Developing America’s largest graphite deposit coincides with major port expansion at critical juncture of the Bering Strait – Richard Mills

2024.01.04

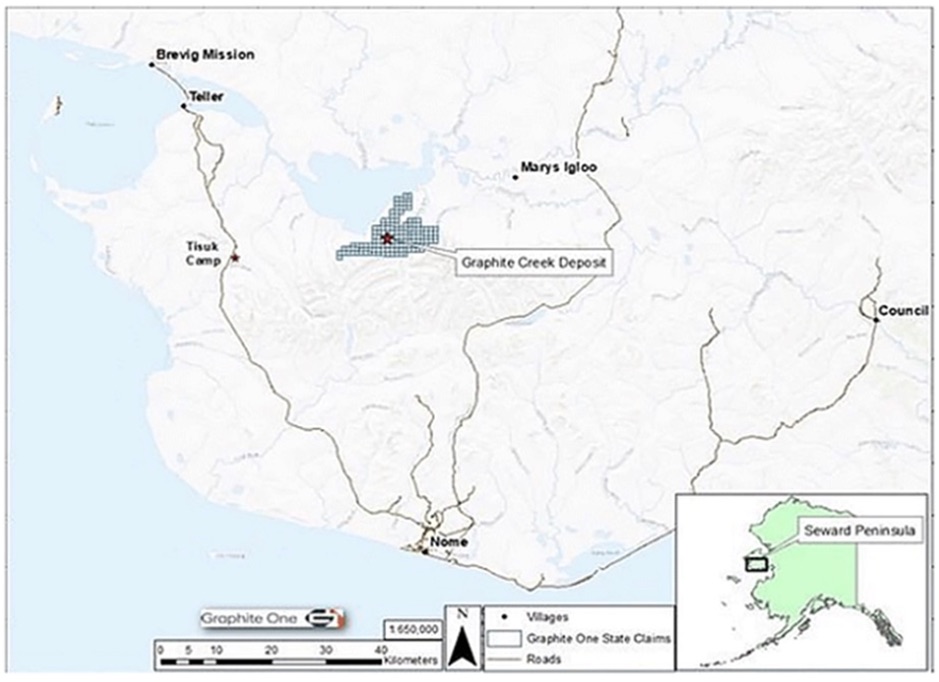

America’s largest graphite resource, and one of the biggest in the world, says the US Geological Survey, is the Graphite Creek deposit in Alaska being developed by Graphite One (TSXV:GPH, OTCQX:GPHOF).

On March 13, 2023, Graphite One updated its resource estimate, which showed an increase of 15.5% in measured and indicated tonnage with a corresponding increase of 13.1% in contained tonnes of graphite.

Measured and indicated resources now stand at 37.6 million tonnes at 5.14% graphite, with an inferred resource of 243.7 million tonnes at 5.07% graphite.

In 2022, Graphite One underwent a major de-risking event with the release of a prefeasibility study (PFS), which portrays the Graphite One project as potentially highly profitable, with expected operating costs of $3,590 per tonne measured against an average graphite price of $7,301 per tonne.

Once up and running, the mine is expected to produce, on average, 51,813 tonnes of graphite concentrate per year during its projected 23-year mine life. The company itself is anticipated to produce about 75,000 tonnes of products a year, of which 49,600 tonnes would be anode materials, 7,400 tonnes purified graphite products and 18,000 tonnes unpurified graphite products.

The PFS is based on the exploration of only one square kilometer of the 16-km deposit, meaning there’s potential to crank up production by a factor several times the PFS’s proposed run rate of 2,860 tonnes per day.

Graphite One planned 10,000 meters of drilling in 2023, with the objective of increasing the annual concentrate production for the upcoming feasibility study (FS) compared to that assumed in the PFS.

The 2023 drill program was designed to double the measured and indicated resources and increase the inferred resource by infill drilling along trend to hole 22GC079. The results of the program will feed into the company’s feasibility study (“FS”), which contemplates increasing production from 50,000 tonnes of graphite concentrate per year as estimated in the PFS to more than 150,000 tonnes of graphite concentrate.

In October, Graphite One announced the completion of the 2023 drill program along with initial set of assay results. The program quadrupled the scope of 2022’s drill program, with 57 holes completed for a total of 8,736 meters — the largest drill program in GPH’s history.

Five geotechnical holes were drilled for the purpose of evaluating construction sites or hydrology conditions. According to Graphite One, the remaining 52 holes all intersected visual graphite mineralization, and continued to demonstrate exceptional consistency of a shallow, high-grade graphite deposit that remains open both to the east and west of the existing mineral resource estimate.

The company anticipates that the remaining assays will be incorporated into the feasibility study, which is anticipated to be released in the fourth quarter of 2024.

Graphite One’s development of the Graphite Creek deposit, explained in more detail below, coincides with a major push by the United States government to upgrade the area’s infrastructure, especially its port facilities.

