Getchell Gold an excellent value play in a rising gold price environment – Richard Mills

2023.03.15

At AOTH, we see Getchell Gold Corp. (CSE:GTCH, OTCQB:GGLDF) as an excellent value play in a rising gold price environment characterized by central bank buying and tighter supplies due to depleted gold reserves and a lack of new discoveries. Gold majors wanting to grow their reserves without incurring large capital expenditures are hunting for cheap gold in the ground. Getchell Gold has 2 million ounces in Nevada and the outer limits of the deposit have yet to be encountered by drilling.

Below are 10 great reasons why buying shares in Getchell, and its Fondaway Canyon project, is a great way to leverage a rising gold price.

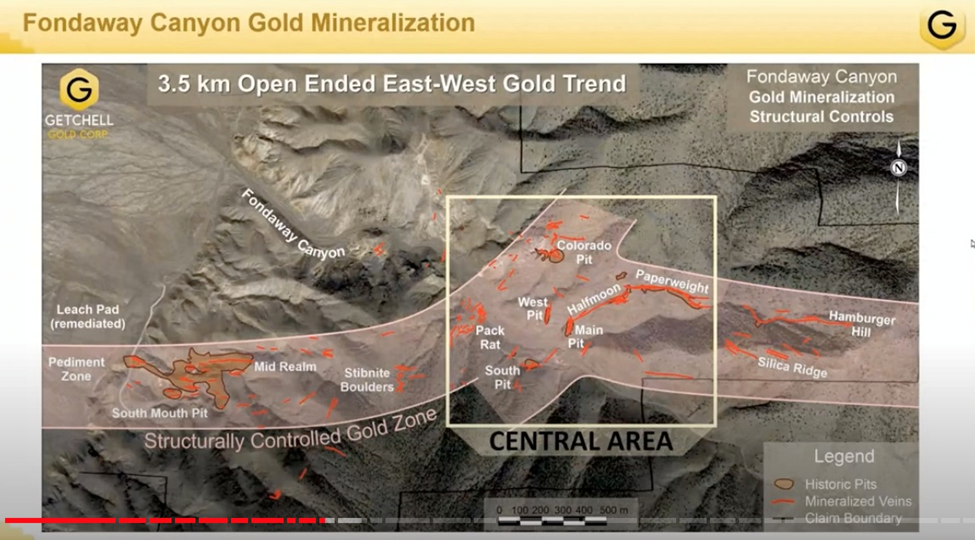

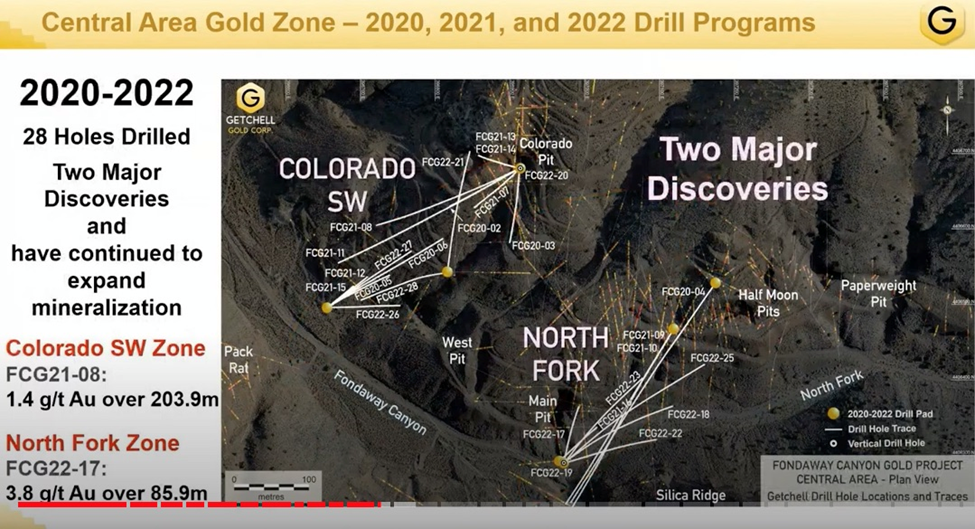

1: Consistent mineralization over three years of drilling. Out of 18 holes drilled, Getchell has yet to miss! The company has been focusing on the Central Area of a 3.5 km east-west gold trend. This is Fondaway Canyon’s nexus of gold mineralization, with the structures providing not only pathways but traps for gold. Getchell has delineated quite a bit of gold in the ground, but they are really only just getting started.

Getchell Gold, a case study of “gold in the ground”

Acquiring the property in 2020, Getchell spent about six months delving into the history of the operation. There was 40 years of surficial, small-scale mining, and multiple drill campaigns focused mainly on the shallow oxide deposits scattered throughout the 3.5 km-long trend.

Getchell identified two priority areas to start with, shown as ellipses on the map below. As they started to drill, Getchell kept hitting gold, and continued to hit gold mineralization in step-out holes.

