Getchell Gold: eliminating country risk by mining in Nevada – Richard Mills

2023.01.19

Country risk is one of the most important factors to consider in deciding whether to invest in a mining property.

This is where the political and economic stability of the host country is questionable and abrupt changes in the business environment could adversely affect profits or the value of the company’s assets.

We’ve seen many instances of companies losing assets that were lawfully theirs. Several countries come to mind as places where shareholders could, without warning, receive news that operations have been taken over by the government or its friends, or where permits get delayed or canceled outright.

Resource nationalism

Closely related to country risk, resource nationalism is the tendency of governments to assert control, for strategic and economic reasons, over natural resources located on their territory. It has been identified as one of the key risks for investors in the natural resources sector.

Miners are easy targets because mining is a long-term investment and one that is especially capital intensive. Mines are also immobile, so mining companies are at the mercy of the countries in which they operate. Seizure of assets happens using the twin excuses of historical injustice and environmental or contractual misdeeds. There is no compensation offered and no recourse.

Governments may get in the way of miners’ progress by implementing anti-mining agendas and/or thinking up new ways to hit the extractive industry with higher taxes.

Some have gone beyond taxation in getting more out of the mining sector with a wave of requirements such as mandated beneficiation (where ore is processed locally rather than exported raw), export restrictions (e.g. Indonesia) and increased state ownership of mines (e.g. Mongolia).

In its 2021 report, global risk consultancy Verisk Maplecroft says there is an increasing trend of “state interventionism, creeping expropriation, and indigenisation” — interventionist measures that are more subtle than, say, outright nationalization or large tax increases imposed on foreign mining or energy companies.

One explanation of why resource nationalism has picked up in recent years has to do with globalization. During the 1970s and ‘80s it was common to see developing world governments nationalizing industries. However when globalization emerged in the 1990s, there was a need for foreign investment as governments privatized industries, resulting in fewer attempts to seize foreign-owned assets like mines.

This changed when governments in Latin America, primarily, saw mining profits moving out of the country and they sought to seize greater control over their mineral wealth.

Lessening risk

Mining being so highly capital intensive — constructing a new mine is usually measured in the hundreds of millions of dollars — it is incumbent upon governments to have policies that create confidence that taxes and regulations will not be capriciously changed.

That, however, is something neither investors nor mining/ exploration companies have any control over. So how to protect your, or your company’s investment against resource nationalism? The literature on this topic offers a number of suggestions.

The Clifford Chance report notes the greatest threat to foreign investors is when changes are made after significant investments have been made, often despite earlier promises of fiscal stability.

It warns that resource nationalism may make foreign investors less willing to invest in the country; cause investors to reduce their exposure; and make projects more difficult and expensive to finance.

The report recommends that foreign investors structure (and document) their deals to minimize the risks of resource nationalism, using mechanisms such as contractual remedies and bilateral investment treaties; and take on political risk insurance.

An article by legal website Lexology, names 10 key issues that mining companies and their investors should consider when it comes to resource nationalism:

- Investment structuring, whereby thought is given to the ability to gain access to international law or arbitration;

- State participation, whereby the foreign investor offers the state some form of participation from the outset;

- Making use of tax treaties, or double tax agreements, to manage the risk of tax on profits and capital gains;

- Consider incorporating environmental and human-rights standards, which usually falls under ESG;

- Have access to sufficient legal remedies, in the event of sanctions or trade bans;

- Look into whether the company can negotiate with a state regarding its local content rules, and if not, whether the investment can be structured through arbitration;

- Carry our rigorous due diligence prior to investing, to avoid or at least be able to document bribery and corruption;

- Retain experienced local counsel;

- Adhere to mining-relevant governance frameworks such as the Responsible Gold Mining Principles, that could be relevant in an investor-state dispute;

- Prioritize employment/ labor issues and implement the right culture and legal framework;

Fraser Institute rankings

Of course the far easier way to lessen, and even eliminate, the risk of resource nationalism, is to steer clear of countries that are ranked highly for investment risk.

For many years the mining industry has been guided by the Fraser Institute’s annual investment attractiveness index, which measures the attractiveness of a jurisdiction based on factors such as onerous regulations, taxation levels, the quality of infrastructure, and other policy-related questions that survey respondents answered.

