Commodities and soon Juniors in vogue

2021.02.23

Gold and copper are up, the dollar is down, and bond yields are surging, as investors price in the likelihood of nearly $4 trillion in new spending under the Biden administration, including a $1.9 trillion covid relief package still under consideration by Congress, and an expected $2 trillion bipartisan infrastructure bill to repair the nation’s crumbling roads, bridges, airports, water systems, etc.

MarketWatch reported on Monday that Analysts have already started to “embed expectations” for infrastructure spending, as evidenced by a 25% surge in projected 2021 earnings for companies in the S&P 500 machinery sub-index since June, as opposed to an average rise or around 6% for companies the broader S&P 500 index, said Mark Hackett, chief of investment research at Nationwide, in an interview.

The machinery group has rallied 118% from its pandemic lows set a year ago on expectations that companies like Caterpillar will benefit from a boost in infrastructure spending. That compares to the S&P 500’s 78% rally during the same time period.

Hackett argues it isn’t only equity investors that are starting to pencil in more spending on infrastructure. US Treasury debt yields are climbing too, driven by the “reflation” trade, which is a bet on a return to inflation, resulting from a wave of stimulus spending and other large public sector investments under President Biden and a Democrat-controlled Congress. MarketWatch states,

Indeed, while economists at Bank of America said they remained skeptical of inflation prospects around the globe, they see the U.S. as an exception. Big rounds of fiscal spending already in the pipeline and perhaps to come, including up to $2 trillion in infrastructure spending over four years, remain an upside risk to the inflation outlook, wrote Ethan Harris and Aditya Bhave, in a Feb. 5 note.

Bond yields have risen sharply this month, as prospects for more US fiscal stimulus boosted hopes for a faster economic recovery. The yield on the benchmark US Treasury note jumped to 1.394% on Monday, the highest since February 2020.

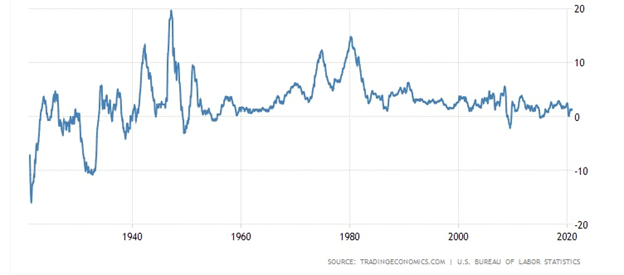

US economic growth is expected to run hotter than any time in the past 35 years, and business investment should move twice as fast as the broader economy, feeding inflation fears, according to Credit Suisse, via Reuters.

On Monday global stock markets fell on expectations of faster growth and inflation. Rising prices are the enemy of equity investors because it is the job of central banks, including the US Federal Reserve, to control inflation below the rate of 2% by raising interest rates if necessary. Higher rates generally mean headwinds for corporate earnings because they squelch borrowing.

Monetary to fiscal shift

Investors who experienced the financial crisis may scoff at the idea of reflation. When the US central bank in 2008 introduced the then-radical concept of quantitative easing, to help the economy to recover, many predicted that the creation of trillions of new dollars would lead to a rapid rise in inflation.

It didn’t happen. Despite three rounds of QE, and the accumulation of $4.5 trillion in Federal Reserve assets (bonds and mortgage-backed securities) between 2008 and 2014, inflation never went above 4%.

Why? Instead of ending up in the hands of businesses and average Americans, who could have purchased goods and services, the funds stayed with the banks, who used it to replenish depleted bank reserves or to swap financial assets.

Indeed, the velocity of money, a measure of how quickly the money supply moves through the economy, has significantly slowed in recent years. Despite the money supply surging from $1.3 trillion in 2005 to $6.8 trillion in 2021, the velocity of money has slowed from 10 to 3. That means the printed money did not reach the so-called “real economy”, but instead was used by banks and institutional investors to accumulate assets and inflate their prices.

The upshot was, the Fed could have its cake and eat it too. It could keep interest rates at or near zero, which was great for the stock market, and for politicians who agreed with central bankers (Obama) or pressured them (Trump) to keep the equities party rocking by holding borrowing costs low. And by keeping the stimulus money in the banking system, it didn’t cause inflation. At the same time, governments cut spending, thinking this would goose economic growth.

The combination of monetary expansion and fiscal contraction however, failed to bring about the expected recovery. Yet when the pandemic struck in 2020, the belief in “monetary therapy” was still strong. There was also limited appetite, especially among the Trump administration, for direct spending to help the masses, $1,400 stimulus checks excluded. According to Project Syndicate,

This prevented governments from thinking seriously about channeling the hundreds of billions of new QE money to those parts of the real economy that remained open for business, rather than giving millions of people months of paid leave.

