Copper price to remain elevated due to increasing demand for electricity and supply challenges – Richard Mills

2025.02.08

“As we look towards 2050, we foresee global copper demand increasing by 70% to reach 50 million tonnes annually. This will be driven by copper’s role in both current and emerging technologies, as well as the world’s decarbonization goals,” says BHP’s chief commercial officer Rag Udd.

The largest mining company in the world expects that by 2050 the energy transition sector will represent 23% of copper demand compared to the current 7%. The digital sector including data centers, 5G and AI is projected to rise from 1% today to 6%.

Transportation’s share of copper demand is expected to climb from about 11% in 2021 to 20% by 2040, thanks to the EV rollout.

On the supply side, BHP points to the average copper mine grade decreasing by around 40% since 1991. The next decade should see between one-third and one-half of the global copper supply facing grade decline and aging challenges.

The company estimates that an investment of $250 billion will be required to address the widening gap between supply and demand.

Two other sources confirm that huge new investments in the copper sector are required.

According to BloombergNEF’s annual Transition Metals Outlook, the industry will need $2.1 trillion by 2050 to meet the raw materials demand of a net-zero-transmissions world. As stated by Mining.com, Despite a decade of growth in metals supply, BNEF reports that current raw material availability remains insufficient to meet the rising demand.

The report highlights that critical energy transition metals, including aluminum, copper, and lithium, could face supply deficits this decade — some as early as this year.

China is the world’s biggest copper consumer, so what happens there is watched closely be copper bulls and bears alike.

China in September announced its biggest economic stimulus since the pandemic, which caused big jumps in Chinese and American stock markets, along with commodities.

The aim is to achieve a 5% annual growth target. Yahoo Finance reported the stimulus — designed to pull the economy out of a slump caused be a property crisis and deflationary measures — includes over $325 billion in monetary measures.

The People’s Bank of China reduced the reserve requirement ratio — the amount required by banks to set aside for loans — by half a percentage point, freeing up about $142 billion in short-term liquidity.

The plan also lowers short- to medium-term interest rates and makes mortgage relief a top priority, says Yahoo Finance.

These moves are expected to benefit about 50 million households, saving them $21.3B annually in interest expenses.

The central bank also introduced a plan to prop up China’s ailing stock market. A $71 billion stock market stabilization program will allow securities firms funds, and insurers to access funding for stock purchases through a swap facility, Yahoo Finance explained.

If China adds fiscal measures (i.e. government spending) to its monetary tools, particularly for infrastructure, commodities would likely see another big push, impacting everything from US manufacturing to energy sectors.

Bank of America projects copper will reach $10,750 per tonne ($4.87/lb) in 2025.

Copper is in a robust position due to strong demand, limited supply, and increased investment in energy transition projects, according to BoA analysts.

Chile raises price forecast

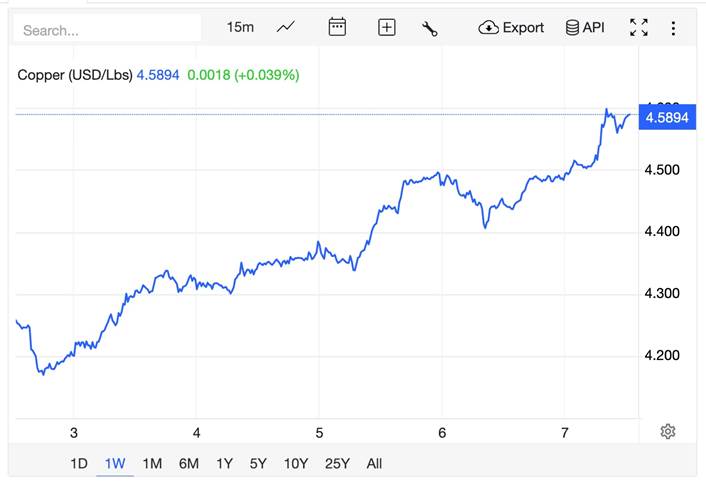

Copper caught a bid this week, rising from $4.12 a pound on Tuesday to $4.58 on Friday as of 10:35 am PST.

Over the longer term, the red metal hit an all-time high of $5.20 per pound in May 2024 due to a supply squeeze. The transition to renewable energy, the rise of electric vehicles, and the growth of artificial intelligence (AI) have all increased demand for copper.

