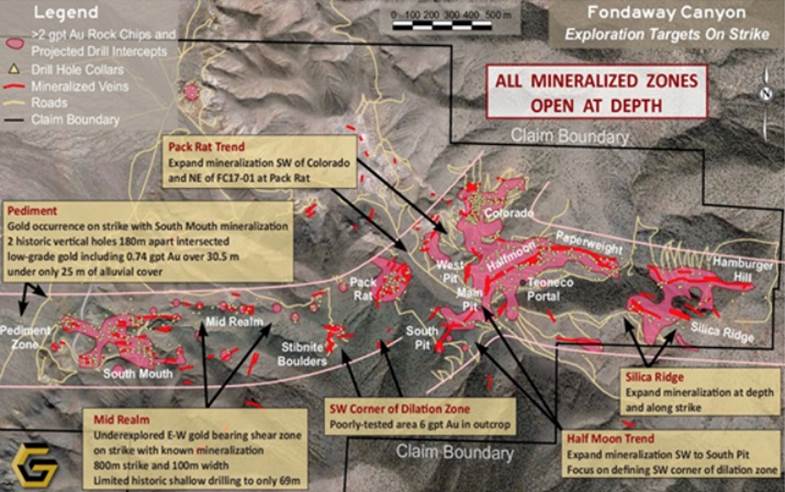

Fondaway Canyon is an advanced-stage gold property comprising 171 unpatented lode claims totaling 1,186 hectares (2,932 acres) in Churchill County, Nevada.

Gold was first discovered in 1977 and over the intervening 40+ years the property has been the subject of multiple exploration campaigns totaling 735 reverse circulation and core drill holes, and small-scale open pit mining of the oxidized zone at surface.

The project has been extensively drilled between 1980 and 2002; records show 591 holes totaling nearly 50,000 meters. Surface sampling, underground channel sampling, geological mapping and geophysical surveys have also been done.

The resource covers 12 known veins, including five mineralized areas and seven untested targets.

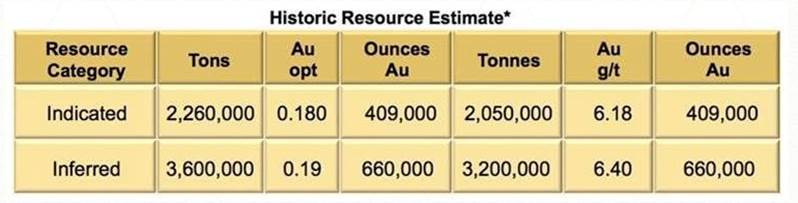

Previous exploration denotes 409,000 oz of indicated resources grading 6.18 grams per tonne, and 660,000 oz inferred grading 6.4 g/t, for a combined 1.1 million ounces.

The estimation, published in a 2017 technical report for Canarc Resource Corp, relates to the high-grade, sulfide-vein mineralization in the eastern half of the project.

The five zones comprising the 1.1 million-ounce resource are Colorado, Halfmoon, Paperweight, Silica Ridge and Hamburger Hill.

Geological model

In a recent Ahead of the Herd video, Getchell Gold President Mike Sieb remarks how five decades of multiple operators have left a voluminous data set – with historical exploration equating to roughly 25 million dollars.

“We’re creating a new geological model that is quite compelling,” says Sieb.

To help shareholders to visualize the mineralized domains used for exploration targeting and mineral inventory, Getchell created an animated video, using a 3D exploration modeling package. Access the Fondaway Canyon Gold Project video through this link

