Dolly Varden Silver (and Gold) Corp. – Richard Mills

2024.03.06

Gold continues to maintain strength, staying above $2,000 in January and February despite interest rates and the dollar remaining high.

Gold demand in 2023 exceeded previous years, and it is expected to keep growing in 2024, as the Federal Reserve moves towards cutting interest rates. Gold is attractive to investors during periods of rate-cutting, as it benefits from lower Treasury yields and a weaker dollar.

According to the World Gold Council, gold prices continue to be held up by central bank buying and safe-haven demand.

Louise Street, a senior analyst at WGC, said economic and geopolitical uncertainty is likely to persist this year, boosting demand for gold:

“In addition to monetary policy, geopolitical uncertainty is often a key driver of gold demand, and in 2024 we expect this to have a pronounced impact on the market,” she said. “Ongoing conflicts, trade tensions, and over 60 elections taking place around the world are likely to encourage investors to turn to gold for its proven track record as a safe haven asset.

If consumer gold demand in the form of ETF purchases gets added to these two demand drivers, when the Federal Reserve starts cutting interest rates, it will be even better news for gold prices.

We’ve seen how sensitive the market is to monetary policy.

Just the suggestion of coming rate cuts pushed gold to a record-high 2,135/oz in December.

The Federal Open Market Committee meets seven more times, meaning seven more opportunities to raise, lower, or pause interest rates, with the next meeting happening on March 19-20. The group has signaled it wants more positive inflation data before pulling the trigger on a rate cut.

Silver, like gold, is a precious metal that offers investors protection during times of economic and political uncertainty.

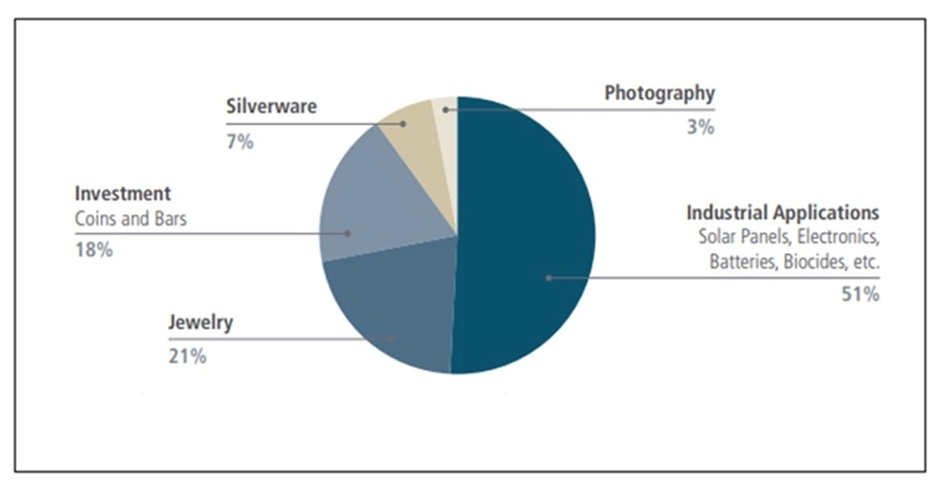

However, much of silver’s value is derived from its industrial demand. It’s estimated around 60% of silver is utilized in industrial applications, like solar and electronics, leaving only 40% for investing.

Lately, silver has garnered a lot of attention of its “green” uses such as in solar and electric vehicles. Silver Academy states that silver is the critical mineral for net-zero economies, pointing out uses in hydrogen fuel cell cars, trucks, vans, ships, barges, ferries, satellites, robotics, AI, solar, wind power, in addition to over 10,000 other applications.

Analysts have long been pointing to a severe shortage of silver due to the relentless growth in demand for the metal.

Falling production in Mexico and China, the top two producers; resource nationalism in Peru, the number 3 producer; too low of an incentive price; and higher input costs are all feeding into a global silver supply deficit.

Mexico could run out of silver by 2026, worsening supply deficit — Richard Mills

According to the 2023 World Silver Survey, the global silver market was undersupplied by 237.7 million ounces in 2022, which the Institute says is “possibly the most significant deficit on record.”

It took just two years of undersupply — the 2022 deficit and the 51.1 million oz shortfall from 2021 — to wipe out the cumulative surpluses from the previous decade.

Global silver mine production is projected to fall 2% this year to about 820 million ounces, compared to forecasted demand of 1.2 billion ounces.

