Dolly Varden Silver drills 25m of 46g/t Au – Richard Mills

2023.03.15

The latest (December) edition of The Silver Institute’s ‘Silver News’ states that silver demand was projected to reach a record 1.21 billion ounces, a 16% increase from 2021 demand. New highs were predicted for physical investment, industrial demand, jewelry and silverware.

Industrial demand was on track to grow to 539 million ounces, driven mainly by vehicle electrification, the rollout of 5G, and governmental commitments to solar power.

Solar could devour most of the world’s silver reserves by 2050

While institutional demand for silver has faced headwinds, due to rising interest rates leading to a decrease in silver ETF holdings, this has been countered by a surge in physical investment, which was on pace to jump by 18% in 2022 to 329Moz.

According to the Silver Institute, “Support has come from investor fears of high inflation, the Russia-Ukraine war, recessionary concerns, mistrust in government, and buying on price dips. The rise was boosted further by a (near-doubling) of Indian demand, a recovery from a slump last year, with investors often taking advantage of lower rupee prices.”

Silver jewelry and silverware were set to surge by 29% and 72%, respectively.

In contrast to robust demand across most categories, silver mine production last year was only forecast to rise by 1%.

After shifting to a deficit in 2021 for the first time in six years, the silver market was expected to post a second, and record shortfall in 2022.

The projected 194-million-ounce deficit compares to 48Moz in 2021 and would be a multi-decade high.

As for 2023, the Silver Institute is expecting a 200Moz deficit.

Four factors that continue to drive silver demand, are industrial fabrication (electronics, solar panels, the automotive industry, brazing & soldering), jewelry, silver coins and bars, and silverware.

The Indian market is particularly strong for silver. Silver consumption there was forecast to surge by around 80% in 2022, Bloomberg said, as warehouse inventories were drawn down after two years of covid.

While little silver was bought in 2020 and 2021, because of hits to supply chains and demand, 2022 sales look back on track:

Local purchases may surpass 8,000 tons in 2022 from about 4,500 tons [in 2021], said Chirag Sheth, principal consultant at Metals Focus Ltd. That’s up from an April [2022] estimate of 5,900 tons.

Indian investors traditionally prefer to hold physical silver, however the introduction of new investment options, including exchange-traded products (ETPs) and “digital silver”, are expected to give them more opportunities to invest in the precious metal.

With digital silver, an investor can buy silver online at a relatively low price point. The metal is then stored in a vault by the seller. The customer can either sell it back on the same platform or take physical delivery in the form of coins or bullion.

Panelists at the LBMA gold conference in Lisbon, in October, agreed that physical demand for gold and silver remains exceptionally strong, particularly in Asia and the Middle East.

Dolly Varden Silver Corp.

My favorite junior silver explorer right now is Dolly Varden Silver Corp. (TSXV:DV, OTC:DOLLF), advancing its Homestake Ridge project in the highly prospective Golden Triangle of northwestern British Columbia.

The 163-square-km property is an amalgamation of Dolly Varden’s namesake project, and the Homestake Ridge project that DV acquired from Fury Gold Mines back in February, 2022.

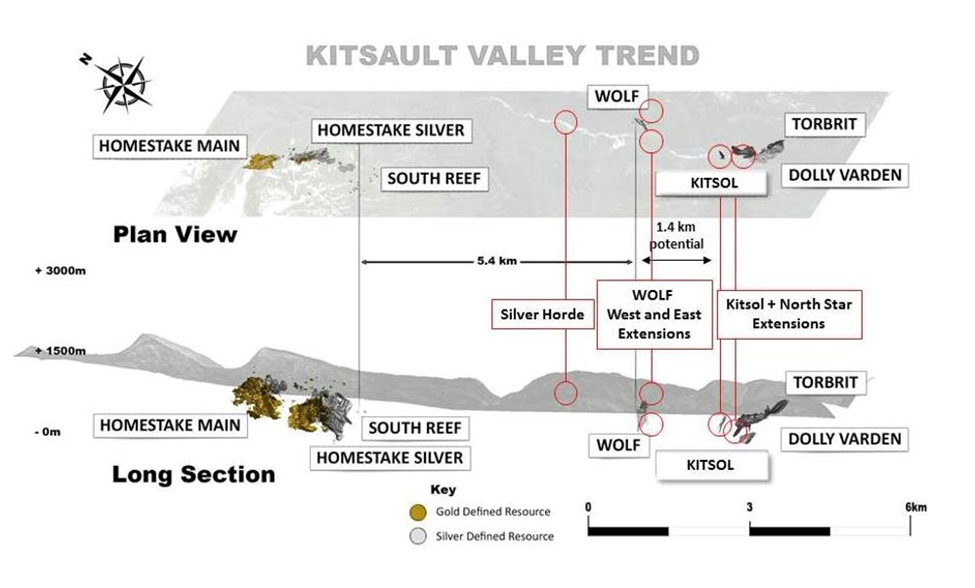

The combined mineral resource of 34.7Moz silver and 166,000 oz gold (indicated), and 29.3Moz silver and 817,000 oz gold inferred, within multiple outcropping deposits, makes Kitsault Valley one of the largest high-grade, undeveloped precious metal assets in Western Canada.

