Evergrande not a Minsky Moment

2021.09.21

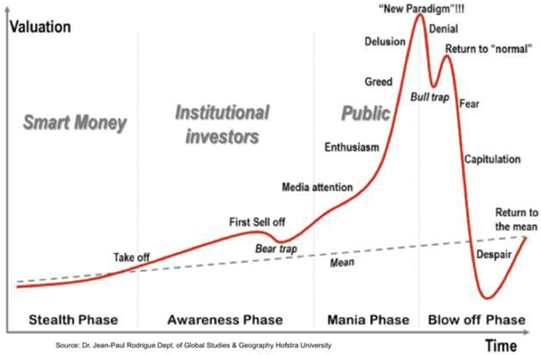

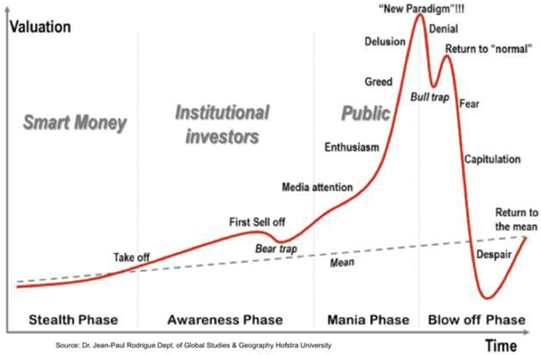

The selloff in stocks that started last week and continued on Monday has some market observers wondering whether this is a “Minsky Moment”.

This refers to the idea that periods of bullish speculation will eventually lead to a crisis, wherein a sudden decline in optimism causes a spectacular market crash.

Named after economist Hyman Minsky, the theory centers around the inherent instability of stock markets, especially bull markets such as the current one that has been in place for over a decade.

On Monday Bloomberg reported U.S. stocks fell the most in about four months amid a global rout sparked by investor angst over China’s real-estate sector and Federal Reserve tapering.

At the close of trading, the Dow Jones Industrial Average fell 1.8%, or 614 points, while the S&P 500 dropped 1.7%. All three of the main US indices are down about 4% this month.

At issue, and currently driving investors’ fears, is the risk of a major Chinese property developer going bust, leading to regional and even global financial contagion, equivocal to what happened during the Lehman Brothers collapse in 2008 and the LTCM hedge fund debacle 10 year earlier.

Market participants increasingly believe that the Chinese government will let Evergrande Group fail, thereby inflicting losses on shareholders and bondholders. The company’s debt burden is the biggest of any publicly traded real estate management company in the world.

Evergrande shares slid more than 10% Monday in Hong Kong, leading a 3.3% slump in the benchmark Hang Seng Index, the biggest loss since late July, and even touching the pandemic-related lows of last year.

As investors and market analysts, we at AOTH want to know, how worried should we be about this market correction? More to the point: How much of an effect will Evergrande’s troubles have on the rest of us?

Evergrande Moment

Properly answering this question begins with an understanding of how the Evergrande Group got itself into this pickle.

The Chinese government has been cracking down on property speculation in an effort to dampen prices, even though the problem was caused by President Xi Jinping’s government. To help the economy to recover from the pandemic, Xi eased regulations on property transactions.

However soaring property values have fueled growing social discontent, which for the Chinese government is a big problem. (Officials in the Politburo remember how the pro-democracy movement led to the Tiananmen Square massacre in 1989. The government’s biggest fear has always been, and continues to be, a repeat revolution among China’s 1.39 billion inhabitants)

Property prices are part of the Communist Party’s economic management policy for the second half of 2021. Among the measures that authorities are taking, are eligibility rules for property purchases and intervening in the second-hand real estate market in cities to prevent inflation.

Enter the Evergrande Group, which grew to be one of China’s largest companies by borrowing more than $300 billion. It currently owns over 1,300 projects in nearly 300 cities across China, and has diversified its business beyond real estate to include wealth management, electric cars, and food & drink manufacturing. Evergrande even owns one of the country’s biggest football (soccer) teams, Guangzhou FC.

Last year, Beijing brought in new rules to control the amount owed by big real estate developers. The new measures led Evergrande to sell its properties at deep discounts to ensure there was enough cash flow, but the firm is now struggling to meet the interest payments on its debts.

The uncertainty has seen Evergrande’s stock price plummet by around 85% over the past year, and its corporate bonds have been downgraded by global credit rating agencies.

It’s estimated around 1.5 million people could lose the deposits on their homes if Evergrande goes under. Then there are the companies that Evergrande does business with, like construction and design firms. They could potentially go bust if their deposits aren’t repaid. The effect on the country’s financial system could also be far-reaching; Evergrande reportedly owes money to around 171 domestic banks and 121 other financial firms.

The banks have been told they won’t receive interest payments on loans due Monday, Sept. 20. Evergrande will be tested again this Thursday, Sept. 23, when $84 million in interest payments on its bonds are due. Sept. 29 is the deadline for another $45.5M in interest on March 2024 notes. The bonds would default if Evergrande fails to pay the interest within 30 days.

