Cypress well-positioned in US lithium/EV supply chain

2021.07.22

According to the most recent report from Wood Mackenzie, mining companies will need to spend $1.7 trillion over the next 15 years, to supply enough lithium, graphite, cobalt, copper and nickel for the shift to a low-carbon world.

The commodities consultancy says meeting new emissions targets being set by countries like Canada, the US, Britain and Japan, will mean large-scale deployment of electric vehicles, renewable power and electrical transmission, all of which will require copious metal content.

Rising demand for lithium is stoking prices for the white metal, padding the bottom lines of large producers like Albemarle and Livent, but setting the table for a potential supply shortfall.

According to a recent article in The Northern Miner, lithium carbonate and hydroxide prices have climbed by 71% and 91% respectively this year, with prices expected to rise further then plateau as more supply comes online in 2021-22. Both are well supplied until 2025, but hydroxide could face a shortage by 2027 as demand for high-nickel chemistry rises.

The higher nickel content in industry-leading nickel-cobalt-manganese (NCM) batteries presents challenges to the battery’s stability. If the metals are used in either the 6-2-2 combination or the 8-1-1 ratio, the chemistry requires lithium hydroxide rather than lithium carbonate.

The future of lithium-ion batteries therefore envisions two key raw materials: nickel sulfate and lithium hydroxide.

Demand for lithium carbonate is expected to rise at a CAGR of 10-14% from 2018-27, while lithium hydroxide demand is seen climbing at a 25-29% CAGR. That change in demand, according to Argus Media, is prompting producers to expand their lithium hydroxide output and shifting mining projects towards developing lithium hydroxide production rather than lithium carbonate.

Resource companies like Cypress Development Corp., discussed further on, which have sizeable lithium deposits and the ability to make lithium hydroxide, are therefore poised to do well. They see themselves profiting from a lithium market segment that is expected to see high demand and potential shortfalls in coming years, especially in North America as the production of battery cells and electric vehicles ramps up.

In Wood Mackenzie’s recent report, entitled ‘Champagne supercycle: Taking the fizz out of the commodity price boom’, the Scotland-based consultancy says another commodities supercycle is on the horizon, but it will be different from any that have come before:

Fossil fuels won’t be in the vanguard and the winners will be the industrial metals needed to electrify society — cobalt, lithium, copper, nickel, and aluminium.

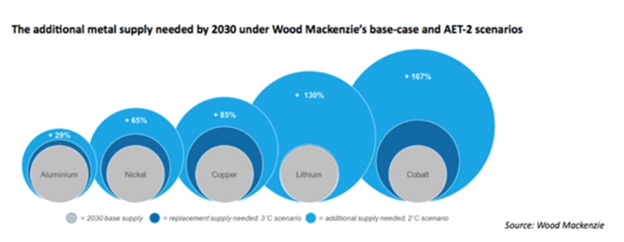

Under Wood Mackenzie’s Accelerated Energy Transition-2 (AET-2) scenario, which is consistent with limiting the rise in global temperatures since pre-industrial times to 2 °C, 360 million tonnes (Mt) of aluminium, 90 Mt of copper, and 30 Mt of nickel will feed the energy transition over the next 20 years. This level of additional metal presents obvious challenges for producers and consumers alike.

Indeed producers will likely play catch-up to explosive lithium demand driven by electrification. The report predicts that 130% more lithium supply needs to be found and extracted, either through hard rock mining, brine operations or clays.

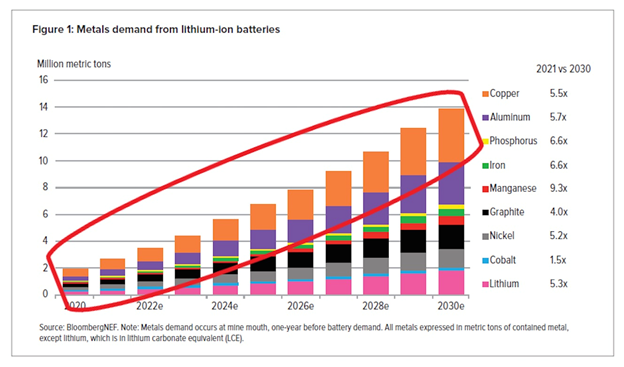

A graph below by BloombergNEF shows 5.3 times more lithium will be demanded in 2030 compared to 2021. In its H1 Battery Metals Outlook, BNEF forecasts total battery demand for 2030 has risen 35% over the past year, owing to expected higher sales of passenger electric vehicles.

