Cypress Development PEA shows rare earth recovery potential

2018.11.27

The devil, or should we say the dollars, are in the details. Two weeks ago we reported on the preliminary economic assessment (PEA) put out by Cypress Development Corp (TSX-V:CYP) on its Clayton Valley Lithium Project.

This week, the full details of that report were revealed on SEDAR (System for Electronic Document Analysis and Retrieval). SEDAR is the official site that provides access to information filed by issuers with the 13 provincial and territorial securities regulatory authorities. SEDAR gives investors in Canadian exploration companies like Cypress Development the information they need to make informed decisions, while also promoting the transparency of Canadian capital markets.

Having the report on SEDAR gives Cypress much greater exposure to their PEA than the shorter version that was published on Sept. 6.

Here we dissect the full PEA – pointing out the most salient facts and figures – which will strengthen our earlier conclusion that the PEA is outstanding. And a pleasant surprise: the proposed mine has, potentially, enough rare earths to significantly reduce the costs of production.

To summarize:

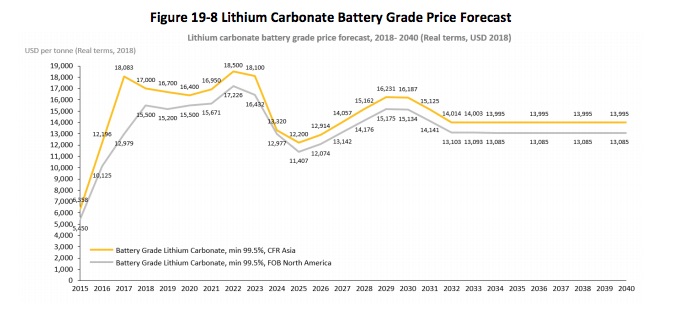

The PEA showed an attractive net present value of $1.45 billion at an 8% discount rate, yielding an internal rate of return (after tax) of 32.7%. Payback is just under three years. The IRR is based on a lithium carbonate price of $13,000 a tonne, what we here at Ahead of the Herd think is a conservative estimate.

The proposed mine would produce an average 24,042 tonnes of lithium carbonate a year, and have a mine-life of 40 years. The mine would be neither a hard-rock nor a lithium brine operation, but rather, would process the lithium from clays in Nevada’s Clayton Valley by leaching with sulfuric acid.

The IRR is all the more impressive considering that Cypress only spent a million dollars in exploration to achieve the numbers in the report. What’s more, the resource increased significantly from the original estimate released in June. The Clayton Valley Lithium Project now hosts a combined indicated and inferred resource of 8.9 million tonnes of lithium equivalent (LCE), which is 2.5 million tonnes more than previously reported. This breaks down to 3.835 million tonnes of LCE in the indicated category, and 5.126 million tonnes of LCE in the inferred category. The grades in the PEA are only slightly different, at 867 parts per million (ppm) indicated and 860 ppm inferred, versus the June resource estimate’s 889 and 888 ppm.

The project

Three years ago Cypress began prospecting in the Clayton Valley, hoping to find a property that could support a lithium carbonate resource to compete with or possibly complement its neighbor, Albemarle’s Silver Peak Mine, whose brine grades are declining. Silver Peak is the only operating lithium mine in the US.

Cypress initially looked at lithium brine ground, but it was also aware that none of the stakes containing basement-scale gravity lows in the valley, known to contain lithium carbonate, had ever produced any brines.

The former head geologist noticed that some of claims on the south flank of an outcropping known as Angel Island had not been staked, and those that had been, had elapsed.

Cypress wasted no time in acquiring two land packages: the 1,520-acre Glory Project totaling 76 placer/lode claims located in Esmeralda County, and the 2,700-acre (35 association placer claims) Dean Project. The Glory claims share their western boundary with claims controlled by Pure Energy Minerals whose lithium brine resource is just west of Cypress’ property boundary.

