Dollar collapse will happen ‘gradually, then suddenly’ – Richard Mills

2023.05.29

“How did you go bankrupt?”

“Two ways. Gradually, then suddenly.”

– Ernest Hemingway, ‘The Sun Also Rises’

The problem is out-of-control government spending.

Since the pandemic, the US has been racking up the debt to fund various spending programs to the point that its debt-to-GDP ratio at one point hit a record high.

In a new Pew Research Center survey about the public’s policy priorities, 57% of Americans cited reducing the budget deficit as a top priority for the president and Congress to address this year, up from 45% a year ago.

The concerns over debt, coupled with the recent banking collapse, raise the stakes of further economic uncertainty, thus undermining the US dollar’s position as the world’s reserve currency.

End of king dollar?

The US dollar is the most important unit of account for international trade, the main medium of exchange for settling international transactions, and the store of value for central banks.

In the 1960s, French politician Valéry d’Estaing complained that the United States enjoyed an “exorbitant privilege” due to the dollar’s status as the world’s reserve currency. His point was well-made.

Because of the dollar’s position, the US can borrow money cheaply, American companies can conveniently transact business using their own currency, and when there is geopolitical tension, central banks and investors buy US Treasuries, keeping the dollar high and the United States insulated from the conflict. A government that borrows in a foreign currency can go bankrupt; not so when it borrows from abroad in its own currency i.e. through foreign purchases of US Treasury bills.

Lately though, “de-dollarization” is being pursued by countries with agendas at odds with the US, including Russia, China, Saudi Arabia and Iran.

Competition for US dollar intensifying

As Reuters noted in a story on May 25, Rivalry with China, fallout from Russia’s war in Ukraine and wrangling once again in Washington over the U.S. debt ceiling have put the dollar’s status as the world’s dominant currency under fresh scrutiny.

One of the most telling signs of de-dollarization, as the phenomenon has come to be known, is the decline of the dollar’s share of official foreign exchange reserves. According to IMF data, the dollar’s share fell to a 20-year low of 58% in the fourth quarter of 2022.

The main reason this is happening, is central banks diversifying to other currencies, following Russia’s invasion of Ukraine. When the United States punished Russia by freezing half of its $640 billion in gold and FX reserves, other countries thought “the same thing could happen to them”. Among the countries re-thinking their foreign exchange composition, are Saudi Arabia, China, India and Turkey.

Furthermore, commodity-producing countries have started conducting trade in currencies other than the greenback. For example, India has started purchasing Russian oil in UAE dirham and roubles, China paid for $88 billion worth of Russian oil, coal and metal in its home currency, the yuan, and Chinese state-owned oil company CNOOC and France’s TotalEnergies in March completed their first yuan-settled LNG trade.

According to the Bank of International Settlements, the yuan’s share of global forex transactions went from almost nothing 15 years ago to 7%.

The Daily Bell notes that, as the yuan’s influence increases, other countries will start holding more of it, to trade with China, meaning less demand for dollars.

In this way, China is using the same playbook as the United States in 1944, when the country aggressively whipped the rest of the world into accepting the dollar as the world’s reserve currency.

One of the best examples is French President Emmanuel Macron urging Europe to become independent from US foreign policy and to rely less on the dollar. Despite being one of American’s oldest allies, France, as mentioned above, completed its first liquefied natural gas trade settled in yuan.

Before that, China bought LNG from the UAE using its own currency.

Most importantly, Saudi Arabia is reportedly open to breaking the petrodollar and to sell oil in yuan. According to the Wall Street Journal,

The talks with China over yuan-priced oil contracts have been off and on for six years but have accelerated this year as the Saudis have grown increasingly unhappy with decades-old U.S. security commitments to defend the kingdom, the people said.

Malaysia, meanwhile, struck a deal with India to trade in the rupee and its Prime Minister has proposed an “Asian Monetary Fund” to reduce dependence on the US dollar, The Daily Bell states, adding that the BRICS — Brazil, Russia, India, China and South Africa — this summer plan to discuss creating a new currency potentially pegged to gold.

