Dolly Varden Silver’s step-out drilling at Homestake Ridge discovers new high-grade gold zone: 79.49 g/t Au over 12.45m, including 1,335 g/t Au over 0.68m – Richard Mills

2024.02.15

The drill hits keep on coming at Dolly Varden Silver’s (TSXV:DV, OTC:DOLLF) Kitsault Valley project in northwestern British Columbia, this time at the Homestake Ridge property.

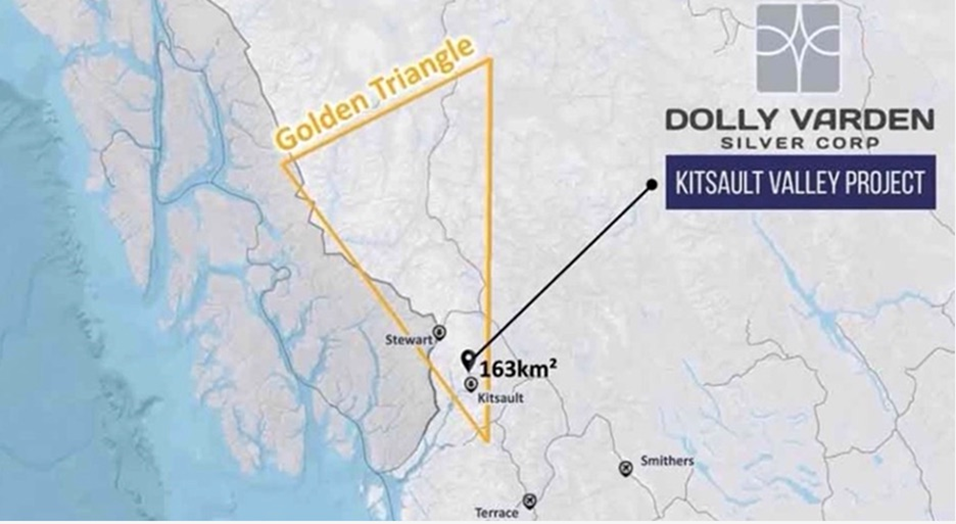

Kitsault Valley is within the famed Golden Triangle region of BC, known for past-producing mines such as Eskay Creek, Premier, Granduc and Snip.

