Falcon Gold continues acquisition spree around central Newfoundland’s mineral belts

2021.09.18

Area plays, where one company makes a discovery then other companies rush in to stake ground nearby, are often the main driver of growth in junior resource markets.

Noteworthy Canadian area plays in recent history include Eskay Creek in 1990, Voisey’s Bay in 1995 and the Yukon’s White Gold Rush in 2010, just to name a few.

At present, the central Newfoundland region is making a strong case for the next area play of the 21st Century. Specifically, the Exploits gold belt area has become the hunting ground for Canada’s next major discovery of gold and other important metals.

Ever since New Found Gold made a blockbuster discovery in late 2019 (one of Newfoundland’s best drill intercepts ever) at its Queensway project, the Exploits Subzone has turned into an attractive destination for gold explorers, with many having found exploration success within a short period of time. NFG, too, continues to report significant drill results to this day.

One up-and-coming explorer that is continuously expanding its land position in central Newfoundland is Falcon Gold (TSXV: FG, Frankfurt: 3FA.G, OTC: FGLDF), which recently acquired two additional properties in the province, both located in strategic locations close to known mineral zones and/or producing mines.

Baie Verte Property

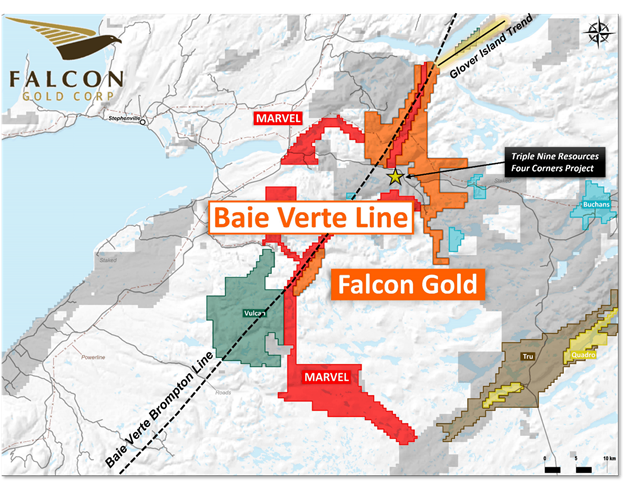

The first deal, announced on August 18, comprises the staking of 548 claims totaling 13,700 hectares located along the Baie Verte Brompton Line (BVBL) of the central Newfoundland belt, home to some of the province’s largest defined gold deposits.

There are more than 100 gold prospects and zones, many of which are orogenic-style, related to major splays and associated second-order structures linked to the BVBL. Falcon’s new property covers a 50 km corridor along the BVBL.

The Baie Verte Peninsula currently hosts all of Newfoundland’s gold production.

Producing mines in the region are headlined by Anaconda Mining Inc.’s Point Rousse gold mine and Rambler Metals & Mining operations. Former producing mines include the Terra Nova mine, and deposits of the Rambler mining camp. All of these mines are in close proximity to the BVBL.

Falcon’s new claims are also 13 km southwest of the Glover Island Trend, an 11 km mineralized corridor that hosts 17 base metal and polymetallic mineral prospects as well as numerous gold showings and anomalies.

These include the Lunch Pond South Extension (LPSE) deposit owned by Mountain Lake Resources, which has indicated and inferred resources of 120,000 ounces of gold (June 2017).

The new land acquisition is also proximal to the Four Corners project held by Triple Nine Resources (see map below).

The Four Corners project consists of iron-titanium-vanadium mineralized rock that has been outlined for 3,000m in strike with intercepts 200m wide and 600m vertically. This project is said to contain sufficient tonnage and grades to warrant developing a world-class mineral resource.

Great Burnt Property

Then, in early September, Falcon announced it has acquired through staking 91 claims totaling 2,275 hectares in the Great Burnt greenstone belt of central Newfoundland, which is rich in base metals.

