Falcon reports up to 168 g/t g Au at Spitfire-Sunny Boy gold project in south-central BC

2021.11.08

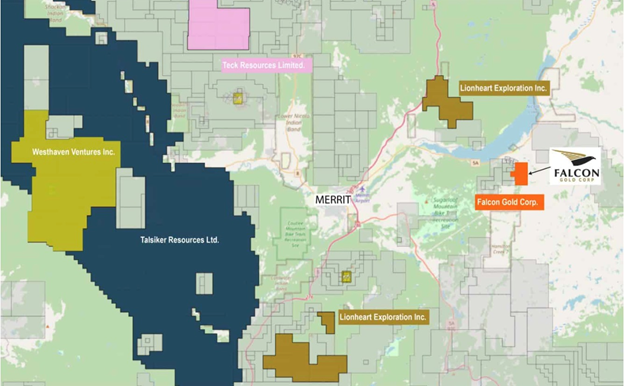

Exploration at Falcon Gold’s (TSXV:FG, OTCQB:FGLDF, GR:3FA) Spitfire-Sunny Boy gold project has returned high-grade assays up to 168 grams per tonne, making it a successful field season at the project located about 16 kilometers east of Merritt.

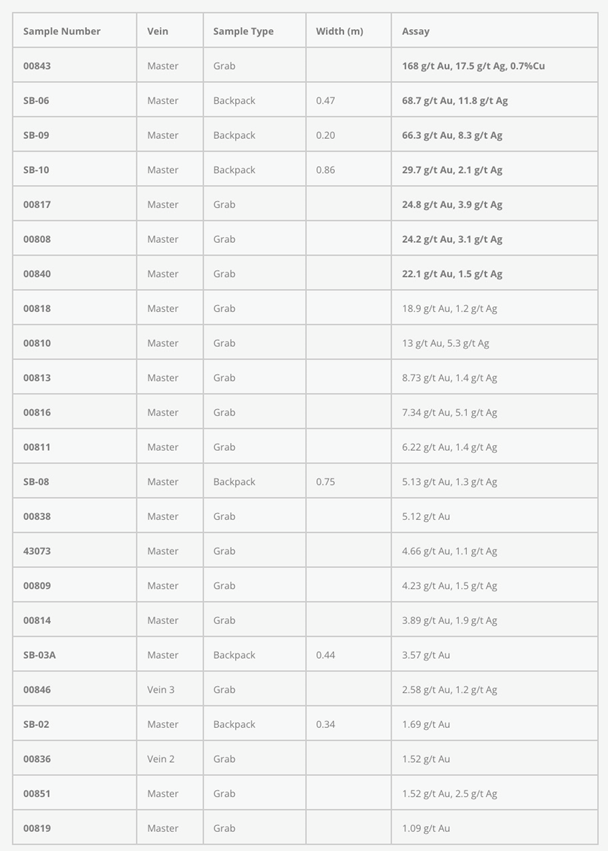

In a Nov. 3 news release, Falcon said the results of the 2021 prospecting and “backpack” drill program include grab samples on the Master Vein ranging from 1.09 to 168 g/t gold, 17.5 g/t silver and 0.7% copper. Backpack drilling from surface produced assays of 68.7 g/t Au and 11.8 g/t Ag over a 0.47m intersection.

The technique utilizes a portable drill to produce rock chips from a small-diameter hole.

The program was designed to test six subparallel vein structures identified at Spitfire-Sunny Boy from previous exploration. Results were very positive with anomalous gold values for almost every sample. Rock samples over a 300m strike length along the Master Vein were collected, and up to a 250m-long strike over other veins at Spitfire-Sunny Boy.

Highlights are tabulated below:

“The sampling and backpack drill program has been a success — this further validates the theory of an epithermal gold system by past operators with its high-grade nature,” said Falcon Gold CEO Karim Rayani. “We have identified multiple parallel gold-silver bearing vein structures over impressive strike lengths. We will continue to evaluate the property in preparation for an inaugural drilling program where historical drilling intersected 3.77 grams per tonne gold, 0.24% copper, and 32.9 grams per tonne silver over 13.4 meters.”