The Silver Institute forecasts a 140Moz silver deficit this year, the third consecutive annual shortfall, against robust silver industrial demand, which is expected to grow 8% to a record 632Moz. Key drivers include investment in photovoltaics, power grid and 5G networks, growth in consumer electronics, and rising vehicle output.

“We are moving into a different paradigm for the market, one of ongoing deficits,” said Philip Newman at Metals Focus, the research firm that prepared the Silver Institute’s data.

Metals Focus believes the deficit will persist in the silver market for the foreseeable future.

Current indications show that silver is undervalued. Right now the gold-silver ratio is 89:1, meaning it takes 89 oz of silver to buy one ounce of gold.

If we look at a historical gold-silver ratio chart, 89 is high but it’s been much higher – meaning silver might be even more undervalued today – such as in April, 2020 when it reached 114. Note that the last time in recent history that silver went on a run was August, 2020. The price reached $33.90 as the gold-silver ratio fell to 68.99, possibly suggesting the ratio has to fall another 20 points or so for the price to react to the upside.

Since the 1970s, when President Nixon decoupled the dollar from gold, the average ratio has been 65:1. And historically the ratio has always returned to the mean.

See the chart below, and linked commentary by Schiffgold.com, showing that Historically, when the spread gets [above 80], silver doesn’t just outperform gold, it goes on a massive run in a short period of time. Since January 2000, this has happened four times. As this chart shows, the snapback is swift and strong.

When precious metals rallied in 2020, on the back of lockdowns, interest rates slashed to zero, QE, and general market fear, silver’s gain was double that of gold. The price ran up 43% from January to December, 2020, compared to gold’s mere 20.8% rise. Earlier in the year, as gold punched above $2,000 an ounce, a 39% gain, silver rallied to nearly $30 an ounce, a 147% increase.

Meanwhile, the silver-gold ratio fell from over 100:1 to just over 64:1.

We’re still waiting for gold and silver to break out. The charts below show both trading in a rather choppy pattern since 2020.

We don’t know when the Fed will cut interest rates, but we know that historically, when the Fed starts lowering rates, the dollar weakens and gold and silver rise.

Dolly Varden Silver (TSX.V:DV, OTC:DOLLF)

Our favorite gold-silver play is Dolly Varden Silver’s (TSXV:DV, OTC:DOLLF) Kitsault Valley project, located at the southern end of the world-famous Golden Triangle in northwestern British Columbia.

Kitsault Valley project

Kitsault Valley represents the amalgamation of Dolly Varden’s original namesake silver property and its Homestake Ridge gold-silver property.

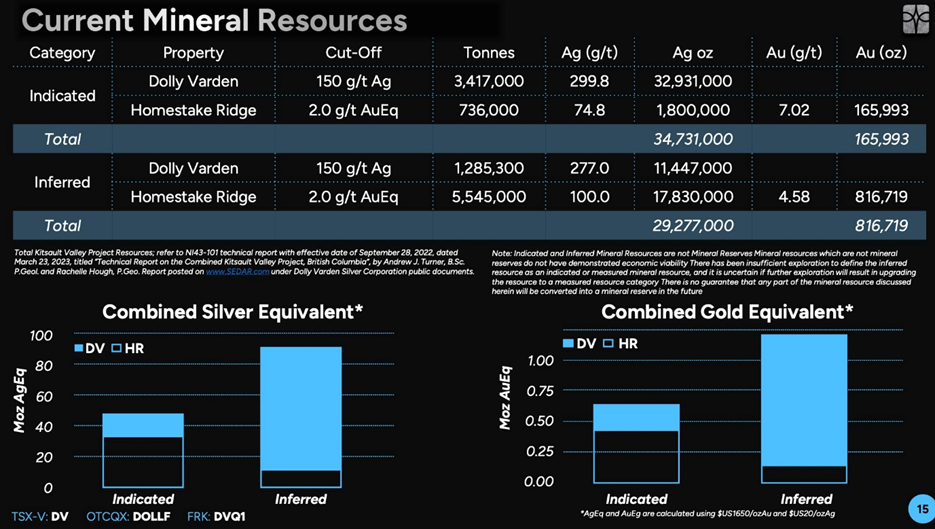

This 163-square-kilometer land package hosts one of the largest undeveloped high-grade precious metals projects in Western Canada. Its current combined mineral resource is estimated at 34.7 million oz of silver and 166,000 oz of gold in the indicated category and 29.3 million oz of silver and 817,000 oz of gold in the inferred category.