In the meantime, Evergrande has started repaying investors in its wealth management business with real estate. Market participants are bracing for what could be one of China’s largest-ever debt restructurings. According to Reuters, regulators have warned that its $305 billion of liabilities could spark broader risks to China’s financial system if its debts are not stabilised.

If Evergrande defaults, banks and other lenders may be forced to lend less, the Economist Intelligence Unit (EIU) told the BBC, which could lead to a credit crunch whereby companies struggle to borrow at affordable rates.

An alarmist Rick Ackerman in his blog says that Evergrande’s failure could make the 1998 collapse of Long-Term Capital Management look like a furniture-store liquidation. Ackerman goes on to argue that Evergrande’s imminent implosion could turn out to be the biggest speculative collapse in history. It is going to take down many big players, causing a chain reaction that will definitively end the buying mania that has gripped shares since Covid-19’s “bullish” failure to put civilization into eclipse.

Up to Their Eyeballs

For now, don’t believe talking-heads blather about how Black Rock, Goldman Sachs et al. hold only relatively small stakes in Evergrande. The truth is, when you connect up the dots, toting up derivatives exposure tied to Evergrande’s epic real estate portfolio, they are all in it up to their eyeballs.

Too big to fail?

Making logical leaps down this path brings up the obvious question: Is Evergrande too big to fail? With $110 billion in sales last year, and $355 billion in assets, the answer might seem obvious.

Indeed some are sure the Chinese government will step in with a bailout to avoid risking supply chain disruptions and enraging homeowners. Others, like the influential editor-in-chief of state-owned newspaper The Global Times, wrote in a social media post that Evergrande should be expected to save itself.

Two banking sources familiar with the matter told Reuters last Friday that the government may step in to “manage an orderly collapse of Evergrande.”

Comparison with LTCM, Lehman

Such talk brings back memories of the 2008 Lehman Brothers bankruptcy and the 1998 Long Term Capital Management (LTCM) crisis.

How does Evergrande stack up against these two property-focused meltdowns? Will the “Evergrande Moment” be closer to the Lehman collapse, a true “Minsky Moment” that presaged the 2008-09 financial crisis, or the less momentous “LTCM Moment”?

Lehman Brothers went bankrupt due to excessive sub-prime lending. Discussions with the Federal Reserve to negotiate financing for the embattled financial services firm failed. On Sept. 15, 2008, Lehman filed for Chapter 11 bankruptcy, the largest in US history involving more than $600 billion in assets.

As Wikipedia describes the event,

The bankruptcy triggered a 4.5% one-day drop in the Dow Jones Industrial Average, then the largest decline since the September 11, 2001 attacks. It signaled a limit to the government’s ability to manage the crisis and prompted a general financial panic. Money market mutual funds, a key source of credit, saw mass withdrawal demands to avoid losses, and the interbank lending market tightened, threatening banks with imminent failure. The government and the Federal Reserve system responded with several emergency measures to contain the panic.

The LTCM Moment occurred when the Connecticut-based hedge fund lost $4.6 billion in under four months due to a combination of high leverage and exposure to the 1996 Asian financial crisis and the 1998 Russian financial crisis. The collapse of Long-Term Portfolio L.P. led to an agreement among 14 financial institutions for a $3.6 billion recapitalization under the supervision of the Federal Reserve. The fund was liquidated and dissolved in early 2000.

LTCM and Lehman both followed a sudden loss of confidence after a period of excessive speculation, however the difference between the two lies in what the authorities did about it. As explained in a recent Bloomberg opinion piece,

After LTCM, the Federal Reserve banged the heads of creditors together to bail it out, and then cut interest rates. That sparked the last mad 18 months of the 1990s bull market. The Lehman Moment happened when the government decided not to repeat the LTCM experience, because it had created too much moral hazard — the irresponsible behavior that comes when people are sure they will be bailed out. The result was the worst U.S. market crisis in eight decades, and arguably the greatest global financial crisis ever.

The welter of research into Evergrande in the last few weeks comes to a clear consensus. Yes, Evergrande is big enough to create a Minsky Moment within the Chinese market. But we should expect the response to be far more LTCM than Lehman. For the short term, therefore, this implies a nasty and messy market, but not an all-out implosion.

Another way to put it, is that Evergrande’s likely debt restructuring, and the fallout from it, is much more likely to be a Chinese contagion, rather than spiraling into a full-blown global financial crisis.

Supporting this thesis, Bloomberg argues, There have been worries about a potential Minsky Moment in the Chinese property market for the best part of a decade now…. There is evident contagion in the real estate sector…

China is pockmarked with speculative properties and it isn’t at all clear that there will ever be buyers for them. This is terrible collateral.

So why is there still relative calm? It boils down to a close reading of the Chinese authorities’ intentions. They have no interest in staging their own Lehman.