In fact, the outstanding feature of Western governments’ responses to the pandemic was their untargeted character. Policymakers preferred mass lockdowns and furloughs to any attempt to keep people working by deploying technically feasible mass testing, tracking, and tracing systems, as many East Asian countries did.

The result is a new belief among macroeconomic policymakers that their previous adherence to monetary policy, as the cure for economic ills, was wrong. Instead, the focus should be on the allocation of capital by government. As stated recently by former Bank of England Deputy Governor Paul Tucker, “monetary policy should now take a back seat to fiscal policy.”

While clearly anathema to libertarians, and quite possibly to many conservatives, Project Syndicate states,

The case for fiscal policy is not only that it is a more powerful (because more targeted) macroeconomic stabilizer than monetary policy, but also that government is the only entity apart from the financial system capable of allocating capital. If we are not willing to allow investment in technology and infrastructure to be shaped by a purely financial logic, then the need for what Mariana Mazzucato calls a “mission-oriented” public investment strategy that includes taxation policy becomes inescapable.

Fiscal policy need not necessarily involve the government “picking [sector] winners” to invest in; rather, “mission-oriented” means choosing directions for change such as a “green” transition, that requires innovation and investment in multiple sectors. Mazzucato in her column compares it to the Apollo mission in which putting a man on the moon required a purpose-driven partnership between the public and the private sectors.

She concludes, There is now a huge opportunity to pursue industrial policies beyond traditional sectoral and technological silos, and to restore mission-driven governance in the public interest. A modern industrial strategy aimed at a Green Renaissance, for example, would require all sectors – from artificial intelligence and transportation to agriculture and nutrition – to innovate and pivot in a new direction.

If there is one thing the pandemic has taught us, it’s that countries and states which invested in their public sectors performed better than those that didn’t. Vietnam and the Indian state of Kerala are two mentioned by Mazzucato. I would point to China, and its ability to lock down millions of people in Wuhan — albeit through state-sponsored surveillance and by flouting civil liberties — and South Korea, which successfully mobilized a covid testing regime that contained virus spread and greatly minimized the number of deaths.

US infrastructure spending

The limelight of Biden’s first few weeks in office has shone on his $1.9 trillion stimulus package, set for a vote this week. But there is a lot more to come, all of which will add to the national debt, currently sitting at about $28 trillion, and buttress the argument for higher inflation.

Consider: Biden’s economic recovery package, which may be unveiled next month, will, according to Bloomberg, far surpass his $1.9T virus-relief plan:

The centerpiece will be possibly the biggest infrastructure-spending commitment since the New Deal — including roads, bridges and rural broadband internet. Progressives are eyeing much more, such as an expansion of Obamacare and a public-sector jobs program, along with tax measures including an increase in the capital-gains levy.

We know the President, despite claiming otherwise, believes strongly in the power of the state to tax and spend, and will face overwhelming pressure from the left wing of the Democratic Party – supporters of hard-left progressives like Elizabeth Warren, Alexandria Ocasio-Cortez and Bernie Sanders – to toe the party line. A long wish list waits to be filled, with little to no concern regarding the already out of control $28 trillion national debt, courtesy of Modern Monetary Theory, or MMT.

Treasury Secretary Janet Yellen, the former US Federal Reserve Chair, is on board with the planned multi-trillion-dollar fiscal outlays — having argued that deficit spending makes sense with interest rates at historic lows.

When campaigning for president, Biden proposed $2 trillion for economic rebuilding, wo we expect the infrastructure bill to contain at least that much. Progressive are eyeing an expansion of Obamacare and a public sector jobs program, so we wouldn’t be surprised if it’s $3 trillion, even $4T. As BNN Bloomberg argues, correctly in our view, Democrats see a narrow opening to forge Biden’s legacy: not just restoring the U.S. economy to its pre-pandemic state, but reversing the trend of sluggish growth in recent years with the most far-reaching measures in decades.

And why wouldn’t they use their majorities in the Senate and the House of Representatives to do so? There was also the news report that Biden, after a lengthy phone call with China’s President Xi Jinping, sees a comprehensive infrastructure bill as necessary to prevent China “from eating our lunch.”

A massive public works building program is increasingly seen as an area that could attract bipartisan support, with projects related to highway improvements, transit, waterways and flood mitigation, likely to be top priorities.

Indeed, the country is suffering from a $2 trillion “infrastructure gap”. In its last “report card” in 2017, the American Society of Engineers gave the country a D+ for failing to replace old infrastructure with new facilities. Back then, it was estimated the United States needed to spend $4.5 trillion over the next 10 years, and with $2.5 trillion already in progress, that left a $2 trillion gap.

“Much of our infrastructure is nearing the end of its useful design life,” says Thomas Smith, the ASCE’s executive director. “We’ve neglected it for far too long, and we’ve watched other countries continue to invest and continue to move ahead of the United States.” The new four-year report card is slated to come out on March 3, its not going to be pretty and will be used by the Democrats to justify, and rightly so, a huge infrastructure spend.