Chile is the world’s largest copper producer and the price forecast from its copper commission, Cochilco, puts copper at $4.25 a pound in 2025 and 2026. It expects copper to remain above $4/lb for the next decade.

As reported by Stockhead, Cochilco expect copper demand to rise 3.2% this year to 27.4 million tonnes, outpacing supply of 27.3Mt and generating a deficit of 118,000 tonnes.

Total mined copper in 2024 was 23 million tonnes, according to the US Geological Survey, with Chile supplying 5.3Mt.

Cochilco’s acting executive vice president Claudia Rodriguez said the country sees copper demand lifting due to the energy transition, electrical networks and restricted supply.

Stockhead notes Chile’s mines have been a disappointment in recent years, and last month downgraded its 2034 supply forecast from 6.43Mt to 5.4Mt, a cut of around 900,000 tonnes, just under the 1Mt annual production of the world’s largest copper mine, Escondida.

Rodriguez expects a stronger global economy will push copper prices higher this year, with the wildcards being China’s economic recovery and President Trump’s tariff war.

A separate article by Stockhead predicts that if 25% tariffs on Canada and Mexico go ahead at the end of this month, the effect on copper is expected to be neutral. According to Benchmark Mineral Intelligence, while Canada supplies 15% of US refined copper exports and 82% of US wire rod imports, “The lost copper import volume from Canada could be mitigated by a curtailment of refined copper and copper wire rod exports from the US to Mexico, supplemented by imports from tariff-exempt countries like Chile,” Benchmark’s analysts wrote.

Electricity grids struggle to keep up with demand

The shift to renewable energy and electric transportation, accelerated by AI and decarbonization policies, is fueling a massive surge in global copper demand, states a recent report by Sprott.

Increasing investments in clean technologies like electric vehicles, renewable energy and battery storage should cause copper demand to climb steadily, and challenge global supply chains to meet this demand.

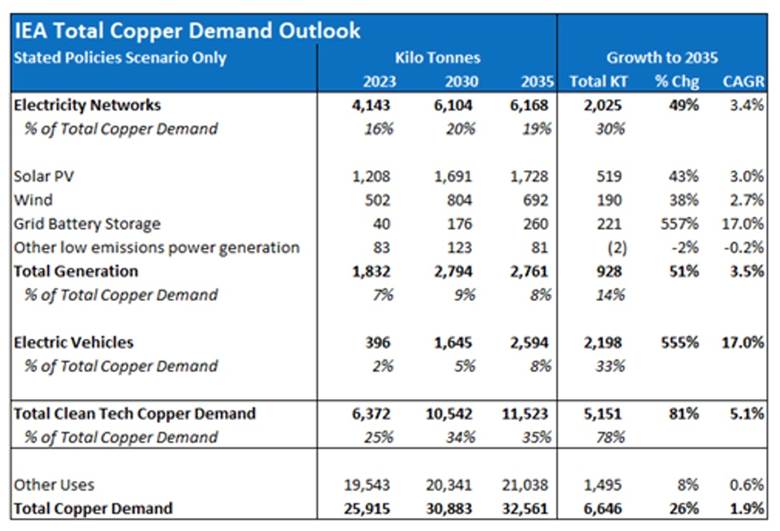

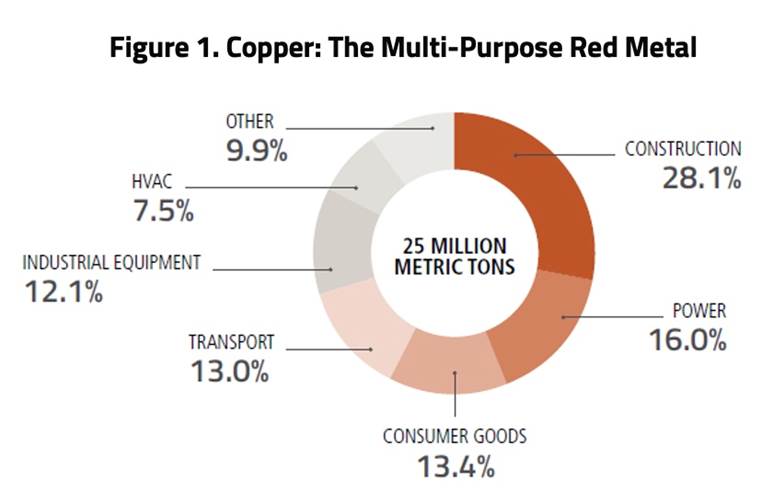

The report cites figures from the International Energy Agency (IEA), such as global copper consumption growing from 25.9 million tonnes in 2023 to 32.6Mt by 2035, a 26% increase. Clean tech copper usage is expected to rise by 81%, from 6.4Mt in 2023 to 11.5Mt in 2035.

