Dolly Varden hits ‘jewelry-box” mineralization – Richard Mills

2023.02.08

The final results from 2022 drilling at Dolly Varden Silver’s (TSXV:DV, OTC:DOLLF) Kitsault Valley project are in, and they are spectacular. The Vancouver-based company returned its best silver assay on the property — an impressive 23,997 grams (23.9 kg) per tonne silver, 1.24% lead, 0.34% Zn over 0.35 meters.

The 163-square-km property is an amalgamation of Dolly Varden’s namesake project, and the Homestake Ridge project that DV acquired from Fury Gold Mines back in February, 2022.

The combined mineral resource of 34.7Moz silver and 166,000 oz gold (indicated), and 29.3Moz silver and 817,000 oz gold inferred, within multiple outcropping deposits, makes Kitsault Valley one of the largest high-grade, undeveloped precious metal assets in Western Canada.

The objective of 2022 drilling was to expand the wide, high-grade silver mineralization at Wolf Vein, step out and infill at Torbrit and Kitsol, as well as test several other nearby exploration targets. Twenty holes for 9,994 meters were completed at Wolf Vein, 18 holes (3,524m) at the Torbrit Deposit, eight holes for 2,900m of infill and step out drilling at the Kitsol Vein, and 6 holes for 2,196 meters in additional exploration. This is over and above the 18,448m in 56 holes at the Homestake Ridge property, for a total of 37,062m in 108 holes on the Kitsasut Valley project in 2022.

Highlights from the Wolf Vein include:

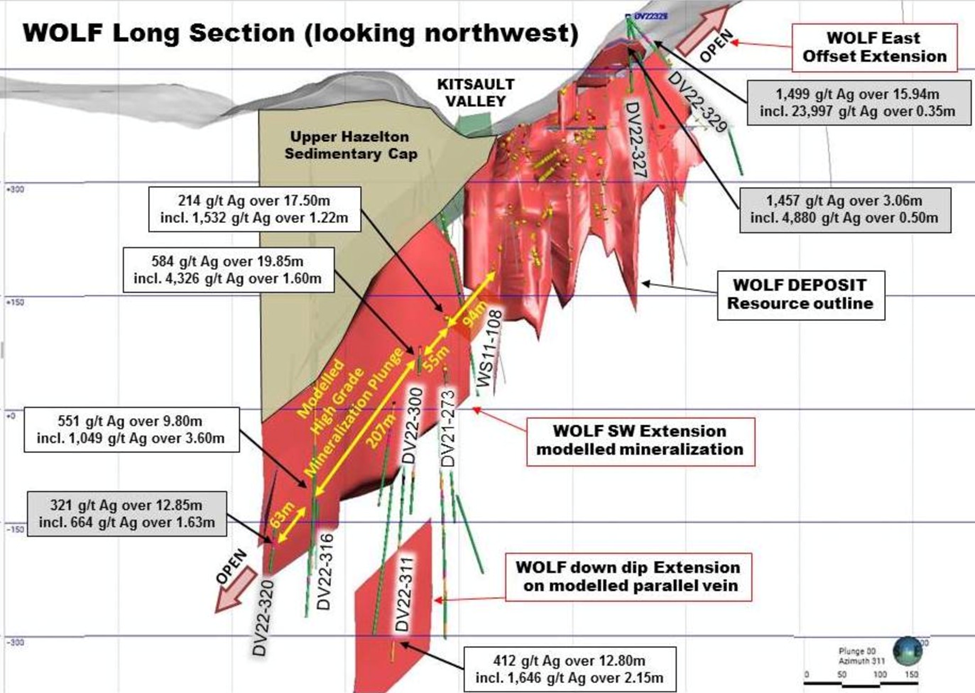

• Wolf Vein Northeast, hole DV22-329:1,499 g/t Ag, 1.89 %Pb, 0.46% Zn over 15.94 meters (8.77 meters estimated true width), including the highest-grade silver assay reported from the project to date, with coarse, native silver mineralization that returned 23,997 g/t Ag, 1.24% Pb, 0.34% Zn over 0.35 meters (0.19m estimated true width).

