Copper Road kicks off 2023 drill program to confirm copper mineralization at JR Zone – Richard Mills

2023.08.23

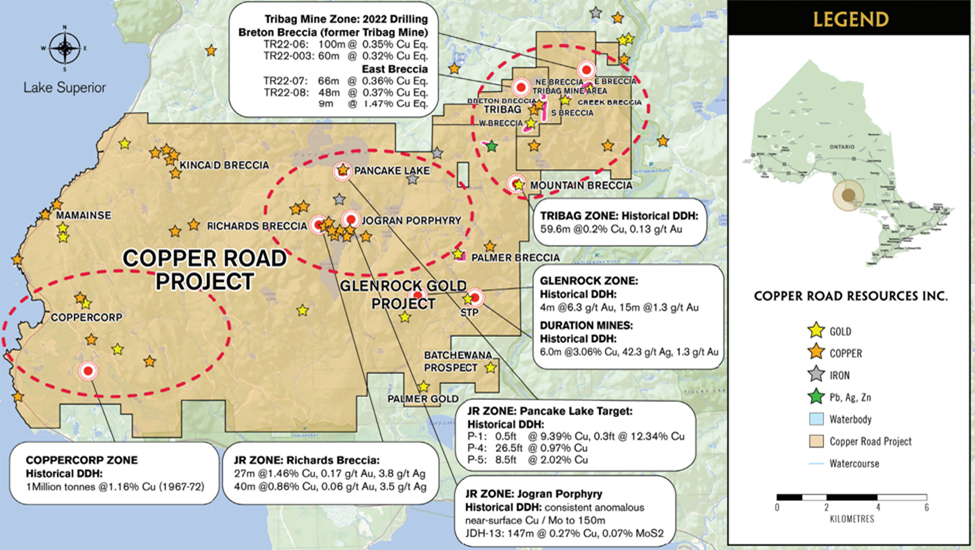

Copper Road Resources Inc. (TSXV: CRD) is kicking off its 2023 summer drill program at the highly prospective JR Zone, part of its Copper Road project located in the Batchewana Bay area of Ontario.

The current drill campaign, which is expected to total 1,000 metres, is designed to demonstrate that the JR Zone hosts a shallow mineralized porphyry and high-grade breccia in the centre of the company’s district-scale land package that hosts two past-producing copper mines.

The drilling, according to Copper Road, is the first step in proving the JR Zone as a large-scale zone of economic copper mineralization at shallow depths.

“We are excited about the prospect of identifying an additional large-scale near-surface zone of copper-molybdenum-gold-silver mineralization in the heart of our 21,000-hectare project,” John Timmons, President & CEO of Copper Road, stated in an August 21 press release.

He added that: “Jurisdiction is becoming increasingly important in the modern quest for critical minerals, and our district-scale property in Sault Ste. Marie, 20 km from the TransCanada Highway, checks all the boxes.”

JR Zone Drilling Targets

The JR Zone consists of the Jogran surface porphyry, which has been drilled to a depth of 200 metres, and the Richards breccia, a near-surface copper target. The two targets are located 900 metres apart.

The entire zone is located approximately 12 km from the former Tribag Mine Zone, which the company drilled in 2022 and returned significant intervals of near-surface mineralization (i.e. 9 metres at 1.47% copper equivalent).

Due to fragmented claim ownership and regional staking closures, the JR Zone has only seen limited diamond drilling into these near-surface porphyry and breccia-hosted copper-molybdenum-gold-silver targets.

Historical exploration by Jogran Mines (1964), Phelps Dodge (1966), Duration Mines (1988), and Aurogin Resources (1997) encountered relatively broad near-surface intersections of copper mineralization that is still untested below 150 metres in the porphyry, and below 75 metres in the breccia.

Copper Road has previously completed Mobile Metal Ion (MMI) soil sampling and digitization of historical geophysical surveys at the JR Zone and has determined the 1.5 km x 800 m area is prospective for the discovery of additional copper mineralization (see figures below).

In June 2023, Copper Road identified the priority targets at JR for its summer drill program to test the Jogran porphyry at depth, the extension of the historic high-grade intercepts in the Richards breccia, and another area of mid-grade copper mineralization.