Bering Strait ‘choke point’

The Bering Strait is a narrow ocean passage that serves as the main gateway to the Arctic; it is a mere 55 miles from the United States side of the strait to the Russian side — meaning the strait is a “choke point” that could easily be utilized to block vessels passing through it in a time of economic or military conflict.

According to Mining News North, This “choke point” provides Pacific Ocean access to two major Arctic shipping lanes that are becoming increasingly important as Earth warms – the Northern Sea Route, which skirts the north shores of Russia en route to Europe, and the Northwest Passage, which heads east around Alaska and Canada before reaching the Atlantic Ocean near Greenland.

Strategic disadvantage

The increased commercial interest in Alaska both from a shipping and a resource development perspective — the area is rich in minerals — has policymakers and maritime experts concerned about the area’s lack of a deepwater port.

In 2019, Retired U.S. Coast Guard Captain Lawson Brigham wrote that the United States has no deepwater port from Dutch Harbor in the Aleutian Islands to the US-Canada border in the Beaufort Sea. This represents a major strategic challenge to the nation, given that there is no safe harbor along the entire western and northern coasts of Alaska where a major combatant, Coast Guard icebreaker (or large cutter), NOAA survey ship, or any other deep-draft government or commercial ship can moor alongside a wharf.

According to Brigham, The absence of a deep-draft Arctic port and associated marine infrastructure is a glaring gap in the United States’ ability to respond to greater marine access and activity at the top of the world. Every other Arctic coastal state, including Canada, Iceland, Denmark (Greenland), Norway, and Russia, has at least one port where a large, deep-draft ship, such as a commercial resupply carrier or naval vessel, can safely moor during Arctic operations.

A U.S. Coast Guard patrol board encountered seven Chinese and Russian naval vessels cooperating in an exercise last year about 86 miles north of Alaska’s Kiska Island, Military Times said, adding that in 2021, Coast Guard vessels spotted Chinese ships 50 miles north of the island.

To answer such concerns, the U.S. Military is building up resources in Alaska, placing fighter jets at bases in Anchorage and Fairbanks, establishing a new Army airborne division, training soldiers for cold-weather conflicts, and ensuring missile defense capabilities.

The Military has nine bases in Alaska, the largest being the Joint Base Elmendorf Richardson camp, but none have deepwater port facilities. The Navy and the Marine Corps currently have no presence in Alaska.

Beyond strategic/ military concerns, there are obvious economic reasons for building a deepwater port in Alaska, occasioned by a warming planet.

Earlier this year, Military Times wrote that, as the Arctic Sea ice retreats, shipping lanes are opening up and more tourists are venturing into Nome, Alaska, a town best known for the Iditarod Sled Dog Race and its 1898 gold rush.

The article notes that Nome has seen six of its 10 warmest winters on record since 2000, and that the Bering Strait shipping lanes have become much busier, going from 262 transits in 2009 to 509 in 2022.

Bering Sea ice now reaches Nome in late November or December, two to three weeks later than it did 50 years ago.

But with no place to park large ships, commercial cruise ships are unable to add Nome to their lists of destinations. In 2016, cruise ship ‘Serenity’ was the largest vessel to sail through the Northwest Passage.

Also, without a deepwater port, U.S. Coast Guard icebreakers are currently unable to dock in the US Arctic. Instead, they must make lengthy re-supply trips to Dutch Harbor.

Nome port expansion

As far back as 2013, the U.S. Army Corps of Engineers and Alaska’s Department of Transportation pared down a list of 14 potential sites in northwestern Alaska that could serve as the future location of a deepwater port to two: Nome and Port Clarence.

“There is a need to invest further in port development for the Alaskan Arctic to protect more than 3,000 miles of coastline against threats posed by increasing ship traffic, 60 percent of which are foreign-flagged vessels,” the two agencies said in a draft analysis released 11 years ago.

Port Clarence, located 70 miles northwest of Nome, is the finishing line for the Iditarod Sled Dog race and a magnet for gold-seekers. The article in Anchorage Daily News states it is home to a tiny Coast Guard station.

Both communities are within a mile of areas with depths of 45 feet, deep enough to handle most ships.

However, to AOTH at least, it is readily apparent that Nome is farther ahead as a deepwater port destination, including receiving hundreds of millions of dollars in government funding.

The 2018 Water Resources Development Act revived the prospect of port expansion, which had previously been considered and then put on hold, according to Arctic Today. In 2020, the plan to expand the port won approval from the USACE.

In June of last year, The Associated Press reported that Nome, population 3,500, is slated to become the country’s first deepwater Arctic port, thanks to a $600 million expansion that would see the new facility operational by 2030:

The expansion… will accommodate not just larger cruise ships of up to 4,000 passengers, but cargo ships to deliver additional goods for the 60 Alaska Native villages in the region, and military vessels to counter the presence of Russian and Chinese ships in the Arctic.

Work is expected to take place in three phases, including dredging a new basin 50 feet deep, effectively doubling the port’s size. Large cruise ships, cargo vessels and every U.S. Military ship except aircraft carriers would be able to berth.

