EGR Exploration: A unique gold junior defined by strategic positioning along the Abitibi trend – Richard Mills

2023.08.02

The gold market has gotten a nice little jolt since the US Federal Reserve’s recent decision to lift interest rates once again, now at their highest in 22 years.

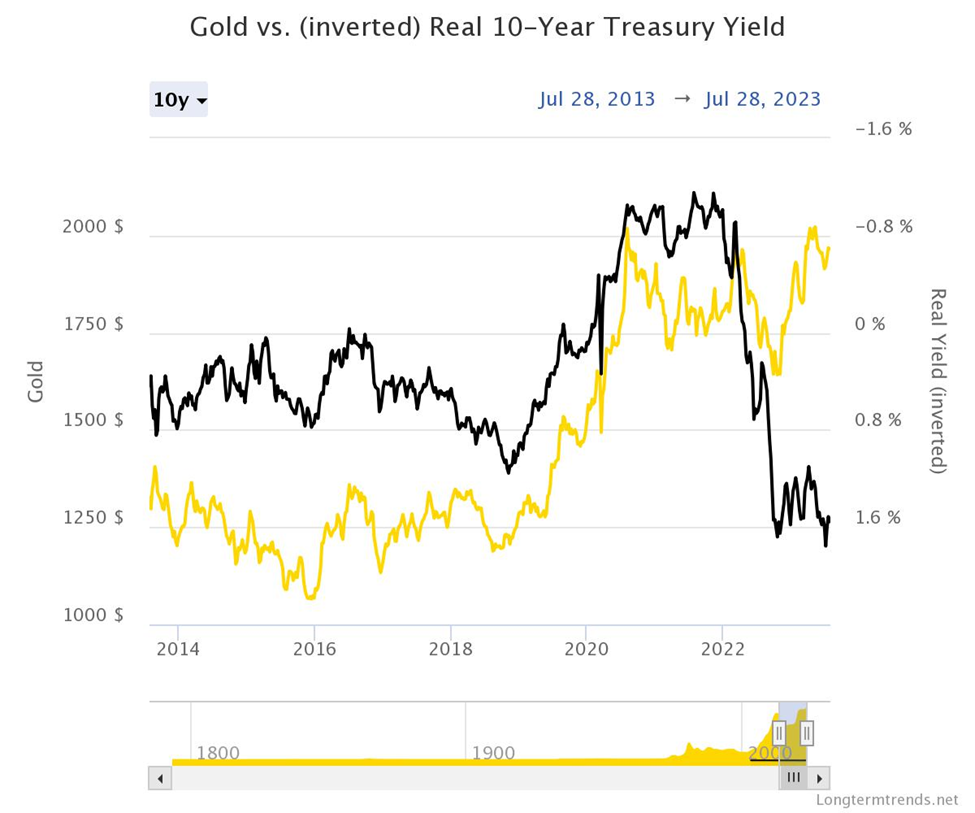

While such a move didn’t come as a shock to most people, it did bring us closer to peak interest rates — and eventually, a Fed pivot — which is positive news for gold. This is because when the US central bank reverses its policy, it tends to weaken both the dollar and yields, both of which are rival assets to gold.

“Yields are starting to look toward the Fed to pivot, and it looks like gold’s just ready to break out. I think these boomer rocks, they’re set up for a boom,” said Mike McGlone, Bloomberg Intelligence senior macro strategist, in a Yahoo Finance report.

“The key thing that has pressured gold the past 10 years or so has been the US stock market outperforming the world,” McGlone explained. “The key trigger will be when the US stock market continues to underperform the rest of the world, and gold will be the shining star.

“A sooner Fed pivot on rate hikes will likely cause another gold price surge due to a potential further decline in the US dollar and bond yields,” an analyst from CMC Markets told CNBC earlier this year. Should that happen, it expects bullion to trade between $2,500 to $2,600 an ounce.

Fed Pivot Approaching?

Although it’s anyone’s guess when that will happen, there are a couple of indications that the current monetary policy tightening cycle — the most aggressive since the 1980s — should be drawing to a close.

First and foremost, the US inflation data is looking better. The PCE Price Index, the Fed’s preferred inflation gauge, rose 3% from a year earlier in June, the smallest increase in more than two years. Core prices — which exclude food and energy and are regarded as a more reliable signal of underlying inflation — advanced 4.1%, also the lowest since 2021 and slower than estimated.

