China weaponizes rare earths in retaliation for escalated US tariffs – Richard Mills

2025.04.10

The Trump administration on April 2nd rolled out “reciprocal tariffs” on countries it perceived as treating the United States unfairly.

A week later, Trump abruptly paused them for 90 days.

Included among the 86 trade partners hit with a minimum 10% tariff on imports to the US was China, whose tariff rate has ratcheted higher over past weeks. It started at 10%, doubled to 20%, and then on April 2nd as part of reciprocal tariffs, China was slammed with another 34% for a total of 54%.

Beijing responded last Friday with a countervailing duty of 34% on all US imports. Reacting to that, Trump increased China’s tariff rate to 104%, effective on Wednesday, April 9th.

China hit back by raising its tariff on US goods to 84%. Trump on April 9 again raised China’s tariff, to 125%.

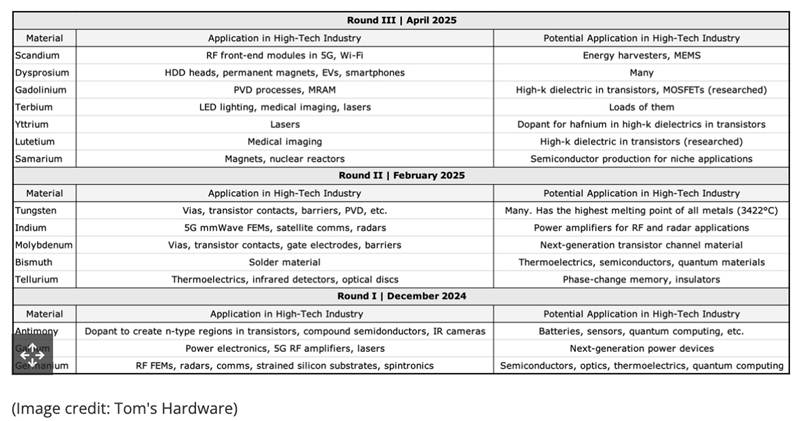

But China had another card up its sleeve, one potentially far more damaging to the US economy and its military. On the same day it announced the 34% counter-tariff, China rolled out new controls on the exports of rare-earth minerals to the US, including scandium, samarium, gadolinium, terbium, dysprosium, lutetium and yttrium.

These seven rare earth elements — part of the 17 REEs on the Periodic Table — are virtually unknown outside of certain defense, semiconductor and clean-technology circles.

But because the United States (and other nations like Canada) are so dependent on China for them, they put some American industries at risk of supply shortfalls. An example is yttrium, a vital input in electronics and aerospace. The US Geological Survey says the US imports 93% of its yttrium from China.

Indeed the US and its allies have few alternatives for sourcing these materials other than China, which mines about 70% of the world’s rare earths and has an even stronger chokehold on their processing, controlling about 95% of the market.

The United States currently has only one rare earths mine in operation, Mountain Pass in California, but the rare earths concentrate is shipped to China for processing into rare earth oxides needed for a litany of uses, everything from electric vehicles and smartphones to military equipment like fighter jets, missiles and satellites.

3 rounds of restrictions

The export controls took effect on April 4th.

They follow an even more aggressive move in December, when China halted (not just restricted) exports to the US of antimony, gallium and germanium. In 2023 China curbed exports of graphite, used in the anodes of lithium-ion batteries, and banned the export of technology to make rare earth magnets.

Germanium is crucial for producing wafers featuring strained silicon and the most high-performance computer chips/ semiconductors made by Intel, TSMC and Samsung, according to Tom’s Hardware. A 300-mm water uses about a gram of germanium.

Antimony is used as a dopant to make transistors, and gallium is key to powering semiconductors, radio frequency (RF) electronics and infrared sensing. When it comes to usage in applications like radar and telecommunications, gallium and germanium are inseparable.

According to Tom’s Hardware, these materials support industries ranging from telecommunications to defense and data centers. That makes the restrictions highly disruptive at the early stage of the semiconductor value and manufacturing chain.

