Corporate profit-taking is greasing the runway for a “soft landing” – Richard Mills

2023.07.28

For over a year now, the financial talking heads have been discussing the likelihood of a “hard landing” versus a “soft landing” for the US economy — based on the actions of the Federal Reserve, which controls the money supply and interest rates.

These are the tools the central bank uses to keep the economy running near full employment, and inflation in the neighborhood of 2%, a kind of “Goldilocks zone” wherein the economy is neither growing too fast, fueling higher consumer prices, nor too slow, which can stall economic growth and result in layoffs.

Since March, 2022, the Fed has been working to control inflation that at one point was the highest in 40 years. They’ve been doing this by raising interest rates in increments from essentially zero to +5%. In June the Fed paused its rate-hiking but today, July 26, they raised the federal funds rate another quarter percentage point, to 5.5%.

I’ve been right in my prediction that the Fed would pause in June, and hike once or twice more before the end of the year.

However, despite rising rates, there will arguably be no hard landing, or recession. The reason is due to higher-than-expected corporate profits, and the realization by the Fed, that they can no longer keep raising interest rates. Each will be explained below.

Falling net interest payments

It may seem obvious, but the first thing to understand is that corporations, as capitalist entities, will increase prices until demand falls. This is so-called “greed-flation”. The argument that companies, by their very nature, exist to make profits, targets the left which claims that they are unfairly profiting from inflation by charging consumers, already hurting from high prices, more than they should. There’s nothing unfair about it, it’s just the way capitalism works.

Also note that companies’ cost inputs have all gone up due to inflation so they are forced to raise prices to maintain their margins.

Less justifiable is so-called “shrink-flation”, the sneaky practice of putting less product into packages, and charging the same price for it as before the shrinkage. Shrinkflation is normally attributed to food but it could really be any product.

The bottom line is companies are making huge profits right now due to greed-flation and shrink-flation, and there is a third factor pushing profitability even higher. Let’s call it the “reverse yield curve” and here’s how it works:

During the pandemic of 2020-22, the Fed slashed interest rates to near 0% and many companies benefited from the low rates by taking on huge amounts of debt. And why not? It was practically free money.

Normally when corporations borrow, it eats into profitability due to the interest they have to pay on their loans. This time is different. By locking in at rock-bottom interest rates, companies paid, and continue to pay, minimal interest, while at the same time, they are plowing their profits into high-interest-bearing investments that, thanks to a 16-month rate hiking cycle, now pay around 5%.

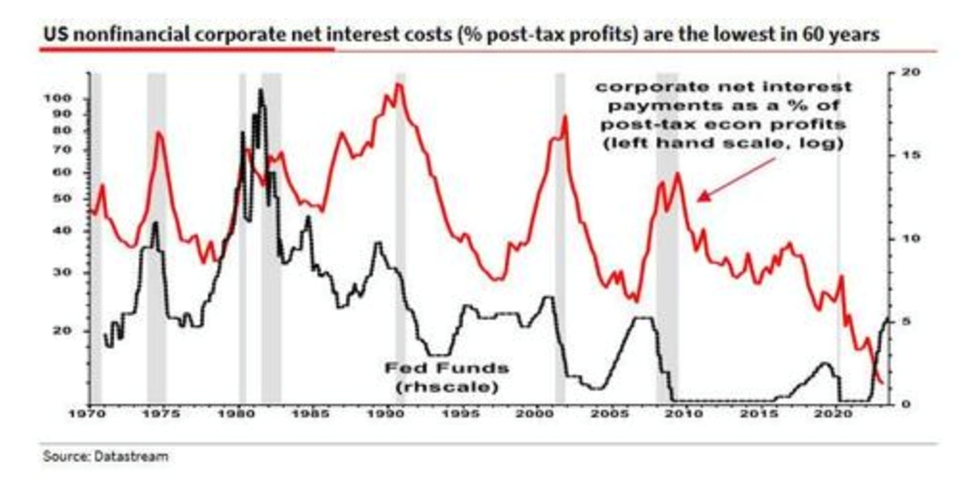

Please take a look at the two charts below, from SocGen strategist Albert Edwards, via via Zero Hedge.

