EV sales red-line as lithium chase continues

2021.11.20

When we turn the calendar on 2021 in a few weeks, the year will be remembered not only for its extreme weather, but the progress that was made in vehicle electrification, considered a necessary step towards carbon emissions abatement in a rapidly warming world.

Transportation makes up 28% of global emissions, so transitioning from gas-powered cars and trucks to plug-in vehicles is an important part of the plan to wean ourselves off fossil fuels.

A 2020 World Bank report entitled ‘The Mineral Intensity of the Clean Energy Transition’, estimated that production of minerals underpinning the clean energy shift, such as the battery metals lithium, graphite and cobalt, would have to increase by nearly 500% by 2050 to meet global demand for renewable energy technology.

Cleaning up the planet, and “going green” will not be possible without major reductions in carbon emissions from the two largest economies, the US and China.

President Biden is pushing forward on climate-oriented programs. His $1.1 trillion infrastructure spending package, recently passed by Congress, is aimed at transitioning the US transportation system to battery-powered vehicles and supporting renewable wind and solar energies over carbon-based sources like coal and natural gas.

Vehicle electrification is a major part of the legislation’s focus. It would provide $7.5B for low-emissions buses and ferries, and aims to deliver thousands of electric school buses to districts across the country. Another $7.5B would go towards building a nationwide network of plug-in EV chargers.

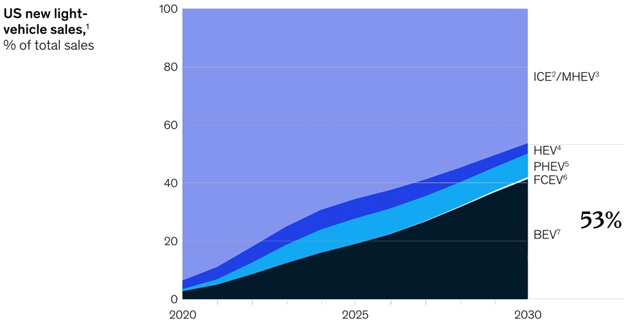

This past August, Biden signed an executive order requiring that half of all US new vehicle sales be electric by 2030.

$65 billion is earmarked for rebuilding the electrical grid including thousands of new miles of power lines and expanding renewable energy, according to the White House.

From an initial social spending/ climate package of $3.5 trillion, panned by Republicans for containing a wish-list of “progressive” priorities, Biden’s Build Back Better legislation is now roughly $2 trillion and has as its centerpiece over $550 billion to tackle climate change and the transition to clean energy. The legislation was passed on Friday by the House of Representatives and is heading to the Senate for a vote.

China is also moving forward rapidly on its plans to electrify and decarbonize. The country is the world leader in electric vehicles and battery production.

President Xi Jinping a year ago announced the country is aiming for carbon neutrality by 2060.

EV growth explosive

EVs are forecast to make up about 15% of new car sales by 2025, doubling to 30%, or 30 million, by 2030.

Power Technology reports electric-vehicle sales have more than doubled, increasing 160% in the first half of 2021 compared to H1, 2020. This 2.6 million units represented 26% of total new car & truck sales.

1.1 million were sold in China, the top electric-vehicle market, compared to 250,000 sold in the United States.

An analysis from IDTechEx quoted by the publication forecasts EV sales in 2021 are on track to surpass 5 million passenger cars. “If they do, it will mean an astonishing growth rate of ~86% CAGR since 2011,” the report reads.

Virta, which claims to be the fastest-growing electric vehicle charging platform in Europe, operating in over 30 countries, is more aggressive in its 2021 EV sales forecast.

“Carried by a decarbonization challenge most leading nations now take seriously, 2021 is a game changer in the history of EV sales and it is expected that 6.4 million vehicles (EVs and PHEVs combined) will be sold globally by the end of the year. It would then represent a 98% year over year increase,” the company states in ‘The Global Electric Vehicle Overview in 2022: Statistics and Forecasts’.

It notes that in 2019, the number of EVs was only 9% higher than in 2018, “a clear deviation” from the growth rates of the previous six years which were between 46% and 69%. The slower uptake was due to decreased sales in the two biggest markets, the US and China.

The big surprise was 2020. Despite the decline in all vehicle sales categories last year due to the pandemic, global EV sales grew by 43% from 2019 and electric-car marketshare, also known as the penetration rate, hit a record 4.6%.

Projecting further out, Virta cites the International Energy Agency’s (IEA) Global EV Outlook 2021, whose Stated Policies Scenario suggests that by 2030, the global EV stock, excluding two- and three-wheelers, will reach nearly 145 million and account for 7% of the total vehicle fleet.