Because Clayton Valley is an endorheic basin – endorheic basins are closed drainage basins that retain water and allow no outflow – precipitation and inflow water from the surrounding mountains only leaves the system by evaporation and seepage.

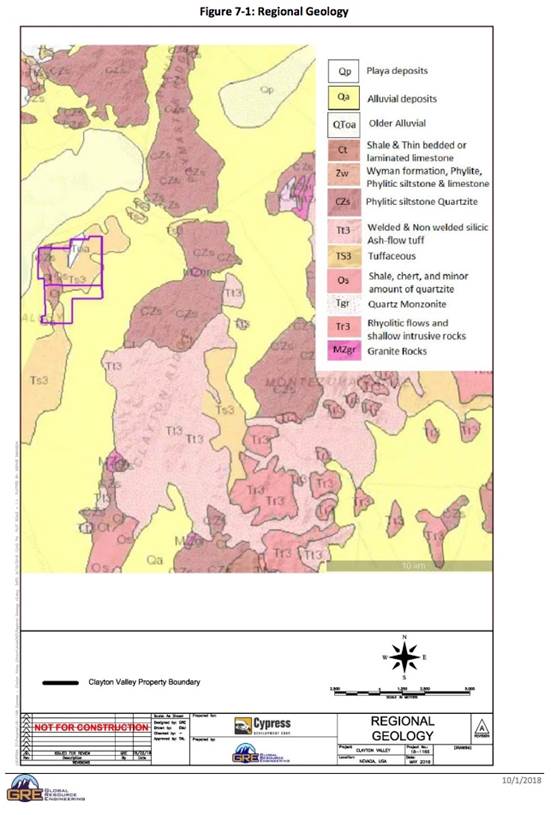

According to earlier (1979, 1986, 2011 and 2013) geological descriptions of the Clayton Valley and summarized in the PEA, “Multiple wetting and drying periods during the Pleistocene [period] resulted in the formation of lacustrine deposits, salt beds, and lithium-rich brines in the Clayton Valley basin. Extensive diagenetic alteration of vitric material to zeolites and clay minerals has taken place in the tuffaceous sandstone and shale of the Esmeralda Formation, and anomalously high lithium concentrations accompany the alteration… These tuffaceous lacustrine facies of the Esmeralda Formation contain up to 1,300 parts per million (ppm) lithium and an average of 100 ppm lithium (Kunasz, 1974; Davis, et al., 1979). Lithium bearing clays in the surface playa sediments contain from 350 to 1,171 ppm lithium (Kunasz, 1974).” (see map below)

Or in layman’s terms, the lithium-rich mudstones likely were allowed to accumulate in a protected, lagoon-type environment, compared to the rest of the valley where boulders and debris were washed away throughout millions of years of rainy seasons.

The PEA describes the mineralization in terms of three layers, with significant lithium concentrations found at surface and up to 124 meters deep – in mudstones and claystones:

The mineralized zone consists of three primary units: an “upper” olive-colored mudstone, “middle” blue mudstone/claystone, and “lower” olive-colored mudstone. The middle (reduced) portion of the mineralized zone represents much of the overall mineralized sedimentary package. The upper and lower mudstone units are oxidized to an olive-green color, while the middle mudstone/claystone is reduced and blue, black, or grey in color in fresh drill core. The three primary units are generally overlain by tuffaceous mudstone and underlain by increasingly sandy mudstones. Elevated lithium concentrations occur in all the uplifted lacustrine strata encountered, but lithium concentrations are notably higher and more persistent in the three primary units. These units are 20 to 80 meters thick, with the middle units, referred to as Upper Olive, Main Blue, and Lower Olive, respectively, having average grades of 850 to 1,100 ppm. Portions of these units could be selectively mined at grades exceeding 1,100 ppm lithium.

The company has established a resource and has an economic metallurgical process for what Cypress believes is a large, bulk-tonnage deposit of leachable, non-hectorite claystone (clays containing hectorite are more difficult and costly to process).

