Geopolitics Stagflation and Gold – Richard Mills

2023.10.13

The crisis playing out in the Middle East has profound strategic and humanitarian implications, but what does it mean for investors, particularly those holding or considering gold and other precious metals that typically attract safe-haven demand?

The horrifying attacks on Israel by the Hamas terrorist organization are less than a week old but already we see an uptick in the price of gold compared to a lackluster 2023 performance.

Last week the yellow metal skidded to a seven-year low, with World Gold Council analysts noting September was the fourth consecutive month of outflows from gold ETFs.

Gold’s performance this year has been flat — the gains between March and May canceled out by the losses from May to October.

Headwinds have included receding fears of a US slowdown, surging bond yields and better-performing equities.

On Oct. 4, gold came within 10 bucks of a 2023 low of $1,811.20.

Then came news of the attack on Israel by Hamas, a Sunni Islamist organization that governs the Gaza Strip of the Palestinian territories.

Gold immediately reacted, climbing from $1837 on Oct. 8, the day of the invasion, to $1874 on Wednesday, Oct. 11, a bump of $37. While a 2% increase is not enough to stir excitement among gold bugs, it’s the threat of the conflict escalating beyond a mere cross-border shelling episode that Israelis and Palestinians have lived with for decades, along with macroeconomic factors, that in my opinion, will be the catalyst for the next sustained upturn in the gold price.

Contagion

Indeed, the prospect of the conflict spreading to Israel’s northern border with Lebanon, where Iran-backed militant group Hezbollah is based, and the involvement of the United States as it moves to defend its staunch ally, Israel, is dominating headlines.

Here is what we know so far:

- At least 1,200 Israelis and 1,055 Palestinians have been killed since Hamas launched a multi-front assault on Israel Saturday morning. Thousands more have been injured. Israel has been heavily bombarding the Gaza Strip while Palestinian groups continue to fire rockets into Israel. So far 22 Americans have died. Gaza hospitals are at full capacity and roughly 200,000 Gazans have been displaced.

- Up to 150 hostages were taken from Israel to Gaza, where Hamas has likely placed them in strategic locations. Terrorist groups routinely use human shields — schools, hospitals or civilian families — to protect themselves, in this case against Israeli bombs and missiles.

- Israel has ordered a complete siege of Gaza, including halting supplies of electricity, food, water and fuel. Gaza’s only power station stopped working after running out of fuel, Wednesday.

- Israel has formed an emergency government and war management Cabinet that will include Prime Minister Benjamin Netanyahu, National Unity Party leader Benny Gantz and current defense minister Yoav Gallant. The government will not pass any laws or make any decisions that do not concern the conduct of war, the announcement said via CNN., Netanyahu has vowed “what we will do to our enemies in the coming days will reverberate with them for generations,” leading many to speculate that Israel intends to obliterate the Gaza Strip with ground troops and tanks.

- The US is sending two carrier strike groups to the region, the USS Gerald R. Ford and the USS Dwight D. Eisenhower. The Ford arrived in the Eastern Mediterranean on Tuesday and the Eisenhower and its strike group is scheduled to leave Norfolk, Virginia this week.

According to Business Insider, the USS Gerald R. Ford strike force includes the USS Normandy, a Ticonderoga-class guided-missile cruiser; three of four Arleigh Burke-class guided-missile destroyers in the fleet; the US Navy destroyer USS Carney (That’s a couple hundred thousands of tonnes of diplomacy – Rick); several F-35 fighter jets, considered to be the most advanced fighter jet in the world; F-15s; F16s, designed for both air-to-air combat as well as air-to-ground combat; and F10s, designed to provide close air support to ground forces. Israel requested interceptors and precision-guided munitions, states BI.

A double aircraft carrier deployment would be a massive show of force in the region and could risk escalating the situation. Some Shia factions in Iraq have threatened attacks on US bases in the country if the US “intervenes” to support Israel against Hamas. (Anti-war.com, Oct. 10, 2023).

- The US administration is in talks with Qatar, which has open lines of communication with Hamas, as part of mediation efforts to free the hostages.

