Copper fundamentals strong despite price weakness

2022.09.08

Copper fundamentals strong despite price weakness

Although the copper price has retreated from a record-high $5.02 a pound, reached in March, the bull market for copper remains fundamentally intact, an AOTH analysis has found — bolstering the case for investing in companies that mine the red metal and exploration companies (“copper juniors”) that explore for it.

Demand

Copper is one of our most important metals with more than 20 million tonnes being consumed each year across a variety of industries, including building construction (wiring & piping,) power generation/ transmission, and electronic product manufacturing.

In recent years, the global transition towards clean energy has stretched the need for the tawny-colored metal even further. More copper will be required to feed our renewable energy infrastructure, such as photovoltaic cells used for solar power and wind turbines.

The metal is also a key component in transportation, and with increasing emphasis on electrification, demand is only going to increase, as EVs use about four times as much copper as regular internal combustion engine vehicles.

A major rise in copper demand from new “blacktop” infrastructure (think roads, bridges, airports, etc.), combined with high demand for copper from large-scale efforts on behalf of governments to decarbonize and electrify, is not being met with an adequate supply of the industrial metal. Trillions worth of new projects are thus in danger of falling by the wayside unless much more copper is discovered — more than is currently possible, in my opinion.

A recent (July 2022) report from S&P Global predicts the world’s appetite for copper will reach 53 million tonnes, on an annual basis, by mid-century. This is more than double current global mine production of 21Mt, according to the US Geological Survey.

How are we going to find the copper?

Not only will that kind of an increase be difficult to carry out, the expected short-fall in copper threatens to scuttle the worldwide transition from fossil-fueled transportation and power generation to electrical and renewable sources.

According to S&P Global’s report, via Reuters, Efforts to reach carbon neutrality by 2050 are likely to remain out of reach as copper supply fails to match demand amid the growing use of solar panels, electric vehicles, and other renewable technologies.

The study goes on to say that EVs and their charging infrastructure, batteries, wind and solar power, all depend on copper, more so than traditional energy sources. For example an EV requires about 4X as much copper as a car with an internal combustion engine, and is critical to renewable energy infrastructure (think cables, transistors and inverters) due to its high electrical conductivity. Solar and offshore wind need two and five times more copper, respectively, per megawatt of installed capacity, than gas- or coal-generated power, with the increased demand for renewable energy deployment expected to triple by 2035, states a recent article in Electrical Contractor magazine.

“Copper is the metal of electrification and absolutely essential to the energy transition,” says Daniel Yergin, vice chairman for S&P Global, regarding the study.

The firm forecasts global copper demand from solar and wind energy will reach 852,000 tonnes this year, while the burgeoning EV market will account for 1.1 million tonnes. Sales of electric vehicles almost doubled from 2020 to 2021, led by China and Europe.

Longer term, S&P expects copper demand from the energy transition will jump to about 21Mt in 2035, nearly triple the current 8Mt. Driving the growth will be EVs, EV charging equipment, and a buildout of the transmission and distribution system.

Meanwhile, demand for copper from traditional uses is also expected to rise. As we reported previously, this is due to the need for countries to reduce their so-called “infrastructure deficits”. Basic infrastructure such as roads, bridges, water & sewer systems, has been poorly maintained, and requires hefty investments, measured in trillions of dollars, to repair or replace.

China, the world’s biggest commodities consumer, has committed to spending at least US$2.3 trillion this year on major infrastructure projects. They are part of Beijing’s most recent Five-Year Plan that calls for developing “core technologies” including high-speed rail, power infrastructure and new energy. Translation: more money will be aside in years two to five. Note that China’s current infrastructure spending commitment for 2022 alone, is nearly double the United States’ which last November passed a US$1.2 trillion infrastructure package.

There is also the Made in China 2025 initiative, which seeks to end Chinese reliance on foreign technology by investing in a number of key sectors, including IT and robotics, and China’s $900 billion “Belt and Road Initiative”, designed to open channels between China and its neighbors, mostly through infrastructure investments. Dozens of countries have signed up to it, including Russia.