“We’ve still been restricted to those two areas as you can see here by our drill traces, but we found incredible bodies of mineralization, excellent grade consistency and thicknesses and it culminated in a resource estimate that we released at the end of last year. So this is a fairly recent event for us and it stamps a point in time of what we’ve accomplished. We basically doubled the historic resource with 18 drill holes,” says Getchell Gold’s President Mike Sieb in a recent video presentation.

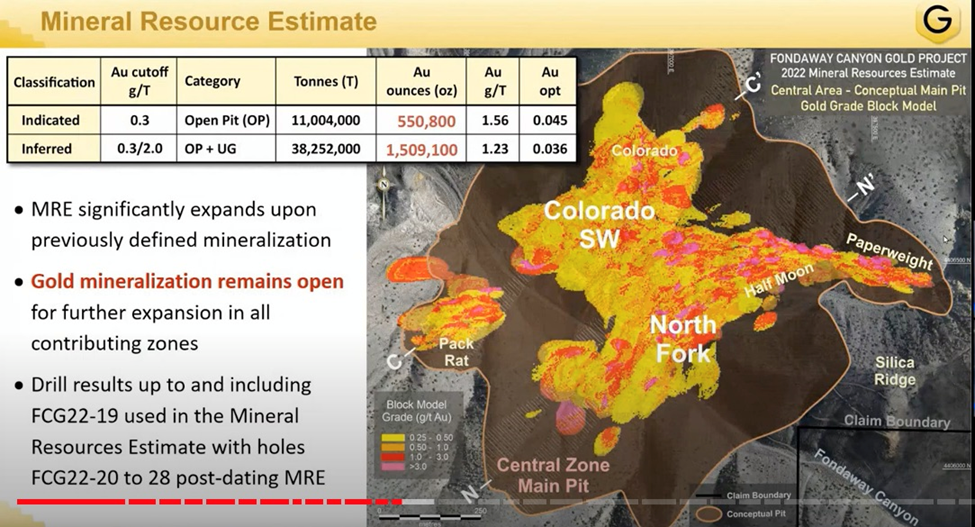

2. Large new mineral resource estimate doubles previously RE. The mineralization is at surface for an open-pit model with good grades.

The RE demarcated 550,000 indicated ounces at an excellent 1.5 grams per tonne gold grade, and 1.5 million ounces in the inferred category.

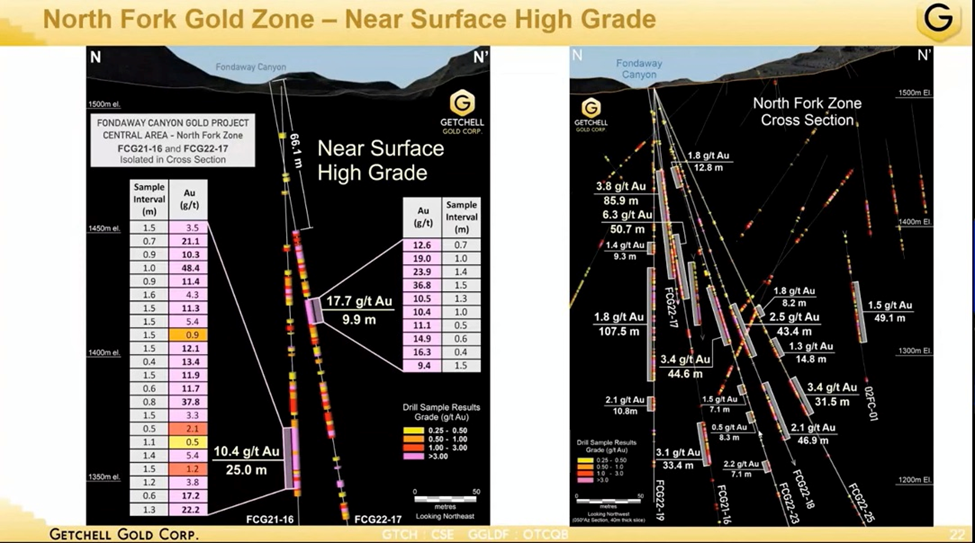

On the right of the slide above you can see the body of mineralization that’s highlighted by the grade, and there are some excellent zones, high-grade conduits that have good continuity to them near surface.

“It’s an incredible boon, the breadth of the mineralization starts at surface and it’s wonderfully shallowly dipping as well, so if there was ever a body of mineralization that is amenable to an open-pit mine model, this is it,” Sieb says.