Adding credence to the notion that US dollar hegemony has peaked, Bloomberg macro strategist Simon White argues that hegemony is not about the dollar’s value, rather, it’s about the dollar’s place in the global financial system. His article carried by Zero Hedge presents four charts proving that dollar dominance is starting to be challenged.

The first chart shows that demand for the dollar is not rising as it normally would. White attributes this to emerging-market countries wanting to lessen their exposure to dollars, should they find themselves in the same position as Russia in having their reserves frozen.

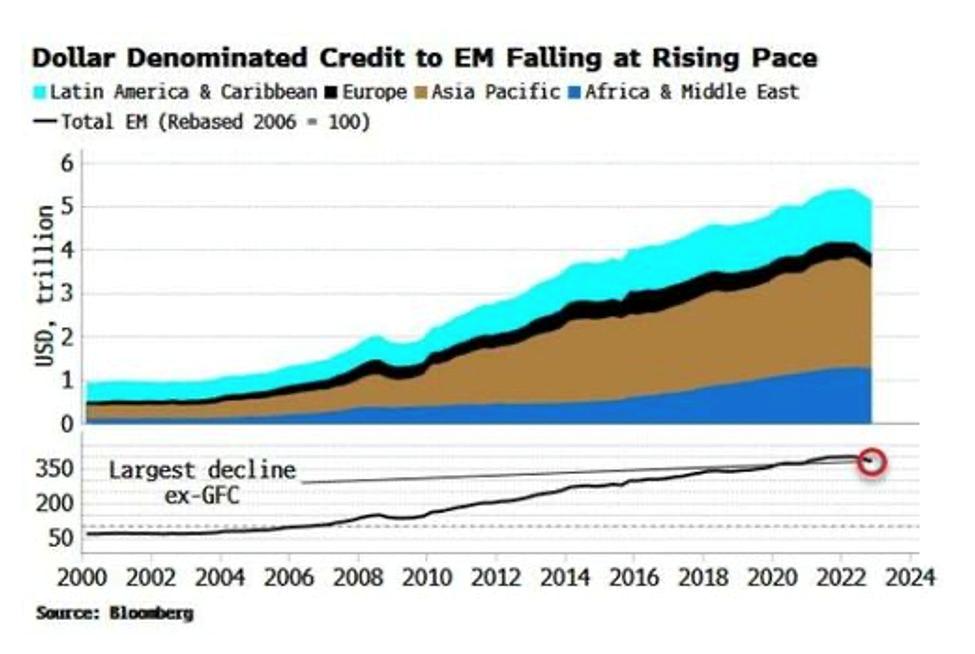

The next chart shows that, after decades of steadily increasing, dollar-denominated credit to EMs is now falling at the fastest rate since the global financial crisis.