The first chart, which Edwards calls “the maddest macro chart I have seen for many years,” has the red line depicting corporate net interest payments as a percentage of post-tax profits. Notice the line plunging from about 8% in 2020 to just above 0% today. In fact, corporations’ percentage of post-tax profits is the lowest in 60 years!

Could this explain why the US economy has so far avoided recession? I believe it helps. As Edwards concludes, a sizeable proportion of the “huge, fixed rate borrowings during 2020/21 still survives on company balance sheets in variable rate deposits” meaning that corporations continue to benefit from locking in the ultra-low rates of 2020 and 2021 even as their cash interest income are soaring.”

Companies have effectively played the yield curve in reverse and become net beneficiaries of higher rates, adding 5% to profits over the last year instead of deducting 10%+ from profits as usual.

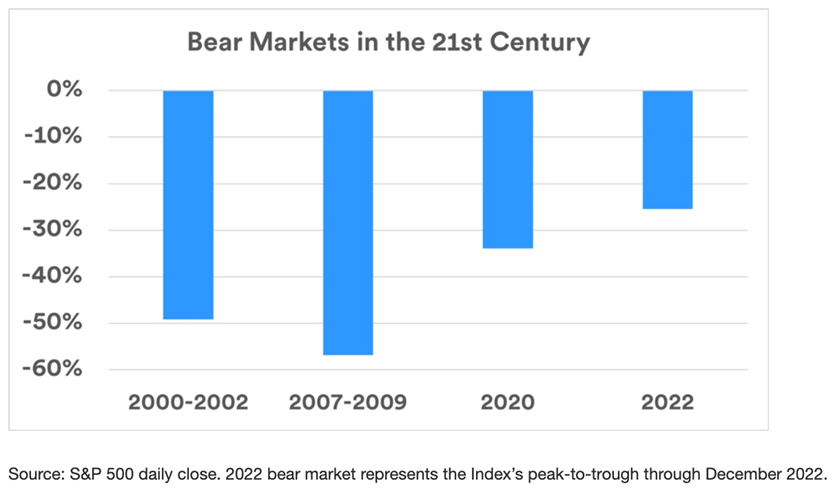

By shining a light on corporate profitability, it’s easier to see why the stock market has been soaring lately — the Dow up for 13 straight days — and the technology-heavy Nasdaq Composite Index gaining almost 32% in the first half of the year. U.S. Bank points out that, to July 5, the S&P 500 regained more than half of the bear market losses suffered in 2022. The chart below also shows that the level of decline in the most recent bear market cycle is not as dramatic as the previous three.

More importantly, with companies making money hand over fist, they are fueling the job market. Unemployment, a key Fed metric, is currently at 3.6%, nationally, and at or near record lows in half of US states. Companies are paying higher wages to attract the best people, and these employees are spending the extra money out in the economy, or stuffing it into high-interest-bearing savings accounts just like corporations are doing.

In this way things aren’t really going according to the Federal Reserve’s plan. The Fed wants to “kill the job market” but I don’t see how that happens with corporations making so much profit. In fact companies now have cash to hire more people, defeating the Fed’s goal.

The upshot, in my opinion, is we get a soft landing with no recession, with the important proviso that the Fed pauses its rate-hiking cycle soon, likely before year-end. For the Fed this means inflation stabilized or reduced, and from the look of things, there isn’t far to go. The latest data shows US inflation at 2.9%, a dramatic reduction since last July, when prices were rising at 8% compared to a year earlier.

No more rate hikes

I’m quite sure the Fed has the same information that we do, about corporate profits, but here’s the thing: what has been helping corporations is hurting the Fed, because the central bank must now pay out more interest on short-term debt such as US Treasuries.

Arguably, the Fed may have to settle for slightly higher inflation than their normal 2% because they can’t keep raising interest rates for the simple reason that they can’t afford it. The chart below should clarify things. It shows the annualized interest payments on federal government expenditures.

The annual payment on US federal debt, which currently sits at $32.6 trillion, is about to hit $1 trillion, surpassing how much the US pays every year on defense! We already showed this in a previous article.

