Getchell Gold: a Nevada junior miner to watch in the current gold bull cycle – Richard Mills

2023.07.06

As Getchell Gold Corp. (CSE: GTCH) (OTCQB: GGLDF) continues to work its way through the Fondaway Canyon exploration program with the aim of adding more gold resources, the company recently announced several key partnerships to elevate the profile of its flagship project in Nevada.

Specifically, Getchell has engaged Blue Summit Ventures as its social media marketing partner, appointed Fairfax Partners as corporate development consultants, and named Daniel Southan-Dwyer as vice president of corporate development.

Blue Summit is a social media marketing agency based in Toronto. It will oversee Getchell’s social media campaigns, harnessing the power of various platforms to raise awareness of Getchell, engage with stakeholders, and communicate the company’s ongoing advancements in the mineral exploration sector.

Fairfax Partners, a renowned consulting firm specializing in corporate development and growth strategies, was selected by Getchell to provide their expertise in managing corporate development initiatives. With a strong track record of assisting companies in achieving sustainable growth, Fairfax will play a pivotal role in shaping the company’s long-term strategic vision and continued development.

Southan-Dwyer, the new VP of corporate development, has an impressive background in corporate finance and business development. He brings a wealth of experience to the company and his expertise in identifying strategic opportunities, executing partnerships, and driving growth initiatives will be instrumental in strengthening Getchell’s position within the industry.

“These strategic moves align with our commitment to expand our corporate development efforts and enhance our marketing capabilities. With their exceptional expertise, we are confident that we will achieve new milestones and unlock the full potential of Getchell Gold,” said Getchell’s president Mike Sieb.

The Fondaway Canyon Project

When Getchell was formed about four years ago, the company’s mandate was to source out a major flagship project, which eventually led to its acquisition of the Fondaway Canyon project in 2020.

Fondaway Canyon represents an advanced-stage gold property located in Churchill county, Nevada. The land package comprises 170 unpatented lode claims with history of previous surface exploration and mining in the late 1980s and early 1990s.

Multiple drill campaigns in the past were focused mainly on the shallow oxide deposits scattered throughout a 3.5 km long trend. While the previous operators found a lot of gold, they also missed quite a bit, which captured the imagination of Getchell’s management team.

“What really intrigued me is that there were all kinds of little hidden jewels that indicated that the mineralizing system at Fondaway Canyon was a lot bigger than what people realized,” Sieb said in a presentation earlier in the year.

After carrying out its own exploration, Getchell identified two priority areas to begin with (shown as ellipses on the map below). As they started to drill, Getchell kept hitting gold, and continued to hit mineralization in step-out holes. In its first year of exploration, the gold miner outlined three new gold zones: Colorado SW, North Fork and Juniper.

The early wide-spaced drilling demonstrated the presence of high-grade shear veins enveloped in thick bands of mineralization and extended the mineralization model a remarkable 800 meters down dip from surface.

Five drill holes hit substantive zones of mineralization, between 50 and 100 meters thick. The company kept drilling in 2021 and 2022, upping the scale and capitalizing on its discoveries.

At the end of 2021, Getchell made a new discovery: a very high-grade zone that was running 10 grams per tonne over 25 meters near surface.

Substantive mineralization in four holes was highlighted by hole FCG21-08, the most northwestern hole, intersecting the Colorado SW zone extending for over 200 meters down hole, and hole FCG21-10, intersecting the North Fork zone extending 82 meters down hole.

The latter interval, hosting the highest-grade gold intercept in the 40+ year drilling history at Fondaway Canyon, and reporting 47 g/t Au over 1.5m, is a prime example of the structures that promote the high-grade concentration of gold at the project.

Million Oz Resource

Drilling continued at Fondaway Canyon in 2022 to follow up on the high-grade discovery at North Fork. The broader drill plan was to continue expanding on the substantive zones of mineralization discovered during the previous two years of drilling.

Partway through the 2022 program, an open-pit model mineral resource estimate was commissioned and published (see below).

Eighteen drill holes doubled the previous resource from 2017, with 550,800 ounces of gold in the indicated category and an additional 1.5 million ounces inferred, all at comparatively excellent gold grades for active Nevada operations (1.56 g/t Au indicated, 1.23 g/t inferred).

