EGR Exploration looks to follow Detour Lake’s footsteps – Richard Mills

2023.05.03

The gold market continues to experience tightness due to difficulties expanding existing deposits and a pronounced lack of large discoveries in recent years.

This problem is being compounded by sky-high demand for the precious metal, with investors and central banks all stockpiling bullion in the current economy.

Last year, global gold demand rose an astonishing 18%, reaching its highest levels since 2011. Meanwhile, supply only grew 1% in 2022 despite halting two years of successive declines.

As the demand for gold is expected to outpace supply sooner or later, investors and mining companies are seeking exploration projects in politically stable jurisdictions with access to infrastructure, including water and power.

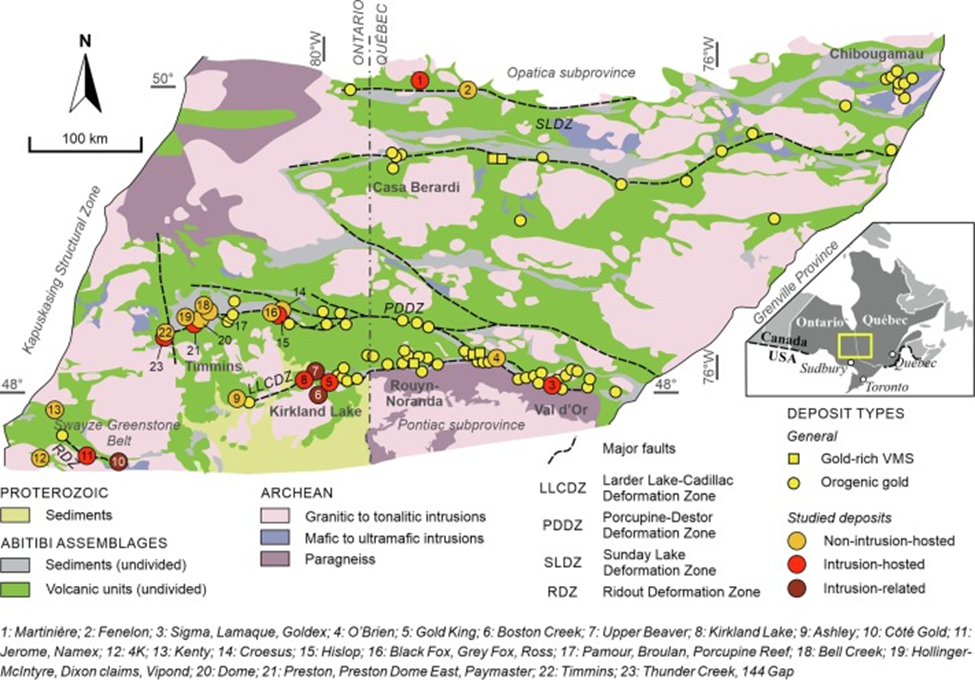

One region that is able to meet all of these criteria is Canada’s Abitibi gold belt. The region spans from Wawa, Ontario to Chibougamau, Quebec, representing the largest mineral-rich greenstone belt in the world.

Ontario and Quebec are two of the biggest mining jurisdictions in Canada and are responsible for over 70% of the country’s gold production, which is the fourth highest in the world (193 tonnes in 2022).

The Abitibi belt also exists in close proximity to a highly skilled workforce, multiple established mining camps and extensive renewable energy sources. Mining companies in both Ontario and Quebec also enjoy mining-friendly governmental policies.

Quebec, for instance, was identified as one of the top 10 mining jurisdictions in the world by the Fraser Institute’s 2021 Annual Survey of Mining Companies in sixth place, while Ontario still positioned highly at 13th.

World-Class Gold Belt

Straddling the provinces of Ontario and Quebec, the Abitibi gold belt is the largest mineral-rich formation of its kind at 450 km long and 150 km wide.

Formed 2.6 billion years ago, the Abitibi belt has evolved to become one of the most prospective regions in the world, producing over 200 million ounces of gold to date, with at least another 100 million ounces yet to be mined.

The defining geological factor of the region is the greenstone belts, which are ancient terrain formed by volcanic flows alongside sedimentary rocks that often contain orebodies of gold, copper, silver, lead and zinc.

Formed over millions of years, greenstone belts begin with the rising of lava and magma through crustal faults that fill a variety of basins across the region. Over extended time, erosion and plate tectonics resulted in high amounts of pressure and heat compressing layers of greenstone rock and gold-bearing volcanic flows to form orebodies of gold and other minerals.

Covering the greenstone belt and its golden deposits is a layer of overburden, topsoil that can range from 1-20 meters of depth. Many of the early discoveries were located near the surface, leaving further gold potential at depth to future generations.

