EGR poised to drill Detour West, proving whether the Sunday Lake deformation zone which hosts the Detour Lake deposit continues onto EGR’s Detour West property – Richard Mills

2024-01-08

Vancouver-based EGR Exploration Ltd. (TSXV:EGR) is exploring for gold next to the country’s largest gold operation and within a region already hosting multiple multi-million-ounce deposits.

EGR checks all our boxes for what we want in an exploration-focused junior.

The company’s flagship Detour West property is located approximately 300 km north of Timmins, Ontario and covers 40,255 hectares of the Abitibi Greenstone Belt, one of the most prospective regions for gold on the planet.

World-renowned for its gold endowment, the Abitibi boasts over 300 million ounces of gold in past production, reserves and resources.

Notable Abitibi gold deposits include Canadian Malartic, with 1.6 million ounces oz gold in proven and probable reserves; Macassa @ 1.9Moz Au P&P reserves; Casa Berardi @ 2.5Moz Au P&P reserves; and Detour Lake @ 20.7Moz Au P&P reserves.

The Abitibi region hosts several key players in the gold mining and exploration space, including Agnico Eagle Mines and Newmont, the world’s leading gold miner.

Agnico Eagle’s portfolio includes Canada’s largest gold operation at Detour Lake (proven and probable reserves of 20.7Moz as of February 2023), which has a mine life of ~28 years with expected average gold production of over 700,000 ounces per year.

In addition to Detour Lake, Agnico Eagle owns the Canadian Malartic mine in northwestern Quebec, which had been the largest open-pit gold operation in Canada prior to 2022. The company is also developing the Macassa and Goldex projects, and the LaRonde complex within the Abitibi.

Newmont maintains a significant presence in this prolific greenstone belt with three projects: Éléonore, Porcupine and Musselwhite.

The success many have had in the Abitibi is a big reason why up-and-coming gold explorers continue to work in region. There are still an estimated 100 million ounces contained in the ground, so the idea of making new, exciting discoveries here is quite plausible.

Located in the northern part of the Abitibi, the Detour-Fenelon trend spans over 200 km of prospective strike length potential along the Sunday Lake and Lower Detour deformation zones. EGR’s property is located 20 km west of the Detour Lake open pit (hence the name “Detour West”), and directly adjoins Agnico Eagle’s holdings along the Detour-Fenelon gold trend. The eastern portion of this trend is being explored by Wallbridge Mining in Quebec. The trend continues to deliver new gold ounces with the recent Chebistuan discovery east of Fenelon and resource expansion at Detour Lake, Fenelon and Martiniere.

Detour West is 150 km from Cochrane, ON, off a highway that is maintained year-round. The project is accessible via a network of trails and logging roads. Paved road, cell service and power run through the southern and eastern portions of EGR’s Detour West project.

In July 2020, EGR — under its previous name Gambier Gold — entered the Detour West project after signing an option agreement on the property.

To maximize its chance of success, EGR has since increased its landholding and consolidated the entire 40,255-hectare Detour West project area, which is now 35 km long by 15 km wide.

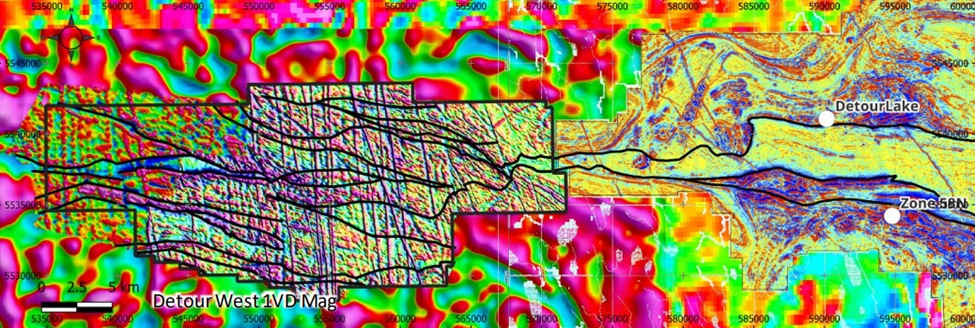

It then carried out an airborne magnetic survey covering approximately two-thirds of the property to investigate the extensions of various deformation zones known to be associated with gold mineralization along the famous Detour-Fenelon trend. Gold mineralization is associated with the structural contact between mafic to ultramafic volcanic rocks of the Deloro Assemblage and younger Caopatina Assemblage sediments. This structural contact is a regional-scale thrust zone, the Sunday Lake Deformation Zone (SLDZ), which is spatially related to over 20Moz of gold reserves at the Detour Lake mine.

The project is underexplored, with only nine diamond drill holes (1,326m) sunk to a vertical depth of 122m, testing the property to date.

Exploration plan

EGR’s exploration plan is clear and simple: replicate the same methods that have been successful for Agnico Eagle at the Detour Lake mine.