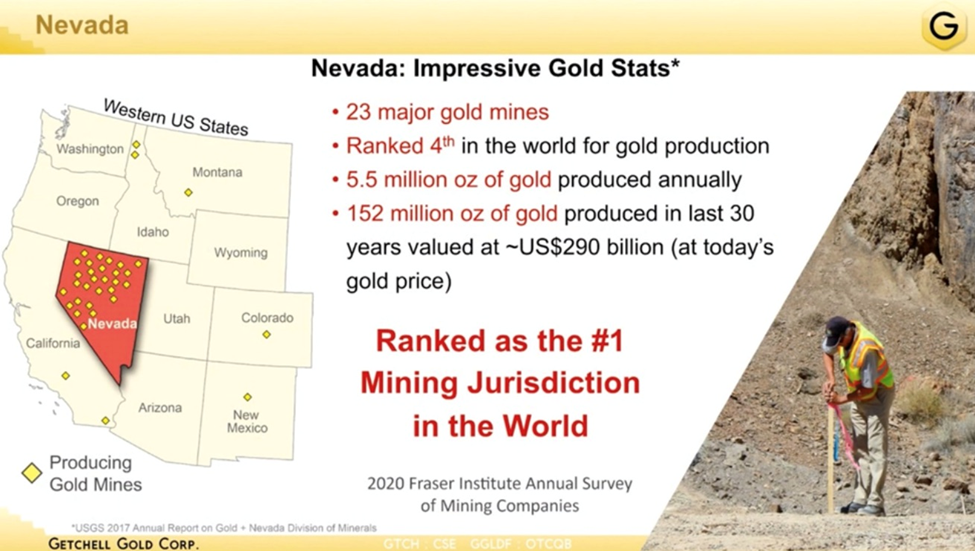

According to the Fraser Institute’s 2021 Annual Survey of Mining Companies, Nevada was the third highest-ranked for investment attractiveness, behind only Western Australia and Saskatchewan. In 2020, Nevada was ranked #1.

Annual Survey of Mining Companies 2021

Nevada

With 160 years of gold mining that dates back to the Comstock Lode discovery in 1859, Nevada has been, and still is, one of the best jurisdictions to find gold.

Between 1835 and 2016, Nevada produced a phenomenal 158 million ounces. This is more than any other gold rush, including California’s, which extracted about $2 billion in precious metals from 1849-62, and the Comstock era, 1860 to 1875, which mined around 34Moz, according to research by The Nevada Sun.

The United States’ primary gold producer has an impressive geological endowment. According to the US Geological Survey, if Nevada were a country, it would be among the world’s top four producers. Nevada currently produces around 80% of all the gold in the United States.

Nearly every rock type known to geologists is found within its desert geography, though silver and gold are the most prevalent. The state owes its unique geology to the northern Great Basin which features a number of mountain ranges and valleys where the rocks below have been smashed together and pulled apart through tectonic activity dating back millions of years.

Most of Nevada’s gold deposits are found within three northwest-trending belts. The most famous is the Carlin Trend, where sedimentary, disseminated gold appears near surface, often surrounded by smaller deposits of similar geology.

Estimated to contain up to 180 million ounces, the Carlin Trend is the second largest gold endowment behind South Africa’s Witwatersrand Basin. The three major players operating mines in the Carlin Trend are Newmont Mining, Barrick Gold and Kinross Gold. Barrick’s Goldstrike mine is one of the world’s most prolific. Between the Betze-Post open-pit mine and the Meikle and Rodeo underground mines, the Goldstrike mines have produced over 1.1 million ounces and have 8.1 million ounces of reserves.

Newmont’s Carlin operations have produced 944,000 ounces out of 15 million ounces in reserves. Kinross’s Bald Mountain mine, purchased from Barrick in 2016, outputted 130,144 gold-equivalent ounces, with 2.1Moz in reserves.

The other two trends, Battle Mountain-Eureka-Cortez (or just Cortez) and Walker Lane, also host some of the world’s most important gold mines, including SSR Mining’s Marigold mine in Humboldt County and McEwen Mining’s Gold Bar operation.

