Cypress hits home-run prefeasibility study

- Home

- Articles

- Uncategorized

- Cypress hits home-run prefeasibility study

2020.05.19

There are times in the junior resource markets when a company slips under the radar and isn’t being properly valued by retail and institutional investors. Such is the case, in my opinion, with Cypress Development Corp (TSX-V:CYP). Cypress just put out a barnburner of a prefeasibility study (PFS) on its Clayton Valley Lithium Project, that is the best I’ve seen in over a decade of investing in and writing about the lithium space.

To summarize:

The PFS shows an outstanding present value of $1.052 billion at an 8% discount rate, yielding an internal rate of return (after tax) of 25.8%. Payback is 4.4 years.

The IRR is based on a lithium carbonate equivalent (LCE) price of $9,500 a tonne. All of the recent lithium PFS, and the more advanced studies, have used at least $12.50/kg, Ioneer’s used $13.20/kg.

Currently LCE sells for US$7.50/kg while lithium hydroxide prices in China, Japan and Korea are US$9.75/kg. (Cypress plans on producing lithium hydroxide, a lithium end-product that is a key ingredient of an electric vehicle’s lithium-ion battery cathode)

The proposed mine would produce an average 27,400 tonnes of LCE a year and have a mine life of +40 years. The mine would be neither a hard-rock mine nor a lithium brine operation, but rather, would process the lithium from claystones in Nevada’s Clayton Valley by leaching the material with dilute sulfuric acid.

The PFS is all the more impressive considering that Cypress went from drilling to prefeasibility in only three years – a very short turnaround time for any junior in any commodity. Moreover, Cypress only spent a million dollars in exploration to achieve the numbers in the report, which are comparable to the preliminary economic assessment (PEA), released in the fall of 2018.

The Clayton Valley Lithium Project hosts Measured and Indicated mineral resources of 593 million tonnes (Mt) averaging 1,073 parts per million (ppm) Li (3.387Mt LCE). Production is based on a Probable mineral reserve of 222 million tonnes (Mt) averaging 1,141 ppm Li (1.353Mt LCE). The project ranks among the largest undeveloped lithium deposits in the world.

Cypress states:

The key features of the claystone deposit include its large size, surface exposure and flat-lying nature. These features allow mining with negligible strip ratio due to minimal overburden and no interbedded waste, and no drilling or blasting in excavation. Metallurgical testing indicates low cost processing can be achieved by leaching with low acid consumption and high lithium recovery. Self-generated power from a 2,500 tpd acid plant is included in the project’s costs.

“This PFS is a major milestone for Cypress. These positive results take us closer to our goal of developing a world-class lithium deposit, said Cypress’ CEO, Dr. Bill Willoughby. “Cypress’ land position and resources afford us the opportunity for a long-life project with low operating costs and potential to be a significant source of lithium for the United States.”

Cypress has a market cap of $17.1 million and was trading at 19 cents a share at Tuesday’s close on the TSX Venture Exchange.

PFS highlights

Let’s take a closer look to show readers just how good the report is, and to see why some investors are missing the boat on what is the largest lithium deposit in North America – one that can be mined cheaply and profitably, churning cash of $112.5 million to $260 million a year for the next four decades.

Resource investors are shying away from large capital expenditure projects in the billions that are too ambitious for juniors. Too many have been burnt in the last mining down-cycle to trust that a micro-cap will be able to raise that kind of money or even interest a larger mining company in a buy-out.

In contrast, Cypress’ PEA has a capex of just under half a billion ($493 million), two-thirds of which will go into building a sulfuric acid plant. Slurried feed from a shallow open pit will be transported to the mill where lithium extraction is achieved through leaching at elevated temperatures with dilute sulfuric acid, followed by evaporative concentration, purification and crystallization. Processing costs are estimated at $3,392 per tonne of LCE, and could be brought down further by selling excess sulfuric acid, selling excess power generated from the acid plant to the electricity grid, along with offsets from the sale of by-products – various salts and rare earths.

If lithium carbonate equivalent continues to sell @ $7,500/tonne, Cypress is looking at a $4,108/tonne profit margin, generating cash flow of $112.5 million a year based on production of 27,400 tonnes LCE. Since Cypress plans on producing lithium hydroxide, currently US$9.75/kg., gross profit would be in the range of $267m. (At AOTH we believe the lows for lithium pricing is in, or close. We explain why we believe this later in the article)

That is without accounting for additional revenue streams from the sale of by-products including rare earth elements and alkali salts.

Cypress has a unique and potentially extremely lucrative opportunity to mine rare earths at its Clayton Valley Lithium Project. REEs were detected in leach solutions ranging from 100 to 200 ppm. The rare earths include scandium, dysprosium and neodymium, in order of economic value.

Cypress ran diagnostic leach tests and determined there is the potential to recover these elements, along with potassium, magnesium and other salts.

