G-7 nuclear pact adds fuel to uranium’s already bullish outlook – Richard Mills

2023.04.20

It’s fair to say that the Russia-Ukraine war has now literally “gone nuclear”.

Late March, Russian President Vladimir Putin revealed plans to place tactical nuclear weapons in Belarus, an ally nation sandwiched between the two warring sides. The move — while predictable — would inevitably necessitate a response from the West.

That response has come, with the G-7 nations now pledging to end Russia’s dominance over the atomic fuel markets. As reported by Bloomberg on April 17, Western allies including Canada, France, Japan, the UK and US have committed to jointly dislodge Russia from global nuclear supply chains.

The commitment took shape at a nuclear industry conference convened on the sidelines of the G-7 meeting in the Japanese city of Sapporo, Bloomberg sources said.

“This agreement will be used as the basis for pushing Putin out of the nuclear fuel market entirely, and doing so as quickly as possible,” according to a statement from UK Energy Secretary Grant Shapps.

Russia’s Nuclear Fuel Dominance

The US and its European allies have long been weighing tough sanctions targeting Russia’s nuclear sector but have struggled to find an agreement. This is because such an agreement, when effected, could have a calamitous effect on the global energy market.

According to the World Nuclear Association, nuclear power energy now provides about 10% of the world’s electricity from about 440 power reactors worldwide.

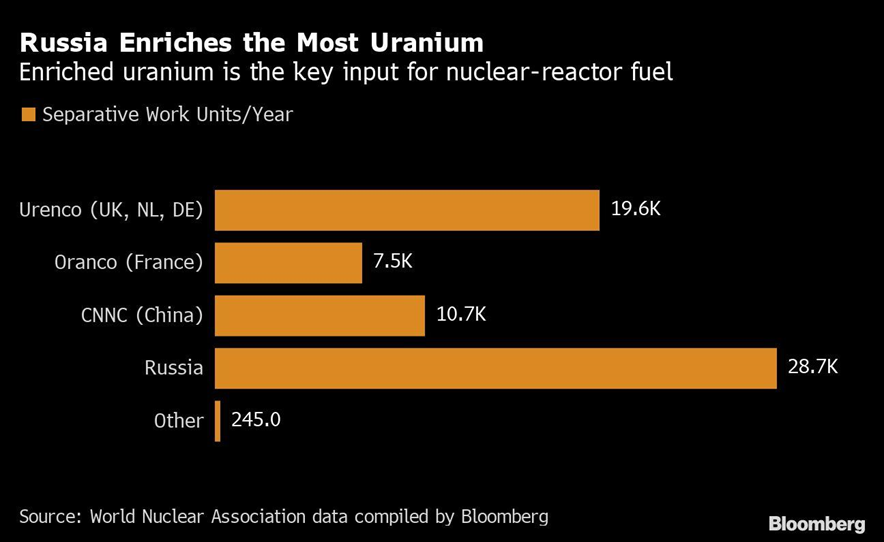

Russia is the world’s biggest supplier of enriched uranium, the type used to fuel nuclear power reactors around the world. The country is also a major supplier of mined uranium with 8% of global resources, though it buys most of the radioactive material from top producer Kazakhstan and turns that into nuclear fuel through its world-leading uranium enrichment capabilities.

For many countries, it would be an economic catastrophe to completely shut off their own nuclear industries from Russian supplies. The US and EU, for example, currently rely on nuclear power for one-fifth of their electricity generation.

Rosatom — the Kremlin-owned nuclear giant — provided about a quarter of the enriched uranium needed for the 92 reactors in the US in 2021. In Europe, utilities that generate power for countries with about 100 million inhabitants still rely on the company, customs data shows.

According to UxC, a nuclear industry researcher, Russia produces about 35% of the world’s enriched uranium for reactors, about twice as much as the No. 2 provider, and supplies about 20% of the US industry.

“If enrichment is curtailed, or supply from Russia is curtailed, it will have an immediate impact on the market,” Jonathan Hinze, president of UxC, told Bloomberg shortly after the war commenced. “Because the West and countries like Japan, Korea, Taiwan and others don’t have their own enriched uranium, we rely heavily in the world on Russian enrichment.”

Complicating matters for the West, Russia’s dominance in nuclear exports has only surged since the war started in February 2022 despite the sanctions.

Exclusive trade data compiled by the UK’s Royal United Services Institute shows that Russian nuclear fuel and technology sales abroad rose more than 20% last year. Purchases by EU members climbed to the highest in three years.

For Russia, while the trade brings in plenty of money already, that’s not the full measure of its importance. Every time the Kremlin’s nuclear giant Rosatom PJSC agrees to build a new reactor, it locks in cashflows — and political clout — for potentially decades ahead, Bloomberg reporter Jonathan Tirone said.

As described by Tirone: “Atomic commerce creates relationships that last. It involves large upfront costs — with Russia usually providing the credit — and long-term agreements to service plants, train their operators and replenish fuel. That kind of financial and technical collaboration can strengthen diplomatic ties too.”

“This is part of the great power competition that we’re in right now,” says Edwin Lyman, director of nuclear power safety at the Union of Concerned Scientists in Washington. Russia’s leaders “see nuclear trade as a way to bolster alliances.”