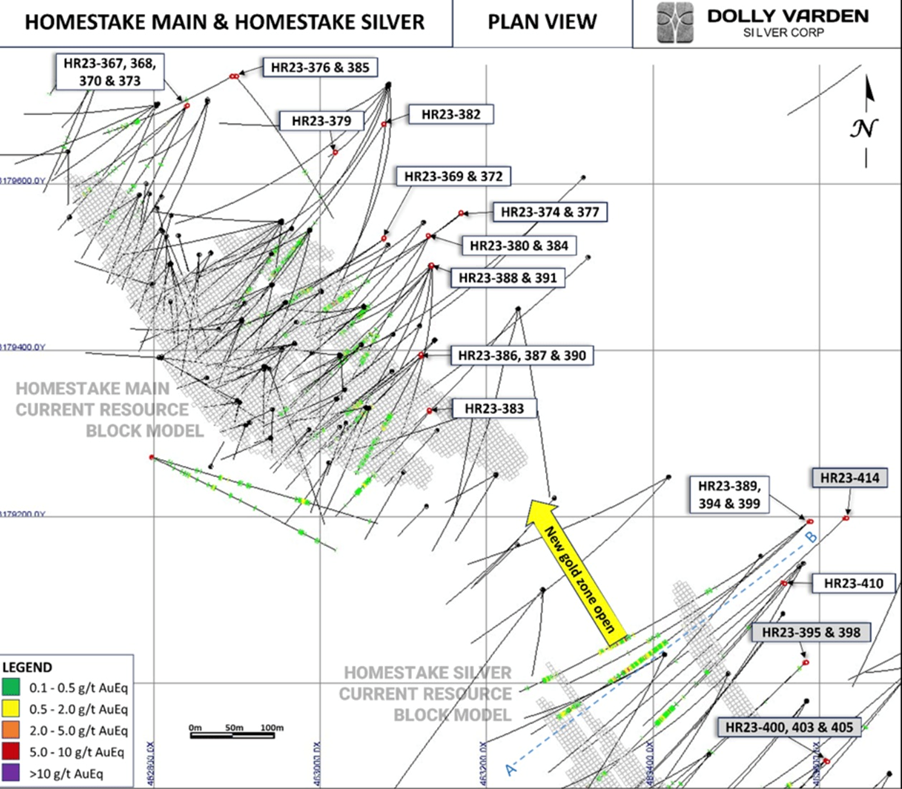

The Vancouver-based company this week announced that 2023 step-out drilling encountered a new gold-rich zone to the northwest of the Homestake Silver deposit.

Highlights included holes HR23-389, HR23-389 and HR23-410:

- HR23-389: 79.49 g/t Au and 60 g/t Ag (80.21 g/t AuEq) over 12.45 meters including 1,335 g/t Au and 781 g/t Ag (1,344.42 g/t AuEq) over 0.68 meters within a broad mineralized zone grading 15.26 g/t Au and 20.05 g/t Ag (15.50 g/t AuEq) over 66.50 meters.

- HR23-399: 43.10 g/t Au and 66 g/t Ag (43.90 g/t AuEq) over 1.01 meters and 40.33 g/t Au and 418 g/t Ag (45.37 g/t Au Eq) over 1.75 meters within a broad mineralized zone grading 2.68 g/t Au and 20 g/t Ag (2.92 g/t AuEq) over 57.70 meters.

- HR23-410: 10.17 g/t Au over 6.61 meters including 50.70 g/t Au over 0.62 meters.

Highlights from in-fill drilling at Homestake Main, below high-grade plunge, included holes HR23-374, HR23-386 and HR23-390:

- HR23-374: 22.60 g/t Au over 0.67 meters, 18.75 g/t Au over 2.00 meters and 10.15 g/t Au over 1.00 meter in separate vein breccias included in a wider mineralized envelope grading 1.22 g/t Au and 1.90 g/t Ag (1.24 g/t AuEq) over 83.51 meters.

- HR23-386: 18.14 g/t Au and 30 g/t Ag (18.51 g/t AuEq) over 2.50 meters including 69.9 g/t Au and 42 g/t Ag (70.41 g/t AuEq) over 0.50 meters.

- HR23-390: 129.00 g/t Au and 218 g/t Ag (131.63 g/t AuEq) over 0.50 meters in a vein breccia included in a wider mineralized envelope grading 1.92 g/t Au and 3.58 g/t Ag (1.96 g/t AuEq) over 50.30 meters.

“Whether we discover new zones of high-grade gold at Homestake Ridge or expand the large, wide and high-grade silver deposits at Wolf and Torbrit, drilling continues to deliver results from the premier, undeveloped gold-silver trend in Canada,” said Shawn Khunkhun, CEO of Dolly Varden Silver.

Rob van Egmond, vice-president exploration, said, “The new high-grade gold and silver mineralization encountered in step-out drilling to the northwest of Homestake Silver represents a significant breakthrough in further defining, upgrading and expanding the mineralization at Homestake Ridge. This new zone remains open to the northwest, projecting towards the Homestake Main Deposit.”

Kitsault Valley project

Located at the southern end of the Golden Triangle, the Kitsault Valley project represents the amalgamation of Dolly Varden’s original namesake silver property and its Homestake Ridge gold-silver property.

This 163-square-kilometer land package hosts one of the largest undeveloped high-grade precious metals projects in Western Canada. Its combined mineral resource is estimated at 34.7 million oz of silver and 166,000 oz of gold in the indicated category and 29.3 million oz of silver and 817,000 oz of gold in the inferred category.