Spitfire-Sunny Boy property

Best described as a swarm of low-sulfidation, epithermal gold veins, Spitfire/Sunny Brook features gold grades up to 127 g/t and 308 to 514 g/t silver in quartz vein material from underground workings. The high-grade veins have been trenched, pitted, blasted and drilled but never commercially mined.

Falcon Gold’s 2019 due diligence work confirmed gold mineralization along the Master Vein over a 300-meter strike length with samples ranging from 0.33 to 2.74 ounces per tonne gold (1 troy oz = 31 grams). Historical exploration suggests that the best exploration targets are high-grade gold vein deposits in the northeastern part of the project. The company sees tightly spaced soil sampling, EM (electromagnetic) and IP (induced polarization) geophysics, and structural mapping as the best approach for identifying new mineralized structures for gold and base metals occurrences.

Highlights from a September 2020 sampling program included a 2.2m channel sample that averaged 59.8 g/t Au. A 1m channel sample from within the 2.2m sample assayed 122 g/t Au on the Master Vein.

A second exploration phase, which commenced in September, was a more aggressive follow-up using backpack drilling along the Master Vein and parallel vein systems. Fifteen holes were completed.

The project’s gold mineralization and geological setting is similar to other developed projects in the region such as the epithermal gold deposits Prospect Valley and Shovelnose currently being worked by Westhaven Ventures.

The Merritt district has a long history of mineral exploration and project development that began in the late 1800’s, with the first recorded discoveries made on the Nicola Lake property in 1908, an area presently covered by the northeastern portion of the Sunny Boy claims block. The original discoveries were gold, platinum and copper.

The main showing, Master Vein, boasts high-grade gold mineralization up to 50.53 oz/t (1,564 g/t). To the southwest of Sunny Boy in an area referred to as the “AL” showing, soil geochemistry, geophysics (magnetometer/VLF), trenching, sampling and diamond drilling have been performed on the mineralized veins.

The best drill result was 3.77 grams per tonne gold, 0.24% copper, and 32.9 grams per tonne silver over 13.4 meters.

Rayani recently told me the objective at Sunny Boy is to try and pull together anywhere from 30,000 to 100,000 ounces of high-grade gold at surface, enough for a bulk sample that, by his estimates, would be a very nice cash generator for Falcon Gold.

The nature of the Sunny Boy mineralization, a series of low-sulfidation, epithermal gold veins, makes it amenable to a bulk sample.

A similar model applies to the Esperanza gold-silver-copper project in Argentina, now under the rubric of a new Latin America-focused company, Latamark Resources. Falcon Gold’s management team has smartly decided to separate out Esperanza and has done so without having to dilute the share structure.

The project has about a 100,000-ounce resource with high-grade narrow veins and a long history of previous exploration.

Falcon Gold is a company on the move with a number of irons in the fire. In addition to Sunny Boy and Esperanza, Falcon has reported visible gold at its flagship Central Canada project in Ontario, where the company is moving towards a new NI 43-101-compliant resource, and significantly expanded its land position in the Central Newfoundland Gold Area Play. There is also lithium discovery potential at the Hope Brook project in Newfoundland, acquired by Falcon in July.

An enticing glimpse of what could lie beneath came via the Sokoman Minerals-Benton Resources alliance, in September. The two companies said that 35 of 58 samples taken from lithium-bearing pegmatite dikes on their Golden Hope project in southwestern Newfoundland confirmed that the pegmatites carry significant lithium values — making it the first documented occurrence of lithium in the province of Newfoundland-Labrador.

Golden Hope is only a kilometer away from Hope Brook, suggesting the mineralization could carry onto Falcon’s property. The company plans to follow-up that theory with further exploration.

Falcon Gold Corp.

TSXV:FG, OTCQB:FGLDF, GR:3FA

Cdn$0.09, 2021.11.04

Shares Outstanding 100.2m

Market cap Cdn$9.3m

FG website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Falcon Gold (TSX.V:FG). FG is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.