Electrification and decarbonization won’t happen without these 4 metals

2021.06.25

The new “green economy” rejects dirty sources of energy and transportation, namely coal, oil, and natural gas. Instead, it relies on carbon-friendly modes of transport and energy production, including electric vehicles, renewable power, and energy storage — the latter required for storing electricity when the wind doesn’t blow and the sun doesn’t shine.

However, the transition to clean and green will not happen without a major boost in the production of so-called battery and energy metals.

According to the most recent report from Wood Mackenzie, mining companies will need to spend $1.7 trillion over the next 15 years, to supply enough lithium, graphite, cobalt, copper and nickel for the shift to a low-carbon world.

The commodities consultancy says meeting new emissions targets being set by countries like Canada, the US, Britain, China and Japan, will mean large-scale deployment of electric vehicles, renewable power and electrical transmission, all of which will require copious metal content.

Lithium

Rising demand for lithium-ion batteries is stoking prices for the light element, which can be extracted from brines, clays or the mineral spodumene found in pegmatites, an igneous rock.

According to Benchmark Mineral Intelligence (BMI), an index of lithium prices climbed 59% between April 2020 and May, 2021.

Another gauge of lithium’s strength, MINING.com’s EV Metal Index, saw average lithium use up 15%, in April 2021 versus April 2020, with total material deployed up 240% over last year.

A few years back this excess supply led to a glut in the market and a period of low prices, but lithium analysts expect it to be different this time.

Chris Berry, an independent battery metals expert, told Reuters, “The next few years are going to be critical in terms of whether there’s enough available lithium supply, and that’s why you’re starting to see commodity prices start to ramp.”

Australian bank Macquarie forecasts a global EV penetration rate of 16% by 2025 (battery electric vehicles and plug-in hybrids combined), and by 2030, 30% globally and 41% in China — a scenario that would push spodumene (hard rock) prices above $720 a tonne, lithium carbonate over $13,000/t, and lithium hydroxide north of $16,000/t.

Utility-scale batteries that store renewable energy, and portable electronics will also contribute to demand, with China top of the heap for battery manufacturing and Germany and the US increasing battery production capacity in the coming years, says Fitch Solutions. (of 142 battery plants worldwide, 109 are in China — a capacity share of more than 70%)

The question is, with all of this growth in battery plants and electric vehicles coming, will supply manage to keep up?

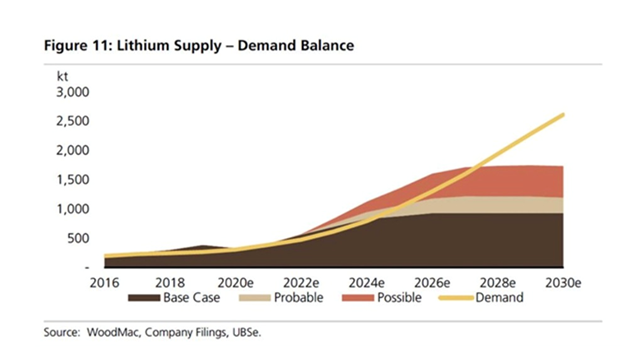

BMI forecasts lithium demand to more than triple between 2020 and 2025, rising to a million tonnes and out-pacing supply by 200,000 tonnes.

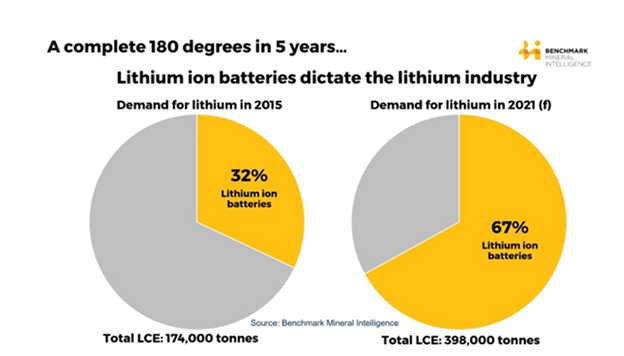

Noting that lithium demand has “flipped 180 degrees in five years,” from 32% demanded by lithium-ion batteries in 2015, to 67% in 2020, Simon Moores of Benchmark Mineral Intelligence predicts a structural deficit could occur as early as later this year and increase to 120,000 tonnes in 2022.