The project has a rich history, which can be traced back to the early 20th century when Scandinavian prospectors first made the silver discovery in what is now the Stewart Complex.

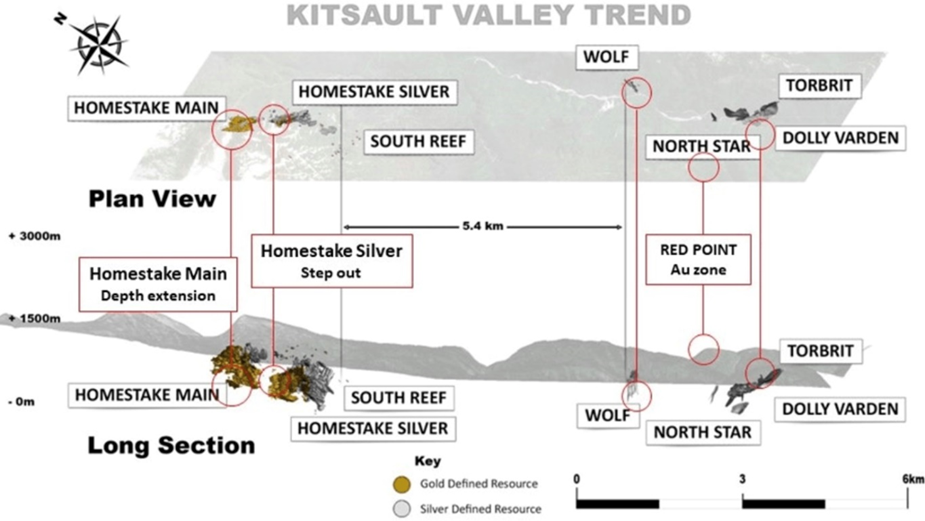

Within the boundaries of the company’s original property are two past-producing silver mines: Dolly Varden and Torbrit, which formed a prolific silver mine camp starting in 1919 that produced more than 20 million ounces in the span of 40 years, with assays as high as 2,200 ounces per tonne.

It should be noted that Dolly Varden was among the most important silver mines in the British Empire during its heyday.

Other historically active mines in the area include North Star and Wolf, which remain underexplored to this day. Together, the four deposits comprise about 90 square kilometers within the Stewart Complex.

While these deposits were already enough to work with, DV always believed that the Kitsault Valley property is prospective for hosting further precious metal deposits, being on the same structural and stratigraphic belts that host numerous other high-grade deposits on the same trend such as Eskay Creek and Brucejack.

Towards the end of 2021, the company further consolidated its position with the acquisition of Homestake Ridge, which occupies the northern half (~75 sq km) of Kitsault Valley. This project features a high-grade gold and silver resource from three known deposits that the company believes can be converted into higher-confidence categories.

In September, Dolly Varden Silver put out encouraging results from early 2023 drilling at the Wolf Vein. The highlight of the bunch was hole DV23-368, a 75m step-out down plunge that intersected 1,898 g/t over 1.00m within 381 g/t Ag over 29.34m core length. The hole was drilled along plunge from the earlier hole DV22-320, which graded 321 g/t Ag over 12.85m.

Dolly Varden Silver hits 1,898 g/t Ag from step-out drilling at Wolf Vein area – Richard Mills

In November, Dolly Varden announced that Hecla Canada will purchase 15,384,616 shares at $0.65 per share for gross proceeds of $10 million. Hecla’s share percentage increases from 10.6% to 15.7%, calculated on an undiluted basis.

Hecla Mining invests $10M in Dolly Varden Silver, upping stake to 15.7% – Richard Mills

In December, Dolly Varden said that it intends to acquire a 100% undivided interest in the southern portion of the Big Bulk Project from Libero Copper & Gold. Dolly Varden will issue Libero 275,000 common shares at a deemed value of $0.78 to close the deal.

