Forward-looking metals and the companies we’re invested in

2021.07.27

While there is little we can do to prevent climate change — the Earth is going to continue to warm until it isn’t — we can do our part in cleaning up the atmosphere by reducing our fossil fuel usage.

The modernization and electrification of our global transportation system will require a change hitherto unprecedented in the history of civilization. Not even the shift from horse and buggy to the crank-start Ford Model T can compete with what it will take to electrify the billion-plus cars on the planet’s roads, and eventually put a complete stop to noxious tailpipe emissions that are poisoning the air we breathe.

The fossil-fuel-based transportation system needs to be electrified, and the switch must be made from oil, gas and coal-powered power plants to those which run on solar, wind and thorium-produced nuclear energy. If we have any hope of cleaning up the planet, before the point of no return, a massive decarbonization needs to take place.

On top of surging demand for metals needed to feed so-called “green infrastructure” programs, we have current and emerging structural deficits for several metals, that will keep prices buoyant for the foreseeable future.

Over the past year, tight supply is reflected in the rising prices of copper, nickel, zinc, and lead, for example.

At AOTH, we are also big believers in gold and silver.

Gold is a hedge against inflation, so it is generally bought when inflation goes up, or looks like it will, to guard against currency devaluation.

The dreaded “i” word is being bandied about freely among financial news sites, and for good reason.

Central bankers have realized that keeping interest rates low and maintaining monthly asset purchases (ie. quantitative easing), have not given the desired economic boost; now they are counting on fiscal policy, ie., government spending, to do the trick. However, the US government does not have the money, so they borrow (print) it, at rock-bottom interest rates.

According to CNBC, the Fed’s easy monetary policy of the past year or so includes a continuation of bond-buying at a pace of $120 billion a month, until the economy reaches full employment and inflation falls to 2%.

If the Fed keeps quantitative easing going for the duration of President Biden’s four-year term, we could be looking at adding $4 trillion to the Fed’s balance sheet, pushing it well above $10 trillion (the current $8 trillion balance sheet has already doubled over the past year).

Meanwhile the US national debt currently sits around $28.5 trillion, after $4.5 trillion in pandemic-related spending. Trillions more is planned by Biden’s free-spending Democratic administration. The big-ticket items include a $1.9 trillion covid relief package passed earlier this year, a $1.2 trillion infrastructure plan being held up in the Senate, and a $3.5T spending bill to expand the social safety net. Biden has also proposed a $6T budget for the fiscal year starting Oct. 1.

According to NPR, it’s part of a plan to overhaul the U.S. economy that would also mean running up deficits of at least $1.3 trillion a year for the rest of the decade despite new tax increases on the wealthy.

The proposal is the biggest budget in recent history, reflecting the massive government spending plans Biden rolled out this spring in his push to bolster the middle class and make the United States more competitive with China.

Certainly, there will be continued recovery in the US, but at what price? How much higher does the already unsustainable national debt have to go?

In October 2020, the debt zoomed past 100% of GDP, for the first time since World War II. The debt is currently the same size as the economy or slightly bigger; very shortly the debt will be much larger than the economy!

There is a historically close correlation between gold prices and debt to GDP. The higher the ratio, the better it is for gold.

We have monetary easing happening at the same time as fiscal spending “carte blanche” (remember Biden believes strongly in the power of the state to tax and spend. A long wish list waits to be filled, with little to no concern regarding the already out of control $28.5 trillion national debt, courtesy of Modern Monetary Theory, or MMT).

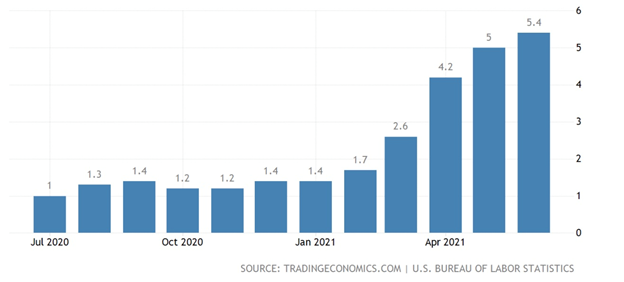

The result of these two forces acting together, is bound to create inflation, which has climbed to 5.4% in June.

Higher inflation is good for gold especially if Treasury yields do not get too high, a situation that would give negative real interest rates. Historical charts prove that every time yields fall below the rate of inflation, ie. they turn negative, gold goes up.

Apart from negative real rates, gold is also, we believe, destined for the next leg up once investors realize the US dollar is being massively devalued.

Gold generally moves higher when the dollar drops. Right now, the US dollar index DXY is holding around 92, but what happens when people realize the federal government has depreciated the greenback by spending $6.5 trillion using borrowed money, plus the Fed’s $8 trillion, meaning the purchasing power of the dollar has been cut in half? The equivalent of half the $28.5-trillion national debt? And with trillions more debt to come, at AOTH we believe there is only one way for the dollar, and only one direction for gold (and silver).

All of our sponsor resource companies at Ahead of the Herd fall under these three top-down investing trends: electrification, decarbonization and inflation.