The more ambitious EV30@30 has, plainly, 30% of all vehicles becoming electric by 2030, putting global sales at 43 million, or almost double that of the Stated Policies Scenario.

Power Technology notes that market penetration has been mostly confined to China, North America and Europe, with the rest of the world lagging significantly. Surprisingly, given the country’s auto-manufacturing history and strength, Japanese cars last year accounted for less than 5% of battery-electric cars sold worldwide.

Virta expects Europe to reach the 14-million milestone by 2025, followed by 33 million by 2030 in low estimates, or 40 million in high estimates. From 2035 onward, the company expects 100% of new cars in Europe to be electric.

Breaking the data down further, Virta says Europe and China accounted for the most electric-vehicle registrations for the first half of the year, a respective 1.06 million and 1.14 million, followed by the United States at 297,000 new registrations.

In Europe, where numbers are growing faster than elsewhere, the increase in registrations is explained by stimulus measures introduced by many European government governments. The European Commission is seeking to have at least 30 million electric vehicles on the roads by the end of this decade – a large increase from the current 1.4 million.

It isn’t only electric cars and trucks that are increasing in popularity. According to Virta, “From public transportation to e-scooters: The entire transport industry is turning electric.”

For example in the US, e-bike sales have more than doubled in 2020, whereas in Europe, electric scooters are becoming more mainstream. The IEA’s Global EV Outlook 2021 found more than 100 European cities have started operating e-scooters.

China represents 99% of the world’s privately owned electric two and three-wheelers, out of a market of 290 million.

Heavy-duty electric truck registrations were up 10% in 2020. This is an important sub-market to penetrate, considering that, while large trucks only account for 10% of ICE vehicles, they are responsible for 70% of CO2 emissions.

Electric buses have also been increasing since 2020, with Virta noting that China registered 78,00 new e-buses in the past year, adding to a global fleet of 600,000 in 2020. Perhaps surprisingly, one of the global leaders in electric buses is Chile, which aims to electrify all its public transport by 2040.

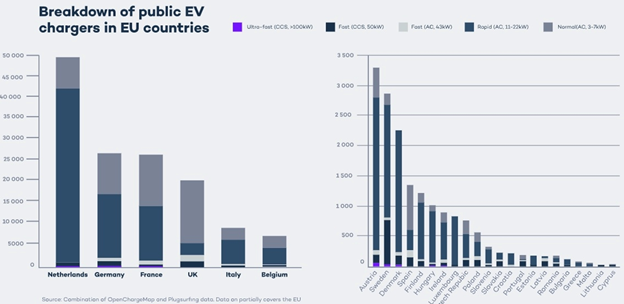

As for charging infrastructure, Virta focuses on Europe, stating that in 2019 there were 175,000 public EV chargers, with the expectation that 1.3 million will be available in 2025 and 2.9 million by 2030. Faster chargers are reportedly becoming the norm, with European slow chargers being replaced by rapid, fast and ultra fast units.

More impressive EV sales statistics can be found in a recent report by McKinsey & Company. Starting with 2020, the consultancy notes that global sales exceeded pre-pandemic levels by the third quarter, with Europe and China achieving fourth-quarter sales increases of 60% and 80%, respectively, over the previous quarter, helping to drive global EV penetration to an all-time high of 6%. (higher than Virta’s 4.6%)

McKinsey’s numbers only go to the second quarter of 2021, when it says US EV sales increased by nearly 200% compared to Q2 2020, contributing to a domestic penetration rate of 3.6% during the pandemic.

Across the country, EV adoption hasn’t occurred evenly, with increased uptake tied to population and cities, unsurprisingly. California, says McKinsey, is the outlier, where electric-vehicle registrations shot up to 425,300 in 2020, representing about 42 percent of EV registrations in the entire country, according to the US Department of Energy’s Alternative Fuels Data Center. That’s more than seven times the rate of registrations for Florida, the state with the second-highest number of EVs registered.

The consultancy believes EV sales will continue increasing, propeled by government policies including the Biden administration’s stated goal that half of all new vehicle sales by 2030 be zero-emission; state-level adoption of credit programs; tougher emissions standards; and increasing electrification commitments from OEMs.

(Carmakers that comprise 57% of the current vehicle market have already announced ICE vehicle sales elimination dates that range from this decade to the year 2050 — McKinsey)

Sales could also be boosted via direct measures such as consumer tax credits on EV purchases, and the Bipartisan Infrastructure Framework, whereby the government has pledged $1.2 trillion for transportation and infrastructure spending over eight years, to be initially funded with $550 billion. As explained by McKinsey, the deal, which has been passed by Congress, includes $15 billion to speed up adoption of EVs and accelerate America’s EV market. The plan sets aside $7.5 billion to construct a nationwide EV charging network and another $7.5 billion for low- and zero-emission buses and ferries to replace school buses that run on diesel fuel.