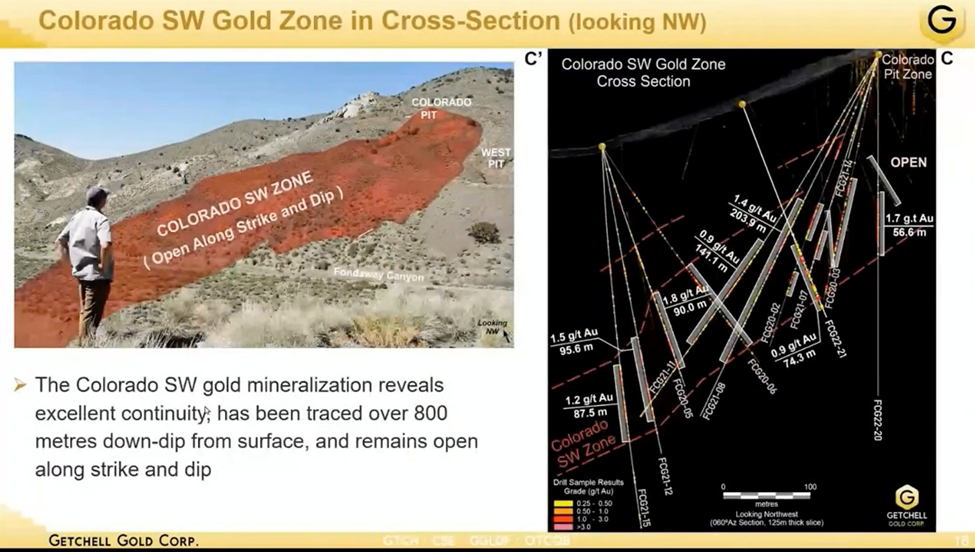

3. Gold mineralization remains open for expansion, leaving the question, “How big can this be?”

The two main zones Getchell has been concentrating on, seen on the map above, are Colorado SW and North Fork. What is incredible is how much GTCH has accomplished with so little, and how much lies ahead for the company.

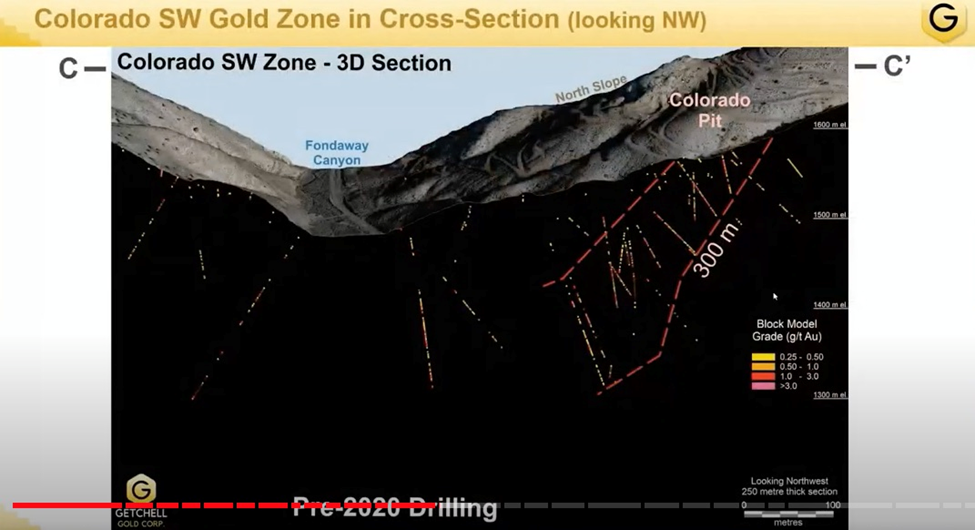

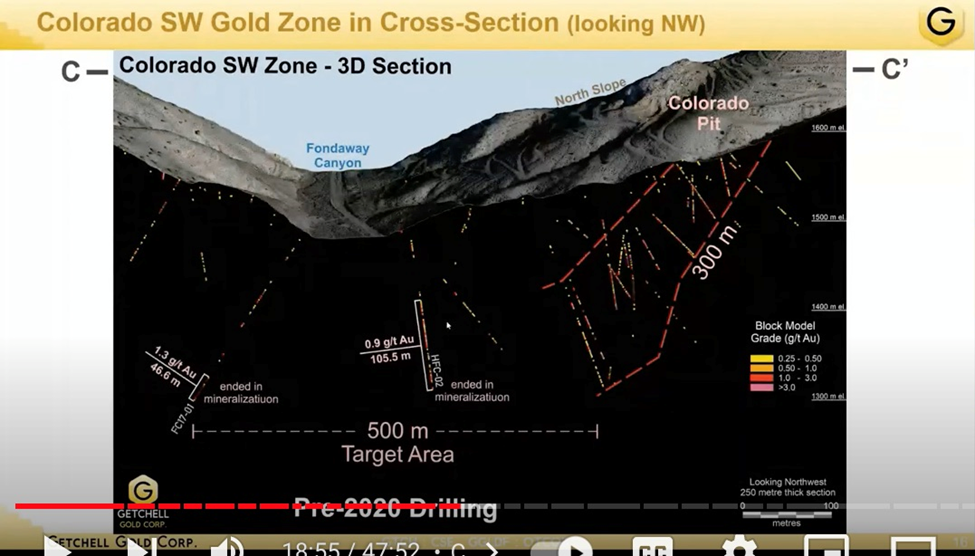

Below is what the Colorado SW section looked like when Getchell acquired the project in 2020. The majority of drilling is seen under the words “Colorado Pit”. It runs for a 300-meter extent.