“Big Bulk is located about 10 kilometers east of the Kitsault Valley Project,” VP Exploration Rob van Egmond told Guy Bennett, CEO of Global Stocks News. “Prior to this transaction, we controlled the northern part of it. It’s a property that we haven’t done a lot of work on because we’ve been focusing on the high-grade silver to the west.”

The southern portion of the Big Bulk property that DV is acquiring rights to earn 100% ownership in, contains seven mineral claims making up 3,025 hectares. When combined with DV’s northern portion, this doubles the size of the Big Bulk Project to approximately 6,000 hectares.

The option will give DV a new consolidated copper-gold porphyry project in the Golden Triangle region of northwestern British Columbia.

In January, Dolly Varden published the results of 23 holes, or 12,150m, drilled at the Homestake Silver property in 2023. The program targeted priority zones within the deposit, and significantly expanded the width and extent of the reinterpreted high-grade silver and gold mineralized plunge.

The Feb. 12 news release contains the remaining drill results from the 48-hole program last year at the Kitsault Valley project, which includes the Homestake Ridge and Dolly Varden properties.

In total, Dolly Varden reported 26 holes at Homestake Main (11,054.90m), four holes (2,478m) from the new gold-rich zone at the Homestake Silver northwestern extension, six holes from the Homestake Ridge property (1,627m), and 12 holes (6,971m) from the Dolly Varden property, including the North Star, Red Point and Wolf areas.

Homestake Silver step-out drilling

According to Dolly, the high-grade gold and silver intersections in holes HR23-389 and HR23-399 are horizontally separated by approximately 40m and are interpreted to be a new gold zone extending northwest, at depth towards the Homestake Main deposit. Deeper in these holes a second, targeted mineralized envelope was encountered (Figure 5). In longitudinal section, the new gold zone overlaps parallel with the known mineralized envelopes approximately 50 meters to the east. This zone remains open to the northwest below historic drilling. Drilling in 2024 will target a 350m long gap between the Homestake Silver and Homestake Main Deposits to expand this new zone (Figure 2).

Drill hole HR23-410 is a 75-meter step-out from previously released holes HR23-395 and 398 (January 4th, 2024 release) and represents an extension of the higher grade veins to depth and below the wide, higher grade plunge.

The dip of drill hole HR23-394 steepened due to hole deviation more than anticipated and remained in the footwall to mineralized zones.

Homestake Main drilling

The objective of 2023 drilling at the Homestake Main and Homestake Silver deposits was to expanded multiple, subparallel mineralized zones and to upgrade inferred mineral resources in the projected plunge of the wider, higher-grade zone. The drilling completed at Homestake Main was primarily resource expansion drilling, targeting both down dip and along strike from current resources.

At Homestake Main, the 2023 drilling tested the depth extent of the structural corridor that hosts the mineralization and infilled in areas of higher grades. Drill hole HR23-374 is located approximately 200m down dip from the modeled wide, high-grade plunge, planned as a depth test at the bottom edge of the known mineralized envelope.

Drilling along the northwest projection of the Homestake Main zone intersected the structural corridor and associated alteration but with a decrease in vein stockwork and vein breccias’ density.

Homestake Ridge exploration drilling

Four exploration drill holes (HR23-417, 420, 421 and 424) tested two parallel, northwest trending structures located 300 meters and 600 meters to the west of the Homestake Silver deposit. HR23-424 tested the Fox Reef, a parallel structure approximately 900 meters to the southwest. Numerous veins and breccias were intersected with lower grade gold values. Another two drill holes (HR23-422 and 423) tested the Dilly-Rambler exploration target 1,500m to the south of Homestake Silver. Although zones of quartz-sericite-pyrite (QSP) alteration and structures of interest were intersected, no significant precious metal grades were returned from the samples in these holes.