With geological data in hand and two prospective properties acquired, Cypress started taking surface samples in September 2016. The samples returned results ranging from 340 parts per million (ppm) to 2,940 ppm, with an average grade of 925 ppm lithium carbonate equivalent (LCE). States the company:

Cypress had discovered high lithium grades in a non-hectorite claystone over a wide area on surface at the Dean Project that well exceeded other reported Clayton Valley sediments and brines.

The first stage of a 2017 drill program involving nine core holes in the claystone delivered average grades of 900 ppm, or 0.48% lithium carbonate equivalent , throughout an average thickness of 250 feet starting from just below surface. 23 holes have now been drilled, allowing Cypress to put out a maiden resource in June.

Since then, the company has managed to increase the resource by 39%, to almost 9 million tonnes of lithium carbonate equivalent (LCE – 3.835 million tonnes of LCE in the indicated category, and 5.126 million tonnes of LCE in the inferred category). According to CEO Bill Willoughby, the increase was mostly in the inferred category, and occurred after staking a key area south of the initial “starter” pit. The term “initial pit shell” in the PEA is a bit of a misnomer, and, while the increase in resources makes Clayton Valley one of the largest claystone deposits, the additional tonnage doesn’t impact the PEA. The initial pit shell now contains about 500 million tonnes of claystone, more than enough to last Cypress 40 years of mining at the rate of 5.5 million tonnes per year. (15,000 tonnes per day)

Five to 10 more drill holes are recommended to convert the indicated material in the starter pit to the measured category, and most of the inferred to indicated or measured.

The company has shown that lithium can be extracted from the claystones using a flow sheet whereby recoveries of +80% can be achieved in short leach times (4 to 8 hours) using conventional dilute sulfuric acid and leaching. The amount of sulfuric acid and reagents needed are relatively low, and being able to leach the lithium with acid avoids more costly processing historically associated with other claystone deposits, specifically those needing high temperature roasting.

Slurried feed from a shallow open pit will be transported to the mill where lithium extraction is achieved through leaching at elevated temperatures with dilute sulfuric acid, followed by evaporative concentration, purification and crystallization of lithium carbonate. Processing costs are estimated at $3,983 per tonne of LCE.

The capex of the proposed lithium mine is $481 million, with the proposed mine producing an average 24,042 tonnes of lithium carbonate a year and having a minelife of 40 years.

As stated the project has a net present value of $1.45 billion at an 8% discount rate, yielding an internal rate of return (after tax) of 32.7%. It’s important to note that the mine’s break-even IRR is at $4,800 a tonne – significantly below current lithium prices, which range from $10,000 a tonne in China for low-quality, non-battery-grade technical lithium, up to $16,500/t for lithium brines produced by world number one and two lithium producers Albemarle and SQM.

“Personally I believe in the project because every step along the way we come to a decision point where we get the answers and the answers have always been positive,” Willoughby said in a recent Ahead of the Herd video interview. “First it was the size of the deposit. Is it really as big as we think it is? Drilling shows us that it is. The second part was on the metallurgy. A year ago was the first time we started doing leach tests on it. We found if we raised the temperature somewhat, used a little bit stronger sulfuric acid, the lithium is leachable, so that was another check box. Now we’re working on the check boxes on economics, as far as operating cost and capital cost, whether we can make a product at the tail end which is market quality. “