The first part of the project is funded by $250 million in federal infrastructure money, with another $175M from the Alaska state legislature, AP said, noting field work should start this year. The expanded dock will accommodate seven to 10 ships at the same time, compared to three currently.

The article quotes Alaska Senator Dan Sullivan stating that the expanded port will become the centerpiece of US strategic influence in the Arctic. “The way you have a presence in the Arctic is to be able to have military assets and the infrastructure that supports those assets,” Sullivan said.

Bering Straits Native Corporation (BSNC)

Media coverage of the Nome port expansion project is lacking in one aspect, and that is the massive importance to, and of the local indigenous First Nations population.

According to Mining News North, the Bering Straits Native Corporation (BCNC) is critically aware that ships taking either the Northern Sea Route, which skirts northern Russia en route to Europe, and the Northwest Passage, which heads east around Alaska and Canada before reaching the Atlantic Ocean near Greenland, must pass its shores.

Moreover, states the piece by publisher Shane Lasley, much of the roughly 2.2 million acres of land conveyed to BSNC under the Alaska Native Claims Settlement Act (ANCSA) was selected for its gold, tin, and other mineral potential.

BSNC sees the responsible exploration and mining of the rich mineral wealth in its region as an opportunity to strengthen the economy and help advance other prospects in the area, including development at Point Spencer, a natural deep-water port of refuge lying just south of Bering Strait.

Towards that goal, the ANCSA corporation and the city of Nome are advocating for a dual-port approach — one port facility at Nome and the second at Port Clarence, located on state and BSNC lands.

Circling back to Graphite One, Mining News North notes that, in addition to holding subsurface rights under village lands, BSNC also owns approximately 145,000 acres of surface and subsurface lands selected for their mineral or other natural resource potential.

Port Clarence is only about 25 miles from Graphite One’s Graphite Creek deposit, meaning G1 could become an anchor customer for a port on BSNC land at Point Spenser.

“While other regions in the state have timber or oil reserves, the Bering Strait region has minerals,” BSNC explains on its website. “Long known for its mineral potential, the region has been successfully mined in the past and continues to offer development and mining opportunities.”

This past September, BSNC announced that it would invest US$2 million in Graphite One, with an option to invest another US$8.4 million, including the exercise of warrants, to support development of the Graphite Creek deposit.

Minerals-rich Alaska

While the Bering Straits region is known for its gold, the Seward Peninsula where Graphite Creek is located is also rich in tin and other critical minerals, including, of course, graphite.

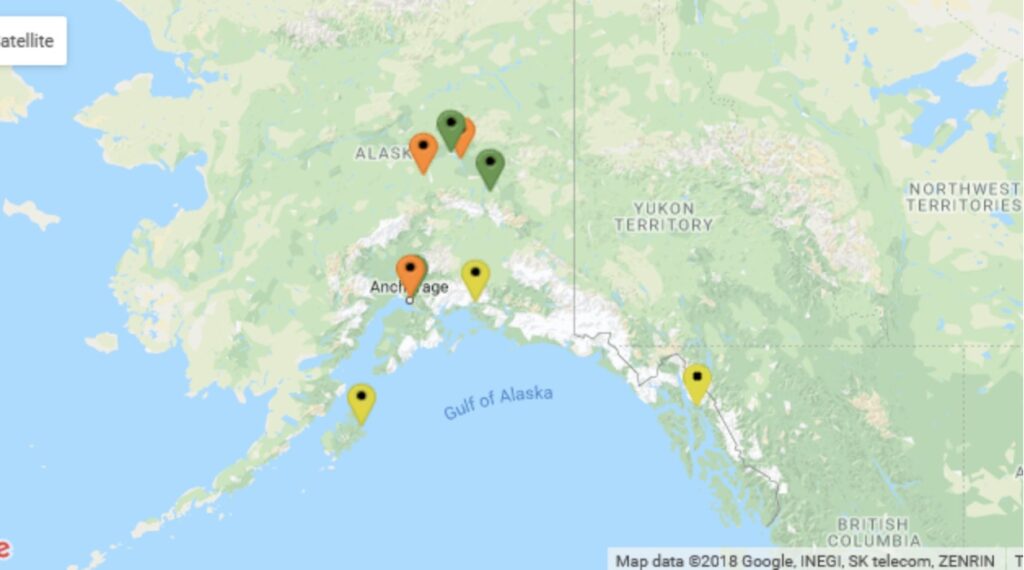

Zinc and germanium are produced at the Red Dog mine in northwestern Alaska, there are cobalt-enriched copper deposits in the Ambler Mining District, and rare earths at the Bokan Mountain project on the Southeast Alaska Panhandle. Between these and thousands of other deposits and prospects, America’s 49th state hosts 49 of the 50 minerals deemed critical to the United States.

Indeed the state of Alaska is practically synonymous with natural resource development, not only hard-rock mining but oil and gas production, coal extraction, fishing and forestry.

Aside from tourism, the remaining contributors to the state’s economy all come from natural resources.