Conclusion

Evergrande then, is no different from the “too big to fail” US banks that in 2008, were among the recipients of $700 billion in government bail-out money, funnelled through the Troubled Assets Relief Program (TARP).

A deal will be done to stabilize Evergrande’s debt and restructure bonds and loans by selling most of its assets, some investors will be repaid with real estate.

The company has reportedly hired two financial advisory firms to explore “all feasible solutions,” while regulators in its home province of Guangdong have dispatched accounting and legal experts.

While the Evergrande Moment certainly has potential to morph into something bigger, more catastrophic, the reality is this is an issue about real estate speculation in China. And remember, the Chinese government caused it, by cracking down on real estate speculation, generally, and specifically, by implementing new rules to control the amount owed by big real estate developers. The latter hit Evergrande right in the pocket book, suddenly throwing shade on the company’s ability to make the interest payments on its more than $300 billion debt. The government is highly motivated to solve this problem internally, and we firmly believe Beijing and Evergrande will come to a solution.

This doesn’t mean we aren’t concerned about the broader ramifications, and that there aren’t problems with North American stock markets.

Last week a report from Deutsche Bank said trailing and forward price to earnings, enterprise value to EBITDA and cash flow valuation metrics are “well into the 90th percentile.”

Historical data shows that when valuations have gotten to such high levels in the past, five-year forward returns were on average negative, Business Insider wrote.

Earlier this year a number of companies unveiled big stock buyback programs, which artificially inflate share prices, after canceling them last year due to the pandemic.

The most insightful thing to say about share buybacks is that they’re good for management, not necessarily shareholders.

There are plenty of negatives, with the most obvious being that buying back shares means that executives are foregoing the opportunity to put that extra cash back into the business instead, which could potentially grow the company long term. Studies have linked increased spending on buybacks to decreased corporate investment — such as expansion plans, more hiring or raises.

And of course, sky-high North American stock markets have the US Federal Reserve to thank for excessive money-printing and rock-bottom interest rates that are always good for corporate earnings and keeping equity valuations buoyant.

The flip side of the Fed’s loose monetary policy is ballooning government, corporate and household debt.

The United States is much more highly indebted than it was in 2010 following the Great Recession, which restricts its borrowing capacity. The federal government is facing a $3 trillion deficit this year, the second in a row, and the interest it must pay on the debt amounts to nearly half a trillion dollars.

According to usdebtclock.org, the current national debt sits at $28.7 trillion, and it is increasing with each tick of the clock.

Corporate debt is also climbing to dangerous levels.

According to the Federal Reserve and the Securities Industry and Financial Markets Association (SIFA), US companies now face the highest debt levels on record, at more than $10.5 trillion. In 40 years the amount of corporate bonds outstanding has grown by over 2,000%, from 16% of US GDP in 1980, to 50% of GDP in 2020.

There has been talk of a “corporate bond bubble” triggering the next financial crisis, after the Fed took extraordinary measures at the beginning of the pandemic to buy corporate bonds — part of a $250 billion program funded by the CARES Act.

In sum, we get that there is a significant risk of overvalued US stock markets correcting in a major way, and the Toronto Stock Exchange following them over the cliff like a doomed buffalo herd. Our markets are going to have a Minsky moment. But we don’t believe Evergrande is the trigger.

Minsky’s view: When times are good, investors take on risk; the longer times stay good, the more risk they take on until they’ve taken on too much…”

US stocks have been overvalued for quite a while. Many nervous investors are dancing close to the exits thinking the signs of a nearing collapse will be clear and they will have time to get out. A mad dash to the exit was apparent today, Monday, but the market clawed back some of it’s losses, and will continue to do so.

Despite headlines pointing to Evergrande as the catalyst for the current rout, arguably there are other, more important factors.

“The Evergrande situation, although big and impactful, isn’t the reason for this selloff. Rather, stalemates in Congress on the debt ceiling, worries on policy changes or mistakes in monetary policy, and a litany of proposed tax increases have dampened the mood for investors. When this occurs, corrections happen,” states a Sept. 19 Bloomberg piece, quoting Jamie Cox, managing partner at Harris Financial Group.

The above-mentioned op-ed has the final word on the subject, with Wei Yao of Societe Generale, the French investment bank, stating:

While we do think that Evergrande is systemically important, we also reckon that Chinese policymakers have the willingness, capability and knowhow to stem a financial market meltdown.

To be clear, an LTCM outcome isn’t great. It leaves the risk of more moral hazard. And while the PBOC can probably avert a full-blown credit crisis, it can’t stop the weakness of the property sector turning into disappointing economic growth for China. Many small savers and hopeful property buyers will inevitably be hurt by whatever deal can be thrashed out — and the precise shape of that deal will matter a lot. But for the moment, world markets are nervous that this could be another LTCM, while comfortable that it won’t be a Lehman. On balance, both of these points look reasonable. Now let’s see what happens.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.