• Wolf Vein Southwest: DV22-320: 321g/t Ag, 0.84 %Pb, 0.84% Zn over 12.85 meters (6.81 meters estimated true width) including 664 g/t Ag, 1.24% Pb, 3.54% Zn over 1.63 meters (0.86 meters estimated true width).

Highlights from exploration drilling at Kitsol Vein and a new discovery at the Red Point target include:

• Kitsol Vein DV22-323: 301g/t Ag, 0.23 %Pb, 0.56% Zn over 15.00 meters (9.60 meters estimated true width) including 434 g/t Ag, 0.41% Pb, 0.69% Zn over 5.90 meters (3.78 meters estimated true width);

• Red Point DV22-321: 8.10 g/t Au, 244 g/t Ag and 5.16% Cu over 1.00 meter;

• Red Point DV22-322: 17.20 g/t Au and 1.65% Cu over 1.15 meters.

“Results from the Wolf Vein continue to exceed expectations, returning the highest-grade silver assay yet received, more than doubling the strike length of the deposit through step outs to the north and south as well as returning wide, robust silver and base metal grades at depth. Our priority during the 2023 will be to connect the Wolf Deposit with the Kitsol Deposit, located 1,400 meters to the south. Additionally, gold, silver and copper mineralization at the new Red Point discovery is encouraging,” said Shawn Khunkhun, President and CEO of Dolly Varden Silver, in the Feb. 6 news.

