EGR moves forward with Detour West exploration plan after airborne magnetics, financing completed – Richard Mills

203.05.22

Ontario-focused gold junior EGR Exploration Ltd. (TSXV: EGR) is setting wheels in motion for what would be the first diamond drill program on its flagship property with a couple of updates this week.

First, it closed a private placement financing for $950,000, issuing a mixture of hard-dollar and flow-through units priced between $0.11-0.14 each, the higher range of EGR’s stock price over the past year. Insiders participated in this financing.

Part of the proceeds will fund the multiple stages of exploration the company has planned on its Detour West property over the next year, culminating with the potential of diamond drilling and additional targets to explore.

Then, in an exploration update, EGR said it has completed flying the airborne magnetics over areas never flown previously at Detour West. All the information is being reviewed and interpreted as they’re made available.

“We are moving forward with our exploration plan. The airborne magnetics is complete, and we are in the process of interpreting the data. This new data will assist in targeting and narrowing down our focus on our large Detour West property,” EGR’s chief executive Daniel Rodriguez commented in a May 15 news release.

The company has also applied for a grant under the Ontario Junior Exploration Program (OJEP), which, if approved, would add another $200,000 to the Detour West exploration budget.

About Detour West

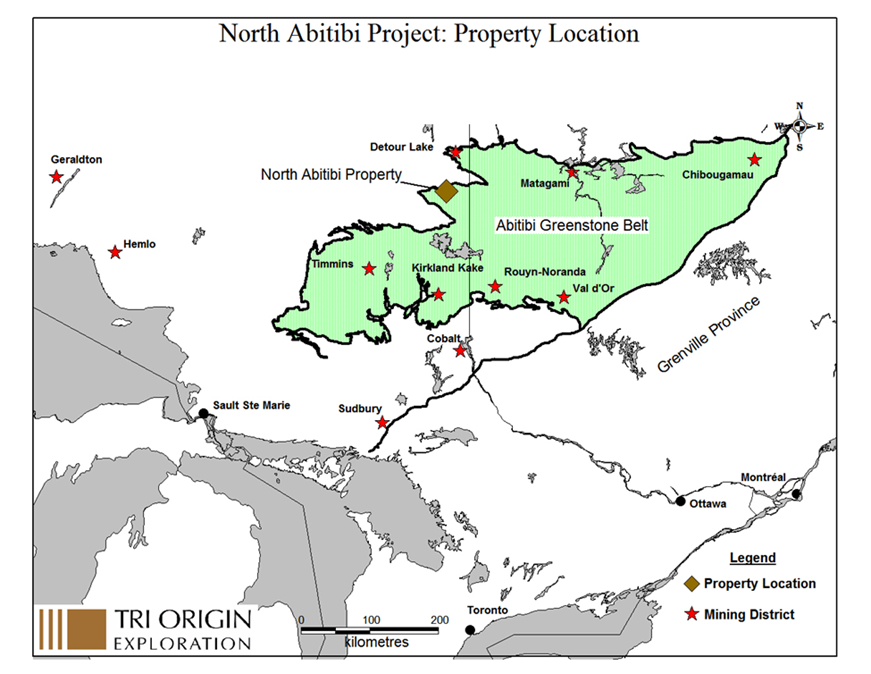

The Detour West property is located 300 km northeast of Timmins, ON, covering 40,255 hectares of the Abitibi Greenstone Belt, one of the most prospective regions for gold on the planet.

Many gold deposits found in the Abitibi area in the past have been considered “world class,” as the average gold deposit grade is higher than the global average. A prime example in the modern era is Agnico Eagle’s Detour Lake, now the largest gold operation in Canada with 20.4 million oz in probable reserves.