The IEA expects the copper needs from electricity networks to grow from 4.1Mt in 2023 to 6.2Mt by 2035, an increase of 49%. Copper demand for solar panels is expected to rise by 43% and for wind power by 38% over the same period.

The fastest-growing area, though, is grid battery storage, where copper demand is expected to surge by 557% to 2035 as the need for energy storage increases, Sprott writes.

Copper demand for EVs is a close second, with a projected rise of 555% from 396,000 tonnes in 2023 to 2.6Mt by 2035, with EVs accounting for 8% of global copper consumption by that year.

Sprott notes that expectations of a surge in demand for electricity over the next decade are creating a “perfect storm” for the US power grid:

- Demand is being driven by new investment in power-hungry industrial facilities, especially the data centers that support artificial intelligence (AI), as well as U.S. reshoring initiatives and the steady electrification of the transport sector.

- Renewable sources like solar and wind, and revived nuclear generation, should play bigger roles in meeting energy needs. For the foreseeable future, natural gas is expected to remain a crucial part of the U.S. energy mix.

One of the biggest challenges for utilities is building new infrastructure quickly enough to meet skyrocketing demand expected from AI-related spending. While data centers can be built in two years, the approval process in the US for new transmission lines can take up to a decade.

Utilities are responding by deploying more solar and wind power while keeping natural gas as a backup.

Grid-enhancing technologies can improve efficiencies by up to 30% but they are costly and require substantial amounts of critical materials, including copper for conductors, transformers and wiring, says Sprott.

The drivers of electricity demand are multi-faceted. Among the most important is massive investment in facilities with large power loads including manufacturing and industrial facilities and especially data centers supporting artificial intelligence.

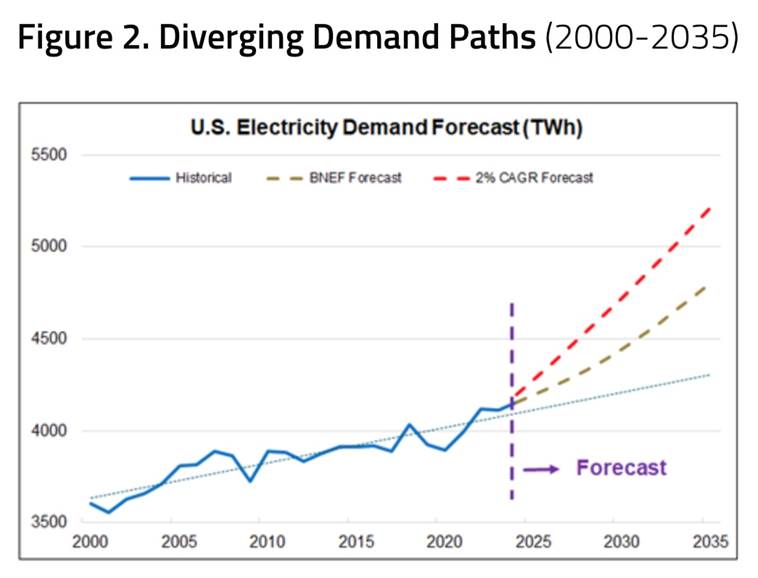

Sprott notes that with an additional 333 terawatt-hours of new electricity demand expected by 2030, investments in transmission infrastructure must rise to keep pace. According to Bloomberg New Energy Finance (BNEF), demand over the next decade is expected to compound at an annual rate of 1.3%, twice the growth rate of the prior decade.

AI

Sprott explains how the data center industry — the core of AI operations — is now entering its third wave of growth, driven by AI, machine learning and edge computing. The first wave was the Internet and e-commerce, and the second wave was cloud computing and big data.

AI processing requires a lot more power than traditional computing tasks. For example AI queries consume up to 10 times the energy of a Google search.

Sprott cites a recent Bloomberg Intelligence report forecasting that electricity consumption by data centers is expected to surge by 4-10 times by 2030. At the upper end, data centers could account for up to 17% of total US electricity consumption by 2030.