Other reputable sources are equally bullish on EVs and grid-scale electricity storage.

Fitch Solutions predicts EV sales to reach over 4.6 million units in 2021. That is 50% more than 2020 which in turn was 36.8% higher than 2019. (despite total passenger vehicle sales falling last year by 20% due to the pandemic)

Australian bank Macquarie forecasts a global EV penetration rate of 16% by 2025 (battery electric vehicles and plug-in hybrids combined), and by 2030, 30% globally and 41% in China — a scenario that would push spodumene (hard rock) prices above $720 a tonne, lithium carbonate above $13,000/t, and lithium hydroxide over $16,000/t.

Utility-scale batteries that store renewable energy, and portable electronics will also contribute to demand, with China top of the heap for battery manufacturing and Germany and the US increasing battery production capacity in the coming years, says Fitch.

By 2025 installed battery production capacity is expected to increase by over 300%, mainly due to the acceleration of vehicle electrification in Europe.

In the United States, there are a number of battery plants in the works to join Tesla, whose first gigafactory in Nevada started production of battery cells in 2017. The company has a plant in Buffalo, New York, and plans to open a third (US plant) in Texas by the end of this year. Tesla also has a “pilot line” at its facility in Fremont, California, for R&D technologies.

In 2020 General Motors announced plans to install its first battery cell factory in Ohio, a project called Ultium Cells launched with its Korean partner LG Chem. The latter opened a plant in Holland, Michigan in 2013.

Another South Korean company, SK Innovation, is planning on opening the first of two battery plants in Georgia this year; the company is a supplier to Volkswagen and Ford.

The latter along with American auto icon GM have big plans to electrify their fleets. Ford announced plans to boost spending on electrification by more than a third, and aims to have 40% of its global volume electric by 2030, which translates to more than 1.5 million EVs based on last year’s sales.

GM reportedly aspires to halt all sales of gas-powered vehicles by 2035, with plans to invest $27 billion in electric and autonomous vehicles over the next five years.

There are currently 11 EV start-ups racing to catch up with market leader Tesla, fueled by money from Wall Street. They include Rivian out of Irvine, California, Lucid Motors based in Newark, CA, Lordstown Motors from Ohio, Nikola Corp (Phoenix), Fisker (Los Angeles), Faraday & Future (Los Angeles), Canoo (Torrance), NIO, Li Auto and XPing from China, and Arrival, based in London.

Tesla

The luxury carmaker is worried about lithium, having had to postpone manufacturing its Cybertruck line of pickups, over a concern it could obtain adequate lithium supply cost-effectively.

Within a week of unveiling the futuristic vehicle, CEO Elon Musk announced they had received 250,000 reservations, a tally that has ballooned to over 1 million, reports Elektrek — partly due to its competitive pricing. A Cybertruck with 500-mile range is likely to be priced from $40,000, with deliveries expected late this year.

Musk raised eyebrows on Tesla’s ‘Battery Day’ in September 2020 when he announced the carmaker had come up with an acid-free way of extracting lithium from clay using sodium chloride, otherwise known as common table salt.

Despite the mining industry’s lack of familiarity with the idea, Musk persisted, earlier this month announcing that the company has filed a new patent for the technology, which it claims is more environmentally friendly than currently used techniques such as acid leaching, and gets higher recoveries.

Tesla summarizes its new method in the patent application’s abstract:

Processes for extracting lithium from a clay mineral and compositions thereof are described. The extraction process includes providing a clay mineral comprising lithium, mixing a cation source with the clay mineral, performing a high-energy mill of the clay mineral, and performing a liquid leach to obtain a lithium rich leach solution.

Last September Tesla was planning a foray into mining

by purchasing Cypress Development Corp. (TSXV:CYP, OTCQB: CYDVF, Frankfurt:C1Z1), which holds a 100% interest in the Clayton Valley Lithium Project in southwest Nevada. However the deal fell through (I suspect the company low-balled CYP), and Tesla went ahead and obtained its own mining rights in Nevada by purchasing 10,000 acres in an undisclosed location.

The company reportedly plans to test its “green lithium” extraction process on its Nevada claims.

Tesla also has a five-year offtake agreement with Piedmont Lithium, which has a project in North Carolina; another five-year supply deal with China’s Sichuan Yahua Industrial Group, and has been sourcing lithium from Ganfeng Lithium, also from China, since 2018.

