Freegold continues to report high-grade assays from Golden Summit, Alaska

2021.06.24

At Freegold Ventures’ (TSX:FVL) flagship Golden Summit property in Alaska, a drill program that started in early 2020 was designed to test a revised interpretation, based on Freegold’s work that higher-grade mineralization may extend to the west of the old Cleary Hill mine workings in an area of limited previous shallow drilling.

Background

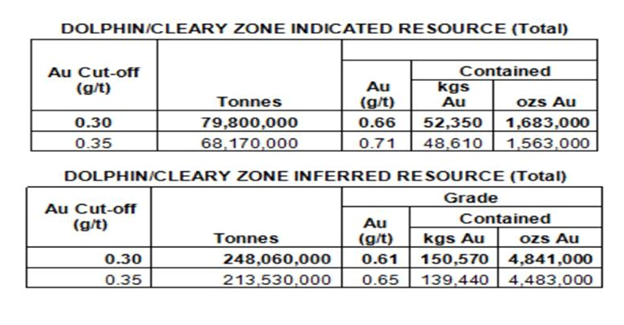

The Golden Summit property has seen continual resource expansion since the inaugural 2011 resource was issued. In 2013 Freegold published a non pit-constrained resource of 6,524,000 ounces of gold as categorized below.

The Dolphin Stock resource is contained predominantly within a uniform intrusive granite body with a modest grade of about 0.63 grams per tonne gold but remains wide open for expansion. In fact, the hole 1 discovery in 2020, collared just north of the resource, proved there may be a much higher-grade, bigger prize potential in the sediments surrounding the intrusive to add to that 6.5Moz.

In January 2016 Freegold completed a preliminary economic assessment (PEA) for a conceptual pit using a 0.30 grams per tonne cut-off grade, and demonstrated 2,947,000 ounces of gold at an average grade of 0.69 g/t as broken out below.

The importance of this study demonstrated just this small part of the deposit would produce 98,000 ounces gold per year for 24 years with peak production of 150,000 ounces at a cash cost of $842/oz using only a $1,300 gold price. A key parameter was the operating cost per tonne of just $18.11 for the sulfide ore and only $14.90 per tonne for the oxide ore.

The PEA also indicated that the first phase of production postulates a heap leach operation for the oxide ore (as did the Fort Knox comparison which sits only 5 km southeast) with estimated capital cost of only $88 million that would last for 8 years. There are 528,000 ounces in the first phase of oxide production at an average grade of 0.63 grams gold.

New discovery

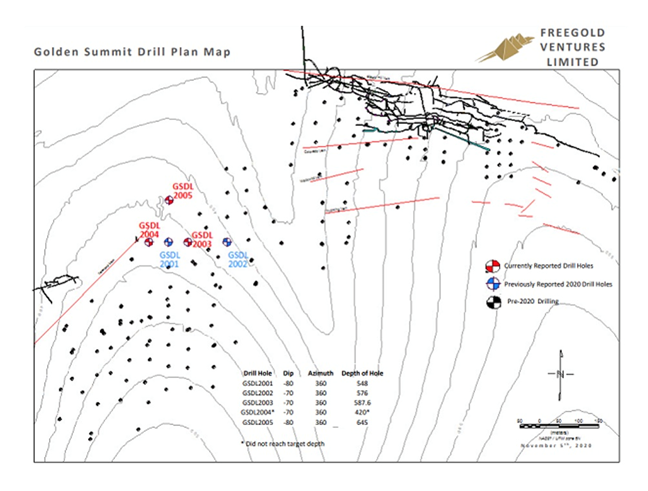

On May 6, 2020, Freegold announced results for GSDL 2001, hole 1 with 257m of 2.94 grams per tonne gold including 188m of 3.69 g/t, which included high-grade sections of 2m of 169 g/t with the last 20m grading 9.87 g/t. The hole was collared just north of the mineralization in the PEA and drilled to the north. The huge improvement in grade came from the altered sedimentary host rocks that surround the Dolphin intrusive. The drill holes showed pervasive silicification and veinlets throughout the sediments, as well as high-grade veins.

This exciting new discovery rocketed the stock to $1.95 per share but delays in the lab and covid precautions with a Canadian company operating in Alaska using Canadian drillers created extraordinary delays and Freegold’s share price has corrected significantly with the rest of the market.

However, we’re finally starting to get a steady flow of news with the assay results from all 18 holes drilled in 2020 released, along with the first two holes of the 2021 drill program.

