‘Fully green’ Palladium One advancing sulfide nickel deposit in Ontario, palladium project in Finland

2021.06.08

There are two kinds of nickel deposits in the world, sulfides and laterites, but only nickel sulfides can be easily (and inexpensively) processed to create battery-grade nickel used in lithium-ion batteries needed for electric vehicles.

While Indonesia, the top nickel producer, has an abundance of nickel supply in laterite deposits, it is very expensive to produce, creates a lot of greenhouse gas emissions, and carries with it the added burden of tailings waste disposal, which in the archipelago nation has meant dumping it into the sea.

Though rare, there are companies that have nickel sulfide deposits under development. Palladium One’s (TSXV:PDM, FSE: 7N11, OTC:NKORF) Tyko project is located in northwestern Ontario’s Mid-Continent Rift Nickel Province, where previous and current work indicates strong potential for Voisey’s-style (referring to the huge Voisey’s Bay nickel mine in Newfoundland, re-opened in 2020 by Vale) feeder dyke nickel-copper-platinum group element (PGE) mineralization. A 4,000-meter drill program and geophysical survey work is planned for Tyko this summer, along with 23,000m at Palladium One’s LK PGE-nickel-copper project in Finland. (Tyko is mainly nickel and LK is mostly palladium)

The problem with Indonesian nickel

Nickel sulfide deposits provide ore for “class 1” nickel users which includes battery manufacturers. These companies purchase the nickel product known as nickel sulfate, derived from high-grade nickel sulfide deposits. Note: less than half of the world’s nickel is suitable for the biggest growth market — EV batteries.

According to BloombergNEF, demand for class 1 nickel is expected to out-run supply within five years, fueled by rising consumption by EV battery suppliers. Demand for nickel from lithium-ion batteries is expected to surge 16-fold to 1.8 million tons by 2030, BNEF said in a July 2020 report.

One way to address the coming supply shortage, is to mine plentiful laterites and convert the nickel product into nickel sulfate, as the Chinese are planning to do in Indonesia.

Reuters has reported on the multi-billion-dollar Chinese-led project to produce battery-grade nickel chemicals, that Indonesia hopes will attract EV manufacturers to the country. At least four high-pressure acid leach (HPAL) plants are currently under construction, led by Chinese stainless steel producers and battery makers.

The country expects to double investment in nickel processing to $35 billion in 2035. Jakarta has also signed a $9.8 billion EV battery deal with South Korea’s LG Energy Solution.

Recently the largest steelmaker in the world, the Tsingshan Group, announced a novel means (the technology has actually been around for decades) for refining nickel from laterite deposits found in Indonesia, the top nickel-producing country where China’s Tsingshan has been extremely active as of late.

The company plans to supply nickel matte, an intermediate nickel product based on converted nickel pig iron (NPI) used in steelmaking, to Chinese companies, who will further process it into nickel sulfate.

Trial production of high-purity (>75% Ni) nickel matte began nearly a year ago at its facilities on the Indonesian island of Sulawesi, allowing Tsingshan to claim it has the capability of producing high-grade matte on a regular basis.

Nickel sulfide deposits are formed from the precipitation of nickel minerals by hydrothermal fluids. The main benefit of sulfide ores is that they can be concentrated using a simple physical separation technique called flotation.

Nickel laterite deposits get created from the weathering of ultramafic rocks and are usually open pit mines. There is no simple separation technique for nickel laterites. The rock must be completely molten or dissolved to enable nickel extraction. As a result, laterite projects require large economies of scale at higher capital costs to be viable. They are also generally much higher cash-cost producers than sulfide operations.

Yet large-scale sulfide deposits are extremely rare. Historically, most nickel was produced from sulfide ores, including the giant (>10 million tonnes) Sudbury deposits in Ontario, Canada, Norilsk in Russia and the Bushveld Complex in South Africa.

However, existing sulfide mines are becoming depleted, and nickel miners are having to go to the lower-quality, but more expensive to process, as well as more polluting, nickel laterites such as found in the Philippines, Indonesia and New Caledonia.

HPAL – whose performance record has been highly mixed — involves processing ore in a sulfuric acid leach at temperatures up to 270 degrees C and pressures up to 600 psi to extract the nickel and cobalt from the iron-rich ore; the pressure leaching is done in titanium-lined autoclaves.

The advantage of HPAL is its ability to process low-grade nickel laterite ores, to recover nickel and cobalt. However, HPAL is unable to process high-magnesium or saprolite ores, it has high maintenance costs due to the sulfuric acid (average 260-400 kg/t at existing operations), and it comes with the cost, environmental impact and hassle of disposing of the magnesium sulfate effluent waste.