The three major trends feature Carlin-style mineralization, but Nevada also has epithermal, low-sulfidation gold deposits. While generally smaller than the large Carlin-type deposits, epithermal vein-type deposits, which are not unique to Nevada, are often high grade, making them excellent targets for gold exploration companies.

Among the reasons for retaining its competitive edge, are Nevada’s lack of income tax, the fact that mining is governed under the federal Mining Act of 1872, which would take an act of Congress to change, and that mining taxes are set out in the state’s Constitution. They can’t be suddenly changed willy-nilly.

Not only does Nevada produce a lot of gold from existing mines, it is also an excellent place to put a new mine into production. That’s because conducting exploration, constructing and building a mine in Nevada is relatively easy. The state isn’t the country’s number one gold producer by far, without good reasons.

In fact, Nevada hosts my favorite company in the junior gold space right now, Getchell Gold.

Getchell Gold (CSE:GTCH, OTCQB:GGLDF)

Getchell carried out three drill programs at its flagship Fondaway Canyon gold project, in 2020, 2021 and 2022. The aim was to significantly upgrade the 2017 resource estimate into a new resource, that combined the drill results from all three drill programs.

Fondaway Canyon is well situated, with a number of prominent mines and deposits to the north and Reno, a short drive to the west. Getchell Gold Corp’s field office is centrally located in Fallon, and provides excellent base from which to manage the ongoing operations.

The new resource estimate, released in November, nearly doubles the previous one, of 1.1 million ounces. It is 2 million ounces, including 550,000 ounces in the indicated category grading 1.56 grams per tonne, and 1.5Moz inferred, grading 1.23 g/t. There are nine holes that haven’t been included in the resource estimate because they missed the cut-off date, and Getchell plans to do a lot more drilling in 2023. Meaning the next RE will be even bigger.