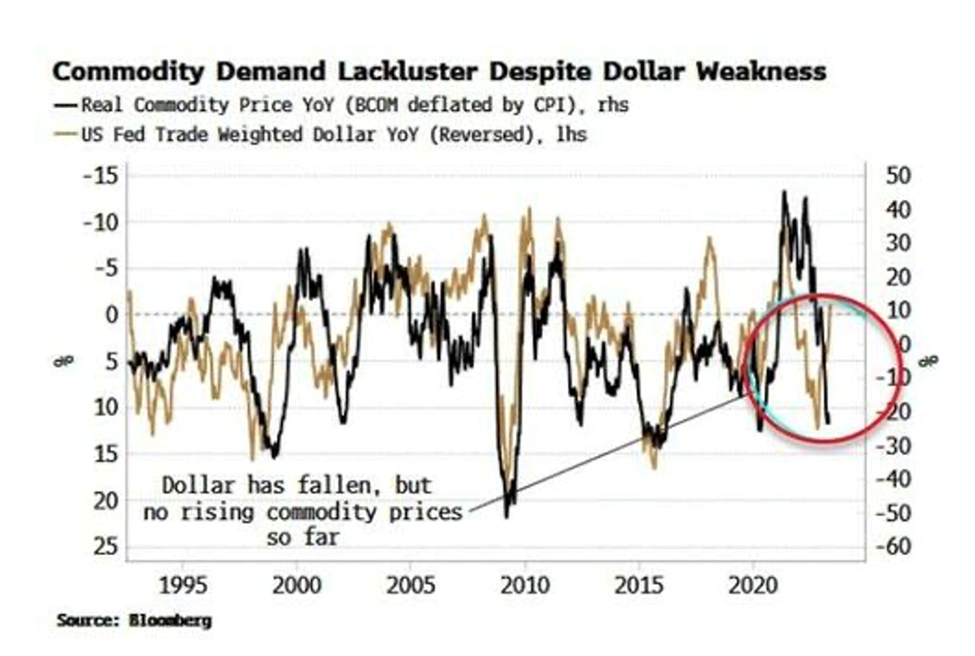

Moreover, the recent fall in the dollar did not stimulate any extra demand for commodities, or lead to higher commodity prices, as the below chart shows.

White argues this chimes with the narrative that countries such as China, India, Russia, Saudi Arabia and others are moving away from a dollar-centric trading system (with, for instance, ruble-yuan trade increasing eightfold since early 2022).

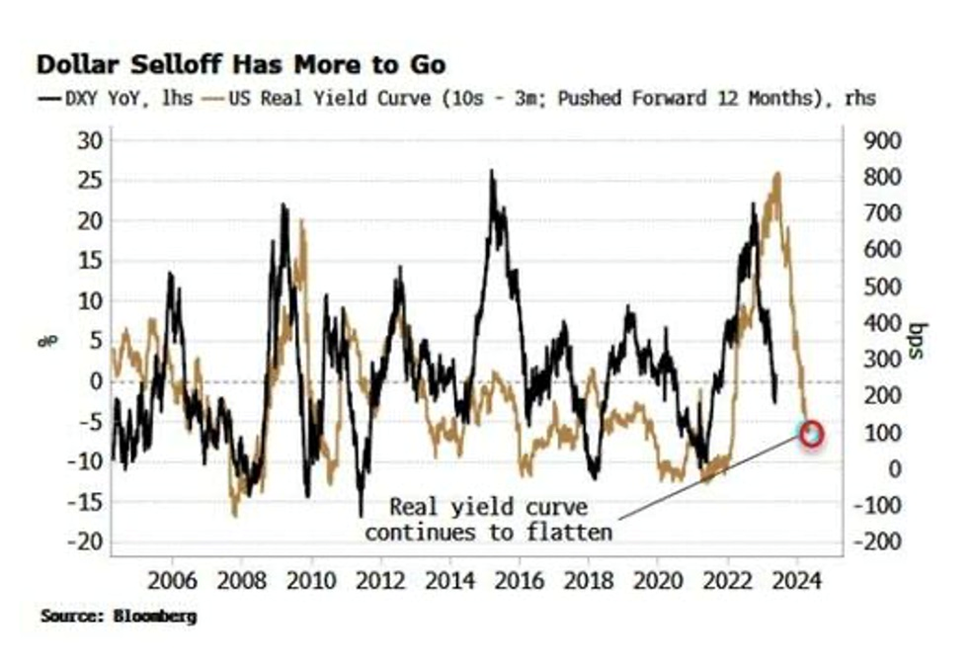

One of the best leading indicators for the dollar is the real yield curve, shown below in chart four. According to White, the curve continues to trend lower, suggesting the dollar should keep doing likewise.

Not so fast

Still, one shouldn’t get carried away with the idea that the end of the dollar is nigh. That’s because de-dollarization would require a vast and complex network of exporters, importers, currency traders, debt issuers and lenders, to independently decide to use other currencies. That’s unlikely to happen. (Gold Switzerland, May 21, 2023)

Also, the dollar’s status is unpinned by the US$23 trillion Treasury market. To date, there is still no credible alternative. Germany’s bond market, for example, is a relatively small $2 trillion, and buying Chinese bonds remains tricky.