Another Mining News North article notes that, like many indigenous cultures throughout the world, Alaskan natives fashioned weapons, dishes, whetstones, lamps and even saws from stone, and hollowed out circular mortars from limestone to grind berries and other foods.

In a 1779 voyage, Spanish explorer Francisco Antonio Maurelle observed that “The natives carry arrowheads made of copper, and spear points manufactured from copper … which caused the Spaniards to suspect mines of this metal nearby”…

Gold was reportedly of low importance to indigenous people, but coal was used as a fuel source for thousands of years. Mining News North’s A.J. Roan states,

In fact, it was the mining efforts of various Indigenes that spurred the search for coal in the vast regions of Alaska in the first place.

Russians observed coal extraction by Alaskan Natives at Chicago Creek on the Seward Peninsula, near Herendeen Bay on the Alaska Peninsula, and at Kootznahoo Inlet on Admiralty Island.

In 1815, Estonian mariner Otto Von Kotzebue observed Inupiat people extracting coal from Cape Corwin on Alaska’s North Slope.

Many years later, in 1881, Captain C. L. Hooper would utilize coal for his vessel, aptly named the Corwin, from the same seam earlier mined by the Inupiat.

The joining of traditional values and modern practices is contained in the 1971 Alaska Native Claims Settlement Act, which came about due to oil discovered in northern Alaska. A.J. Roan writes:

Due to the nature of Alaska’s stewards and the abundance of the state considered a “geological storehouse of minerals critical to the United States,” a symbiotic relationship between mining companies and the landholders has created an important modern means of survival for many Alaskan Natives.

This relationship enables many Natives to have significantly higher standards of living and, due to the fruitful survival, allows many to practice the traditions of their people as a cultural aspect instead of purely survival…

More importantly, resource development in Alaska adheres to a strict system of approval by both government departments and aboriginal people, as well as many other hurdles before an actual mine can be developed.

Graphite Creek

Located on the Seward Peninsula, Graphite Creek in early 2021 was given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC). The HPIP designation allows Graphite One to list on the US government’s Federal Permitting Dashboard, which ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process. In other words, having HPIP means that Graphite Creek will likely be fast-tracked to production.

The US Geological Survey has cited Graphite Creek as the country’s largest known graphite deposit, and one of the biggest in the world.

Government funding

The US Department of Defense, the Alaska government and the Bering Straits Native Corporation (BSNC) have all committed to moving Graphite One’s vision of a US-based graphite materials supply chain forward.In July, the DoD awarded GPH with a technology investment grant of up to $37.5 million under Title III of the Defense Production Act.

Graphite One Awarded $37.5 Million Department of Defense Grant Under the Defense Production Act

The company subsequently announced it had entered into a one-year $5 million loan agreement with Taiga Mining Company, its largest shareholder.

The proceeds will be used for infill drilling, as Graphite One moves towards its feasibility milestone. The company granted Taiga an option to purchase up to a 1% net smelter royalty (“NSR”) in increments of 0.25% for every $1.25 million advanced to the company on 133 claims owned or lease by the company, which was bought back for approximately $0.5 million on June 21, 2023. The option may be exercised at any time prior to maturity. If and when the option is exercised, the outstanding loan balance and accrued interest will be deemed the consideration paid for the purchase of the NSR. On December 27, 2023, Taiga exercised its option to acquire the NSR from Graphite One, leaving the company debt free heading into 2024.

Neither the grant nor the loan is dilutive to shareholders.

In September, Graphite One closed a US$2 million strategic investment by way of a private placement from Bering Straits Native Corporation, with an option to invest a further US$8.4 million to support the development of Graphite Creek.

The BSNC investment follows multiple community meetings with residents and company officials during 2023, Graphite One said. It also bolsters Graphite One’s position and brings added credibility to the project. With the support of BSNC, the company can proceed with increased confidence as it strives to bring the Graphite Creek project to full-scale operations.

Also in September, Graphite One was awarded a $4.7 million contract from the Defense Logistics Agency (part of the US Department of Defense), to develop a graphite and graphene-based foam fire suppressant as an alternative to PFAS fire-suppressant materials, as required by US law.

Under a signed agreement, Vorbeck Materials Corp of Maryland is the primary sub-contractor on the DLA contract. Vorbeck is a global leader in graphene production and advanced graphene applications. Its graphene offering, VOR-X, can produce the material at large-scale levels and integrate it into numerous solutions.

2023 Year in Review

Graphite One’s 2023 Year in Review highlights the fact that G1’s production is expected to qualify under the Inflation Reduction Act tax credits in both categories, based on U.S. Treasury/Department of Energy guidance and strong support from Alaska elected officials.

“2023 was a year of major milestones for Graphite One,” said Anthony Huston, Graphite One’s president and CEO. “We were awarded two Department of Defense grants, the USGS once again validated the significance of the Graphite Creek deposit, and we welcomed a strategic investment from Alaska’s Bering Straits Native Corporation, approved unanimously by BSNC’s Board. We also quadrupled this year’s drilling program year-over-year, made possible by the DoD grant. 52 of 52 holes drilled in the summer program intercepted graphite, proving the excellent continuity of near surface, flat lying graphite mineralization. We commenced delivering samples of both natural and synthetic graphite, materials essential to EV battery anodes, to potential end-users and a U.S. National Lab for further development of end products. And with the sale of the NSR and the continued support from Taiga, G1 is debt free heading into 2024.