In McKinsey’s estimation, the most likely EV-adoption scenario, would see EV sales comprising about 53% of all passenger-car sales by 2030.

If Electric Adoption continues to accelerate, EVs are likely to account for more than half of all US passenger car sales by 2030

As to the question of EV affordability compared to regular gas vehicles, the consultancy expects it will take until 2024 to 2026 to achieve cost parity as battery prices continue to decline.

Energy storage surge

A lithium-ion battery is a type of rechargeable battery technology common to portable electronics, electric vehicles and large grid-scale storage systems for renewable energy.

These batteries consist of an anode, cathode, separator, electrolyte and two current collectors (positive and negative). The cathode contains lithium, either in the form of lithium carbonate or lithium hydroxide, while the anode is made up of graphite. There are no substitutes for either in a li-ion battery.

Researchers at Imperial College London developed a model to determine the lifetime costs of nine electricity storage technologies for 12 applications, between 2015 and 2050. The model predicted that the cost of lithium-ion batteries would fall far enough to beat pumped hydro energy storage – currently the cheapest way to keep energy on ice, as it were.

The finding opens up a potentially lucrative market for lithium and other metals that go into lithium-ion batteries, beyond electronics and EVs. The energy storage market was just 1.4 gigawatts (GW) worldwide in 2017 but it could reach 8.6GW by 2022, according to GTM Research. The US and China are currently the biggest supplies of stored energy and are expected to remain so until 2022, GTM Research said in a 2018 report.

A more recent forecast by BloombergNEF found that global energy storage installation is expected to be 20 times larger within a decade (358 gigawatts, or 1,028 gigawatt-hours compared to 17GW/ 34GWh).

“BloombergNEF’s 2021 Global Energy Storage Outlook estimates that 345 gigawatts/999 gigawatt-hours of new energy storage capacity will be added globally between 2021 and 2030, which is more than Japan’s entire power generation capacity in 2020,” the report reads. “The US and China are the two largest markets, representing over half of the global storage installations by 2030.”

Other top markets include India, Australia, Germany, the UK and Japan.

BNEF’s report suggests that over half (55%) of energy storage by 2030 will be for energy shifting, i.e., storing solar or wind power for release later. It also states that, while the industry is adopting multiple lithium-ion battery chemistries, the dominant one for energy storage is lithium-iron-phosphate (LFP).

According to BNEF, in 2021 LFP batteries were used more than nickel-manganese-cobalt (NMC) batteries, popular in EVs, for the first time, and they are expected to be the chemistry of choice until at least 2030,“driven by its dominant role in China and increasing penetration in the rest of the world.”

Although non-battery technologies such as compressed air and thermal energy storage are being developed, the report says batteries are expected to dominate the market at least until the 2030s, “in large part due to their price competitiveness, established supply chain and significant track record.”

Lust for lithium

Rising demand for lithium-ion batteries is stoking prices for the light element, which can be extracted from brines, clays or the mineral spodumene found in pegmatites, an igneous rock.

The increase this year in electric car registrations has resulted in higher production of automotive lithium-ion batteries, up by 33% from 2019, according to the above-cited Virta report. China remains the leading country for battery-making, accounting for over 70% of global production capacity.

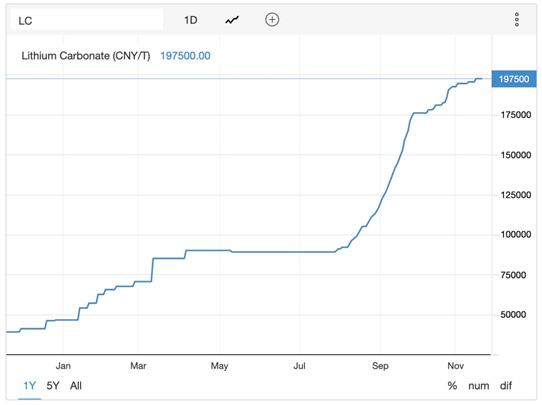

The prices of lithium carbonate and hydroxide, both used in the li-ion battery cathode, have soared this year on break-neck demand and tight supply.

In mid-September lithium prices reached their highest since 2018; they have continued to climb. Prices for lithium carbonate in China have risen more than 160% this year, while in Australia, where most “hard rock” lithium mining is done, spodumene prices in September jumped 144% to $990 per tonne.

“Right now it’s very simple: the market is so tight that players are fiercely competing for any spot tonnage available,” Reuters quoted a trader at Transamine in Geneva.

