Falcon Gold has two advanced stage projects ready to generate cash flow

2021.10.13

It is unusual for a junior gold company to have as many properties as Falcon Gold (TSXV:FG, Frankfurt:3FA.G, OTC:FGLDF), and rarer still for two of those projects to have reached such an advanced stage of development as to become cash-generating assets.

With all that it has going on, Vancouver-based FG has been generating a lot of news lately, so much that it’s a challenge to keep up. We spoke to CEO Karim Rayani on Thanksgiving Monday who gave us the ahead of the herd track on the company’s business strategy as it relates to advancing multiple mineral exploration properties across Canada and one in Argentina.

Central Canada flagship

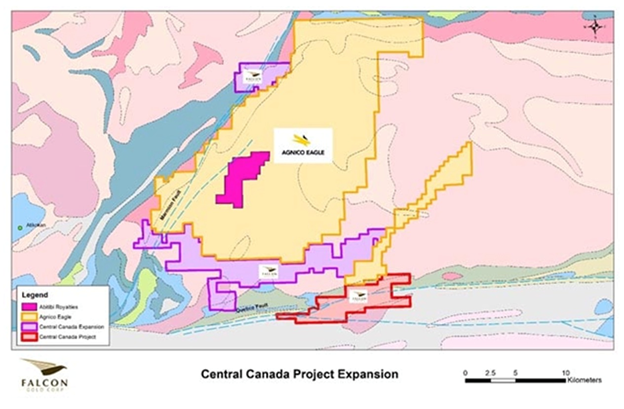

With a total area of 10,392 hectares, Falcon Gold has the largest land position in Ontario’s Atikokan gold camp — bested only by Agnico Eagle and its 32,070-hectare Hammond Reef exploration project.

The company’s flagship project — known as the Central Canada Gold & Polymetallic Project — is located about 20 km southeast of Agnico’s Hammond Reef gold deposit, which has an estimated 3.32 million ounces of gold (123.5Mt grading 0.84 g/t Au) in mineral reserves, and 2.3 million ounces of measured and indicated mineral resources (133.4Mt grading 0.54 g/t Au).

The Hammond Reef property lies on the Hammond shear zone, which is a northeast-trending splay off of the Quetico Fault Zone (QFZ), and may be the control for the gold deposit. Falcon’s Central Canada property lies on a similar major northeast-trending splay of the QFZ.

Under Falcon Gold’s ownership, an initial seven-hole, 1,055m program completed in July 2020 featured a 3m interval of 10.17 g/t Au at 67m downhole. Falcon also intersected a new mineralized zone, untested by previous operators, at 104m depth, which sampled 18.6 g/t Au over 1m.

A second round of drilling took place last November-December, with another 10 holes totaling 1,890m.

By March 2021, all assays from Falcon’s inaugural drill program were received, from which continuity of the mineralized trend containing the historical shaft was confirmed.

Encouraged by these results, the company has undertaken additional work programs on the property this year, with initial focus on the outcrop exposures and trenched areas. The geological team has been conducting detailed structural mapping along the 275 meter-long strike of the Central Canada mine trend.

The team is also attending to the other high-priority gold targets along strike and paralleling the mine trend.

For the 2021 drill program, Falcon plans to complete up to 20 diamond drill holes for approximately 2,000m of core. The goal is to target gold mineralization in the shaft area, and to test other excellent gold zones such as mineralized quartz-feldspar porphyries and the northern vein, also known as the No. 2 vein.

A notable aspect of the Central Canada gold project, which hosts a historical resource of 230,000 oz grading just shy of 10 g/t Au, is the historical Staines copper and cobalt showing, with a reported drill intersection of 0.64% copper, 0.15% cobalt, 1.1% zinc and 0.35% gold over a true width of 40m.

“Part of this polymetallic system, we’re very fortunate to have cobalt numbers, we have the copper, we have the gold, when you add the cobalt in there it’s quite a significant project,” says Rayani, referring to the mineral necessary for electric vehicle batteries whose price he is bullish on.