- The possibility of Israel having to fight a two-front war against Hamas and Hezbollah has grown stronger, with cross-border violence between Israel and Lebanon extending into a fourth and fifth day, Wednesday and Thursday. Hezbollah is considered to be more formidable and better equipped than Hamas. A drone infiltration scare sent millions of Israelis into shelters. The Israeli Homefront Command ordered residents in one far north town to stay in their homes and lock their doors, warning of an infiltration of militants. An IDF spokesman confirmed Wednesday that Israel fired rockets into Lebanon, striking Hezbollah positions after the group hit Israeli soldiers with anti-tank missiles. Citing the same spokesman, Fox News reported that Israel has deployed tens of thousands of additional units along the northern border. Hezbollah claims to have killed and wounded a large number of Israeli troops. On Wednesday the group issued a statement saying that it sees the United States as a direct accomplice in Israel’s killing of Gazans.

- Syria launched missiles on the Israeli-occupied Golan Heights, prompting an emergency statement advising residents to stay near shelters.

Military aid: Ukraine loses to Gaza

This level of American commitment to a foreign war is understandable, given the strength of the Jewish lobby in Washington and the size of the diaspora within the continental United States. However, in my opinion, it’s also two-faced.

For months, the US and Europe have reportedly struggled to provide Ukraine with the huge amount of munitions it needs for a prolonged counter-offensive against Russia.

In July officials said the US was nearing the end of a set level of US munitions stockpiled around the world, as it continued to supply Ukraine with 155mm ammunition. As a stopgap measure, the Pentagon decided to send cluster munitions until more rounds are produced, even though they pose a risk to civilians.

Yet suddenly the ammo is available, to be shipped to Israel tout-suite, along with a full carrier fleet and another one on standby. How can this be? Either the US has the munitions or they don’t.

A week before the Hamas invasion, the Pentagon warned Congress that it is running low on money to replace weapons the US sent to Ukraine. A letter obtained by the Associated Press urges Congress to top up the $25.9 billion weapons fund, which has just $1.6 billion left. The weapons include millions of rounds of artillery, rockets and missiles.

Remember, part of the GOP’s Congress’s deal with the White House to avoid a government shutdown was to drop all assistance to Ukraine.

In the context of depleted US military aid to Ukraine, and the exhaustion of weapons stockpiles themselves, the timing of this Middle East flareup is certainly interesting. Could Russia be behind it? Putin is notorious for meddling in world affairs, in ways that embarrass the West. Examples include interference in the 2016 US election, the UK poisonings, and fighting on the side of Syrian dictator Bashar al-Assad.

Ukrainian president Volodymyr Zelensky has accused Moscow of supporting Hamas.

“We are certain that Russia is supporting, in one way or another, Hamas operations,” he said in an interview with the France 2 television channel on Tuesday. “The current crisis… bears witness to the fact that Russia really is seeking to carry out destabilizing actions all over the world.”

Zelensky also expressed concern that the international community is turning away from the war in Ukraine in the face of the “tragedy” that has befallen Israel following the attacks, said The Times of Israel.

While there is yet no proof of Russian involvement, it’s no secret that Russia has historical ties to Hamas, and would benefit from a war set to divert attention from its own atrocities, war crimes, in Ukraine.

Pro-war Russian propaganda has been spotted on social media, including by a military correspondent known for his support of ethnic cleansing of Ukrainians, who wrote “Not a drop of pity or sympathy (for the Israelis),” on his Telegram channel.

“This mess is beneficial for Russia…Iran is our real military ally,” said Russia’s prominent propagandist Sergey Mardan.

The Kyiv Independent notes the Soviet Union fostered relations with the PLO, largely to ensure the spread of communism in the region and to counter American influence. While Moscow has condemned some of Hamas’ terrorist attacks, it has not called it a terrorist organization.

After Hamas won the 2006 Palestinian elections, the Kremlin and Hamas leadership met several times — the latest meeting taking place in March, 2023 in Moscow, when Russian Foreign Minister Sergey Lavrov hosted Ismail Haniyeh, head of Hamas.

