Fed 101 Cure inflation by destroying demand – Richard Mills

2023.01.14

US inflation cooled in December, putting the US Federal Reserve on track for a possible smaller interest rate increase when the Federal Open Market Committee (FOMC) meets next at the end of the month.

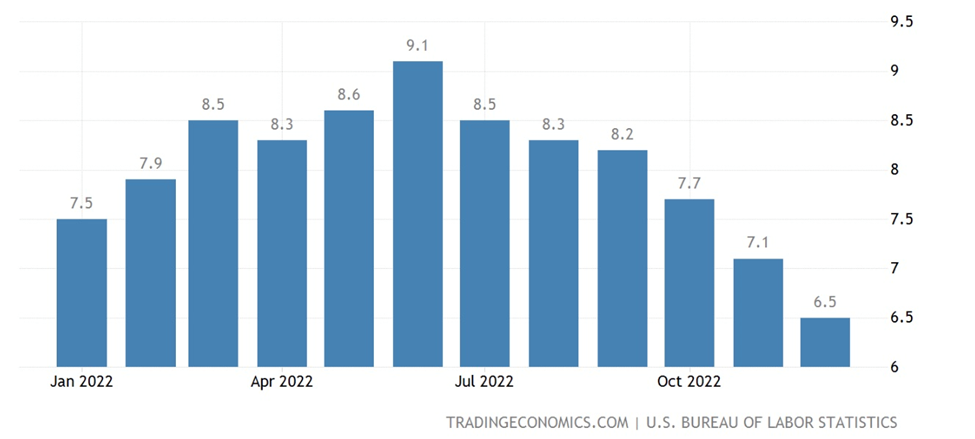

Data publicized yesterday, Jan. 12, found the consumer price index (CPI) fell 0.1% from November. More importantly, the 6.5% rise in prices compared to a year ago, was the lowest inflation level since October 2021, and the December inflation print was the first decline since May, 2020.

The slower CPI was led by lower energy costs, according to a Labor Department report. Gasoline prices dropped 9.4%, by far the largest contributor to the decrease in the headline figure, the report said. Fuel oil fell 16.6%, the biggest decline since February 1990.

The fact that core CPI, the measure that excludes food and energy, was up just 5.7% compared to a year earlier, and that services inflation seems to be abating, rising only 0.3%, when energy and rent are excluded (a number the Fed follows closely), is leading some to conclude that the Fed’s string of consecutive interest rate increases are working to tame the worst inflation in 40 years. Many are calling for the US Federal Reserve to taper its interest-rate hiking cycle to 0.25%, from the 0.5% raise in November and four consecutive 0.75% rate hikes in 2022. Financial markets have priced in a 25-basis point rate increase at the Fed’s Jan. 31-Feb. 1 meeting, according to CME’s FedWatch Tool.

Federal Reserve Bank of Philadelphia leader Patrick Harker said “the days of us raising [interest rates] 75 basis points at a time have surely passed. In my view, hikes of 25 basis points will be appropriate going forward.”

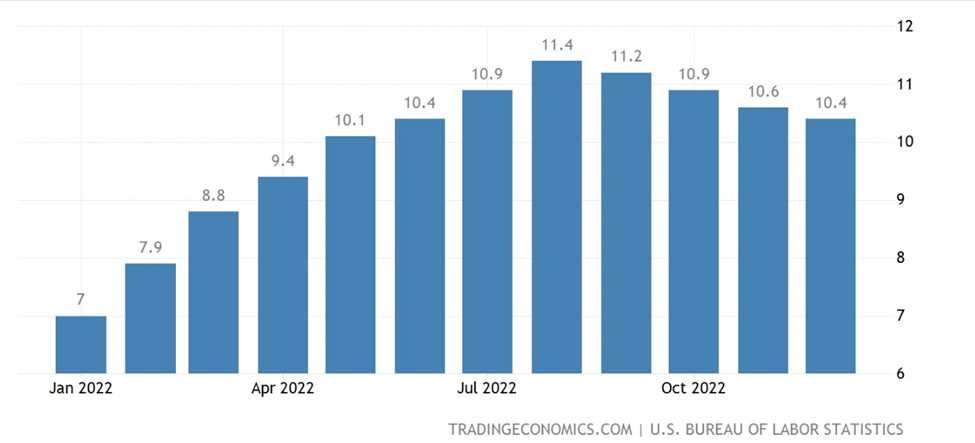

However, despite the optimistic headlines, a more in-depth look at prices shows that a lot of inflationary pressure remains. Food and shelter in particular continue their relentless climb. Despite rising just 0.3% on a monthly basis, year on year, food has jumped 10.4%, according to Bureau of Labor Statistics data. Shelter costs were up another 0.8%, month on month.

