Getchell Gold continues to hit high-grade at Fondaway Canyon

2022.01.14

Inflation is one of the best determinants of gold price movements, because investors buy precious metals (gold, silver, platinum and palladium) as an inflation hedge when the prices of goods and services are rising faster than interest rates.

Although gold offers neither a yield (bonds, GICs) nor a dividend (stocks and mutual funds), it is considered a smart investment when inflation diminishes an investor’s principal or erodes the purchasing power of a currency.

Gold is even more popular when real interest rates, typically the yield on the US 10-year Treasury note minus the inflation rate, are below zero, like currently.

The current 10-year Treasury note yields 1.74% and the December CPI rate of inflation (minus food & energy) is 7%, making real interest rates minus 5.26% — an ideal environment for gold prices.

Spot gold on Thursday climbed to $1,820/oz, at time of writing, corresponding with a lower US Dollar Index (DXY has fallen from 96.32 at the start of January to 94.80 currently) and following the release of December inflation figures.

Ticking off all the bullish factors for gold right now, we have a falling US dollar, rising and “sticky” inflation that is pushing up against Fed plans to control it with a pitiful 0.75% rate increase this year, at most 2% over three, and negative real bond yields which are always a strong buy signal for gold investors.

Rising geopolitical tensions continue to add to gold’s allure. There are a number of hot spots in the world today that could easily flare up into a conflagration that escalates into a shooting war or even the nightmare scenario of missiles being launched.

They include the ongoing threat of war between North and South Korea that would draw in the United States; tensions between the US, China and its neighbors over Taiwan; and a migrant crisis in Belarus that Ukrainian officials believe is a ruse invented by Russia to stage an invasion of Ukraine, similar to what happened in 2014 when Russian forces annexed Crimea.

At AOTH, we like physical gold bullion for its store of value, and gold juniors for their leverage to rising gold prices. One of our favorites is Nevada-focused Getchell Gold.

Getchell Gold (CSE:GTCH, OTCQB:GGLDF)

About 170 km northeast of Reno, Nevada, Getchell is in the midst of a drill campaign at the advanced-stage Fondaway Canyon project, comprising 170 unpatented lode claims in Churchill County.

The property has been the subject of multiple exploration campaigns dating back to the late 1980s and early ‘90s, with nearly 50,000m of drilling completed. It covers 12 known veins, including five mineralized areas — Colorado, Halfmoon, Paperweight, Silica Ridge and Hamburger Hill.

A 2017 technical report estimated 409,000 oz indicated gold resources grading 6.18 g/t Au and 660,000 oz inferred grading 6.4 g/t Au, for a combined 1.1 million oz. Up to 80% of these ounces are within the Colorado, Paperweight and Halfmoon zones, with the remainder found in parallel veins or splays off the main veins.

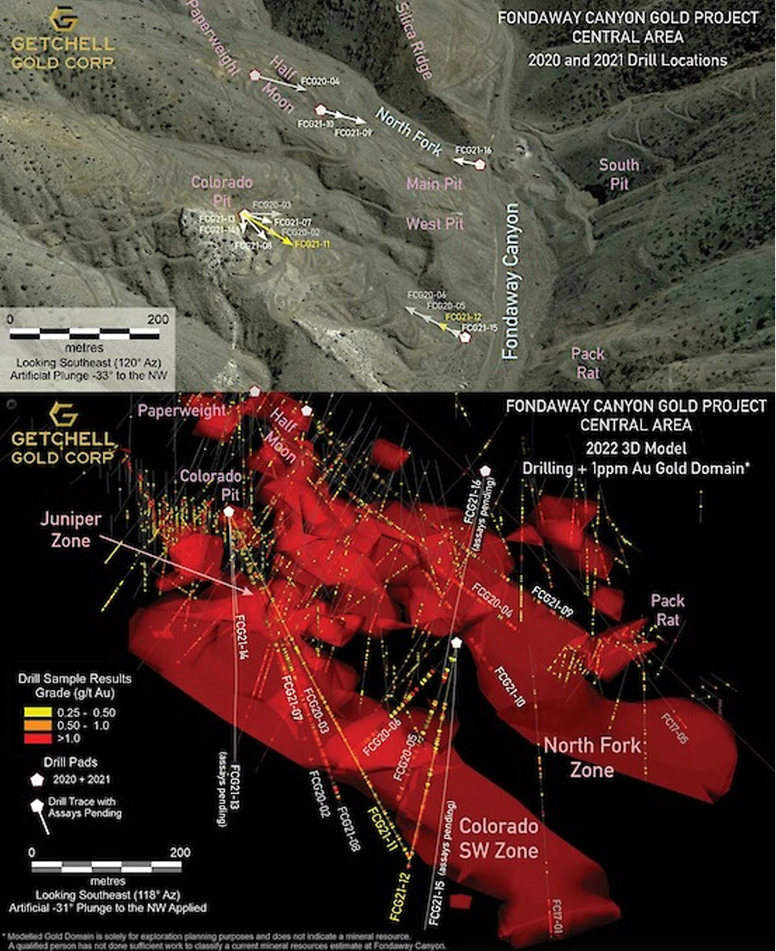

Sixteen holes were drilled throughout 2020-21, 12 of which have reported assay results.