Experts mentioned by the Kiev Independent say that while the war may benefit Russia, there is no evidence Russia was directly involved. Instead, they say the blame falls largely on Iran, which is the main benefactor of Hamas, funding it with tens of millions of dollars and providing weapons and training:

“Iran is acting with an increased sense of emboldening in the region,” Hanna Notte, an expert on Russia’s foreign and security policy at the Center for Strategic and International Studies, told the Kyiv Independent.

“And that is a product of the changed Russian-Iranian relationship on the back of the war in Ukraine,” she added.

Russia and Iran grew increasingly close following Russia’s full-scale invasion of Ukraine, with Iran now supplying Russia with weapons.

The fact that Russia’s being armed by Iran, provides an impetus to support Iran’s activities in the Middle East, even indirectly. As tensions escalate, I would not be in the least bit surprised to see Russian and Iranian fingerprints all over an outbreak of a much wider conflict in the middle east..

Call me paranoid, but I also believe that Hamas’ timing, and the likely involvement of Iran possibly with Russian backing, comes as the United States Congress is in complete disarray. The legislative body narrowly avoided a government shutdown, followed by the ouster of Speaker Kevin McCarthy by a group of Republican hard-liners.

The Washington Post reported policymakers in Europe “looked with furrowed brows at the chaos consuming the House of Representatives,” with the French newspaper LeMonde writing in an editorial,

“The field of ruins that the House of Representatives has become can only worry America’s allies and delight its adversaries.”

With the chamber in paralysis, WaPo asserts that Washington may be unable to authorize crucial new installments of military aid when a new battle for government looms next month. If that happens, it will be very good news indeed for Putin’s Russia.

IMF outlook worsens

This week, the International Monetary Fund raised its 2024 inflation forecast to 5.8% from an earlier 5.2%, while at the same time trimming its global growth forecast from 2.9% to 2.8%. Bloomberg notes this is below the 3.8% average of the two decades before the pandemic:

Factors holding back the expansion include the long-term consequences of the pandemic; the invasion of Ukraine; the breakdown of the world economy into blocs; and the central bank policy tightening.

The fund predicts inflation will stay above central bank targets until 2025.

Stagflation and gold

High inflation + low growth = stagflation.

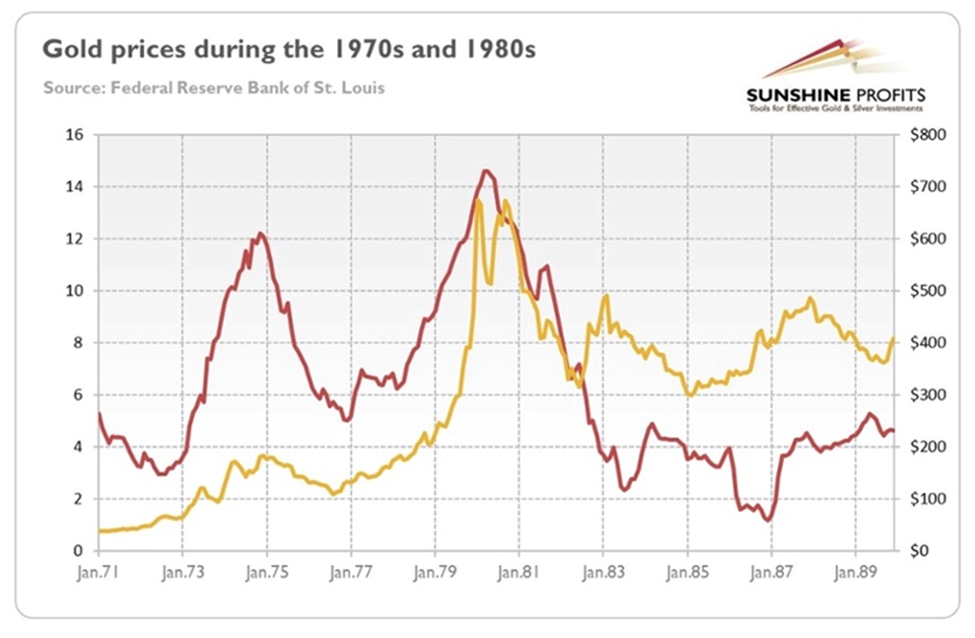

How has gold done during stagflation? As it turns out, quite well. The chart below by Sunshine Profits shows the gold price climbing during the stagflationary 1970s, surging from $100 per ounce in 1976 to around $650 in 1980, when CPI inflation topped out at 14%.