According to Rayani, as the company moves towards a new NI 43-101-compliant resource at Central Canada, for every hole they drill, they are adding significant ounces to the original resource estimate.

“We’ve done three phases of drilling, hitting mineralization all the way through. Our first two programs were designed to test the surface mineralization, we’ve been adding a meter to a meter and a half, some zones are higher-grade some are low. Even the low it’s 2-3 grams per tonne, that really helps with our modeling.”

Additional field work including sampling, mapping and stripping has identified a number of new zones that extend the high-grade mineralization. The next step for Falcon is to continue drilling the system to depth, going beyond the current 200m level being tested, to 300m below surface.

Newfoundland properties

The Hope Brook property’s 996 claims, or 24,900 ha, acquired by Falcon Gold in July, are contiguous to the Sokoman Minerals- Benton Resources joint venture, Marvel Discovery Corp’s claims and First Mining’s ground which is optioned to Big Rig Exploration. Rock lithologies and structures on the property are also related to those associated with Marathon Gold’s Valentine gold deposits, Sokoman’s Moosehead gold project and New Found Gold’s Queensway gold project — the first mover in the highly prospective Central Newfoundland Gold Area Play.

The Hope Brook mine was in production from 1987 to 1997, producing 752,163 oz. Coastal Gold outlined 6.3Mt at an average grade of 4.68 g/t Au, for 954,000 oz in the indicated and inferred categories.

Asked why the focus on snapping up fresh, unworked ground in Central Newfoundland, Rayani told me, “We were able to acquire this ground for 10 cents on the dollar, most of our assets are owned 100%, no NSRs (net smelter royalties). That’s really my motto,” he stated. “By doing this we can really focus in on the projects ourselves and the company doesn’t have to give away the farm, the objective here is to really assess what we have on our three assets.”

An enticing glimpse of what could lie beneath came via the Sokoman Minerals-Benton Resources alliance, in September. The two companies said that 35 of 58 samples taken from lithium-bearing pegmatite dikes on their Golden Hope project in southwestern Newfoundland confirmed that the pegmatites carry significant lithium values — making it the first documented occurrence of lithium in the province of Newfoundland-Labrador.

Golden Hope is only a kilometer away from Hope Brook, suggesting the mineralization could carry onto Falcon’s property. The company plans to follow-up that theory with further exploration.

“Falcon and our sister company Marvel Discovery have made a lot of noise as of late not only in acquiring sizable land positions tied on to major structures but also following the structures to find what we believe are hidden gems that were overlooked and passed by. Sokoman and Benton’s new Lithium discovery being less than a 1 km away is a testament to our business model,” Rayani stated in a Sept. 17 news release.

Initial permits have been filed for a first phase of exploration at Hope Brook which includes high-resolution magnetic gradiometry surveys that help to sort structural complexities in geological terranes. The company will also be sending prospecting crews to begin baseline prospecting to determine if the magnetic trends highlighted in regional government surveys are due to similar mineralized structures as those hosting the nearby Sokoman/Benton lithium discovery.

Falcon Gold recently acquired two new properties in Central Newfoundland, both located in strategic locations close to known mineral zones or producing mines.

Baie Verte

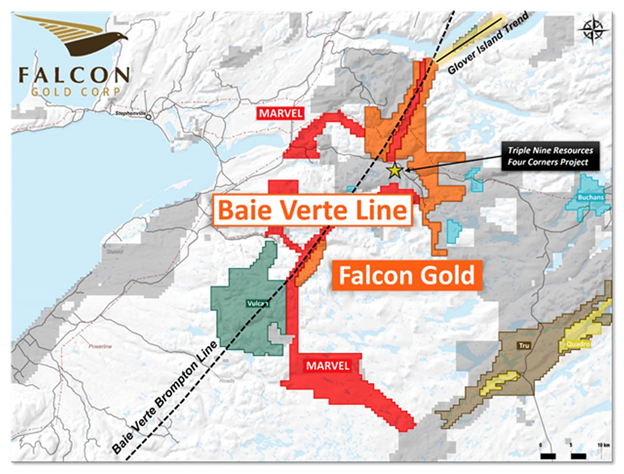

The first deal, announced on Aug. 18, involved 548 claims totaling 13,700 hectares located along the Baie Verte Brompton Line (BVBL) of the Central Newfoundland gold belt, home to some of the province’s largest gold deposits.