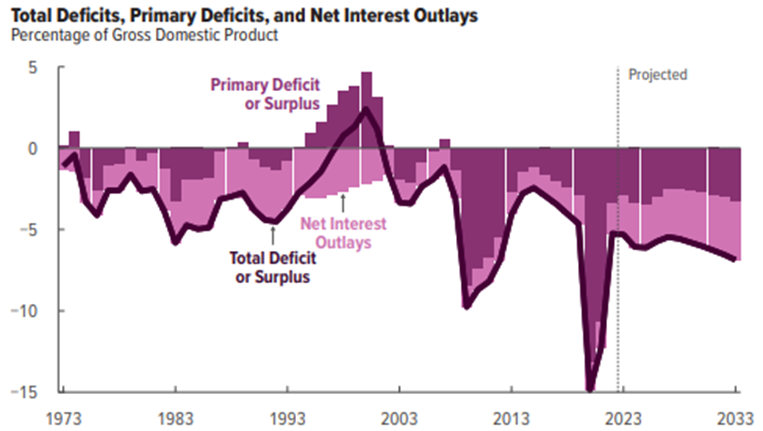

Then there’s the swelling federal debt accumulated during the current monetary cycle. For the first nine months of the fiscal year, the US government deficit totalled $1.4 trillion — a 170% increase from the same period a year earlier. At the current rate of spending, it could easily reach $3 trillion.

“We are projected to spend more on interest payments in the next decade than we will on the entire defense budget,” Maya Macguineas, president of the Committee for a Responsible Federal Budget, told NPR. “How can anyone possibly think this trend is sustainable?”

At some point, the Fed’s rate hike campaign would be deemed too costly for the benefit it provides, and at least some Fed officials are acknowledging that the current cycle is nearing its end.

“We’re likely to need a couple more rate hikes over the course of this year to really bring inflation” sustainably back to the US central bank’s 2% goal, San Francisco Fed President Mary Daly said during an event at the Brookings Institution in July.

However, Daly added that while the risks of doing too little are still greater than those of overdoing it on rate hikes, the two sides are getting into better balance as the Fed nears “the last part” of its hiking cycle.

According to the CME’s FedWatch Tool, the probability that the Fed will leave rates unchanged this year is at 60%.

“I don’t think the Fed’s going to make a move in September, but later in the year, if we continue to get strong economic data, the Fed probably will make one more rate-hike,” Jim Wyckoff, senior market analyst at Kitco, said via Reuters this week.

“Right now, the gold and silver markets are waiting for the next catalyst… if demand from China starts to recover, we see more upside in gold and silver,” he added.

Gold Demand Still Robust

One aspect of the gold market investors shouldn’t worry about is demand.

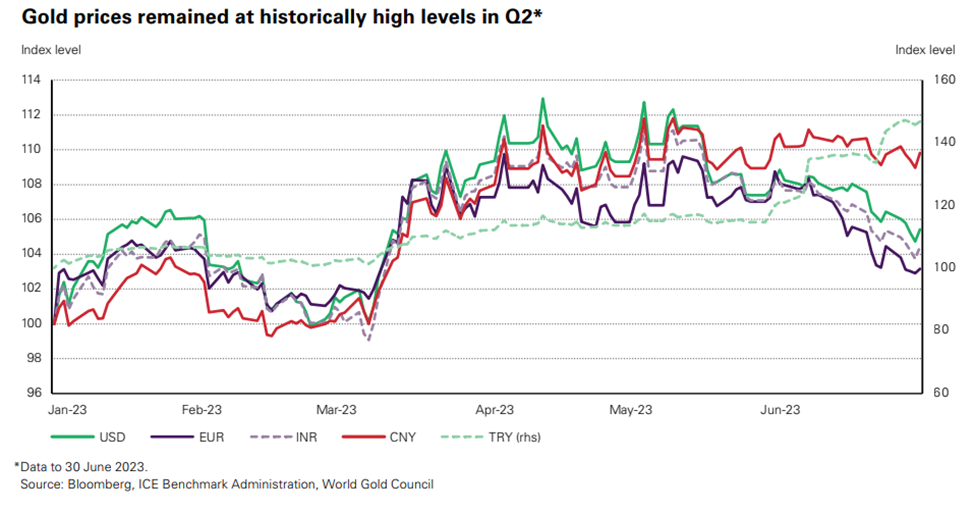

This week, the World Gold Council (WGC) put out a fresh quarterly report confirming the metal’s demand trajectory. In Q2 2023, gold investment in Q2 was healthy compared with the same quarter of last year, up 20% to 256t. Jewelry consumption also strengthened modestly y/y, up 3% to 476t despite historically high (if not record) prices in most markets.