The Great Burnt greenstone belt is host to the Great Burnt copper zone that contains an indicated resource of 381,300 tonnes at 2.68% Cu and inferred resources of 663,100 tonnes at 2.10% Cu.

Recent drilling by Spruce Ridge Resources in the area has returned some of the best copper results across the board, highlighted by 8.0% Cu over 27.2m and 6.9% Cu over 22.7m.

The Great Burnt greenstone belt also hosts the South Pond A and B copper-gold zones and the End Zone copper prospect within a 14 km mineralized corridor.

The greenstone belt is characterized by Besshi-type massive sulphide deposits, which generally occur in thick sequences of marine sedimentary rocks. Sulphide lenses can be several metres thick and extend for several kilometres. Besshi-type massive sulphide deposits are generally copper dominant and can contain precious metals such as gold and often cobalt.

As shown in the map below, Falcon’s Great Burnt property is located right in the middle of Spruce Ridge’s land package. It is also situated 4 km west of the Crest Resources-Exploits Discovery joint venture project within the Exploits Subzone.

The Exploits Subzone is known to contain deep-seated gold-bearing structures of the Dog Bay-Appleton Fault — GRUB Line deformation corridor, and is home to the high-grade Keats gold zone of New Found Gold. Falcon’s new property is located just 20 km west of the Queensway project held by NFG.

“This property not only has the potential to host important Exploits Subzone orogenic gold mineralization but also copper-rich massive sulphides that contain gold,“ Karim Rayani, CEO of Falcon Gold, stated in a news release.

Since acquiring the claims, the company has received two joint venture offers, both of which were turned down as it believes the value of the property could only go up, seeing as most of the land in the Great Burnt belt has already been tied up.

“If right next door on the same fault line these guys are hitting up to 90% Cu, and this is a VMS system, Newfoundfound is going to have multiple discoveries,” Rayani stated in a Proactive interview.

Falcon now intends to perform a high-resolution airborne magnetic and electromagnetic survey over the entire property, integrating mineralization trends and historical results to vector its exploration efforts.

As the company tends to do extensive research before picking up a project, there’s a good chance that multiple areas of interest could emerge from exploration work.

Flagship Gold Project

Central Newfoundland is just one of the many mineral-rich areas in Canada where Falcon holds a prominent land position.

With a total area of 10,392 hectares, Falcon presently has the largest land position in Ontario’s Atikokan gold camp — bested only by Agnico Eagle and its 32,070-hectare Hammond Reef exploration project.

The company’s flagship project — known as the Central Canada gold mine — is located approximately 20 km southeast of Agnico’s Hammond Reef gold deposit, which has an estimated 3.32 million ounces of gold (123.5Mt grading 0.84 g/t Au) in mineral reserves, and 2.3 million ounces of measured and indicated mineral resources (133.4Mt grading 0.54 g/t Au).

The Hammond Reef property lies on the Hammond shear zone, which is a northeast-trending splay off of the Quetico Fault Zone (QFZ), and may be the control for the gold deposit. Falcon’s Central Canada property lies on a similar major northeast-trending splay of the QFZ.

The Central Canada gold mine has an interesting mining history dating back to the beginning of the 20th Century.

Between 1901-1907, a shaft was sunk to a depth of 12m, and 27 ounces of gold from 18 tonnes were mined using a stamp mill. During the 1930s, the shaft was deepened to 40m, with about 42m of crosscuts, and a 75 t/d gold mill was installed.

Diamond drilling by Anjamin Mines in 1965 returned a 0.6m intersection of 37 g/t Au. Another hole assayed 44 g/t Au over 2.1m.

A more aggressive drill program in 1985 saw Interquest Resources punch in 13 holes for a total of 1,840m, the highlight being a 1.1m intercept of 30 g/t Au.