While the Indonesian government is happy to accept the foreign investment in its burgeoning EV industry, it is no longer willing to tolerate the environmental degradation that laterite nickel production entails.

Recently the country announced it will forbid mining companies from dumping mining waste into the ocean, a practice known as deep sea tailings (DST). To clarify: the government hasn’t actually banned DST, but by not issuing new permits, it could delay planned projects and complicate efforts to dispose of waste, Reuters reported. The lengthy wait means land tailings will eventually become “the only option,” a mining company source told the news outlet.

That, in turn, could affect the economics of any new projects — disposing of the tailings on land, in a nation of islands where space is at a premium — will surely throw a wrench into operations and significantly add to their costs per tonne.

For more visit Submarine Tailings Disposal (STD) / Deep Sea Tailings

Consider: although only one nickel mine in Papua New Guinea is using DST, according to the Nickel Institute, most of the four above-mentioned HPAL plants plan to dump their tailings waste into the sea. Reuters quotes a nickel cost researcher at Wood Mackenzie saying, “It would cost a fortune to switch from one established form of tailings disposal to another method.”

Not only do established nickel miners in Indonesia plan to continue the environmentally egregious practice of DST, due to cost considerations, the process of refining nickel to make nickel pig iron, and now, nickel matte, is highly energy-intensive (it relies on coal-fired power) and creates a lot of air pollution.

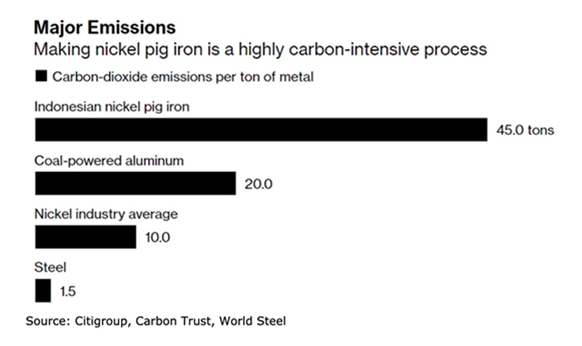

According to the graph below, producing 1 ton of nickel in nickel pig iron creates 45 tons of carbon dioxide emissions, compared to just 20 tons for coal-powered aluminum and steel production requiring an average 2 tons of CO2 per ton of metal.

With nickel more carbon-intensive than aluminum, zinc, copper, lead and steel, in that order, automakers are questioning whether they want to have anything to do with Tsingshan’s dirty nickel processing methods, especially in light of the increased importance to most corporations of environmental, social and governance (ESG) practices.

“The technology is definitely real, but does not meet ESG standards,” Bloomberg quotes Jon Lamb, portfolio manager at metals and mining investment firm Orion Resource Partners. “As consumers are focused on the lifecycle carbon intensity of their supply chains it is difficult to see how this production would earn a spot in these supply chains.”

One of the referenced Bloomberg articles has a great quote from mining magnate Robert Friedland, who stated during a recent industry event:

“The automobile industry is not going to nuke hundreds of thousands of acres of tropical jungle in Indonesia and dump the tailings in the ocean and try to convert ferronickel into batteries. That’s disinformation or whistling in the dark.”

Where will mining companies look for new nickel sulfide deposits, from which the extraction of high-grade nickel needed for battery chemistries is economically and technically feasible? The pickings are slim.

Decades of under-investment equals few new large-scale greenfield nickel sulfide discoveries. Only one nickel sulfide deposit has been discovered in the past decade and a half, Nova-Bollinger in Western Australia.

The result of such limited nickel exploration is a very low pipeline of new projects, especially lower-cost sulfides in geopolitically safe mining jurisdictions. Any junior resource company with a sulfide nickel project will therefore be extremely attractive to potential acquirers.

Tyko nickel project

Boots-on-the-ground exploration has opened up exciting new possibilities at Palladium One’s Tyko nickel-copper-PGE project.

Notable for its high nickel tenor potential, Tyko is located in northwestern Ontario around 25 km north of the Hemlo mine, and 55 km from the Marathon deposit which hosts a measured and indicated resource of 3 million ounces palladium and 618 million pounds of copper.

The Archean-aged mafic-ultramafic intrusion is rich in nickel; Tyko’s ore contains twice as much nickel as copper, and equal amounts of platinum and palladium.

