China will become more copper-hungry

2018.11.02

China is already the world’s biggest copper buyer, representing half of global demand. But its need for the metal used in plumbing, construction, telecommunications, plus its growing importance for renewable energy applications and electric vehicles – where copper is used in the electric motor, batteries, inverters, wiring and in charging stations – is about to get stronger, thanks to the expansion of China’s ‘Belt and Road Initiative’.

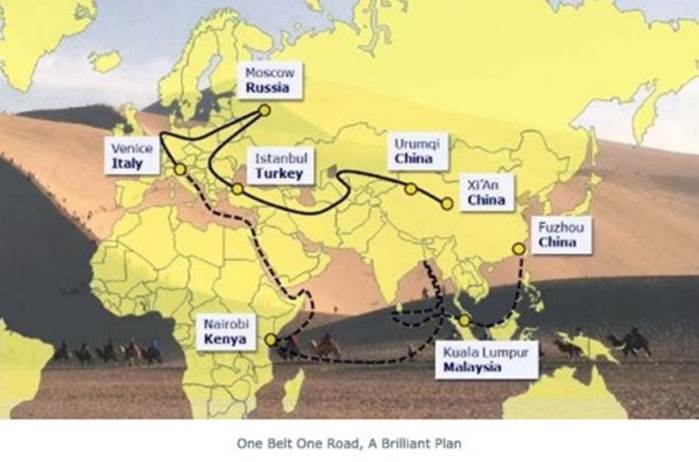

The “Belt” refers to a network of overland road and rail routes and oil and natural gas pipelines planned to run along the major Eurasian land bridges: China-Mongolia-Russia, China-Central and West Asia, China-Indochina Peninsula, China-Pakistan, Bangladesh-China-India-Myanmar. They’ll stretch from Xi’an in Central China through Central Asia reaching as far as Moscow, Rotterdam and Venice.

The “Road” is a network of ports and other coastal infrastructure projects from South and Southeast Asia to East Africa and the northern Mediterranean Sea.

“A network of new “South-South” trading routes connecting Asia, the Middle East, Africa and Latin America are set to revolutionize the global economy. Trade and capital flows between emerging areas of the world could increase tenfold in the next forty years. In the same way that trade between the developed nations exploded in the 1950s and 1960s, we expect the 21st Century to see turbocharged trade growth between the emerging nations.” HSBC Global Research

“In all trade corridors in which China participates, strong growth is anticipated. So strong in fact that it is no exaggeration to highlight this as the emergence of a new world trade order; by 2030, China will effectively be fulfilling the central trade role occupied by the US and the EU today.” The Super-Cycle Report, Standard Chartered Research 2010

This shift is already underway. According to BHP, the largest mining company on the planet, the impact on commodity demand of China’s Belt and Road Initiative (BRI) is spreading, significantly. Analyzing the impact of BRI on commodity demand, based on a database it constantly updates, BHP learned that China’s overseas expansion plan now covers 115 partners across not only Eurasia (essentially the revival of the old ‘Silk Road’ trading route from China to Europe) but Africa, Latin America and Oceania. This is nearly double the 68 countries or regions China cited as being part of its expansion plans last September, Reuters reports.

What does that mean for commodity demand? Well, it means that over half the world’s population will be involved in servicing new Chinese infrastructure, potentially boosting copper use by 1.6 million tonnes, equivalent to 7% of annual demand, BHP says.

Another source, TMX Media, estimates that BRI will generate an extra 2.2 million tonnes of copper demand, between now and 2030, worth US$13 billion based on a copper price of $2.75 a pound.

Most of the demand will come from power projects, which would further increase the need for copper due to the multiplier effect.

According to Reuters, “[BHP’s] latest analysis estimated the BRI represented one third of the global economy and would drive spending of up to $1.3 trillion over the decade to 2023.”

That’s a big number.

Due to its large manufacturing sector, the Chinese import roughly 70% of the copper they use. Other big copper consumers are the manufacturing sectors in Europe and the United States. The urbanization trend, where low-income rural people are drawn to the cities for a better life, is happening not only in China, but India, Southeast Asia, and parts of Africa.

BHP has signaled its intent to expand in copper and oil. In September the company bought a 6.1% stake in SolGold, an Ecuador-focused explore-co, which is developing a large copper asset named Casabel.

“Consistent with our positive long-term outlook, copper is a key exploration focus for BHP as we seek to replenish our resource base and grow this important business,” BHP’s chief executive Andrew Mackenzie said in a press release announcing the deal.

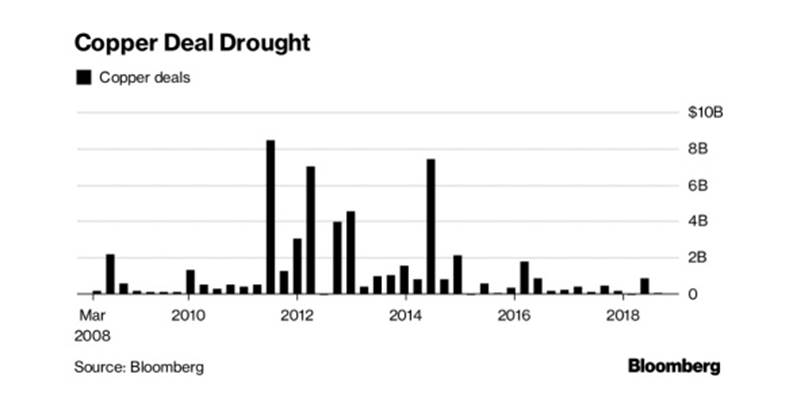

The same month China’s biggest gold mining company, Zijin Mining, fought off a hostile attempt by Lundin Mining to take over NevsunResources, which has two copper mines, one in Serbia and another in Eritrea. The $1.4 billion deal is the largest in copper this year, and breaks a four-year M&A drought.

