Despite two new proposed transmission lines, BC’s industrial power demands could force choice between mines and LNG – Richard Mills

2025.11.28

Earlier this month, Canadian Prime Minister Mark Carney added the North Coast Transmission Line to his list of projects of national importance — part of a larger strategy to expand the country’s electricity grid and to further develop Canada’s natural gas and critical mineral reserves.

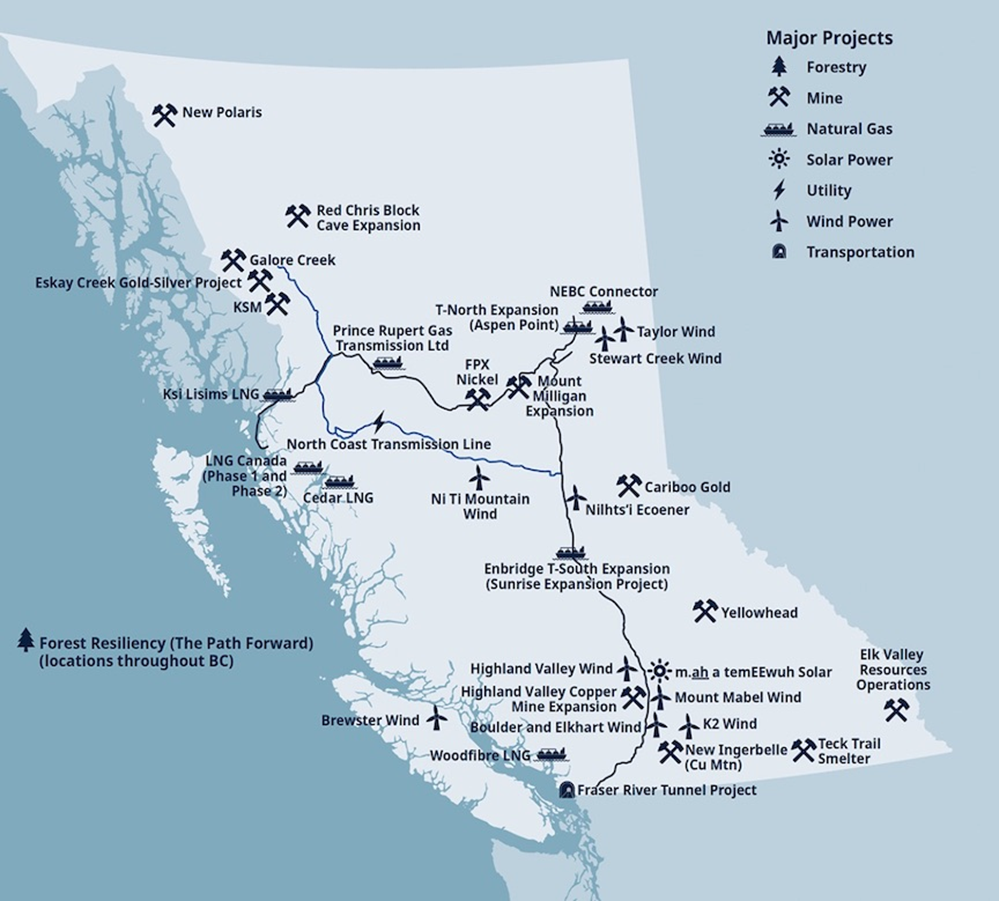

The $6 billion transmission line in northern BC will be fast-tracked by the Major Projects Office. Our analysis of past and proposed transmission lines shows that mines in the BC northwest and those in the Yukon Territory stand to benefit from the increased electrical connectivity to areas currently un-connected to the grid.

However, they could be delayed or pushed out by LNG.

Carney’s major projects push

Fed up with Donald Trump’s tariffs, Canada is on a mission to double non-US exports over the next decade and unleash $1 trillion in new investment over five years, according to a Nov. 21 press release.

The North Coast Transmission Line (NCTL) is part of 11 projects of national importance the Carney government has proposed. Four are in BC: LNG Canada Phase 2 in Kitimat; the Red Chris mine expansion near Dease Lake; The Ksi Lisims LNG project at Pearse Island; and the North Coast Transmission Line.