Highlighted in the next slide are two drill holes. HFC-02, drilled in 1985, intersected about one gram over 100 meters, which is a fairly significant intercept. Another 300 meters along on this section there was a hole drilled in 2017 that went past its target zone and ended in mineralization 1.3 grams over 46.6m. “When we looked at the section we targeted this 500-meter stretch that was sort of ripe for discovery and it definitely didn’t fail us,” says Sieb.

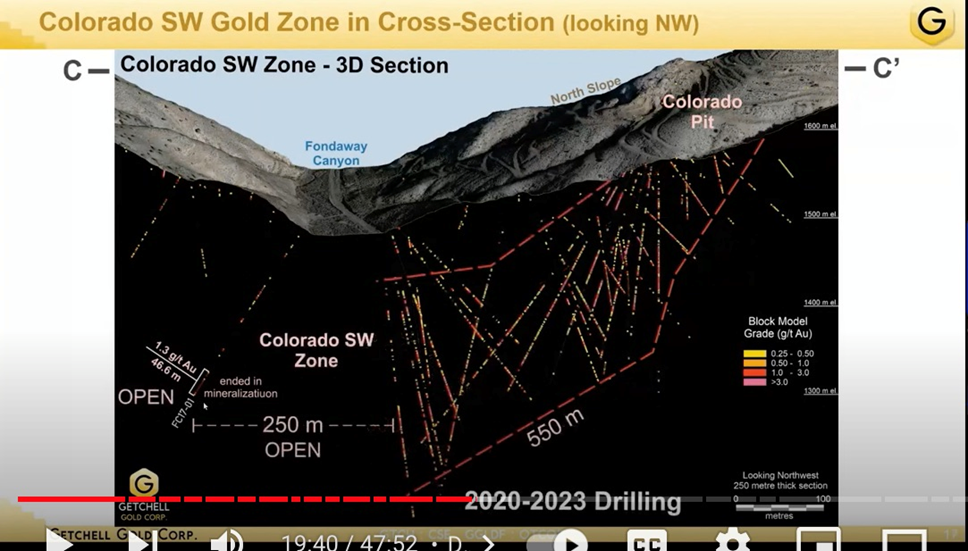

The next slide shows what Getchell’s drill pattern at Colorado SW looks like today.

Sieb continues: “This is a marked difference from what it looked like it in 2020. We’ve increased not only the length of the mineralisation from surface but also the thickness as well, right now we’ve modeled an extent about 550 to 600 meters down dip, the mineralization is still continuing on strong. Our last drill hole hit close to 90 meters of solid mineralization and as you can see here we’ve only walked halfway through our original 500m target zone, that one 2017 drill hole that ended in mineralization is still another 250 meters away so if there is one section that really speaks to the potential or the completely untested, untapped potential at Fondaway Canyon it’s this slide right here.”

Along the way, Getchell has hit some excellent grades, including 200 meters of 1.4 g/t in hole FC021-18. “These are excellent drill intercepts, excellent great consistency and it speaks to not only the potential of the project, but also it inherently adds to the confidence in the robustness of the existing resource model,” according to Sieb.