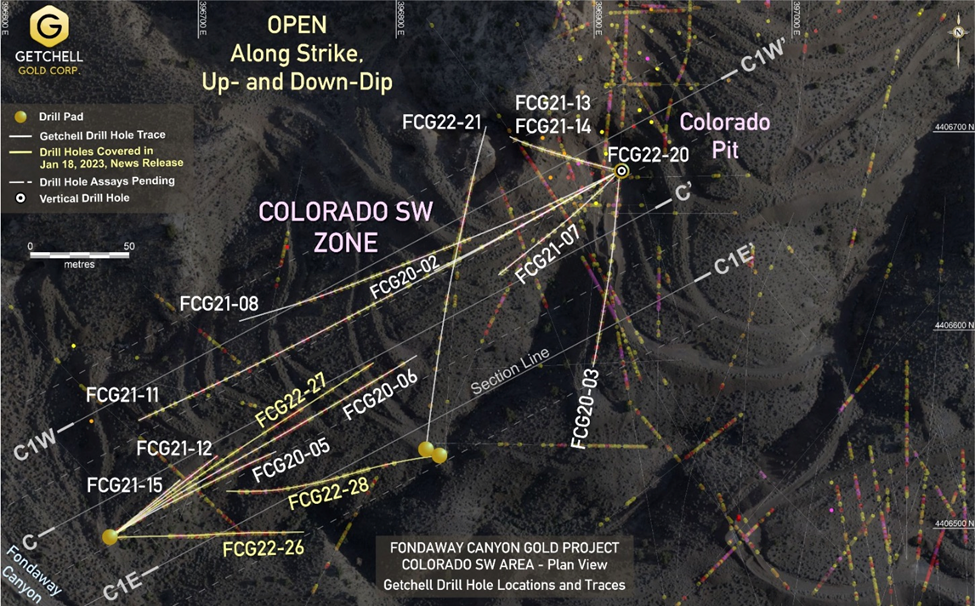

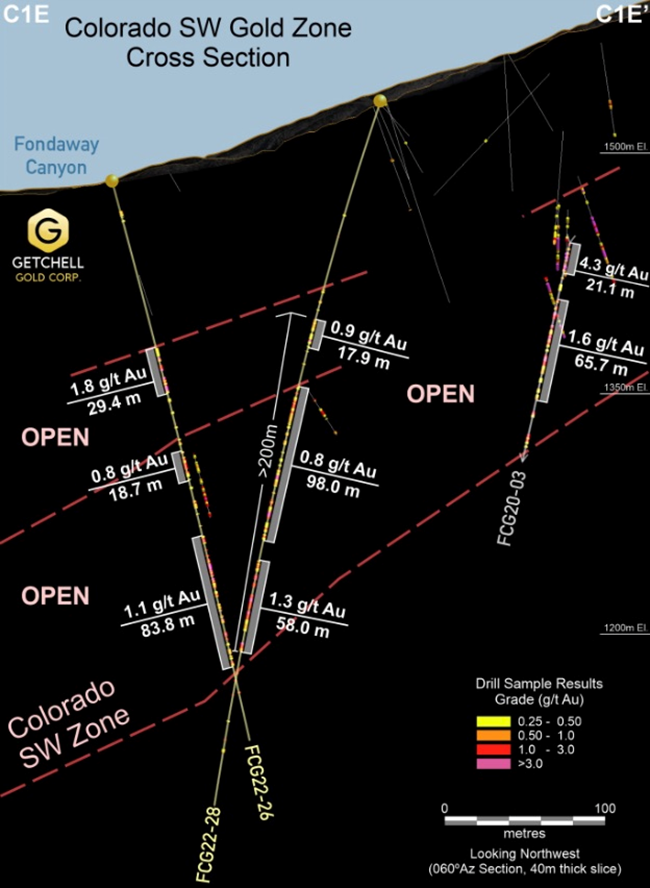

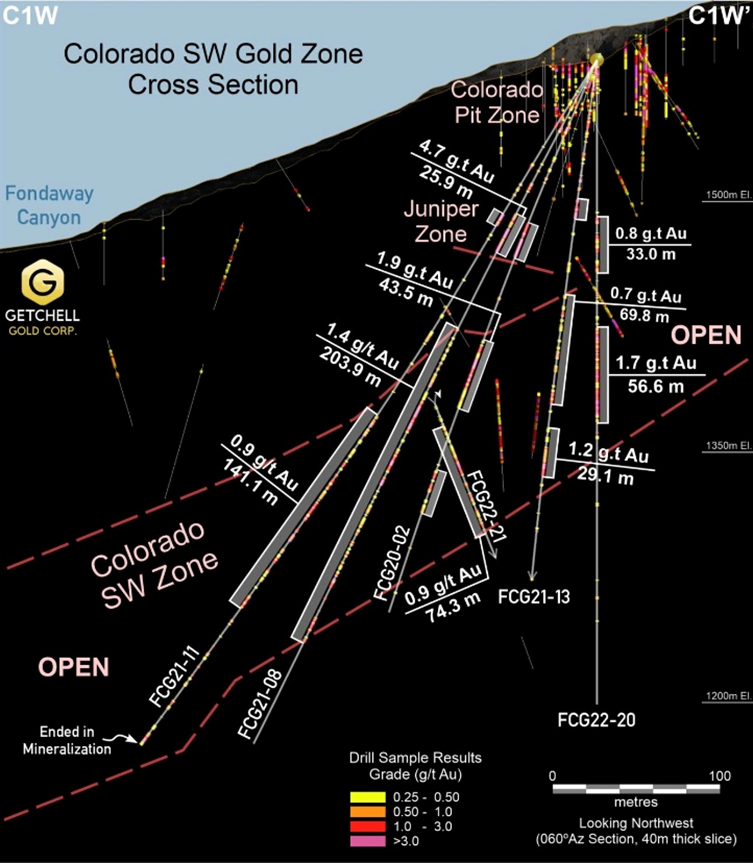

This week, the company published the drill results from holes FCG22-26 to 28, which according to Getchell, continue to demonstrate significant intervals of gold mineralization, and extended the Colorado SW Zone 40 meters towards the southeast in the Central Area.