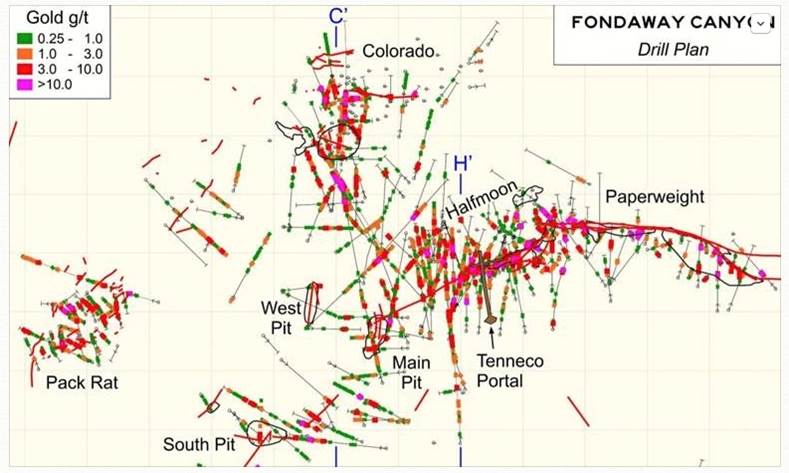

The exploration model in the video is constructed from drill hole sample intervals and shows two mineralized domains: a higher-grade gold domain based on drill intercepts grading >1 g/t Au; and an enveloping lower-grade domain based on drill intercepts grading >0.25 g/t Au.

Significant intervals within a large historic resource, detailed in a May 6, 2020 news release, include 2.83 g/t Au over 65.4m (Hole FC17-03) and 1.77 g/t Au over 62.9m (Hole FC17-02) at the Colorado zone; and 1.01 g/t Au over 66.1m (Hole FC17-04) at the Halfmoon zone.

The 3.5-km-long gold mineralized trend remains open along strike and at depth.

Mike Sieb does a great job in the AOTH video of explaining the new model Getchell has put together and will be testing in its 2020 drill program.

Past geological models at Fondaway Canyon focused on vertical gold shoots thought to be conduits for the mineralization. The new model supports a second direction for gold emplacement, one where the gold is trapped underneath “sills”. A sill is a tabular sheet that has intruded between older layers of sedimentary rock, beds of volcanic lava or tuff, or along the direction of foliation in metamorphic rock.

Getchell has confirmed this gold emplacement is broader than they expected.

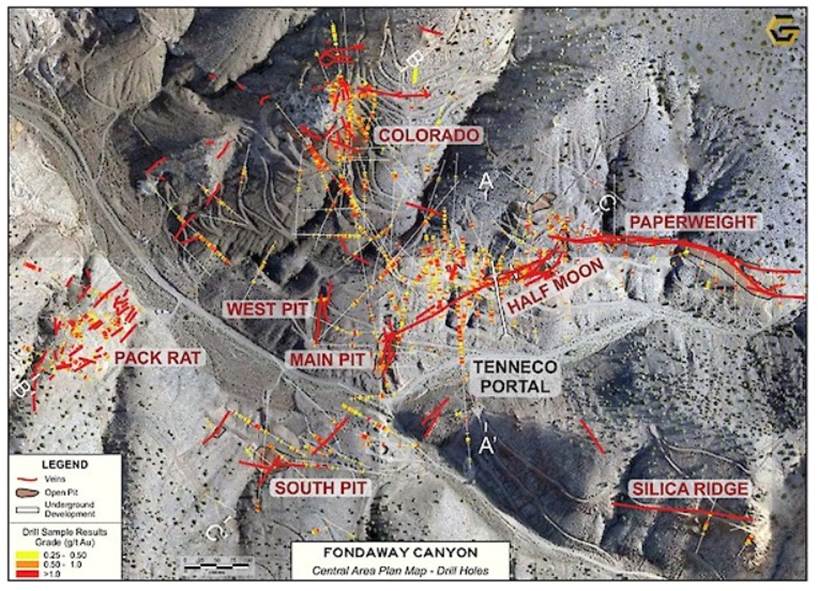

“There’s going to be evident plumes. And you can see it by the zones that have been focused on in the past, where you come across a zone where there’s a high density of mineralization,” Sieb explained. [what we at AOTH have referred to as “vein swarms” trending east to west, shown in red in the map above]

“That’s because it’s a juncture of those structures that are controlling the gold emplacement,” Sieb continued. “We’ve now identified what those structures are, so we can spot our future exploration, to tap into those areas and start connecting the dots, hopefully adding more gold to the model.”