Morningstar quotes Albert Chu, portfolio manager at Man Group, stating “In the U.S. alone, data centres consumed 17GW of energy; by the end of the decade, it is estimated that data centre energy requirements will double to 35GW.”

Artificial intelligence is hungry for copper.

Morningstar quotes another source, Benjamin Louvet, head of commodities funds management at Ofi Invest Asset Management, saying that “Let us assume that the U.S., where about half of the AI market is concentrated, will increase its development by an additional 5 GW each year. This alone would increase demand by 500,000 tonnes worldwide, which is equivalent to a 2% increase in global copper demand.”

Supply

Researchers at the University of Michigan and Cornell University found that copper can’t be mined fast enough to keep up with current US policy guidelines to make the transition from fossil-fueled power and transportation to electric vehicles and renewable energies.

“We show in the paper that the amount of copper needed is essentially impossible for mining companies to produce,” said Adam Simon, co-author of the paper, published by the International Energy Forum (IEF).

A recent graphic by Visual Capitalist cites data from Benchmark Mineral Intelligence showing that meeting global battery demand by 2030 would require 293 new mines or plants.

In the table below, notice that, of all the metals, copper requires the most additional tonnage, an increase of 3,664,000 tons, or 61 mines.

Visual Capitalist notes, and we wholeheartedly agree, that it is no easy task to build new copper mines, or any mines, for that matter:

After discovery and exploration, mineral projects must go through a lengthy process of research, permitting, and funding before becoming operational.

In the United States and Canada, building a copper mine from discovery to production can take upwards of 30 years.

Other jurisdictions such as Ghana, the DRC and Laos build mines faster, but even in the top copper-producing countries, there are problems.

Chile and Peru are grappling with strikes and protests, along with declining ore grades. Seventh-ranked Russia faces an expected decline due to the ongoing war in Ukraine.

Some of the world’s largest mining companies, market analysis firms and bank are warning that this year, a massive shortfall will emerge for copper, which is now the world’s most critical metal due to its essential role in the green economy.

The deficit will be so large, The Financial Post stated, that it could hold back global growth, stoke inflation by raising manufacturing costs, and throw global climate goals off course.

Two reasons identified by Sprott why supply is not keeping up with demand; developing a new copper mine is lengthy and expensive, often taking over a decade from exploration to production; and the mining sector has seen long periods of underinvestment, when low copper prices meant reduced exploration budgets and fewer discoveries.

There has also been an overdependence on mergers and acquisitions. It’s much easier for a copper mining company to increase its reserves by purchasing a smaller company (and its reserves), than dedicating capital to greenfield exploration, which is expensive and risky.

Capital for the development of copper mines peaked at $26.13 billion in 2013. Since then, it has almost halved and remained low, with only $14.42 billion spent in 2022, according to Sprott.

Despite the funding gap, several commentators have mentioned the dawn of a new copper supercycle focused on the global energy transition, compared to the previous commodity supercycle that was driven by China’s industrialization and urbanization.

Five reasons why we are entering the next copper super cycle — Richard Mills

Morningstar reports that Global efforts towards decarbonisation are a structural growth engine for many raw materials or metals, and copper is one of the key metals for the energy transition.

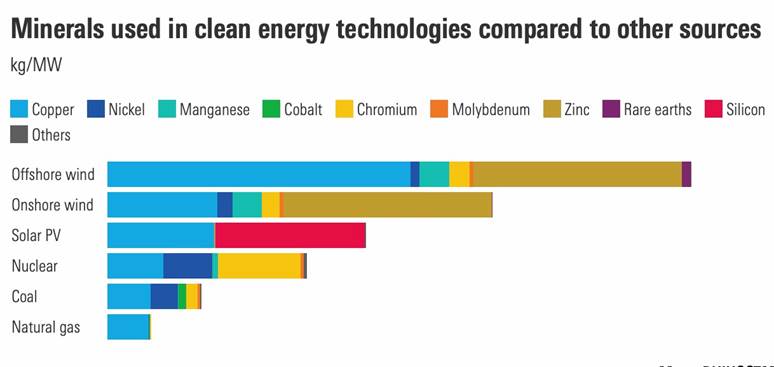

For example, wind and solar are among the most popular forms of renewable energy today. The graph below shows the amount of copper required to generate energy from offshore wind (wind turbines in the sea), onshore wind (wind turbines on land) and solar photovoltaics compared to fossil fuels such as coal and natural gas.