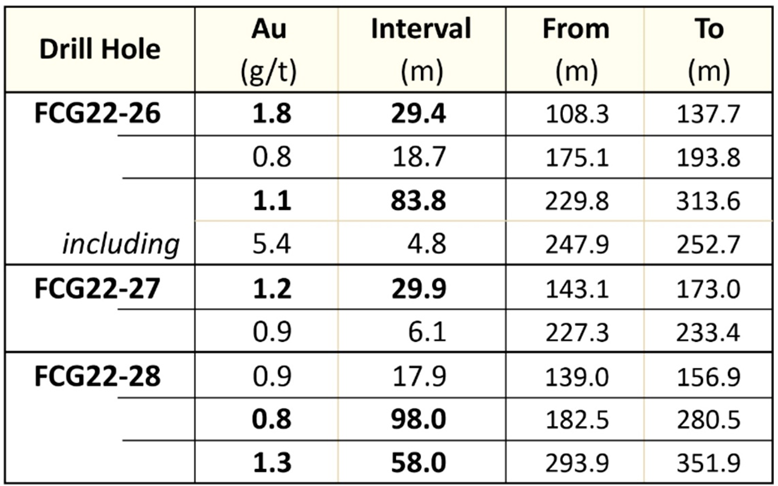

Among the key highlights, hole 26 intersected three gold-mineralized intervals, including 1.8 g/t Au over 29.4m and 1.1 g/t over 83.8m. Hole 27 drilled 1.2 g/t over 29.9m partway through the targeted zone before being lost. Hole 28 intersected three gold intervals including 0.8 g/t over 98m and 1.3 g/t Au over 58m.

Importantly, the Colorado SW Zone remains open in all directions.

“Stepping out into a new area comes with its risks and rewards. In this instance, our drilling has successfully demonstrated that the Colorado SW gold zone clearly extends along strike to the southeast while maintaining a considerable thickness,” Getchell Gold’s President Mike Sieb, said in the Jan. 18 news release. “Once again, we finished a drill season on a high note by expanding the limits of our recent gold discoveries and continuing to reveal the exceptional exploration potential at Fondaway Canyon.”

Getting a bit technical, FCG22-26 and 28 were centered on a new drill section, a 40m step out to the southeast from previous drilling that included FCG20-05, grading 1.8 g/t over 90.0m (Figures 1 to 3).

Both holes revealed excellent gold grade consistency and mineralized thickness with respect to the adjoining drill section, intersecting the Colorado SW Zone over a 200m down hole length, with highlighted gold intervals detailed in Table 1.

Getchell Gold has now traced the Colorado SW Zone for over 300m on this section. The mineralization remains open up and down dip, as well as along strike to the southeast, a region without any drilling.

Drill hole FCG22-27 was designed to test the up-dip continuation of the Colorado SW Zone on the section with hole FCG20-06, that intersected 1.5 g/t over 37.7m and 1.1 g/t over 38.3m.

The hole intersected an upper interval returning 1.2 g/t over 29.9m, but the drill rods became stuck and the hole was lost partway through the targeted zone at a depth of 240m (Figure 3).

Figure 4 shows the company’s previous drill results on the section 40 meters to the northwest, with excellent gold grade consistency and mineralized thickness.

This section is highlighted by holes FCG21-08 and FCG21-11, that intersected the Colorado SW Zone grading 1.4 g/t over 203.9 m and 0.9 g/t over 141.1m, respectively.

This section is the most northwesterly drilled section and is bounded by a region without any drilling.

According to Getchell, hole FCG22-28 marks the last hole drilled during a very successful 2022 drill program, with all gold zones drill-tested remaining open along strike and up and down dip.

The company’s technical team is in the process of compiling and analyzing the results from the 2022 drill program, as they plan this year’s drill program at Fondaway Canyon, which is expected to be even more ambitious than 2022’s.

After an extremely aggressive and much more ambitious exploration program and drilling in 2023 the next milestone will be delivering a preliminary economic assessment (PEA) by the end of the year.

In a year-end interview with AOTH, President Mike Sieb makes a great point about the mineralization remaining open: “The geological model has connected the dots for about 800 meters downdip, roughly the same on strike, and completely remains open — not only external to the drilling but also in between the areas that we’ve drilled.”

“Rick we don’t know how much gold is there. We’ve been drilling for three years and we have yet to hit the extents of the mineralization either along strike left-right or downdip, the mineralization still carries on,” he told me. As yet there is no indication that the gold mineralization is coming to any sort of truncation at Fondaway Canyon.”

Getchell Gold Corp.

CSE:GTCH, OTCQB:GGLDF

Cdn$0.43, 2023.01.18

Shares Outstanding 105m

Market cap Cdn$45.2m

GTCH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Getchell Gold Corp. (CSE:GTCH). GTCH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.