There are more than 100 gold prospects and zones, many of which are orogenic-style, related to major splays and associated structures linked to the BVBL. Falcon’s new property covers a 50-km corridor along the BVBL.

Producing mines in the region are headlined by Anaconda Mining Inc.’s Point Rousse gold mine and Rambler Metals & Mining operations. Former producing mines include the Terra Nova mine, and deposits of the Rambler mining camp. All of these mines are close to the BVBL.

Falcon’s new claims are also 13 km southwest of the Glover Island Trend, an 11-km mineralized corridor that hosts 17 base metal and polymetallic mineral prospects as well as numerous gold showings and anomalies.

These include the Lunch Pond South Extension (LPSE) deposit owned by Mountain Lake Resources, which has indicated and inferred resources of 120,000 ounces of gold (June 2017).

The new land acquisition is also close to the Four Corners project held by Triple Nine Resources (see map below).

The Four Corners project consists of iron-titanium-vanadium mineralized rock that has been outlined for 3,000m of strike with intercepts 200m wide and 600m vertically. This project is said to contain sufficient tonnage and grades to warrant developing a world-class mineral resource.

With the Baie Verte acquisition, Falcon now controls a large swath of mineralization for a distance of between 10 and 15 kilometers, including a 300-meter-long identified gold structure.

And with much of the ground already surveyed by government, the company saves a lot of money — Rayani estimates around $2 million — in geophysical studies. “Because we have government mag with at least 60 to 70% of it [surveyed], we’re in pretty good shape.”

Great Burnt

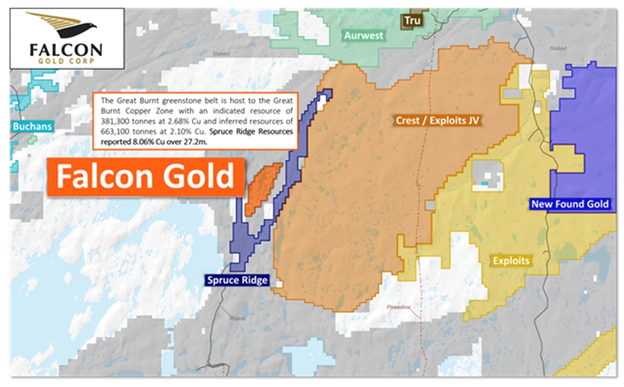

Then, in early September, Falcon announced it has acquired through staking 91 claims totaling 2,275 hectares in the Great Burnt greenstone belt of central Newfoundland, which is rich in base metals.

The Great Burnt greenstone belt is host to the Great Burnt copper zone that contains an indicated resource of 381,300 tonnes at 2.68% Cu and inferred resources of 663,100 tonnes at 2.10% Cu.

Recent drilling by Spruce Ridge Resources returned some of the best copper results across the board, highlighted by 8.0% Cu over 27.2m and 6.9% Cu over 22.7m.

The Great Burnt greenstone belt also hosts the South Pond A and B copper-gold zones and the End Zone copper prospect within a 14-km mineralized corridor.

The greenstone belt is characterized by Besshi-type massive sulfide deposits, which generally occur in thick sequences of marine sedimentary rocks. Sulfide lenses can be several meters thick and extend for several kilometres. Besshi-type massive sulfide deposits are generally copper-dominant and can contain precious metals such as gold, and often cobalt.

As shown on the map below, Falcon’s Great Burnt property is located right in the middle of Spruce Ridge’s land package. It is also situated 4 km west of the Crest Resources-Exploits Discovery joint venture project within the Exploits Subzone.