In an interview with Ahead of the Herd, CEO Daniel Rodriguez said the company plans to test the extension of the Sunday Lake deformation, trying to prove that Detour West is on trend with Agnico-Eagle’s Detour Lake mine and its 20.7Moz of reserves.

“We see the east-west structures on our property, we know that the Sunday Lake and the Lower Detour and the Detour-Fenelon trend is an E-W structure and that’s where people are having success and gold can be hosted in a variety of different types of rocks, so we have the potential to make a discovery,” he said.

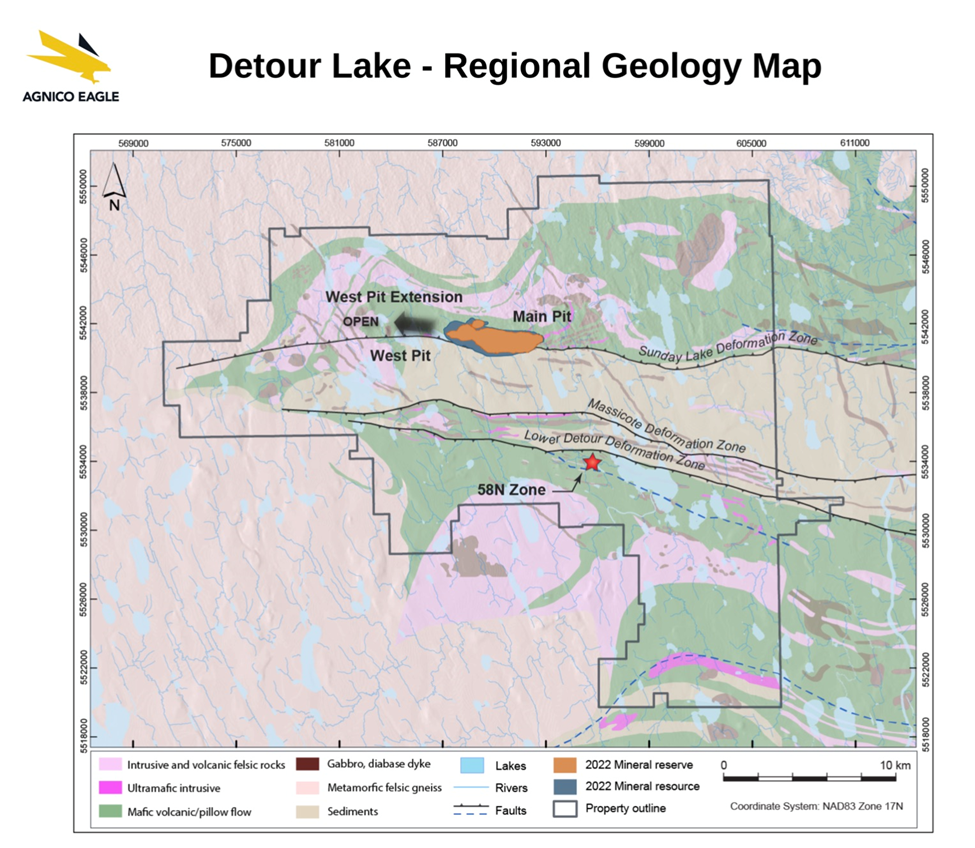

A regional geology map from Agnico Eagle shows three deformation zones running east-west, right to the edge of Agnico’s Detour Lake property. The deformation zones are labeled Sunday Lake, Massicote and Lower Detour. Notice the Sunday Lake Deformation Zone runs through the Detour Lake mine’s Main Pit, West Pit, and the West Pit Extension.

About a year ago, Agnico-Eagle was conducting exploration about 12 kilometers away from EGR’s Detour West, drilling out the West Pit in an effort to go underground to add resources. The pit itself is 25 kilometers away from Detour West.

This below image reflects an important change to Agnico Eagle’s interpretation of the geological structures crossing its Detour Lake property.

If the Detour Lake – Regional Geology Map is correct in its interpretation, it would mean that, rather than ending abruptly at the western edge of the Detour Lake property, the Sunday Lake Deformation Zone, and potentially the other two deformation zones, Massicote and Lower Detour, continue in a westerly direction, possibly right onto EGR’s Detour West.

“That to me was an aha! moment,” Rodriguez told me.

In fact, as seen in the slide below from its corporate presentation, EGR’s Detour West property butts up against the western edge of Agnico-Eagle’s Detour Lake mine property.

An airborne magnetic survey has been flown on the property, located 20 km west of the Detour Lake pit. That survey, plus historical data, a Lidar interpretation, and limited outcrop prospecting, indicate there are possible gold-bearing structures running onto Detour West.

The next step is to drill it.

The mag survey findings will guide the implementation of a comprehensive till and top-of-bedrock reverse circulation drill program, which EGR expects to start in the first quarter.

The drill sites are currently being permitted, including consultation with local First Nations, and in late December a crew was on site examining the stream crossings by snowmobile.