AOTH Interview With Cypress CEO Bill Willoughby

Not all lithium is created equal

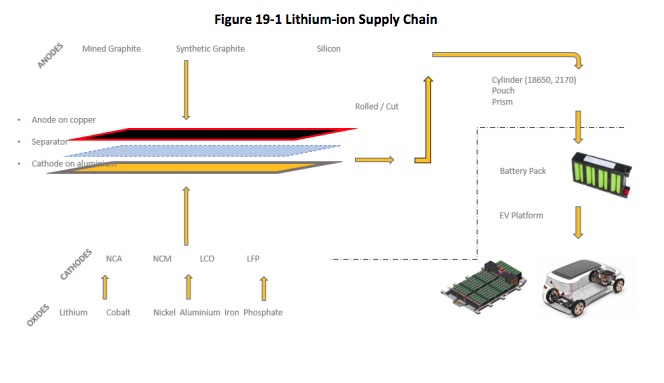

Central to the success of any lithium project is the ability to process the lithium to a high enough percentage to make it marketable. The explosion of interest in electric vehicles worldwide has vaulted the demand for battery-grade lithium needed to make lithium-ion batteries used not only for EVs but cell phones and a myriad of other electronic devices. Lithium miners are aiming for battery-grade lithium they can sell to battery manufacturers who are the suppliers to the big automakers – nearly all of which are rolling out new electric models of cars, SUVs and even trucks.

While some lithium is easy enough to process to 99.5% – the grade required for lithium-ion batteries – other lithium is too low quality for batteries and must be upgraded to a higher percentage.

Such is the case with the “technical-grade” lithium being produced by China right now. While China used to be an important supplier of battery-grade lithium, they have run out and are now producing the lower-quality lithium used in glass and ceramics. But upgrading that lower-grade lithium is expensive, and the Chinese are looking elsewhere. The country has signed lithium offtake agreements with mines in Australia, Canada and Africa, and is especially eyeing the “lithium triangle” straddling Chile, Argentina and Bolivia, which produces 70% of the world’s lithium.

This is a big game changer for the industry. It means that while China used to be a significant supplier of battery-grade lithium, this is changing, opening the door to other lithium mines – namely, brine deposits in South America, hard-rock mines in Australia and elsewhere, and lithium clay deposits in the USA. Bottom line: not all lithium coming into the market can be purified, in a cost-effective manner, to produce an acceptable battery-grade product. SQM, the world’s second largest lithium miner, received US$16,500 per tonne for its second quarter lithium sales. A far cry from the US$10,000 per tonne received in China.

Many junior exploration companies chasing lithium projects are not cognizant of the economic and technical challenges; no brine mining projects and even fewer hard rock projects have been put into production for the last two decades and when done so it’s been by the major lithium producers.

Hard rock lithium miners have large problems facing them when competing with brine economics – firstly most have large capital costs for start up and secondly their production cost is roughly twice what it is for the brine exploitation process.

Lithium products derived from brine operations can be used directly in end-markets, but hard-rock lithium concentrates need to be further refined before they can be used in value-added applications like lithium-ion batteries.

Regarding the metallurgy at the Clayton Valley Lithium Project, Cypress describes a series of purification processes that separate the lithium carbonate from the source clay using an acid leach solution. As described in the PEA:

The process is broken down into primary impurity removal (PIR), secondary impurity removal (SIR), solution polishing, and product formation. The PIR process uses lime and/or self-neutralizing properties of the feed to raise the pH and cause iron and aluminum impurities to precipitate. The SIR process raises the pH further to cause calcium, magnesium, and manganese impurities to precipitate. A further ion exchange solution polishing circuit is often employed to remove residual impurities. Final product as lithium carbonate is precipitated using soda ash. A series of solid-liquid separation stages are involved between purification stages along with changing temperatures to facilitate the chemical reactions. The final lithium carbonate product is dried at low temperature for final product delivery, purities typically exceed 99.5%.

Significantly, the PEA notes that membranes could be used to improve the recovery rates of lithium from the acid leach solution. The membranes pump solutions at high pressure and allow the selective passage of elements across the membrane surface. While the technology has not yet been applied to the lithium industry, Cypress has apparently engaged a third party vendor to develop a flowsheet and estimated capex/opex for such a system.

“The costs appear competitive with the base case processing flowsheet, and further consideration is warranted given the flowsheet includes potential recovery of rare earth elements and magnesium,” the PEA states.

Rare earths potential

Did somebody say rare earths? Yes, you read that right.

