Emerging supply gap in second half of the decade necessitates new batch of copper mine projects

2021.11.29

Copper’s widespread use in building construction, power generation and transmission makes it a key metal for civil infrastructure renewal. Roskill forecasts that the world’s total copper consumption is set to exceed 43 million tonnes by 2035, driven by population and GDP growth, urbanization, and electricity demand.

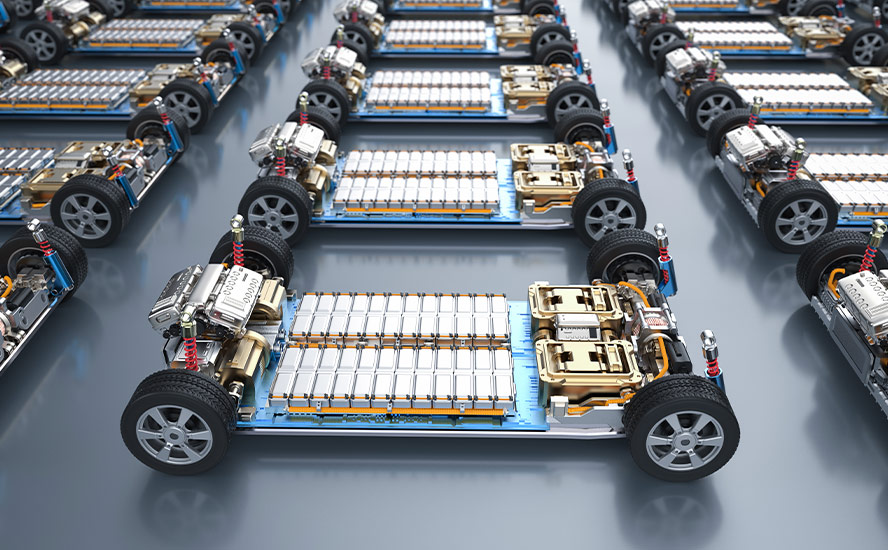

This decade, with the global push towards vehicle electrification, demand for copper is about to take off, given that a typical EV uses about four times more of the metal as a regular internal combustion engine (ICE) vehicle.

Consulting firm AlixPartners estimates that EVs, which at the moment only represent 2% of the total global vehicle sales, will make up 24% of total sales by 2030. Investments in EVs by 2025 could total $330 billion, it predicts.

Seeking to make half of the new US auto fleet electric by 2030, President Joe Biden has already called for $174 billion in government spending to boost EVs, including $100 billion in consumer incentives.

Such measures are sure to put a strain on the global copper sector, which is already suffering from years of underinvestment dating back to the 2000s, translating to a lack of new mines being developed.

In 20 years, BloombergNEF says copper miners need to double the amount of global copper production just to meet the demand for a 30% penetration rate of electric vehicles — from the current 20Mt a year to 40Mt.

Keep in mind that electrification does not just include cars, but also trucks, trains, delivery vans, construction equipment, and two-wheeled vehicles like e-bikes, motorcycles and scooters; so copper usage is bound to go higher than projected.

Copper, too, is needed for charging stations and renewable energy, particularly in photovoltaic cells used for solar power, and wind turbines.

Data from CRU Group shows copper consumption by green energy sectors globally is set to jump five-fold in the 10 years to 2030.

Overall, to electrify societies’ infrastructure and to achieve a 1.5˚C global warming trajectory, approximately $50 trillion of investment will be needed over the next two decades, according to global energy consultancy Wood Mackenzie.