But the most talked-about source of demand has to be central banks, which bought a record 1,136 tonnes of gold last year and followed that up with another 228t in Q1, the most ever in a first quarter.

While central bank net buying slowed to 103t in Q2 2023, down 35% y/y from an extremely high base, the selling activity has done little to dent the underlying positive trend in central bank gold demand, which saw its highest first half on record dating back to 2000, the WGC said.

“Record central bank demand has dominated the gold market over the last year and, despite a slower pace in Q2, this trend underscores gold’s importance as a safe haven asset amid ongoing geopolitical tensions and challenging economic conditions around the world,” Louise Street, senior markets analyst at the WGC, commented.

Looking ahead, the Council expects the positive central bank trend to continue, and an economic contraction could bring additional upside for gold, further reinforcing its safe-haven asset status.

“In this scenario, gold would be supported by demand from investors and central banks, helping to offset any weakness in jewelry and technology demand triggered by a squeeze on consumer spending,” Street said.

Leveraging Gold’s Bull Market

This WGC report, plus gold’s performance during the first half (up 8.2% year to date as we speak), should assuage any concerns that the bull market is fading away. In fact, signs are mostly pointing to the contrary.

Randy Smallwood of Wheaton Precious Metals, chairman of the WGC, told CNBC reporters that “continued central bank buying of gold bodes well for long-term prices.” He forecasts that prices could eventually hit $2,500 an ounce.

An even wilder prediction recently surfaced from Wall Street research firm Goehring & Rozencwajg (G&R), which believes it’s only a matter of time before gold surpasses double digits on its way to $12,000-15,000 an ounce. In a recent interview, managing partner Adam Rozencwajg said he believes “gold has entered into a new phase of this bull market,” and it’s now the perfect time to step back in.

Instinctively, as we head into the second half of the year, investing in gold seems to be the logical choice; yet, buying physical gold like bullion, coins or jewelry may not be logistically feasible for all.

There is, however, an alternative or perhaps more profitable route to realizing the growth potential of physical gold: investing in gold-related stocks. Like with every sector, gold companies can come in different sizes, depending on how much they produce (if at all).

The biggest producers (a.k.a seniors) are likely the most reflective of the market and represent the safest bet, but in terms of reward, it’s the exploration-stage companies (“juniors”) that are more attractive.

In fact, junior gold stocks offer incredible upside potential during gold bull markets. Anecdotally, during a bull market, senior gold miners typically outperform the metal by a multiple of 2 to 3 times. Junior gold stocks – though riskier – can outperform the precious metal’s return by 5 or even 10 times during a bull market.

EGR Exploration

The most attractive gold juniors are those with assets in established mining jurisdiction, preferably in close proximity to mines operated by the majors.

One that perfectly fits the profile is Vancouver-based EGR Exploration Ltd. (TSXV: EGR), which is exploring for gold next to the country’s largest gold operation, within a region already hosting multiple multi-million-ounce deposits.

Getting its name from “Everywhere Good Results”, the company is looking to live up to that hype and announce the next significant gold discovery at its flagship Detour West property, located approximately 300 km north of Timmins.

The property covers 40,255 hectares of the Abitibi Greenstone Belt, one of the most prospective regions for gold on the planet. Many gold deposits found in the Abitibi area in the past have been considered “world class,” as the average gold deposit grade is higher than the global average.

The Abitibi region now hosts several key players in the gold mining and exploration space, including Canada’s Kirkland Lake Gold and Agnico Eagle, which merged into one company last year, as well as Newmont, the world’s leading gold miner.

The newly consolidated Agnico portfolio includes Canada’s largest gold-producing operation at Detour Lake, which has a mine life of approximately 22 years with expected average gold production of 659,000 ounces per year.

In addition to Detour Lake, Agnico owns the Canadian Malartic mine in northwestern Quebec, which had been the largest open-pit gold operation in Canada prior to 2022. The company is also developing the Macassa and Goldex projects and the LaRonde complex within the Abitibi belt.

Newmont also maintains a significant presence in this prolific greenstone belt with three projects: Éléonore, Porcupine and Musselwhite.