Another market analysis firm, CRU, foresees 2021 lithium demand of about 450,000 tonnes will exceed supply by around 10,000 tonnes.

A December 2020 Forbes article quotes investment bank UBS stating that at today’s prices, lithium “might run out by 2025.”

The story notes that EV parity — the point when the prices of EVs match regular vehicles — is expected to be reached by 2024, removing a major roadblock to EV penetration. For this reason, UBS projects EVs will make up nearly half of new car sales by 2030, as shown in the chart below.

The upshot is that in the next nine years, UBS analysts estimate the lithium market will grow by 8X, resulting in supply being unable to keep up with swelling demand:

“There is not sufficient supply to meet this demand projection based on our knowledge of known projects today. That includes all projects whether they are under construction, in feasibility or still in exploration,” wrote Glyn Lawcock, global head of mining research, in the report.

Whether or not supply is able to meet demand, will depend on what kind of lithium compound is required for batteries, ie., lithium carbonate vs lithium hydroxide. A brief digression:

A lithium-ion battery consists of an anode, cathode, separator, electrolyte and two current collectors (positive and negative). The anode and cathode are used to store the lithium, while the electrolyte carries ionized lithium atoms from the anode to the cathode, and vice versa.

The separator, which is located between the anode and cathode and is permeable, allows the lithium ions to pass through due to their small size.

The preferred battery chemistry for electric vehicles, due to its higher performance, is a combination of lithium, nickel, cobalt and manganese (NCM). However, because cobalt is so expensive, some battery makers are planning to change their battery chemistries to a higher percentage of nickel so they can use less cobalt.

The NCM cathode is commonly 60% nickel, 20% manganese and 20% cobalt (6-2-2) but as battery technology advances, the percentage of nickel is going up; the most popular ratio is now 80% nickel, 10% cobalt and 10% manganese (8-1-1).

“NMC is used by nearly every automobile maker in the world save for Tesla. For at least the next decade, the evolution of the lithium ion battery and its NMC chemistry is towards a more nickel-rich cathode,” states a 2019 blog post by Benchmark Mineral Intelligence.

However, the higher nickel content presents challenges to the battery’s chemical stability. If the metals are used in either the 6-2-2 combination or the 8-1-1 ratio, the chemistry requires lithium hydroxide rather than lithium carbonate.

The future of lithium-ion batteries therefore envisions two key raw materials: nickel sulfate and lithium hydroxide.

According to Chilean state lithium miner SQM, demand for lithium carbonate is expected to rise at a CAGR of 10-14% from 2018-27, while lithium hydroxide demand is seen climbing at a 25-29% CAGR.

Where will the lithium hydroxide come from? The economics do not favor lithium brine operations, which must produce lithium carbonate as the first step of a two-step process.

In contrast, lithium hydroxide can be made directly from the lithium-bearing mineral spodumene in lithium hard rock mines such as those found in Australia — Greenbushes is the biggest.

In May, Chinese lithium hydroxide prices averaged $14,275 per tonne, against $13,975/t for lithium carbonate, a trend BMI believes will continue, owing to a large extent due to the demand for NCM batteries requiring lithium hydroxide:

Benchmark forecasts NCM cathodes to represent over 75% of cathode market share by 2030, with well over half of these being the 811 high-nickel variety, meaning demand for lithium hydroxide is only set to rise further and challenge the already delicate supply-demand balance, supporting Benchmark’s expectations of further rising prices in the Chinese domestic hydroxide market.

The firm also notes that production of NCM and NCA cathode cells has been ramping up in China, with the country averaging 6.1 gigawatt hours (GWh) per month so far in 2021, compared to a two-year average in 2019 and 2020 of 4.3GWh per month.

The bright outlook for lithium hydroxide demand and prices is great news for lithium miners that produce the battery cathode ingredient, as well as explorers with deposits amenable to hydroxide production.