Mineralization

Gold mineralization is spread over 3.5 kilometers of east-northeast trending and steeply south dipping structures, developed within fine-grained Triassic carbonaceous siliciclastic sedimentary rocks and Jurassic limestone, cut by tertiary dikes.

Getchell’s job is to figure out whether its project fits the picture of a big “Carlin-style” Nevada gold system, and if it does, how do they find the pathways that carried the gold from a presumably much larger deposit, below the near-surface mineralization?

Equally important: Where is/ are the intrusive(s)? ie., the igneous rock potentially hosting hundreds of meters of mineralization. The trick is finding the main conduit hosting the mineralizing fluids to depth, or on strike which may have soaked into the right age of sandstone along their path. It is likely parallel to one of the east-west conduits from the Pediment zone to Hamburger Hill, or the 60-degree offset from the Stibnite Boulders zone to the Colorado zone.

That’s why Getchell needs to chase the system at depth and along strike.

From the 2017 technical report:

Mineralization is characteristically a gold/silver ratio of greater than 1:1 and is associated with the sulfide minerals of pyrite, arsenopyrite, and stibnite with lesser amounts of chalcopyrite, tennantite/tetrahedrite, sphalerite, and galena. Gold/electrum is mainly identified as inclusions within pyrite of hydrothermal wall rock replacement and silica/carbonate-rich fracture-fill/breccia cement assemblages, in places in close spatial association and intergrowths with chalcopyrite, sulphosalt minerals and arsenopyrite.

Shale and ardillite are fine-grained sedimentary rocks that are tightly packed together – fluid doesn’t move through them. Sometimes units of shale lie overtop of sandstone, capping the fluids underneath. If these fluids sat for a long time in porous sandstone, there could be a monster Carlin-style deposit lurking underneath the vein swarms.

If that’s the case at Fondaway, and there is gold in the sandstone, how did it get up to the veins near surface? This happens wherever there is a break in the shale, allowing the trapped gold-bearing fluids to flow into the upper stratigraphy. The gold is deposited into rock fractures, becoming veins.

There are two ways forward with the veins at Fondaway Canyon. One is to follow them to depth and see whether the mineralization becomes stronger in more cohesive structures. A second way is to investigate whether the veins change composition as they snake into different geological packages. Ideally they get into even more receptive host rock, ie., a district-scale, Carlin-style gold deposit.

The fact that Fondaway Canyon has stibnite boulders on the property is very encouraging. Most Carlin-style environments are gold, arsenic and antimony. Numerous zones at Fondaway have arsenic – the Pack Rat zone has the most. The combination of arsenic and antimony (stibnite) is a strong indicator of a big system – one that has the right temperature, the right pressure and the right chemistry to be a Carlin look-alike.

Mike Sieb concludes,

“The extensive near-surface gold mineralization as depicted by the exploration model in the video is quite compelling and reflects our high expectations for the Fondaway Canyon Gold Project. We look forward to the much-anticipated drill program that will test the further extent of the gold mineralization.”

Adding ounces

One way to add significantly more ounces is to change the cut-off grade.

The 2017 technical report is based on an underground mining scenario, with a cut-off of 1.8 meters (6 feet) horizontal width and = or >3.43 g/t.

Put simply, this means that any grades below 3.43 g/t were excluded from the resource estimate.

For ounces to be included, they had to be at least 3.43 g/t. In Canarc’s 1.8m-wide section, which runs mostly through the Paperweight, Halfmoon and Colorado zones, there were gold grades higher and lower than 3.43 g/t, but the average grade was 6.29 g/t (average grade of Indicated and Inferred resources).

Plugging in dollar figures establishes the per-tonne value of the ore. Using US$1,250/oz gold (Canarc used $1,250/oz in the resource estimate) yields $40.32 per gram ($1,200/31 grams per ounce). Ie., if gold was $1,250/oz, anything less than $138.29 a tonne (3.43 g/t x $40.32) over the 1.8m horizontal width was uneconomic to mine.

Now, if we drop the cut-off grade, the Indicated and Inferred grades will be lower, but the number of ounces will rise. With a gold price of say $1,900 per ounce, each gram is now worth $61.29 ($1,900/31g) so the same $138.29 breakeven price allows the cut-off to drop to 2.26 grams Au, which could add nicely to the existing ounces in the resource estimate.