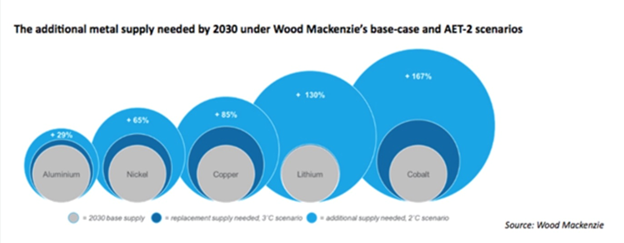

According to a recent report from Wood Mackenzie, mining companies will need to spend $1.7 trillion over the next 15 years, to supply enough lithium, graphite, cobalt, copper and nickel for the shift to a low-carbon world.

The commodities consultancy says meeting new emissions targets being set by countries like Canada, the US, Britain, China and Japan, will mean large-scale deployment of electric vehicles, renewable power and electrical transmission, all of which will require copious metal content.

At the 2016 Paris climate summit, 196 countries agreed to try and limit the warming of the Earth by 2 degrees Celsius, and preferably 1.5 degrees C, compared to pre-industrial levels, by mid-century.

The 2-degree threshold is used in another of Wood Mackenzie’s reports, entitled ‘Champagne supercycle: Taking the fizz out of the commodity price boom’.

The Scotland-based firm says another commodities supercycle is on the horizon, but it will be different from any that have come before:

Fossil fuels won’t be in the vanguard and the winners will be the industrial metals needed to electrify society — cobalt, lithium, copper, nickel, and aluminium.

Under Wood Mackenzie’s Accelerated Energy Transition-2 (AET-2) scenario, which is consistent with limiting the rise in global temperatures since pre-industrial times to 2 °C, 360 million tonnes (Mt) of aluminium, 90 Mt of copper, and 30 Mt of nickel will feed the energy transition over the next 20 years. This level of additional metal presents obvious challenges for producers and consumers alike.

The challenge for producers, ie., mining companies, is finding enough metal to meet the demand.

The report predicts by 2030, cobalt producers will have to add 167% more supply, ie. more than double the 140,000 tonnes per year of the battery metal currently mined. For nickel it’s a necessary 65% increase, for copper it’s +85%, and for lithium producers, 130% more supply needs to be found and extracted, either through hard rock mining, brine operations or clays.

Below we outline some of the most important forward-looking metals needed for a lower-carbon world (we also want to be invested in gold and silver to position ourselves for a prolonged period of high inflation and low interest rates), and our stock picks corresponding to these trends.

Copper

Curiously, copper is often overlooked when tallying up the metals required for the transition to clean energy and electrification. There is no shift from fossil fuels to green energy without copper, which has no substitutes for its uses in EVs, wind & solar energy, and 5G.

Copper’s widespread use in construction wiring & piping, and electrical transmission lines, make it a key metal for civil infrastructure renewal.

The continued move towards electric vehicles is a huge copper driver. In EVs, copper is a major component used in the electric motor, batteries, inverters, wiring and in charging stations.

The latest use for copper is in renewable energy, particularly in photovoltaic cells used for solar power and wind turbines. The base metal is also a key component of the global 5G buildout. Even though 5G is wireless, its deployment involves a lot more fiber and copper cable to connect equipment.

The big question is, will there be enough copper for future electrification needs, globally? And remember, in addition to electrification, copper will still be required for all the standard uses, including copper wiring used in construction and telecommunications, copper piping, and copper needed for the core components of airplanes, trains, cars, trucks and boats.

The short answer is no, not without a massive acceleration of copper production worldwide.

A recent research report from Jefferies Research LLC concluded: “The copper market is heading into a multiyear period of deficits and high demand from deployment of renewable energy and electric vehicles. The secular demand driver in copper is electric passenger vehicles, as the average EV is about four times as copper intensive as the average ICE automobile. Renewable power systems are at least five times more copper intensive than conventional power.”

in 20 years, BloombergNEF says copper miners need to double the amount of global copper production, just to meet the demand for a 30% penetration rate of electric vehicles. That means an extra million tonnes a year, over and above what we mine now, every year for the next 20 years!

The world’s copper miners need to discover the equivalent of two Kamoas (referring to Invanhoe Mines’ giant Kamoa-Kakula copper deposit in the DRC which just reached commercial production) at 500,000t, each and every year, while keeping current production at 20Mt.

Remember we still need to cover all the copper demanded by electrical, construction, power generation, charging stations, renewable energy, 5G, high-speed rail, etc., plus infrastructure maintenance/ buildout of new infrastructure.

That might be another 5-7Mt. So not only is there a 20Mt increase in copper usage required for a 30% EV penetration, but another (we estimate) 5-7Mt increase to meet demand for all of copper’s other applications. To keep up, the industry will need to find an additional two to three Kamoas a year, each producing 500,000t, for the next 20 years!

As we have previously reported, over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place. It’s going to be hard enough to maintain the current 20Mt per year, let alone add so much more production.

Where is this new, and replacement, supply going to come from? When copper becomes so rare it hits $10,000 a tonne, what’s going to happen to 30% EV penetration? High-speed rail? 5G? We suggest that without new copper deposits, these well-intentioned plans are in jeopardy.