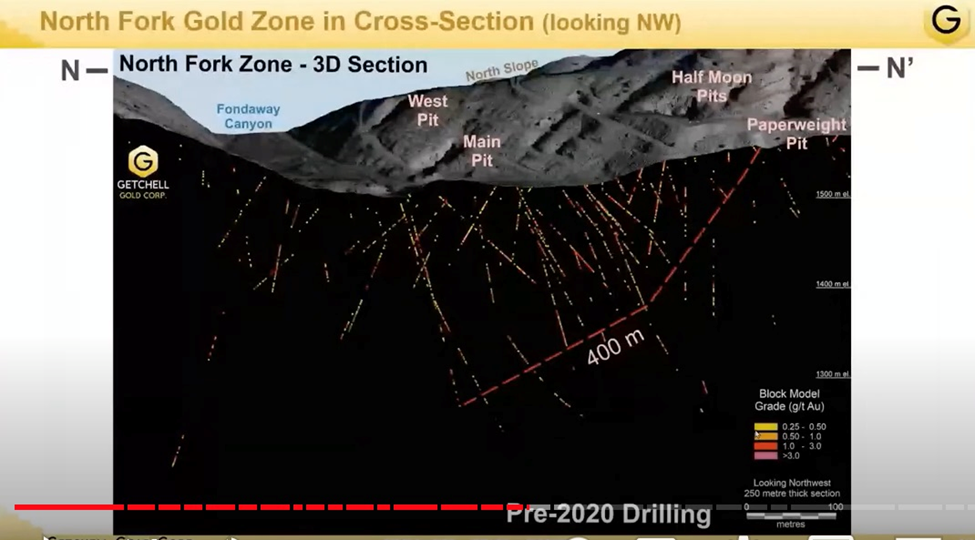

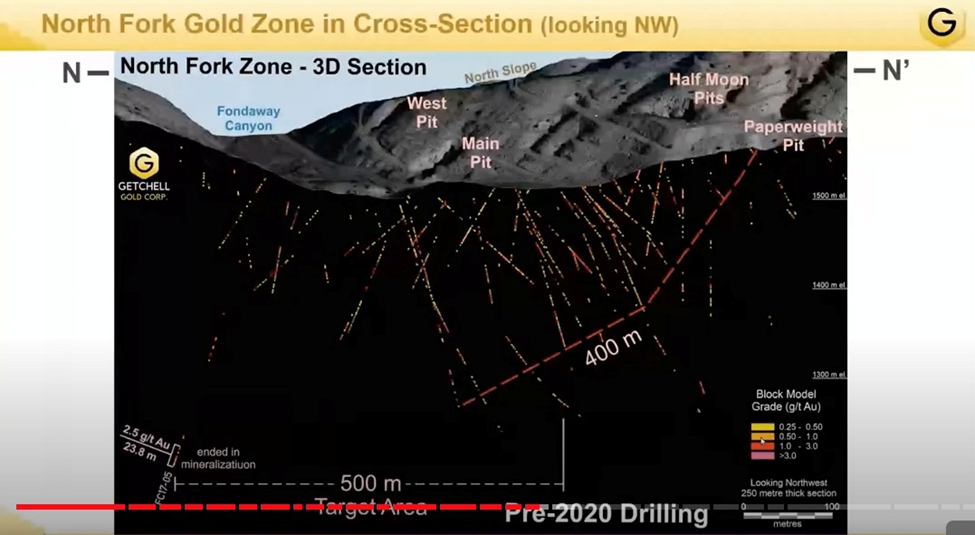

Moving 300 meters southeast to the North Fork section, the slide below shows what it looked like in 2020.

The previous operators were following the high-grade Half Moon shear vein, to a greater extent 400 meters but like at Colorado SW, it was only the top 300 meters that had any real density of drilling — it was still wide open, so Getchell again targeted a 500-meter target area that they anticipated would be a potential discovery zone.

At the far left of the slide there is a drill hole drilled in 2017 that once again hit excellent mineralization at the bottom of the hole (still wide open) that graded 2.5 grams over 23.8 meters.

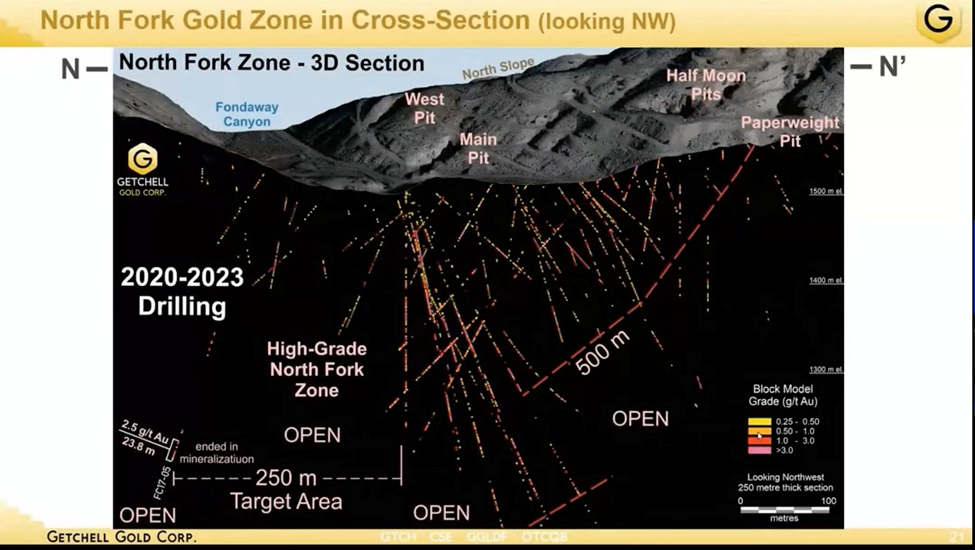

From 2020 to 2023, Getchell only drilled partway down its target zone, when they discovered the high-grade North Fork Zone.

“Again there’s 250 meters of open area down dip to the left, there’s that mineralization that was hit in 2017 and everything is still wide open, the mineralization is getting broader, we’re finding higher-grade mineralization, we hit some of the best intercepts in the 40-year history of the project in our drill programs in 2021 and 2022, so it really speaks to not only what we’ve done with just 18 drill holes, we’ve doubled the historic resource but we’ve only just started and these two slides highlight the high grades we’re seeing here,” Sieb says.