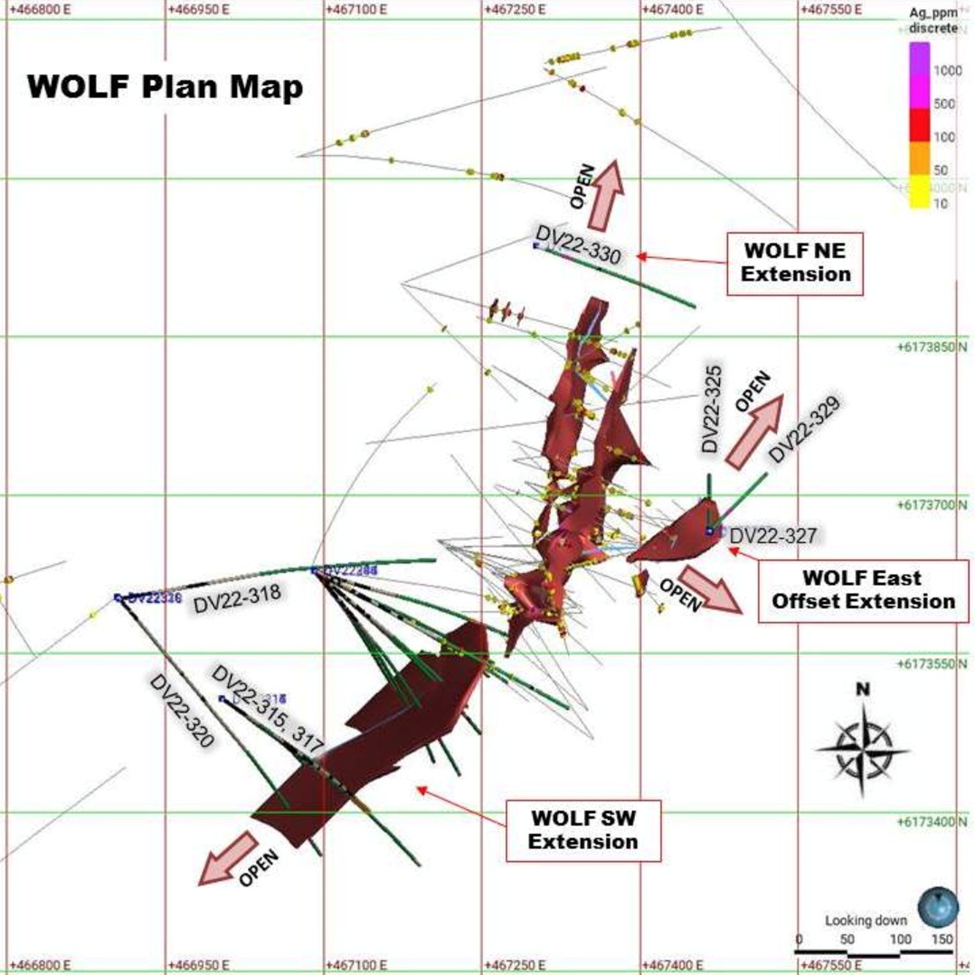

On the East Wolf offset, the 50m step out drill hole DV22-329 cut an interval of multi-phase veins and breccia, demonstrating the robust Wolf Vein system remains open along strike to the east and northeast.

Testing the southwestern known limits of the Wolf Vein, drill hole DV22-320 is the southern-most hole completed to date, and the vein intercept in that hole is over 825 meters down plunge from the reported intercept in drill hole DV22-329. DV22-320 is also a 63m step-out down plunge from previously reported DV22-316, which intersected 550 g/t Ag over 9.80m (see November 21, 2022 news release). Lastly, the hole is located over 350m to the southwest from the 2021 discovery, drill hole DV21-273, demonstrating that silver-rich mineralization hosted by the Wolf Vein continues to depth and remains open for expansion to the southwest under the sedimentary cover rocks (Figure 2).

At the Kitsol Vein, step-out hole DV22-323 expanded high-grade silver mineralization an additional 85 meters down-plunge from previously released results (Figure 6).

At the Red Point exploration target, high-grade gold and silver mineralization was discovered, with significant copper in strong pyrite-chalcopyrite mineralization in a new area (Figure 7). Mineralization is wide open for expansion.

Wolf Vein

Mineralization at the Wolf Vein consists of multiple epithermal silica vein and brecciation events along a northeast trending, steeply northwest dipping zone (Figures 2 and 3). Silver-bearing minerals include native silver, silver sulphosalts, tennantite, argentite and argentiferous galena (Figures 4 and 5).

The interval in DV22-320 suggests an open-ended 350-meter-long mineralized shoot to the southwest of discovery hole DV21-273, which returned 17.50m averaging 214 g/t Ag and 0.47% Pb including 1.22m averaging 1,532 g/t Ag, 0.44 g/t Au, 2.11 % Pb and 1.07% Zn (see December 20, 2021 news release). Drilling to the southwest tested mineralization within volcanic rocks, below the Upper Hazelton sediment cap, that are associated with strong potassic alteration. This trend continues south for 1,400m to the Kitsol Vein (Figure 7).

Drill holes DV22-315 and 317 are on the section with DV22-316 (Figure 2) but intersected the Wolf structure approximately 100 meters above and 75 meters below, respectively, the projection of the higher-grade silver zone intersected in DV22-316.

High-grade silver in drill hole DV22-329 occurs within a very strong, multiphase vein and breccia vein that is offset to the main Wolf Vein by a post-mineral fault. The dip of the offset limb is approximately 55 degrees to the northwest, is open to the east and northeast, projecting just below the slope surface (Figures 2 and 3). Two other step outs from the same pad include DV22-325 and 327. Drill hole DV22-327 is approximately a 25-meter step-out returning 1,457 g/t Ag over 3.06 m (1.68m estimated true thickness). Drill hole DV22-325 intersected a post-mineral mafic dyke at the projected depth of vein mineralization.

