Getchell Gold: A rare find

A junior resource company’s place in the mining food chain is to acquire projects, make discoveries and advance them to the point when a larger mining company either buys the much de-risked project, or takes the junior over. Understand that today’s junior resource companies own most of the projects that are tomorrow’s mines.

Discoveries won’t be made if junior exploration companies aren’t out in the bush turning over rocks.

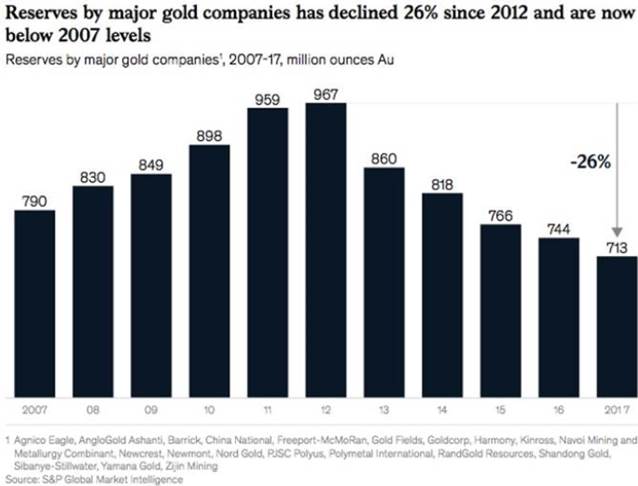

It used to be that major gold companies had large budgets with which to conduct exploration to replace and expand their reserves. After the gold market crash in 2012, austerity programs demanded cuts to exploration budgets. As an industry, annual budgets went from $10.5 billion in 2012 to just $3.2B in 2016.

“The effect of this reduced spend and limited scope meant that mining companies were barely able to replace produced ounces while converting nearby resources to reserves,” a recent report from McKinsey & Co. states.

Moreover, the majors shifted their attention to brownfield projects (past producers) from more risky greenfields (undeveloped projects), leaving that to the gold juniors – those that could find funding.

Less juniors, fewer discoveries

Passing on the responsibility for greenfield exploration to the juniors would have been fine if the money pipeline to these companies kept flowing.

But junior mining financing has pretty much dried up. Between 2017 and 2018, bought-deal financings, whereby investment banks buy chunks of shares from juniors – have slumped 40%.

Diminished funding to the juniors has resulted in a culling of the herd, so to speak. The number of mining company listings has dropped considerably over the past few years on the materials-centric Toronto Stock Exchange (TSX) and its sister TSX Venture Exchange. Whereas in the first half of 2012, there were 1,673 companies listed, by H2 2018 they had dropped to 1,136 – a decrease of 484.

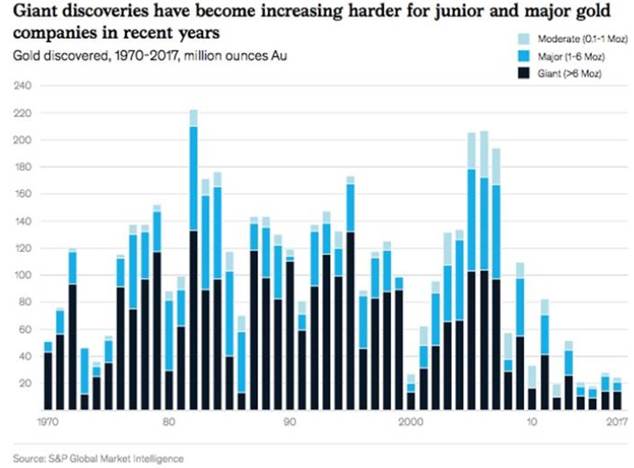

Less companies out there exploring, means fewer discoveries.

According to McKinsey, in the 1970s, ‘80s and ‘90s, the gold industry found at least one +50Moz gold deposit and at least ten +30Moz deposits. Since 2000, no deposits of this size have been found, and very few 15Moz deposits.

It used to be that gold majors wouldn’t even take a sniff at properties that could not deliver 5 million ounces; these days, a 1-million-ounce deposit would likely interest companies like Newmont Goldcorp, AngloGold Ashanti and Barrick, who are all trying to find new deposits to replace reserves at their mines which, some having been worked for decades, are becoming depleted.