Commodities in vogue

At AOTH we have long been of the opinion investors should be taking a hard look at commodities, which as an asset class, are up 43% since last April. Many are starting to see the light.

According to John Normand, head of cross-asset fundamental strategy at JP Morgan, via Bloomberg, The lessons of history, current valuations and carry suggest that the best hedges for a “too-hot economy” are a commodity index, oil, agriculture, energy equities and emerging-market commodity FX.

Variant Perception thinks we are on the cusp of a new commodities super-cycle and cites three big drivers: The long era of monetary-policy dominance is over, leading to a heightening of inflation risks not seen since the 1960; Investors are deeply underweight and will need real assets such as commodities as a hedge against inflation; Commodities are generationally cheap, both compared to themselves and to other assets.

It is rare in macro-forecasting when the stars align so perfectly. The combination of substantially different inflation risks, capital scarcity across several commodity sectors, and 50 years’ of underperformance compared to financial assets make commodities one of the most compelling long-term investment opportunities at the moment.

Goldman Sachs states that the next structural bull market for commodities will be driven by spending on green energy.

In 2003 the commodities super-cycle was driven by growth in China, which demanded almost every commodity under the sun to meet double-digit annual increases to its GDP. This time is different. I believe we are going to see demand across the board for nearly every type of commodity, based on infrastructure renewal, electrification, reduction of carbon, and food demand.

When I was interviewed by Financial Sense last fall, I explained the four over-riding global themes I believe are setting us up for a bull market in commodities like no other in history. They are:

- Blacktop/ basic infrastructure such as roads, bridges, water & sewer systems, etc., that has been poorly maintained. Governments need to spend trillions to repair their crumbling infrastructure and bring it up to the needs of a modern economy. The latter includes investments in smart power grids, 5G and high-speed rail.

- Electrification of the global transportation system. The move away from fossil-fuel-powered vehicles to EVs run on batteries is happening in almost every country. Governments are spending billions on EV charging infrastructure and subsidies to incentivize consumers to switch to hybrids and plug-in electric cars, vans and trucks. China is the leader but other countries are catching up, as large automakers like Volkswagen, Mercedes Benz, GM and Ford come out with new EV models and plan new EV manufacturing/ assembly plants in North America and Europe.

- Reducing our carbon footprint. Not only do we need to figure out a way to transition from gas and diesel-powered vehicles, but there is also the question of how to fill the batteries demanded by electrification. Creating that energy — mostly solar and wind but also hydro-electric power — involves a massive use of metals to build batteries, battery storage systems, transmission lines and smart grids.

- Meeting the global demand for food. Food supplies are constantly under pressure due to expanding populations, and as developing countries move up the “food chain” to include more protein in their diets. Reducing food insecurity thus has to be an important part of this latest commodities boom, which sees the first three trends happening all at the same time.

Copper

A green infrastructure spending push will mean a lot more energy metals will need to be mined, including lithium, nickel and graphite for EV batteries; copper for electric vehicle wiring and renewable energy projects; silver for solar panels; rare earths for permanent magnets that go into EV motors and wind turbines; and tin for the hundreds of millions of solder points necessary in making the new electrified economy a reality.

Copper’s widespread use in construction wiring & piping, and electrical transmission lines, make it a key metal for civil infrastructure renewal.

The continued move towards electric vehicles is a huge copper driver. In EVs, copper is a major component used in the electric motor, batteries, inverters, wiring and in charging stations. An average electric vehicle contains about 4X as much copper as regular vehicles. Electrification includes not only cars, but trucks, trains, delivery vans, construction equipment and two-wheeled vehicles like e-bikes and scooters.

According to the Copper Development Association (CDA) a high-speed train required 10 tonnes of copper components, plus another 10t in the power and communication cables per kilometer of track. Even the most basic gasoline-powered passenger car requires a kilometer of copper wiring, and between 15 and 28 kilos of copper, depending on its size. A traditional internal combustion engine cannot be built without 23 kg of Cu.

BloombergNEF forecasts by 2040 there will be a need for 12 million charging points, each requiring about 10 kg of copper. The number of charging stations recently passed the one million mark.

The latest use for copper is in renewable energy, particularly in photovoltaic cells used for solar power, and wind turbines.

The adoption of smart grid technology in developed and developing countries will boost demand for copper strips used in switchgear, devices that protect equipment and circuits from power spikes. Copper is the conductor material used in transformer windings, strips and busbars. Both power and distribution transformers use copper strips.

Beyond the United States, there is China’s Belt and Road Initiative (BRI), consisting of a vast network of railways, pipelines, highways and ports that would extend west through the mountainous former Soviet republics and south to Pakistan, India and southeast Asia.