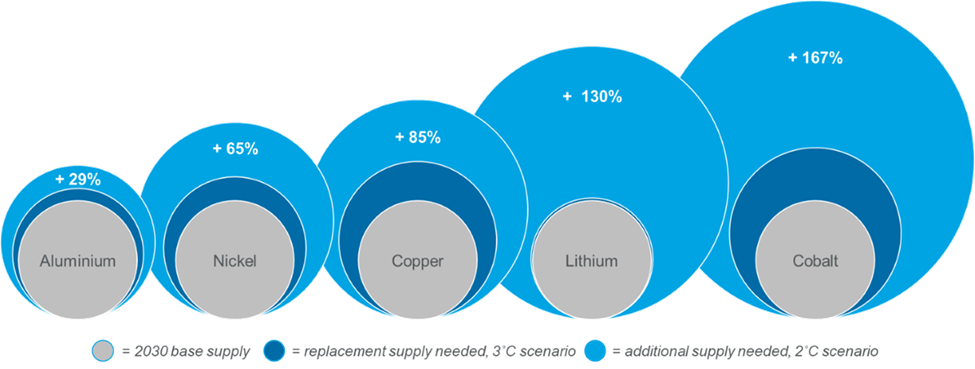

Under WoodMac’s more lenient Accelerated Energy Transition-2 (AET-2) scenario, which is consistent with limiting the rise in global temperatures since pre-industrial times to 2°C, roughly 19Mt of copper will be needed to feed the energy transition over the next 20 years — representing an additional supply increase of 85% (see above).

This is an obvious challenge that today’s producers must overcome, not just now but for the next two decades and beyond.

Supply Lagging Demand

S&P Global Market Intelligence predicts that due to a shortage of projects, supply will lag demand starting in the long term.

While the New York-based analytics firm expects mined copper production to rise to 21.87Mt and 26.14Mt in 2021 and 2025, respectively, from 21.16 Mt in 2020, that would not prevent a supply gap in the post-2025 years.

Production from existing copper mines, including concentrate and solvent extraction-electrowinning, is expected to increase at a CAGR of 1.0% in 2021-25 but fall at a CAGR of 4.7% in 2026-30, driven by declining ore grades and mine closures.

These mines include Glencore’s 33.75%-owned Antamina (BHP 33.75%, Teck Resources 22.5%, Mitsubishi 10%), Codelco‘s Radomiro Tomic and Teck’s Highland Valley.

As a result, production from existing operating mines — not considering those assets that are starting up, project expansions or mine restarts — is projected to fall to 15.90Mt in 2030 from 20.53Mt in 2021.

Diminishing supply from currently operating mines, combined with the projected increase in demand for copper concentrate over 2021-2030, would result in a 3.85Mt production shortfall in 2025, according to S&P Global estimates.

The refined copper market will also move into a 279,000-tonne deficit by 2025, from a 142,000-tonne surplus in 2020, S&P Global adds.

From 2026 to 2030, the copper industry will be unable to meet a growing demand for concentrate, even when including uncommitted development-stage projects that could potentially move forward and start up during this period, S&P Global says.

Dwindling copper reserves and lower ore grades at some of the world’s largest mines also mean that a new deposit would just be replacing the existing output, thus not contributing to supply growth at all.

CRU estimates that over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.

The solution, as simple as it sounds, is to have more copper projects that can be developed into producing mines. S&P Global has identified 14 probable and 26 possible projects in the copper pipeline, though the firm admits it’s unlikely that all will come to fruition.

Therefore, given the copper‘s increasing demand from the EV and the renewable energy revolution, more action from the mining industry is imperative to close the supply gap.

S&P Global estimates that new copper discoveries have fallen by 80% since 2010.

As of now, the global copper cupboard is quite bare. Remember, to even have a chance at net-zero emissions, at least 19Mt of additional metal must be delivered by 2040, the equivalent of one new Escondida mine (1Mt annual production) every year.

While such a feat is difficult to achieve, finding the right investments in projects leading to copper discoveries would help to close the supply gap.

According to CRU, the copper industry needs to spend upwards of $100 billion to erase what it estimates to be a 4.7Mt deficit by 2030.

Prospective Copper Projects

At AOTH, we are paying close attention to several companies that are holding onto highly prospective copper projects.

In Chile, notorious for its world-leading copper production, Pampa Metals Corp. (CSE: PM) (FSE: FIRA) is advancing as many as eight projects right in the heart of northern Chile’s proven copper belts.