Zero Hedge observed that the services component of the CPI soared to the highest in 40 years, while real (after inflation) wages shrunk for the 21st month in a row.

I’m on record saying that the Fed will slow its pace of rates hikes to a quarter-point in early 2023, so the calls for a 0.25% raise are confirmation that we at AOTH have been right all along.

But I’m also of the opinion that inflation is a lot “stickier” than most people believe. Bringing it down to the Fed’s, for now, 2% target will take time, likely measured in years, not months.

Nothing would please me more than seeing the Fed lower interest rates by a quarter point on Feb. 1, (gold investors note that just on speculation the Fed would and then when the Fed downshifted the increase from 0.75% to 0.5% in November, gold jumped $200), I just don’t believe it will happen. Not yet. Previously I argued that it would take at least one 0.5% rate hike or perhaps two in 2023, to quell inflation to the point when a lowering would be okay, say to 25 basis points, and by the end of the year, we’d see a return to lower interest rates. I have to stick to the call, because I don’t believe the Fed has yet brought inflation under control. Also, the Fed needs to have several months of data indicating a deflationary trend; three months worth is promising, but imo, it’s not enough.

Another reason I don’t see the Fed trimming its rate hike just yet, is because of a fear of history repeating itself. As Reuters notes in a recent piece,

Fed policymakers have repeatedly said they want to avoid repeating the mistakes of the 1970s, when the central bank raised rates and then cut them when inflation appeared to recede, only to have to raise borrowing costs even higher to bring the price pressures back in line.

The damage of 5%

According to Bloomberg Economics, “A mostly favorable December CPI report gives the Fed room to further downshift the pace of rate hikes to 25 basis points at the Jan. 31-Feb. 1 meeting. We expect the Fed funds rate to peak at 5 per cent in March and stay at that level for the rest of the year.”

The Fed reportedly penciled in a stopping point of 5.1% for 2023 at the last FOMC meeting.

While 5% interest isn’t as bad as the double-digit rates American consumers had to contend with in the early 1980s, the last time inflation was this bad, it is still very high by today’s standards.

Consider: only two years ago, the US Federal Reserve slashed interest rates to near zero, to deal with covid-19. All of the government debt issued at 0.25% interest, now has to be paid back at 5%, assuming that Bloomberg Economics is right and interest rates move to that level.

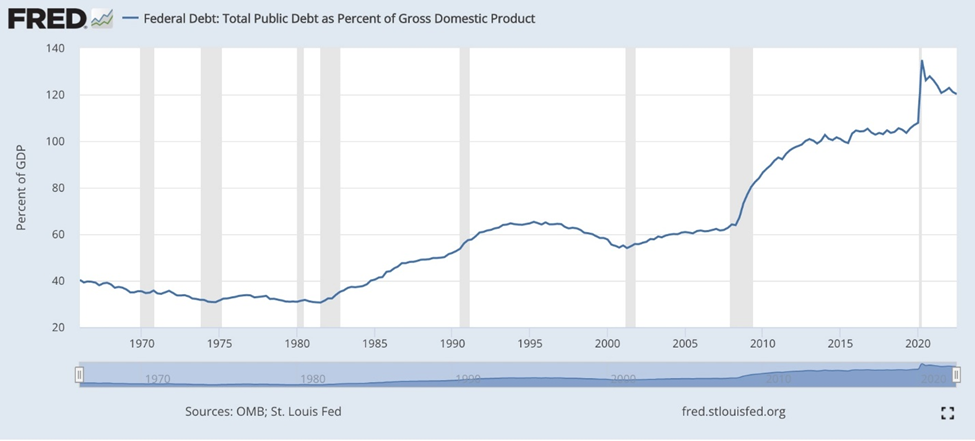

The other difference between now and the 1980s, is the level of debt.

According to the FRED chart below, the US debt to GDP ratio in 1982 was around 35%. Today it is more than three times higher, at 120%.

This severely limits how much and how quickly the Fed can raise interest rates, due to the amount of interest that the federal government must pay on its debt.

During 2021, before interest rates began rising, the federal government paid $392 billion in interest on $21.7 trillion of average debt outstanding, @ an average interest rate of 1.8%. If the Fed raises the federal funds rate to 4.6% (it is already @ 4.5% following the 50-basis-points hike in November), interest costs will hit $1.028 trillion (if all debt were to roll-over in the short term).

Moreover, I don’t believe we’ve yet seen the negative impacts of higher interest rates, on the US and Canadian housing markets, and on the levels of household debt.