Mining rare earth elements (REEs) is fairly straightforward but separating and extracting a single REE takes a great deal of time, effort and expertise.

The ore is ground up using crushers and rotating grinding mills, magnetic separation (bastnaesite and monazite – are highly magnetic, they can be separated from non-magnetic impurities in the ore through repeated electromagnetic separation) and flotation gives you the lowest value sellable product in the rare earth supply chain – the concentrated ore. The milling equipment; crushers, grinding mills, flotation devices, and magnetic, gravity, and electrostatic separators all have to be configured in a way that suits the type of ore being mined – no two ores respond the same way.

The major value in REE processing lies in the production of high purity rare earth oxides (REOs) and metals – but it isn’t easy. A REE refinery uses ion exchange and/or multi-stage solvent extraction technology to separate and purify the REEs. Solvent-extraction processes involve re-immersing processed ore into different chemical solutions in order to separate individual elements. The elements are so close to each other in terms of atomic weight that each of these processes involve multiple stages to complete the separation process. In some cases it requires several hundred tanks of different solutions to separate one rare earth element – heavy rare earth elements are the hardest, most time consuming to separate.

The composition of REOs can also vary greatly; they can and often are designed to meet the specifications laid out by the end product users. An REO that suits one manufacturer’s needs may not suit another’s.

For more on REEs, read our Mine to Magnet.

According to the PEA Cypress has a unique and potentially extremely lucrative opportunity to mine rare earths at its Clayton Valley Lithium Project. REEs were detected in leach solutions from hole DCH-2 in all samples, ranging from 100 to 200 ppm. The rare earths include scandium, dysprosium and neodymium, in order of economic value (ie highest to lowest price).

Cypress ran diagnostic leach tests and determined there is the potential to recover these elements, along with potassium, magnesium and other salts. From the PEA:

Using just the 1-hour leach test extractions and an annual feed rate of 5.475 million tonnes, the project, for example, could generate 10 to 15 tonnes of scandium, 25 to 40 tonnes of neodymium, and 5 to 10 tonnes of dysprosium in solution as potentially recoverable oxides. Additional test work is warranted.

Let’s pause for a moment and examine those numbers. Even though dysprosium oxide sells for US$230.20kg and neodymium oxide sells for US$59kg, and after a lot more refining their metals much higher, we want to focus on scandium, an extremely valuable rare earth element that is alloyed with aluminum to make lighter yet stronger airplanes for example. Russia was the first to recognize scandium as a useful metal in the 1950s, and found applications for it in Soviet aircraft and weaponry. Since then, Russia, Ukraine, Kazakhstan and Uzbekistan produced the vast majority of the world’s scandium concentrates and other scandium compounds. Over this period the US and Australia produced small amounts of scandium as a byproduct of fluorite, uranium and tungsten ore processing, according to an interview in Streetwise Reports.

Scandium is expensive, but the market is small. According to the USGS, supply and consumption of scandium is estimated at just 10 to 15 tonnes per year. The same USGS webpage details scandium prices, which are eye-poppingly high. A gram (yes a gram, not an ounce or pound a single gram) of scandium oxide at 99.9% purity sells for US$8 a gram, while a gram of the same-purity scandium acetate is $44 a gram. The really big numbers come from 99.9% scandium chloride, which sells for $124 a gram, and 99.9% scandium fluoride, which goes for a whopping $277 a gram.

Now we can’t, and won’t, assume that Cypress has the flowsheet to produce and sell scandium acetate, chloride or fluoride, but mining 15 tonnes of scandium oxide, over the life of the mine, fetching $8 a gram could be looked at a couple of ways – as enough revenue to pay for the acid plant, projected to cost just over $100 million or the potential for the recovery of saleable rare earths with the lithium could also represent a major reduction in processing costs.

And that isn’t counting the revenue from the magnesium and potassium salts, which could shave off more costs per tonne.