Using this example, Getchell’s Indicated and Inferred grades would drop from the average of 6.29 g/t, but, the lower cut-off grade will capture more ounces, perhaps significantly more than the Indicated and Inferred (I&I) 1.1Moz identified in the 2017 resource estimate.

Interestingly enough, Fondaway could also have a very attractive open-pit scenario that would need far lower grades to be profitable than the underground model used by Canarc.

Key to the open-pit strategy is the area between the Colorado and South Pit zones. Historical data reveals multiple structures coming together in an east-west corridor of mineralization.

The drill map below readily shows the open-pit/ underground model potential we at Ahead of the Herd envision.

To add tonnage to the 1.1Moz already identified, our opinion is: the lowest-hanging fruit could be picked by driving a portal in from the lower part of the creek bed, gaining access to Paperweight and Hamburger Hill, without sinking a shaft. There are also easy ounces available by peeling off the hillside at Silica Ridge.

Higher-grade material (>6 grams per tonne) could be economically mined with a 3:1 or 4:1 strip ratio in the area between Colorado and South Pit. Even better, 10 to 14 g/t material unearthed by a previous operator could be accessed underground at Colorado.

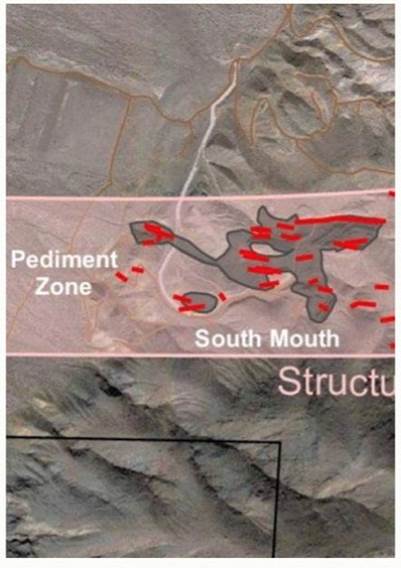

However the most intriguing option to us at AOTH, and what could be underpinning the entire structurally-controlled gold zone all the way to Hamburger Hill, is the Pediment zone, appearing at the (enlarged) left edge of the map below.

From the technical report,

Much work remains to integrate the western portion of the project area, which has a correspondingly sparse and predominantly shallow drill history, along a 1 mile corridor to the South Mouth zone, the area of previous surface mining. This corridor has detailed rock and soil geochemistry, with several areas of highly anomalous gold geochemistry suggesting continuity of gold mineralization through this zone. The South Mouth zone, where mining excavated the shallow oxide mineralization, has not been explored sufficiently to quantify the down dip extension of the sulfide mineralization to depth.

What’s really exciting is what happened when a former lease-holder, NCI, step-out drilled into the pediment – visualized as a flat plain that fronts the hills and valleys where the rest of the targets are dotted throughout.

Underlying the plain is about 25 meters of alluvial (gravel-bed) cover, making for easy overburden removal.

Visualize a heat source millions of years ago squeezing boiling-hot magma from west to east through the fissures and faults of the Earth’s crust, depositing gold and silver minerals all the way from the westerly range-front, several kilometers up into the hills as far as the Hamburger Hill and Silica Ridge zones.

In Nevada this is a familiar geological model – one that led to discovery of the Pipeline and South Pipeline deposits that became the Cortez mine, one of three Tier 1 assets that comprise the 2019 Nevada Gold Mines’ joint venture between Barrick Gold and Newmont Mining.

Deposits on the shoulders of the hills behind Cortez were mined for decades before drills pierced Pipeline. The geological model used to find Pipeline, the same theory that might apply at Fondaway, is predicated on the notion that larger deposits lie closer to the deep crustal structures, found in the basin bottoms, than in the upper parts of the geological system – like mountain ridges.

Testing that thesis would require further drilling into the pediment – looking for the engine driving the whole gold system.

Drill program

That is exactly what Getchell plans to do in its recently announced drill program.