In early November, Equifax Canada’s consumer survey found that the average credit card balance reached a record-high $2,121. While credit card debt declined during the pandemic, due to lockdowns and government direct payments, like the CERB, the use of cards as of Nov. 1, 2022 had risen for six consecutive quarters.

The average non-mortgage debt is now $21,188, a level not seen since the first quarter of 2020.

“Credit card usage is reaching historic highs,” Equifax Canada said in a press release, via The Financial Post. “This can be a slippery slope for some, as it doesn’t take long to find yourself burdened by debts, which may become challenging to pay back in this economic environment.”

In Canada, the five lowest credit card interest rates in 2023 range from 8.9% to 12.9%. In the United States, the average credit card interest rate is 21.59% for new offers and 16.27% for existing accounts, according to WalletHub’s Credit Card Landscape Report.

Meanwhile, a housing crisis looms across America, due to demand-killing higher mortgage rates.

“When you have a rise and increase in interest rates like we’ve had, that is a big problem for housing. Interest rates are like the mother’s milk of housing,” Pulte Capital CEO Bill Pulte told FOX Business, Thursday. (Yahoo Finance) “And if you cut it off, you’re in big trouble. And when you’ve had these massive increases in interest rates, it just puts a lot of things to a stop.”

For example: One of the nation’s largest homebuilders, KB Home, saw a 68% cancelation rate on new construction projects.

Things aren’t much better on the housing front in Canada. According to a new report from Royal LePage, Canada’s housing market correction ended the year with the first year-over-year decline for quarterly home prices in more than a decade.

The aggregate price of a home in the fourth quarter of 2022 was $757,100, down 2.8% compared with the year-ago Q4. The declines were steeper in the overpriced Toronto and Vancouver markets, the report showed.

The only people who benefit from lower housing prices are first-time home buyers trying to get into the market. For homeowners, they invariably mean a loss of equity that for some, especially those forced to sell because they overleveraged themselves, can be financially ruinous.

Sticky inflation

Pardon the pun, but I’m sticking with my prediction that inflation is going to be more persistent than the Fed and most other analysts, market observers and participants believe.

A couple of links will prove my earlier point about food inflation continuing to rise.

According to the U.S. Department of Agriculture, In 2023, all food prices are predicted to increase between 3.5 and 4.5 percent, food-at-home prices are predicted to increase between 3.0 and 4.0 percent, and food-away-from-home prices are predicted to increase between 4.0 and 5.0 percent.

A story published yesterday in MarketWatch states that there are a few factors affecting food prices, that are not going away soon. They include the war in Ukraine impacting the cost of fertilizers and animal feeds; the avian flu continuing to have an impact on the supply of eggs, which have risen nearly 60% over the past year; and extreme weather complicating food production. Regarding the latter, California may have just experienced record rainfall and flooding, but that doesn’t mean the 1,200-year drought plaguing farms, orchards, wineries and ranches in the US south and southwest is over.

Other US food items whose prices are expected to soar in 2023, include butter (up 31.4%), due to extreme heat and smaller cow herds; and margarine, currently 43.8% more expensive. Margarine is largely made of vegetable oil, and vegetable oils come from soybeans, corn and sunflower seeds, which are among the crops most affected by the war in Ukraine. Another dynamic, says MarketWatch, is a large amount of vegetable oil is being diverted to the production of renewable fuels.

Meanwhile in Canada, the cost of groceries is expected to keep rising this year, providing no relief to already-stretched households.

The latest Canada Food Price report, via Global News, estimates food prices will increase by another 5-7% on average, adding hundreds of dollars to the average family’s annual expenses.

A recent article by Schiff Gold contributor Michael Maharrey makes a few interesting points about inflation going forward.

The first point, and we’ve made it before, is that the way inflation is currently measured, differs from the formula used in the 1970s. If that same method were utilized today, CPI would be close to double the official numbers.

Second is the fact that, while the markets have priced in a 25-basis-points interest-rate rise at the next Fed meeting, the markets seem to be missing the fact that any slowdown in Federal Reserve monetary tightening will almost certainly set the stage for bigger price increases down the road. Simply put, an end to the war on inflation means more price inflation.

Clearly the Fed has a difficult task ahead of them, in timing a rate trim.