The project has a rich history, which can be traced back to the early 20th century when Scandinavian prospectors first made the silver discovery in what is now the Stewart Complex.

Within the boundaries of the company’s original property are two past-producing silver mines: Dolly Varden and Torbrit, which formed a prolific silver mine camp starting in 1919 that produced more than 20 million ounces in the span of 40 years, with assays as high as 2,200 ounces per tonne.

It should be noted that Dolly Varden was among the most important silver mines in the British Empire during its heyday.

Other historically active mines in the area include North Star and Wolf, which remain underexplored to this day. Together, the four deposits comprise about 90 square kilometers within the Stewart Complex.

While these deposits were already enough to work with, DV always believed that the Kitsault Valley property is prospective for hosting further precious metal deposits, being on the same structural and stratigraphic belts that host numerous other high-grade deposits on the same trend such as Eskay Creek and Brucejack.

Towards the end of 2021, the company further consolidated its position with the acquisition of Homestake Ridge, which occupies the northern half (~75 sq km) of Kitsault Valley. This project features a high-grade gold and silver resource from three known deposits that the company believes can be converted into higher-confidence categories.

Silver hits

Over the past six months, Dolly Varden has released results of its 2023 51,500m drill program, and they contain some spectacular, “jewelry-box” silver grades.

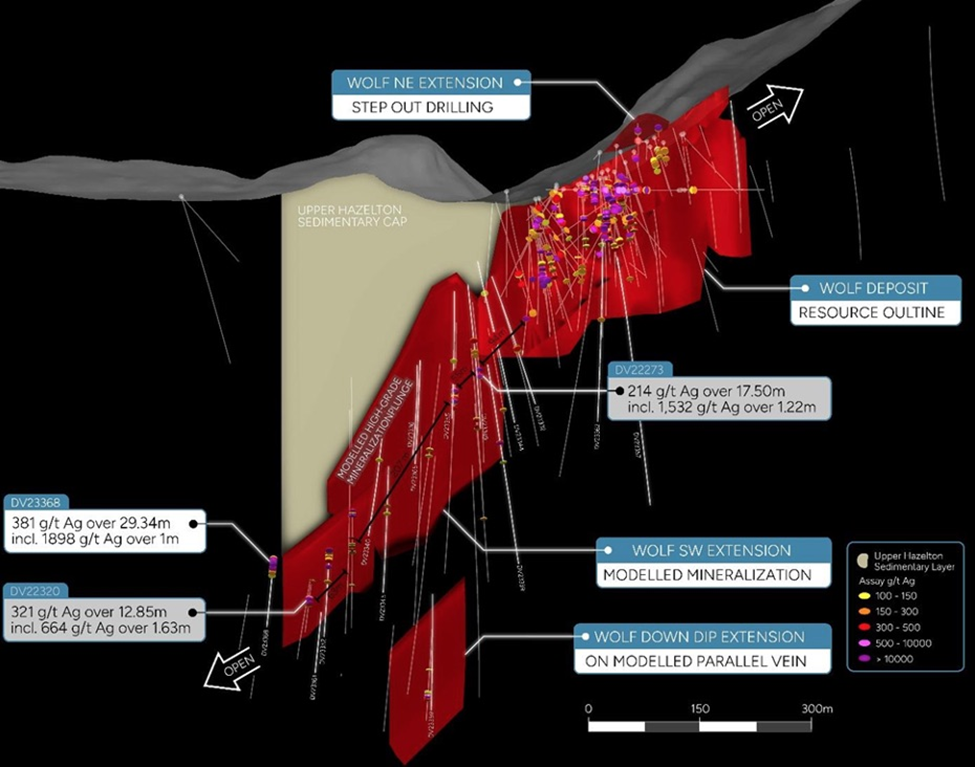

In September, the highlight of a grouping of holes from the Wolf Vein was hole DV23-368, a 75m step-out down plunge that intersected 1,898 g/t over 1.00m within 381 g/t Ag over 29.34m core length. The hole was drilled along plunge from the earlier hole DV22-320, which graded 321 g/t Ag over 12.85m.