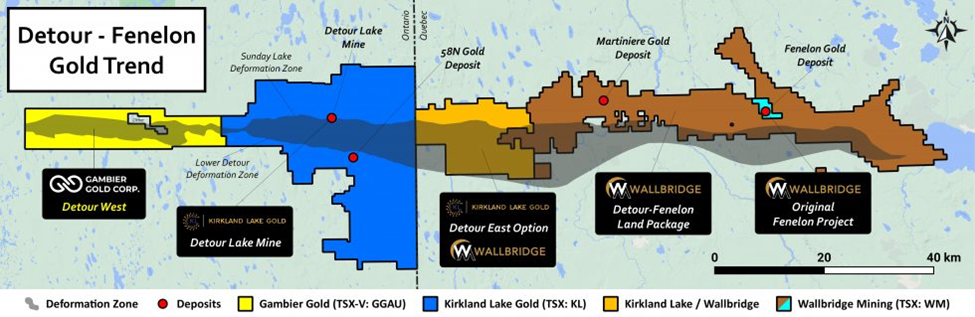

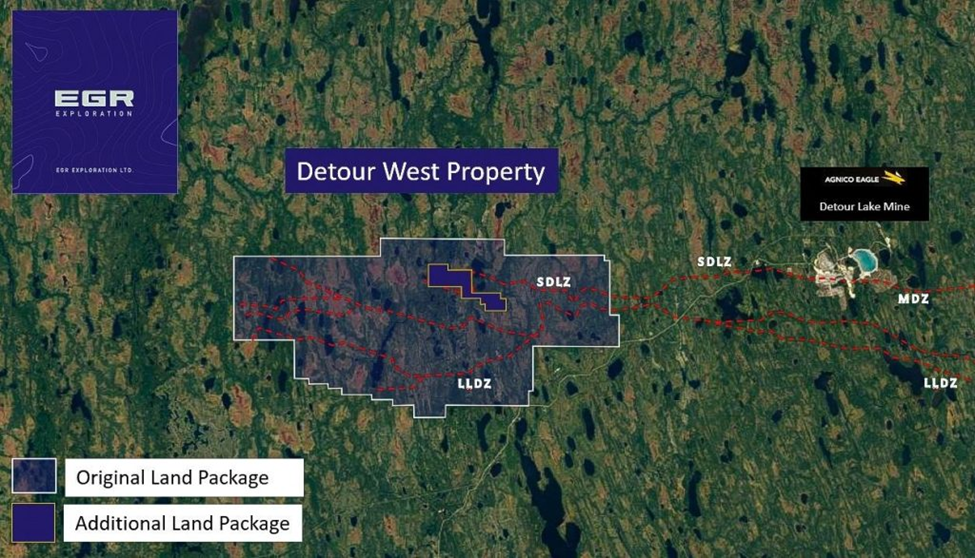

EGR’s property is found approximately 20 km west of the Detour Lake open-pit mine (hence the name “Detour West”), and directly adjoins Agnico Eagle’s holdings along the Detour-Fenelon gold trend. The eastern portion of this trend is being explored by Wallbridge Mining in Quebec.

In July 2020, EGR — under its previous name Gambier Gold — entered the Detour West project after signing an option agreement on the property, which at the time was less than half the current size (approximately 32 km long and 6 km wide).

Exploration work by previous operators on the Detour West property indicated to the company that its property be underlain by previously underexplored and unrecognized extensions of the rock units contained within the Sunday Lake, Massicotte and Lower Detour deformation zones that host the nearby Detour Lake gold deposit.

In 2016, Tri Origin Exploration flew a helicopter-borne geophysical survey over the eastern part of the Detour West property. Magnetic results from this geophysical survey confirmed Tri Origin’s initial interpretations of the presence of the western extension of rock units and fault structures hosting the Detour Lake, EGR noted in the 2020 agreement.

These responses flank the northern and southern boundaries of a west-northwest trending magnetic low interpreted to represent the westward extension of the Caopatina Assemblage, which is also present within the Detour Lake and Lower Detour gold deposits.

After optioning the Detour West project, the EGR team conducted a review of historical airborne geophysical surveys, yielding numerous highly conductive geophysical anomalies along and proximal to the Sunday Lake and Lower Detour deformation zones that cross the property. The company then expanded its landholdings by an additional 4,917 hectares.

In 2021, EGR embarked on its first-ever exploration program at the Detour West property, consisting of sonic drilling to sample till and the top of bedrock in an area of thick overburden. Forty-nine sonic holes were drilled for a total of 2,241.5 metres, which was more than originally planned.

However, results from that program also strayed from the company’s expectations, in a not-so-positive way.

About 58% (230/395) of the samples analyzed from the reverse circulation (RC)/rotasonic (RS) drilling on the Detour West project contained free gold grains, and out of those, just one sample had more than 10 grains (To be considered anomalous in the Detour Lake area, an RC/RS sample should have at least 10 free gold grains). Also, only six samples had calculated gold grades of above 1.0 g/t, which is generally the grade required to be considered economic within the Abitibi.