Note, however, that this resource estimate is already out of date. There are nine holes that were excluded in the resource estimate because they missed the cut-off date, and Getchell plans to do a lot more drilling on its wide-open deposit in 2023.

Also worth noting is that Getchell hit mineralization in all 18 holes, which is almost unheard of in mineral exploration.

To date, the gold mineralization at Fondaway has been traced for a half a kilometer on surface and half a kilometer down dip. It remains open as the drilling has yet to encounter any limits, with the potential size and ultimate scale of the mineralization unknown.

2023 Exploration Plans

For Getchell, 2023 could well be another year of significant progress made on its Fondaway project.

The company is already working to expand its resource estimate through drilling. Preparations for a much larger drill program than previously are underway; a steady stream of results is expected throughout the second half and into next year.

Getchell plans to keep on expanding the mineralization, drawing it along strike and down dip, thus enlarging the conceptual open pit.

“We’ve been increasing the drill meterage into the ground from 2020 through 2022, and this year we’re targeting two drills turning all year long to continue to expand and increase the resources at Fondaway Canyon and also perform just enough infill drilling to take all that inferred and put it into the indicated category,” says Sieb.

The chief executive added the market can expect an updated resource estimate and the completion of Getchell’s next major milestone, a preliminary economic assessment (PEA), in the first half of 2024.

“We’re moving up the tiers of de-risking and adding confidence to the project as we go,” he said.

Expanded Drill Program

As part of the 2023 drill program, Getchell recently announced it is applying for an additional 12 drill pads.

“After three years of drilling and delineating a sizeable mineral resource 600 metres down dip from surface and 600 metres along strike, the gold mineralization remains fully open for further expansion. Exploration of these ample and very evident priority targets requires the company to permit more drill pads than previously anticipated based on the past three years’ drilling success,” Sieb stated in a May 24 news release, adding: “The 2023 drill program and drill hole sequencing will be finalized after permit approval is received.”

The company reiterated the fact that 18 of 27 holes drilled into the Central Area were responsible for doubling the 2017 resource, and that the remaining nine holes, completed in the latter part of 2022, didn’t make it into the resource estimate. These nine holes, says Getchell, “all intersected substantive mineralization, fully supporting the mineralizing model and attest to the upside potential and strength of the Fondaway Canyon gold project.”

The latter bodes well for an updated resource, expected in the first half of next year.

It is also important to emphasize that the current RE conceptualizes an open-pit mine model — much cheaper than mining underground — although the minor amount of contiguous mineralization currently extending beyond the open pit limits has been categorized for potential underground mining. Getchell’s plan is to expand the mineralization to grow the mineral resource and, in the process, support a larger open-pit model which can then convert the current underground mineral resources to open pit mineral resources.

Getchell expects the majority of inferred resources, currently sitting at 1.5 million ounces, could be upgraded to indicated with continued exploration.

Gold Bull Market

For gold mining juniors like Getchell, this is a very favorable market environment to get as much exploration done as possible to leverage on the high metals prices.

So far this year, gold prices have gone up by about 5%, outperforming many other commodities and most of our favorite asset classes. For a while, it looked like it could even surpass the record high price of $2,074 set nearly three years ago.

Yet despite a recent slump (as with other metals), many believe that the gold bull market has only just begun.

One analyst believes it’s only a matter of time before gold surpasses double digits on its way to $12,000-15,000 an ounce.

In a recent interview, Adam Rozencwajg of Goehring & Rozencwajg (G&R), the Wall Street commodities investment firm, said “We think that gold has entered into a new phase of this bull market.”

Rozencwajg bases this statement on the firm’s first-quarter report, which found that two factors in 2020 prompted G&R to take a step back from gold: 1/ that the gold-oil ratio was favoring energy, and 2/ that silver had “caught up” to gold.