Source: Sunshine Profits

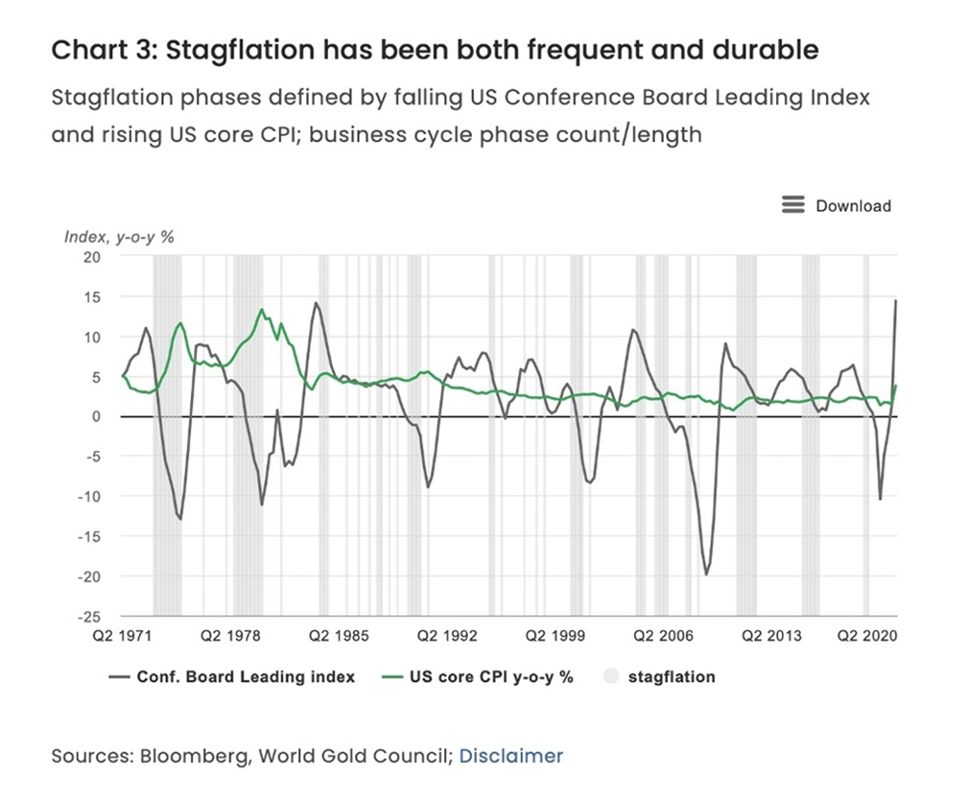

In fact, gold outperforms other asset classes during times of economic stagnation and higher prices. The table below shows that, of the four business cycle phases since 1973, stagflation is the most supportive of gold, and the worst for stocks, whose investors get squeezed by rising costs and falling revenues. Gold returned 32.2% during stagflation compared to 9.6% for US Treasury bonds and -11.6% for equities.

According to the World Gold Council, a look at US economic history back to 1971 reveals that stagflation has been the most frequent scenario (occurring in 68 of the 201 quarters) as well as the most enduring, having twice lasted eight consecutive quarters.

Conclusion

Returning to our original thesis, now may be an opportune time to own gold considering the heightened level of geopolitical turmoil in the Middle East, combined with macroeconomic uncertainty, in particular stagflation and the weak fiscal position the United States finds itself in.