The Homestake Ridge deposits are interpreted as a structurally controlled, multi-phase epithermal vein stockwork and vein breccia system hosted in Jurassic Hazelton Volcanic rocks. Mineralization consists of pyrite and chalcopyrite in a breccia matrix within a silica breccia vein system and quart-carbonate veining (Figure 3). The northwest orientation of the main Homestake structural trend appears to have numerous subparallel internal structures that are interpreted to form the controls for higher-grade gold and silver shoots within a broader low-grade (>0.1 g/t Au) zone at the Homestake Main deposit. The main structural corridor dips steeply to the northeast at Homestake Main and rolls to steeply southwest at Homestake Silver (Figures 2 and 5).

and previous drill holes

Dolly Varden exploration drilling

The results of 12 drill holes completed at the end of the 2023 season on the Dolly Varden property come from three main areas: Red Point, North Star and Wolf (Figure 6).

this news release

Red Point

Three holes were drilled in the Red Point area, located at the southern end of the western gold belt, approximately 10 kilometers southeast along the trend from the Homestake Ridge deposits. Styles of mineralization encountered included varying degrees of quartz and quartz-carbonate veining in a QSP alteration halo, similar to what is seen at the Homestake Ridge deposits.

Highlights included hole HR23-60:: 1.92 g/t Au over 13.10 meters including 7.25 g/t Au and 1.12% Cu over 2.30 meters near surface all within a broad mineralized halo grading 0.44 g/t Au over 120.62 meters.

North Star

Two drill holes intersected the stratabound mineralization of the North Star deposit, part of the Torbrit horizon, approximately 50 meters down dip from historic underground drilling in the 1960s. The surface drill holes collars were moved further back to intercept the horizon at a better angle and test for continuity. The North Star deposit has higher lead (Pb) and zinc (Zn) values than the Torbrit deposit located across the Kitsault Valley. The current mineral resource Eetimate for North Star does not include any credits for the significant base metals in the mineralized horizon.

Highlights included hole HR23-358, west step out, entire horizon: 199 g/t Ag with 1.28% Pb and 1.21% Zn (292 g/t AgEq) over 18.10 meters including 1,510 g/t Ag, 1.23% Pb and 5.34% Zn (1,755 g/t AgEq) over 0.58 meters and 753 g/t Ag, 0.51 g/t Au, 15.20% Pb and 4.32% Zn (1,430 g/t AgEq) over 1.00 meters.

The North Star deposit along the Torbrit horizon remains open to the west down dip, for follow-up in the 2024 drill program.

Wolf

The five drill holes press-released for Wolf were part of an end-of-season follow-up to test below the plunge of the wide, higher-grade zone. The Wolf structure was intersected with low silver grades and increased lead and zinc values, typical of below and outside of the plunge of the high-grade silver zone (Figure 7).

Conclusion

Much of silver’s value is derived from its industrial demand. It’s estimated around 60% of silver is utilized in industrial applications, leaving only 40% for investing.

Lately, silver has garnered a lot of attention of its “green” uses such as in solar and electric vehicles. Silver Academy states that silver is the critical mineral for net-zero economies, pointing out uses in hydrogen fuel cell cars, trucks, vans, ships, barges, ferries, satellites, robotics, AI, solar, wind power, in addition to over 10,000 other applications.

Top silver producers are pushing to include the metal on the list of critical minerals in Canada and the US. The CEOs of 19 mining companies, including Coeur Mining, Hecla Silver and First Majestic Silver, have sent a letter to Jonathan Wilkinson, Canada’s Minister of Energy and Natural Resources. The letter says that considering silver a critical mineral would position Canada to be a supplier of choice for strategic allies.

As the metal with the highest electrical and thermal conductivity, silver is ideally suited to solar panels. A 2020 Saxo Bank report stated that “potential substitute metals cannot match silver in terms of energy output per solar panel.”

One projection has annual silver consumption by the solar industry growing 85% to about 185 million ounces within a decade, according to a report by BMO Capital Markets. Solar Power Europe expects global solar power installations will more than double in three years to reach 2.3 terawatts by 2025, up from 1 terawatt in 2022.