Holding onto what may be a rare, district-scale copper-silver project in the underexplored region of northeastern Colombia, Max Resource Corp. (TSXV: MXR, OTC:MXROF, Frankfurt:M1D2) has not only been finding high-grade mineralization at its CESAR property but expanding these zones, confirming its hypothesis of a massive sediment-hosted system comparable to the best in the world. The Max exploration team interprets the sediment-hosted stratabound mineralization of the Cesar Basin to be analogous to both the Central African Copper Belt and the Polish Kupferschiefer deposits in terms of grade, scale and mineralogy.

As Chief Executive Brett Matich previously emphasized: “CESAR provides Max shareholders significant copper exposure, the key metal for the green revolution’s move to electric vehicles, solar, wind and clean power grid infrastructure.”

His claims are backed up by the magnitude of industry interest in the asset since its acquisition. There are already multiple non-disclosure agreements in place to advance the project, including a collaboration agreement with an industry-leading copper producer.

Work completed to date on the CESAR drill cores cannot be overlooked. In less than two years, the Max team has already reported multiple copper-silver discoveries on the CESAR property, with room for further expansion.

Nickel

Producing nickel-rich battery cathodes requires high-purity nickel, in the form of nickel sulfate, derived from ‘Class 1’ nickel sulfide deposits. This nickel can be processed at relatively low cost, and with minimal waste, using a simple flotation technique.

However, there is a problem, in that the majority of today’s nickel production is nickel pig iron (NPI) used in steelmaking (also known as ferro-nickel), which is ill-suited for making battery-grade nickel.

Another problem is the rarity of nickel sulfide deposits. Existing sulfide mines are becoming depleted, and nickel miners are having to go to the lower-quality, but more expensive to process, as well as more polluting nickel laterites such as found in the Philippines, Indonesia and New Caledonia.

According to BloombergNEF, demand for Class 1 nickel is expected to out-run supply within five years, fueled by rising consumption by lithium-ion electric vehicle battery suppliers.

Where will mining companies look for new nickel sulfide deposits, from which the extraction of high-grade nickel needed for battery chemistries is economically, technically and environmentally feasible? The pickings are slim.

Decades of under-investment equals few new large-scale greenfield nickel sulfide discoveries. Only one nickel sulfide deposit has been discovered in the past decade and a half, Nova-Bollinger in Western Australia.

The result of such limited nickel exploration is a very low pipeline of new projects, especially lower-cost sulfides in geopolitically safe mining jurisdictions. Any junior resource company with a sulfide nickel project will therefore be extremely attractive to potential acquirers. At AOTH, we happen to have two.

Palladium One Mining (TSXV:PDM, OTC:NKORF, FSE:7N11) continues to outline a high-grade sulfide nickel system at its Tyko nickel-copper-PGE project in Ontario.

A second-phase, 2,000m drill program started in April, following up on high-grade hits of 9.9% Ni_Eq (23% Cu_Eq) (30 g/t Au_Eq) over 3.8m – US$1,765.70 per tonne at a price of US$8.09/lb and 6.3% Ni_Eq (US$1,123/ tonne) over 0.9m, published on Jan. 19.

The objective of the phase 2 drill program was to test the down-dip continuity of the two EM “plates” (an upper plate and a lower plate) that Palladium One modeled after the first-phase drill program in the fourth quarter of 2020.

A number of high-grade intersections were reported, all near surface, including:

- 1.7m @ 10.2% Ni_Eq (or 31g/t Au_Eq) within 4.5m @ 7.5% Ni_Eq (or 22 g/t Au_Eq)

- 1.7m @ 8.3% Ni_Eq (or 25vg/t Au_Eq)

- 1.7m @ 9.5% Ni_Eq (or 29g/t Au_Eq)

These are some of the highest sulfide nickel grades in the world.

Renforth Resources (CSE:RFR, OTCQB:RFHRF, Frankfurt:9RR) is progressing with a drill program and field prospecting on its Surimeau district property, located south of the Cadillac Break gold structure in Quebec.

What makes Surimeau intriguing is that unlike many copper-zinc VMS systems around the world, this property also happens to host an ultramafic sulfide nickel system at surface nearby.

While the scale of this nickel sulfide system remains to be seen, Renforth considers it to be representative of another “Outokumpu-like” occurrence, referring to a district in eastern Finland that is known for several unconventional sulfide deposits with economic grades of copper, zinc, nickel, cobalt, silver and gold.

Victoria West is one of six polymetallic target areas on the Surimeau property historically documented as hosting mineralization, with several targets confirmed as mineralized and explored by Renforth.

Results are still outstanding from the April/May drill program at Victoria West, which was first drilled with 2.5 short holes in October 2020.

Zinc

Primarily used to coat and protect steel from corrosion, zinc is unquestionably a staple in a nation’s infrastructure buildout. What also makes zinc a critical commodity is the metal’s fundamental role in building a green energy future.