The drill program envisions a regional approach to investigating prospective structural environments across the sprawling 40,000-ha property. To do that, 85 reverse-circulation (RC) holes will be sited on fences spaced roughly 3 km apart, with the holes on each fence spaced every 400m.

“That will give us a giant picture of the property and then be able to narrow down our targets further,” said Rodriguez.

Says Rodriguez:

“We’ve created our plan for drilling, and we have fences running across two of the major structures that we see.

Rodriguez said the idea is to test several targets and not just home in on one or two because it’s possible a discovery could be missed that way.

“I’d rather scratch a majority of the area to know where we need to, or not, scratch later,” he said, adding “I want to make sure that we’re covering this whole thing.”

Once EGR can show enough gold-in-till from the fenced RC holes it can vector into the source of the mineralization.

Conclusion

EGR is executing an inexpensive 80-plus hole reverse-circulation drill program that encompasses multiple targets. Hopefully the RC drills will prove that the deposit is on trend with the massive Detour Lake mine to the east, and point the exploration team in the right direction as far as finding the source(s) of potential mineralization.

As mentioned at the start, EGR has everything I like to see in a greenfield exploration project; it checks all my boxes: it’s got power, roads and even cell phone service. It’s located in a geopolitically safe jurisdiction, in one of the most famous gold belts in the world, the Abitibi. Most importantly, it’s possibly on trend with Detour Lake’s 20-million-ounce deposit.

Agnico-Eagle’s Detour Lake – Regional Geology Map shows the Sunday Lake Deformation Zone (SLDZ) running in almost a straight line east-west. Contrary to previous interpretations, it doesn’t end at the western end of the property line.

EGR’s current geological theory is that the Detour-Fenelon Trend continues onto Detour West, and the drill program intends to prove (or disprove) whether Detour West is on trend with Detour Lake.

In this way, the company’s plan of action is what I like to call “drill it to kill it”. EGR is not teasing shareholders with a few holes that may or may not indicate it’s close to a source of mineralization. Rather, EGR is planning a major reverse-circulation drill program (85 holes) that should show whether the underlying gold structures at Detour Lake continue onto Detour West. If they do, the next step will be vectoring into the mineralization with more expensive diamond drill holes. If they don’t, EGR will likely move on to another project.

It should be remembered that mineral exploration is a scientific process that is all about forming hypotheses and testing them.

“Drill it to kill it” may sound harsh, but this is what makes for great speculation and in my opinion it’s a smart strategy.

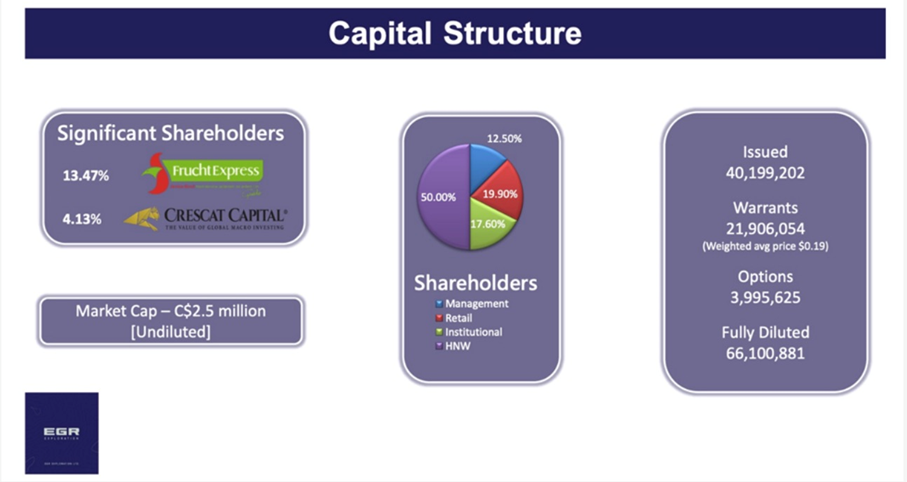

EGR has a tight capital structure at just over 40 million shares out with nearly 22 million warrants. Retail is the smallest component of the shareholder base, with management, institutions and high net worth individuals owning the rest.

Two significant shareholders, including Crescat Capital, own 17.6%. Two insiders have been buying shares in the market, enough to now own 13% of the company’s outstanding shares, which to me is an additional vote of confidence for the company and its future plans.

A key point here is the risk-reward opportunity EGR presents to shareholders. While the Detour West project is early stage, the company is not spending a lot of money to gather intelligence on it — between $600,000 and $1.5 million – their approach is an extremely prudent use of company funds.

The reward could be twofold, the discovery of gold and the confirmation that the Sunday Lake Deformation Zone continues onto EGR’s Detour West property – meaning it’s on trend with Detour Lake’s 20-million-ounce deposit. The risk? $0.05 per share of a company that has two insiders accumulating in the market and two significant shareholders, including Crescat Capital, owning 17.6%.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of EGR Exploration Ltd. (TSXV:EGR)

EGR is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of EGR

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.