China’s copper futures launch may spell the beginning of a new market benchmark

2020.11.21

While all eyes were on American politics over the past few weeks, China is continuing to make moves that it deems necessary to challenge its Western rival for global supremacy.

A recent development across the Pacific saw the world’s biggest consumer market join a regional trading pact for the first time with the signing of the Regional Comprehensive Economic Partnership (RCEP).

This trade pact — which involves 10 ASEAN countries plus Australia, Japan, New Zealand and South Korea — not only extends China’s “sphere of influence” within the Asia Pacific region, but also “unites” those countries impacted by President Donald Trump’s “America First” policies.

In fact, the RCEP would be the largest trade alliance in the world, with the 15 nations accounting for nearly one-third of the global population and nearly 28% of last year’s trade totals.

With the promise of lower tariffs and standardized rules, the deal could increase global national income by $186 billion annually by 2030 and add 0.2% to the economy of its member states, according to the Peterson Institute for International Economics.

What this means is that China and the US will likely move further apart on trade and technology matters. On a more dramatic scale, the entire landscape of international trade could shift, beginning with the demise of the US dollar.

Then there is the ambitious Belt and Road Initiative, which is seen as an unparalleled economic driver that could lead China to what it believes to be a “highway to global dominance”. This may lead to an endlessly rising demand for resources to build the level of infrastructure required.

Growing economic independence from the US could allow China to be more adventurous when it comes to strategies involving commodities, which are beginning to take shape over recent years with the nation overtly looking to lock up minerals and energy resources all over the world.

So far, China has already managed to dominate the processing of many commodities such as rare earths and graphite, but it is now clearly looking at controlling the supply and trading of commodities.

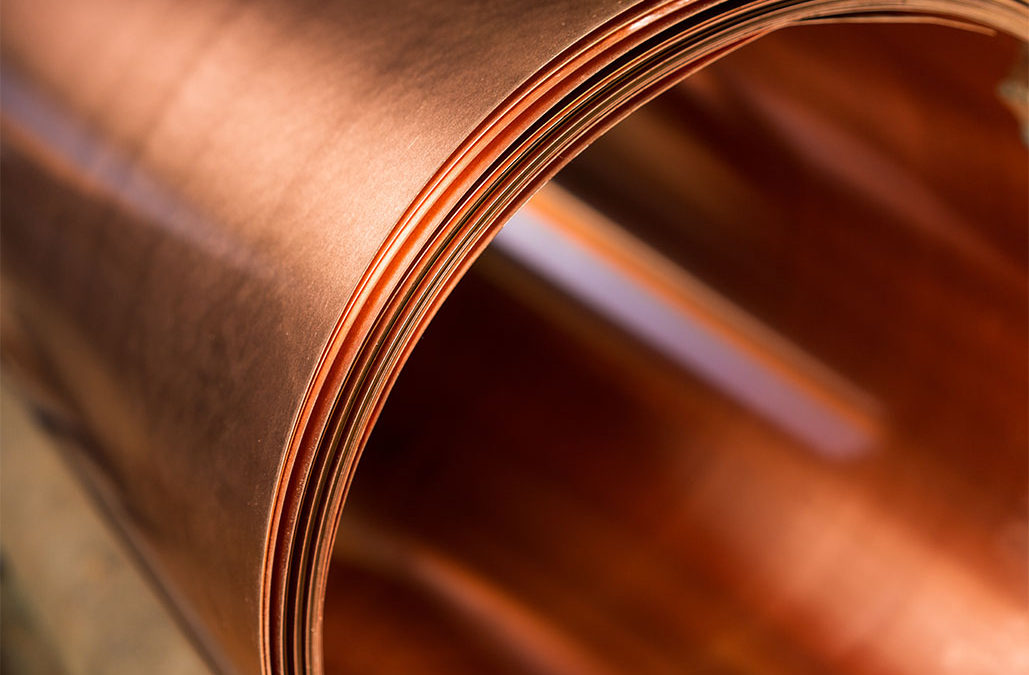

Shanghai Copper Futures Launch

This week, copper prices surged to new multi-year highs thanks to China’s launch of a new copper futures contract in Shanghai.

Shanghai exchange unveils copper futures product

While there is an existing copper contract on the Shanghai Futures Exchange, this new copper instrument is more ambitious — It’s the first of its kind to be made available directly to overseas investors.