Gold Switzerland’s Matthew Piepenburg borrows a journalistic term in stating that “the USD still has legs — for now…”, noting that,

With over 40% of global debt instruments denominated in Greenbacks and over 60% of the reservoir of global currencies composed of USDs, this reserve status (and hence forced demand) ain’t going anywhere too soon.

A disorderly reset

True enough. On the other hand, the unprecedented level of debt being accrued by Western governments right now is a major cause for concern, as it has a direct impact on currency valuations.

In another Gold Switzerland article, author Egon von Greyerz sees us moving into “a catastrophic deb spiral” beginning with no foreign countries wanting to hold US debt or dollars, a serious problem for the US as budget deficits, fueled by much higher levels of government spending, grow larger in coming years.

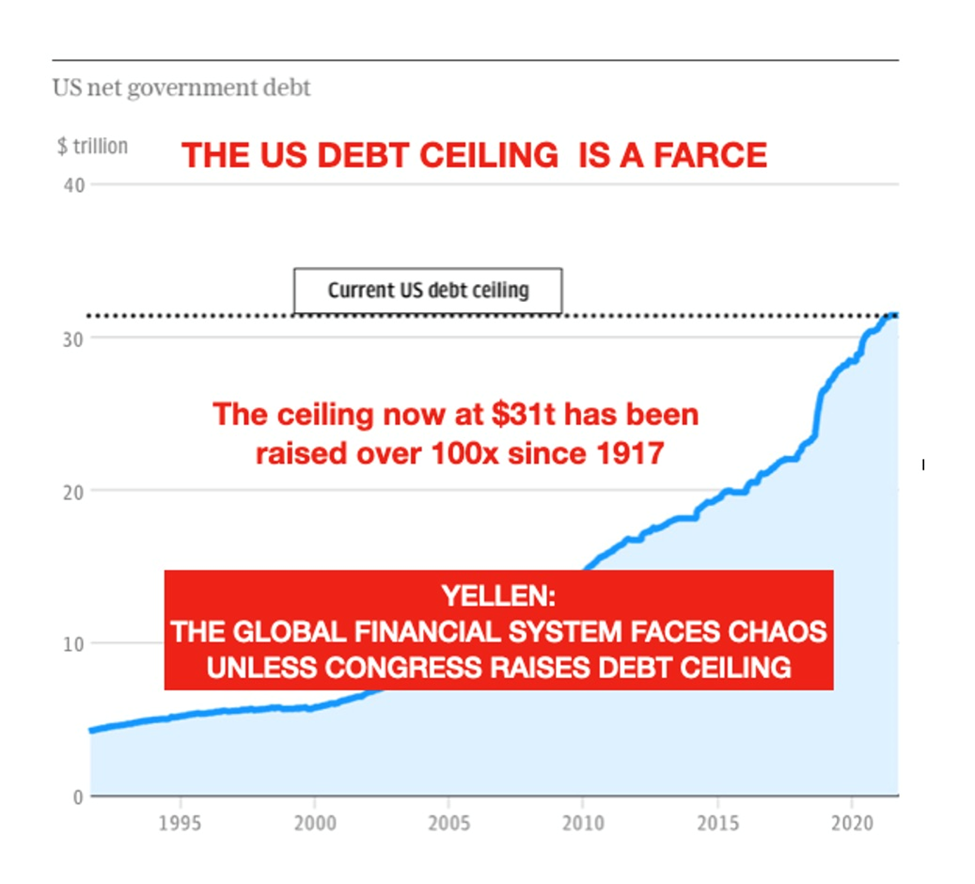

As the petrodollar collapses and US debt explodes, beyond the already huge $31.4 trillion, the Fed will be forced to step in as the sole buyer of US Treasuries, to fund ballooning expenditures.

“So the DEBT spiral of higher debt, higher deficits, more Treasuries, higher rates and falling bond prices will soon turn into a DEATH spiral with a collapsing dollar, high inflation and most probably hyperinflation,” von Greyerz writes.

Among the factors that could cause this debt explosion, are:

- Bank failures: According to Gold Switzerland, a Hoover Institute report calculates that more than 2,315 US banks currently have assets worth less than their liabilities. The market value of their loan portfolios is $2 trillion lower than the book value. The European banking sector is in an even worse state, with European banks sitting on large losses from bond portfolios acquired when interest rates were negative.