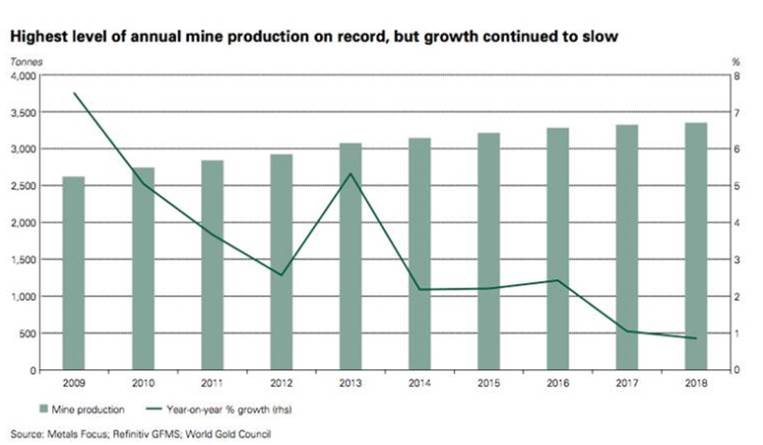

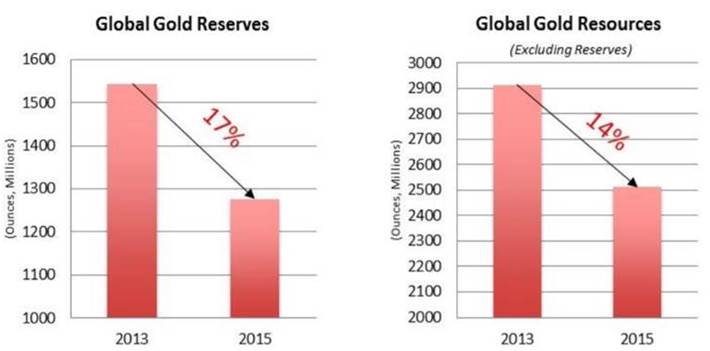

It’s a problem world-wide. Global gold reserves in 2016 were 34% below their 2011 level, having declined for five years straight.

At that rate of depletion, and without meaningful discoveries, reserves and production will continue to drop. In fact, gold production is expected to peak in 2019, followed by a steady decline.

The low rate of discovery along with drastically less capital to put towards exploration, has left the industry with a weak pipeline of development projects. Of these future mines, many are lower grade than previous discoveries. In 2016 the average reserve grade for 266 primary gold mines (ie. no co/ by-product metals) was 1.47 grams per tonne, compared to 1.02 g/t for 310 undeveloped deposits.

Potentially less viable than high-grade operations, these future lower-grade mines will contribute less to global gold production, requiring more discoveries. And there’s another problem: It is taking longer, much longer, to commission greenfield mines. While it used to take 12 years to bring a new discovery to production a decade ago, today it will be 20 years. Some mines in sensitive jurisdictions, requiring copious environmental studies and special interest group sign-offs, could soon take up to 30 years! That’s unacceptable.

Canadian resource extraction

The mining industry in Canada was dealt a major blow this week with the election of a minority government. The Liberals may have won the most seats, but they will rely on the NDP and the Greens for passing legislation, and commanding the confidence of the House of Commons.

With only one party supporting mining, the pro-resource extraction Conservatives, it’s hard to imagine any real progress being made, in making the Canadian mining industry more competitive, attracting capital to the space, or building new mines.

Before the last government was dissolved for the election, it passed Bill C-69. Dubbed the “Pipeline Killer” by Andrew Scheer and Jason Kenney, Bill C-69 broadens the scope of the environmental assessment process and adds more consultation with the public and particularly indigenous groups. The legislation introduces a whole new level of uncertainty to the environmental review process that is critical to the passage of a mining project.

Mining is so capital-intensive, investors need a great deal of certainty that their money will be safe and offer good returns for years, often decades, from exploration to production to mine closure. Uncertainty keeps capital away, delays add costs to already hugely expensive construction plans.

C-69 is bad for the industry. But it could get worse. The NDP’s platform would go even further down the rabbit-hole of endless consultation with special interest groups that have little interest in “getting to yes” on a mining proposal.

