First US graphite processing plant approved

2021.06.22

After decades of neglect, allowing China to monopolize world graphite production, the United States is finally starting to pay more than lip service to the need for a domestic supply of electric battery raw materials including graphite.

This week, Alabama Governor Kay Ivey confirmed that an agreement has been reached with Colorado-based Westwater Resources (NASDAQ:WWR), to bring a graphite processing plant to the state.

The project, the first of its kind in the US, will involve an initial investment of $80 million, followed by a second phase, pushing the total funding commitment to $125 million.

Graphite for the plant will be sourced from mining properties owned by Westwater Resources, which acquired Alabama Graphite Products in 2017 — however, mining operations are not expected to begin until 2028, according to local news provider WSFA.

Westwater has two graphite projects — Bama in Chilton County, and Coosa in the county of the same name. The latter, located between Birmingham and Montgomery, has a preliminary economic assessment completed in 2015. The PEA denotes an indicated resource of 1.876 million tonnes of graphite graded 2.39%, and 2.034Mt inferred, @ 2.56% Cg.

Under an agreement with the state, Westwater’s subsidiary, Alabama Graphite Products, will be provided with tax credits totaling nearly $30 million over 15 years, and $925,000 in job-training and employee recruitment incentives.

Once complete, the processing plant will produce about 7,500 tons of battery-grade graphite per year, eventually ramping up to 15,000t — construction is expected to start in 2021.

Critical mineral

Why graphite, and why now? Well, the United States has declared graphite a critical mineral.

Graphite is included on a list of 23 critical metals the US Geological Survey has deemed critical to the economy and national security.

This past February, the Biden administration announced it would conduct a government review of US supply chains to seek to end the country’s reliance on China and other adversaries for crucial goods.

About 30% of an electric car’s cost goes towards its battery, which requires metals such as lithium, graphite and cobalt — all on the US critical minerals list.

Graphite is the second-largest battery component by weight, about 10 to 15 times more than the lithium content in an EV battery. As such, it is indispensable to the global shift towards clean energy.

Under former President Trump’s executive order (September 2020), graphite was identified as one of four minerals considered essential to the nation’s “national security, foreign policy and economy.”

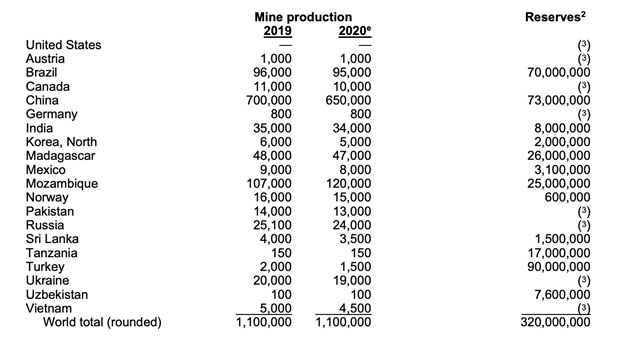

The mineral is sourced from only a few places. China currently is the world’s biggest producer, with 650,000 tonnes of mined graphite in 2020, representing nearly 70% of global supply.

China imports a significant amount of North Korea’s large flake graphite production, raising doubts in regards to China’s abilities to ramp up its own graphite supply. Indeed, China has already taken steps to retain its graphite resources by restricting its export quota – the country imposed a 20% export duty, a 17% VAT and also closed state-owned enterprises.

“The days of cheap, abundant graphite from China are over.” — Industrial Minerals Magazine

After China, the next leading graphite producers are Mozambique, Brazil, Madagascar, Canada and India. The United States does not produce any natural graphite and therefore must rely solely on imports to satisfy domestic demand.

US import dependence

The executive order also highlighted the vulnerability of America’s graphite supply chain: “The US is 100% reliant on imports for graphite, which is used to make advanced batteries for cellphones, laptops, and hybrid and electric cars.”

The level of foreign dependence has increased over the years. The US imported 38,900 tonnes of graphite in 2016, 70,700t in 2018 and 41,000t in 2020.

It’s thought that the increased use of lithium-ion batteries could gobble up well over 1.6 million tonnes of flake graphite per year (more than current mined supply of 1.1Mt) – only flake graphite, upgraded to 99.9% purity, and synthetic graphite (made from petroleum coke, a very expensive process) can be used in lithium-ion batteries.