Like copper and nickel, zinc has clean energy applications. It can be used as anode material for batteries, making it a key part of energy storage systems as we move towards a world of renewables. Recent research also shows batteries built around zinc can be a cheaper, safer, and more effective alternative to the lithium-ion battery systems commonly used in electronics and electric vehicles today. This finding could potentially alter the landscape of the global energy storage market.

Given the current rate of consumption, it is projected that global zinc reserves — estimated by the US Geological Survey at 250 million tonnes — will only last another 17 years. The zinc market has reached a critical stage when more mines are needed. But even if all the development projects come online at full capacity, industry experts think that won’t be enough to outpace demand.

Thus, explorers like ZincX Resources (TSXV:ZNX, Frankfurt:M9R, US:ZNCXF) are facing tremendous growth opportunities. Its Akie project in British Columbia is one of the premier global zinc projects in a top-tier jurisdiction (Canada was at one point the world’s largest zinc producer). Through its Cardiac Creek discovery, the company has demonstrated a high-grade, large-tonnage deposit that has expansion potential and even district-level prospectivity — via the Kechika Trough. A 2021 drill program envisions three holes totaling 2,000 meters.

Earlier this month, the Vancouver-based junior announced completion of the first hole drilled into the Cardiac Creek deposit. The hole targeted the northwest area of high-grade core close to three historical drill holes, all of which yielded outstanding results, including 23.42 meters (true width) of 12.40% zinc (Zn) + lead (Pb) and 15.1 g/t silver (Ag); and 28.67m true width of 10.38% Zn + Pb and 14.2g/t Ag.

Tinka Resources’ (TSXV:TK, OTCP:TKRFF) Ayawilca project in Peru comprises 170 km2 of contiguous claims, situated along a world-class mining belt known for producing base metals. About 100 km to the north is the giant Antamina copper-zinc mine jointly owned by BHP, Glencore, Teck Resources and Mitsubishi.

Ayawilca is a carbonate replacement deposit (CRD), an important style of polymetallic mineralization containing economic amounts of zinc, silver, lead and copper.

According to the latest resource update (November 2018), the Ayawilca Zinc Zone contains an estimated 1.8 billion lb zinc and 5.8 million oz silver in the indicated category, and 5.6 billion lb zinc and 25.2 million oz silver in the inferred category as sulfides. This area alone would make Ayawilca the largest zinc development project in Latin America and one of the biggest zinc resources held by a junior explorer.

Norden Crown Metals (TSXV:NOCR, OTC:NOCRF, Frankfurt:03E) is searching for high-grade silver and zinc deposits in Scandinavia. The Canadian firm has started drilling at Fredriksson Gruva, a past-producing Swedish mine originally discovered in 1976.

Having completed the first three drill holes, the company has successfully shown not only that the mineralization continues at depth, but that it has qualities consistent with a Broken Hill Type (BHT) deposit. BHT silver-zinc-lead deposits constitute some of the largest and highest-grade ore deposits in the world.

The findings from the first three holes confirmed that Norden Crown is into a Broken Hill Type deposit such as those found in Australia, South Africa and parts of the Bergslagen mining district of southern Sweden where Gumsberg is located.

Reported grades from mined ore are remarkably consistent, and past drilling rarely missed mineralization, which Norden Crown’s chairman and CEO Patricio Varas says is very encouraging for further resource expansion.

Iron Ore

Iron ore prices in May hit a record $218 per tonne amid a sustained rally in commodities prices as demand from top consumer China remains as robust as ever.

At the center of the rally is rising steel prices, from Asia to North America. Steel demand remains strong as economies — China in particular — continue their massive investments in steel-intensive infrastructure.

The World Steel Association forecasts global steel demand to grow 5.8% this year to exceed pre-pandemic levels, followed by another 2.7% increase the year after. China’s consumption, about half of the global total, will keep growing from record levels.

Also fueling iron ore’s relentless surge is the intensifying diplomatic spat between China and Australia. On May 6, China indefinitely suspended all activity under a China-Australia Strategic Economic Dialogue, exacerbating the strained relationship between the two countries.

Australia is by far the biggest iron ore producer in the world, followed by Brazil. Accordingly, Australia is China’s top supplier of the raw material.

Manning Ventures Inc. (CSE:MANN, Frankfurt:1H5) currently has boots on the ground at three of its iron ore projects — Lac Simone, Hope Lake and Broken Lake in the Wabush-Fermont Iron Ore District of Quebec — collecting samples and mapping in preparation for an upcoming drill program.

Lac Simone was explored by Jubilee Iron Corp. between 1956 and 1964. During that time, Jubilee completed ground and airborne magnetic surveys at the northernmost magnetic anomaly, as well as mini-bulk sampling with basic metallurgical testing and three diamond drill holes. Bulk sampling in test pits produced an average head grade of 35.51% Fe, that was upgraded to a concentrate grade of 66.02% Fe. Of the three drill holes completed, mineralized intervals up to 16.15 meters of 29.05% Fe were recovered.

The Hope Lake property has also been the focus of several exploration campaigns. In 2011 and 2013 Champion Iron Mines visited 48 outcrops and collected 16 samples, which reported average grades of 28.7% FeT and 33.7% FeT from each program, respectively. The sampling programs indicated that the property hosts high-grade quartz-hematite +/- magnetite iron formation.