Nickel

According to CRU, the commodity market analysis firm, nickel usage in batteries is expected to grow seven-fold, from 70,000 tonnes in 2017 to 240,000 tonnes in 2023, a compound annual growth rate (CAGR) of 20%. The Bank of America projects that 13.6 million EVs sold in 2025 would need 690,00 tonnes of nickel. That represents nearly the entire mined supply of Indonesia, the world’s top nickel producer, which in 2020 outputted 760,000 tonnes, out of the 2.5Mt total.

The majority of nickel usage, around 70%, goes into stainless steel production, however this is expected to change dramatically over the next decade, as the need for nickel in EV batteries ramps up.

According to CRU, current global primary nickel demand was approximately 2.2 million tonnes per annum for 2018 and is expected to grow to 2.8 million tonnes by 2023. Mined nickel production in 2020 was only 2.5 million tonnes, meaning if the market doesn’t see an annual supply increase of at least 300,000 tonnes in the next two years, it will slip into deficit. (Remember, the market not only has to supply enough nickel to meet stainless steel demand, but the 7-fold increase in demand from EV batteries)

Glencore CEO Ivan Glasenberg recently said nickel supplies need to grow by an additional 250,000 tonnes a year, and he projected annual nickel demand will rise from 2.5 million tonnes currently to 9.2Mt, over the next few decades.

We are already seeing evidence of this trend of increased nickel consumption.

According to MINING.com’s EV Metal Index, the amount of nickel deployed for electric vehicle batteries tripled in April compared to the same month in 2020.

Like lithium, what’s important is the type of nickel needed to make batteries.

Producing nickel-rich battery cathodes requires high-purity nickel, in the form of nickel sulfate, derived from ‘Class 1’ nickel sulfide deposits. This nickel can be processed at relatively low cost, and with minimal waste, using a simple flotation technique.

However, there is a problem, in that the majority of today’s nickel production is nickel pig iron (NPI) used in steelmaking (also known as ferro-nickel), which is ill-suited for making battery-grade nickel.

It’s important to note that less than half of the world’s nickel is suitable for the biggest growth market — EV batteries.

Another problem is the rarity of nickel sulfide deposits. Nickel deposits come in two forms: sulfide or laterite. About 60% of the world’s known nickel resources are laterites, which tend to be in the southern hemisphere. The remaining 40% are sulfide deposits.

Existing sulfide mines are becoming depleted, and nickel miners are having to go to the lower-quality, but more expensive to process, as well as more polluting nickel laterites such as found in the Philippines, Indonesia and New Caledonia.

According to BloombergNEF, demand for Class 1 nickel is expected to out-run supply within five years, fueled by rising consumption by lithium-ion electric vehicle battery suppliers.

Where will mining companies look for new nickel sulfide deposits, from which the extraction of high-grade nickel needed for battery chemistries is economically, technically and environmentally feasible? The pickings are slim.

Decades of under-investment equals few new large-scale greenfield nickel sulfide discoveries. Only one nickel sulfide deposit has been discovered in the past decade and a half, Nova-Bollinger in Western Australia.

The result of such limited nickel exploration is a very low pipeline of new projects, especially lower-cost sulfides in geopolitically safe mining jurisdictions. Any junior resource company with a sulfide nickel project will therefore be extremely attractive to potential acquirers.

Graphite

There are no substitutes for lithium and graphite; these critical metals are expected to remain the foundation of all lithium-ion EV battery chemistries for the foreseeable future.

Lithium is in the battery cathode and graphite, or more precisely, spherical graphite, is in the anode.

Graphite has long been used in the aviation, automotive, sports, steel and plastic industries, as well as in the manufacture of bearings and lubricants. Graphite is an excellent conductor of heat and electricity, is corrosion- and heat-resistant, and is strong and light.