Mining-friendly Nevada

That’s a real shame, because we at Ahead of the Herd are predicting a tidal wave of capital returning to junior mining. Some of it could go to Canada, but probably won’t now. After years of under-investment, interest in the juniors is picking up, encouraged by a series of stepped rises in the gold price since 2016. In the past three months the precious metal has never sunk below $1,400/oz, and in fact has spent much of it’s time above $1,500.

Among the reasons to believe in continued gold price support, are low interest rates, the return of monetary easing, and negative real bond yields.

History has consistently shown that the best leverage against a rising gold price is to invest in junior explorers, who own the world’s future gold mines.

We usually like Canada as a mining destination but new money into the sector might be taking a close look at Nevada.

With 160 years of gold mining that dates back to the Comstock Lode in 1859, Nevada has been, and still is, one of the best jurisdictions to find gold.

Between 1835 and 2016, Nevada produced a phenomenal 158 million ounces. This is more than any other gold rush, including California’s, which extracted about $2 billion in precious metals from 1849-62, and the Comstock era, 1860 to 1875, which mined around 34 Moz, according to research by The Nevada Sun.

Nevada currently produces roughly 80% of all the gold mined in the United States. If it were a country, the state would be among the world’s top four gold producers.

But it’s not just production that should put Nevada on the radar screens of every precious metals investor.

In the Fraser Institute’s latest (2018) survey, Nevada was ranked number 1, as the most attractive jurisdiction for mining investment.

Among the reasons for retaining its competitive edge, are Nevada’s lack of income tax, environmental laws are well-defined, mining is governed under the federal Mining Act of 1872, which would take an act of Congress to change, and that mining taxes are set out in the state’s Constitution. They can’t be changed willy-nilly.

All of the above are so important not only for limiting an exploration company’s cash burn rate, but also preserving a project’s economics. Consider – in most countries it could take decades to move from discovery to drill, do a resource estimate, consultations, a PEA, a PFS, more consultations, a feasibility study and get environmental approvals, mining permit etc. The years from initial discovery to actual mining start can, in many places, be counted in decades. The delay throws off the economics, making your projects stated net present value (NPV) and internal rate of return (IRR) pretty much irrelevant.

Nevada also offers excellent infrastructure, a skilled workforce and relatively easy access to mine sites from main roads.

Major interest, money flowing

When Barrick Gold went looking for areas thought to be prospective for adding ounces to replenish its dwindling reserves, it went straight to Nevada.

In July Newmont and Barrick established a new joint venture partnership, Nevada Gold Mines LLC, 61.5% owned and operated by Barrick, and 38.5% belonging to the newly merged Newmont Goldcorp. The JV makes Nevada Gold Mines the largest producing gold complex on Earth. Its northeastern Nevada assets include 10 underground and 12 open-pit mines, plus autoclave, roasting and heap leach facilities that in 2018 produced 4.1 million gold ounces – double that of the next largest gold mine, Muruntau in Uzbekistan.

Nevada Gold Mines 2018 Reserve and Resource Base:

Proven & Probable reserves 48.3Moz @ 2.3g/t

Measured & Indicated resources 27.4Moz @ 2.2g/t

Inferred resources 7.5Moz @ 3.1g/t

It didn’t take long for Nevada Gold Mines to find exploration success. In September Barrick hit a discovery hole just north of its Fourmile project. The new orebody increases the strike length of the Goldrush-Fourmile trend to 6 kilometers, and opens the potential for adding one more Tier 1 asset to the three already wrapped into the Nevada Gold Mines partnership – Goldstrike/Carlin, Cortez and Turquoise Ridge/Twin Creeks – by combining Fourmile with the nearby Goldrush development. Read the news release.

The creation of Nevada Gold Mines has piqued the interest of other companies looking to discover and develop new ounces in the golden state.

Some are jumping in with both feet. Take AngloGold Ashanti. The South African gold company plans to drill the Silicon project it optioned from RenGold in 2017, located in the Bare Mountain mining district. Its CEO, Kevin Dushnisky, described Silicon as “a very interesting deposit” during a Bloomberg interview, and “the base of Anglo’s increasing presence in North America.”

Dushnisky added that Anglo is open to joint venture partnerships, including with the two main players in Nevada, Barrick and Newmont.

“Since I’ve taken the role at AngloAshanti I’ve had a lot of inbounds [calls from industry peers] to discuss that particular asset so there will be a lot of interest at the right point in time,” he told the Bloomberg interviewer.