Research by the International Copper Association found BRI is likely to increase demand for copper in over 60 Eurasian countries to 6.5 million tonnes by 2027, a 22% increase from 2017 levels.

The base metal is also a key component of the global 5G buildout. Even though 5G is wireless, its deployment involves a lot more fiber and copper cable to connect equipment.

Another report by Roskill forecasts total copper consumption will exceed 43 million tonnes by 2035, driven by population and GDP growth, urbanization and electricity demand. Total world mine production in 2020 was only 20Mt. In many countries it takes 20 years to go from discovery through permitting to mining.

The big question is, will there be enough copper for future electrification and energy needs, globally? And remember, in addition to electrification, copper will still be required for all the standard uses, including copper wiring used in construction and telecommunications, copper piping, and copper needed for the core components of airplanes, trains, cars, trucks and boats.

The short answer is no, not without a massive acceleration of copper production worldwide.

As we have reported, without new capital investments, Commodities Research Unit (CRU) predicts global copper mined production will drop from the current 20 million tonnes to below 12Mt by 2034, leading to a supply shortfall of more than 15Mt. Over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.

Some of the largest copper mines are seeing their reserves dwindle; they are having to dramatically slow production due to major capital-intensive projects to move operations from open pit to underground.

A recent report from Jefferies Research LLC concluded: “The copper market is heading into a multiyear period of deficits and high demand from deployment of renewable energy and electric vehicles.”

Tightening supply, combined with all the above-mentioned demand drivers, plus inflation expectations, are cranking up the copper price. On Monday, Feb. 22, copper vaulted over $9,000 a ton for the first time in nine years, moving closer to the all-time high of $10,190 reached in February, 2011.

The red metal is on track for an 11th straight monthly gain and has doubled in price since a mid-March 2020 low. In a telling sign of emerging tightness, spot copper contracts are trading in backwardation, ie., at a premium to futures, suggesting that spot demand is outpacing supply as London Metal Exchange inventories run low.

Citigroup is predicting an annual 500,000-tonne deficit, starting this year, with copper supply falling short of demand most years. Inventories in LME warehouses are currently near 2005 lows — when demand ran hot in the middle of the last commodities super-cycle.

Every investor should take a long hard look at the third chart below. There has been a long-term structural deficit in copper supply. When pent-up demand, and massive new demand as described above, meet structural unfixable long term supply deficits there is only one way for prices.

Conclusion

The price of copper has been rising along with a number of other metals including iron ore, zinc, and nickel, amid what some are calling a new super-cycle.

As supply disruptions and sustained demand from China continue to create practically ideal conditions for the mining industry, some companies are passing their profits on to shareholders.

BHP, the world’s largest mining firm, reportedly forecasted a “very constructive” outlook for commodities market fundamentals, and rewarded investors with a record interim dividend of US$1.01, up from $0.65 last year. Profit in the first half jumped 16%, to a 7-year high, owing to demand from top metals consumer China boosting iron ore prices by 70% in 2020.

The Anglo-Australian miner said if iron ore and copper prices maintain current levels, it would be able to slash its net debt. Glencore meanwhile will resume payouts, with a US$1.6 billion return to shareholders after scrapping its annual dividend last August.

Critically for AOTH purposes, though, the key statement came from BHP’s Vice President, Market Analysis & Economics, Huw McKay, who indicated the company sees continued need for additional supply, both new and replacement:

“Looking even further out, long term demand from traditional end–uses is expected to be solid, while broad exposure to the electrification mega–trend offers attractive upside,” BHP Vice President, Market Analysis & Economics, Huw McKay, wrote on Feb. 16.

Where is BHP likely to get this new supply? During the last super-cycle, mining majors like BHP, Rio Tinto, Glencore and others tried to increase output through mergers and acquisitions with other large mining companies or mid-tier producers. The strategy largely failed. A lot of M&A happened at the top of the market, with acquirers overpaying. When metals prices fell across the board, they were left holding the bag. Asset sales and multi-billion-dollar write downs ensued, which contributed to hundreds of millions of market value lost.

I’d like to think that the majors have learnt their lesson, and won’t “eat each other” again, in pursuit of higher production and reserves replacement. Mining companies know they need to get into long-life, scalable projects, with the capability of replacing their depleting reserves/ resources, that can be developed at reasonable cost to shareholders.

There has been a long-term structural deficit in copper supply. When pent-up demand, plus massive new demand meet structural, unfixable, long term supply deficits there is only one way for prices to go.

Every investor should take another look at the chart below.

Fact: Junior mining companies are the owners of the world’s next mines. They have the deposits the majors and the mid-tiers need, to replace reserves and continue producing at their current levels, and to make a difference to the bottom line.

Fact: History shows that juniors offer the best leverage to rising metals prices especially those with a deposit likely to be of interest to a major mining company or financing partner.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.