The mid-Tertiary porphyry copper belt of northern Chile is currently host to three of the world’s top five copper mining districts: Collahuasi, Chuquicamata and Escondida. The adjacent Paleocene mineral belt also hosts a series of important porphyry copper deposits such as Cerro Colorado, Spence and Sierra Gorda.

Together, the company’s properties cover a total area of 59,000 hectares, making it one of only a few juniors with significant landholdings in the Atacama region that is mostly dominated by major miners.

Still, a large part of the region remains underexplored to this day as roughly half of northern Chile is covered by gravel that was deposited after the formation of the porphyries, which means more mineral deposits are likely concealed underneath.

On the other side of the Andean copper belt in Colombia, Max Resource Corp. (TSXV: MXR) (OTC: MXROF) (Frankfurt: M1D2) may be holding onto what could potentially be a massive sediment-hosted system comparable to some of the world’s best.

Max interprets the sediment-hosted stratabound copper-silver mineralization in the Cesar basin to be analogous to both the Central African Copper Belt, which contains nearly 50% of the copper known to exist in sediment-hosted deposits, and the Polish Kupferschiefer, Europe’s largest copper source.

For over a year, the company has not only been finding high-grade copper zones at its flagship CESAR property but expanding these areas to confirm this hypothesis. To date, five copper discoveries have been made along an 80 km belt, demonstrating its significant regional potential.

Max’s goal is to partner up with a major to begin drilling at CESAR. Interest so far has been strong, with multiple non-disclosure agreements in place to advance the project, including a collaboration agreement with an industry-leading copper producer.

Just this week, the company was granted three key mining concession contracts, for a total of four, for the URU copper zone, one of the discoveries from earlier this year along the 90 km long copper-silver belt.

Europe, too, has an abundance of porphyry copper deposits that can be traced back to the Paleozoic and Late Cretaceous to Miocene ages. The Baltic Shield, in particular, has often drawn comparisons to the Canadian Shield and cratons in South Africa, and is currently one of the most active mining areas on the continent.

Part of the Shield covers most of Scandinavia, where Norden Crown Metals Corp. (TSXV: NOCR) (OTC: NOCRF) (Frankfurt: 03E) is looking to bring back its gloried copper past.

The company recently began exploration drilling at its Burfjord project in northern Norway. The property is located in the Kåfjord copper belt, which is highly prospective for iron oxide-copper-gold (IOCG) and sediment-hosted copper mineral deposits.

Mineralization at Burfjord belongs to the same deposit clan of the northern Fennoscandia region, a key IOCG province globally. Copper mineralization was mined in the Burfjord area during the 19th Century, with over 30 historic mines and prospects developed along the flanks of a prominent 4 km x 6 km anticlinal structure.

The 2021 drill program is designed to continue testing copper-gold grades and continuity of new targets, historical mines and prospects at the Burfjord property.

In Finland, months of drilling success by Palladium One Mining (TSXV:PDM) (FRA:7N11) (OTC:NKORF) on its Läntinen Koillismaa (LK) PGE-Cu-Ni property have culminated in a much-increased resource endowment, further confirming the project’s potential to host a large bulk-tonnage deposit.

At the Haukiaho zone there are significant base metals, with two-thirds of the zone’s value in nickel and copper.

The latest resource estimate of 1.2 million ounces palladium equivalent (PdEq) grading 1.15 g/t, comprises only 3 km of strike length; 2 km of strike extent, immediately east of the Haukiaho resource estimate, contains two significant IP chargeability anomalies with sufficient historical drilling to potentially be upgraded to inferred resources with modest additional drilling.

The remaining 12 km of the Haukiaho trend has not been drill tested, though widely spaced historical drilling provides a high level of confidence for potential additional nickel-copper resources to be delineated, says Palladium One.

Palladium One also continues to outline a high-grade nickel-copper system at its Tyko Ni-Cu-PGE project in Ontario, where a second-phase drill program started in April and a recently announced expansion increases the size of the property by over a fifth.