“It is a testament to our strategic plans and talented G1 team and Board aiming to fill the lack of battery-grade graphite material in the United States.”

Graphite One enters 2024 planning an early-stage commercial facility to complete a finishing and coating line for synthetic graphite by late 2025, with Phase 1 production of 25,000 tonnes of synthetic anode material by mid-2026 and production growth from then on as market demand requires.

In the first quarter, G1 intends to submit a proposal to the U.S. Department of Energy seeking a grant for a precursor development plant and an early-stage commercial synthetic graphite anode facility.

“This is planned to be a direct path to revenue, even as we continue to develop our Graphite Creek natural graphite deposit.” said Huston.

Q1 2024 is also expected to see Graphite One select a site for its graphite anode material production facility, in keeping with the company’s US-based graphite supply chain strategy.

Graphite One and Sunrise (Guizhou) New Energy Material Co are negotiating a technology license agreement to share expertise and technology for the design, construction, and operation of Graphite One’s proposed graphite material manufacturing facility in Washington State.

A previous news release states, “The TLA is intended to comply with the requirements of the U.S. Inflation Reduction Act so that the use of the licensed technology itself to make Graphite One’s anode materials would not affect its customers’ eligibility to qualify for IRA tax credits.”

The Year in Review says the TLA should be completed in Q1 2024.

Fast forward to the fourth quarter of 2024, when Graphite One expects to finish its feasibility study a full year ahead of schedule, thanks to DoD Defense Production Act funding — the above-mentioned $37.5 million grant.

Regarding the initial $2 million invested in Graphite One by the BSNC, interim president and CEO Dan Graham said:

“This is not just an investment in Graphite One, it is a long-term investment in our region. We at BSNC have watched for years as Graphite One has worked to advance the Graphite Creek project and become a friendly neighbor in the region. Graphite One has told us of its intent to develop an environmentally responsible project and provide an exciting economic opportunity for the region that hopefully will play a crucial role in the nation’s transition to a clean energy future. This is at the heart of our Board’s unanimous support of the project.”

In February and March 2023, analysis of the 2022 drilling increased Graphite One’s Graphite Creek measured and indicated resource by 15.5%. The M&I resource not sits at 37.6M tonnes at 5.14% graphite, with an inferred resource of 243.7 M tonnes at 5.07% graphite.

The company also reported that holes drilled 2 km east of previous drilling and 4 km west of the PFS pit boundary showed significant intervals above cut-off grade, indicating that the Graphite Creek resource remains open to the east and west.

In January 2023, G1 announced collaborations with two of the DoE’s national laboratories. The company concluded a material transfer agreement with Pacific Northwest National Laboratory (PNNL) to test anode active and other materials to verify conformity to EV battery specifications, and delivered Graphite Creek sample material to Sandia National Laboratories to test for the occurrence of additional critical minerals and assess recovery potential as part of Sandia’s green extraction processing work, conducted under the auspices of Sandia’s Climate Change Security Center.

In April 2023, G1 announced that it had received active anode material samples produced from Graphite One’s Alaska graphite by Sunrise. The sample material and the sample specification data have been provided to PNNL for additional testing, and sample material has been sent to a leading EV manufacturer for evaluation.

In early December 2023, Graphite One said it delivered synthetic graphite anode material samples for analysis by US-based global end users. Three of the active anode material samples delivered are each designed to meet different lithium-ion battery requirements: high energy capacity above 360 mAh/g; fast charging above 4C; and cycle life above 6,000 cycles, respectively.

These material deliveries are consistent with Graphite One’s updated plan to first construct a synthetic anode material production facility to produce a range of synthetic anode materials. A natural graphite anode material production line would later be added, in time to receive natural graphite the Graphite Creek deposit once it is permitted and operating. Ultimately Graphite One intends to produce both synthetic and natural graphite anode materials for lithium-ion battery applications in North America.

“With the U.S. currently not producing any natural and synthetic anode materials, Graphite One has formulated a fast-track path-to-production strategy jump-starting our battery anode material production,” said Huston. “In contrast to the typical resource development track, our strategic plan is to make Graphite One a synthetic anode material producer while Graphite Creek moves through permitting and into production.

“Ultimately, Graphite Creek’s natural graphite would supply our anode material facility alongside our synthetic production, to deliver a full range of natural and synthetic anode materials to EV customers, 100% manufactured in the United States.”

G1’s project continues to receive strong support from Alaska politicians, including Senators Lisa Murkowski and Dan Sullivan and Congresswoman Mary Peltola, as well as Alaska Governor Mike Dunleavy. In July 2023, Senator Murkowski took the Senate floor to express support for Graphite One and its development of the Graphite Creek deposit near Nome.