What This Means For Uranium

We’ve seen in the past how Western sanctions have impacted the market for key commodities such as nickel, palladium and potash. The latest decision by the G-7 nations to isolate Russia from the nuclear fuel supply chain could cause a similar, if not bigger, disruption to uranium.

Surely, shutting out a major provider of the nuclear fuel means that other countries would be relied upon to meet the world’s energy needs. But that’s not as easy as it sounds.

Take Saudi Arabia, for example, which had ambitions to break into the ranks of global uranium suppliers but eventually came short as its exploration investments failed to find any significant deposits of the heavy metal.

“A cut-off would affect nuclear power plants,” Paul Dabbar, the Department of Energy’s former deputy secretary warned last year. “It would put pressure on Western markets. Changing these supply lines will take a lot of time.”

Moreover, even amid Western sanctions, Russia’s Rosatom has remained the world’s biggest exporter of reactors and fuel, with many buyers being NATO countries, and it has also been eyeing new reactor projects across Africa, Asia and the Middle East.

As recently as February, Rosatom chief Alexey Likhachev told Bloomberg that the company is in talks with about 10 countries on new projects, and three or four are close to signing inter-government deals. In all the countries where Rosatom is already building nuclear plants, “everything is on track,” he added.

It’s also important to note that Rosatom isn’t handicapped by non-proliferation rules imposed by the US Department of Energy. In India, Russia is supplying its nuclear fuel and is building two reactors scheduled to open in 2025. In China, it provided more than $375 million worth of fuel for a reactor last year, and the two nations are reportedly deepening cooperation on a key atomic technology.

Meanwhile the US, which boasts the biggest fleet of nuclear reactors, can only supply 1% of its demand, which means it has been reliant on Russia’s uranium. In 2021, the US imported about 14% of its uranium and 28% of all enrichment services from Russia, according to data from the US Energy Information Administration. The EU, too, imported 20% of its uranium from Russia.

These figures imply that any measure taken against Russia and its nuclear sector could severely handicap many uranium buyers, potentially leaving the global uranium market in complete disarray and causing prices to skyrocket.

“We’ve allowed ourselves to become dependent on too few sources of supply,” said Dan Poneman, CEO of Centrus Energy Corp., which is trying to reboot the US uranium-enrichment industry. “It will take four or five years to replace that capacity that the world has come to rely on.”

One thing we have to remember is that nuclear power plays a key role in the clean energy transition, and so demand for uranium is only going to rise and outstrip supply. Demand for uranium is expected to grow by about a third through 2030, the World Nuclear Association said last year, citing a projected 16% increase in global reactor capacity.

On the supply side, the forecast is much more uncertain despite several production restarts being scheduled in North America. Kazakhstan, which produces more than 40% of the world’s uranium, cut its output guidance this year due to supply chain challenges.

Bullish Fundamentals

As things stand, the market fundamentals are quite bullish for uranium. Sprott Asset Management’s latest uranium report revealed that the heavy metal has fared well against other commodities since the start of 2023.

While spot U3O8 fell slightly from $50.85 to $50.70 for the month of March, it remains up 4.93% year-to-date, whereas other commodities declined 6.47% (as measured by the Bloomberg Commodity Index) over the same period.

Over the longer term, uranium has demonstrated even greater resilience within the commodity space, Sprott said. For the five years ended March 31, 2023, U3O8 spot appreciated a cumulative 140.95%, compared to 20.62% for the BCOM.

“We believe that uranium market fundamentals, which are the most positive in over a decade, will continue to support prices. Physical uranium, which demonstrates low correlation to other major asset classes, also shows low historical correlation to other commodities,” stated Jacob White, ETF Product Manager at Sprott Asset Management.

These characteristics, according to Sprott, make uranium “an attractive option when considering portfolio diversification,” especially since the metal has appreciated significantly in the past couple of years as part of a decade-long bull market (see below).

Going forward, Sprott cited uranium’s critical role in energy security as a key driving force in solidifying its bullish long-term outlook. Growing global recognition by governments, catalyzed by the need for greater energy security, is likely to continue to be a dominant theme, the firm said.

“We believe the uranium bull market still has a long way to run. Conversion and enrichment services price increases may likely cascade to the uranium spot price and support uranium miners. Over the long term, increased demand in the face of an uncertain uranium supply may likely support a sustained bull market,” the firm wrote.

Russia’s invasion of Ukraine has also sparked a global energy crisis that forced many countries to reimagine their energy supply chains. In past years, Western countries’ energy policies have predominantly favored renewable energy to reduce reliance on fossil fuels.

However, renewables often suffer from intermittency and low capacity and require offsets with baseload energy sources, such as coal, natural gas or nuclear power plants. Of these, nuclear power has the highest baseload capacity.

“We believe ongoing supply chain risks may likely cause utilities to seek out the baseload reliability of nuclear power,” Sprott’s White said, adding that the “uranium bull market remains intact despite the uncertain macroeconomic environment.”

Conclusion

Uranium has found itself in a solid upward trajectory after years of downtrend following the 2011 Fukushima nuclear disaster. Governments are continuing to recognize nuclear power as a crucial solution for decarbonizing the economy, which will further tighten the uranium market that is already undersupplied.

A weakened Russian influence on the nuclear energy market could serve as a reminder of the fragility of supply. At the same time, there is an unprecedented amount of power plants being restarted around the globe. These developments would uphold the uranium bull market for much longer.

Richard (Rick) Mills

aheadoftheherd.com

Subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.