2020 saw Getchell develop a new geological model, evidenced by the discovery of three new gold zones: Colorado SW, North Fork and Juniper. All five holes drilled that year hit substantial mineralization. Early wide-spaced drilling (200-300m apart) demonstrated the presence of high-grade shear veins enveloped in thick bands of mineralization, and extended the model a remarkable 800m down-dip from surface.

The 2021 program was designed to further delineate and expand upon the mineralization discovered in 2020, focusing on the 1×1-kilometer Central Area, which Getchell management believes is a nexus for the gold mineralization and host to a near-surface sizable historical resource, in addition to the extensive gold zones discovered in 2020.

Ten holes were completed for a total of 3,874 meters.

The first four holes were highlighted by hole FGC21-08, the most northwesterly, which hit the Colorado SW Zone and extended it for over 200m down-hole; and FGC21-10, which banked the highest-grade intercept in the 40+ year drilling history of the project.

The latter tested the North Fork Zone up-dip from FC21-09, intersecting the North Fork mineralization over 82.2m. The best intercept was 3.0 g/t Au over 41.6m, including 47.0 g/t Au over 1.5m. The hole also intersected North Fork up-dip from 2020’s FCG20-04, which graded 2.5 g/t Au over 58.0m.

According to Getchell, this is a prime example of the structures that promote the concentration of high-grade gold at Fondaway Canyon.

“Compared to other projects in the region, this is high-grade, relatively near-surface mineralization,” Getchell Gold President Mike Sieb said during a Jan. 13 webinar focusing on drill results. He added: “This is no small deposit. It still remains open along strike, it’s open to depth, we have yet to see any of the mineralization weakening.”

Fast forward to 2022’s exploration program which is expected to double last year’s drilling capacity with the addition of a second drill rig.

The second drill will also enable Getchell to maiden drill-test Star, a copper-gold-silver project known for historical small-scale mining of exceptionally high-grade mineralization.

“There’s a significant leakage of the mineralization at surface. What we’re trying to do is find the big body of mineralization that’s buried underneath that section, the source of the mineralization that you see at surface,” says Sieb.

There are two main historical showings, the Star Point copper mine and the Star South series of artisanal workings.

Last year the company identified a number of compelling geophysical targets, received drill permits and built drill pads in preparation for the upcoming program.

In a December 2021 President’s Message, Sieb said January and February 2022 promise to be a very active period with continuous news flow as the Company releases results from six 2021 drill holes for which assays have yet to be received. In addition, with the bulk of the outstanding warrants expiring in January, the Company’s capital structure will be significantly strengthened, as will the treasury. It is anticipated that the Company will have in excess of $4 million before the start of the 2022 exploration field programs, providing a solid financial position moving forward.

The company has just released the assays from two holes that targeted the Colorado SW and Juniper zones.

Within the Colorado SW Zone, hole FGC21-11 hit multiple gold intercepts over 242 meter down-hole, including 1.4 g/t over 14.9m, 1.0 g/t over 52.5m and 2.2 g/t over 9.1m. Hole 11 also encountered high-grade, near-surface mineralization at the Juniper Zone, returning 8.8 g/t over 8.2m.

Hole FGC21-12 also found the Colorado SW Zone, hitting mineralization over 92 meters down-hole, including 6.3 g/t over 3.6m, 2.5 g/t Au over 24.5m, and 1.6 g/t Au over 25.5m.

According to Getchell, the Colorado SW Zone has now been drill-tested with eight holes, confirming its continuity on a 150-meter-wide section along a 300-meter down-dip extent.

Including historical drilling, the zone is modeled to extend for 800m down-dip from surface, and remains open on strike and at depth.

Assays are pending for the last four holes, FGC21-13 to 16.

“The gold assay results from these latest two drill holes continue to demonstrate the strong continuity and potential scale of the mineralizing system at Fondaway Canyon and provide an excellent start to 2022,” states Sieb, in the Jan. 12 news release.

Getchell expects to compile the results of the last two years of drilling at Fondaway into an updated resource estimate sometime in the second half of 2022.

Getchell Gold

CSE:GTCH, OTCQB:GGLDF

Cdn$0.60, 2022.01.13

Shares Outstanding 95.5m

Market cap Cdn$52.3m

GTCH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Getchell Gold (CSE:GTCH). GTCH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.