Dolly Varden Silver hits 1,898 g/t Ag from step-out drilling at Wolf Vein area – Richard Mills

In a September ‘Silver State of the Union’ video, CEO Shawn Khunkun described the progress at Wolf:

“It was a small deposit and we’ve now got a kilometer of strike length, we’ve been stepping out 95 meters, 75 meters, 100 meters, 200 meters, we just keep hitting it and hitting it, it’s still open and we’re still hitting it. What’s happening is that 9-meter vein is now 29 meters and the grades are intensifying. So the 29 meters is averaging 381 grams per tonne.”

He noted anything under 150 g/t Ag, DV doesn’t count in the resource — a testimony to the quality of the mineralization.

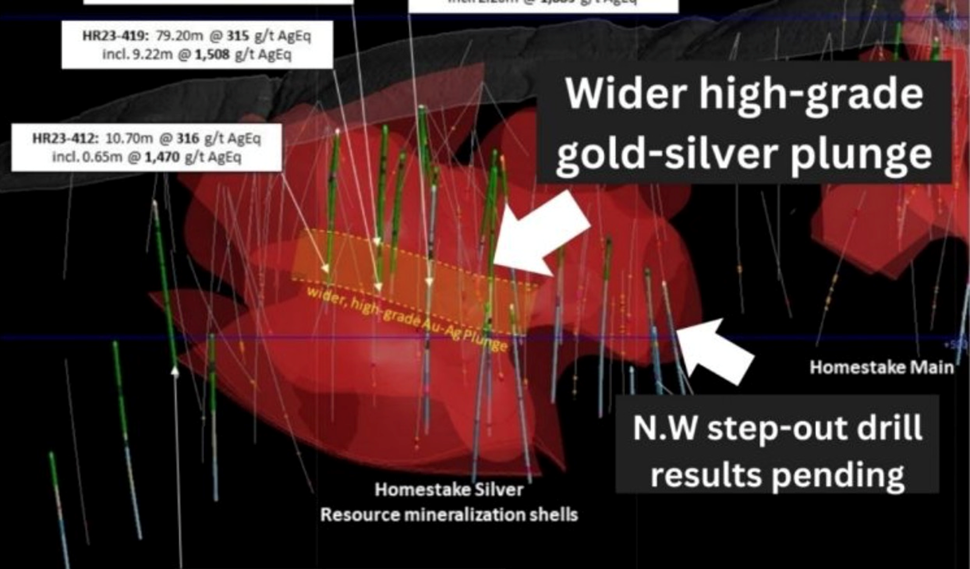

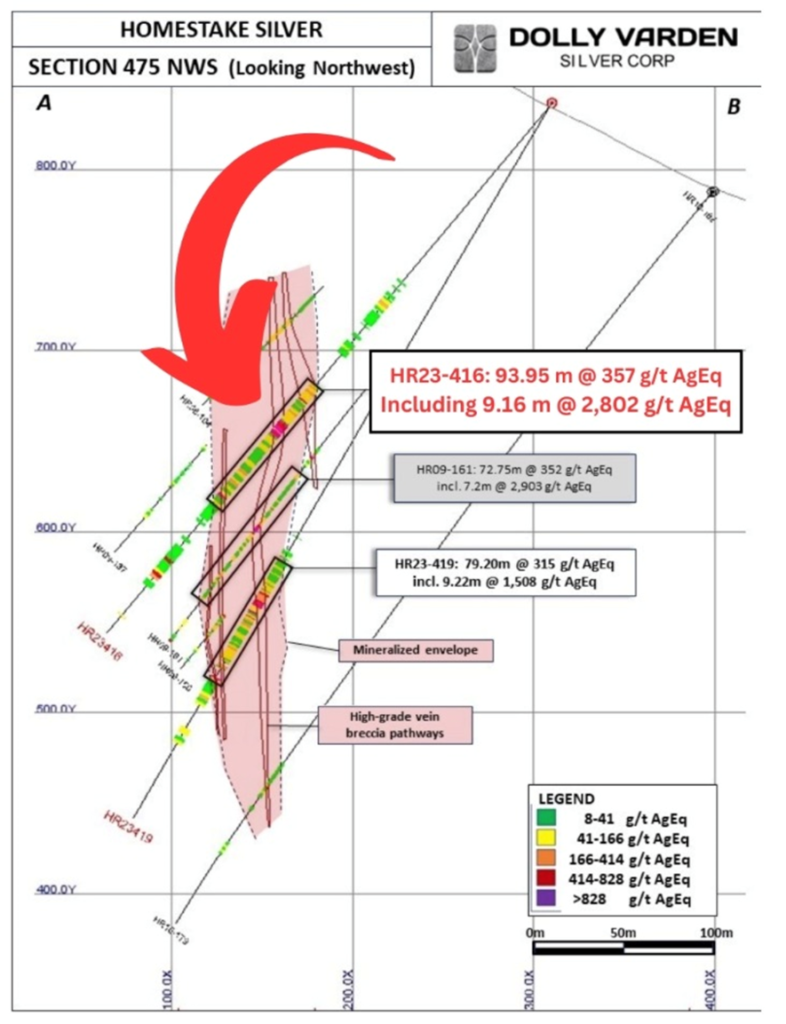

In January, Dolly Varden published the results of 23 holes, or 12,150m, drilled at the Homestake Silver property in 2023. The program targeted priority zones within the deposit, and significantly expanded the width and extent of the reinterpreted high-grade silver and gold mineralized plunge.

Core length highlights included:

- HR23-416: 357 g/t AgEq (1.74 g/t Au, 213 g/t Ag) over 93.95 meters, including 9,422 g/t AgEq (55.40 g/t Au and 4,830 g/t Ag) over 1.02 meters.

- HR23-419: 315 g/t AgEq (2.57 g/t Au and 102 g/t Ag) over 79.20 meters.

- HR23-415: 630 g/t AgEq (5.11 g/t Au and 206 g/t Ag) over 22.80 meters.

- HR23-413: 226 g/t AgEq (1.40 g/t Au and 110 g/t Ag) over 40.00 meters.

- HR23-407: 246 g/t AgEq (2.32 g/t Au and 54 g/t Ag) over 55.90 meters.

- HR23-411: Expansion step-out hole to the southeast; 445 g/t AgEq (0.91 g/t Au and 369 g/t Ag) over 10.55 meters.

“We acquired Homestake at the beginning of 2022, and it doubled the size of our project,” Rob Van Egmond, Dolly Varden’s VP exploration told Global Stock News’ CEO Guy Bennett. “It had about million ounces of gold, mainly in the inferred category, and about 18 million ounces of silver all in the inferred category.”

