Copper price: Chile, Codelco face another lost decade of output growth

By Frik Els

2022.09.04

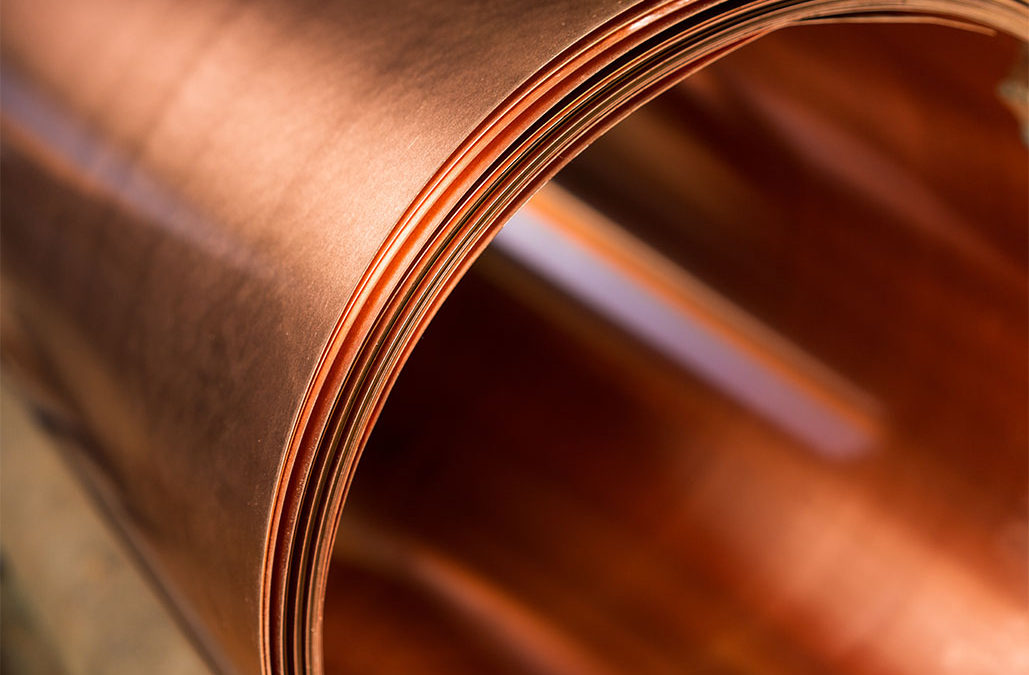

After an early jobs-report bump on Friday in New York, the copper market turned negative by lunchtime, marking its sixth straight session of losses. December contracts for the orange metal are now trading down 8% for the week.

The carnage was evident among copper stocks, with the top producers suffering double digit losses over the last week of trading: Freeport-McMoRan gave up 12%, Southern Copper declined 11%, First Quantum Minerals fell by 18%, Antofagasta lost 11%, Teck Resources –10%, Glencore –12% while KGHM has lost 18% on the Warsaw exchange.

Disappointing manufacturing data in China was behind the recent pullback after PMIs from the country, responsible for 55% of global copper consumption, unexpectedly slipped into contractionary territory.

But worries about global growth, inflation and interest rates, and an energy crisis in Europe have been hounding the metal for months. The copper price has now fallen by on

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.