2020 drill program

In November 2020, AOTH contributor Brad Aelicks presented a geological analysis of the results from the first five holes of the 2020 drill program. His report appears below in italics:

At first blush these are, imo, outstanding numbers in every regard. Here’s my takeaway after a thorough review.

First: The plan map shows these holes are not small step outs, they are starting to define an area over 200m wide east to west between hole 2 and hole 4 and 110m north south between hole 1 and hole 5.

Second: These are monster mineralized intercepts:

- Each hole has at least one intercept of a minimum 146 meters.

- All holes have multiple intercepts or are continuously mineralized.

- Adding the total mineralized meterage for each hole and then averaging the intercepts of the 5 holes delivers an impressive 309.8m.

- The weighted average grade of those intercepts as reported is an impressive 1.54 grams per tonne gold.

But wait, the bull boards became bear boards after an irresponsible post claimed that the one intercept in Hole 5 was smearing the 3 meters of high grade over the length of the hole and the writer claimed when removing that intercept, the company had Sweet F All. Although the point is worth looking at, it is absolutely ridiculous to imagine the company throwing out 3m of 131.5 grams gold no matter where it lays within the 119 m of continuous mineralization let alone the 573 meters of mineralization that it lies within.

Any concern over the influence of high-grade intercepts within a drill hole or deposit is commonly addressed on projects by cutting any one-off high-grade intercepts to come in line with other notable intercepts. So, I posed the question to Freegold’s management and I was told that during their 43-101 reporting process the ultra high grade should be cut to 88 grams per tonne gold. This is still too high for my liking so I’ll take you through an exercise below cutting the high grades from over 4 and 5 ounces per tonne to 1 ounce per tonne.

If we take a look at these five holes, three of them report intercept grades over 100 grams per tonne gold. Hole 1 with 2m of 169.5 g/t gold, Hole 3 with 3m of 107 g/t gold and Hole 5, with 3m of 131.5 g/t gold. The average of these intercepts is actually 136 grams gold – and we’re not talking about 30 cm single assays here – these are 2- and 3-meter wide intercepts.

These intercepts alone make the drill holes incredibly successful no matter what the bulk tonnage zones are. But just to be absolutely sure I cut the assays and recalculated the huge-mineralized intercepts to see if the bulk tonnage expansion into the sediments remains a viable target. I didn’t use the company’s suggested 88 grams either. I slashed the high-grade down to the bone, to 1 oz or 31.1 grams gold. Here’s what I got:

Now it’s important to understand that I don’t have access to the raw data and cutting these intervals using the raw data could be slightly different. Nonetheless, after completing the exercise, you can see that only two of the holes are even affected, holes 1 and 5, since the hole 3 intercept of 3m of 107 grams gold was a stand-alone interval (outside the zone) and the bulk tonnage intercepts remain the same grade, 1.32 grams over 33m, 0.8 grams over 146.5m and 0.95 grams gold over 55m.

Both of the other holes delivered resounding results that are equivalent to or significantly better than the existing global, historical resource of 6.524 million ounces at 0.63 grams and dwarf the numbers being mined only 5 km away at Fort Knox’s 0.33 grams per tonne gold. In fact, the average mineralized intercepts across the 5 holes after cutting the high-grade still delivers 309 meters of 1.02 grams gold, 50% better than the Dolphin Stock grade and over 3X the grade at Fort Knox!

Third: Freegold is building ounces incredibly quickly. If we take the area of influence of the 5 holes 250m east to west and 150m north south with 309m of mineralized intercepts at 2.68 specific gravity then cut the volume in half as currently this is a triangular wedge and not a rectangle yet, we arrive at 15.53 million tonnes of influence. After cutting the high grade to 1 oz Golden Summit could expect to deliver a minimum 509,000 ounces at 1.02 grams gold. As Freegold continues to tighten the drill spacing and proves the continuity of the high-grade without cutting, the average grade of 1.54 grams calculates to 769,000 ounces. At [Nov 2020] prices $1,850 gold, Freegold may have just added between $925 million and $1.42 billion in gross metal value with five holes. No matter which way you cut it (pun intended) it’s a long way from Sweet F All and could be the most cost-effective ounces drilled in North America [in 2020].

Fourth: Every hole has delivered additive mineralization in the top 100m of their sections which will improve the economics and strip ratios of the preliminary economic assessment discussed above. Freegold has not indicated how much of this is oxide or sulfide but they have announced additional work to be completed on metallurgical studies.