“Homestake is split between three deposits,” Egmond continued. “The main two are Homestake Main and Homestake Silver. The first year we did infill drilling at Homestake Main to make sure the continuity and grade lined up with the stated resource. That was successful. The infill holes had higher grades than the resource.”

“We are drilling both Homestake deposits with ‘oriented core’, which gives us the structural measurement of the vein, how it sits in real space. We are using that to develop a model.”

“The 2023 drilling at Homestake Silver has identified a substantial zone of exceptional precious metal grades, often typified by multiple phases of silver and gold mineralization, over wide, continuous intervals that are potentially amenable to bulk underground mining methods,” Khunkhun stated in the Jan. 16 news release.

“Some of these old, narrow-vein deposits don’t work in the modern era,” Khunkhun told Bennett. “You don’t want to be chasing narrow veins, hand sorting material. Our goal is that Dolly Varden Silver will create an efficient, highly mechanized mine with a low All-In-Sustaining-Cost (AISC).”

In a January, 2024 video, Khunkhun notes that Dolly Varden is one of a handful of “pure” silver mines, meaning the mineralization is mostly silver, not diluted by other minerals like zinc and lead (though as mentioned, the Kitsault Valley property also contains gold).

“Most of the pure silver mines are in Argentina, Bolivia, Mexico, our project is in Canada,” he said. “Most of the silver in the world, only 30% of the silver that’s produced comes from pure silver mines like the mines we have at Dolly Varden. Having a large high-grade silver project in a safe jurisdiction really is the differentiator of Dolly Varden.”

The southern part of the Golden Triangle Dolly Varden is operating in, Khunkun added, is the richest 20 kilometers on the planet for gold, silver and copper mineralization.

Gold hits

Kitsault Valley is within a region of BC known for large past-producing high grade mines such as Eskay Creek, Premier, Granduc and Snip.

In February, Dolly Varden announced that 2023 step-out drilling encountered a new gold-rich zone to the northwest of the Homestake Silver deposit.