Something else we find interesting regarding production cost reductions is potential revenue from Cypress’ proposed sulfuric acid plant. A sulfuric acid plant converts molten sulfur into low-cost sulfuric acid, reducing transportation costs and providing a low-cost source of power. Excess acid could be sold locally to large consumers and if a co-generation facility were built, it could provide enough carbon-free electricity to power the entire project, with excess power being sold to the grid.

Cypress has the potential to sell excess sulfuric acid and generate more revenue that way – further bringing down its costs per ton – while also generating electricity from the acid plant to recover power costs.

Metallurgy

The size of a lithium deposit is of limited value if the metallurgy doesn’t work. The prefeasibility study proves that the metallurgical process for separating lithium from clays is commercially viable.

Cypress’ vision is to build a mine with the ability to extract whatever oxides they choose, from the processing plant. The end result is that through by-product credits Cypress could shave millions of dollars off of their processing costs – further enriching what we already think is a very profitable mine.

Picture the operation as a sulfuric acid plant with an open pit on one side, a processing plant on the other. Sulfuric acid produced from elemental sulfur in the acid plant is combined with water and claystone from the pit in heated, agitated leach tanks. Solid particles are then separated and the leach solution goes into the lithium recovery plant where lithium carbonate is the end result, which will be further refined into lithium hydroxide. Magnesium, potassium and rare earth oxides – scandium, dysprosium and neodymium – are potentially recovered out of the leach solution along the way.

Last year Cypress completed the first two phases of the prefeasibility study – confirming that lithium can be acid-leached and extracted at high enough recovery rates, to successfully separate the lithium-rich claystone ores from the sulfuric acid leachate. Large leach tests yielded an average 86.5% extraction of lithium into solution and 126.5 kg/tonne for acid consumption.

It’s a major technical problem to separate ultra-fine clay particles (<5 microns) from a leach solution. Cypress has done it, putting the company at the forefront of lithium clay projects globally.

The US now has a major source of lithium hydroxide and potentially a considerable amount of rare earth elements and alkali salts.

Dr. Willoughby and his team contracted an engineering firm, NORAM, to do commercial-grade testing, putting Cypress one step beyond bench-scale testing of its metallurgical process, that is normally sufficient for a PFS.

Cypress had done enough testing to release its prefeas in the fall of 2019 but determined “we want more proof” that the metallurgy works, specifically, on a commercial scale. Cypress thus hired NORAM Engineering to conduct bulk-sample testing.

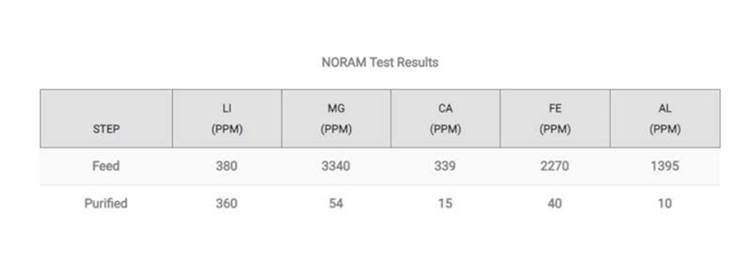

The results of NORAM’s six-week test program, presented below, are great. Starting with a feed of 380 ppm, using Cypress’ flowsheet NORAM was able to strip out all the impurities to negligible levels (magnesium, calcium, iron and aluminium) and end up with a concentrated solution of 360 ppm lithium – only a fraction less than what it started with.

The PFS therefore comes with an extra layer of certainty/ derisking, because it not only has bench-scale but commercial-sized bulk sample test results. This data will be extremely valuable to a potential joint-venture partner or a company considering a buy-out.

Project design is based on mining 15,000 tonnes per day to produce 27,400 tonnes per year of lithium carbonate equivalent. The “test pit”, a small portion of the Clayton Valley Lithium Project resource, will target drill intersections encountered during 2019 drilling, at a cut-off grade of 900 ppm. The constrained pit shell contains mostly Measured and Indicated resources, with only 2.3Mt (averaging 1,005 ppm Li) in the Inferred resource category.

This test pit is expected to support the first 18 years of production. Material will be open-pit mined at a low 0.15:1 strip ratio and transported using semi-mobile feeder-breaker and conveyors.

As the foundation for further work, the PFS opens Cypress up to partnership agreements, financing deals, or even a buy-out.

The next step is to conduct a pilot plant study prior to initiating a feasibility study and permitting; the program is estimated to cost $6.75 million. The company is continuing testing and planning in preparation for the pilot plant, has begun baseline environmental studies, and is engaged in sourcing funds for further studies.

The US needs Cypress’ lithium

According to Benchmark Mineral Intelligence the US only produces 1% of global lithium supply and 7% of refined lithium chemicals, versus China’s 51%. The country is about 70% dependent on imported lithium.

To lessen US lithium dependency will require the building of a mine to battery to EV supply chain in North America.