Some investors may not realize that in its heyday, the Dolly Varden Mine was one of the most important silver mines in the British Empire. Another interesting fact, is the mine manager between 1919 and 1921 was none other than Herbert Hoover. The 31st US President also translated a classic book on mining written during the Middle Ages, with his wife Lou Henry Hoover, a geologist and Latinist.

Dolly Varden recently encountered extremely high-grade mineralization at its Wolf Vein target.

Dolly Varden hits “jewelry-box” mineralization

Hole DV22-329 cut a true width 8.77 meter intercept of 1,499 g/t Ag, 1.89 % Pb and 0.46% Zn. Within that intercept was the “jewelry-box style” mineralization grading 23,997 g/t Ag, 1.24% Pb and 0.34% Zn over a true width of .19 meters.

Highlights from the Wolf Vein include:

• Wolf Vein Northeast, hole DV22-329:1,499 g/t Ag, 1.89 %Pb, 0.46% Zn over 15.94 meters (8.77 meters estimated true width), including the highest-grade silver assay reported from the project to date, with coarse, native silver mineralization that returned 23,997 g/t Ag, 1.24% Pb, 0.34% Zn over 0.35 meters (0.19m estimated true width).

• Wolf Vein Southwest: DV22-320: 321g/t Ag, 0.84 %Pb, 0.84% Zn over 12.85 meters (6.81 meters estimated true width) including 664 g/t Ag, 1.24% Pb, 3.54% Zn over 1.63 meters (0.86 meters estimated true width).

Highlights from exploration drilling at the Kitsol Vein and a new discovery at the Red Point target include:

• Kitsol Vein DV22-323: 301g/t Ag, 0.23 %Pb, 0.56% Zn over 15.00 meters (9.60 meters estimated true width) including 434 g/t Ag, 0.41% Pb, 0.69% Zn over 5.90 meters (3.78 meters estimated true width);

• Red Point DV22-321: 8.10 g/t Au, 244 g/t Ag and 5.16% Cu over 1.00 meter;

• Red Point DV22-322: 17.20 g/t Au and 1.65% Cu over 1.15 meters.

“Results from the Wolf Vein continue to exceed expectations, returning the highest-grade silver assay yet received, more than doubling the strike length of the deposit through step outs to the north and south as well as returning wide, robust silver and base metal grades at depth. Our priority during the 2023 will be to connect the Wolf Deposit with the Kitsol Deposit, located 1,400 meters to the south. Additionally, gold, silver and copper mineralization at the new Red Point discovery is encouraging,” said Shawn Khunkhun, President and CEO of Dolly Varden Silver, in the Feb. 6 news.

To find out whether, and how economical, these grades would be in an underground mining scenario, we made a few calculations… just for grins and giggles.

A two-meter width for mechanized underground mining is certainly possible — but at AOTH we are conservative, so we’ll use a much more comfortable 4 meters. So happens when we mine 4 meters of rock to extract mineralization grading 23,997 g/t Ag over 0.19 meters?

We dilute the ore with waste by a factor of 20, 24,000 g/t silver over 4m leaves 1,200 g/t per meter. Kitco’s Rocks in the Box yields a value of $858/tonne @ $22.24/oz. But remember, this is in US dollars. Dolly Varden is a Canadian company working in Canada and paying expenses in Canadian dollars. Using today’s foreign exchange, USD$858 is CAD$1,174 a tonne.

On a more serious note the 8.77 meters of 1,500 g/t silver works out to, again using Kitco’s ‘Rocks in the Box’ calculator, USD$1,073 per tonne or CAD$1,442.

The zinc/ lead values over 8.77 meters, 1.89% Pb and 0.46% Zn adds US$54.29/t combined.

The Vancouver-based company on Jan. 30 announced assays from its Homestake Main and Homestake Silver deposits.

The highlights from a batch of drill results included:

- From Homestake Main, 46.31 g/t Au, 70 g/t Ag and 0.19% Cu over 25.00 meters in hole HR22-333, including 1,145 g/t Au, 826 g/t Ag and 0.51% Cu over 0.48 meters;

- From Homestake Silver, 2,500 g/t Ag, 15.04 g/t Au and 0.17% Cu over 1.20m in hole HR22-361; and

- 469 g/t Ag over 2.70m including 1,040 g/t Ag over 0.65m in hole HR22-365.