Highlights included holes HR23-389, HR23-389 and HR23-410:

- HR23-389: 79.49 g/t Au and 60 g/t Ag (80.21 g/t AuEq) over 12.45 meters including 1,335 g/t Au and 781 g/t Ag (1,344.42 g/t AuEq) over 0.68 meters within a broad mineralized zone grading 15.26 g/t Au and 20.05 g/t Ag (15.50 g/t AuEq) over 66.50 meters.

- HR23-399: 43.10 g/t Au and 66 g/t Ag (43.90 g/t AuEq) over 1.01 meters and 40.33 g/t Au and 418 g/t Ag (45.37 g/t Au Eq) over 1.75 meters within a broad mineralized zone grading 2.68 g/t Au and 20 g/t Ag (2.92 g/t AuEq) over 57.70 meters.

- HR23-410: 10.17 g/t Au over 6.61 meters including 50.70 g/t Au over 0.62 meters.

Highlights from in-fill drilling at Homestake Main, below high-grade plunge, included holes HR23-374, HR23-386 and HR23-390:

- HR23-374: 22.60 g/t Au over 0.67 meters, 18.75 g/t Au over 2.00 meters and 10.15 g/t Au over 1.00 meter in separate vein breccias included in a wider mineralized envelope grading 1.22 g/t Au and 1.90 g/t Ag (1.24 g/t AuEq) over 83.51 meters.

- HR23-386: 18.14 g/t Au and 30 g/t Ag (18.51 g/t AuEq) over 2.50 meters including 69.9 g/t Au and 42 g/t Ag (70.41 g/t AuEq) over 0.50 meters.

- HR23-390: 129.00 g/t Au and 218 g/t Ag (131.63 g/t AuEq) over 0.50 meters in a vein breccia included in a wider mineralized envelope grading 1.92 g/t Au and 3.58 g/t Ag (1.96 g/t AuEq) over 50.30 meters.

“Whether we discover new zones of high-grade gold at Homestake Ridge or expand the large, wide and high-grade silver deposits at Wolf and Torbrit, drilling continues to deliver results from the premier, undeveloped gold-silver trend in Canada,” said Khunkun.

Rob van Egmond, vice-president exploration, said, “The new high-grade gold and silver mineralization encountered in step-out drilling to the northwest of Homestake Silver represents a significant breakthrough in further defining, upgrading and expanding the mineralization at Homestake Ridge. This new zone remains open to the northwest, projecting towards the Homestake Main Deposit.”

The Feb. 12 news release contains the remaining drill results from the 48-hole program last year at the Kitsault Valley project, which includes the Homestake Ridge and Dolly Varden properties.

In total, Dolly Varden reported 26 holes at Homestake Main (11,054.90m), four holes (2,478m) from the new gold-rich zone at the Homestake Silver northwestern extension, six holes from the Homestake Ridge property (1,627m), and 12 holes (6,971m) from the Dolly Varden property, including the North Star, Red Point and Wolf areas.

On Feb. 13, Khunkhun discussed the news with CEO.ca on-air host Amrit Gill.

“These results represent a brand-new gold zone,” Khunkhun told Gill. “If you go to the Homestake Ridge part of the property, there are two dominant zones, Homestake Main and Homestake Silver. There’s about 350 meters that separate the two zones.”

“One is a silver zone with gold. The other is a gold-dominant deposit. We’ve just tagged a very high-grade gold area,” he continued. “This represents a 50-meter step out. The closest data point is 75 meters away. So, it’s a significant step out. As we look ahead at the next round of drilling, we’re going to want to see how big this zone is.”

Let’s step back a minute and unpack what this means.

Dolly Varden’s latest assay results demonstrate high-grade gold potential, in addition to the Dolly Varden and Torbrit deposits, which have always been high-grade silver with some gold. Homestake Ridge was high-grade gold with good silver values.

Hole 23-389, the best hole from step-out drilling, showed a remarkable 79.49 g/t gold across 12.45 meters, with 60 g/t silver, from within 66.5 meters of 15.26 g/t gold with 20.05 g/t silver.

Nearby, hole 23-399 reported 2.68 g/t Au and 20 g/t Ag over 57.70m.

The Homestake group of deposits, within Dolly’s Kitsault Valley project, is on the same trend as the past producing high grade gold and silver Eskay Creek mine, a volcanogenic massive sulfide (VMS) deposit just under 100 km away.