There’s also the Northwest Critical Conservation Corridor, or NCCC, though it’s not an official project. According to The Logic,

Conceptually, the NCCC would act as a kind of superhighway for the development of power lines, pipelines and railways across northern B.C. and Yukon, in turn providing the region’s mines and gas fields with critical access to electricity and transportation capacity. The corridor, according to the federal government, “sits atop vast deposits of critical minerals” and includes a “conservation area the size of Greece.”

It does sound good for mining. But wait. Haven’t we heard this before? The Logic reminds us that “the northwest corridor in in keeping with a concept that has tantalized officials for decades.” It’s not new, and Carney has centered his major projects around the concept of economic corridors (e.g. the “Port of Churchill Plus” and the “Arctic Economic and Security Corridor”) — the idea being that approved rights-of-way can be established that de-risk major projects (code for keeping environmentalists and indigenous from blocking them) and help proponents to secure capital.

As part of the corridor proposal, the government aims to build new transmission lines, i.e., the NCTL, upgrade highways, install fiber and cell towers, and invest in communities. (more propaganda: Carney really is starting to sound like a politician — Rick)

What’s important is that the NCCC includes the NCTL, if you’re with me on the acronyms. The Logic says the NCTL would deliver electricity to various mines, LNG export facilities and other industrial projects in the province’s north. The expansion of the Red Chris mine, formerly 100% owned by Imperial Metals but now split between Imperial and Newmont after Newmont bought Newcrest, is connected to the NCCC, according to the federal government.

A spokesperson for Western LNG, developing the proposed Ksi Lisims LNG project, says the line will help the facility to compress and liquify natural gas using clean hydroelectricity rather than with natural gas.

Look West Strategy

Before we get into the details of the shiny new North Coast Transmission Line, its predecessor, the deceptively similar-sounding Northwest Transmission Line, and the proposed add-on to the NWTL, the Yukon-BC Grid Connect Project, we need to mention one more federal government initiative.

The Look West Strategy focuses on speeding up permitting and delivering big projects. The strategy has a 10-year target of securing $200 billion in major project investment by meeting and beating permitting deadlines. (more propaganda, sorry)

Again, sifting through the crud, what’s important is there are 18 priority BC projects, including four critical mineral mines: Eskay Creek being developed by Skeena Gold & Silver, and three mine expansion projects — Red Chris, Mt. Milligan and Highland Valley. All except the Highland Valley copper mine expansion are in progress. Teck Resources’ board recently approved the life-of-mine extension at Highland Valley.

The North Coast Transmission Line is part of the Look West Strategy.

By 2032, the strategy expects to have four new mines or expansions, three new natural gas projects, and 10 new renewable energy projects in operation. Link to the complete list of BC projects.

