Dolly Varden set for initial 30,000m program at newly consolidated Kitsault Valley property

2022.05.27

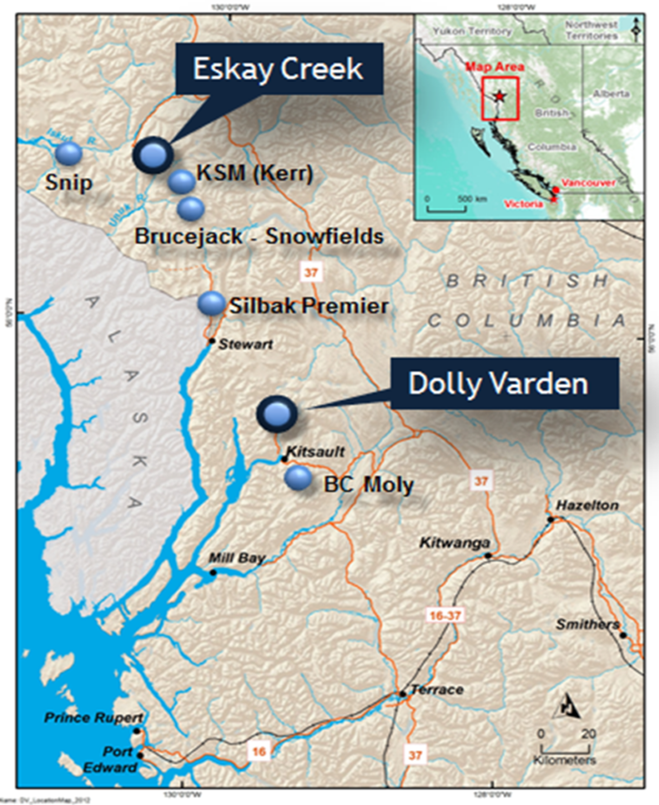

Fresh off a $13 million financing involving big name investors like Hecla Canada and Eric Sprott, precious metals explorer Dolly Varden Silver Corp. (TSXV: DV) (OTC: DOLLF) is now ready to begin field activities on its Kitsault Valley project, located near tidewater in the Golden Triangle of northwestern British Columbia.

Three diamond drill rigs are being mobilized to the village of Alice Arm to complete an initial 99-hole program totalling 30,000 metres along the Kitsault Valley trend. Camp expansion and infrastructure upgrades are underway to accommodate the expanded exploration team, with a significant contingent of team members of the Nisga’a Nation.

2022 Program

Objectives of the 2022 field program are to upgrade the mineral resources at Kitsault Valley, expand known deposits, and discover new silver and gold mineralization along the Kitsault Valley trend of multiple deposits and historic mines.

The Kitsault Valley project currently hosts 34.7Moz silver and 166,000 oz gold in indicated resources, plus an additional 29.3Moz silver and 817,000 oz gold in inferred resources, within multiple outcropping deposits in the 163 km2 property.

Resource upgrade and expansion drilling will begin at the Torbrit silver deposit, initially targeting step-outs at the Wolf mine and between the Torbrit and North Star silver deposits.

Then, in late spring, drilling will begin at the Homestake Main and Homestake Silver deposits, with the purpose of expanding mineralization along strike and downdip, as well as upgrading the current inferred resources.

Through detailed geological mapping integrated with innovative geochemical, geophysical and remote sensing methods, Dolly Varden’s technical team has identified new greenfield target areas along the Kitsault Valley trend.

Additional surface mapping and sampling coupled with IP geophysical surveys will help refine drill targets to be tested during the 2022 program. As many as 20 exploration targets have been initially identified, eight of which have been classified as top priority.

About Kitsault Valley

In February 2022, Dolly Varden acquired the Homestake Ridge gold-silver project from Fury Gold Mines Ltd. (TSX: FURY), which covers a 75 km2 land package contiguous to and northwest of Dolly Varden’s own 88 km2 property in the Stewart mining complex of northwestern BC.

Following this deal, Dolly Varden amalgamated the two projects into a single asset known as Kitsault Valley, with a combined mineral resource base of 34.7Moz silver and 166,000 oz gold indicated, and 29.3Moz silver and 817,000 oz gold inferred. This combination makes Kitsault Valley one of the largest high-grade, undeveloped precious metal assets in all of Western Canada.

The combined project consolidates the highly mineralized Kitsault Valley trend along with seven precious metal deposits, thereby transitioning Dolly Varden’s 100% owned silver project into a project with 50/50 gold-silver resources measured by value.

Dolly Varden Silver Project

The Dolly Varden project is considered a rare exploration asset as it has significant silver resources within a safe jurisdiction. It includes four known precious metal deposits: Wolf, North Star, Dolly Varden and Torbrit — two of which are past producers (Dolly Varden and Torbrit).