Broken Lake features about an 18 km-long trend of iron formation from which a well-mineralized interval exceeding 84m was reported, although no assays were documented. A 6 km-long belt of highly magnetic rocks has not yet been drill-tested, but it has been mapped as a magnetite-rich iron formation, representing a prime exploration target.

Palladium

As the world transitions from fossil-fueled “ICEs” to battery-powered electric vehicles, the internal combustion engine is unlikely to be resigned to the scrap heap, just yet. Gasoline vehicles and gas-electric hybrids will gradually displace more-polluting diesels, the former equipped with catalytic converters to filter out pollutants like NoX and particulate matter.

This means growing demand for materials that go into gas-powered autocatalysts, including palladium.

The platinum group metal is set for a supply deficit for the 10th straight year. Driving palladium demand are higher sales of gasoline vs diesel units and tighter pollution controls.

Palladium use in hybrid vehicles, seen as a bridge between gas-powered cars and pure electrics, is a growing source of demand. The lustrous metal is also used in electronics, surgical instruments, jewelry, watch making, aircraft spark plugs, hydrogen purification and groundwater treatment.

Supply, meanwhile, is being challenged by production disruptions, for example flooding at Arctic mines.

On May 4 palladium hit a new record of $2,890/oz.

Palladium One Mining’s (TSXV:PDM, OTC:NKORF, Frankfurt:7N11) LK (Läntinen Koillissmaa) project in Finland is a “basal Cu-Ni-PGE bearing sulphide accumulation within the larger Koillismaa Layered Mafic Intrusion”.

In 2019 Palladium One published the first (maiden) NI 43-101-compliant resource at the Kaukua Zone. Using a 0.3 g/t Pd cut-off grade, the optimized pit-constrained mineral resource at Kaukua includes:

- 635,600 Pd_Eq ounces of Indicated resources grading 1.80 g/t Pd_Eq (“palladium equivalent”) contained in 11 million tonnes, and

- 525,800 Pd_Eq ounces of Inferred resources grading 1.50 g/t Pd_Eq contained in 11 million tonnes.

In addition to Kaukua, Palladium One also has about 900,000 ounces Pd_Eq in a historical resource at the Haukiaho Zone, which the company plans to convert to 43-101 standards in the second half of this year; perhaps ~3-500,000 oz at Murtolampi, also referred to as the northern satellite pit; and a street expectation of what could be an additional 2.5Moz at Kaukua South, where a maiden resource is expected in the first quarter of 2022.

In total, the company has amassed perhaps 4-5Moz of open-pittable resources at its wholly-owned LK project in Finland.

Graphite

Lithium-ion batteries contain 10 to 15 times more graphite than lithium. An average hybrid vehicle carries up to 10 kg of graphite and a plug-in EV has around 70 kg. Every million EVs require in the order of 75,000 tonnes of natural graphite. This represents a 10% increase in flake graphite demand. The need for lithium batteries not only for EVs, but energy storage, handheld tools like drills, and an array of consumer electronics like cell phones and laptops, is almost certain to outstrip supply.

Roskill expects total graphite demand over the next 10 years to grow around 5 to 6% per annum.

To meet this demand, 12 battery megafactories are being planned or built in the United States, including Tesla’s Texas “Terafactory”, which would have an annual battery production capacity of 1 terawatt-hours, or 1,000 gigawatt-hours (GWh).

According to Benchmark Mineral Intelligence, just one 30 GWh per year lithium-ion battery factory needs roughly 33,000 tonnes of graphite anode material per year. The Texas Terafactory would demand more than 1 million tonnes of graphite per year.

If all 12 megafactories are built, they will require about 396,000 tonnes of graphite, every year. This is nearly two-thirds the amount of graphite produced by China, by far the largest graphite producer in the world, in 2020. The US currently produces no natural graphite.

We have clearly reached a point when much more graphite needs to be discovered and mined.

Located on the Seward Peninsula in western Alaska, Graphite One’s (TSX.V:GPH, OTCQB:GPHOF) Graphite Creek property hosts America’s highest-grade large flake deposit. A preliminary economic assessment (PEA) released in 2017 showed 81 million tonnes of resources, mostly in the inferred category at a grade of 7% Cg, containing about 5.7 million tonnes of graphite. The same study envisioned a long-life (40 years) operation — based on drilling less than 20% of the deposit — with a mineral processing plant capable of producing 60,000 tonnes of graphite concentrate (at 95% Cg) per year once full production begins in the sixth year. Tests carried out on the property found that 75% of the flake graphite could be converted into spherical graphite, which is the form used in EV batteries.

A 3,000-meter drill program began this week, with the goal of expanding the project’s measured and indicated resources of graphitic carbon for the feasibility study that will follow the pre-feasibility study (“PFS”), on track for completion in Q4.

Lomiko Metals (TSXV:LMR, OTC:LMRMF, Frankfurt: DH8B) continues to advance its high-grade La Loutre flake graphite property in Quebec. The company is currently working on a preliminary economic assessment (PEA).