Northwest Transmission Line

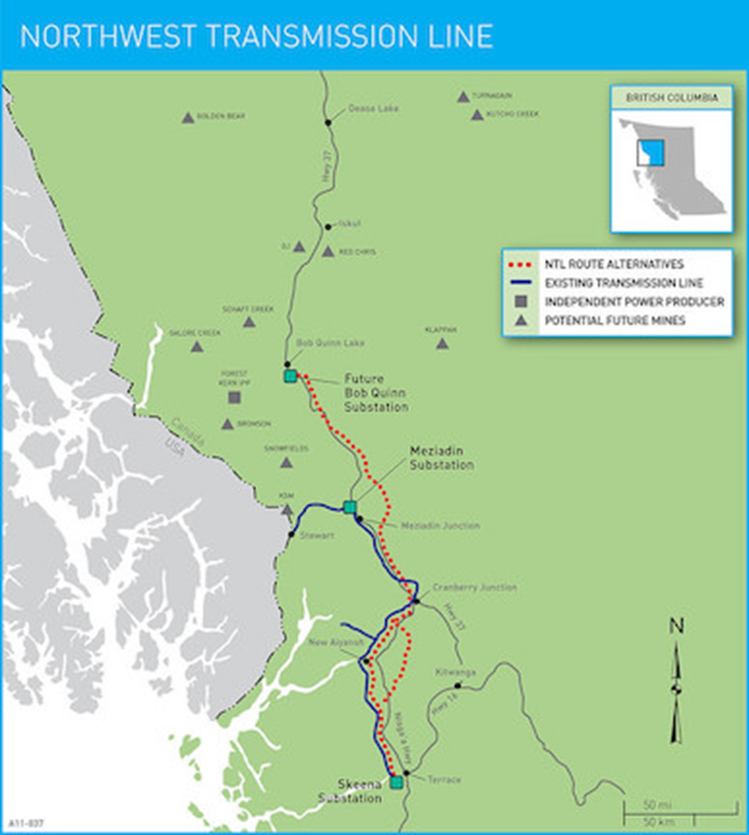

We remind our readers that there is already a high-voltage transmission line in place in northern BC. The Northwest Transmission Line entered service in July 2014. The $746 million line was designed to bring power to mining properties previously inaccessible to the grid and reliant on diesel-powered portable generators.

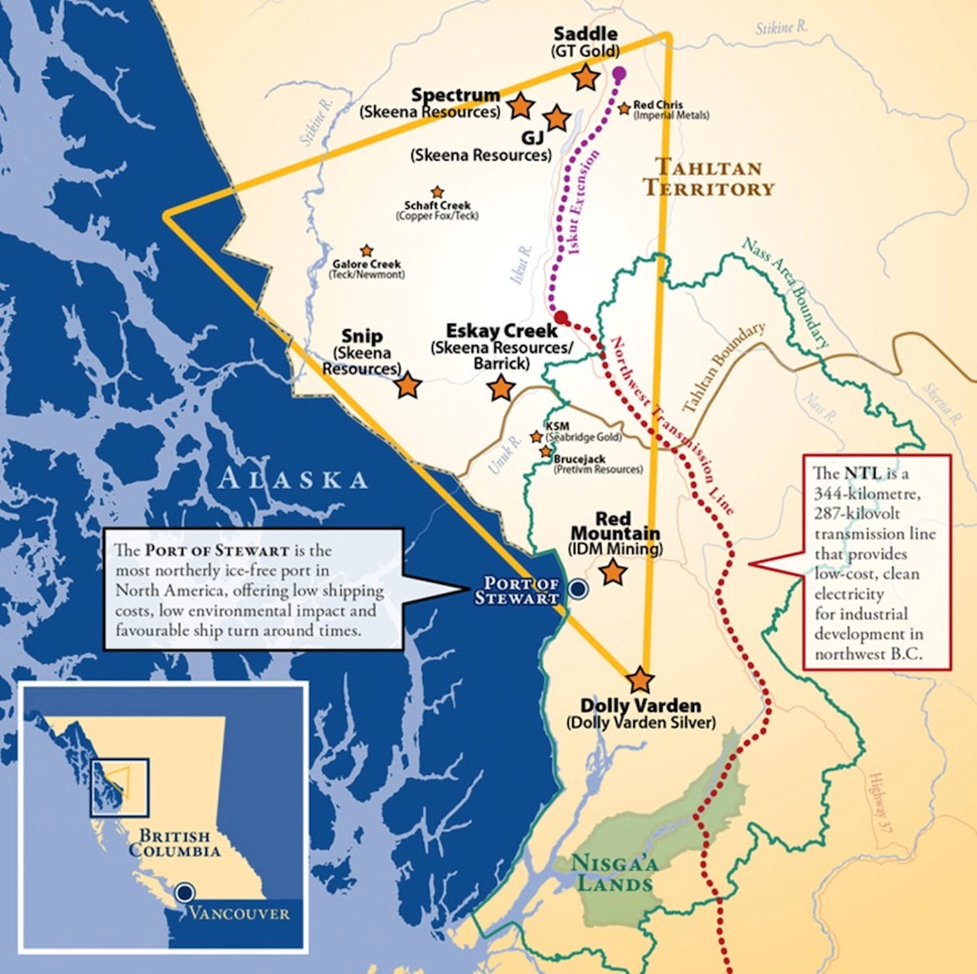

A BC Hydro press release announcing its opening states that the 344-kilometer line stretches from Terrace to Bob Quinn Lake. It took two years to complete. The Red Chris mine was the first to hook up to the NWTL, followed by the high-grade Brucejack gold mine. Both are in BC’s Golden Triangle.

BC Hydro noted at the time that it is planning to acquire a 93-km extension being built by Imperial Metals and the Tahltan nation. This line was expected to run between the new Bob Quinn substation, and a new substation BC Hydro was planning to build near Tatogga Lake. The extension was for the purpose of powering the Red Chris mine and providing electricity to the small community of Iskut.