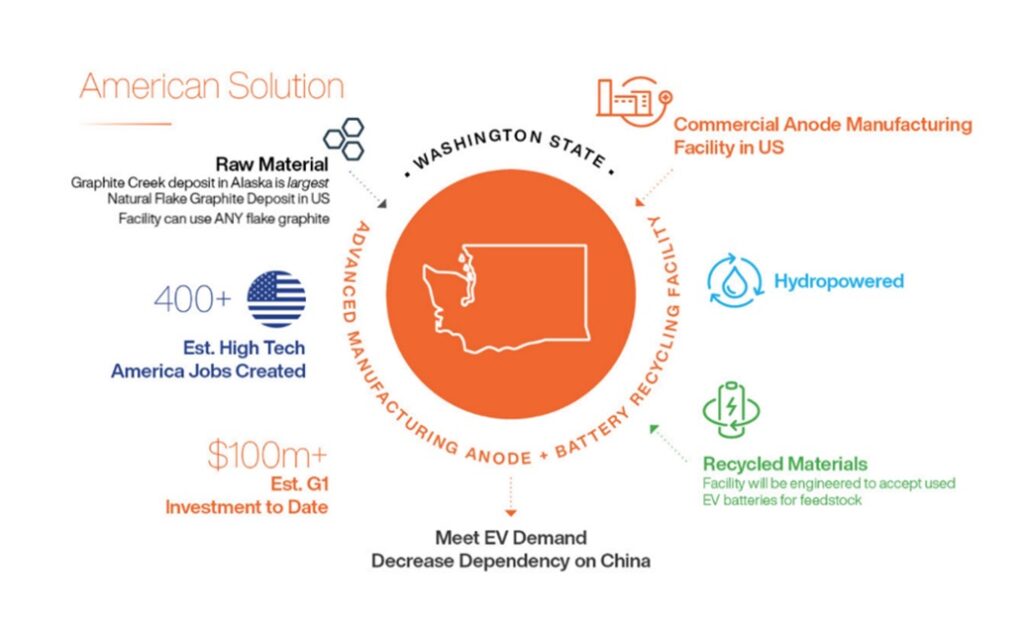

In her address, Sen. Murkowski stated, “I’ve always supported Graphite One and what they’re doing in Alaska, but after my site visit there on Saturday, I’m convinced that this is a project that every one of us, those of us here in the Congress, the Biden Administration, all of us needs to support. Graphite One’s vision is to build a complete domestic supply chain for natural graphite. Their project would be anchored by responsible mining of the Graphite Creek deposit producing tens of thousands of metric tons a year, but it would also extend to a battery anode manufacturing facility in Washington State which would be co-located with a battery recycling plant, which is why their CEO Anthony Huston often describes Graphite One as a technology company that mines graphite. This, Mr. President, is a major opportunity for us.”

In 2023, Graphite One donated $30,000 to the Nome Emergency Shelter Team which provides shelter services to the local community. The company also worked with Arctic Access, a non-profit organization whose employees are local community members that have completed a rehabilitation program to supply camp janitorial services to G1’s camp operations during the summer drilling program.

Graphite One has also donated $50,000 each to the communities of Teller and Brevig Mission for support projects that benefit the quality of life of the community members.

Graphite market

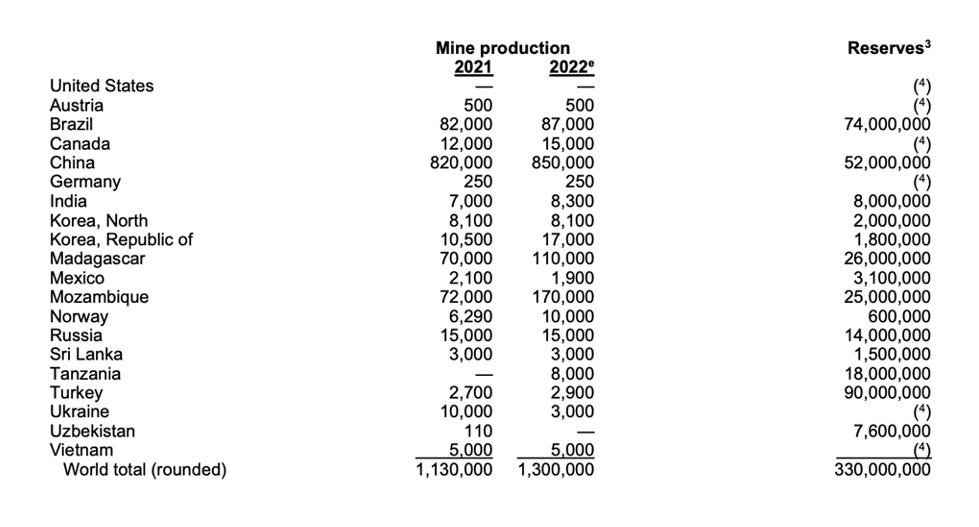

China is by far the biggest graphite producer at about 80% of global production. It also controls almost all graphite processing, establishing itself as a dominant player in every stage of the supply chain.