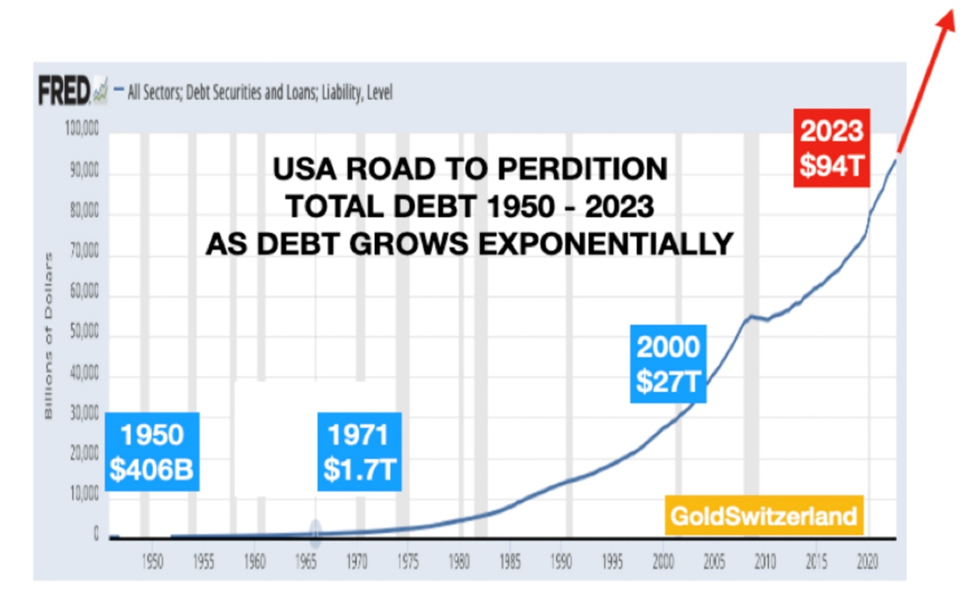

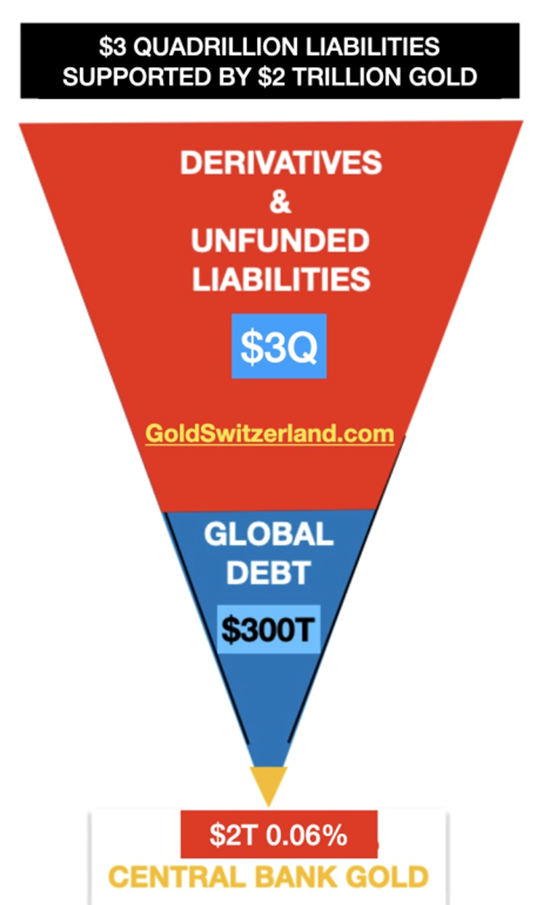

- $3 quadrillion of global debt and liabilities: “Too big to fail” comes to mind when we add total unfunded liabilities (e.g. Medicare, Social Security) plus total outstanding derivatives, to the global debt pile, which recently hit $300 trillion, arriving at about $3 quadrillion. (a quadrillion is 1 followed by 15 zeros, compared to a billion’s nine zeros) “Sadly, the Western financial system is now both too big to save and too big to fail,” von Greyerz writes. “Still all the king’s horses and all the king’s men cannot save it. So even if the system is too big to fail, it will with very dire consequences.”