Something else we find interesting regarding production cost reductions is potential revenue from Cypress’ proposed sulphuric acid plant. A sulfuric acid plant converts molten sulfur into low-cost sulfuric acid reducing transportation costs and providing a low-cost source of power. Excess acid could be sold locally to large consumers and if a co-generation facility were built in, it could provide enough carbon-free electricity to power the entire Project with excess power being sold to the grid.

Cypress has the potential to sell excess sulfuric acid and generate more revenue that way – further bringing down its costs per tonne – while also generating electricity from the acid plant to recover power costs. Lithium Americas, in its recent Prefeasibility Study estimates a US$1,500.00 per ton reduction in production costs from its acid plant excess acid/power sales.

I think we’re going to have some extremely interesting numbers come the first quarter of 2019 when the PFS is due.

And remember, this 10 to 15 tonnes of scandium scenario is only for the initial pit, which has enough material to last 40 years of mining. That’s only 1/10th of the total deposits current indicated/inferred resource. Recall that Cypress had identified 3.835 million tonnes of LCE in the indicated category, and 5.126 million tonnes of LCE in the inferred category.

Cypress has been studying the rare earth values found in solution for about six weeks, and while they can’t yet be included in the PEA, the upcoming prefeasibility study (PFS) is likely to put some hard numbers to them and the other by-product credits, and maybe additional revenues from the acid plant.

Conclusion

In just two years, Cypress Development Corp has come a long way in developing not only a maiden resource for its Clayton Valley Lithium Project, but a preliminary economic assessment. The PEA clearly shows the project is economic, with a fantastic IRR of 32.7%. The economics of the PEA are calibrated at $13,000 a tonne but the mine makes money all the way down to $4,800/t, an unlikely low price due to the continuing demand for lithium needed for EV batteries.

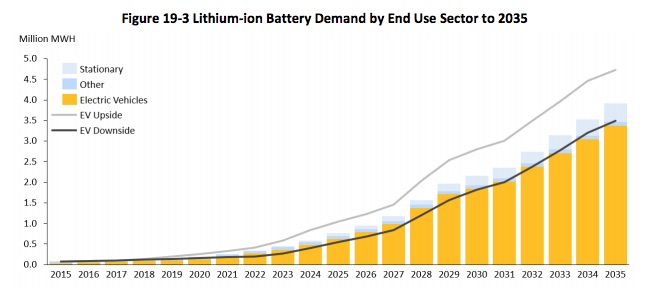

According to Benchmark Mineral Intelligence, the lithium market will grow in three phases. The first phase, where we are currently, is showing the last year of tightness. However lithium carbonate prices are expected to remain high between 2019 and 2022. At that point, the market may experience some oversupply as new projects come online, but the consultancy expects prices to settle at $13,000 a tonne. Longer term, the forecast is for $15,500 to 17,200/t through 2023.

As we’ve said before, don’t listen to the lithium bears who think the market is being flooded by new supply that will ratchet the price down further. South American lithium is still selling north of $16,000 a tonne, and low-cost Chinese lithium isn’t battery-grade.

Demand is going bonkers. EVs surpassed 2 million units in 2016 and Bloomberg New Energy Finance predicts they will make up an astounding 54% of new car sales by 2040. One Tesla car battery uses 45kg or 100 pounds of lithium carbonate.

In-depth analysis shows that the supply-demand balance skews heavily towards the demand side which is still extremely bullish. Lithium supply forecasts must be weighed carefully, because most lithium mines will never make it into production due to the difficult technical challenges involved. Cypress Development Corp, however, is one of the few exceptions, which is why I own shares.

I’m looking forward to the next step, as Cypress moves into prefeas to demonstrate that the project is economic. It’s hard to imagine it wouldn’t be, given what we’ve seen in the detailed PEA.

Richard (Rick) Mills

Just read, or participate in if you wish, our free Investors forums.

Ahead of the Herd is now on Twitter.

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard owns shares of Cypress Development Corp (TSX-V:CYP).

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.