Subsequent mining companies that tapped into the Northwest Transmission Line include Skeena Resources, which this year signed an agreement with the Coast Mountain Hydro Limited Partnership allowing Skeena’s Eskay Creek gold-silver project to connect to CMH’s transmission line that feeds into the NWTL; and Seabridge Gold, which in 2022 announced that its subsidiary, KSM Mining, signed an agreement with BC Hydro to supply its KSM copper-gold-silver project with hydroelectricity.

Under the agreement, KSM’s future plant site would join the Northwest Transmission Line via a 30-kilometer branch line that connects to a switching station at the junction of KSM’s Treaty Creek access road and Highway 37. The cost of the substation is $28.9 million.

North Coast Transmission Line

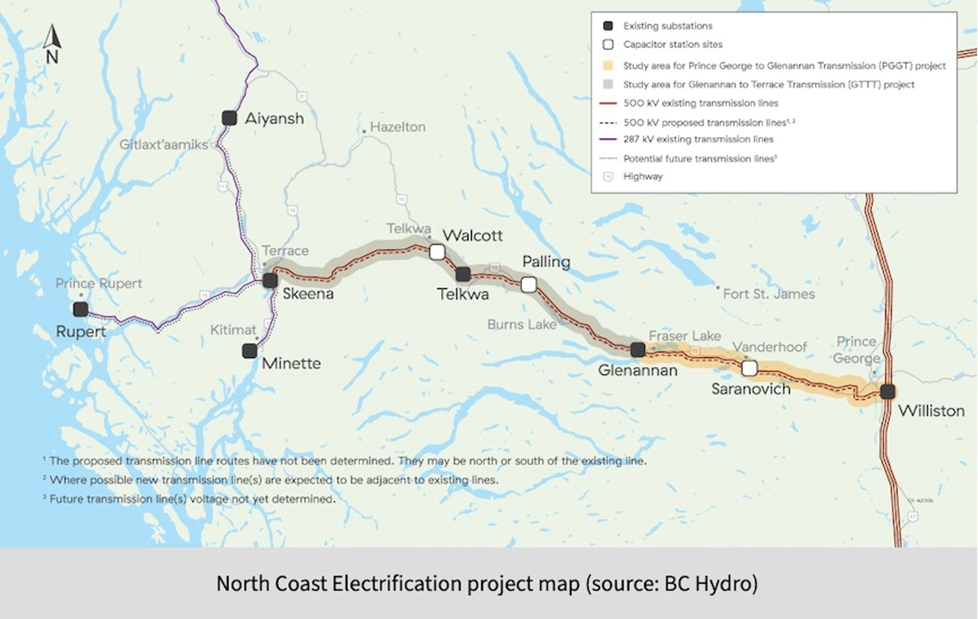

BC Hydro proposes to build a new 500-kV transmission line and associated infrastructure from Prince George to Terrace in two phases. A third phase is also planned.

The first phase would travel about 170 km from Williston substation near Prince George to the Glenannam substation. From there the line would go 130 km to the Telkwa substation, and from there another 145 km to the Skeena substation near Terrace.

In a third phase, the proposed transmission line would head north from Terrace to Bob Quinn Lake, the current terminus of the Northwest Transmission Line.

As part of Phase 3, another line would run from the Rupert substation at Prince Rupert to the Port of Prince Rupert — expanding the port’s power capacity.

In other words, the proposed North Coast Transmission Line would go from Prince George to Terrace, and from there it splits in three directions: Kitimat, Aiyansh and Prince Rupert.

Energy Minister Adrian Dix says the line is needed to supply power to proposed critical mineral mines, liquefied natural gas projects, and an expanded Port of Prince Rupert.

The North Coast is currently supplied by 450 km of 500-kV transmission lines from Williston substation near Prince George to Skeena substation near Terrace. Glenannan and Telkwa substations are located along the 500-kV lines.

From Terrace, transmission lines head north towards the Aiyansh substation near Gitlaxt’aamiks (formerly New Aiyansh), south to Kitimat, and west to Prince Rupert.