The Exploits Subzone is known to contain deep-seated gold-bearing structures of the Dog Bay-Appleton Fault — GRUB Line deformation corridor, and is home to the high-grade Keats Zone of New Found Gold. Falcon’s new property is located just 20 km west of the Queensway project held by NFG.

“This property not only has the potential to host important Exploits Subzone orogenic gold mineralization but also copper-rich massive sulphides that contain gold,“ Rayani stated in a news release.

In my conversation with him, Rayani commented,

“The Great Burnt project is in a world-class copper district, it’s probably one of the more prolific mining camps in Newfoundland. Most of the defined deposits are in that jurisdiction. We’re next door to some of the highest-grade deposits there.”

Falcon now intends to perform a high-resolution airborne magnetic and electromagnetic survey over the entire property, integrating mineralization trends and historical results to vector its exploration efforts.

Spitfire/Sunny Boy

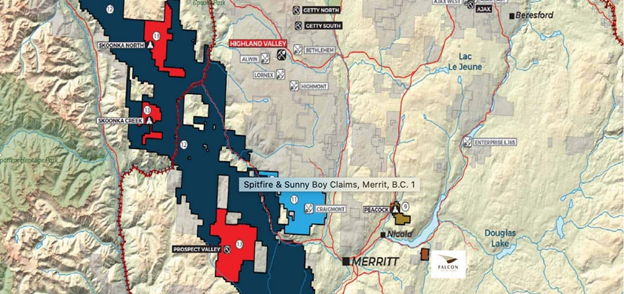

Heading to the other side of the country, at Falcon’s Spitfire/Sunny Boy project near Merritt, BC, a second phase of exploration commenced in mid-September.

Best described as a swarm of low-sulfidation, epithermal gold veins, Spitfire/Sunny Brook features reported gold grades up to 127 g/t gold and 308 to 514 g/t silver in quartz vein material from underground workings. The high-grade veins have been trenched, pitted, blasted and drilled but never commercially mined.

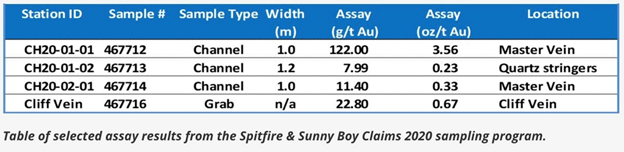

Falcon Gold’s first phase of exploration last year successfully identified gold mineralization over a 300m strike length. Highlights from a September 2020 sampling program included a 2.2m channel sample that averaged 59.8 g/t Au; a 1m channel sample from within the 2.2m sample assayed 122 g/t Au on the Master Vein. Additional highlights are in the table below.

The company’s second phase is a more aggressive follow-up using pack-sack drilling along the Master Vein and four parallel vein systems. Fifteen holes have been completed with assays pending.

“We are thrilled to finally send exploration crews to follow up on our original findings from last year. We believe the nature of the veining conforms to a low sulfidation epithermal deposit type model that could host world class gold grades,” Rayani said in the Sept. 22 news release.

In my conversation with him Rayani went further, telling me the objective at Sunny Boy is to try and pull together anywhere from 30,000 to 100,000 ounces of high-grade gold at surface, enough for a bulk sample that, by his estimates, would be a very nice cash generator for Falcon Gold.

Gaspard

Meanwhile Falcon Gold’s Gaspard gold claims acquisition was approved by the exchange in March.

Comprising three mineral claims (3,955 ha) in the Clinton mining district of central BC, the Gaspard property is located 60 km from Williams Lake and about 16 km from the Blackdome gold mine. Blackdome has indicated resources of 144,500 tonnes grading 11.29 g/t gold and 50 g/t silver, and 90,600t inferred grading 8.79 g/t Au and 18.61 g/t Ag.

