Cypress closing in on billion-ton resource in Nevada’s Clayton Valley

- Home

- Articles

- Metals Battery Metals

- Cypress closing in on billion-ton resource in Nevada’s Clayton Valley

2018.08.09

As interest in battery metals continues (it was a major theme at this week’s Vancouver Resource Investment Conference), investors are on the hunt for lithium plays that will “hit it out of the park” Ie. find a high-grade discovery hole or identify a significant resource of lithium carbonate, to support the trend towards increased electrification of vehicles that require more and more lithium and other battery metals like cobalt and graphite.

As I have suggested before, the most promising of the early-stage lithium explorers is Cypress Development Corp (TSX.V:CYP), whose project in Nevada’s Clayton Valley is close to the only producing lithium mine in the United States, yet with a very interesting geological footprint that is unlike any other property in the valley. And with excellent results from a 2017 drill program recently released and plenty of blue sky upside, this is perhaps THE lithium junior to watch in 2018.

Clayton Valley

The decision by electric car maker Tesla to locate a battery manufacturing plant in Nevada for the companies EV’s has triggered a rush of lithium claims in the Clayton Valley.

Three years ago Cypress began prospecting in the valley, hoping to find a property that could support a lithium carbonate resource to compete with or possibly complement Albermarle’s Silver Peak Mine, whose brine grades are declining.

Three years ago Cypress began prospecting in the valley, hoping to find a property that could support a lithium carbonate resource to compete with or possibly complement Albermarle’s Silver Peak Mine, whose brine grades are declining.

VP Exploration Bob Marvin initially looked at lithium brine ground, but he was also keenly aware that none of the stakes containing basement-scale gravity lows in the valley, known to contain lithium carbonate, had ever produced any brines.

Marvin noticed that some of claims on the south flank of an outcropping known as Angel Island had not been staked, and those that had been, had elapsed.

“There was almost no staking done in this land area around Angel Island,” Marvin told Ahead of the Herd in an exclusive interview. “We got to the field, and sure enough, it was open. It was a pretty wild time to be adding huge chunks of ground, and hoping for the best.”

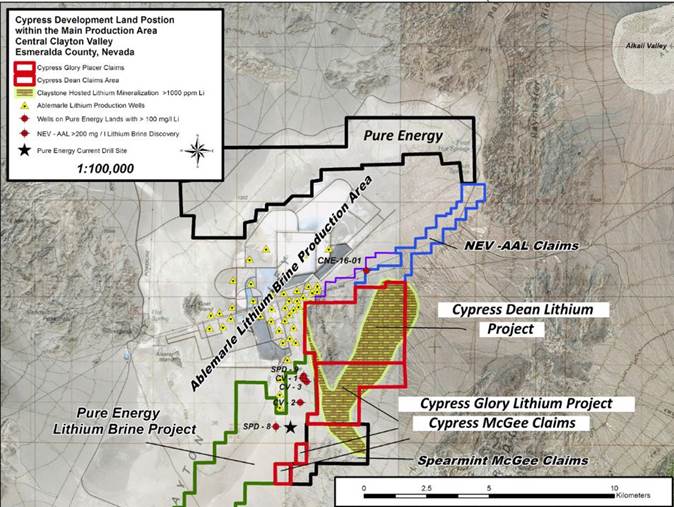

Cypress wasted no time in acquiring two land packages: the 1,520-acre Glory Project totaling 76 placer/lode claims located in Esmeralda County, and the 2,700-acre (35 association placer claims) Dean Project. The Glory claims share their western boundary with claims controlled by Pure Energy Minerals whose lithium brine resource is just west of Cypress’ property boundary.

According to Cypress, the lithium brines being produced for almost 50 years at the Silver Peak Mine have come from the flanks of Angel and Goat Islands.

Cypress had reviewed the seismic data in Pure Energy Minerals NI 43-101 Technical Report titled “Inferred Resource Estimate for Lithium, Clayton Valley South Project”, dated July 17, 2015. The data appears to indicate favorable lithium brine exploration targets along the western and west central portions of Cypress’ Glory Project.