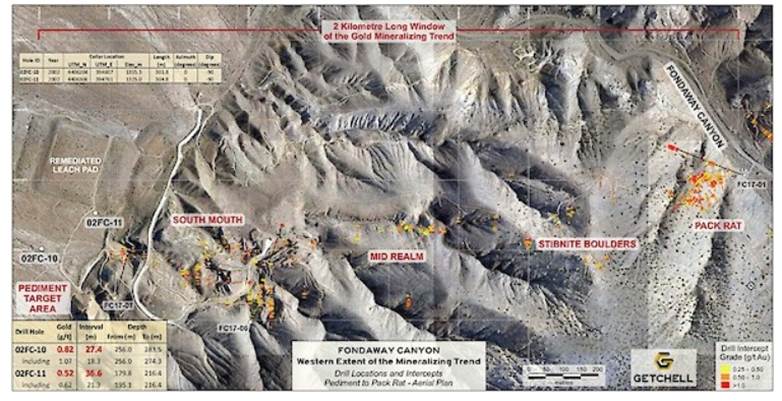

Fondaway Canyon West Area Plan Map showing main shear veins, drill traces and gold intercepts

Pediment Area

In 2002, two holes were drilled only 185m apart, along the western edge of the 3.5-km east-west trending Fondaway Canyon gold mineralized corridor. Each pulled up significant mineralization – one hole had 0.82 grams per tonne over 27 meters; the other was 0.52 g/t over 36m. While those grades aren’t enough to energize gold investors, there is a good possibility that the deposits found in the hills at Fondaway are just the “smoke” from a major gold system that originates underneath the pediment.

One drill hole of six is planned to test the mid-point between these two historic gold intercepts. The goal is to characterize the geological setting and gold mineralization, in order to determine orientation and design a follow-up drill program.

It is significant that the mineralized intervals are hosted in limestone, which is very different from the siltstone-mudstone hosted mineralization east of the range front fault along Fondaway Canyon; the environment is reflective of major Carlin-type gold deposits in the region.

According to Getchell, the Pediment Area may represent a discrete geological target with significant potential in its own right. The reported mineralization is another major indicator that Fondaway Canyon may form part of a larger gold mineralizing system that has yet to be revealed.

Fondaway Canyon Pediment Target Area drill hole FCG20-01 looking South

The other five holes are planned for the highly mineralized Central Target Area to extend the known mineralization, and to characterize it for further geological and resource modeling.

Central Target Area

The Central Target Area is a 1,000 x 700-meter highly mineralized NE-SW extensional zone within the 3.5-km east-west trending Fondaway Canyon gold trend. According to Getchell, the Central Target Area is a nexus for the extensive gold emplacement mineralizing system observed at the project. Gold mineralization has been traced from surface to greater than 300m below surface at certain locales and remains open in all directions. Five of the six drill holes will be collared within this Central Target Area and will focus on the Half Moon – South Pit and the Colorado – Pack Rat mineralized corridors.

Fondaway Canyon Central Area Plan Map showing main shear veins, drill traces and gold intercepts

Conclusion

Getchell Gold started with 1.1Moz but the blue-sky potential is evident. I’m optimistic Getchell is, so far, just tickling the surface of a much bigger system.

The bottom line for me? Getchell Gold’s Fondaway Canyon has a large alteration footprint more characteristic of intrusives, ie., much bigger systems than what we are seeing with the emplacement of gold in veins.

The company has done what it needed to do, in compiling and analyzing previous drill log data to come up with what looks like a very compelling geological model for Fondaway Canyon.

Now it’s time to put the theory to the test with six strategically placed drill holes. I am optimistic that the 2,000m drill program will open up more prospective ground for further exploration, and/or add to what is already a considerable resource at Fondaway Canyon, in Nevada, one of the best jurisdictions in the world for gold and silver mining.

Getchell Gold

CSE:GTCH, US OTC:GGLDF

Cdn$0.44, 2020.09.09

Shares Outstanding 58,157,977m

Market cap Cdn$25.5m

GTCH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Getchell Gold (CSE:GTCH). GTCH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.