Blackdome mineralization is characterized as volcanic-hosted epithermal gold and silver, and according to Falcon, may represent the target type for the Gaspard gold claims.

Historical work includes stream sediment and soil sampling in the northern part of the claims, where gold geochemical anomalies were discovered.

Next steps include a helicopter magnetic survey comprised of 320 km of flight lines along 150m spacings; additional stream sediment sampling; and more prospecting, mapping and sampling of the brecciated rhyolite with quartz vein stockwork, needed to determine the source of the stream and soil anomalies. A budget of around $250,000 is expected to yield drill targets.

Latamark spinout

On March 11 the TSX Venture Exchange approved the company’s option to acquire a 100% interest in the Esperanza gold, silver and copper mineral concessions located in La Rioja province, Argentina.

On Oct. 7 Falcon Gold announced it plans to spinout the project into a new entity known as Latamark Resources Corp. Under the terms of a reworked option agreement, Falcon will pay the vendors 500,000 common shares plus 500,000 warrants along with USD$350,000 in exploration expenditures to earn an 80% interest in the project.

Comprising 10 mineral concessions covering 11,768 hectares, Esperanza is within the Sierra de Las Minas district, where there are a number of past-producing gold and silver mines.

High-grade gold mineralization was first discovered in 1865 at the Callanas occurrences, which was followed by limited mining on a gold-copper-silver zone. Nine hundred meters of drilling was conducted at Callanas during the 1990s, from which two holes reported encouraging results — 1m @ 9.11 g/t gold and 28.59 g/t silver; and 0.42m @ 24.3 g/t Au and 61.10 g/t Ag.

More recently, Esperanza Resources mapped the Callanas West zone along a northwest-southeast strike for about 4 km.

In 2018 Falcon Gold completed a limited sampling program as part of its due diligence on the property. Highlights included a trench sample from Callanas East reporting 1m @ 5.61 g/t Au, and a 2.5m continuous chip sample from Callanas East showing 5.90 g/t Au, 20.6 g/t Ag and 0.29% Cu.

Around 4 km east of the Callenas area, a 30-cm chip sample assayed 15.63 g/t Au and a grab sample of a quart vein float returned 28.43 g/t Au.

Surface sampling results featured 27.03 g/t Au across 50cm from Callana III vein; and a 50-cm width of visible gold from the Callana IV vein that assayed 45.71 g/t Au with >100 g/t silver and 0.78% Cu.

Falcon completed its first exploration work on the Esperanza property in January 2019, with visible gold samples from the Callenas area of 44.90 g/t Au, 123.2 g/t Ag, 0.73% Cu; and another 50-cm chip sample that assayed 26.07 g/t Au, 424 g/t Ag and 1.23% Cu.

Rayani told me the company has similar plans for Latamark Resources, as for their Spitfire/Sunny Boy property in south-central British Columbia.

The project has about a 100,000-ounce resource with high-grade narrow veins and topography similar to Nevada — known for its epithermal, near-surface gold deposits and disseminated, “Carlin-style” gold.

“There’s multiple pods and we believe we can turn it into a cash-flow property. If each pod has 20koz on the low side we can bulk sample and process it ourselves. Because this project is outside of North America I thought it was in the best interests of Falcon and its shareholders not to dilute the current share structure, we’d spin this out into a wholly owned subsididary called Latamark Resources,” said Rayani, in explaining the rationale for the spinout.

He added the company is currently going through the process of filing an NI 43-101 resource, with the structure of the new-co expected to unfold within the next four the six weeks.

Conclusion

Falcon Gold is very active junior with multiple properties located within some of Canada’s best mineral districts, and an advanced-stage project in Argentina.

Since we started covering the company about a year ago, Falcon has reported visible gold at its flagship Central Canada project, significantly expanded its land position in the Central Newfoundland Gold Area Play, started phase 2 exploration at Spitfire/Sunny Boy in BC, and spun out the high-grade Esperanza gold project in Argentina into a new company, Latamark Resources.