But this absolutely doesn’t mean there is no significant gold source at Detour West; In the grand scheme of things, EGR sees the 2021 RS drilling as just a small blip given the exploration approach it took.

The company has now decided to use the exact same exploration methods that have been successful for Agnico at the Detour Lake mine.

Finding Another Detour Lake?

A review of the Detour Lake 2018 NI 43-101 technical report indicated that a successful pre-drilling exploration approach, especially south of the Lower Detour Deformation Zones (LDDZ), involved Induced Polarization (IP) surveys on 200 m line spacing and Mobile Metal Ions (MMI) geochemical survey to assist in ranking of the geophysical IP anomalies.

Back in 2010 and 2011, Detour Lake Mines collected 10,000 MMI samples at 50 m spacing on lines 400 m apart along 30 km of the LDDZ. The samples were collected at depths of 10 to 25 cm and a 25 g split from each sample was analyzed. Between 2011 and 2017, the miner completed 838.4 line km on mainly 200 m line spacing principally along the LDDZ, with detailed 100 m line spacing around the Zone 58N gold deposit.

EGR therefore started a similar two-phase program along an 8 km stretch of the western interpreted extension of the Saturday Lake Deformation Zone (SLDZ), starting approximately 1 km to the southeast of the A series RS drill holes.

The initial phase would be MMI sampling along the 8 km length on 400 m spaced lines, to be followed by IP survey over initially the highest MMI anomalies to define drill targets. The drilling will be done by a combination RC-diamond core drill allowing for both till and rock core sampling.

To maximize its chance of success, EGR further increased its landholding in February 2023 with the acquisition of 50 mining claims, thereby consolidating the entire 40,255-hectare Detour West project area (see below).

Interpretation of the existing magnetics data over the newly acquired claims shows the potential for segments of the Sunday Lake Deformation Zone (SDLZ), Massicotte Deformation Zone (MDZ), and secondary splays from them, to extend onto the property, EGR said.

The company then carried out an airborne magnetic survey totaling 4,620 line km on a line spacing of 75 m at the Detour West project. The survey will cover approximately two-thirds of the property investigating the extensions of the Sunday Lake, Massicotte and Lower Detour Lake deformation zones known to be associated with gold mineralization along the Detour-Fenelon trend, which hosts Agnico’s Detour Lake mine.

Data obtained from this airborne magnetic survey, which has now been completed, will provide what EGR considers to be a “superior and consistent dataset” that will form the basis for target refinement of future till and top of bedrock sampling and reverse circulation drill programs.

A field program will be implemented afterwards to follow up on a previous Lidar survey, investigate outcrops identified from the survey, and plan access and drill pad locations for drilling.

Should everything go according to plan, EGR will initiate the till sampling program in mid-December 2023, which is expected to continue through the winter. The goal will be to test for gold in glacial till and identify potential gold grain dispersion trains emanating from gold mineralization associated with the extensions of known deformation zones.

All Eyes on Gold Assets

EGR’s quest to find gold within the Abitibi belt presents an interesting story to follow at a time when gold assets, especially those in prime mining jurisdictions, are being eyed up by those at the top of the pyramid.

We are all aware that the industry is dealing with depleted mine reserves, but years of underinvestment leading to a lack of new discoveries has only made it worse. Crescat Capital predicts the combined proven and probable reserves of the top 20 gold producers will start to fall in 2028 and continue on a downward slide until 2039, by which those reserves will be completely mined out.

This explains why the major players have been on an active lookout for deals, because it’s easy to turn gold into cash, but not the other way around, and the trend in mergers and acquisitions is telling.

Since 2019, there has been a major uptick in M&A deals in the gold sector, both in terms of the number of transactions and the total dollar value of deals. Last year, the top 10 gold deals equated to $17.5 billion, eclipsing the record set in 2021 which saw Agnico acquire Kirkland Lake and its Detour Lake mine for $10.6 billion.

One of the biggest deals in 2022 also involved Agnico, which bought the Canadian assets held by Yamana Gold including the famous Canadian Malartic mine.