BC Hydro is proposing to develop:

- New 500 kV transmission lines and associated infrastructure from Williston aubstation near Prince George to Skeena substation in Terrace.

- New 500-kV infrastructure north of Terrace from Skeena substation to Bob Quinn substation.

- New transmission infrastructure in the Prince Rupert area.

The company is also proposing to upgrade the existing 500-kV transmission lines between Williston and Skeena substations.

The NCTL, then, is basically a twinning project.

Phase 1 (Prince George to Glenannan) is slated to be in operation by fall 2030 and Phase 2 (Glenannan to Terrace) by mid-2032. The BC government expects “shovels in the ground” in 2026.

The project is expected to double electricity flowing from Prince George to Terrace, and at a later stage, northward to Bob Quinn Lake.

The Canada Infrastructure Bank is providing a $140 million loan to BC Hydro, to fund early work on the transmission line.

To clear the path to development, the provincial government in May passed legislation to exempt the project from an environmental assessment. The confidence vote was tight, squeaking by 47 to 46, with the Speaker of the House breaking the tie.

The Globe and Mail reports Michael Goehring, president and CEO of the Mining Association of BC, saying that the 18 proposed critical-mineral mines that are in advanced development in BC need access to significant power, or they won’t move forward.

He gave the Turnagain nickel project and Galore Creek, a large copper-gold project, as examples.

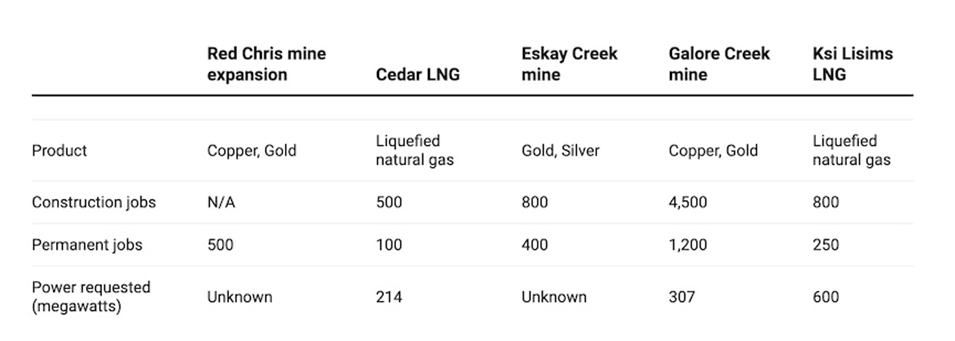

To what other major projects would the North Coast Transmission Line provide connectivity? The provincial government has been tight-lipped on the matter, but The Narwhal managed to find out through an Oct. 28 press release from the NDP caucus that there are five projects.

The Red Chris mine expansion we already know about, there’s also Galore Creek — mentioned by Michael Goehring; Eskay Creek, which is already connected to the Northwest Transmission Line; and two LNG projects.

Four other proposed mines in northwest BC area also “among the mining projects along the North Coast transmission line that will benefit from access to clean power and improved grid reliability,” according to the Ministry of Mining and Critical Minerals, via The Narwhal.

An expression of interest call issued by BC Hydro in 2023 received 29 submissions, with the highest number of submissions coming from the mining sector.

An FOI request by The Narwhal revealed that nearly half of the capacity of the 2,200-megawatt NWTL — 900 megawatts — could be dedicated to mines. Among the projects requesting power, according to a 2024 briefing note for Premier David Eby, were Seabridge Gold and its KSM project (220 megawatts); and Galore Creek, a joint venture between Teck Resources and Newmont (307MW).

Another 620 megawatts from the transmission line could go to LNG, the briefing note said, with an additional 600MW earmarked for potential hydrogen production projects.