Falling production in Mexico and China, the top two producers; resource nationalism in Peru, the number 3 producer; too low of an incentive price; and higher input costs — are all feeding into a global silver supply deficit.

Mexico could run out of silver by 2026, worsening supply deficit

According to the 2023 World Silver Survey, the global silver market was undersupplied by 237.7 million ounces in 2022, which the Institute says is “possibly the most significant deficit on record.”

Global silver mine production was projected to fall 2% last year to about 820 million ounces, compared to forecasted demand of 1.2 billion ounces.

The Silver Institute forecasted a 140Moz silver deficit, the third consecutive annual shortfall, against robust silver industrial demand, which was expected to grow 8% to a record 632Moz. Key drivers included investment in photovoltaics, power grid and 5G networks, growth in consumer electronics, and rising vehicle output.

“We are moving into a different paradigm for the market, one of ongoing deficits,” said Philip Newman at Metals Focus, the research firm that prepared the Silver Institute’s data.

Silver is interesting in that there is the same amount of investable silver above ground as there is gold, because 60% of silver goes into industrial uses and 80% of that end up in landfills. Just 40% is used for investing.

Silver, like gold, is a precious metal that offers investors protection during times of economic and political uncertainty.

After Russia’s invasion of Ukraine, the flight to safety subsequently sent silver prices past the $26/oz mark, which was last seen in August, 2021.

This silver rally proved to be a flash in the pan, however. An aggressive interest rate hike campaign by the US Federal Reserve, along with a high US dollar, has kept the safe-haven metal in check.

Still, there are reasons to believe that longer term, silver will rebound. One is the same reason to be bullish on gold, i.e., that continued monetary debasement due to high inflation, out-of-control spending and monstrous government debt, will eventually push bond and stock investors over to precious metals.

Assuming the US Federal Reserve proceeds to cut interest rates, likely around the mid-point of the year, silver and gold could both rally, as the opportunity cost of holding metals gets lower.

Copper and silver are essential metals when it comes to the transition from fossil-fueled transportation and power generation to electricity-based systems.

A good argument can be made that to get the electrical juice flowing from any kind of energy source to any type of energy storage device, you have to have copper and silver.

Copper has been officially recognized as a critical mineral by the United States, and major silver companies are pushing for silver to be included as well.

Electric vehicles use triple the amount of copper as gasoline-powered cars. There’s copper in the wiring, lithium-ion battery, motor and cables. Charging stations will also need plenty of copper.

Millions of feet of copper wiring will be required for strengthening the world’s power grids, and hundreds of thousands of tonnes more are needed to build wind and solar farms.

As the metal with the highest electrical and thermal conductivity, silver is ideally suited to solar panels.

Silver’s superior electrical properties make it hard to replace across a wide and growing range of automotive applications.

Battery electric vehicles contain up to twice as much silver as ICE-powered vehicles. Charging stations are also expected to demand a lot more silver.

While silver is primarily an industrial metal, as economist Peter Schiff reminds us, it is also a monetary metal:

Despite being more volatile in the short term, silver tends to track with gold over time. Historically, it has outperformed gold in a gold bull market.

At some point, investors will have to reckon with the shrinking supply of silver coupled with rising demand, along with the Fed’s inability to bring inflation back to its 2% target. When that happens, the price of silver will likely take off. If it does, $25 silver will look like a real bargain.

This also means silver-focused exploration companies like Dolly Varden will be held in higher regard within the mining industry than before.

Dolly Varden Silver Corp.

TSXV:DV, OTC:DOLLF

Cdn$0.68, 2024.02.14

Shares Outstanding 254.6m

Market cap Cdn$183.6m

DV website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Dolly Varden Silver Corp. TSXV:DV

DV is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of Dolly Varden Silver Corp. TSXV:DV

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.