The property consists of one large contiguous block of 42 mineral claims totaling more than 2,500 hectares.

Originally explored for base and precious metals, historical reports showed graphite to be present on the property in quartzite and biotite gneiss and in shear zones where the graphite content ranges from 1-10% on surface including visible flakes.

A recent grab sampling and mapping program confirmed a graphite-bearing structure of approximately 7 km by 1 km, with results up to 22% graphite in multiple parallel zones 30m to 50m wide. Another 2 km x 1 km area consisting of multiple parallel zones, 20m to 50m, includes up to 18% graphite.

The property has an estimated resource of 18.4 Mt of carbon flake graphite (Cg) grading 3.19% in the indicated category and 16.7 Mt at 3.75% in the inferred category, using a cut-off grade of 1.5% Cg.

The new PEA will include the latest drill results from the property’s Graphene Battery zone to the south and the EV zone to the north.

Lithium

Rising demand for lithium-ion batteries needed for electric vehicles, consumer electronics and utility-scale electricity storage, is stoking prices for the light element, which can be extracted from brines, clays or the mineral spodumene found in pegmatites, an igneous rock.

According to a recent article in The Northern Miner, lithium carbonate and hydroxide prices have climbed by 71% and 91% respectively this year, with prices expected to rise further then plateau as more supply comes online in 2021-22. Both are well supplied until 2025, but hydroxide could face a shortage by 2027 as demand for high-nickel chemistry rises.

Chris Berry, an independent battery metals expert, told Reuters, “The next few years are going to be critical in terms of whether there’s enough available lithium supply, and that’s why you’re starting to see commodity prices start to ramp.”

Australian bank Macquarie forecasts a global EV penetration rate of 16% by 2025, and by 2030, 30% — a scenario that would lithium carbonate prices over $13,000/t, and lithium hydroxide north of $16,000/t. (current prices are $14,920/tonne for lithium hydroxide and $13,606/tonne for lithium carbonate according to FastMarkets)

Demand for lithium carbonate is expected to rise at a CAGR of 10-14% from 2018-27, while lithium hydroxide demand is seen climbing at a 25-29% CAGR. That change in demand, according to Argus Media, is prompting producers to expand their lithium hydroxide output and shifting mining projects towards developing lithium hydroxide production rather than lithium carbonate.

Cypress Development’s (TSXV:CYP, OTC:CYDVF) Clayton Valley lithium deposit in Nevada would be mined from neither brine nor hard rock, but claystone. An average production rate of 15,000 tonnes per day to produce 27,400 tonnes LCE annually over a +40-year mine life means the project stacks up extremely well against any of the 10 deposits listed here. The company, in our opinion, is extremely undervalued, having already completed a preliminary economic assessment (PEA) and prefeasibility study.

In January of this year Cypress said progress has been made in a scoping-level study of chloride-based leaching to recover lithium from claystone; and in March, began developing a pilot plant that would initially process one tonne per day.

In Q1, Cypress also announced that a previous C$8.5 million bought deal financing was doubled to $17 million due to strong demand from investors.

Cypress and its Clayton Valley Lithium Project presents a compelling partnership opportunity for Tesla, Albemarle, or other electric vehicle and lithium battery manufacturers in the United States.

In March, Victory Resources (CSE:VR, FWB:VR61, OTC:VRCFF) began conducting a geological program at its recently acquired Smokey Lithium project, located in Esmeralda County, Nevada, a region known for its prolific lithium clay deposits. Victory’s project is 25 km northwest of Noram Ventures’ Zeus lithium project and 35 km southwest of American Lithium’s flagship Tonopah property.

The property also lies adjacent and contiguous to Jindalee Resources (ASX:JRL). Outcropping clay on the Australian explorer’s Clayton North property has demonstrated lithium grades as high as 930 parts per million (ppm) lithium (Li), which may trend northwest onto Smokey Lithium.

Victory is looking to secure drill permits in anticipation of a drill program starting later this summer or early fall, in an area of Nevada this is highly prospective for lithium clay deposits. A discovery hole at Smokey would be a game changer for Victory Resources and its recently expanded exploration focus from precious metals to battery metals.

Gold

Low interest rates and Treasury yields are going to be with us for at least the next two years, maybe longer. Theoretically the Fed can independently hike rates to deal with a post-pandemic inflation that is global, rising, and more permanent than temporary, but the fact is the US central bank is severely constrained in how much it can raise rates.

The United States is much more highly indebted than it was in 2010 following the Great Recession, which restricts its borrowing capacity. The federal government is facing a $3 trillion deficit this year, the second in a row, and the interest it must pay on the debt amounts to nearly half a trillion dollars.

True, the Fed gradually raised interest rates following the financial crisis, but it quickly reversed course when it became clear that economic growth, and inflation, wasn’t rising fast enough. Now we have the opposite problem. Central banks are having to walk a tight rope between keeping rates low enough to keep economic growth going after more than a year of virus-caused economic pain, and stopping inflation from getting out of hand.

In these circumstances gold (and silver) is the only asset that is all but guaranteed to increase in value over time, since prices are not held back by inflation, like investments priced in fiat currencies.