Fifth: Freegold has indicated at least 80 known high-grade gold occurrences on their property at least a half dozen of which have seen production at better than 1 ounce per tonne average. The current drilling is demonstrating that these high-grade veins persist to at least 500m in depth and are often associated with pervasive silica flooding and quartz veinlets that provide opportunities for bulk underground mining no matter what level of pit floor is ultimately proven.

Between January and June, 2021, Freegold released the remaining assays from the 18-hole 2020 drill program as they became available. Highlights are as follows:

- Located nearly 600 meters apart, both holes GSDL2007 and GSDL2008 successfully intercepted broad zones of above-resource grade at their projected target depths. Management is very encouraged with the ongoing results, as they continue to demonstrate the potential for larger higher-grade portions within what could be open-pittable depths over a significant area. Significant intercepts included 231.5 meters @ 1.2 g/t gold, including 57.3m of 2.07 g/t Au, from the Cleary vein system. Read more

- Holes GSDL 2009 and 2010 confirmed broad zones of higher than resource-grade mineralization from the Dolphin Zone across to the Cleary Zone. The two holes were approximately 500 meters apart. Significant intercepts included 93.6m @ 2.67 g/t Au, from hole GSDL2009 in the Cleary Zone. Read more

- Holes GSDL 2011-2018 were designed to target the northern extension of the Dolphin Zone and the deeper extension of the Cleary vein system. Assay results from five of these holes successfully confirmed Freegold’s revised interpretation that there is potential for a higher-grade corridor, effectively a vein swarm, consisting of multiple veins, veinlets and stockwork zones within areas of intense silicification extending from the area of the old Cleary Hill mine workings towards the Dolphin intrusive. Drilling is also continuing to demonstrate the potential for higher-grade mineralization at Cleary Hill, well below the previous drilling. Hole GS2017 which returned 1.7m grading 588 g/t Au is the highest-grade intercept intersected by Freegold in drilling at Golden Summit. Read more

- The last two holes of the 2020 drill program reported a 350.9-meter interval grading 0.51 g/t Au from the Dolphin Zone, and 40.4m @ 1.29 g/t Au, from Cleary. Read more

2021 exploration

Since drilling at Golden Summit resumed in February, 2021, 14,700 meters have been drilled, as of June 3, in 27 holes. Four rigs have been mobilized.

So far, only the assays from the first two holes have been reported — GS2101 and GS2108. They featured a 421.6-meter interval grading 1.11 g/t Au; 110m @ 1.54 g/t Au; and 296.3m @ 1.4 g/t Au, including 3.99 g/t Au over 41.1m, all from the Dolphin Zone. Read more

According to Freegold, 2021’s 40,000-meter drill program will continue to focus on continuing to determine the orientation of the zones of higher-grade mineralization consistent with its revised interpretation, in particular, to the north, east and west of the Dolphin intrusive. Drilling will also be directed to the south of the Cleary Hill mine workings where previous workings including the Colorado, Wackwitz and Wyoming vein zones have never been tested to depth or along strike to the east. Past drilling in the Cleary Hill area has been largely shallow in nature and it is interpreted that the Dolphin intrusive likely underlies the Cleary Hill area at depth.

The program’s two key objectives are to determine the orientation and extent of the higher-grade mineralization; and to expand the currently known resource and upgrade resource categories as part of efforts to further advance the project through pre-feasibility.

The company also plans to test other targets that may have potential to host additional resources and other buried intrusives. Ground geophysics and soil sampling have been conducted and further drilling is planned to test these areas.

Conclusion

Freegold is just getting out of the gates with results from this year’s ambitious 40,000m drill program and although they have had their share of challenges with covid-19 and lab turnaround, the four drills they have turning will continue to bang out a combination of bulk tonnage and high-grade intercepts for the foreseeable future, as they move north and east towards the former high-grade production areas.

Backstopped by a historical resource of 6.524 million gold ounces and $30 million in cash, my money is on Freegold’s Golden Summit project cruising to +10 million ounces of gold. The current price correction is an excellent opportunity for those willing to do some proper diligence, to capitalize on one of the fastest-growing leveraged plays to gold in North America.

Freegold Ventures

TSXV:FVL

Cdn$0.60, 2021.06.22

Shares Outstanding 334,049,366

Market cap Cdn$200m

FVL website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Freegold Ventures (TSXV:FVL).

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.