The company is currently drilling the following priority targets at the JR Zone:

J-P-23-01: the hole will test the Jogran porphyry at depth proximal to historical drill holes from 1964: JDH-13 (5 to 152 m: 147 m at 0.27% Cu, 0.068% MoS2, 0.53% CuEq) and JDH-16 (5 to 170 m: 165m at 0.23% Cu, 0.054% MoS2, 0.43% Cu Eq), neither of which were assayed for potential by-product metals (e.g. Au, Ag, Re, W). The hole will be designed to test the porphyry mineralization to a vertical depth of 400 m which is approximately twice the extent of known mineralization.

R-P-23-01: the hole will test the extension of the historic high-grade intercepts in the Richards breccia by stepping out approximately 50 m to the west of AR98-07 (27 m at 1.46% Cu, 0.17 g/t Au, 3.8 g/t Ag) at a vertical depth of approximately 50 m. The company interprets the high-grade mineralization to follow the perimeter of the breccia pipe similar to the Breton breccia, Tribag Mine Zone. This is supported by the semi-circular geometry of the Gradient IP anomaly associated with the Richards breccia (as shown below).

According to the company, additional drill holes have been engineered to follow-up on the new targets, such as the J2 “Roof Zone” and the Richards NW chargeability anomaly, as well as follow-up on visual results of mineralization in the first two proposed holes (J-P-23-01 and R-P-23-01) with step-outs.

Copper Road Property Overview

Copper Road’s property is district-scale, covering 21,000 hectares within the Batchewana Bay district, about 85 km north of Sault Ste. Marie, ON.

Part of the Copper Road project encompasses Proterozoic volcanic-sedimentary rocks intruded by breccia-porphyry bodies, and another part (previously, the Glenrock project) covers an adjacent window of classic Archean greenstone rocks.

The property package has a proven history of copper production, containing two former mines: The Tribag mine, which produced 1.2 million tonnes grading 1.52% Cu, and the Coppercorp mine, with historic production of 1 million tonnes at 1.16% Cu.

To date, there are several confirmed zones of mineralization within property boundaries — Tribag, Glenrock, JR (Richards/Jogran) and Coppercorp — each hosting multiple targets for exploration. Together, they span a total length of 30 km.

The former Tribag mine represents a porphyry-style copper deposit, consisting of four breccias (Breton, West, East South). Its reported historical production (1967-1974) was predominantly from the Breton breccia.

Historical estimates by Teck Resources, its former operator (1966-1972) and a household name in the Canadian mining industry, identified 40 million tonnes at 0.4% Cu from the Breton breccia, and estimated 125 million tonnes at 0.13% Cu and 0.05% Mo from the East breccia.

In 2022, Copper Road completed 3,000 m of drilling at the Tribag mine zone, designed to test the continuity of the significant zones of copper mineralization of the Breton and East breccia pipes.

All eight holes drilled in the program intersected significant intervals of near-surface mineralization, proving the continuity, depth, and additional mineralization outside of historical models at the Breton breccia. Notable results include hole TR22-006, with 100.39m at 0.32% Cu and 2.99 g/t Ag (0.35% CuEq), including a 5m interval at 1.11% Cu and 4.69 g/t Ag (1.15% CuEq).

The 9 m high-grade zone (1.47% CuEq) at depth also indicated potential for high-grade mineralization related to a feeder structure at the East breccia, Copper Road said.

Given last year’s success, the company plans to continue exploring the Tribag zone in 2023, on top of the current drill program at the JR Zone.

Copper Enters Crucial Stage

The importance of copper exploration projects cannot be understated. In an era dictated by continued global warming, the world would require more infrastructure to support renewable energy applications, which use large amounts of the metal.

For example, millions of feet of copper wiring will be required for strengthening the world’s power grids, and hundreds of thousands of tonnes more are needed to build wind and solar farms. An offshore wind turbine contains 8 tonnes of copper per megawatt of generation capacity.

Electric vehicles, now a fast-rising source of demand, use over twice as much copper as gasoline-powered cars, which contain about 30 kg. Not to mention, there is more than 180 kg of copper in the average home, reminding us just how indispensable the metal really is.