When the prices of many goods and services are climbing, we want to be invested in things that are going up, to balance out what we are losing to inflation. The best way to make money off of rising gold prices, is to invest in quality gold stocks.

Consider: “quantifornication” is still going on in the US, Britain and the EU, meaning that excessive money-printing is continuing to devalue currencies at an alarming rate.

Trillions more in economic recovery spending is promised, with little concern over the mounting debt pile. Recently the Wall Street Journal reported that the pandemic has pushed global debt to the highest level since World War II, surpassing annual economic output. Despite a budget deficit of $3 trillion for the second year in a row, and fear of inflation, the benchmark 10-year Treasury yield is only 1.2%.

With inflation running at 5.4%, negative real rates are a shocking -4.2! Rates this negative are a flashing buy signal for gold. In June, the United States Gold Bureau pointed out that the gap between the 10-year and the CPI was -3.5%, the highest since 1980. And it’s gotten worse! (currently -4.2%) The gap, states the bullion dealer, has only been more negative than 3.5% for 10 months in the last 70 years, all of which took place in the hyperinflationary 1970s (1974, 1975 or 1980).

Last year was an exceptional year for gold stocks, owing to the exciting gold bull that ran for the second half, “floating all boats” in the gold space. Several of our gold picks did extremely well. Despite a lower gold price in 2021, we’ve already had three winners (NFLD, NFG and FVL), and we expect more successes to come. Companies are out exploring and it will only be a matter of weeks before drill assays start rolling in.

Exploits Discovery Corp (CSE:NFLD, Frankfurt:634-FF) is making excellent headway on its 2021 exploration program, having completed first-phase drilling at Schooner, one of five drill targets that have been identified in the Exploits Subzone of Central Newfoundland. Three of the targets host visible gold at surface with high-grade assays up to 194 g/t Au.

The company has mobilized the drill to its second target, the Quinlan Veins, where Exploits has an option agreement to earn a 100% interest by paying a combination of cash and shares to the claim owners. Quinlan is within Exploits’ Dog Bay project, one of nine properties in its Newfoundland portfolio, that have geological, geochemical and structural settings comparable to both New Found Gold’s (TSXV:NFG) Queensway project and Marathon Gold’s (TSX:MOZ) Valentine Lake deposit.

In addition to the five drill targets, Exploits has identified two more prospects within its Dog Bay gold property — Duder Lake and Titan.

With the 2021 exploration program well underway at its Blackfly gold project in Ontario, Marvel Discovery Corp. (TSXV: MARV, OTCQB:MARVF, Frankfurt: O4T1) recently announced promising results from earlier surface sampling. This year’s exploration program at Blackfly is a continuation of the work initiated in 2020. Several geophysical anomalies were identified from the ensuing geophysics report, and targets for follow-up were recommended.

The company has also assembled a sizeable land position, about 60,000 hectares, right in the thick of the Exploits Subzone of Central Newfoundland — potentially one of the world’s last easily accessible, district-scale gold camps. Having established itself as a major landowner with five projects in this highly prolific region, Marvel represents an intriguing opportunity for investors looking for the next gold play in Central Newfoundland.

Falcon Gold (TSXV:FG, OTC:PINKS:FGLDF, Frankfurt:3FA) is actively exploring its Central Canada gold & polymetallic property in Ontario, located approximately 21.5 km east of Atikokan, and about 160 km west of Thunder Bay.

The 2021 exploration program envisions drilling up to 2,000 meters in 20 holes, the goal being to target the historical shaft area initially and complete further infill along the 275m strike of the Central Canada mine trend.

Falcon Gold has just increased its chances of making a discovery by acquiring nearly 1,000 claims in the Hope Brook area of southern Newfoundland — part of the highly prospective

Exploits Subzone of the Central Newfoundland Gold Belt.

Magna Gold (TSXV:MGR, OTCQB:MGLQF) recently announced commercial production at its flagship San Francisco mine in Mexico, targeting 90,000 ounces per year. Located 150 km north of Hermosillo, the 47,395-hectare property consists of two previously mined open pits (San Francisco and Chicharra) and associated heap leaching facilities. The mine was previously operated by Geomaque from 1995 through 2000.

Last September, the company released an updated pre-feasibility study (PFS) on the property, showing total proven and probable reserves of 47.6 million tonnes, graded at 0.495 g/t Au, leaving 758,000 ounces of contained gold. There is also ample room for resource expansion, with an estimated upside of 3Moz gold and 50Moz silver.

Drilling on five other properties is also set to get underway, increasing the company’s likelihood of making new discoveries in this mineral-rich region of Mexico.

At Freegold Ventures’ (TSX:FVL) flagship Golden Summit property in Alaska, a drill program that started in early 2020 was designed to test a revised interpretation, based on Freegold’s work that higher-grade mineralization may extend to the west of the old Cleary Hill mine workings in an area of limited previous shallow drilling.

In 2013 Freegold published a non pit-constrained resource of 6,524,000 ounces of gold. Since drilling at Golden Summit resumed in February, 2021, 14,700 meters have been drilled, as of June 3, in 27 holes. Four rigs have been mobilized.