Opened in 1994, Eskay Creek at the time was the highest-grade gold mine in the world and the fifth largest silver mine, producing an eye-popping 3.3 million ounces of gold and 160 million ounces of silver at average grades of 45 g/t gold and 2,224 g/t silver from 1994 -2008.

The 350-meter stretch between Homestake Main and Homestake Silver represents a juicy target for Dolly Varden going forward.

The Big Bulk

In December, Dolly Varden said that it intends to acquire a 100% undivided interest in the southern portion of the Big Bulk Project from Libero Copper & Gold.

“The Big Bulk porphyry was discovered in the early 1900s,” stated van Egmond, in explaining the consolidation strategy. “It’s above treeline, the rocks are exposed so it got prospected first, revealing some high-grade silver and gold veins, peripheral to the porphyry system.”

“A porphyry means it has larger crystals in it,” van Egmond continued. “The mineralized fluids are often lower grade, copper, gold, silver and molybdenum. The deposits tend to be homogeneous. They are amenable to low-cost open pit mines. It’s a bulk tonnage scenario.”

Similar copper-gold porphyry deposits in the region include Red Mountain, KSM and Red Chris.

“Big Bulk is located about 10 kilometers east of the Kitsault Valley Project,” van Egmond told Guy Bennett, CEO of Global Stocks News. “Prior to this transaction, we controlled the northern part of it. It’s a property that we haven’t done a lot of work on because we’ve been focusing on the high-grade silver to the west.”

The southern portion of the Big Bulk property that DV is acquiring rights to earn 100% ownership in, contains seven mineral claims making up 3,025 hectares. When combined with DV’s northern portion, this doubles the size of the Big Bulk Project to approximately 6,000 hectares.

The option will give DV a new consolidated copper-gold porphyry project in the Golden Triangle region of northwestern British Columbia.

Conclusion

Dolly Varden was always a silver play but with its latest incredible length and grade of gold assays, it’s inevitable to me that the combined (Dolly Varden + Homestake Ridge) Kitsault Valley project will now be compared to the historic Eskay Creek deposit, which was only 100 km away and on trend.

The 2021 acquisition of Homestake Ridge doubled the size of the project and Dolly has been working on expanding the silver and gold deposits and stepping out to find new mineralization. Enticingly, over half of the strike length has yet to be explored.

In its latest presentation, the company shows a silver-equivalent resource of about 140 million ounces using a silver price of $20/oz, and about 1.5Moz of gold at $1,650/oz — obviously both conservative prices compared to today’s.

Since 2019, Dolly Varden has spent $40 million on exploration and drilling, 51,500 meters completed in 2023 alone with excellent results. Shareholders should expect an updated technical report after the 2024 drill program, funded by $10 million in the treasury.

Something I like to see in an early-stage junior is a high percentage of shares owned by insiders. In Dolly’s case, 22% are owned by Fury Gold Mines as a result of the $39.2 million deal for Homestake Ridge.

Hecla Mining owns 15% following a November announcement that Hecla Canada will purchase 15,384,616 shares at $0.65 per share for gross proceeds of $10 million. The share percentage of America’s largest silver producer increases from 10.6% to 15.7%.

Hecla Mining invests $10M in Dolly Varden Silver, upping stake to 15.7% – Richard Mills

Hecla’s current market cap is $2.3 billion on the New York Stock Exchange. It produced 14.2 million ounces of silver in 2023.

“We have this new North American focus,” Hecla CEO Phil Baker told Kitco Mining in January. “To the extent we can continue to grow in the US and Canada, we’ll certainly do that. You can see that with our investment in Dolly Varden Silver.”

Institutions own 47% and silver bug Eric Sprott owns 9%, leaving just 7% of the shares available to the public.

“What gives us an opportunity to be successful, is having these supportive shareholders who are continuing to fund, and not only funding but also bringing their technical expertise to the opportunity,” Khunkun said.

He notes DV’s market capitalization under his watch has grown 10 times and the share price is up about 300%.

“But why I think we’re only 15% of our way through our journey is the amount of prospectivity and the rate of new discoveries we’re making,” he concluded.

Dolly Varden Silver Corp.

TSXV:DV, OTC:DOLLF

Cdn$0.78, 2024.03.05

Shares Outstanding 270m

Market cap Cdn$210.6m

DV website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does does not own shares of Dolly Varden Silver Corp.

(TSXV:DV). DV is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of Dolly Varden

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.