The new contract will exclude value-added taxes, making it similar to international prices. The copper metal will be delivered into bonded warehouses outside of customs areas, so they are free of import duties. These are designed to help the contract compete with those traded on the London Metal Exchange.

There are also benefits to domestic traders, as the copper futures contract could also help them hedge international price exposure in their own currency, commodity experts say.

This copper futures launch was not just regarded as a challenge to London’s dominance in the world’s metals trading stage.

Since the contract will be denominated in yuan (or renminbi), China is also sending a signal to the world that the biggest consumer now wants to raise the profile of its currency — and perhaps even have the yuan supplant the greenback somewhere down the road.

New Copper Benchmark?

While similar initiatives have been undertaken in the past for other commodities such as iron ore and crude, this copper contract promises to be an even bigger advance, according to Bloomberg columnist Clara Ferreira Marques.

In her latest piece, Ferreira Marques wrote:

“Copper could outshine these efforts, thanks to fortuitous timing, global appetite for an economic bellwether and the sheer clout of the world’s largest consumer.”

At the moment, China consumes more than half of the world’s copper, according to BMO Capital Markets, up from 39% in 2010 and 12% in 2000. Its appetite has only grown this year — the country took in more unwrought copper and has already increased its purchases of refined metal by more than one million metric tonnes compared with last year.

This means a yuan-denominated copper contract could leave a much bigger mark on the metals trading landscape than any other commodity.

Colin Hamilton, an analyst at BMO Capital Markets, recently said the contract has a “high chance of being extremely successful” given that more than 70% of copper consumption takes place across Asia.

“China was now the ‘market of last resort for purchasers’, assuming they can stomach the currency risk,” Hamilton added. “[We] expect this may become the international copper market benchmark over time.”

As Ferreira Marques points out: “Shanghai’s yuan-based contract is the country’s first, and perhaps most dramatic, endeavor in international futures markets.”

Copper Pricing Power

Every buyer wants to dictate the price as much as possible. Given how heavily dependent it is on commodity imports, it makes sense for China to want to have a say in the copper market.

The metal is considered a key indicator for an economy that has recovered from the pandemic faster than the rest of the world. “The strong macro China data is giving copper another ride higher and it reinforces the view that China’s demand recovery is holding its shape,” ING analyst Wenyu Yao recently said.

Add to the fact that China — the world leader in electric vehicles — will lead the hunt for metals that are essential to the auto industry for years to come, it’s easy to see why it wants to be a price maker, not a price taker, for copper.

Copper rally LME

A yuan-denominated copper contract would propel China towards that status, as it achieves two things.

First, as mentioned above, the new futures contract elevates the international role of the yuan (and to a degree diminishes that of the US dollar). In fact, the yuan is one of the most actively traded currencies right now and should be included in the top tier of foreign-exchangeS, according to HSBC’s newly named head of FX research Paul Mackel.

Second, with copper being the most traded metal in the world, the new futures contract would greatly enhance the yuan’s convertibility and liquidity.

Eventually, the goal is to have the price quoted in yuan dominate copper trading internationally.

Other Commodities

Copper is not the only industrial metal that has rallied since the US elections. Both iron ore and aluminum — both of which China consumes the most out of any other nation — as well as zinc, have all gone up.

Demand for these metals remains healthy, with iron ore continuing to enjoy a tailwind from a record Chinese steel production. Aluminum too has benefited from rising construction and manufacturing activity in China.

But the big surprise is zinc, which has even stolen copper’s spotlight in London with a surge to near 18-month highs. A supply crunch was the main catalyst, but the demand side pull from China steelmaking is still strong.

As for crude oil, China is considered the lone country that’s still “thirsty” for oil. This year, it has been quietly stockpiling inventory under the low-price environment, buying up more barrels than the prior year. Many believe this could be a strategic move to gain energy security as its rivals begin to cut orders.

Conclusion

It’s clear that China is seeing the outcome of the election — which some view as still “unresolved” — as an opportunity to joust for its position in the global economy.

Its latest move with copper futures is an emblem of its ambitions and may serve as a precursor for more moves to secure market power in other commodities.

The timing could not have been better either. Most of its rivals are still reeling from the impact of the pandemic while its own economy has mostly recovered.

Then we have to see how the “currency war” plays out, in which the copper contract will surely play an important factor.

“Industrial metals are red hot,” TD Securities analysts including Bart Melek recently commented. And as the world leader in consumption, China is sure to be in the thick of things.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security.

AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.