Besides having ounces in the ground, the high-grade component adds to the potential economics of the project. The slide below shows some of the grades and drill intercepts within 60 or 70 meters from surface. “These are spectacular on any scale not just Nevada and so that’s what Fondaway Canyon provides, is an extremely robust existing resource with completely untapped potential.”

4. US President signs landmark act. Sieb says a major boon to Getchell’s operation is a piece of legislation signed at the end of 2022 by President Biden. “What it does is it actually releases a land freeze on the neighboring area around our property ,and so that opens up our ability to grow almost as much as we can now, it’s unfettered.”

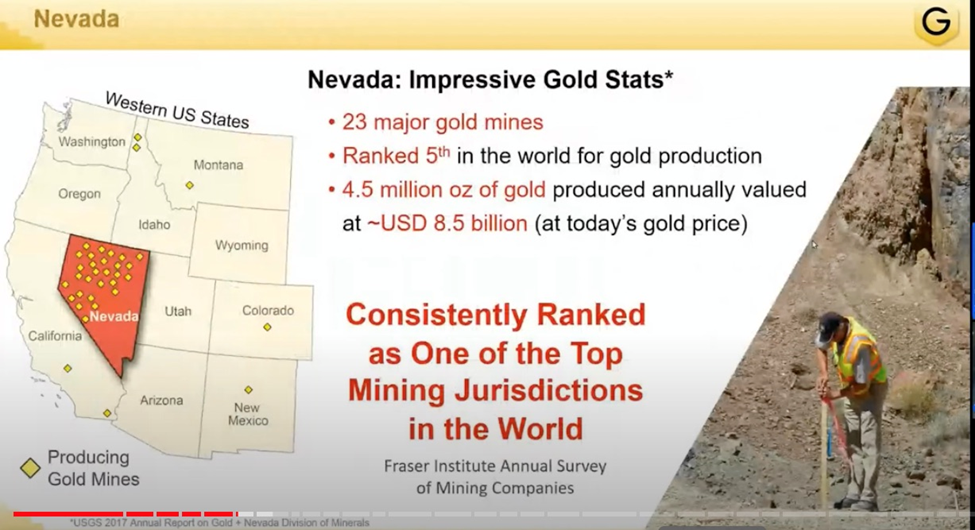

5. Advanced-stage project in Nevada, a premier mining region. With 160 years of gold mining that dates back to the Comstock Lode discovery in 1859, Nevada is one of the best jurisdictions to find gold.

Between 1835 and 2016, Nevada produced a phenomenal 158 million ounces. This is more than any other gold rush, including California’s, which extracted about $2 billion in precious metals from 1849-62, and the Comstock era, 1860 to 1875, which mined around 34Moz, according to research by The Nevada Sun.

The United States’ primary gold producer has an impressive geological endowment. According to the US Geological Survey, if Nevada were a country, it would be among the world’s top four producers. Nevada currently produces around 80% of all the gold in the United States.

The state is home to 23 active gold mines and is consistently ranked as one of the top mining jurisdictions in the world, providing confidence not only to companies advancing their projects, but also for investors in those companies. On an annual basis we are talking about 4.5 million oz of gold produced, worth some USD$8.5 billion.

Nevada rose to prominence in gold production in the late 1980s, but since then there has been a slow decrease in production. “Nevada knows this, the producers in Nevada know this, and so the stage is set for the acquisition of companies to bolster the depleting production in Nevada,” Sieb says, noting that “Getchell Gold Corp is right in the middle there amongst all the major players, we’re in the perfect spot, we are in the right place at the right time to really take advantage of what has been set forth in front of us.”

6. Gold has strong fundamentals, with a projected price increase. Below is a 20-year chart of the daily spot price. You can see we’ve come a long way at ~$1,900 dollars an ounce, and there are revised estimates that see gold going well beyond $2,000 through 2023 and 2024.

For example JP Morgan anticipates the average price of gold in Q4 is going to be USD$2,045. We’re seeing the gold price lag behind the market and its macro fundamentals. Sieb said he believes “there’s many things that are going to fall into place here over the next little while, that is really going to facilitate the continued increase in the price of gold, concluding “It’s a really good time to be invested in gold.”

Of course, I have my own opinions.

Last year, central banks purchased 1,136 tonnes — the most on record and a more than 150% increase from 2021. (Kitco News, March 2, 2023)

Gold would undoubtedly be higher if investors were treating it as a monetary metal — one to go to as a safe haven. We find perplexity in the fact that, with all that is going on in the world — four hot spots in 2023 are the war in Ukraine, Iran protests, US-China trade relations, and North Korea — there appears to be little safe-haven demand for gold.

Instead, investors are piling into the tried and true haven, US Treasuries. Government bond yields are up, the result of higher interest rates, and that is attracting a lot of foreign bondholders. According to the US Treasury Department, foreign residents increased their holdings of US Treasury bills by $44.1 billion in December.