“The data appears to indicate favorable lithium brine exploration targets on the property. Several targets exist on the Dean property which include the discovery of extensive outcropping of altered green lithium-rich claystone and the presence of paleo hot spring vents leading Cypress to believe that additional lithium bearing brine aquifers could be localized at the water table below the highly mineralized claystone. These lithium-rich claystone exposures are believed to represent uplifted portions of the lake bed stratigraphy within which the lithium brines of the Clayton Valley basin are found and produced from.”

Bedded Ash Unit Overlying Salty Green Lithium-Rich Claystone at Cypress’ Dean Project

In other words, Cypress believes that lithium-bearing brine aquifers could be located below the “claystone”. The company is working to establish a resource and economic metallurgical process for what Cypress believes is a large, bulk-tonnage deposit of leachable, non-hectorite claystone. If, as indicated by early results, the claystone is proven to be a significant lithium source rock, then Cypress will be in the enviable position of having the best of both hard rock lithium and brine – a combination of mining an at-surface leachable deposit, the claystone, that’s capable of producing a ‘synthetic lithium brine’.

Promising surface samples

With geological data in hand and two prospective properties acquired, Cypress started taking surface samples in September 2016. The samples returned results ranging from 340 parts per million (ppm) to 2,940 ppm, with an average grade of 925 ppm lithium carbonate equivalent (LCE). States the company:

Cypress had discovered high lithium grades in a non-hectorite claystone over a wide area on surface at the Dean Project that well exceeded other reported Clayton Valley sediments and brines.

High-grade assays

The first stage of a 2017 drill program involving nine core holes in the claystone delivered average grades of 900 ppm, or 0.48% lithium carbonate equivalent , throughout an average thickness of 250 feet starting from just below surface. Cypress has just completed the first five holes of a second-stage 12 to 14-hole program – with results recently published. The assays from the last two drill holes showed the mineralization continuing about 2.4 miles long and 1.2 miles wide across the Dean property. The fourth of five holes averaged 1,206 ppm over 88.4 meters while the fifth hole ended in three meters of 912 ppm.

The now known strike length at both the Dean and Glory projects is 3.7 miles long by 1.2 miles wide. Importantly, Cypress has tested surface samples of Dean claystone and determined that a synthetic brine can be created that is similar to those produced by Albemarle and Pure Energy brines. In fact a synthetic brine from Dean shows double the lithium value compared to an actual production well from Pure Energy and four times the Albemarle production brine.

Rare mudstones

Cypress needed to know whether the claystones were similar to those in the Kings Valley deposit owned by Lithium Americas Corp. A 2016 technical report on that project showed higher than expected economics due to problems with metallurgical recovery. The claystones at Kings Valley are hectorite, meaning the “hot springs” type lithium system is tied up in a lattice of hectorite clay and is difficult, and costly, to separate. By contrast Cypress’ non-hectorite clay can achieve 30% lithium recoveries by water alone. Initial extraction studies using low amounts of sulfuric acid on oxidized and reduced material revealed recoveries up to 74% in both sample types. Metallurgical testing continues.

“We’ve shown already that if you take the claystones and let them incorporate with pure water, that your chemistry is quite similar to the brines, which have been mined here for 50 years,” says Marvin. “I think the lesson is that the brines and the claystones are from the same source. They’re both from one parent event, and that would be volcanic ash rich in lithium.”

Moreover, the mudstones found at the eastern flank of the Clayton Valley are extremely rare; according to Marvin, nothing similar has been found at other properties in the valley.

Moreover, the mudstones found at the eastern flank of the Clayton Valley are extremely rare; according to Marvin, nothing similar has been found at other properties in the valley.

Green Lithium-Rich Claystone Discovered at Cypress’ Glory Claims

The lithium-rich mudstones likely were allowed to accumulate in a protected, lagoon-type environment, compared to the rest of the valley where boulders and debris were washed away throughout millions of years of rainy seasons.

“The rocks are either covered under horrendously thick boulder conglomerates under the bigger mountains, or they just were never there. I think it’s quite possible those mudstones don’t exist anywhere but where we are,” he said.