Yukon–B.C. Grid Connect Project

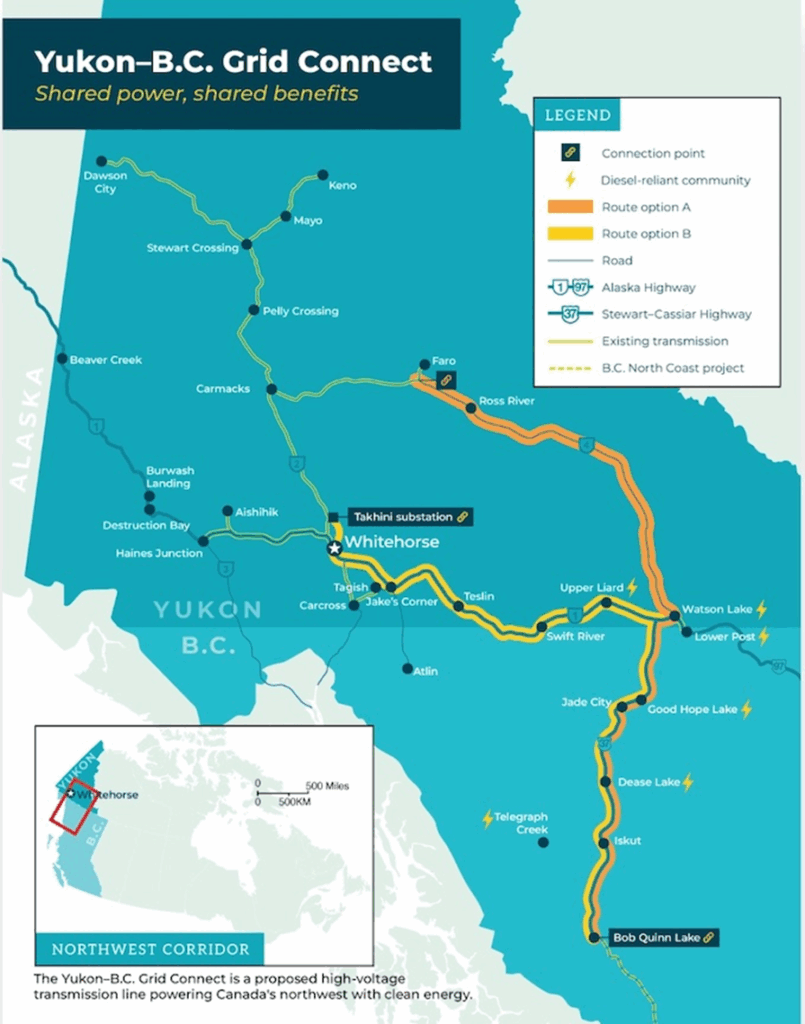

In May, the governments of British Columbia and the Yukon signed a memorandum of understanding to collaborate on connecting Yukon’s isolated energy grid to the BC grid, which currently runs to within 260 km of the Yukon-BC border.

The MOU sets in motion a plan for another electricity transmission project, the Yukon-B.C. Grid Connect Project.

Earlier this month, the Carney government put the Yukon-BC grid connection on the list of nation-building projects. However, so far, no serious money has materialized, besides $40 million Ottawa has ponied up for a feasibility study — a small portion of the estimated $4 billion price tag.

According to the Yukon government, the line would electrify six diesel-only communities, enable up to 2,000 megawatts of new energy, deliver clean power to critical minerals development, and provide more energy to meet Yukon’s peak winter demand.

The Yukon Development Corp continues to advance the project through the pre-feasibility stage, with funding from the Canadian government Critical Mineral Infrastructure Fund and the YDC Fund.

The line would eventually link up with the existing Northwest Transmission Line. As shown on the map below, the YBCGCP has a Route Option A and B. Option A runs from Faro, YT to Bob Quinn Lake, BC, tracing the route of existing roads including Highway 37 in BC and Highway 4 in the Yukon.

Option B travels from Watson Lake to Whitehorse, tracing the same route as the Alaska Highway 1.

Which mines would benefit from the YBCGCP? According to a recent CBC News story, the Casino copper-gold-molybdenum deposit would use more than 200 megawatts, which exceeds the 148MW the territory currently produces.

The transmission line would finally connect Watson Lake, YT, which is currently entirely run on diesel power, to the grid.

The article notes the Yukon grid is maxed out in winter, with Yukon Energy Corporation relying on diesel generators to meet peak demand. Projections for the grid-connect project suggest the Yukon could generate and sell surplus hydroelectric power in the summer.

Will there be enough power?

According to The Narwhal, a government press release states that the 29 submissions answering BC Hydro’s 2023 expression of interest call outlined “5,000 megawatts of potential industrial load (about five times the capacity of the Site C hydroelectric project).”