Resource nationalism

The term “resource nationalism” is loosely defined as the tendency of people and governments to assert control, for strategic and economic reasons, over natural resources located on their territory.

Two relatively recent examples of copper resource nationalism took place in Peru and Panama.

Peru, the world’s second-largest copper producer in 2023 was racked by protests owing to a change of government. A strike at the Las Bambas copper mine threatened about 250,000 tonnes of annual production.

Also in 2023, the government of Panama ordered First Quantum Minerals to shut down its Cobre Panama operation, removing nearly 350,000 tonnes of copper from global supply.

Political turmoil

Another reason for copper supply running short has to do with instability in copper-producing countries.

Last year, Morningstar reported a 6.5% reduction in quarterly production at Ivanhoe Mines’ Kamoa-Kaukula copper complex in the Democratic Republic of Congo, Africa’s largest copper producer.

Ivanhoe blamed the production miss on the DRC’s unstable power grid.

However, the DRC has never been a great place to go mining, and companies that set up operations there do so at considerable risk.

The DRC holds two major distinctions. First, it is the richest country in the world in terms of mineral wealth, at an estimated $24 trillion, and it is the country in which the highest number of people — estimates go as high as ten million — have died due to war since World War II.

Allegations of human rights abuses including child labor have put the DRC in the wrong kind of spotlight, Daimler (owner of Mercedes), Volkswagen and Apple are among big-name companies that source raw materials from the DRC and are facing intense pressure to make their supply chains transparent.

Since 1996, conflict in eastern DRC has led to approximately six million deaths. Read more

Recent news is disturbing. On Friday, United Nations human rights chief Volker Turk said the worst may be yet to come in east Congo’s escalating crisis, warning that abuses including rape and sexual slavery may increase. (Reuters, Feb. 7, 2025)

Rwanda accuses neighboring Congo of planning a large attack, with Rwanda’s ambassador to the UN adding that Kinshasa and its allies had stockpiled weapons in and around Goma airport.

Then there is the threat of disease. The conflict has reportedly multiplied the risk of diseases spreading, including cholera, malaria, tuberculosis and the deadly mpox virus. According to Reuters,

The WHO reported 600 suspected cholera cases and 14 deaths in the last month in North Kivu province, where disrupted water supplies have heightened the risk of the spread of the disease.

Conclusion

The price of copper is largely influenced by the health of the global economy due to its widespread applications in almost all sectors. This includes power generation and transmission, construction, factory equipment and electronics. The base metal is often referred to as “Dr. Copper” for its ability to predict economic trends. A rising copper price suggests strong economic health while a decline suggests the opposite. (Investopedia, July 14, 2022)

Copper: Humanity’s first and most important future metal — Richard Mills

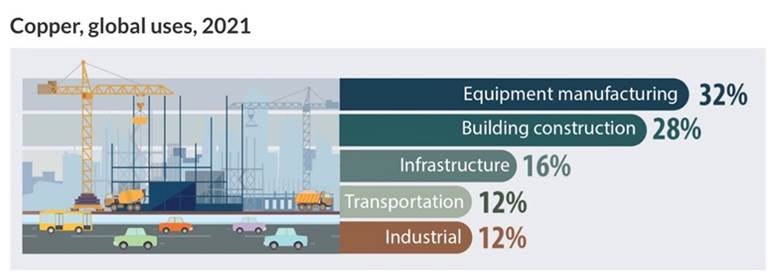

The Copper Development Association divides its uses into four categories: electrical, construction, transport and other. By far the largest sector for copper usage is electrical, at 65%, followed by construction at 25%.

Copper is useful for electrical applications because it is an excellent conductor of electricity. The only metal that has higher conductivity is silver, but silver is expensive by comparison.

Copper is a critical metal for infrastructure. In the United States alone, nearly 7 million miles of electrical wires power homes, businesses and industry.

While traditionally used in construction and electronics, copper’s new frontier is energy. According to Sprott, This sector currently consumes 25% of global copper demand, and this figure is projected to move higher to 61% by 2040, given our growing reliance on wind, solar and electric vehicles.