That leaves only one other explanation for gold and silver strong performance amid a higher dollar, and that is the “float all boats” theory. I believe the general surge in commodity prices is also lifting up gold and silver, like a rising tide, even though they aren’t directly connected to electrification & decarbonization government funding, or infrastructure investments.

The link between commodities and inflation

If we do end up with a recession, or if one of four global hotspots (Ukraine, Iran, North Korea, US-China trade relations) heats up, look for gold to gain further on strengthened safe-haven demand.

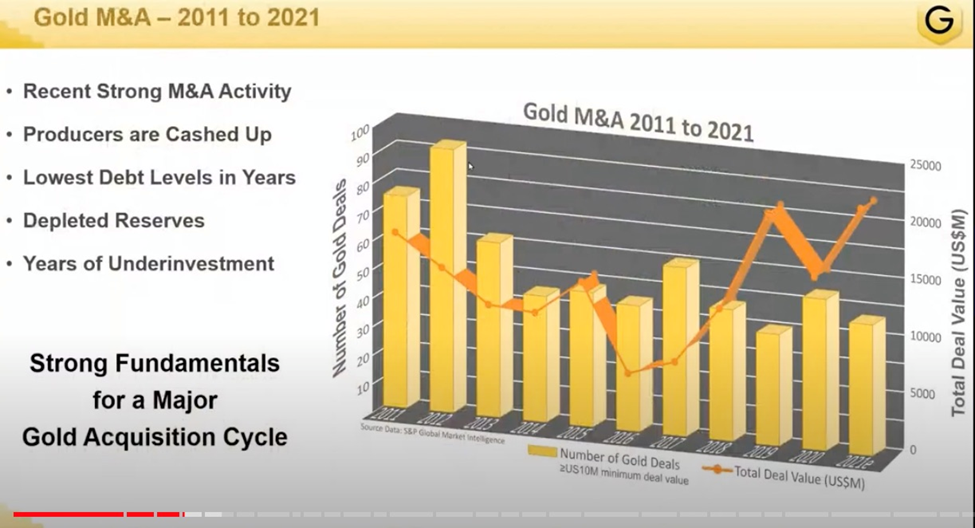

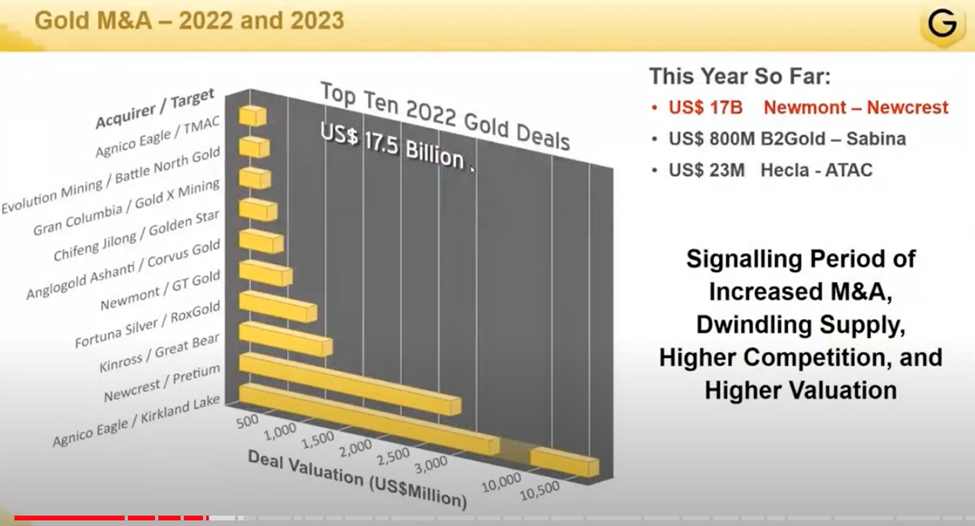

7. Protracted M&A cycle needed to address lower production and reserves. As we have seen in the news lately, we’ve entered a gold mergers and acquisition (M&A) cycle, with some of the big players realizing that they need more gold to bolster their reserves.

The slide below shows that starting in 2019, there has been a major uptick in gold M&A, with a large number of transactions as well as the total dollar value of the deals. In 2022, the top 10 gold deals equated to $17.5 billion, topping a record set in 2021. So far in 2023, the industry has seen close to $18B in acquisition offers, the most prominent being Newmont’s offer to buy Newcrest.

“I think you’re going to see a very strong increased valuation in gold companies that have the right assets andI strongly believe that Getchell Gold Corp is one of those companies,” says Sieb, leading into the eighth reason for considering Getchell as an investment:

8. Share price at attractive entry point. Sieb states: “Anybody who’s been following the market knows we are at a highly attractive entry point, we’ve increased the project valuation, the technical aspect of it, the gold in the ground over the last three years, we’re triple the company we were three years ago and so if you look at our share price relative to what we have and what’s going forward, I can’t sell this point enough that you should you should own Getchell.”