Albemarle

Tesla isn’t the only major US company that is taking a close look at lithium clay deposits. The largest lithium miner in the world, Albemarle Corp (NYSE:ALB), in January of this year announced it will double the current capacity of Silver Peak by 2025, and start a program to evaluate clays for commercial production.

According to the news release, Beginning in 2021, the company plans to invest $30 million to $50 million to double the current production at the Nevada site by 2025, making full use of its brine water rights. Additionally, in 2021 the company plans to commence exploration of clay and evaluate technology that could accelerate the viability of lithium production from clay resources in the region.

“As a leader in the lithium industry, our priority is to optimize our world-class resources and production. This includes Silver Peak, a site uniquely positioned as the only lithium-producing resource in the United States,” said Eric Norris, Albemarle President, Lithium. “This investment in domestic capacity shows that we are committed to looking at the many ways in which Silver Peak can provide domestic support for the growing EV market.”

In addition to examining clay resources, Albemarle is seeking ways to optimize lithium extraction from its brine resources, including those in the Clayton Valley. Through a Department of Energy-sponsored research project with Argonne National Laboratory, the company is investigating a process to streamline production of lithium hydroxide, which is principally used in EV batteries, from brine resources.

So, not only is Albemarle interested in lithium clay deposits, it is also trying to produce lithium hydroxide directly from brines, which would skip the intermediate step of making lithium carbonate first. As I alluded to earlier, Cypress has a lithium claystone deposit from which it will produce lithium hydroxide, the lithium compound currently used in high-nickel-content EV batteries that is likely to drive future lithium demand.

Another source identified by AOTH reports that, while the Silver Peak expansion will be a notable increase in production (Albemarle had very low annual production from 2018-20 in spite of being one of the top global lithium producers; last year only about 6 tonnes was outputted from Silver Peak), it will quickly be sucked up by a sharp increase in US lithium demand as vehicle production grows.

Moreover, Albemarle reportedly has its eye on additional domestic sources of lithium. The company has options. It controls lithium-containing brines in Arkansas that are part of its bromine business; it could resume mining hard rock (spodumene) deposits it owns at Kings Mountain, NC, where it operates a lithium chemical plant. Most interesting to us at AOTH, Albemarle could examine its sedimentary deposits at Silver Peak — clay formations that are the original source of the lithium in its brines.

We know that Albemarle provided Cypress with lithium brine for metallurgical testing, and is helping to shape the final product at the pilot plant. Albemarle’s Jan. 7, 2021 news release regarding its plans to investigate lithium clays gives us a good indication of what might be taking place under a confidential non-disclosure agreement between the two companies, if in fact such an NDA exists.

Cypress Development Corp

Cypress’ property covers a total area of 5,430 acres and is located immediately east of Albemarle’s Silver Peak mine, North America’s only lithium brine operation, which has been in continuous operation since 1966. Exploration and development by Cypress have led to the discovery of a world-class resource of lithium-bearing claystone adjacent to the brine field to the east and south of Angel Island, an outcrop of Paleozoic carbonates protruding up through the lakebed sediments.

In a pre-feasibility study (PFS) released in 2020, it is estimated that the Clayton Valley project could produce on average 27,400 tonnes of lithium carbonate equivalent (LCE) per year, at a mining and processing rate of 15,000 tpd of mill feed.

The production figure is based on probable mineral reserves of 213 Mt averaging 1,129 ppm Li (1.28 Mt LCE). Reserves and production plan are derived from an indicated mineral resource of 1,304 Mt averaging 905 ppm Li (6.28 Mt LCE).

Mineral resources and reserves for the PFS are derived from only a portion of the initial pit, showing a mine life of 40-plus years. All resources and reserves are pit-constrained by property and geological boundaries.

The large size — combined with its surface exposure and flat-lying nature — is a key feature of claystone deposits. This would allow mining with a negligible strip ratio of 0.29:1 due to minimal overburden, and no drilling or blasting.

As such, the Clayton Valley project has the potential to be a sustainable, low-cost lithium producer.

The company is currently working towards a feasibility study and permitting of a mine and metallurgical facility for its large deposit of lithium-bearing claystone.

Should everything go according to plan, Clayton Valley would become a viable source of high-purity lithium hydroxide (LiOH) suitable for EV battery usage for decades.

In March, Cypress took a vital step in advancing the Clayton Valley project towards production by announcing the development of a lithium extraction pilot plant for the lithium-bearing claystone.