Historical records show these two deposits together have produced more than 20Moz of high-grade silver between 1919-1959, with assays of ore as high as 2,200 oz (over 72 kg) per tonne.

Production subsequently ceased due to low silver prices, and the assembled property was eventually acquired by the company with a view of re-awakening the historic silver mine.

An updated NI 43-101 resource estimate completed in 2019 revealed 32.9Moz silver in indicated resources and 11.477Moz inferred, for a total of 44Moz, all adjacent to the historical deposits.

Drilling and underground work that went into the resource estimation confirmed that the mineralization occurs as two styles.

The first is a bedding-parallel VMS at the Torbrit deposit, which hosts the bulk of the resources on the property. Dolly Varden considers this to be similar to that mined at Eskay Creek to the north (see map below).

Once the highest-grade gold mine in the world, Eskay Creek produced 3.3Moz gold and 160Moz silver at average grades of 45/g/t Au and 2,224 g/t Ag respectively between 1994 and 2008.

The second is a cross-cutting epithermal mineralization similar to that being developed at Pretium’s Valley of the Kings deposit (Brucejack mine), which, like Eskay Creek, is also located on the same structural trend to the north of the company’s ground.

The Dolly Varden property also lies immediately to the west of Hecla Mining’s (NYSE: HL) Kinskuch property, an early-stage project with potential for discovery of epithermal silver-gold, gold-rich porphyry and VMS deposits.

So far, the exploration focus on this part of the property has been silver. Dolly Varden is currently in the midst of an aggressive two-year drilling campaign designed to expand the existing silver resource of the Torbrit deposit and to test multiple highly prospective targets on the property.

From 2017-2021, the project has seen in excess of 86,000 metres of drilling, with new discoveries made in a 100-year-old mining camp as a result of modern exploration technologies, data reinterpretation and drilling.

Homestake Ridge Gold-Silver Project

The newly acquired Homestake Ridge project features a high-grade gold and silver resource, including three known precious metal deposits: Homestake Main, Homestake Silver and South Reef.

Mineral resources contained within the Homestake Ridge land package are estimated at 165,993 oz gold and 1.8Moz silver in the indicated category, and 816,719 oz. gold and 17.8Moz silver in the inferred category.

The property is located within the prolific Iskut-Stewart-Kitsault belt, which hosts several precious and base metal mineral deposits, about 32 km southeast of Stewart, BC. It is situated close to regional infrastructure: Northwest Transmission Corridor, deep water access and existing road within 6 km of the deposit.

“The close proximity of the deposits that make up the current mineral resource estimates, combined with common infrastructure in the region, is expected to generate substantial co-development synergies as these deposits are advanced in combination,” Dolly Varden previously stated in a news release announcing its acquisition.

To date, more than 275 holes for over 90,000 metres of drilling have been completed on the Homestake property; multiple exploration targets remain to be tested along a combined 15 km strike length.

A standalone preliminary economic assessment (PEA) for the project indicated an after-tax net present value (NPV) of $173 million and an internal rate of return (IRR) of 32%, based on a 1,620/oz gold price and $14.40/oz silver price.

The study estimated a total gold-equivalent production of 590,040 oz over a 13-year initial mine life, at an all-in sustaining cost (AISC) of $670/oz gold.

Conclusion

Dolly Varden had previously stated that it effectively follows a two-pronged approach to increasing shareholder value. Not only does it aim to grow its resource base through more drilling, but the company was also eyeing properties surrounding its original land package, which led to the Homestake Ridge acquisition and subsequent formation of the Kitsault Valley property.

Now holding onto what is considered one of the largest high-grade, undeveloped precious metal assets in Western Canada, with a total of seven deposits located along a combined 15 km strike length within a 163 km2 consolidated land package, Dolly Varden is ready to make its strategies count, beginning with its initial field program at Kitsault Valley.

The goal, according to Dolly Varden’s president and CEO Shawn Khunkhun, is to “dramatically grow and upgrade the resource at our current deposits, setting the company up to be the next development project in the Golden Triangle.”

Despite the recent market downturn, the company still managed to secure a significant financing to support its exploration program at Kitsault Valley. In addition to new strategic shareholders, the latest $13 million private placement also involved existing shareholders Hecla, which is developing another project next door, and Eric Sprott, who is widely renowned for his successful investments in Canadian mining projects.

“With a robust $25 million treasury, a discovery-focused technical team and a target-rich environment, 2022 is setting up to be a historic year for Dolly Varden Silver,” Khunkhun recently stated.

BTV-Business Television features Dolly Varden Silver on BNN Bloomberg & FOX Business

Dolly Varden Silver Corp.

TSXV:DV, OTC:DOLLF

Cdn$0.64, 2022.05.24

Shares Outstanding 230.5m

Market cap Cdn$138.3m

DV website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Dolly Varden Silver Corp. (TSXV:DV). DV is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.