Research commissioned by the International Copper Association, quoted by Mining Technology, found that Belt and Road projects in over 60 Eurasian countries will push the demand for copper to 6.5 million tonnes by 2027.

That much copper equates to nearly a third of the 21Mt of copper produced in 2021 — new copper supply that would need to be either mined from existing operations or discovered.

The US is pursuing its own $1.2 trillion infrastructure package, to be spent on roads, bridges, power & water systems, transit, rail, electric vehicles, and upgrades to broadband, airports, ports and waterways, among many other items.

The Infrastructure Investment and Jobs Act is the largest expenditure on US infrastructure since the Federal Highways Act of 1956. Rolled out over 10 years, it includes $550B in new spending. According to S&P Global, Among the metals-intensive funding in the legislation is $110 billion for roads, bridges, and major projects, $66 billion for passenger and freight rail, $39 billion for public transit, and $7.5 billion for electric vehicles.

Again I have to ask, where are we gonna find the copper?

Supply

The obvious answer is, mine more, but that is easier said than done.

Bloomberg New Energy Finance (NEF) estimates that in 20 years, the world’s copper miners must double the amount of global production — from the current 20 million tonnes annually to 40 million tonnes — just to match the demand for a 30% penetration rate of electric vehicles.

This is a tough ask considering some of the world’s largest mines are seeing depleted copper reserves and lower ore grades, so it would be difficult for global production to even maintain a 20-million-tonne-per-year pace.

Bank of America in a recent report predicts the copper market will flip into a deficit as early as 2025 following the completion of the current wave of project buildouts, the latest being Ivanhoe Mines’ massive Kamoa-Kakula project in the Democratic Republic of the Congo. Short-term copper supply will be bumped up by newly established copper mines that are expected to begin production soon. They include the Timok Mine in Serbia and the Mina Justa Mine in Peru.

“While visibility over the near-term project pipeline is good, activity increases come with a wrinkle,” the bank’s analysts say. “Indeed, many of the projects currently developed have been in the making for almost three decades, and with exploration activity relatively limited in recent years, supply increases may fade from 2025.”

Five years later, analysts at Rystad Energy project that copper demand will outstrip supply by more than 6 million tonnes. That equates to nearly the entire annual production of Chile, the world’s top producer.

By 2040, the supply shortfall grows to 14Mt, according to a BloombergNEF August report, with a “best-case scenario” shortage of >5 million short tons possible by 2040.

As for where this new copper supply would come from, it won’t be from domestic sources. S&P Global forecasts that US copper imports are likely to grow from about 44% of the nation’s consumption this year to as much as 67% by 2035. It’s difficult to develop a copper mine (or any mine) in the US, due to organized opposition, over-regulation and length of permitting times, up to 20 years in some cases.

The International Energy Agency says on average it takes 16 years to develop a copper mine from initial discovery to production.

The article above by Electrical Contractor makes an interest point:

To offset the shortage, existing mines are increasing production and recycling efforts have amplified. The fact remains, however, that production and processing are concentrated in even fewer countries than oil production. Some of those regions, such as Chile, are experiencing water shortages, while others, including Australia, China and Africa, are enduring flooding and severe heat. All these issues hamper copper processing.

Last week, Chile’s state-owned copper miner Codelco said it expects 2022 output to reach between 1.49 million tonnes and 1.51Mt, down from its previous forecast of 1.61Mt. The 2023 guidance is even lower, just 1.45Mt, and the firm’s “best forecast” between 2023 and 2027 is an annual average 1.5Mt.

According to Mining Intelligence, that would constitute the lowest output in at least as decade, and compares to average attributable output of 1.74Mt since 2010, setting up Mining.com’s headline ‘Chile, Codelco face another lost decade of output growth’.

In fact, BMO Markets describes the situation as two “lost decades” of copper production growth: “Following the steady ramp-up in the 1990s and early 2000s, output levels have stagnated, with the projections of 6Mtpa-plus of output never coming to pass.

“And this is not for a lack of investment, with a number of large new mines coming to market over this period. Rather, it is a function of decline at existing assets.”

Copper grades have dropped about 25% in Chile over the last decade, bringing less ore to market.