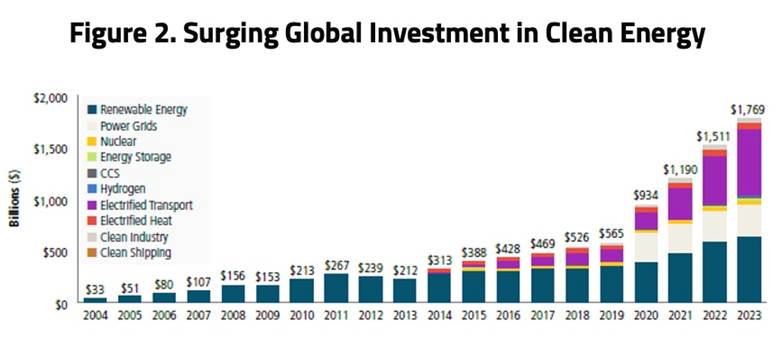

Global investment in the energy transition surged to $1.8 trillion in 2023 and now far exceeds investments made in fossil fuels.

A few more points by Sprott:

- Copper is essential in renewable energy and EVs, with its demand in clean energy projected to reach 61% by 2040 as part of the global energy transition.

- Power grids and electric vehicles heavily depend on copper for efficient electricity transmission. In recognition of its vital role, copper has been designated as a critical mineral by major global players, including the European Union, the US, Canada, Japan, China and India.

- In an EV, copper finds uses in electric motors, batteries, inverters, wiring and charging stations. An EV requires 53 kilograms of copper in electric motors, batteries, inverters, wiring and charging stations, about 2.4 times more than a conventional combustion vehicle uses. This volume of wire can extend up to a mile in length. Although efforts are underway to reduce copper in EVs, demand is still projected to hit 2.8 million tonnes by 2030.

- By 2050, it’s projected that the global electric grid will need to double in capacity to meet the 86% increase in electricity demand. These upgrades necessitate a substantial amount of copper, estimated at 427 million tonnes by 2050. Moreover, as urban areas grow, the shift toward underground wiring, which requires twice as much metal as overhead lines, is intensifying the demand for copper.

- Additionally, the IEA reports that renewable energy infrastructure, including solar and wind power, needs 2.5 to 7 times more copper than fossil fuel-based technologies.

However, there is a problem. The breakneck speed at which copper demand is growing is about the slam into a brick wall of insufficient supply. Bad weather, declining ore grades, depletion, strikes, protests, wars and resource nationalism are some of the reasons for this.

We agree with Sprott’s conclusion that The journey to global net-zero emissions by 2050 may likely see copper taking center stage in its role as the leading transmission metal. However, existing copper supplies are dwindling, and new mines take years to develop. This is creating a race to meet increasing copper demand that is more urgent than ever.

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

1 Comment

Leave a Reply Cancel reply

You must be logged in to post a comment.

Hi Rick. Another great article. I know you have updated on sister companies Alde and Reg tsx v previously but maybe soon we can get another? Alde is probably a little further down the line but Reg has got to be close to having someone pull the trigger. In conversations with John Black there’s appears to be many and varied groups going over Reg ( and the neighbours Coimolache) with a fine toothed comb. You would think a sustained rally in Cu above $4.50 should get these potential suitors hot under the collar, but the market just doesn’t seem to get this brownfield situation. In addition to this I have heard talk of a potential consolidation of the entire Cajamarca area including Yanacocha, Tantakori, and Cerro Corona. Here is a quote from a ResearchGate report related to that. ” The triangular zone concentrates the highest endowment of Au and Cu. Indeed, the Yanacocha mining district has ~60 Moz of Au and >40 Mt Cu fine, in its emblematic high-sulfidation epithermal deposits and Cu porphyries, most of which are telescoped. These deposits constitute a good source of high-grade copper as in Yanacocha Verde and in Tantahuatay (~10 Mt Cu Eq” https://www.researchgate.net/publication/386877576_New_knowledge_of_Andean_evolution_and_an_update_of_the_metallogenesis_of_Peru_Victor_Carlotto_2024 . Or this article which calls Antakori one of the top exploration projects in Peru and this is before what should be a major resource update. https://www.globaldata.com/store/report/peru-copper-mining-market-analysis/?utm_source=News&utm_medium=19-675902&utm_campaign=recommended-reports-nonlgp&_gl=1 I look forward to any comments you might have. Thanks again for the great Cu update.