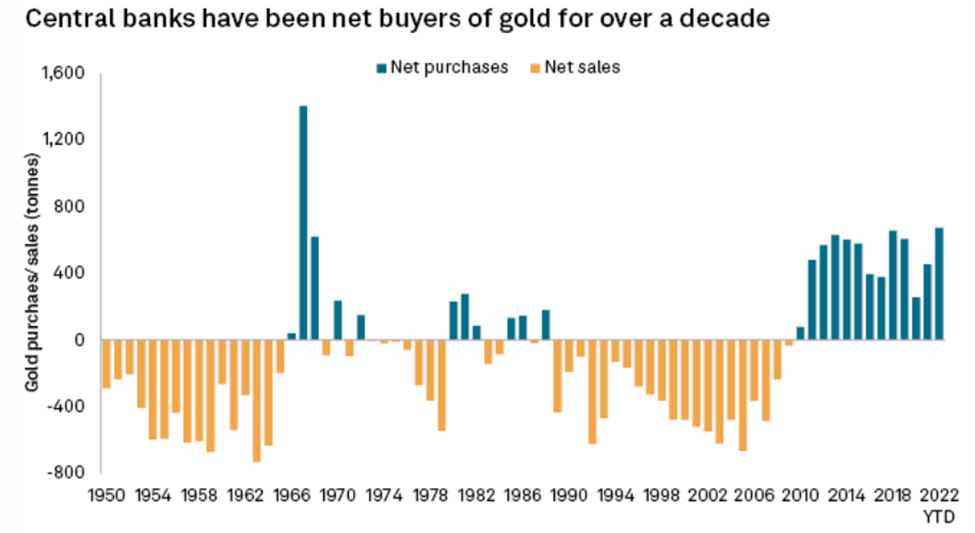

G&R now believes it’s time to step back in, mostly due to demand for gold being driven by central bank bullion purchases, which hit records in 2022 and the first quarter of 2023, but also the result of factors such as implied gold backing, referring to how much gold the government holds versus the number of dollars in circulation.

The general expectation of a recession is also building a case for gold’s bullish outlook. In the US, there is a confluence of factors (liquidity risk, credit stress, credit crunch, US Treasury market dysfunction, bond volatility, inflation and regional banking stress) that are setting the tone for an economic downturn, according to analysis by Sprott.

So far this year, we’ve already witnessed three of the four biggest banking failures in US history, together holding assets totalling $532 billion, surpassing the $526 billion (adjusted for inflation) owned by the 25 banks that failed in 2008.

The bigger worry, though, is that the bank failures might lead to doubts about relatively healthy banks, creating a financial contagion that could impact the wider economy.

“The US banking crisis has increased the demand for gold as a proxy for lower real rates as well as a hedge against a ‘catastrophic scenario,’” JPMorgan Chase strategists Nikolaos Panigirtzoglou and Mika Inkinen wrote in a Bloomberg note.

“Recent downside surprises in US economic data have lifted the chances of a recession over the next 12 months, with safe-haven flows providing somewhat of a cushion for gold,” Yeap Jun Rong, a market analyst at IG, said in a recent CNBC interview.

Conclusion

With the bull market looking solidified, junior gold miners would be considered an excellent value play, considering that their stock values often trail the prices of metals themselves.

We also have to consider the implicit growth potential of assets held by these miners within the industry. Currently, the biggest mines in the world are running out of reserves, and the top producers all want to replenish those reserves, but without incurring large capital expenditures.

The best solution, therefore, is to hunt for cheap gold in the ground, and with over 2 million ounces and still counting, Getchell appears to be a good candidate to partner with or even acquire.

The location of its Fondaway project could be a deciding factor. The mining-friendly state of Nevada is host to the largest gold mining complex on Earth: the Nevada Gold Mines joint venture between Newmont and Barrick.

Formed in 2019, NGM consists of as many as 10 underground and 12 open-pit mines, plus autoclave, roasting and heap leach facilities. Total production last year from NGM reached more than 3 million ounces, about 3% of the world’s total.

Aside from Fondaway, Getchell holds three other projects in Nevada, including the Dixie Comstock project, also in Churchill county, which consists of 26 unpatented lode claims and has evidence of some historic mining.

Blessed with a proven gold-mining location, plus a $2.5 million financing announced this year to power its exploration programs, Getchell is primed to have an exciting second half of this year and beyond.

Getchell Gold Corp.

CSE:GTCH, OTCQB:GGLDF

Cdn$0.19, 2023.07.04

Shares Outstanding 106.2m

Market cap Cdn$20.2m

GTCH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Richard owns shares of Getchell Gold Corp. (CSE:GTCH). GTCH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.