Tenors average 8.6% Ni, 4.6% Cu and 3.3 g/t PGE at the RJ Zone, and 16.3% Ni, 8.7% Cu, and 12.8 g/t PGE at the Tyko zone, at 100% sulfides. According to Palladium One, the high tenor of the sulfide minerals suggests a valuable concentrate could be produced, and that even if the sulfides are disseminated, the deposit could still be economic.

Though previous operator Noranda did some historical exploration, the property remains under-explored, and un-mapped, even by the Geological Survey of Ontario.

The Tyko project covers over 20,000 hectares, including the 7,000 hectare mafic-ultramafic Bulldozer intrusion, which has seen virtually no geological mapping nor exploration.

A VTEM (Versatile Time Domain Electromagnetic) geophysical survey run by Noranda clipped the Smoke Lake target that is currently Palladium One’s focus at Tyko.

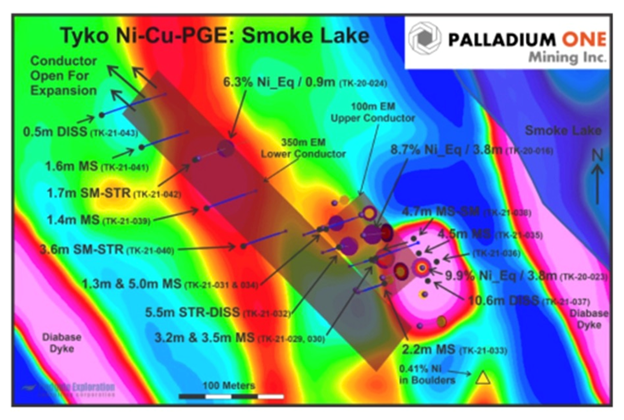

The 2020 drill program was designed to test the Smoke Lake electromagnetic (EM) anomaly.

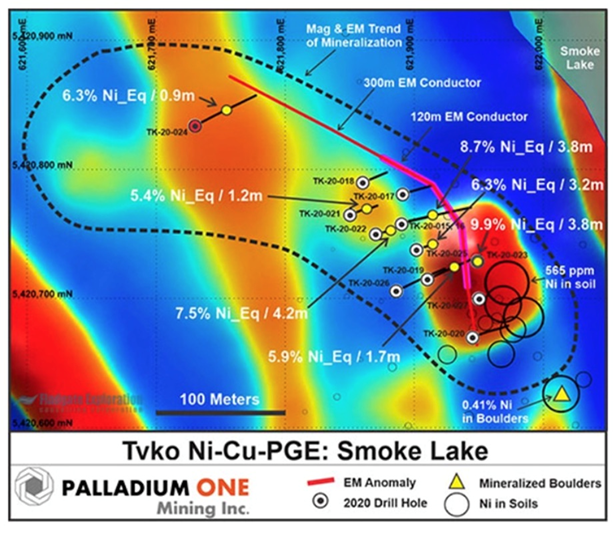

EM surveys identified two near-surface, closely spaced conductors, the largest of which had a strike length of over 300 meters.

A drone-based magnetic survey also pinpointed a strong bullseye associated with soil anomalies (up to 565 ppm nickel and greater than 40 times background levels), representing the surface expression of the EM anomaly.

Mineralized boulders with high nickel (up to 0.41% Ni) and copper values were discovered, indicating potential for high-grade massive sulfide mineralization.

This potential was validated by the first two diamond drill holes, which intersected 4m and 2m of massive magmatic sulfides, respectively, both at less than 30m true depth.

This was the first confirmed occurrence of massive sulfides on the Tyko project. All 13 holes drilled at Smoke Lake intersected magmatic sulfides, with widths ranging from 1 to 15 meters.

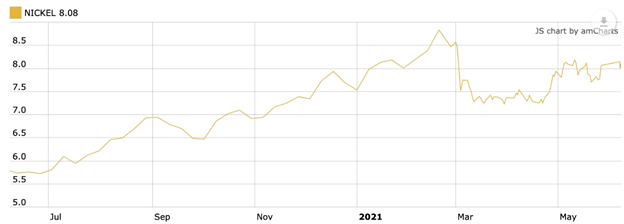

A second-phase, 2,000m drill program started in April, following up on high-grade hits of 9.9% nickel equivalent (NiEq) over 3.8m – US$1,765.70 tonne at today’s price of US$8.09/lb and 6.3% NiEq (US$1,123 tonne) over 0.9m, published on Jan. 19.

These are some of the highest nickel grades in the world.

“Smoke Lake continues to deliver extraordinarily high-grade intercepts. The highest to date being 9.9% Ni_Eq over 3.8 meters, within a broader intercept of 6.1% Ni_Eq over 7.5 meters! An extremely high-value, near surface resource appears within our grasp at Smoke Lake,” said Palladium One President and CEO Derrick Weyrauch.