Kitsol Vein

Mineralization in drill hole DV22-323 at the Kitsol Vein demonstrates the continuity of steeply plunging, high-grade silver mineralization within the Kitsol structure. Mineralization was encountered 85 meters down plunge from previously reported drill hole DV22-283 with 414 g/t Ag over 50.00m (see August 10, 2022 news release). A further step out drill hole DV22-326 crossed the northwest-striking Moose Lamb Fault into the hanging wall rock and did not encounter the Kistsol Vein (Figure 6).

Exploration targets

Three exploration drill holes from one drill pad tested an induced polarity (IP) chargeability anomaly and the depth extent of gold-bearing veins from the Red Point Area. The target is located approximately 500m west of the Kitsol Vein. All holes intersected strong QSP (quartz-pyrite-sericite) alteration with stockwork veining that returned anomalous gold over broad intervals. In areas where the quartz veining intensified and brecciation occurred, gold and copper grades increased.

Highlights from the two drill holes oriented to the southwest that tested below the surface veining at the Red Point prospect include:

• DV22-321: 0.59 g/t Au over 49.00m

• DV22-321: 2.94 g/t Au and 1.65% Cu over 5.00m

• DV22-321: 8.10 g/t Au, 244 g/t Ag and 5.16% Cu over 1.00m

• DV22-322: 17.20 g/t Au and 1.93% Cu over 1.15 m

The North Star Connection target, located to the west of Torbrit in the center of the Kitsault River Valley, was tested with drill holes DV22-328 and 331. Vein-style mineralization was intersected along the projected trace of the North Star structure and appears to be continuous with the Torbrit deposit. No significant silver mineralization was encountered, however anomalous gold values within the vein were received.

Exploration drill hole DV22-324 was drilled approximately 1,200 meters northwest of the Wolf deposit, testing underneath the sediment cap (Figure 1). The drill pad was located in the centre of the valley, west of the Silver Horde alteration zone. Minor veining and moderate alteration was encountered with no significant assay results. Further targeting work is ongoing in this area.

Analysis

Dolly Varden encountered “jewelry-box style” mineralization at its Wolf Vein target.

Hole DV22-329 cut a true width 8.77 meter intercept of 1,499 g/t Ag, 1.89 % Pb and 0.46% Zn. Within that intercept was the “jewelry-box style” mineralization grading 23,997 g/t Ag, 1.24% Pb and 0.34% Zn over a true width of .19 meters.

To find out whether, and how economical, these grades would be in an underground mining scenario, we made a few calculations…just for grins and giggles.

A two-meter width for mechanized underground mining is certainly possible — but at AOTH we are conservative, so we’ll use a much more comfortable 4 meters. So happens when we mine 4 meters of rock to extract mineralization grading 23,997 g/t Ag over .19 meters?

We dilute the ore with waste by a factor of 20, 24,000 g/t silver over 4m leaves 1,200 g/t per meter. Rocks in the Box yields a value of $858/tonne @ $22.24oz. But remember, this is in US dollars. Dolly Varden is a Canadian company working in Canada and paying expenses in Canadian dollars. Using today’s foreign exchange, USD$858 is CAD$1,154 a tonne.

On a more serious note the 8.77 meters of 1,500 g/t silver works out to, again using Kitco’s ‘Rocks in the Box’ calculator, USD$1,073 per tonne or CAD$1,442.

The zinc/ lead values over 8.77 meters are 1.89 % Pb and 0.46% Zn and adds US$54.29t combined.

Dolly Varden Silver continues to return high-grade silver results from the southern end of the highly mineralized Golden Triangle — one of only a few pure-play silver districts in the world, and the largest such project in all of Canada. We know the market is soft but there are always 5 to 10% of companies that will stand out from the others; we believe DV is one of those and we continue to regard Dolly Varden as among the best exploration companies in the sector.

Dolly Varden Silver Corp.

TSXV:DV, OTC:DOLLF

Cdn$1.00, 2023.02.06

Shares Outstanding 230m

Market cap Cdn$253.4m

DV website

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Dolly Varden Silver Corp. (TSXV:DV). DV is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.