The success many have had in the Abitibi is a big reason why many up-and-coming gold explorers continue to gather in the region to this day. Worth noting: there are still an estimated 100 million ounces still contained in the ground, and so the idea of making new, exciting discoveries here is quite plausible.

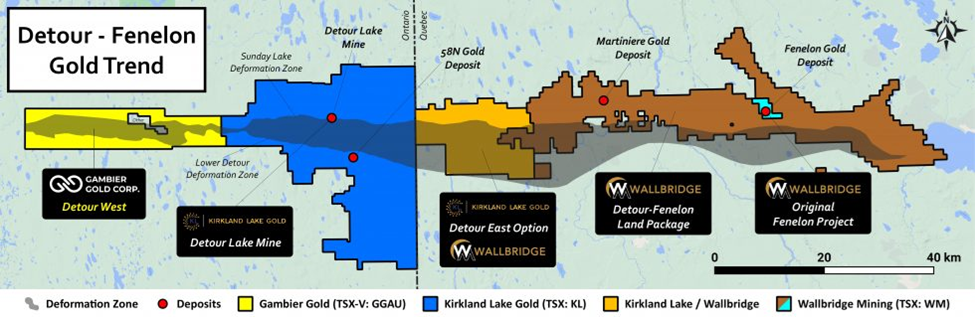

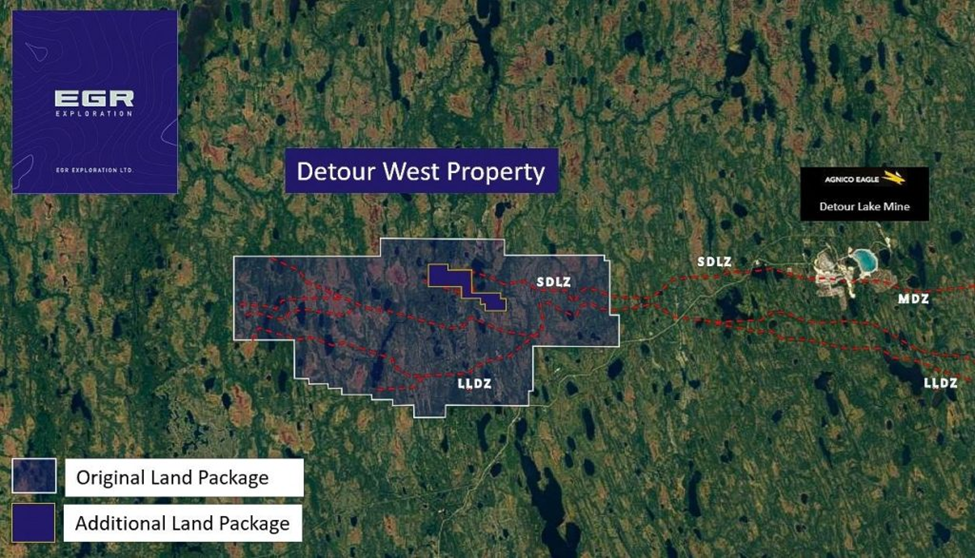

EGR’s property is conveniently located 20 km west of the Detour Lake open-pit (hence the name “Detour West”), and also directly adjoins Agnico Eagle’s holdings along the Detour-Fenelon gold trend. The eastern portion of this trend is being explored by Wallbridge Mining in Quebec (see figure below).

In July 2020, EGR — under its previous name Gambier Gold — entered the Detour West project after signing an option agreement on the property, which at the time was less than half the current size (approximately 32 km long and 6 km wide).

To maximize its chance of success, EGR has since increased its landholding and consolidated the entire 40,255-hectare Detour West project area (see below).

It then carried out an airborne magnetic survey covering approximately two-thirds of the property to investigate the extensions of various deformation zones known to be associated with gold mineralization along the famous Detour-Fenelon trend.

Under the new management team, EGR’s exploration plan has been clear and simple: replicate the exact same methods that have been successful for Agnico at the Detour Lake mine.

The company is currently analyzing the survey to provide what it considers to be a “superior and consistent dataset” that will be used to refine targets and identify potential areas of interest. These findings, according to EGR, will guide the implementation of a comprehensive till and top of bedrock reverse circulation drilling program, which it expects to start as early as Q4 this year.

News will be announced in due time as it builds up its upcoming winter drill campaign, the company announced recently via its Twitter account.