The first step is to develop new North American lithium mines.

Currently the only US lithium producer is chemicals giant Albemarle. Lithium products from Albemarle’s Silver Peak lithium brine operation in Nevada are sent to its processing plant in North Carolina. This material is then loaded on ships and sent to Asian battery manufacturers, which sell the batteries to EV companies.

Automakers plan on spending a combined $300 billion on electrification in the next decade.

It’s curious how several top EV manufacturers are planning on, or are already building, electric vehicle plants and facilities in the United States, without disclosing how they will source their raw materials.

In 2017, Mercedez-Benz announced plans to set up an electric car production facility and battery plant at its existing Tuscaloosa, Alabama plant.

Volkswagen has said it will invest $800 million to construct a new electric vehicle – likely an SUV – at its plant in Chattanooga plant, starting in 2022.

Korean company SK Innovation has said it will invest US$1.7 billion in the US’ first electric vehicle plant, to serve Volkswagen, in neighboring Georgia. The 9.8 gigawatt-hour-plant would be the first EV battery plant in the United States. SK recently announced a second 10-GWh plant requiring an investment of $1 billion.

GM has rolled out its 2020 Cadillac SUV, built in Spring Hill, Tennessee, in a move designed to challenge Tesla.

Recently Tesla announced plans to introduce a new battery in its Model 3 sedan, in China this year or early next.

Reuters reports the new low-cost, long-life battery is expected to bring the cost of electric vehicles in line with gasoline models.

The batteries, designed to last a million miles, will rely on low-cobalt and cobalt-free chemistries. The California-based company with “gigafactories” in Nevada and China, is reportedly talking to CATL, the largest electric-vehicle battery maker in the world, about employing CATL’s lithium iron phosphate batteries, which use no cobalt, the most expensive metal in EV batteries.

Prices for these cobalt-free battery packs have fallen below $80 per kilowatt hour, while CATL’s low-cobalt NMC (nickel, manganese, cobalt) battery packs are close to $100/kWh – which is the point when EV prices reach parity with gasoline vehicles, notes The Drive. (batteries are the most expensive component of an EV)

Comparable low-cobalt batteries being developed by General Motors and Korea’s LG Chem are not expected to reach those levels until 2025. However, GM this week said it is “almost there” on building its own EV battery with a million-mile lifespan.

The iconic US automaker in March unveiled its Ultium advanced battery system, to be made in Ohio through a $2.4 billion battery production joint venture with partner LG Chem, Reuters reported.

Meanwhile Volkswagen, which as mentioned is investing close to a billion dollars in EV production at its Tennessee plant, is racking up electric vehicle sales despite the sharp downturn in car purchases associated with worldwide coronavirus lockdowns.

The German company said in a podcast Monday morning that many of its EVs are already “sold out far into the second half of the year,” according to Bloomberg.

CEO Herbert Diess said Volkswagen’s EV market share has more than doubled to nearly 4% and could rise to 5% or 6% by the end of this year, thanks to incentives and tax breaks. The company is aiming for EVs to represent about 40% of deliveries by 2030, and is “very confident” it “won’t lose sight of Tesla,” Diess said in the podcast.

Conclusion

A positive prefeasibility study means CYP has successfully completed another step on its development path to building a mine.

The project is next to Albemarle’s Silver Peak Mine, the only producing lithium mine in the United States. Albemarle (NYSE:ALB) is the world’s largest lithium producer. Tesla is the world’s largest EV manufacturer; its Gigafactory is just 200 km away from CYP’s Clayton Valley Lithium Project.

Current annual lithium (LCE) supply is around 360,000 tonnes. Total lithium demand of LCE is expected to reach over 1 million tonnes by 2025 or higher, states S&P Global Platts Analytics.

The United States is about 70% dependent on imported lithium.

How will the United States, how will Volkswagen, Tesla, Albemarle, GM, Mercedes and SK Innovation obtain enough lithium for the storm of demand that is brewing? Enter Cypress Development Corp. – a US based company, by getting in bed with CYP, would have the capability of producing batteries for electric vehicles that are affordable to the average American, while also becoming the beach-head for a powerful North American electric-vehicle supply chain that could compete with China, and be independent of its critical minerals.

That would be huge.

There’s no way Silver Peak can produce enough lithium to supply American needs, especially with all of the EV battery and auto production facilities planned.

When you think about the huge amount of ore available to be mined – it’s among the largest LCE resources in the world – and the valuable products that will be coming out of the relatively easy processing flow sheet at the end, we believe Cypress may have the most important mine in America in decades.

Cypress Development Corp

TSX-V:CYP Cdn$0.19 2020.05.19

Shares Outstanding 90,077,001m

Market cap Cdn$17,114,630m

CYP website

Richard (Rick) Mills

subscribe to my free newsletter

aheadoftheherd.com

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Cypress Development Corp. (TSX.V:CYP)

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.