A billion-ton ‘blanket of lithium’

Marvin described the deposit as starting at the top of the outcrop and descending to around 350 feet below surface. The high-grade portion, with grades between 500 and 1,000 ppm Li, is now estimated to be nearly 70 meters thick. He said what’s remarkable about the deposit is its consistent lithology.

“As you go down it becomes finer grain and finer grain, until you’re eventually in an olive-colored, very ash-rich mudstone. Then right about 90 feet on average, bang, you go from olive green to gray black. As you cross the redox, the lithology doesn’t change at all. It’s still a beautiful, consistent, thick-bedded ash rich mudstone that goes on for another 60 or 70 meters.”

“It begins to take on some harder units after about 100 meters average down. You’re starting to hit some thin hard units. The color starts to go back to olive, then, tan, and then you’re done. Your background, is still 300, 400 ppm lithium. The stuff that’s over 1,000 is in that main midsection that’s just so ash rich, it’s unbelievable.”

Your author did some conservative calculating and the tonnage numbers are very impressive.

3,500 meters length X 2,000 meters width X 70 meters thick X 1.75 specific gravity (density) = 857,500,000t of lithium enriched claystone (approx. 4.5mm tonnes of LCE).

Since we have no assays from Glory these numbers are from what CYP has, so far, drilled on their 100% owned Dean claims only.

Expanding east

The latest drill results from January show the formation-type package of rocks seems to get thicker and higher grade as the drills move east.

Applications are with the BLM for further drilling. Marvin said the plan is to drill eight to 10 more extension holes to the east within the next few weeks. There are still entire two and three-kilometer square blocks that have yet to be delineated.

“We couldn’t be more excited about it, because we’re stepping off some pretty nice holes that are better than we’ve seen,” said Marvin, adding, “we haven’t drilled our highest grade yet.”

Then there will be infill drilling to close in the hole fences which are now around half a mile apart. After that, Cypress will be close to releasing a resource estimate, along with a PEA that includes drill results, metallurgical studies and other economic data.

Both Marvin and Huston think what Cypress has going for it is the massive tonnage of lithium contained within the claystones, while acknowledging there will still be challenges with the metallurgy and lithium recoveries.

“Any time in the resource industry when a new deposit type is discovered, there’s a certain amount of pain that goes into figuring out how to beneficiate the ores, right? So, how do we de-risk that for us? Our best way forward is to continue to expand this resource,” said Marvin.

Conclusion

As lithium juniors go, the package of land that Cypress had identified and begun exploring is one of the best, if not the best, going in the market right now. The sheer size of the anticipated resource means that a lot of attention will be focused on the company as it continues to expand the property, particularly beneficiation methods. An intriguing possibility exists for Cypress to partner with Albermarle to improve the latter’s lithium recoveries, or join with neighboring exploration firms to do joint ventures that could grow the land package. With a million dollars in the kitty, Cypress is well-financed to fund its new exploration phase.

Here’s two important points to consider when doing your own due diligence – Firstly it’s not like this mudstone thing Cypress has gotten hold of is long known about low grade leftovers. No, that’s not the case at all – this is a brand new twist on an old district. Secondly, investors still have time to get into the company while it is currently only valued around $14 million, or $0.25 a share, with a number of upcoming catalysts possibly offering ample stock price upside.

“We’re very pleased and extremely excited with what we have found on our 5,000 acre Dean/Glory claims. The high grade lithium content, a superior location in regard to permitting and all the existing infrastructure in place, with the uniqueness of the new deposit model, and of course the fact we have no competition in the basin, we believe we’ve really got a hold of something here. We’ll see what the next little while brings,” said Huston.

The possibilities of what ‘the next little while brings’ is why Cypress Development Corp TSX.V:CYP is on my radar screen. Is it on yours?

If not, maybe it should be.

Richard (Rick) Mills

Sign up for Ahead Of The Herd’s free highly acclaimed newsletter.

***

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills owns shares of Cypress Development Corp TSX.V:CYP and CYP is a sponsor of his website aheadoftheherd.com.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.