Making matters worse, after more than a decade of drought, freshwater supplies are becoming a big problem in Chile. Copper mines there happen to require lots of water to process sulfide ores, and the lower the grade, the more water must be used.

Since major copper miners are increasingly turning to low-grade sulfide deposits to beef up their production, their water consumption is expected to jump up to 20.9 cubic meters per second (about half an average household pool). Water scarcity in effect hinders their ability to produce.

Meanwhile Peru, the world’s second largest copper miner, has also underperformed. Copper production in July totaled 195,234 tonnes, following a respective 9.1% and 14.5% drop in output at the Antamina and Southern Copper mines. The result was a 6.6% year-on-year loss.

While copper production at China-owned Las Bambas recovered in June, following a truce with indigenous communities who oppose the mine, the truce ended in July and renewed protests could risk copper supplies, Reuters said this week.

Both Chile and Peru are seeing a wave of resource nationalism, where governments try to exact a greater share of resource revenues through various means, such as higher royalties and export bans of raw ores.

In December, leftist candidate Gabriel Boric was elected president of Chile, on a mandate to impose higher taxes, sending a chill through the mining industry which argues the change will impede competitiveness. A vote is scheduled in Congress in the coming weeks.

Peru’s President Pedro Castillo has also proposed to raise taxes on the mining sector by at least 3%, which the country’s mining chamber says could cost USD$50 billion in future investments.

Recycling no help

For some metals (e.g. gold) recycling helps to fill any shortfalls in mined supply. Copper, too, can be melted down and used again. The problem is, there just isn’t enough recycled copper, at current levels, to make a difference.

A recent BloombergNEF report found that “Investing in technologies related to recycling, lowering costs and improving recovery rates from low-grade deposits could help bring new copper supply online to meet growing demand.”

The accompanying Bloomberg story notes that mining challenges mean the focus shifts to secondary production, with a jump in recycling projected to help fill the gap.

According to the US Geological Survey, in 2021 old (post-consumer) scrap, converted to refined metal and alloys, provided an estimated 160,000 tons of copper. Purchased new (manufacturing) scrap, derived from fabricating operations, yielded an estimated 710,000 tons.

Total recycled copper of 959,000 metric tons in 2021 represented just 4.5% of last year’s 21 million tonnes of mined supply.

A recent analysis by Business in Vancouver rejects recycling as a viable solution to the copper crunch.

The article by mining reporter Nelson Bennett affirms the criticality of copper for making the energy transition, noting that it’s copper that is the biggest worry, (even more so than lithium, whose prices have shot up nearly 400% from a year ago), and that copper could rival oil as a national energy security concern for some countries.

In shooting down battery recycling as a means of lessening the supply-demand deficit for copper and other battery metals, Bennett makes the following points:

- While a recycling and reuse industry for EV batteries will be needed, it won’t come anywhere close to supplying the necessary metals.

- If the number of EVs on the road today remained static for the next 20 years, recycling the metals in them might be able to make up the bulk of the demand. But EV sales are growing exponentially.

- There were 3 million electric cars sold globally in 2020, according to the IEA. That more than doubled in 2021 to 6.6 million. By 2030, S&P Global forecasts there will be nearly 27 million sold annually.

- Assuming a battery life of 10 years (some may last as long as 20 years), even if every one of the 3 million batteries and motors sold in EVs in 2020 were to be recycled, that would provide only 11% of the metals needed in 2030 for 27 million electric cars.

- The IEA estimates that recycling could meet only about 10% of the demand for battery materials in 2040.

Conclusion

The expected shortfall in copper supply and the inability of recycling to fill the gap, measured against robust demand for copper from both traditional and so-called “green” applications (mainly electric vehicles and renewable energy) bodes well for companies exploring for copper. After all, they are the owners of the world’s next copper mines.

At AOTH, our favorite copper junior is Max Resources (TSXV:MAX; OTC:MXROF; Frankfurt:M1D2), known for its CESAR copper-silver project in northeastern Colombia.