After China, the next leading graphite producers are Mozambique, Brazil, Madagascar, Canada and India. The US currently produces no graphite, and therefore must rely solely on imports to satisfy domestic demand.

According to the US Geological Survey, in 2022 the US imported 82,000 tonnes of natural graphite, of which 77% was flake and high-purity. The top importers were China (33%), Mexico (18%), Canada (17%) and Madagascar (10%).

But taking into account the fact that EV batteries require run-of-mine graphite to go through purification and coating, a process controlled by China, the US was actually not 33% dependent on China for its battery-grade graphite, but 100%. This is a precarious position to be in should the country want to stay in contention for EV dominance.

In October, Beijing said it will require export permits for some graphite products “to protect national security”. The real reason is retaliation against the United States for widened curbs on Chinese companies’ access to semiconductors, including stopping sales of more advanced artificial intelligence chips made by Nvidia; and the European Union for daring to impose tariffs on Chinese-made EVs the Europeans argue unfairly benefit from subsidies.

Under the new graphite restrictions, which took effect Dec 1, exporters must apply for permits to ship two types of graphite: synthetic graphite, and natural flake graphite and its products.

While it’s unclear how much effect the ban will have in the short term, Bloomberg reported that, “With this new graphite export curb, South Korean firms which heavily rely on China for graphite imports would need to seek alternatives, such as mines from the United States or Australia, but it would likely increase the cost burden for many,” said Kang Dong-jin, an analyst at Hyundai Motor Securities.

Deficits are expected to kick in by 2025 as new graphite mines fail to keep up with surging demand from automakers.

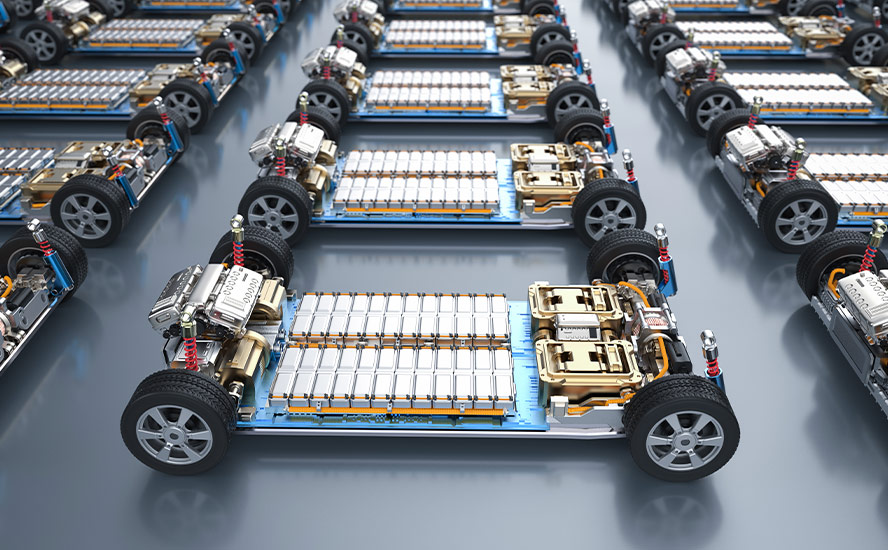

Graphite has the largest component in batteries by weight, constituting 45% or more of the cell. Nearly four times more graphite feedstock is consumed in each battery cell than lithium and nine times more than cobalt.

Graphite is indispensable to the EV supply chain.

BloombergNEF expects graphite demand to quadruple by 2030 on the back of an EV battery boom transforming the transportation sector. It is not an exaggeration to say that electrification of the global transportation system doesn’t happen without graphite.

Conclusion

Given its significant graphite resource, which the USGS now places Graphite Creek among the world’s largest, the deposit’s potential exploration upside, and its anticipated Washington State graphite product manufacturing facility, Graphite One is building the foundation for its goal of becoming the first vertically integrated producer to serve the US EV battery market.

To do that, the company entered an MOU in April 2022 with Sunrise (Guizhou) New Energy Material Company, a China-based lithium-ion battery anode material producer. The intent is to sign a technology licensing agreement, and to share expertise and technology for the design, construction, and operation of the proposed graphite material manufacturing facility in Washington State.

The Washington facility represents the second link in Graphite One’s advanced graphite materials supply chain. A planned recycling facility to reclaim graphite and other battery materials is to be co-located at the Washington plant, completing the third link.

The world simply needs more graphite, a key ingredient in EV batteries and energy storage systems for which there are no substitutes.

Analysts estimate that by 2030, it will take at least 5 million tonnes of graphite per year to fill battery demand. This is roughly four times the 1.3 million tonnes mined globally, according to the USGS’s Mineral Commodities Summaries 2023.

This is why the DoE, in its assessment, ranked graphite near the top of its list of minerals critical to America’s energy future. The US federal government’s critical minerals list also has graphite as one of five key battery minerals that are at risk of supply disruptions.

The only way to alleviate that risk is for the United States to find its own source of graphite production, and at AOTH we believe a project like Graphite One’s ticks all the boxes.