The Canadian Infrastructure Bank says the demand for electricity is expected to exceed the capacity of the region’s existing transmission system, which as mentioned, is currently served by just one 500-kV transmission line running from Prince George to Terrace.

On Oct. 20, Michael Goehring of the BC Mining Association said critical minerals and precious minerals projects in the Golden Triangle alone could add 1,000 megawatts of new electricity demand.

This week, a government-commissioned independent review of CleanBC concluded that the massive electricity demand from six proposed or approved liquefied natural gas (LNG) terminals would require a staggering 40,000 gigawatt-hours per year, an amount B.C. does not currently possess.

“To put that into perspective, that quantity of power roughly matches the output of 7.5 Site C dams,” the review says.

Moreover, that quantity of power is expected to compete directly with the power needs of other priorities like critical minerals mining.

The bar graph below shows BC Hydro’s demand forecast for 2030, at 70,000 GWh/year, dwarfs both the amount of power required for all the proposed LNG projects if built and electrified, just over 40,000 GWh/year, and BC’s total power demand in 2022 of ~60,000 GWh/year.

The amount of power we are talking about generating, to meet the expected demand, may force the BC government to make a difficult decision between providing power for LNG versus mining.

The Globe and Mail notes the province needs to provide somewhere between 400MW and 700MW of power by 2035:

That could use up more than half of the power available from the new transmission line, leaving little for developing LNG, port expansion or anything else.

Goehring argues, and I agree, that mining – especially the critical minerals that Canada has identified as a priority – should come first. “The North Coast Transmission Line is critical to our province’s mining sector and the economy of Northwest B.C.,” he said.

More broadly, an op-ed piece this week carried by Business in Vancouver (BIV) finds that the province is being too conservative in its assessment of future power needs.

According to BC Hydro’s new Integrated Resource Plan, its overly conservative assumptions for future electricity loads, especially including industrial ones, aren’t sufficiently visionary to build B.C.’s electrified future.

To quantify that, consider this: Should the BC projects on Carney’s list of 11 projects of national interest come to fruition, it would mean two large LNG facilities, the North Coast Transmission Line and a mine expansion. If fully electrified, these “nation-building” projects would consume up to two Site C’s of power, and that is before accounting for the additional mining projects the NCTL could unlock.

“As a result, BC Hydro’s cautious approach to integrated planning could leave the utility scrambling to meet demand,” writes Mark Zacharias, a fellow at Simon Fraser University, and Rachel Doran, the executive director of Clean Energy Canada.

Will LNG make money?

Mark Carney cites the business case for LNG, stating that by 2040, global LNG demand is expected to rise by 60% and “Canada will be ready.”

But Canada is late to the LNG game, with the US, Australia and Qatar, to name three LNG leaders, far ahead of us.

The profitability of BC’s LNG projects, particularly the flagship LNG Canada, is a subject of intense debate, with various reports suggesting they face significant financial risks due to high production costs and volatile global markets, while proponents argue they will yield long-term profits. At their very best, BC’s LNG projects will manage, despite being late to the LNG game and facing fierce competition, to squeak out a profit and provide revenue to the provincial government. The NDP says LNG Canada will bring in CAD$22 billion to BC’s coffers over 40 years.

Studies from organizations like the International Institute for Sustainable Development (IISD) and the Institute for Energy Economics and Financial Analysis (IEEFA) indicate that Canadian LNG projects have substantially higher production costs compared to competitors like Qatar and the US Gulf Coast. Many analyses argue that without substantial government subsidies (including tax breaks and discounted electricity prices), projects would struggle to compete, effectively shifting a portion of the financial risk onto the public. And new analyst reports suggest the global LNG market is expected to be oversupplied in the coming years as lackluster demand growth and a glut of new production comes online, which could depress prices and make BC the late entrant into a crowded market.

A senior economist with the Canadian Centre for Policy Alternatives says there’s a real risk that the BC and federal government’s LNG ambitions won’t be realized, leaving stranded assets. Predictions are that there will be a declining demand for LNG in the coming decade.

“Our politicians are all racing to get this stuff built to show that they’re doing stuff for the economy, but it may just be a complete white elephant, said Marc Lee, via northern BC local newspaper Vanderhoof Omineca Express.

Will it be green?

Not if the proposed transmission lines are used to power numerous LNG projects up and down the BC coast.