Therefore, it’s no surprise that the region boasts a rather rich mining history, with 124 established gold mines since 1901. At least 15 of those have produced more than 3.5 million ounces.

High Discovery Potential

The gold deposits found in the area have been considered “world class,” as the average gold deposit grade is higher than the global average.

The Abitibi region now hosts several key players in the gold mining and exploration space, including Canada’s Kirkland Lake Gold and Agnico Eagle, which merged into one company last year, as well as Newmont, the world’s leading gold miner.

The newly consolidated Agnico portfolio includes Canada’s largest gold-producing operation at Detour Lake, which has a mine life of approximately 22 years with expected average gold production of 659,000 ounces per year.

In addition to Detour Lake, Agnico owns the Canadian Malartic mine in northwestern Quebec, which had been the largest open-pit gold operation in Canada prior to 2022. The company is also developing the Macassa and Goldex projects and the LaRonde complex within the Abitibi belt.

Newmont also maintains a significant presence in this prolific greenstone belt with three projects: Éléonore, Porcupine and Musselwhite.

The success many have had in the Abitibi is a big reason why many up-and-coming gold explorers continue to gather in the region to this day. Remember, there are still an estimated 100 million ounces still contained in the ground, and so the idea of making new, exciting discoveries here is quite plausible.

EGR Exploration

One junior miner we see a high chance of delivering on that promise is EGR Exploration Ltd. (TSXV: EGR), which is exploring for gold in the Detour-Fenelon gold trend approximately 300 km north of Timmins, Ontario.

The company’s flagship Detour West gold project is contiguous to Agnico Eagle’s property which contains the Detour Lake gold mine (hence the project’s name, “Detour West”), and is approximately 20 km from the mine, which is also hosted in the Abitibi Greenstone Belt.

The first thing you notice about the Detour West project is its enormous size: the entire property covers 40,255 hectares in the northwestern part of the Abitibi belt, directly adjoining the holdings of Agnico Eagle.

Gold mineralization at Agnico’s Detour Lake mine is characteristic of greenstone-hosted orogenic lode gold style deposits. The mine — now the largest in Canada — produced about 733,000 ounces of gold in 2022 and has proven and probable mineral reserves of 20.4 million ounces (835.1 million tonnes at 0.76 grams per tonne of gold) as of July 2022.

The Detour Lake area comprises thick sequences of mafic to ultramafic volcanic rocks referred to as the Deloro Assemblage (DA) in structural contact to the south with the younger sediments of Caopatina Assemblage (CA).

This contact between the DA and CA is characterized by a crustal-scale deformation zone referred to as the Sunday Lake Deformation Zone (SLDZ). According to EGR, the structures of the SLDZ are spatially related to most of the gold mineralization observed in the Detour Lake area.

Brief History – Detour Lake West

In July 2020, EGR — under its previous name Gambier Gold Corp. — entered the Detour Lake West project after signing an option agreement on the property, which at the time was 18,929 hectares in size (approximately 32 km long and 6 km wide).

Exploration work by previous operators on the Detour West property indicated to the company that its property be underlain by previously underexplored and unrecognized extensions of the rock units contained within the Sunday Lake, Massicotte and Lower Detour deformation zones that host the adjacent Detour Lake gold deposit.

In 2016, Tri Origin Exploration flew a helicopter-borne geophysical survey over the eastern part of the Detour West property. Magnetic results from this geophysical survey confirmed Tri Origin’s initial interpretations of the presence of the western extension of rock units and fault structures hosting the nearby Detour Lake gold mine, EGR noted in the 2020 agreement.

These responses flank the northern and southern boundaries of a west-northwest trending magnetic low interpreted to represent the westward extension of the Caopatina Assemblage, which is also present within the Detour Lake and Lower Detour gold deposits.

Later that year, the EGR team conducted a review of historical airborne geophysical surveys on the Detour West property, yielding numerous highly conductive geophysical anomalies along and proximal to the Sunday Lake and Lower Detour deformation zones that cross the property. As a result, the company expanded its landholdings at Detour West by an additional 4,917 hectares.

In 2021, the company set on a new path of systematic exploration at the Detour West property, beginning with the first phase of sonic drilling, which consisted of deep till sampling by means of sonic drilling, in addition to remote sensing surveys. Forty-nine sonic holes were drilled during the first phase of deep till sampling at Detour West, for a total of 2,241.5 metres.

In March 2022, EGR unveiled the results of processing and analysis for the 395 samples received from the reverse circulation (RC)/rotasonic (RS) drilling on the Detour West project. Of the samples that had free gold grains, six had calculated gold grades of above 1.0 g/t.