Global graphite consumption has been increasing steadily every year since 2013, although in 2019 there was a reduction of 14%. The covid-19 pandemic has mostly affected graphite supplies outside of China, according to the USGS.

Roskill expects total graphite demand over the next 10 years to grow around 5 to 6% per annum.

To meet this demand, 12 battery megafactories are being planned or built in the United States, including Tesla’s Texas “Terafactory”, which would have an annual battery production capacity of 1 terawatt-hours, or 1,000 gigawatt-hours (GWh).

According to Benchmark Mineral Intelligence, just one 30 GWh per year lithium-ion battery factory needs roughly 33,000 tonnes of graphite anode material per year. (recall, from above, Graphite One’s processing plant would produce 41,850 tonnes of spherical graphite and 13,500 tonnes of graphite powders per year). The Texas Terafactory would need more than 1 million tonnes of graphite per year.

If all 12 megafactories are built, they will require about 396,000 tonnes of graphite, every year. This is nearly two-thirds the amount of graphite produced by China, by far the largest graphite producer in the world, in 2020. Remember, the US currently produces NO natural graphite.

We have cleared reached a point when much more graphite needs to be discovered and mined.

Graphite One

Along with the “Alabama Graphite Belt”, the target of the Alabama state government’s above-mentioned $125M investment, the US boasts an abundance of graphite in a remote area of Alaska, according to the US Geological Survey.

In a 2017 critical minerals report, the USGS specifically named the Kigluaik Mountains on the Seward Peninsula as home to a deposit that has both the size and grade to meet growing EV battery needs.

Earlier this year, the deposit known as Graphite Creek, was given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC). It is considered the largest known graphite resource on the continent, spanning 18 km of the Kigluaik Mountains.

The project is being advanced by Vancouver-based junior Graphite One Inc. (TSX.V:GPH, OTCQB:GPHOF), which aims to become the first vertically integrated domestic producer to serve the EV battery market.

The latest resource estimate (March 2019) for Graphite Creek showed 10.95 million tonnes of measured and indicated resources at a grade of 7.8% Cg, for some 850,000 tonnes of contained graphite. Another 91.9 million tonnes were tagged as inferred resources, with an average grade of 8.0% Cg containing 7.3 million tonnes.

A preliminary economic assessment (PEA) envisions a 40-year operation with a mineral processing plant capable of producing 60,000 tonnes of graphite concentrate (at 95% purity) per year. This is four times the size of the proposed Alabama graphite processing plant, @ 15,000 tonnes maximum capacity.

Once in full production, Graphite One’s graphite product manufacturing plant — the second link in its proposed supply chain strategy — is expected to turn graphite concentrates into 41,850 tonnes of battery-grade coated spherical graphite (CSG) and 13,500 tonnes of graphite powders per year.

These production figures are based on resource estimates prior to the 2019 update, leaving room for potentially higher production.

Looking to advance what would be an integral part of the US graphite supply chain, Graphite One in February announced the completion of two non-brokered private placement offerings, raising gross proceeds totaling C$10 million. Proceeds will be used to further develop Graphite Creek, including a prefeasibility study (PFS) scheduled for completion in the fourth quarter.

Towards that goal, Graphite One earlier this month published news of its 2021 drill program. 3,000 meters of HQ core drilling is planned to infill and expand the measured and indicated resources of graphitic carbon for the feasibility study (FS), the next step after the prefeas.

According to the company, the drill program and other field work is expected to begin in July, including geotechnical drilling for open pit design and to advance understanding of ground conditions at proposed infrastructure sites.

“With the growing demand for graphite in electric vehicle batteries and other energy storage applications — and recent actions by the Biden administration to secure US supply chains for critical minerals — we see Graphite One’s aim to produce a U.S.-based supply chain solution becoming increasingly significant as a new potential source of advanced graphite products for decades to come,” Anthony Huston, Graphite One’s President and CEO, states in the June 1 news release.

“While the 2017 Preliminary Economic Analysis indicated excellent economics, we are very excited about the potential for the PFS to show a clear path for further development.”

Graphite One Inc.

TSXV:GPH, OTCQB:GPHOF

Cdn$01.35, 2021.06.22

Shares Outstanding 62.1m

Market cap Cdn$84.6m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security. Richard owns shares of Graphite one. GPH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.