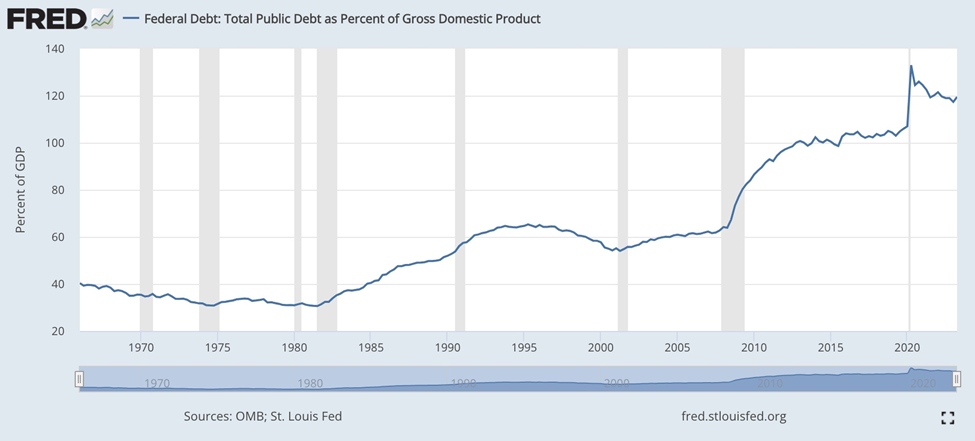

In an interview on CNBC, iconic investor Paul Tudor Jones said “It’s a really challenging time to want to be an equity investor and in US stocks right now,” noting “You’ve got the geopolitical uncertainty… the United States is probably in its weakest fiscal position since certainly World War II with debt-to-GDP at 122%,” a number which will keep rising to 195% in 2053 according to the Congressional Budget Office (CBO).

As we at AOTH have stressed, staggeringly high debt is what differentiates the current economic environment from previous periods, especially the inflationary late 1970s.

The US debt to GDP ratio in the ‘70s was around 35%. Today it is nearly three and a half times higher, at 119%.

This severely limits how much the Fed can raise interest rates, due to the amount of interest that the federal government is forced to pay on its debt.

Interest on the debt to track to exceed military expenditures

During 2021, before interest rates began rising, the federal government paid $392 billion in interest on $21.7 trillion of average debt outstanding, @ an average interest rate of 1.8%. We calculated if the Fed raised the federal funds rate to 4.6%, interest costs would hit $1.028 trillion — more than 2021’s entire military budget of $801 billion!

We’ve already blown past that. The FFR is 5.5%, compared to 3.5% a year ago.

The national debt has grown substantially under the watch of Presidents Obama, Trump and Biden. Foreign wars in Afghanistan and Iraq have been money pits, and domestic crises required huge government stimulus packages and bailouts, such as the 2007-09 financial crisis, the covid-19 pandemic in 2020-22, and Biden’s nearly $1 trillion, ironically named Inflation Reduction Act.

Each interest rate rise means the federal government must spend more on interest. That increase is reflected in the annual budget deficit, which keeps getting added to the national debt, now sitting at a shocking $33 trillion.

Paul Tudor Jones agrees, stating that “as interest costs go up in the United States, you get in this vicious circle, where higher interest rates cause higher funding costs, cause higher debt issuance, which cause further bond liquidation, which cause higher rates, which put us in an untenable fiscal position.”

Now throw in escalating Middle Eastern violence, which in the worst-case scenario could bring in a cascade of countries including the US, Iran, Egypt, Jordan, Syria and Saudi Arabia, and gold starts to look extremely attractive as a safe haven.

(Let’s not forget the other geopolitical hotspots are still simmering and could easily boil over, this includes a belligerent North Korea, and the tense situation between China and Taiwan. An incident in the South China Sea would be all that it takes to put the United States and China on a collision course).

I personally believe we are heading for all-out war in the Gaza Strip with the next step ground troops and tanks. If Israel carries through on its threat to “crush and destroy Hamas”, I fear the fate of the hostages may be sealed, despite talk of an SAS rescue mission.

It’s unlikely the hostages will survive an Israeli ground war and so the next outcry will likely be their murder.

There are two carrier strike groups mobilizing towards the region which imo is a very dangerous situation for the US military. They could be sailing into a trap. Carrier fleets typically need hundreds of kilometers of wide-open ocean in which to operate; the confined space of the eastern Mediterranean shares coastline with Egypt, Lebanon and Syria, all countries harboring anti-Israel/ anti-US military groups.

Might Russia and Iran have been preparing Hamas, Hezbollah and Islamic State for this scenario all along? Could there be thousands of missiles and air and sea drones lined up along the coast, ready to strike?

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.