This past August, Anglo stepped up with a $1.3 million private placement for Nevada-focused junior Corvus Gold. The company with 21 operations on four continents didn’t mind paying a $2.60/share premium for Corvus to put towards its Motherlode and North Bullfrog properties.

Coeur Mining has also stepped into Nevada through the acquisition of Northern Empire Resources and its Sterling project. The United States’ largest silver producer had encouraging drill results from areas near the past-producing Sterling mine and Daisy zone, including 21 meters at 6.1 grams per tonne gold.

A third major gold miner, Kinross, has a large land package on the western edge of AngloGold Ashanti’s Rhyolite project from which it plans to drill epithermal targets. The Toronto-based firm made a huge investment in Nevada in 2015, when it acquired the Bald Mountain and Round Mountain mines from Barrick, for a substantial $610 million in cash.

Getchell Gold

We’ve had Getchell Gold (CSE:GTCH) on our list of quality juniors with excellent projects, undervalued and ripe for investment, but felt it wasn’t quite ready. That all changed when I read the October 17 news release.

The Toronto-based company announced an option agreement with Canarc Resources (TSX:CCM) to acquire two Nevada properties:

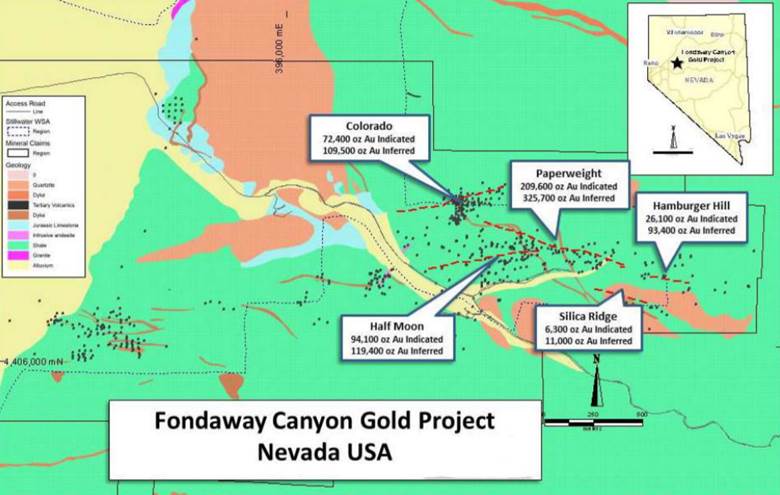

Fondaway Canyon and Dixie Comstock. Both have historical resource estimates – which immediately puts GTCH head and shoulders above the hundreds of juniors out there trying to build a resource. It’s already got two. Plus, Fondaway Canyon is high grade, close to surface, and open in at least two directions with excellent upside exploration potential. That, my friends, is very rare in Nevada, which usually hosts low-grade disseminated gold that takes a heck of a lot of drilling to shore up a resource.

The news release gives further details on Fondaway Canyon and Dixie Comstock. A 2017 technical report denotes a historical estimate at Fondaway Canyon of 409,000 indicated resources, and 660,000 oz inferred, grading 6.18 grams per tonne.

Metal price for the Mineral Resource estimates was $1,225 per ounce Au, the trailing three year average on December 31, 2016. The minimum reporting cut-off was 0.10 opt Au (3.43 g/t), over a minimum horizontal width of 6 ft (1.8m). Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability.

According to Getchell, “The Fondaway Canyon mineralization is contained in a series of 12 steeply dipping en-echelon quartz- sulphide shears outcropping at surface and extending laterally over 1200 m, with drill proven depth extensions to > 400 m. The deposit is hosted by Mesozoic age sediments and minor volcanics and is classified as “orogenic”, ranging from mesothermal to epithermal in depositional environment. Mineralization is hosted within shears.”

The property’s database contains the records of 591 holes totaling just over 49,000 meters of drilling.

“The broad zones of mineralization intersected in the drilling program extend mineralized zones to depth and along strike and, together with previous exploration results, define bulk tonnage mineralization that may be amenable to open pit mining. Previous efforts in the district focused on the underground mining potential of the district by exploring narrow high-grade zones” states Canarc Resources’ December, 2017 news release.