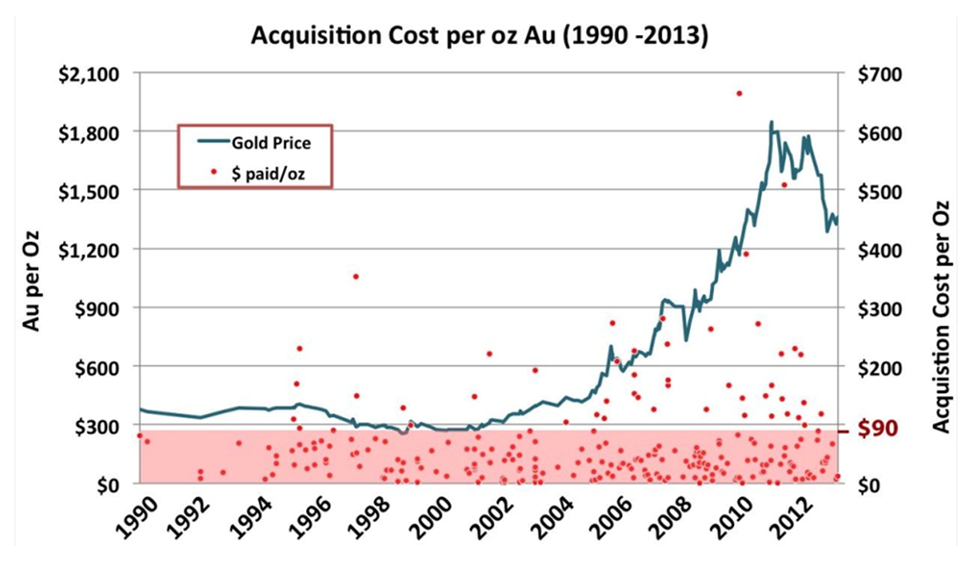

A Cipher Research Report published in 2015 examined a 24-year history of mergers and acquisitions to determine the real value of gold in the ground and to incorporate that value into their project and company valuation models.

Cipher determined that in the most basic terms, the value of a gold mineral project is equal to the number of ounces in the ground that will be potentially extracted times the value or price of an ounce in the ground.

Value = Quantity x Price

Cipher examined 253 transactions involving gold projects or companies owning a gold project, which were acquired from 1990 to 2013.

Getchell carried out three drill programs, in 2020, 2021 and 2022. The aim was to significantly upgrade the 2017 resource estimate into a new resource, that combined the drill results from all three drill programs.

The new resource estimate, released in November, nearly doubled the previous one, of 1.1 million ounces. It is 2 million ounces, including 550,000 ounces in the indicated category grading 1.56 grams per tonne, and 1.5Moz inferred, grading 1.23 g/t. There are nine holes that haven’t been included in the resource estimate because they missed the cut-off date, and Getchell plans to do a lot more drilling on it’s wide open deposit in 2023.

GTCH’s resource estimate is 2,058,900 oz gold. Cipher’s’s average price paid for an oz of gold in the ground, 1990-2013, was USD$63.

$63 x 2,058,900 = USD$129M / 122 million shares outstanding, fully diluted = USD$1.06/ Cdn$1.46 per share. As of Wednesday morning, March 15th, the market valued Getchell at just Cdn$0.30 cents a share.

Cipher’s brilliant report is outdated in two areas. First, resource nationalism is now much much worse than from 1990-2013, covered in their report. Imo, an oz of gold in Nevada is worth more than say in Burkino Faso. Second, again over the years this report was concerned about, gold’s average price was not, for the most part, anywhere near what it’s been trading for the past 10 years.

9 and 10. Active 2023 exploration program planned/ PEA next milestone. Preparations for a much larger 2023 drill program than those previously are underway. Results should be generated throughout the year. According to Sieb, “this year we’re going to continue to drill heavy and work ourselves towards a preliminary economic assessment by the start of next year. That will really start to add the kind of economics to the equation, which everything that you’ve seen here provides in a very positive light. Our ultimate goal is to take the Fondaway Canyon gold project and build it into a Tier 1 asset in a Tier 1 mining jurisdiction.”

Over the past three years Getchell Gold has increased the mineralization substantially, decreased risk significantly and demonstrated that there is a lot of upside left to grow the resource at its Fondaway Canyon project.

In a rising gold price environment, ripe with M&A, and characterized by central bank buying, tighter supplies due to depleted gold reserves and a lack of new discoveries AOTH sees Getchell Goldas an excellent value play

Getchell Gold Corp.

CSE:GTCH, OTCQB:GGLDF

Cdn$0.30, 2023.03.14

Shares Outstanding 105m

Market cap Cdn$31.8m

GTCH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Getchell Gold Corp. (CSE:GTCH). GTCH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.