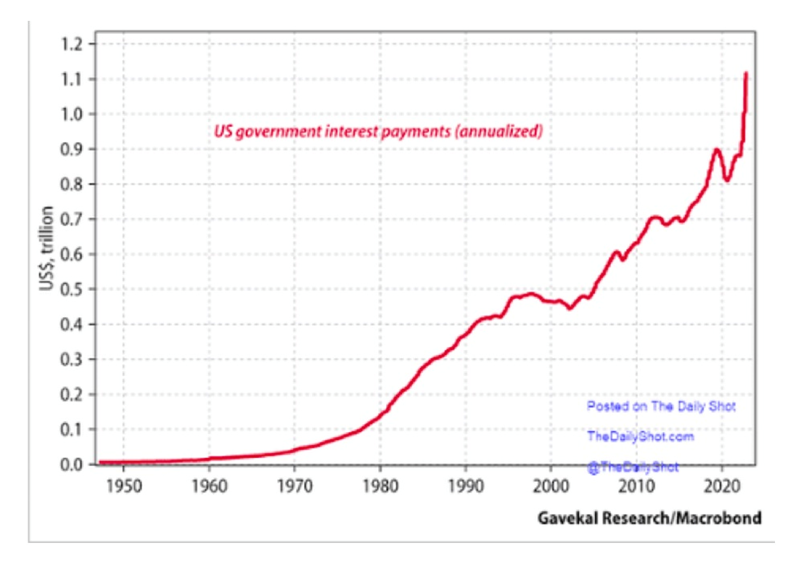

The problem is not only the debt but the cost of financing it, a topic we covered in a previous article. Assuming the annualized cost of servicing the debt is currently $1.1 trillion, the very real possibility of the debt climbing to $40 trillion within two years, would put 5% interest costs at $2 trillion, or 43% of current tax revenue. As the economy deteriorates, interest could easily exceed 50% of tax revenue. That’s insane.

The USA is screwed

As the US deficit-spends its way into a debt spiral, “the up and down moves of the USD will eventually just sink, Titanic-like, in one direction as ever-more USD’s collide with a growing debt iceberg,” writes Gold Switzerland’s Matthew Piepenburg, who maintains that, “The last bubble to die in a debt-soaked regime is always the currency.”

At this point, the US will essentially be broke, meaning the only way for it to pay its bills and creditors is to print money (QE), and/or drastically devalue the currency.

Some alarming numbers to come out of the latest Treasury Borrowing Advisory Committee (TBAC) report indicate that the United States has already deficit-spent $2 trillion in the first half of 2023, the interest alone of which is 101% of tax receipts.

The spending is on par with covid, during a time when the pandemic can no longer be blamed for the country’s debt addiction.

Projected US deficits for 2023 to 2025 have risen by 30-50% in just the last 90 days.

“At $95+T in public, household and corporate debt, the US has irreversibly passed the Rubicon of any easy solutions,” Piepenburg states.

“As Egon von Greyerz makes abundantly clear week after week, the US in general and the Fed in particular have irrevocably cornered themselves.

“Stated otherwise: The USA is screwed.”

Gold to the rescue

As the world lurches towards financial Armageddon, many are choosing to protect their wealth with gold. Not only is the precious metal considered one of the best hedges against inflation, which has been crushing consumer’s purchasing power, it has held its value over time.

Consider: in the 110 years since the Federal Reserve was created, the dollar has lost 99% of its purchasing power, while gold has barely been touched by relentless annual inflation. For example, a Roman toga cost one ounce of gold 2,000 years ago. Today, one gold ounce is roughly the price of a high-quality men’s suit.

As importantly, since the dawn of the new millennium, gold is up 8 to 10 times against most currencies — a performance unmatched by virtually all major asset classes.

While no fiat currency has survived history, gold has held its own, and then some.