Interest on the debt on track to exceed military expenditures

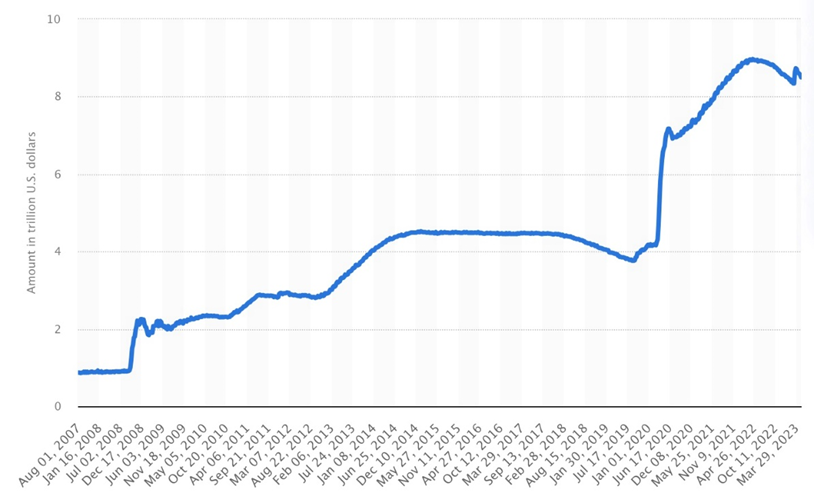

Moreover, the Fed is essentially broke. If it was a regional bank it would already have been taken over due to its obscene balance sheet, whose assets now total over $8 trillion. The Fed has no reserves to draw from, no more bullets in the chamber, so its only choice is to print money. Increasing the money supply is inherently inflationary.

Source: Statista

(When the Federal Reserve buys debt instruments like Treasury notes or mortgage-backed securities, it is seeking to increase their price and lower yields, while signaling a looser monetary policy to support the economy. Conversely, the sale of Fed assets is a policy tightening approach that constrains financial conditions and asset values…

The Federal Reserve has dramatically expanded its securities holdings to cushion the economic shocks of the 2008 global financial crisis and, later, the COVID-19 pandemic. (Investopedia, April 7, 2022))

Conclusion

Greed-flation, shrink-flation and the reverse yield curve play are enriching corporations that, only a few months ago, were battening down the hatches for the expected recession storm. Instead, earlier decisions to lock in loans at rock-bottom interest rates are paying off, especially since they can plow profits into investments that pay +5% yield. The result is plunging net interest payments, and higher profits.

It’s a remarkable turn of events, and incredibly positive for markets.

Three months ago, forecasters were predicting almost zero growth in the second quarter. It now appears there will be no hard-landing and no recession, with the more probable outcome being a soft landing. The Federal Reserve raises interest rates just enough to stop the economy from experiencing high inflation, without causing a severe downturn.

In fact over the last couple of days, the case for a soft landing has strengthened, judging from the latest economic figures and statements from Fed Chairman Jerome Powell.

Data released Thursday by the U.S. Commerce Department showed gross domestic product grew at 2.4% in the second quarter, bettering 2% GDP growth in the first quarter. The Wall Street Journal said that Overall, the GDP report adds to evidence the economy remains resilient amid higher interest rates. The labor market is still tight, and inflation is easing.

Economists are now dialing back their recession expectations many had projected a downturn would start in the middle of the year in response to Fed policy.

At Wednesday’s Fed meeting, Chairman Powell said his staff had ditched the recession forecast it put in place in March, when banking-sector turmoil had raised fears about a potential credit crunch. (Bloomberg, July 27, 2023)

Powell also seemed to agree with me, in that the Fed doesn’t need to wait until inflation gets to 2% before it pauses interest rate increases. It can tolerate a higher level — somewhere between 2 and 3%.

“The idea that we would keep hiking until inflation gets to 2%, it would be a prescription of going way past the target. That’s clearly not the appropriate way to think about it,” Powell said. “The federal funds rate is at a restrictive level now. So if we see inflation coming down credibly, sustainably, then we don’t need to be at a restrictive level anymore.”

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.