In addition to drilling, surface sampling, underground channel sampling, geological mapping and geophysical surveys have also been done at Fondaway Canyon.

The potential gold mine is open along strike, and at depth, and has expansion potential along a one-mile corridor to the South Mouth Zone which was previously surface-mined. Detailed rock and soil geochemistry were also completed.

According to the technical report;

The South Mouth zone, where mining excavated the shallow oxide mineralization, has not been explored sufficiently to quantify the down dip extension of the sulfide mineralization to depth.

2002 NCI drilling intercepted mineralized zones with two holes drilled in the pediment west of the South Mouth pit. These results should be followed up with additional drilling to determine if a bulk tonnage, disseminated gold deposit exists in that area, or if there are potentially offset extensions of the Fondaway Canyon vein systems associated with mineralization at the South Mouth pit.

Metallurgy

From the Technical Report; “There is significant metallurgical testing completed recently and historically (including sizeable underground bulk sampling). The 2016 metallurgical testing provided confidence that the mineralized material tested to date can be treated appropriately to concentrate 79-85% of the gold in less than 10% weight percent via flotation processes. Test results indicate that additional gold might be recovered by incorporating a gravity circuit, and also through treatment of the tails with conventional cyanidation methods. Further testing is recommended to find the most cost-effective process for future mining.”

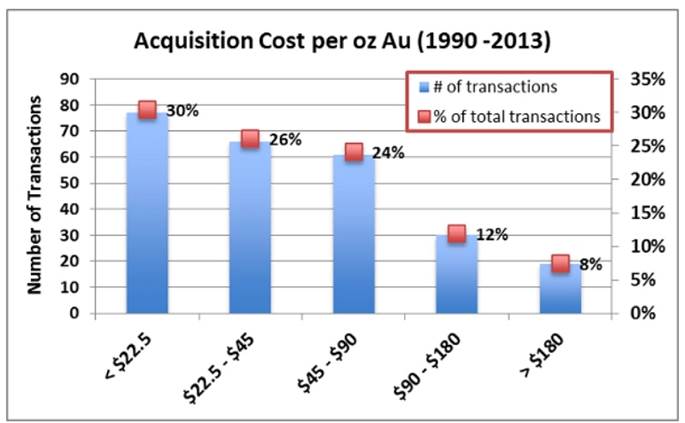

The deal that Getchell Gold cut with Canarc Resources for Fondaway Canyon offers excellent value for GTCH shareholders. For US$2 million in cash and US$2 million in shares, Getchell Gold gets the option to acquire a 1.1-million-ounce resource for a fraction of the cost of drilling – US$4 per ounce of gold in the ground, compared with a median acquisition cost of $39/oz, based on 253 acquisition transactions over a 13-year period.

In my opinion the close to surface high-grade nature of Fondaway Canyon’s resource, plus the starting ratio of indicated to inferred, may attract a market premium. It’s also reasonable to believe that GTCH would have an easier time converting inferred resources to indicated, and indicated to measured, with a 6 g/t deposit compared to say, current producing mines sporting a global average gold grade of 1.47 g/t, or the average global waiting to be developed deposit having a 1.02 g/t gold grade.

Consider too that at the current exchange rate, a mine would earn CAD$2,000/oz – a hefty revenue kicker for a Canadian company. Existing roads provide easy access onto the Fondaway Canyon property, there are existing wells on the property and water is available for mining use under the lease agreement.

AOTH cautions readers that Getchell Gold still needs to do normal due diligence, as any company would have to do – ie. geology, tenure and metallurgy – when acquiring a property. I expect the deal with Canarc to close in December, however it might bleed over into January 2020 because of holidays.

At Dixie Comstock, there is some evidence of historical mining, but no production records. The deposit is characterized as a low-sulfidation, epithermal system that runs along an east-dipping fault.

As for Getchell Gold’s other properties, Hot Springs Peak is the most interesting.

Located 55 km from the town of Winnemucca, the project is within the highly mineralized Northern Nevada Rift and close to the Sleeper and Spring Valley deposits, and the Florida Canyon, Relief Canyon and Rochester mines.

Among the area’s historical production, Barrick’s Goldstrike mine in the Carlin Trend produced 795,664 oz in 2018 (open pit + underground), the Sleeper mine cranked out 1.66Moz gold and 2.3Moz silver over a 10-year period, and the Getchell gold mine had an output of 2.5Moz gold and 26Moz silver.