All 13 holes drilled at the Smoke Lake target intersected magmatic sulfides, with widths ranging from 1 to 15 meters. A second-phase, 2,000m drill program started in April, following up on high-grade hits of 9.9% nickel equivalent (NiEq) over 3.8m. A number of high-grade intersections were reported, all near surface.

Excited as Palladium One is about its nickel results, there are also notable copper and nickel occurrences, in particular the RJ and Tyko zones located about 18 km west of Smoke Lake. Drilling in 2015 returned several intercepts over 1% nickel + copper with a high of about 1.5% Ni + Cu.

The 7,000-hectare mafic-ultramafic Bulldozer intrusion, which has seen virtually no geological mapping nor exploration, also has significant historical copper showings.

Another place well-known for its copper minerals is British Columbia, Canada, home to big copper-gold and copper-molybdenum porphyries, such as Red Chris and Highland Valley. Here, GSP Resource Corp. (TSXV: GSPR) (FRA: 0YD) is currently looking to bring back the past-producing Alwin mine located 18 km from the town of Logan Lake.

The property lies in the vicinity of several large-scale mine operations. It is southwest of the New Afton and Ajax mines, and right next to Teck Resources’ Highland Valley copper operation.

A drilling campaign is set to begin soon at the Alwin project, aimed at testing the bulk tonnage copper potential of unmined mineralization within and surrounding the historical mine.

In the province of Quebec, Renforth Resources’ (CSE: RFR) (OTCQB: RFHRF) (FSE: 9RR) 260-square-kilometer Surimeau property hosts several target areas for gold and industrial metals (nickel, copper, zinc, cobalt, silver) located south of the Cadillac Break, a major regional gold structure.

Summer prospecting on the southwestern part of the Huston target returned 1.9% nickel, 1.3% copper, 1,170 parts per million (ppm) cobalt and 4 grams per tonne silver, from a grab sample taken from strongly foliated diorite.

The little-explored Huston area is located about 18 km northwest of the Victoria West target, where recent drilling, trenching and surface sampling reveal an area of interest that includes about 5 km of strike on the western end of a 20 km magnetic anomaly.

The company interprets this anomaly to be a nickel-bearing ultramafic sequence unit, which occurs alongside, and is intermingled with, VMS-style copper-zinc mineralization.

Renforth management says the spectacular result from Huston (grades above 1% nickel and copper are today considered high grade) is the first documented nickel occurrence in the area.

At its Malartic West property, Renforth plans to follow up channel and grab samples that revealed a copper and silver mineralized system known as the Beaupré copper discovery.

In the northern part of the property this system has been traced over 175 m and remains open. The 53 sqkm project is contiguous to Victoria West and adjacent to the western border of Canadian Malartic, Canada’s largest open-pit gold mine.

Conclusion

“The energy transition starts and ends with metals.” This is a direct quote and call-to-action from WoodMac’s latest energy outlook report.

Julian Kettle, senior vice president of the firm’s metals and mining division, says “delivering the base metals to meet [net zero 2050] pathways strains project delivery beyond breaking point from people and plant to financing and permitting.”

All in all, base metals capex needs to quadruple to about $2 trillion to achieve an accelerated energy transition.

Copper, which WoodMac emphasizes “sits at the nexus of the energy transition”, stands out particularly. At least 20Mt of additional metal must be mined over the next two decades to place us on track to reach net zero by 2050.

A goal like that is not insurmountable, but it will take major investments in copper exploration, at a scale that has never before been attempted.

Any copper junior with a deposit of significant size and grades will have no problem attracting a major or mid-tier acquirer that can help finance a future copper mine and bring it to commercial production.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks.

Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Max Resource Corp. (TSXV: MXR), Norden Crown Metals Corp. (TSXV: NOCR) and Renforth Resources’ (CSE: RFR).

MXR, NOCR, PM, NOCR, RFR, PDM and GSPR are paid advertisers on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.