On April 28 PDM announced that 11 of 14 holes completed so far intersected massive sulfides, ranging from 1.3 to 5m in length.

According to Palladium One, the most significant result of this Phase 2 drill program, was the linking of massive sulfide mineralization in the “upper conductor” with the “lower conductor” (see image below). The lower conductor has been confirmed to host massive to semi-massive sulfide mineralization (hole TK-20-024 returned 6.27% Ni over 0.9m (US$1,118 tonne), potentially adding additional high-grade intercepts. The upper conductor was tested in the Phase 1 drill program.

Drilling confirmed continuity along the 350-meter strike length, thus increasing the scale of known nickel-copper mineralization.

“We are extremely pleased to have extended known mineralization in the Phase II drill program at Smoke Lake,” said CEO Weyrauch. “We plan to conduct additional EM surveys with the objective of extending the existing Plate(s) and refining future drill locations. The lower conductor remains open to the northwest and drilling has shown it to be a continuation of sulphide lens we intersected at surface in the Phase I program. We are eagerly awaiting first assay results from the lab.”

This summer’s exploration activities at Tyko will include Borehole Electromagnetic (“BHEM”), horizontal loop EM and regional airborne magnetic and EM surveys, as the company’s expanded program centers on new target development, infill drilling, and expansion of known high-grade nickel mineralization at the Smoke Lake zone.

High-grade intersection from hole TK-20-025 which returned 11.8% Ni_Eq over 0.6 meters (9.6% Ni, 3.7% Cu, 1.5g/t PGE) from 37.2 to 37.8m.

Gas-powered transition

Nickel is one of only a handful of “battery metals” required by lithium-ion battery makers, that are expected to be in high demand in this and coming decades. Others include lithium, graphite, cobalt and manganese.

But electrification can only take us so far, so fast. As the world transitions from fossil fueled “ICEs” to battery-powered electric vehicles, the internal combustion engine is unlikely to be resigned to the scrap heap, just yet. Gasoline vehicles and gas-electric hybrids will gradually displace more-polluting diesels, the former equipped with catalytic converters to filter out pollutants like NoX and particulate matter.

This means growing demand for materials that go into gas-powered autocatalysts, including palladium.

The platinum group metal is set for a supply squeeze for the 10th straight year. Driving palladium demand are higher sales of gasoline vs diesel units and tighter pollution controls.

Palladium use in hybrid vehicles, seen as a bridge between gas-powered cars and pure electrics, is a growing source of demand. The lustrous metal is also used in electronics, surgical instruments, jewelry, watch making, aircraft spark plugs, hydrogen purification and groundwater treatment.

Supply, meanwhile, is being challenged by production disruptions, for example flooding at Arctic mines.

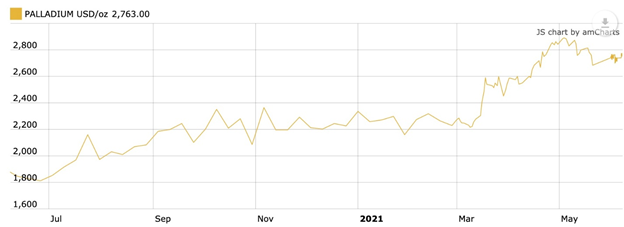

On May 4 palladium hit a new record of $2,890/oz. Over the past year, Pd is up a sizzling 49.6%.

LK palladium project

At Palladium One’s Läntinen Koillismaa (LK) project in north-central Finland, phase 2 drilling at the Murtolampi Zone intersected high-grade mineralization in hole LK20-026 of 13m at 3.4 g/t palladium equivalent (Pd_Eq US$315 per tonne) within 79m at 2.0 g/t (Pd_Eq US$185/ tonne).

The first results (seven holes) from a 2,000-meter drill program at the Haukiaho trend were announced on May 26, including 72m @ 1.8 g/t Pd_Eq at LK21-071 — one of 12 holes, or 1,943m, drilled at Haukiaho. According to PDM, the results from the first seven holes of the program are enough to build an NI 43-101-compliant resource estimate at Haukiaho, anticipated sometime in the third quarter. The five remaining holes, released on June 1, featured 8m @ 2.2 g/t Pd_Eq within a wider 116-meter zone grading 1.2 g/t Pd_Eq. Notably, the results filled in a 200-meter gap in the historical resource drilling, and delivered average grades and widths above those of the historical resource estimate.