Other stand-out intersections from Homestake Main:

- HR22-324: 4.32 g/t Au and 76 g/t Ag over 22.50 meters including 19.42 g/t Au and 375 g/t Ag over 4.50m;

- HR22-336: 6.19 g/t Au and 1,844 g/t Ag over 3.90m and 6.37 g/t Au, 29 g/t Ag and 1.51% Cu over 6.00m;

- HR22-338: 4.16 g/t Au, 21 g/t Ag and 1.42% Cu over 5.10m including 20.80 g/t Au, 115 g/t Ag and 11.60% Cu over 0.50m;

- HR22-345: 8.73 g/t Au and 12 g/t Ag over 29.54m, including 260 g/t Au, 102 g/t Ag over 0.70m;

- HR22-359: Three higher-grade zones @ 9.49 g/t Au over 1.52m, 24.00 g/t Au over 0.70m and 46.20 g/t Au over 0.50m within a 40.50-meter interval.

And from Homestake Silver:

- HR22-349: 211 g/t Ag over 3.50m, and 688 g/t Ag over 0.80m;

- HR22-357: Three higher-grade silver intersections @ 1,185 g/t Ag over 0.50m, 816 g/t Ag over 0.50m and 1,085 g/t Ag over 0.50m within a 129-meter-wide structural corridor;

- HR22-362: 1,252 g/t Ag, 0.81 g/t Au and 0.14% Cu over 2.50 meters, including 3,330 g/t Ag, 0.75 g/t Au and 0.38% Cu over 0.75m.

Analysis

Besides the headline-grabbing grades, key to understanding the Dolly Varden Silver story is the addition of ounces in the ground. Shawn Khunkhun has said that since taking over as CEO in February 2020, Dolly has significantly grown the resource to almost 50 million silver-equivalent ounces, indicated, and another 90Moz inferred.

2022 drilling potentially added between 22 and 24 million silver ounces, which could mean a 30 to 40% increase of DV’s silver resource.

According to VP Exploration Rob van Egmond, the 2023 drill programs will start around the first week of May, with four drill rigs in operation by the end of May. The focus will be on Homestake Ridge expansion, and the discovery of additional mineralization at Dolly Varden. Due to the discovery success at Wolf and other exploration targets, in 2023 the focus will shift to seeing how large the system is, and infilling the new discoveries to get them into the next resource update.

A drill will first start turning at Wolf, up to 700m depth, before crews pivot to Homestake at the beginning of July.

An updated resource estimate for the combined project is planned for Q2 of 2024, and will be used in a consolidated PEA for the Kitsault Valley project, which is scheduled for the second half of 2024.

Khunkhun says the next chapter is organic growth with the newly acquired Homestake Ridge ground that is continuous and to the north.

It’s important to differentiate between the Dolly Varden project, which is a pure silver play, and Homestake Ridge, which contains a lot more gold. Not only has DV expanded the silver resource, it appears that the Homestake Ridge project they picked up from Fury Gold Mines a year ago, has the potential to throw off assays similar to Eskay Creek. That volcanogenic massive sulfide (VMS) deposit contained gold, silver, copper and zinc, and produced 3.3 million ounces gold and 160Moz of silver at average grades of 45 g/t gold and a mind-bending 2,224 g/t silver, from 1994 to 2008.

Dolly’s recent assays from Homestake Ridge might of changed the game, for example 46.3 grams of gold and 70 grams of silver over 25 meters, is huge.

Dolly Varden has already got a million ounces of gold and 65 million ounces of silver, so “it’s nibbling at Eskay Creek potential,” as one commentator recently put it.

According to van Egmond, lots of gold in soils has been found at Homestake. Another important indicator for gold is the presence of rhyolite domes, like with Eskay Creek.

Conclusion

Dolly Varden is still connecting the dots and will focus on joining the Kitsol and Wolf Vein system in 2023. Although there is almost 1.5 kilometers between both discoveries, it will be interesting to see how Dolly Varden can improve its understanding of the project and the geological structures.

CEO Shawn Khunkhun and VPEx Rob van Egmond are doing much more with the project than previous operators, raising $65 million so far without much share dilution, acquiring Homestake Ridge, and getting very strong assay results that are piquing the market’s attention.

With over CAD$26 million in the bank, the company is in a strong position to execute its 2023 field program. The goal is to put over $20M into the ground and to drill between 40,000 and 50,000 meters.

Dolly is 50% owned by institutional investors, including US Global and Sprott Asset Management. Fury Gold Mines has 23%, Hecla Mining holds 23%, Eric Sprott 10%, and retail investors just 7%.

The Dolly Varden project is one of only a few pure-play silver districts in the world. There is also potentially a lot of gold to be found at Homestake Ridge, which only adds to combined project’s allure. Dolly’s Kitsault Valley is one of the largest high-grade, undeveloped precious metal assets in Western Canada.

Khunkhun believes Dolly Varden is a leading take-over candidate, and I agree with him. “We are where size meets grade in a safe jurisdiction,” he says. “Our differentiator is that it is the only project with this level of resources in terms of size of both silver and gold at these grades in the US or Canada.”

Dolly Varden Silver Corp.

TSXV:DV, OTC:DOLLF

Cdn$0.85, 2023.03.14

Shares Outstanding 230m

Market cap Cdn$216.1m

DV website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Dolly Varden Silver Corp. (TSXV:DV). DV is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of DV

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.