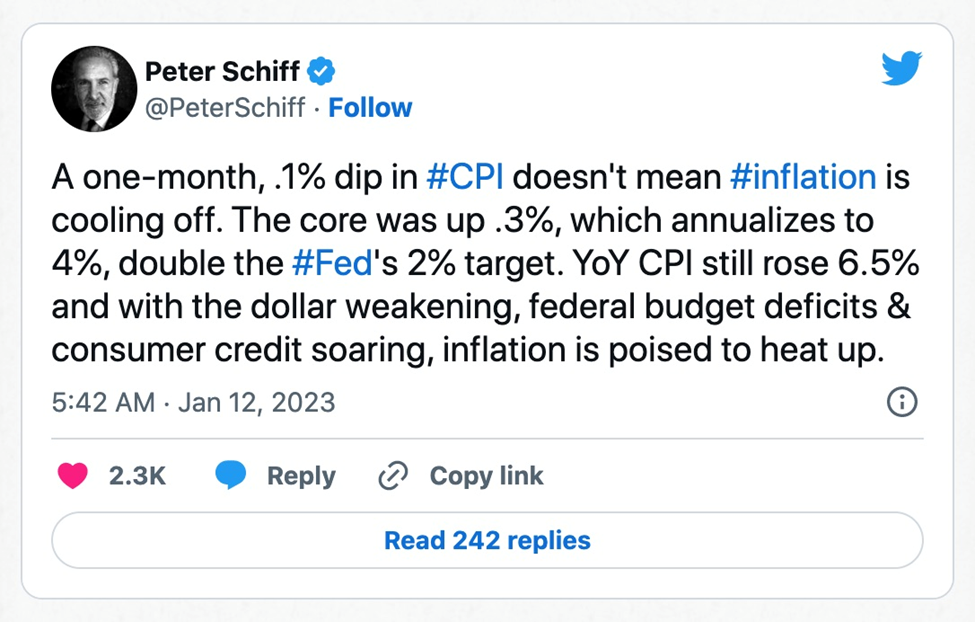

As for whether inflation has peaked, you already know my thoughts on the topic. In a recent podcast, Peter Schiff weighs in:

“I don’t think inflation has peaked. Now, it may have peaked for a short period of time. It may take until the second half of 2023 before we get a year-over-year rate of inflation that was higher than the high water mark for 2022. Who knows? Maybe it will take into 2024. But the one thing that I’m certain of is that we’re not going anywhere near 2%. And that is what investors still don’t understand — that the days of low inflation are over, and we’re living in an era of high inflation. That is a complete game-changer for the Fed and the Fed has yet to come to terms with this new reality, nor has the market.”

Maharrey’s third point, and this ties into the second, is that when the Fed eventually turns dovish and begin lowering interest rates again (let’s face it, the markets are begging for this to happen), it will mean a return to accommodative monetary policy, i.e. money creation. Printing money by its very nature is inflationary.

He says two things are necessary to beat inflation: the first is positive real interest rates, where the interest rate is higher than the CPI. Note this would entail a federal funds rate of over 6.5%! Imagine what that would mean for the amount of interest the government would have to pay, to service its ever-expanding debt? The second thing is for the government to stop running huge budget deficits (which again, are inflationary, because they involve borrowing and printing money).

Good luck with that! The Democrats just rammed through a $1.7 trillion omnibus bill rich with left-leaning “pork”. Among the list of many “woke priorities”, are $1.2 million earmarked for LGBTQIA+ Pride Centers, $3 million for the American LGBTQ+ Museum in New York City, and $856,000 for the “LGBT Center” in New York.

And this just in: On Friday, CNBC reported that Treasury Secretary Janet Yellen notified Congress that the U.S. will reach its statutory debt limit next Thursday.

After that, the Treasury Department this month will begin “taking certain extraordinary measures to prevent the United States from defaulting on its obligations,” Yellen wrote in a letter to new House Speaker Kevin McCarthy, R-Calif.

Conclusion

Inflation is slowing, the Fed will start reducing the amount it’s raising rates from .5 to .25, maybe not at the end of January but it will certainly happen early in the year.

But it’s really never been about how much each raise was or will be. The problem is the called for minimum target 5% interest rate for the rest of the year, that’s what really is going to break everything. We have barely begun to feel any impact of that, let alone the full impact.

Soaring consumer credit card debt, mortgage rates financed at a higher rate means renting costs soar and massive rollover of current short term government debt <1% to 5% are serious problem causing issues. High long term interest rates (along with soaring food prices) directly aimed at the consumer are what will break the US & global economy and give the Fed, and other Central Banks what they want – a massive decrease in demand by crushing the consumer who is 70% of both the US and global economy, they tamed inflation.

Of course rising interest rates are a double barreled shotgun pointed at both consumers and the Fed. Most federal level debt is short term, 2 years, it was easy to make payments at .25% but 5% is a different animal altogether.

The questions I ask myself are a/ who is going to finance that massive debt mountain of US$32T with global de-dollarization underway? b/ when will the Fed have to return to QE and start printing money just to make interest payments?

“First they need to take it to 5%, pause and then reassess – which might mean they need to go to 6%” by next fall.” JPM CEO Jamie Dimon

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.