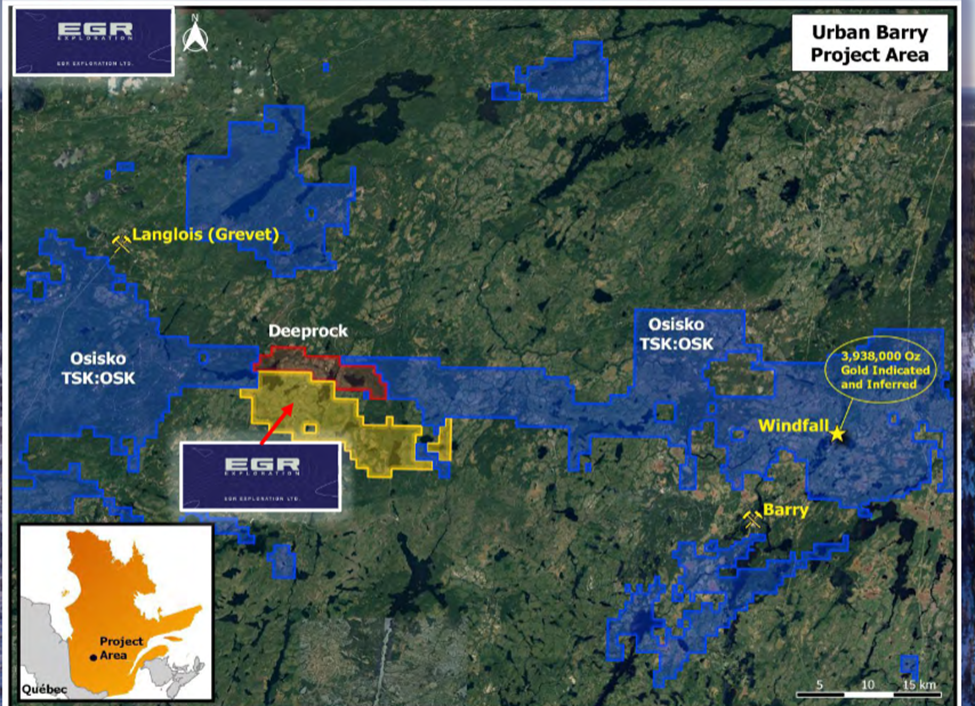

In addition to Detour West, EGR is also looking to explore the Quebec side of the Abitibi belt. The company’s Urban Barry project is located in the James Bay region, near Osisko’s Windfall deposit which holds nearly 4 million oz. of gold resources.

The Urban Barry property encompasses an area of approximately 10,762 hectares and directly adjoins Osisko’s property, with the Langlois base metal-silver-gold mine located approximately 30 km to the northwest.

From November 2019 to March 2020, EGR flew an airborne drone magnetic geophysical survey over the property. Results from this survey confirm the presence of the northwest extension of rock units and fault structures hosting the nearby Windfall gold deposit.

Like Detour West, the company is currently reviewing all historical data on its Urban Barry property and is in the process of planning future field programs.

Conclusion

The strategic positioning of EGR’s holdings, in particular the Detour West property, is what makes the company really stand out amongst all gold explorers.

Upon examining the Detour-Fenelon trend map, you’d notice that EGR is the sole junior miner in this part of the prolific Abitibi belt, and its land is tantalizingly close to that held by Agnico, a well-established gold producer in Canada.

In recent years we have witnessed a significant amount of consolidation of holdings along the Abitibi belt, such as Wallbridge’s acquisition of Balmoral Resources and the previously mentioned Detour Lake deal by Agnico.

Ryan Long of Proactive Investors UK calculates that the recent average transactional value of projects in this area is C$151,000 per km2. Based on this, EGR’s 403-km2 Detour West project would have an implied valuation of about C$61 million, while the company’s own market capitalization is just under C$3 million; so there’s value to be had here.

And with exploration/drilling looking to get underway at Detour West later this year, there’ll be plenty of exciting news coming from EGR.

EGR Exploration Ltd.

TSXV: EGR

Cdn$0.065, 2023.07.31

Shares Outstanding 40.2m

Market cap Cdn$2.61m

EGR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Richard does not own shares of EGR Exploration Ltd. (TSXV: EGR). EGR is a paid advertiser on his site aheadoftheherd.com. This article is issued on behalf of EGR Exploration Ltd.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.