The URU discovery spans a major structural corridor and remains open in all directions. Geologically, Max compares the sediment-hosted copper-silver mineralization at URU to that found in the Central African Copper Belt (e.g., Ivanhoe Mines’ 95-billion-pound Kamoa-Kakula copper deposit in the DRC).

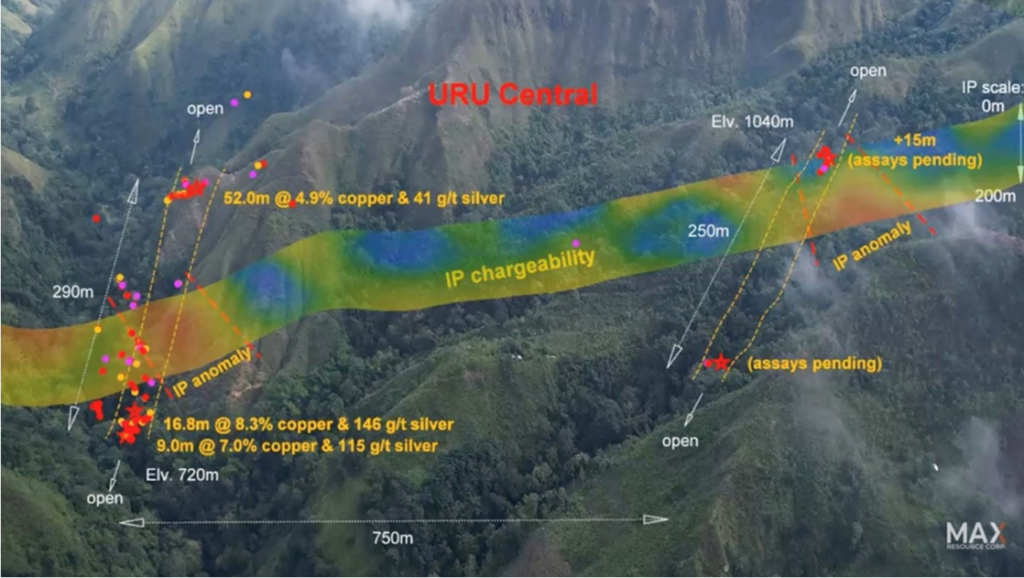

First, the Max field team conducted an IP survey at URU so that they could see in three dimensions what the mineralization looks like before they start drilling it. Because the primary copper mineral is highly conductive chalcocite, it lights up nicely on an IP geophysical survey. The next step for Max after doing IP at URU, is to drill. According to Max, the IP chargeability on the survey correlates with two copper-silver rich discoveries at “URU Central” that extend at least 200m below surface. The first two drill targets are “URU-C” and “URU-CE”.

In our opinion, the two targets are impressive. The lower portion of URU-C is 290 meters long by 9 meters wide by 200m deep, with a specific gravity of 2.8. The target on the right, URU-CE, is 250m long by 15m wide by 200m deep, also with a specific gravity of 2.8.

At URU we know that chargeability relates to mineralization, thus the IP survey confirms what we thought we had on surface, to a depth of 200m. The next step is to go in with a drill to ground-truth the IP, and establish the grades. Important to note, is the fact that we are currently looking at an area of only about 1 km x 1 km; the strike at URU is 20 km, meaning there is a great deal of work left to be done – Max has barely scratched the surface. The fact that we already have two parallel zones that are open laterally and at depth, imo is a great start.

On Aug. 23 Max was awarded a fifth mining concession at URU, bringing the district’s total area to 74 square kilometers, of the 90-km-long CESAR North copper-silver belt. Max has so far received 20 mining concessions covering 188 km² — more than any other company has ever received in Colombia.

Sitting on about a $20 million treasury, the company is poised to drill CESAR for the first time later this month. I’m expecting major news flow from Max as assay results from URU are received. They should, imo, provide plenty of evidence backing up CESAR’s extremely unique geological model, and the potential of building out a large resource.

Max Resource Corp.

TSXV:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.30 2022.09.07

Shares Outstanding 160.2m

Market cap Cdn$49.3m

MAX website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Max Resource Corp. (TSXV:MAX) MAX is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.