As for Getchell Gold’s other properties, Hot Springs Peak and Star Point are the most interesting.

Star Point

Star Point is one of three mineralized targets, along with Star South and HS Canyon, that comprise Getchell Gold’s Buena Vista Project, located on the western edge of the highly mineralized Northern Nevada Rift. The three areas occur along the thrust fault boundary separating two plates.

Results of the first phase of a four-hole drill program were published on Jan. 21, 2019, based on earlier exploration including mapping-sampling, airborne magnetic and ground IP-Resistivity surveys. The past-producing Star Point copper-gold prospect is about 25 kilometers from Newmont Goldcorp’s Phoenix copper-gold mine, which contains 14 million gold-equivalent ounces.

The historic, near surface-mining operation at Star Point is believed to contain copper-sulfide mineralization based on an IP-Resistivity survey that returned chargeability and resistivity highs, possibly intrusion-related. Getchell Gold is centering its drill-testing at the mine shaft; the plan is to penetrate into the magnetically defined intrusion – an area of high chargeability and conductivity. The sulfide target within the intrusion sits below surface copper oxide deposits, that were mined from quartzite, chert and phyllite host rocks.

Hot Springs

Located 55 km from the town of Winnemucca, Hot Springs Peak is within the Northern Nevada Rift and close to the Sleeper and Spring Valley deposits, and the Florida Canyon, Relief Canyon and Rochester mines.

Among the area’s historical production, Barrick’s Goldstrike mine in the Carlin Trend produced 795,664 oz in 2018 (open pit + underground), the Sleeper mine cranked out 1.66Moz gold and 2.3Moz silver over a 10-year period, and the Getchell gold mine had an output of 2.5Moz gold and 26Moz silver.

At Hot Springs Peak, Getchell completed an IP survey and drilled four reverse-circulation holes totaling 3,350m in December 2018. The early-stage project is described as a “Carlin-style” alteration system.

Conclusion

Mines are built not found. Exploration is a hunt for minerals. If it was as easy as flying a helicopter survey, taking a few soil samples, and then punching in some corresponding holes, everyone would be successful at it. But it doesn’t work that way, the earth guards her secrets closely.

It’s geo-chemical and geo-physical studies combined with ground-based, direct observation, what geologists see with boots and hammers, essentially old-fashioned picking and turning over rocks, that leads to a successful drill program. A good lesson for gold explorers is that while “the truth machine” (drill) reveals all, in-the-field exploration, and proper interpretation of results makes for a successful exploration program. All of this takes expertise, time and usually a lot of money. When you buy 1.1 million ozs of high grade gold in the ground, for $4.00 an ounce, you save a lot of time and money. But even than you still have to build your mine.

To recap, exploration companies and investors know Nevada is the place to go for gold. Buying the shares of a producer is purchasing expensive gold. Getchell Gold has managed to consolidate an outstanding property for a fraction of the cost of drilling – just US$4 per ounce compared to a peer median $39/oz.

The Fondaway Canyon project already has a resource of 1.1 million ounces in indicated/ inferred categories, allowing Getchell to skip the time-consuming and expensive process of building, and drilling, a resource from scratch. The deposit is close to surface, with a high-grade 6.1 grams per tonne – virtually unheard of in the normally low-grade, disseminated gold fields of Nevada. However there is still work to be done.

A mapping and modelling work program might also include various air/ ground surveys and RC/ core drilling for integration into a three-dimensional structural model of the mineralization. This model will enable more precisely targeted drilling to expand, and upgrade, existing estimated resources along strike and down dip. The updated model will also identify additional exploration targets westward through the Packrat – Mid Realm area, to South Mouth and under the western pediment anomalies. Getchell Gold’s Buena Vista and Hot Springs Peak projects provide additional upside from possible exploration success.

The industry is consolidating and pretty soon the majors are going to need to look at buying out juniors to bulk up their reserves. When they do, I see Nevada as excellent acquisition territory and Getchell Gold as a definite target.

Richard (Rick) Mills

subscribe to my free newsletter

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions.

Richard does not own shares of Getchell Gold (CSE:GTCH) and GTCH is not an advertiser on his site. That could change.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.