“Things are heating up and there is huge anxiety about where lithium supply is going to come from in the near future,” said Benchmark Mineral Intelligence analyst George Miller, adding, “If new lithium doesn’t start coming to market, we might start to see electric vehicle production rates hamstrung by a lack of raw material supply.”

Benchmark forecasts lithium demand to more than triple between 2020 and 2025, rising to a million tonnes and out-pacing supply by 200,000 tonnes.

Another market analysis firm, CRU, foresees 2021 lithium demand of about 450,000 tonnes will exceed supply by around 10,000 tonnes.

EV sales are expected to hit 55% of total vehicle sales as early as 2030. That represents 65 million units, and 3 million tonnes of lithium in just eight years, compared to the 400,000 tonnes of lithium per year mined currently.

Shorter-term, Chilean-state-owned SQM expects lithium prices to shoot nearly 50% higher in the last three months of the year compared to the third quarter, as strong demand for the electric-vehicle battery ingredient continues to pressure the market to deliver.

The world’s second largest lithium miner is reporting a huge increase in revenues and profitability, on higher prices. Net profits in the third quarter were about $106 million compared to just $1.7M last year, while revenues of $661M outpaced third-quarter 2020 revenues by 46%.

The benchmark lithium index has more than doubled in 2021 and prices in China have hit records. As MINING.com notes, with little to no inventory in the system, buyers are snapping up all the lithium they can, forcing SQM and number one lithium miner Albemarle to fast-track expansion plans.

Chile, which currently generates close to 30% of world supply, plans to double production by 2025 to about 250,000 tonnes of lithium carbonate equivalent (LCE). Nonetheless, the country is predicting a shortage by 2030, with expected supply of 1.5 million tonnes unable to meet a quadrupling of demand to 1.8Mt.

Despite surging prices, the mining industry saw several major deals involving lithium firms in October.

Rock Tech Lithium plans to locate its first battery metals smelter within a 90-minute drive of Tesla’s gigafactory under construction outside Berlin, in a bet that Germany will take the lead in Europe’s electric vehicle transition.

South Korea’s LG Energy Solution, one of the biggest EV battery makers globally, recently agreed to buy as much as 100,000 tonnes of lithium a year as part of a six-year “take-or-pay” deal with Vancouver-based Sigma Lithium Corp., which controls a hard rock lithium deposit in Brazil.

China’s top battery maker, Contemporary Amperex Technology (CATL), outbid Ganfeng Lithium to acquire Canadian miner Millennial Lithium, which holds lithium assets in Argentina.

As China’s largest lithium compounds producer and the world’s biggest lithium company by market value, Ganfeng has gone on an acquisition spree over the years, having invested in several lithium projects in Argentina (Caucharí-Olaroz, Mariana), Australia and China.

In August, Ganfeng proceeded with a takeover of Mexico-focused lithium developer Bacanora, and in the same month, inked a four-year supply deal with Australia’s Core Lithium for 300,000 tonnes of spodumene concentrate, a partly processed form of the battery material.

China’s Zijin Mining, known for its status as a major gold and copper producer, announced its first foray into the lithium sector with a $770 million purchase of Neo Lithium, outbidding many other Chinese bidders.

Neo Lithium’s main asset is a high-grade brine operation in Argentina, with CATL already being one of its backers.

In total, Bloomberg Intelligence analyst Christopher Perrella estimates five companies essentially control the $4 billion global lithium market, two of which are Chinese.

Conclusion

Recent mergers and acquisitions (“m&a”) in the lithium space show the industry is consolidating in an effort to secure enough lithium supply to meet future demand. As Chris Berry of House Mountain Partners, a well-known battery metals expert, was quoting saying earlier this year, the bidding war for Millenial Lithium “is just a taste of what’s to come. I do see more mergers and acquisitions even at existing pricing.”

“It’s not just hedge funds riding momentum,” he added. “These are larger strategic players from both inside and outside the EV supply chain positioning amidst the decarbonization thesis.”

“We have and will continue to see the Chinese looking to buy lithium,” agreed Matthew Hind, head of global mining at the Scotiabank’s investment banking division, in a July Forbes piece. “There will also be small-cap consolidation as well as EV companies buying stakes in mines with strategic partners in order to secure supply.”

The latter bodes well for lithium juniors, especially those with large, scalable lithium deposits that can separate lithium and other saleable minerals from brines, spodumene or claystones at relatively low cost.

The rise in the popularity of electric vehicles can no longer be dismissed as media hype. The trend of decarbonization and electrification is happening and it is accelerating. In fact the horse and barn analogy seems appropriate, where EVs are the stallion that has bolted out the barn door and the suppliers of lithium and other battery metals are running to catch it while they still can.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.