Following Detour Lake’s Path

Although the results of RS drilling were unsatisfactory, it was only seen as a blip, and the company has decided to take an exploration approach that has been successful for Agnico’s Detour Lake mine.

A review of the Detour Lake 2018 NI 43-101 technical report indicated that a successful pre-drilling exploration approach, especially south of the Lower Detour Deformation Zones (LDDZ), involved Induced Polarization (IP) surveys on 200 m line spacing and Mobile Metal Ions (MMI) geochemical survey to assist in ranking of the geophysical IP anomalies.

In 2010 and 2011, Detour Lake Mines collected 10,000 MMI samples at 50 m spacing on lines 400 m apart along 30 km of the LDDZ. The samples were collected at depths of 10 to 25 cm and a 25 g split from each sample was analyzed. Between 2011 and 2017, the miner completed 838.4 line km on mainly 200 m line spacing principally along the LDDZ, with detailed 100 m line spacing around the Zone 58N gold deposit.

EGR therefore started a similar two-phase program along an 8 km stretch of the western interpreted extension of the Saturday Lake Deformation Zone (SLDZ), starting approximately 1 km to the southeast of the A series RS drill holes. The initial phase would be MMI sampling along the 8 km length on 400 m spaced lines, to be followed by IP survey over initially the highest MMI anomalies to define drill targets. The drilling will be done by a combination RC-diamond core drill allowing for both till and rock core sampling.

But before rolling out this exploration plan, a few more things were needed to ensure the maximum chance of success.

The company first strengthened its technical team with the appointment of Brian Atkinson, a geologist with 40 years of experience, to its advisory board. Atkinson spent the majority of his career as Regional Resident Geologist for Ontario Geological Survey in Red Lake and Timmins. Currently, he is a consultant and practicing registrant of Professional Geoscientists Ontario.

In early 2023, EGR further increased its holdings in the Detour Lake area with the acquisition of 50 mining claims within the Detour West property, allowing the company to consolidate the entire 40,255-hectare project area (see below).

Interpretation of the existing magnetics data over the newly acquired claims shows the potential for segments of the Sunday Lake Deformation Zone (SDLZ), Massicotte Deformation Zone (MDZ), and secondary splays from them, to extend onto the property.

Recently, the company carried out an airborne magnetic survey totaling 4,620 line km on a line spacing of 75 m at the Detour West project. The survey will cover approximately two-thirds of the property investigating the extensions of the Sunday Lake, Massicotte and Lower Detour Lake deformation zones known to be associated with gold mineralization along the Detour-Fenelon trend, which hosts Agnico’s Detour Lake mine.

Data obtained from this airborne magnetic survey, the company says, will provide a “superior and consistent dataset” that will form the basis for target refinement of future till and top of bedrock sampling and reverse circulation drill programs.

A field program will be implemented afterwards to follow up on a previous Lidar survey, investigate outcrops identified from the survey, and plan access and drill pad locations for drilling.

Should everything go according to plan, EGR will initiate the till sampling program in mid-December 2023, which is expected to continue through the winter. The goal will be to test for gold in glacial till and identify potential gold grain dispersion trains emanating from gold mineralization associated with the extensions of known deformation zones.

Conclusion

While the biggest defining factor in gold mining is location, the bigger determinant is proximity, and that’s what truly differentiates EGR’s flagship project.

Being right next to Agnico’s property hosting Canada’s largest gold mine, there is plenty of exploration upside to be had at Detour Lake West. At Detour Lake, for example, Kirkland Lake has enjoyed significant success since it first acquired the property in 2020, including a more than three-fold increase in the open-pit measured and indicated resources to its current 14.7 million ounces.

Now under Agnico ownership, the Detour Lake operation is still expanding. The Canadian gold miner plans to develop two new pits to the west of Detour Lake along with extending the existing pit to the same direction. As the West Detour project advances, it’s entirely conceivable that EGR’s large property could come into play.

We’ve already seen other areas surrounding Detour Lake receive plenty of interest. For example, in 2020, Kirkland Lake entered into a $35 million option agreement to acquire a 75% interest in Wallbridge’s Detour East property, which is located immediately east of Kirkland’s holdings along the SLDZ.

The Detour East project, according to EGR, is a mirror image of its Detour West property, which means the Detour Lake operators are clearly looking at projects nearby. The upcoming exploration program, with a bigger property size and new team, provides a real opportunity to gain the industry’s attention.

EGR Exploration Ltd.

TSXV: EGR

Cdn$0.10, 2023.05.01

Shares Outstanding 32m

Market cap Cdn$3.2m

EGR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Richard does not own shares of EGR Exploration Ltd. (TSXV: EGR). EGR is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of EGR

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.