Lithium-ion batteries contain 10 to 15 times more graphite than lithium. An average hybrid vehicle carries up to 10 kg of graphite and a plug-in EV has around 70 kg. Every million EVs require in the order of 75,000 tonnes of natural graphite. This represents a 10% increase in flake graphite demand. The need for lithium batteries not only for EVs, but energy storage, handheld tools like drills, and an array of consumer electronics like cell phones and laptops, is almost certain to outstrip supply. The lithium-ion battery manufacturing capacity currently under construction would require flake graphite production to double by 2025.

Only flake graphite, upgradeble to 95.95% purity, can be used as anode material in a lithium-ion battery.

According to MINING.com’s EV Metal Index, graphite prices have held steady above $700 a tonne in 2021, after hitting a low of $644/t last September. But the more important number is the dramatically higher amount of graphite being used for EV batteries. MINING.com states:

In April 2021, just over 14,000 tonnes of synthetic and natural graphite were deployed globally in batteries of all newly-sold passenger EVs combined, a 233% jump over the same month last year.

It’s thought that the increased use of lithium-ion batteries could gobble up well over 1.6 million tonnes of flake graphite per year (more than current mined supply of 1.1Mt) — only flake graphite, upgraded to 99.9% purity, and synthetic graphite (made from petroleum coke, a very expensive process) can be used in lithium-ion batteries.

Global graphite consumption has been increasing steadily every year since 2013, although in 2019 there was a reduction of 14%. The covid-19 pandemic has mostly affected graphite supplies outside of China, according to the USGS.

Roskill expects total graphite demand over the next 10 years to grow around 5 to 6% per annum.

To meet this demand, 12 battery megafactories are being planned or built in the United States, including Tesla’s Texas “Terafactory”, which would have an annual battery production capacity of 1 terawatt-hours, or 1,000 gigawatt-hours (GWh).

According to Benchmark Mineral Intelligence, just one 30 GWh per year lithium-ion battery factory needs roughly 33,000 tonnes of graphite anode material per year. The Texas Terafactory would demand more than 1 million tonnes of graphite per year.

If all 12 megafactories are built, they will require about 396,000 tonnes of graphite, every year. This is nearly two-thirds the amount of graphite produced by China, by far the largest graphite producer in the world, in 2020. Remember, the US currently produces NO natural graphite.

We have clearly reached a point when much more graphite needs to be discovered and mined.

Copper

Curiously, copper is often overlooked when tallying up the metals required for the transition to clean energy and electrification. There is no shift from fossil fuels to green energy without copper, which has no substitutes for its uses in EVs wind and solar energy, and 5G.

Copper’s widespread use in construction wiring & piping, and electrical transmission lines, make it a key metal for civil infrastructure renewal.

The continued move towards electric vehicles is a huge copper driver. In EVs, copper is a major component used in the electric motor, batteries, inverters, wiring and in charging stations. Electrification includes not only cars, but trucks, trains, delivery vans, construction equipment and two-wheeled vehicles like e-bikes and scooters.

The latest use for copper is in renewable energy, particularly in photovoltaic cells used for solar power, and wind turbines. The base metal is also a key component of the global 5G buildout. Even though 5G is wireless, its deployment involves a lot more fiber and copper cable to connect equipment.

The big question is, will there be enough copper for future electrification needs, globally? And remember, in addition to electrification, copper will still be required for all the standard uses, including copper wiring used in construction and telecommunications, copper piping, and copper needed for the core components of airplanes, trains, cars, trucks and boats.

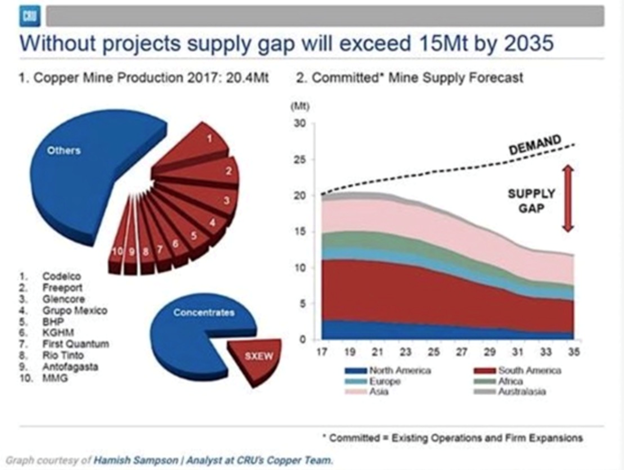

The short answer is no, not without a massive acceleration of copper production worldwide.