“These latest results also extended the core Haukiaho zone to the east and into a second large IP anomaly that was delineated in 2020. This extension indicates substantial near-term upside at Haukiaho,” said Derrick Weyrauch, President and CEO. He added:

“At 17 kilometers in length, the Haukiaho trend currently represents the largest continuous patch of blue-sky potential on the LK property.”

At the Kaukua South target, drilling returned grades of 47m @ 2.6 g/t Pd_Eq, including a higher-grade core of 12m @ 4.2 g/t Pd_Eq – US$389/tonne. IP surveys have begun to expand the strike length by up to 3 km, from the current 4 km.

Assay results have been reported from 34 holes of 46, with the remaining 12 holes still to come. They feature 38m @ 2.1 g/t Pd_Eq in the Lower Zone at Kaukua South, announced on May 11. Drilling also expanded the strike length of the Upper Zone having intersected robust mineralization of 51 meters @ 0.9 g/t Pd_Eq.

According to Palladium One, “drilling demonstrates significant continuity of open pit grades and widths in both the Upper and Lower Zones at Kaukua South. Results to date are highly encouraging and show a clear path toward a maiden open pit resource at Kaukua South.”

The LK property is part of an intrusive belt that runs east-west across Finland and into neighboring Russia. Palladium One in January secured a $12.5 million cash injection from Sprott Capital Partners. The bought deal financing (upsized to C$15M due to being over-subscribed) ensures a healthy treasury that PDM can draw from, as it continues to explore its projects in Canada and Finland. 27,000 meters is planned this year from a total exploration budget of $11.5 million.

Palladium One expects to complete resource drilling at the Kaukua South and Haukiaho zones, and to initiate drilling at eastern and western extensions of Kaukua South.

Conclusion

By giving investors exposure to palladium and nickel, and a lot of coming news flow, Palladium One ranks, imo, as one of the best battery/green metal companies.

Palladium has the hot hand among precious and platinum group metals, trading consistently above $2,000 since last July, thus outperforming gold. Palladium has been burnished by robust demand for gasoline autocatalysts, its principal application, as pollution standards tighten, and squeezed supply due to production problems at Arctic mines.

A new source of palladium demand may actually come from lithium-ion batteries. In July 2019 Platinum Group Metals and Anglo American Platinum invested $4 million in a joint venture company called Lion Battery Technologies. According to The Northern Miner, the two PGM miners, through Lion, the JV company, will lead efforts to commercialize the development of next-generation battery technology that uses platinum and palladium.

The partnership was inspired by research at Florida International University, which found that PGMs could dramatically improve the performance of next-gen lithium-air and lithium-sulfide batteries, which have a higher energy density than the best-performing lithium-ion batteries currently available on the market or under development.

“They offer the promise of batteries with lower production costs and significant increases in the range and performance of battery electric vehicles (BEVs),” the Northern Miner quotes Michael Jones, Platinum Group Metals’ president and CEO.

Nickel, too, is no slouch. While the battery metal saw a steep correction in March, owing to Chinese stainless steel producer Tsingshan announcing it plans to make battery-grade nickel out of nickel matte in Indonesia, it has since recovered substantially. According to Fitch Solutions, nickel will keep trending up as the global market remains in deficit. Earlier this month the firm upgraded its 2021 nickel price forecast from $15,759 per tonne to $16,500/t.

Mining Indonesian nickel from laterites and turning it into battery-grade nickel using the highly polluting HPAL method, or worse, processing nickel matte as Tsingshan plans to do, is no match for a rare, and valuable, nickel sulfate deposit such as Palladium One’s Tyko, in a mining-friendly jurisdiction like Ontario.

The company has been getting spectacular results at its Canadian nickel project, reporting massive sulfide intersections in multiple holes. More assay results are coming, as well as the resumption of drilling.

At the LK project in Finland, Palladium One is well on its way to defining a maiden resource at Kaukua South. Twelve holes are left to report and drilling is expected to resume soon. High-grade mineralization was intersected at the Murtolampi Zone, and at the Haukiaho target, there are enough drill results to compile a NI 43-101-compliant resource estimate, expected sometime in Q3. President and CEO Derek Weyrauch says the 17-km Haukiaho trend is “the largest continuous patch of blue-sky potential on the LK property.”

I see nothing but blue overhead for Palladium One investors, too, as 2021 exploration ramps up.

Palladium One

TSXV:PDM, OTC:NKORF, FSE:7N11

Cdn$0.35, 2021.06.07

Shares Outstanding 248m

Market cap Cdn$83.4m

PDM website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Palladium One (TSXV:PDM). PDM is a paid advertiser on Richard’s site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.