Backstopped by a historical resource of 6.524 million gold ounces and $30 million in cash, my money is on Freegold’s Golden Summit project cruising to +10 million ounces of gold.

Drilling at Getchell Gold’s (CSE:GTCH, OTCQB:GGLDF) flagship Fondaway Canyon gold project in Nevada is well underway and a second project, Star, is slated to be drill-tested in a few weeks.

In a July 13 exploration update, the company says two holes of the 4,000-meter drill program at Fondaway Canyon have been completed, with assay results pending. Also, Getchell has received permits for more drill pads at Fondaway, and for its inaugural drill program at the Star copper-gold-silver project, situated about 60 kilometers north of the flagship.

“The stellar results from the 2020 drill program blew the potential of the Fondaway Canyon Gold Project wide open,” said Getchell Gold President Mike Sieb, in the June 1 news release.

Provenance Gold (CSE:PAU, OTCQB:PVGDF, Frankfurt:3PG) has three projects in Nevada: White Rock, Mineral Hill and Silver Bow. 2021 exploration involves drilling at White Rock while sample collection/ drilling at Mineral Hill, followed by drilling for silver at Mineral Hill after the White Rock drill program is completed.

The White Rock property, located near Newmont’s Long Canyon mine, hosts a large gold system estimated to be 3.2 km long by 1.6 km wide. Past drilling only tested the structures, which returned excellent results but no infill drilling was done. Much of the central area of mineralization remains undrilled.

Provenance also has a high-grade past-producing silver mine in Mineral Hill. According to county geological reports, silver was first mined there in 1868 at a jaw-dropping 140 ounces Ag per ton (3.9 kilograms per ton). Mining continued until 1939, at an average grade of 25 oz/t silver, or 0.7 kg/t.

Surface samples from bedrock exposures returned values ranging from 50 to 1,215 grams per tonne silver, and 0.1 to 5.2 g/t gold.

Silver

Analysts at Capital Economics think silver prices should gain momentum on the back of ongoing fiscal stimulus in China, and greater industrial activity which drives around half of annual silver consumption. They point out the latter will be helped by governments investing in green energy, including solar panels which contain silver paste.

The solar power industry currently accounts for 13% of silver’s industrial demand.

5G technology is set to become another big new driver of silver demand.

The Silver Institute (SI) expects silver demanded by 5G to more than double, from its current ~7.5 million ounces, to around 16Moz by 2025 and as much as 23Moz by 2030, which would represent a 206% increase from current levels.

A third major industrial demand driver for silver is the automotive industry. While copper and battery metals are usually thought of as the main beneficiaries of electrification, it appears the white metal will get swept up in the EV growth story. SI anticipates that, due to the evolution of hybrid and battery electric vehicles, the auto industry is expected to absorb 90 million ounces of silver by 2025, rivaling silver consumption in photovoltaics, currently the largest application of global industrial silver demand.

According to the 2021 World Silver Survey, global demand for silver this year is expected to outpace supply by 7% (+ 8% supply vs +15% demand). Demand will be led by investments in industrial and investment-grade physical silver, as a result of economic recovery from the pandemic, as well as healthy coin and bar purchases building on 2020’s gains.

The Silver Institute therefore expects the silver price to advance a whopping 33% in 2021.

Dolly Varden Silver (TSXV:DV, OTC: DOLLF) has commenced drilling at its namesake silver project located near tidewater in northwest British Columbia.

This initial surface diamond drill program will consist of 10,000 meters, split 50/50 between infill and expansion of the high-grade, potentially bulk-mineable silver resource at the Torbrit deposit and regional exploration of multiple highly prospective targets throughout the property.

The program is the first phase of an aggressive two-year drill campaign at Dolly Varden to expand and upgrade the Torbrit silver deposit and multiple silver-rich satellite zones. The ultimate goal is to advance Dolly Varden to be the next high-grade pure silver mine in the province.

The property hosts four historically active silver mines — Dolly Varden, Torbrit, North Star and Wolf — all of which have parts that remain unexplored.

The much-anticipated drilling program at Mountain Boy Minerals’ (TSXV:MTB, OTCQB:MBYMF, Frankfurt:M9U) flagship American Creek project in British Columbia is just around the corner.

The company this week announced that detailed structural mapping, as well as underground mapping and sampling, are now underway on the property.

The American Creek project is a 2,600-hectare property centered on the past-producing Mountain Boy silver mine, located 20 kilometres north of Stewart in BC’s Golden Triangle.

A previously unrecognized intrusion is similar in age to the many Jurassic-age intrusions found in the area, including the Premier porphyry, which is directly related to what was formerly North America’s largest gold mine.

The upcoming drill program is targeting four areas: the High-Grade Zone, the newly discovered extension of the High-Grade Zone, the Four Bees Zone and the Maybee Zone to the north.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares in MXR, NOCR, GPH, CYP, FVL, GTCH, PAU.

MXR, PDM, RFR, ZNX, NOCR, MANN, GPH, LMR, VR, NFLD, MARV, FG, DV, MGR, GTCH, MTB are paid advertisers on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.