A recent research report from Jefferies Research LLC concluded: “The copper market is heading into a multiyear period of deficits and high demand from deployment of renewable energy and electric vehicles. The secular demand driver in copper is electric passenger vehicles, as the average EV is about four times as copper intensive as the average ICE automobile. Renewable power systems are at least five times more copper intensive than conventional power.”

Wood Mackenzie is equally bullish on copper demand for the purpose of electrification and decarbonization. Via Reuters, the metals consultancy estimates that copper demand from renewables, energy storage, electricity transmission and electric vehicles/ charging infrastructure will more than double from to 8.6 million tonnes in 2025, from 2020 levels, under a scenario that limits global warming to 2 degrees C.

The firm forecasts that 15.1Mt will be consumed in energy transition applications by 2030.

Getting more granular, according to BloombergNEF, there are currently about 7 million electric vehicles in the world today. By 2040, they estimate around 30% of the world’s passenger cars will be electric. To me that’s a conservative and reasonable number. It means 500 million EVs will be on the road in 20 years, out of a total vehicle fleet of 1.6 billion. If each EV contains 85 kg of copper, that is 42,500,000,000 kg, or 42,500,000 tonnes of copper, roughly twice the current volume of copper produced by all of the world’s copper mines.

Just so we’re clear — in 20 years, BloombergNEF says copper miners need to double the amount of global copper production, just to meet the demand for a 30% penetration rate of electric vehicles. That means an extra million tonnes a year, over and above what we mine now, every year for the next 20 years!

The world’s copper miners need to discover the equivalent of two Kamoas (referring to Invanhoe Mines’ giant Kamoa-Kakula copper deposit in the DRC which just reached commercial production) at 500,000t, each and every year, while keeping current production at 20Mt.

Remember we still need to cover all the copper demanded by electrical, construction, power generation, charging stations, renewable energy, 5G, high-speed rail, etc., plus infrastructure maintenance/ buildout of new infrastructure.

That might be another 5-7Mt. So not only is there a 20Mt increase in copper usage required for a 30% EV penetration, but another (we estimate) 5-7Mt increase to meet demand for all of copper’s other applications. To keep up, the industry will need to find an additional two to three Kamoas a year, each producing 500,000t, for the next 20 years!

As we have previously reported, over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place. It’s going to be hard enough to maintain the current 20Mt per year, let alone add so much more production.

Where is this new, and replacement, supply going to come from? When copper becomes so rare it hits $10,000 a tonne, what’s going to happen to 30% EV penetration? High-speed rail? 5G? We suggest that without new copper deposits, these well-intentioned plans are in jeopardy.

But copper bulls like me haven’t had to wait that long, to see a price reaction.

New chapters of the copper success story that started in 2020 are being written as the red metal basks in the glory of global climate pledges, and an economic recovery from the pandemic underpinned by strengthened industrial demand.

From one year ago, copper is up more than 150%!

The main factors driving prices higher are increased Chinese orders amid a strong manufacturing sector, post-pandemic; a return to growth following a disastrous 2020; trillions in promised green and blacktop infrastructure spending particularly in the US, Europe, and China; and supply disruptions resulting from covid-19-related mine closures.

In China, which consumes half of the world’s copper, the government has been trying to dampen rising commodity prices by releasing (or are they just threatening to release?) portions of its stockpiles.

So far it hasn’t worked.

Despite China’s National Food & Strategic Reserves Administration announcing that it intends to sell 20,000 tonnes of copper in the first week of July, copper futures on Wednesday jumped 2.6% from Tuesday’s settlement price, touching $4.34 a pound in mid-day trading.

According to Citigroup, via Bloomberg, Beijing’s measures “target managing expectations and deterring speculators rather than solving supply/demand imbalances.”