In 2012, further diamond drilling was completed by TerraX Minerals, consisting of three holes totaling 363m, spaced 55m apart to test a 110m strike length of the main Central Canada structure. The first hole of that program cut 10.61m averaging 1.32 g/t Au, including 1.82m of 4.77 g/t Au.

Central Canada Exploration Plans

Under Falcon Gold’s ownership, an initial seven-hole, 1,055m program completed in July 2020 featured a 3m interval of 10.17 g/t Au at 67m downhole. Falcon also intersected a new mineralized zone, untested by previous operators, at 104m depth, which sampled 18.6 g/t Au over 1m.

A second round of drilling took place in November-December, with another 10 holes totalling 1,890m to complement the previous seven holes plus the three holes done in 2012 by TerraX.

By March 2021, all assays from Falcon’s inaugural drill program have been received, from which continuity of the mineralized trend containing the historical shaft was confirmed.

Encouraged by these results, the company has undertaken additional work programs on the property this year, with initial focus on the outcrop exposures and trench areas. There, the geological team will be conducting detailed structural mapping along the 275m long strike of the Central Canada mine trend. The team will also expand its attention onto the other high-priority gold targets along strike and paralleling the mine trend.

For the 2021 drill program, Falcon is planning to complete up to 20 diamond drill holes for approximately 2,000m of core. The goal is to target gold mineralization in the shaft area, and to test other excellent gold zones such as mineralized quartz-feldspar porphyries and the northern vein, also known as the No. 2 vein.

Other Properties

In addition to the Central Canada gold mine and the two newly acquired projects in Central Newfoundland, Falcon currently has five additional projects across Canada, plus one project in Argentina.

In Ontario’s Red Lake mining camp, the company has acquired a strategic land package at the Springpole West project. This property is directly tied onto First Mining Gold Corp.’s Springpole gold deposit, reported as one of the largest undeveloped gold projects in Canada, and Falcon’s property contains the same geological terrain as that world-class gold deposit.

Near Sudbury, Ontario, Falcon also has a 49% interest in the Burton gold property, located 38 km northwest of IAMGOLD’s Cote Lake deposit, which has an indicated resource of 35 million tonnes averaging 0.82 g/t for 930,000 oz of contained gold, plus an inferred resource of 204 million tonnes averaging 0.91 g/t for 5.94 million ounces of contained gold.

Falcon’s first land position in central Newfoundland was established in July 2021 with its acquisition of the Hope Brook gold property. This property is hosted within the Exploits Subzone of the central Newfoundland gold belt, contiguous to First Mining Gold, the Sokoman Minerals-Benton joint venture and Marvel Discovery Corp.

In British Columbia, the company has further work planned for the Spitfire-Sunny Boy project and the Gaspard gold claims, the latter was acquired earlier this year.

Falcon’s acquisition of the Esperanza gold-silver-copper property in La Rioja province, Argentina, was announced around the same time as the Gaspard project. Consisting of 10 mineral concessions covering 11,768 hectares, the Esperanza property is located within the Sierra de Las Minas district, which hosts a number of past-producing gold and silver mines.

Conclusion

Falcon Gold has all the elements we like to see in an exploration-stage gold junior. The company is a large landowner in a past-producing mining district, with a mid-tier gold producer, Agnico-Eagle Mines, exploring just off its northern boundary.

We also like the recent acquisitions, especially the recently staked claims in central Newfoundland. The properties are all strategically located near areas with potential to grow into a world-class gold resource, and thus could well be a game-changer.

With projects also in BC and Argentina, Falcon has a diversified portfolio of projects with a rich mining history and potentially even richer endowment of mineral resources that can be rapidly generated.

Falcon Gold Corp.

TSXV:FG, OTC:FGLDF, FSE:3FA.G

Cdn$0.105, 2021.09.16

Shares Outstanding 100.2m

Market cap Cdn$10.5m

FG website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Falcon Gold (TSXV:FG). FG is a paid advertiser on Richards site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.