The pilot plant is located at a metallurgical facility south of Beatty, Nevada, owned and operated by del Sol Refining Inc., which is permitted under the State of Nevada for chemicals use with permits in place with the US Environmental Protection Agency (EPA).

The initial operation of the pilot plant will focus on chloride-based leaching to confirm the results of the company’s scoping study on lithium extraction.

The pilot plant is planned to operate at a rate of one tonne/day and will be designed for correct interaction and testing of the major components within the extraction process and assessment of the resulting lithium products.

According to Cypress, the program will provide essential data for a planned feasibility study and enable the company to produce marketing samples to support negotiations with potential offtake and strategic partners.

Conclusion

Cypress and its Clayton Valley Lithium Project presents a compelling partnership opportunity for Tesla, Albemarle, or other electric vehicle and lithium battery manufacturers in the United States.

Albemarle’s US production is low and the company has plans to double output at Silver Peak. ALB is seeking ways to optimize lithium extraction from its brine resources, including those in the Clayton Valley. Cypress’s Clayton Valley Lithium Project shares a land border with Silver Peak. Albemarle plans to start exploring clays, and evaluating technology that could accelerate the viability of lithium production from clay resources in the region.Would it not make sense for the two companies to cooperate?

Tesla also has good reasons to do a deal with CYP. The junior has a world-class lithium deposit and its extraction process uses low amounts of acid and water. The metallurgy is environmentally friendly since it can recapture and recycle its liquids and be cost-effective.

In late December China’s Sichuan Yahua Industrial Group Co Ltd signed a deal to supply battery-grade lithium hydroxide to Tesla for the next five years. The deal valued at US$630-$880 million over 2021-25 translates into 63,000-88,000 tonnes – 12,600-17,600 tonnes per year – over the 5 years.

The only US producer currently in the US is Albemarle which only outputted ~6 tonnes last year. When you add the 11 other electric vehicle manufacturers that are competing with Tesla for marketshare, that plan to produce EVs as early as 2022, the increase in lithium demand is going to be off the charts.

Tesla went overseas, for 5 years, to get its lithium, but as we have seen with rare earths and personal protective equipment during the pandemic, the Chinese tend to lord power over their competitors and will restrict supply when it’s in Beijing’s best interests. For security of supply, Tesla would be far better off sourcing its lithium and other raw materials domestically, as Elon Musk has repeatedly said he would. What better location than Nevada, voted the best jurisdiction for mining investment attractiveness in the latest (2020) Fraser Institute survey?

In short, there is enormous lithium demand in the United States, and an enormous shortage of US lithium supply — a situation begging for new players to bridge the gap.

This bodes very well for junior companies in the lithium developmental phase advancing towards commercial readiness.

Lithium is the trend and can be investors’ friend. Junior companies like Cypress that have large, commercially viable lithium deposits are in a very desirable position for a larger company to buy a majority stake or make a takeover offer.

Ford, GM, Toyota, VW, Tesla, Rivian, Lucid, or Albemarle, are all likely candidates for taking a majority stake in CYP, making an acquisition, or signing an offtake agreement similar to what Tesla announced with Piedmont Lithium.

Cypress’s prefeasibility study in 2020 showed a net present value (NPV) of US$1.3 billion, but this was based on a lithium carbonate equivalent (LCE) value of $9,500 per tonne.

This year, lithium prices have gone on a tear. If current prices for battery-grade lithium carbonate and lithium hydroxide are used ($14,920/tonne for lithium hydroxide and $13,606/tonne for lithium carbonate according to FastMarkets), the NPV will be considerably higher.

Despite being on a path to commercial production, with a water rights agreement in place with Sunrise Gold, and a license agreement with Chemionex for their Direct Lithium Extraction (DLE) technology and equipment, Cypress trades at a significant discount to its peers, just C$1.14 per share with a market value of only $137 million.

CYP has an agreement (imo with Albemarle) to obtain brine material but is unable to discuss, since it is under a confidential non-disclosure agreement.

It has a proprietary metallurgical processing flow sheet which is considered to be environmentally friendly — an important consideration for Tesla and any other EV company whose manufacturing processes “from mine to showroom” will be under intense scrutiny for “greenwashing”.

If a deal is made for any of the following — a production offtake agreement, an offer to shareholders for a majority stake, or a full takeover offer — CYP shares will reflect closer to a fair and reasonable price.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Cypress Development Corp. TSX.V:CYP.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.