“We do not think the rally is over,” the bank said in a note.

Glencore’s CEO Ivan Glasenberg is one of many calling for increased copper production amid expected supply shortages.

The multi-billionaire mining tycoon told the Qatar Economic Forum this week that the copper supply needs to double by 2050.

“Today, the world consumes 30 million tonnes of copper per year and by the year 2050, following this trajectory, we’ve got to produce 60 million tonnes of copper per year,” he said.

“If you look at the historical past 10 years, we’ve only added 500,000 tonnes per year … Do we have the projects? I don’t think so. I think it will be extremely difficult.”

Conclusion

Lithium, graphite, nickel and copper are the building blocks of the new green economy. Politicians can talk about grand designs for carbon reduction in their economies, and business leaders can announce plans for battery factories and new electric vehicle models, but without a steady, reliable supply of raw materials, nothing happens.

The supply chain for batteries, wind turbines, solar panels, electric motors, transmission lines, 5G — everything that is needed for a green economy— starts with metals and mining. Demand for lithium, nickel and graphite on the battery side and copper on the energy side is expected to rise rapidly.

This is old news to us at AOTH. We’ve been banging the drums of electrification and decarbonization since Obama first began setting government funding aside for it in 2009.

What is new is how quickly demand for metals that will feed into these two global trends, is outstripping supply, creating a huge problem for the mining industry but also a once-in-a -ifetime opportunity for savvy resource investors.

Once thought of as an obscure mineral, extracted as a byproduct of potash mining, lithium is now considered “white gasoline”, and for good reason.

Australian bank Macquarie forecasts a global EV penetration rate of 16% by 2025, and 30% by 2030. Even with higher lithium prices, supply is struggling to keep up. Simon Moores of Benchmark Mineral Intelligence predicts a structural lithium deficit could occur as early as later this year and increase to 120,000 tonnes in 2022.

Because of the explosive demand for a particular high-performing lithium-ion battery chemistry — NMC 8-1-1 (80% nickel, 10% manganese, 10% cobalt) — the future of lithium-ion batteries envisions two key raw materials: nickel sulfate and lithium hydroxide.

According to CRU, nickel usage in batteries is expected to grow seven-fold, from 70,000 tonnes in 2017 to 240,000 tonnes in 2023.

Producing nickel-rich battery cathodes requires high-purity nickel, in the form of nickel sulfate, derived from ‘Class 1’ high-grade nickel sulfide deposits.

However, existing sulfide mines are becoming depleted, and nickel miners are having to go to the lower-quality, but more expensive to process, as well as more polluting nickel laterites such as found in the Philippines, Indonesia and New Caledonia.

Where will mining companies look for new nickel sulfide deposits, from which the extraction of high-grade nickel needed for battery chemistries is economically, technically and environmentally feasible? The pickings are slim.

Decades of limited nickel exploration mean a very low pipeline of new projects, especially lower-cost sulfides in geopolitically safe mining jurisdictions. Any junior resource company with a sulfide nickel project will therefore be extremely attractive to potential acquirers.

There is no shift from fossil fuels to green energy without copper, which has no substitutes for its uses in EVs (electric motors and wiring, batteries, inverters, charging stations) wind and solar energy, and 5G.

Arguably, the red metal is the most critical of all critical metals, because of its necessity in electrification, and the fact that there is an actual shortage of copper coming.

Mainstream media and the large mining companies are finally catching on to what we at AOTH have been saying for the past two years: the copper market is heading for a severe supply shortage due to a perfect storm of under-exploration/ lack of discovery of new deposits, clashing with a huge increase in demand due to electric vehicles and renewable energy.

The way we’re going, ie., with declining investment in mineral exploration and a lack of new discoveries, we are simply not going to be able to meet demand. If nothing changes the supply-demand gap for a certain group of green metals will keep widening, with the expected knock-on effects on prices, which we expect to stay buoyant.

Which is why we at AOTH are invested in quality juniors that are exploring for metals required by the powerful, long-term investable trends of electrification and decarbonization.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.