The M&A activity got even hotter in 2023, led by Newmont’s $19.2 billion takeover of Newcrest Mining to create by far the world’s largest gold miner. And with that, we’ve already surpassed last year’s total deal value. Not willing to fall behind its rival, Barrick CEO recently admitted to the Financial Times that his company is on the hunt for takeovers.

This year is likely to see more mergers in the gold mining sector, Endeavour Mining’s chief executive Sébastien de Montessus told Reuters in an interview in February, days after news broke of Newmont’s first bid for Newcrest.

“I think we will probably see more [deals], simply because some companies are lacking a clear strategy,” de Montessus said, adding that: “You’ve got historical companies like IAMGOLD, Gold Fields, AngloGold, Kinross, where there are a lot of questions about whether their portfolio is well-suited, and whether their strategy is clear enough for investors and shareholders.”

More mergers and acquisitions in the gold mining sector are inevitable as companies will look to replace depleting assets, Harmony Gold’s CEO Peter Steenkamp said in a separate interview.

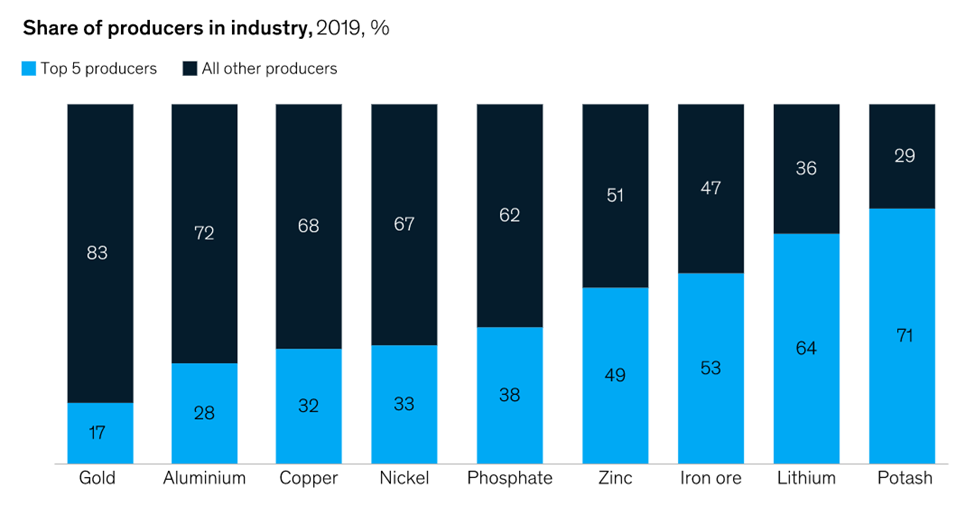

Another thing to consider is this: The gold industry is super fragmented. A 2021 McKinsey report revealed that the top five gold producers contribute to less than 20 percent of the world’s total supply. In contrast, for most other metals, the top five producers make up between one-third and two-thirds of global production (see below).

This suggests that more deals to consolidate premium gold assets could be on the horizon as companies continue to seek synergies and cost efficiency.

What’s in Store for EGR?

What the new wave of gold M&As should tell us is that there’s value in holding onto assets in close vicinity of the established players, because that would be the first place they would look.

The land position accumulated by EGR is a prime example of that.

And we know that Agnico has been active, having acquired Detour Lake and full ownership of the Canadian Malartic in less than two years. At Detour Lake, the Toronto-based miner has been adding more ounces to its reserve base and is proposing a westward expansion of the existing open-pit mine.

Should Agnico continue to explore in this direction along the same Detour-Fenelon structure, eventually it will touch down on EGR’s property.

Remember, the Quebec side of Agnico’s holdings is being explored by Wallbridge, which recently upped its indicated resources by 14% to 3 million oz. Also remember, there are still over 100 million oz. left to be uncovered within the Abitibi region.

Adding everything together, the EGR’s Detour West property fits the description of a sought-after gold asset once the drilling gets underway and the resource potential is confirmed. Everything is in place to get the 2023-2024 exploration underway.

EGR Exploration Ltd.

TSXV: EGR

Cdn$0.08, 2023.05.19

Shares Outstanding 32m

Market cap Cdn$2.4m

EGR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Richard does not own shares of EGR Exploration Ltd. (TSXV: EGR). EGR is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of EGR

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.