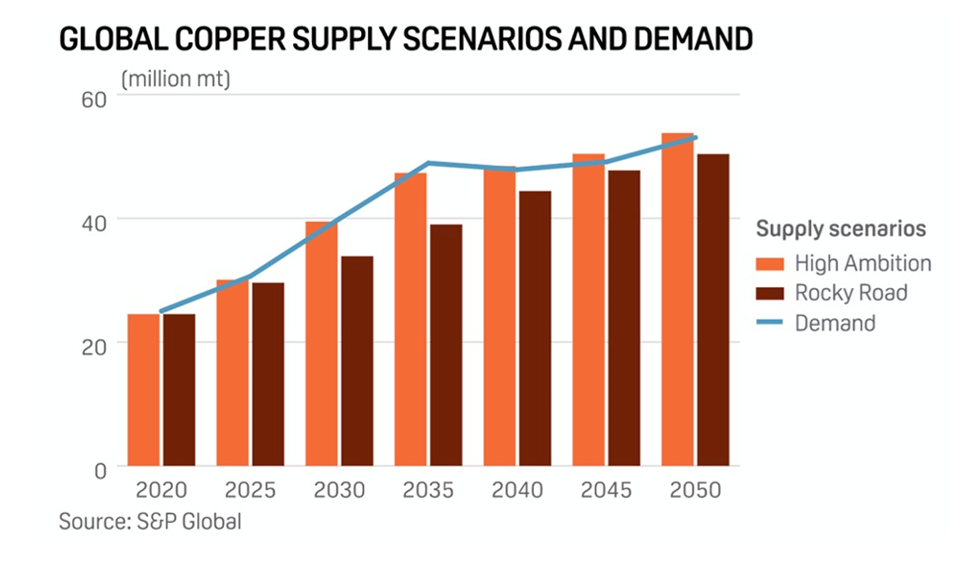

According to consulting firm McKinsey, electrification is expected to create a 6.5 million tonne shortfall at the start of the next decade, highlighting a substantial output gap that the mining industry has to address.

However, the consultancy firm forecasts copper supply to be around 30.1 million tonnes, leaving a gap of 6.5 million tonnes by the start of next decade.

Green uses of copper accounted for 4% of copper consumption in 2020, but this is expected to rise to 17% by 2030, Aditi Rai, an analyst at Goldman Sachs, wrote in a note. He added a “net-zero emissions” path would mean the world would need an additional 54% of copper by 2030 on top of that forecast.

S&P Global Market Intelligence goes a bit further out, projecting that annual global copper demand will nearly double to 50 million tonnes by 2035. Last year, global copper mine production sat at approximately 22 million tonnes, short of even the current demand.

“Assuming mining output continues to grow at a rate of 2.69% annually (as it has done for the past decade), global output will reach a mere 31 million tonnes, a far cry from the 50 million figure that we’d need as previously mentioned,” S&P said.

“The market overall is pretty tight,” Robert Edwards, copper analyst at CRU, mentioned in a recent Wall Street Journal piece. “Longer term there’s a narrative around resource scarcity and the green transition with EVs and renewables as well as the build-out of electricity grids. On paper it’s quite a substantial supply gap opening up over the next 10 years.

All of this means one thing — that the global copper market is entering an age of deficits so large that it could derail our climate goals.

The solution, therefore, is to build more copper mines from scratch. This begins identifying exploration projects with production potential, preferably in well-established jurisdictions. It’s no coincidence that the biggest mining companies like Glencore, Vale and Anglo American are all actively looking for copper development assets, setting off a new wave of investments.

Conclusion

This is where Copper Road could potentially come into the picture.

According to its CEO: “There have been very few new shallow copper discoveries in Tier-1 jurisdictions in the past decade. Given the potential large scale of the JR Zone, Copper Road is poised to unlock significant value for shareholders, and we look forward to the results from the summer program.”

To fund its exploration activities, the company recently closed a private placement of $400,000, its second this year for the same amount. It goes to show that the company and its project have plenty of support to achieve its exploration goals.

Copper Road Resources

TSXV:CRD

Cdn$0.09, 2023.08.21

Shares Outstanding 47.3m

Market cap Cdn$4.26m

CRD website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Richard does not own shares of Copper Road Resources (TSXV:CRD). CRD is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of CRD.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.