To von Greyerz, the fact that gold, despite all its positive attributes, remains unloved — probably due to its volatility and the fact that gold pays neither interest nor a dividend — “[tells] us that this gold bull market, or currency bear market, has a very long way to go.”

Others think that, while the dollar will not yet die as a transactional currency, it is likely to be replaced by gold as the reserve asset currency. Gold Switzerland states:

The combination of de-dollarization and liquidation of US treasuries by foreign holders will lead to this development.

Commodity countries will sell for example oil to China, receive yuan and change the yuan to gold on the Shanghai gold Exchange. They will then hold gold instead of dollars. This will avoid the dollar as a trading currency when it comes to commodities…

As gold is now in an acceleration phase, we are likely to see much higher levels however long it takes.

What is clear is that fiat money, bonds, property and stocks will all decline precipitously against gold.

What is important for investors is to take protection now against the most significant RESET in history which is a disorderly reset.

So if you don’t hold gold yet, please, please protect your family, and your wealth by acquiring physical gold.

Of course, it isn’t only individual investors who see gold as a safe haven amid turbulent financial markets.

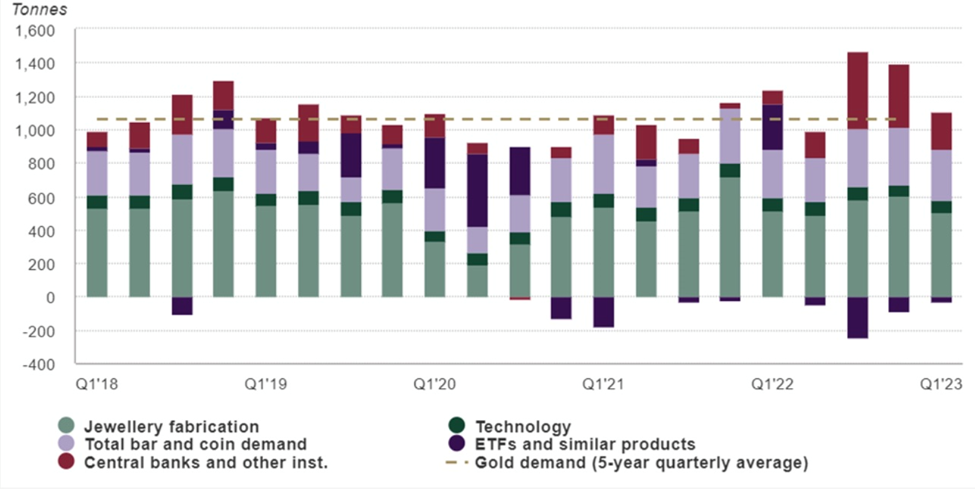

Central banks are among the most significant buyers of gold bullion.

According to UBS, a multinational investment bank, demand for gold among central banks remains strong, even after 2022’s record year of purchases. The Swiss bank says CBs are on pace to buy 700 tonnes of gold this year, compared to 1,078t in 2022.

“We think this trend of central bank buying is likely to continue amid heightened geopolitical risks and elevated inflation,” UBS said, via Business Insider. “In fact, the US decision to freeze Russian foreign exchange reserves in the aftermath of the war in Ukraine may have led to a long-term impact on the behavior of central banks.”

While the US dollar has traditionally been a mainstay of central bank reserves, the article confirms what was written earlier, in that the recent surge in the demand for gold is seen as a sign of de-dollarization, after the dollar was “weaponized”, i.e., used to put financial pressure on Russia for its war on Ukraine.

Sustained high demand from central banks is one of the main reasons UBS thinks gold will hit $2,100 an ounce by year-end, states Business Insider, adding another factor that will help gold rally is weakness in the dollar (the two variables move in opposite directions).

According to UBS, the dollar is set to decline further, with the Fed planning to pause its tightening cycle while other central banks continue to raise rates, putting upward pressure on non-dollar currencies.

Two other reasons to be bullish on gold, are the risk of US recession — UBS notes deterioration in GDP, construction, manufacturing and consumer sentiment.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.