Only about 20% of LNG Canada Phase 1’s power needs are met by hydroelectricity, much of it coming from the Site C dam. The rest is powered by natural gas-fired turbines.

According to the above-cited independent review of CleanBC, if all six proposed or approved LNG projects become operational, they would add 13 megatonnes to BC’s emissions, at a time the province aims to lower its emissions by 21 megatonnes by 2030.

Opponents say the project will blow the NDP’s goal of cutting GHGs by 40% by 2030 and 80% by 2050, out of the water.

We already know that LNG Canada in just the first phase of production will result in 36.4 million tonnes of emissions, which is more than half of British Columbia’s current annual emissions.

Cedar LNG would produce quite a bit less, just 7.8Mt, but as The Sierra Club calculates, that is still more than the 6.5Mt generated annually by the city of Vancouver.

Most importantly, the new rules continue to ignore the additional emissions related to fracking, pipelines, shipping and re-gasification, including the leakage of methane, a greenhouse gas that is 86 times more powerful than CO2 over a 20-year period.

According to two reliable sources, methane from the production of natural gas makes LNG about as bad a greenhouse gas emitter as coal, and that when it comes to lifecycle GHG emissions, LNG sometimes emits more than coal.

Contrary to the industry’s message, there is no evidence that LNG exports would reduce coal use around the world. A 2023 report found that China is building six times more coal plants than other countries. This massive increase in the use of coal is happening despite China’s state-owned enterprise PetroChina holding a 15% ownership stake in the LNG Canada joint venture.

The Vancouver Sun says that the expansion of LNG in BC could add 200 LNG tankers a year over the coming decade.

Some tanker routes pass through waters designated or proposed as critical habitat for marine life, including orcas, humpback whales and salmon. A report found that more than 1,000 kilometers of tanker routes pass through federally designated critical habitat areas.

It has long been suspected that engine noise from freighters, cruise ships and other large vessels disturbs cetaceans, the family of marine mammals that includes whales, porpoises and dolphins.

Researchers found that male humpback whales swimming close to freighters stop “singing” to attract females. They also noticed that the noise from the ships impacted the ability of the whales to navigate and to identify food. Cetaceans use a process known as echolocation (bio-sonar) to navigate and locate prey in the often dark or deep ocean waters.

Noise from the loudest ships was found to be 173 underwater decibels, which equates to around 111 dB in air — around the same level as a loud rock concert. Other research shows that whales spend between 70 and 84 per cent of their time foraging in the absence of ships and boats to meet their daily energy needs. As noise levels increase, the whales were less likely to start foraging and more likely to stop the activity.

A July report from conservation groups says that orcas off BC’s coast face a “high probability of extinction” if conditions don’t change.

Expanded LNG tanker traffic will mean more pollution, no more whales — Richard Mills

Advocacy groups say provincial policy continues to undervalue its water resources as the province pushes to expand major projects, from mining to LNG to AI data centers.

As drought grips northeastern BC, oil & gas companies pay a pittance for frack water — Richard Mills

BC’s industrial water users pay just $2.25 per million liters, the lowest in Canada and far below the $54 to $79 charged in other provinces.

The BC government is enabling the LNG travesty by practically giving away the water the industry uses for fracking, which pollutes the air and water and causes earthquakes. The province’s majestic orcas could soon be extinct if the expected hundreds more LNG tankers are plying BC’s coast, interfering with their ability to mate and find food.

Conclusion

British Columbia’s power demands, especially with all the new industrial projects proposed for northern BC, threaten to outstrip supply, despite the recent completion of the Site C dam.

Without new sources of power, the government may be forced to make some tough choices. If it comes down to LNG versus mining projects, mining should win every time. Current and future mines should be given access to power to unlock billions worth of economic value, while at the same time helping to alleviate import dependencies of critical minerals like lithium, graphite, copper and rare earths.

The LNG projects can always burn natural gas to run their turbines that condense the gas for transport, rather than using hydroelectricity. The projects are already an environmental disaster when it comes to air and water pollution, the displacement of killer whales and other cetaceans, and extreme water usage for next to nothing. Transmitting more power for them (at the expense of lost mining) won’t change the fact that they are a financial and environmental boondoggle that shafts BC taxpayers.

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.