As the company moves towards a new NI 43-101-compliant resource at Central Canada, for every hole they drill, they are adding significant ounces to the original resource estimate. The first two programs were designed to test surface mineralization, and they’ve been hitting it all the way through.

Now the drills are diving deeper, up to 400m, to see how far down the system goes. Sampling, mapping and stripping have identified a number of new zones that extend the high-grade mineralization.

Rayani told me “we’re in the system” and Falcon is in the process of completing a model on it. “There’s 50,000m of historic drilling and I would say ~50% of that we’re actually able to use towards the current 43-101, the former numbers and the numbers we’re drilling right now are all very consistent.”

A notable aspect of the Central Canada gold project, which hosts a historical resource of 230,000 oz grading just shy of 10 g/t Au, is the historical Staines copper and cobalt showing, with a reported drill intersection of 0.64% copper, 0.15% cobalt, 1.1% zinc and 0.35% gold over a true width of 40m.

Falcon has “close-ology” in its favor at Central Canada too. With a total area of 10,392 hectares, Falcon has the largest land position in Ontario’s Atikokan gold camp — bested only by Agnico Eagle and its 32,070-hectare Hammond Reef exploration project. Hammond Reef has an estimated 3.3 million ounces of gold in reserves and 2.3Moz in measured and indicated.

In Central Newfoundland, Falcon Gold has been busy acquiring projects in ground attached to the larger players in the camp. They started off with the Hope Brook project and now have Baie Verte and Great Burnt. With the Baie Verte acquisition, Falcon controls a large swath of mineralization between 10 and 15 kilometers, including a 300-meter-long identified gold structure. Great Burnt not only has the potential to host important Exploits Subzone orogenic gold mineralization but also copper-rich massive sulfides that contain gold.

In September the Sokoman Minerals-Benton Resources alliance discovered the first occurrence of lithium in the province of Newfoundland-Labrador. It happens to be 1 km away from Falcon Gold’s Hope Brook. Initial permits have been filed for a first phase of exploration at Hope Brook.

The last but certainly not least two projects, have the exciting potential to give Falcon Gold a revenue stream as it continues to develop, or perhaps spin out other properties within its exploration portfolio. The nature of the Sunny Boy mineralization, a series of low-sulfidation, epithermal gold veins, makes it amenable to a bulk sample. Fifteen short holes have been drilled with assays pending.

A similar model applies to the Esperanza gold project now under the rubric of a new Latin America-focused company, Latamark Resources. Falcon Gold’s management team has smartly decided to separate out Esperanza and has done so without having to dilute the share structure.

The project has about a 100,000-ounce resource with high-grade narrow veins and a long history of previous exploration.

In 2019 FG identified visible gold-silver copper samples of 44.90 g/t Au, 123.2 g/t Ag, 0.73% Cu; and another 50-cm chip sample that assayed 26.07 g/t Au, 424 g/t Ag and 1.23% Cu. Pretty impressive.

Two future cash-cow projects would be nice, but for now, Falcon Gold’s treasury is flush from a recent financing, raising just over a half-million dollars at $0.13. Rayani told me that current exploration activities have already been paid for, and with a low burn rate, he expects they will get most of the first-pass drill targets in Newfoundland identified, and still have lots of money left over for drilling. Again, pretty smart.

From what I’ve seen so far, I have a lot of confidence in Falcon Gold being able to deliver on its goals. Between drilling in Ontario, assay results from the Sunny Boy program in BC, potential lithium at the Hope Brook project in Newfoundland, plus developments at the two new projects, Baie Verte and Great Burnt, we can expect a ton of news flow from Falcon Gold and multiple catalysts for stock price appreciation for the remainder of this year and into 2022.

Falcon Gold Corp.

TSXV:FG, Frankfurt:3FA.G, OTC:FGLDF

Cdn$0.09, 2021.10.12

Shares Outstanding 100.2m

Market cap Cdn$9.9m

FG website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Falcon Gold Corp. (TSXV:FG). FG is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.