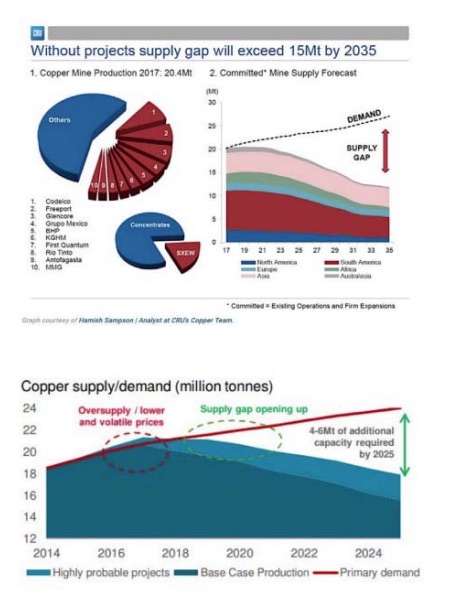

Global refined copper demand has risen steadily from 2005, when it was around 18 million tonnes, to the current global consumption of about 24 million tonnes. Where’s all this copper going to come from?

Mine supply has failed to come to fruition due to regular labor disruptions at the world’s major copper mines like Grasberg in Indonesia and Escondida in Chile.

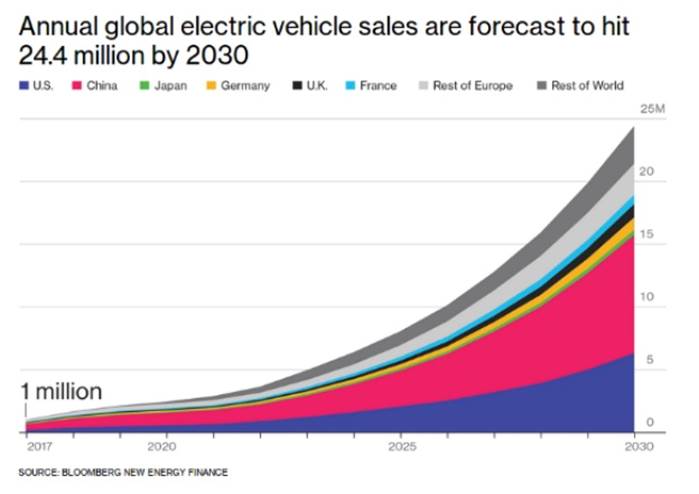

KPMG is predicting that by 2020 global copper demand will outstrip mine output. Electric vehicles alone are expected to account for an additional 300 million kgs of copper by 2023, according to a forecast by Bloomberg New Energy Finance.

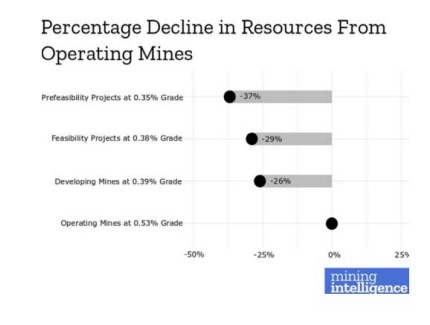

Lower ore grades are also expected to be painted into the waning supply picture. Copper grades have declined about 25% in top producer Chile in the last decade – highlighting the urgent need for grassroots exploration to arrest the trend. Producing copper mines are feeling the pinch, having noticed a significant decline in resources.

London-based commodities analyst CRU says unless new investments arise, existing mine production will drop from 20 million tonnes to below 12 million tonnes by 2034, leading to a supply shortfall of more than 15 million tonnes. That’s because over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.

To head off the expected gap in supply by 2020 – just two years away – the industry needs a faster path to production.

For more on this topic, read our The coming copper crunch

Even with expansions at existing mines and the ramp-up of the relatively few new copper mines like Cobre Panama, Radomiro and Toquepalain, it will not be enough to meet the onslaught of demand that is coming from China as it continues to modernize and urbanize, and make electric vehicles, which use three times as much copper as regular ones. Internal combustion engine powered vehicles use 23kg of copper per vehicle, hybrids use 40kg and plug in EV’s use 60kg of copper per vehicle – call it an equal mix using 50kg of copper per EV.

Bloomberg Energy Finance shows the EV percentage of total vehicle sales climbing to 55% in 2040.

Morgan Stanley says by 2047 there will be, globally, a billion electric cars on the road.

BP forecasts a much more moderate growth curve for plug-in electric car sales –15% of the almost 2 billion world car fleet in 2040 will be plug-in electric cars, that’s 300 million vehicles.

Between Morgan Stanley’s and BP’s that’s 6.8mt to 22.7mt of new copper production needed over the next 22 years JUST FOR ELECTRIC VEHICLES.

The shift to electrification of our transportation system is real, it’s not going to go away or stop. That means massive new copper supplies are needed. Bottom line? We gotta find more copper.

Conclusion

How do we get there? One answer is for mining companies with deep pockets, like BHP, to invest in copper properties that are practically shovel-ready. Maybe not huge, lower-grade deposits like Northern Dynasty’s Pebble Project in Alaska (facing an uncertain future, given its close proximity to sensitive salmon habitat), but smaller, high-grade deposits that can start producing quickly.

I’ve got junior copper developers that can help to fill the massive deficit that is coming the market’s way on my radar screen.

Richard (Rick) Mills

Ahead of the Herd is on Twitter

Ahead of the Herd is now on FaceBook

Ahead of the Herd is now on YouTube

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.