The results of its 2022 drill campaign demonstrate the potential, in my opinion, for significant resource expansion. Step-out hole 22GC079 was the furthest step-out from the campaign, collared over 2 km west of the next closest hole and 4 km west of the PFS pit boundary. It intercepted a combined 58.2m of mineralization averaging 4.18% graphite. These are excellent grades; flake graphite ore suitable for electric-vehicle batteries typically grades 2-3% Cg.

The 2023 drill program was designed to double the measured and indicated resources and increase the inferred resource by infill drilling along trend to hole 22GC079.

In October, Graphite One announced the completion of the 2023 drill program along with a selection of assay results. The program quadrupled the scope of 2022’s, with 57 holes completed for a total of 8,736 meters — the largest drill program in GPH’s history.

Between the manufacture of synthetic graphite and the natural graphite produced from the Graphite Creek deposit, Graphite One could represent a significant portion of the amount of graphite demanded by the United States, currently.

Consider: In 2022 the US imported 82,000 tonnes of natural graphite, of which 77% was flake and high-purity, suitable for electric vehicles.

Graphite One enters 2024 planning an early-stage commercial facility to complete a finishing and coating line for synthetic graphite by late 2025, with Phase 1 production of 25,000 tonnes of synthetic anode material by mid-2026 and production growth from then on as market demand requires.

Based on the PFS, the Graphite Creek mine is anticipated to produce, on average, 51,813 tonnes of graphite concentrate per year during its projected 23-year mine life. The company itself would produce about 75,000 tonnes of products a year, of which 49,600 tonnes would be anode materials, 7,400 tonnes purified graphite products and 18,000 tonnes unpurified graphite products.

Fact – 25,000 tonnes of synthetic graphite + 58,813 tonnes of graphite concentrate = 83,813 tonnes, more than the 82,000 tonnes the United States imported in 2022.

If all goes according to plan, the feasibility study — ahead of schedule by one year — would move Graphite One’s Graphite Creek deposit that much closer to becoming America’s only source of mined graphite, helping to shed its import reliance. (In fact, the FS contemplates a tripling of production, from 50,000 tonnes of graphite concentrate per year as estimated in the PFS to more than 150,000 tonnes)

G1’s development of the Graphite Creek deposit is occurring alongside the company’s many other activities, including the technology transfer agreement with Sunrise for a proposed graphite material manufacturing facility in Washington State; the synthetic graphite plant that will precede the natural graphite plant and provide a source of revenue as the mine is being developed; material transfer agreements with two of the DoE’s national laboratories, and the delivering of synthetic graphite anode material samples for analysis by US-based global end users.

More broadly speaking, Graphite One’s activities should be considered a bolt-on to what is already happening in northwestern Alaska with respect to the building of the first deepwater port in the US Arctic region.

The U.S. Army Corps of Engineers and Alaska’s Department of Transportation have chosen two sites for a deepwater port facility: Nome and Port Clarence. Nome has received $600 million in government grants and appears to be well on its way to doubling the size of its existing port to accommodate the world’s largest commercial and military vessels. Work is expected to start this year.

Port Clarence is only about 25 miles from Graphite One’s Graphite Creek deposit, meaning G1 could become an anchor customer for a port on BSNC land at Point Spenser. At AOTH, we are agnostic as to which deepwater port site gets built — both Port Clarence and Nome are within a short distance of Graphite Creek and could easily be connected by road.

While the development of Graphite Creek is in its early stages, the project has been given a leg up by the federal government, which in 2021 gave the project High-Priority Infrastructure Project (HPIP) status. This ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process. In other words, having HPIP means that Graphite Creek will likely be fast-tracked to production.

Although there has been criticism of Alaska’s permitting system, at AOTH we don’t believe Graphite Creek would be subject to lengthy delays. The project isn’t near a salmon fishery and it has the backing of local communities such as Nome, which has a long history of resource extraction.

The company has political help from the highest political offices in Alaska — the governor and senators. They clearly see an investment to increase domestic capabilities for graphite as money well spent.

The Bering Straits Native Corporation has pledged its support for the project including an up-front US$2 million investment with an option to increase its investment up to US$10.4 million.

The United States must build port infrastructure and start developing this region if it wants to maintain Arctic sovereignty, and we see Graphite One’s Graphite Creek project as fitting in perfectly with these plans.

If and when the deposit becomes a mine, Graphite One can begin producing spherical/natural graphite for anodes, alongside the synthetic graphite production line.

We see Graphite One taking a leading role in loosening China’s tight grip on the US graphite market by mining feedstock from its Graphite Creek mine in Alaska and shipping it, either through Nome or Port Clarence, to Washington State to manufacture lithium battery anodes (and other graphite products).

Graphite One Inc.

(TSXV:GPH), OTCQX:GPHOF

2024.01.03 share price: Cdn$0.78

Shares Outstanding: 129.0m

Market cap: Cdn$102.8M

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Graphite One Inc. (TSXV:GPH)

GPH is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of GPH

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.