In early February, China restricted exports of tungsten, along with four other critical minerals (tellurium, bismuth, indium, and molybdenum), in response to US tariffs on Chinese goods.

Tungsten is renowned for its exceptional tensile strength, meaning it can withstand significant pulling forces without breaking. For example it is used to make bullets. Tungsten is also in the tiny vertical connections between layers of circuitry in semiconductor chip, CNC machine tools, and high-performance alloys that go into everything from jet engines to deep-drilling rigs.

According to Clean Technica, When China put tungsten behind a licensing wall, it wasn’t targeting one sector—it was targeting the industrial base of a specific big country that’s trying to re-grow precision manufacturing at scale.

Tom’s Hardware says tungsten and molybdenum are used in transistor contacts, gates, and interconnects in advanced nodes where extreme thermal and electrical reliability are necessary. Indium is crucial for 5G mmWave front-end modules, satellite communications and photonic chips.

Indium, says Clean Technica, is the transparent conductor that makes your screens light up, your fiber optics communicate, and your laser diodes actually lase. Without indium, touchscreens become paperweights, and 5G base stations start to look like 3G nostalgia boxes. The U.S. has zero domestic production, and while Canada, South Korea, and Japan produce some, the global market still revolves around Chinese supply. Try ramping up your semiconductor fab or solar plant when your indium source just dried up.

What the export controls mean

Effective immediately, exporters of products containing the seven rare earth elements outlined above must apply for an export license from China’s Ministry of Economy. The application requires customers to detail the final use of the material (Tom’s Hardware)

The new rules cover various products containing these materials, including raw ore, metal, compounds and finished goods.

According to Clean Technica, These licenses give Beijing control over not just where these materials go, but how fast they go, in what quantity, and to which politically convenient customers.

The U.S.? Let’s just say Washington should get comfortable waiting behind the rope line. The licenses have to be applied for and the end use including country of final destination must be clearly spelled out. Licenses for end uses in the U.S. are unlikely to be approved.

According to Bloomberg, Other metals have seen export volumes crash to zero after controls were rolled out, with exporters needing time to get certified.

“The new controls may further tighten global supply,” analysts from Citic Securities Ltd. said in a note.

Mining Technology notes that China added 16 US entities to its export control list, including 15 companies from the defense and aerospace sectors. Another 11 US companies were placed on China’s “unreliable entity” list giving Beijing the right to impose penalties such as bans and fines. The targeted companies include Skydio and BRINC Drones for supplying arms to Taiwan.

Rare earths 101

The rare earths are a group of 17 elements comprising scandium, yttrium, and the lanthanides. The lanthanides are a group of 15 (cerium, dysprosium, erbium, europium, gadolinium, holmium, lanthanum, lutetium, neodymium, praseodymium, samarium, terbium, thorium, thulium, ytterbium) chemically similar elements with atomic numbers 57 through 71, inclusive.

Yttrium isn’t a lanthanide but is included in the rare earths because it often occurs with them in nature — it has similar chemical properties. Scandium is also included in the group although it usually occurs only in minor amounts.

The most abundant rare earth elements are found in the Earth’s crust in amounts equal to nickel, copper, zinc, molybdenum or lead. Cerium is the 25th most abundant element of the 78 common elements in the crust. Even the two least abundant REEs (thulium, lutetium) are nearly 200 times more common than gold. Overall REEs have an abundance greater than silver and similar amounts to copper and lead.

The “rare” in rare earth elements came from frustrated 19th century chemists who decided they were uncommon after trying to isolate these chemically related elements. REES are also very hard to find in economic concentrations.

The lanthanides are divided into light rare elements, LREE, and heavy rare earth elements, HREE. Light REEs are made up of the first seven elements of the lanthanide series: lanthanum (La, atomic number 57), cerium (Ce, atomic number 58), praseodymium (Pr, atomic number 59), neodymium (Nd, atomic number 60) promethium (Pm, atomic number 61) and samarium (Sm, atomic number 62).

HREEs are made up of the higher atomic numbered elements — europium (EU, atomic number 63), gadolinium (Gd, atomic number 64), terbium (TB, atomic number 65), dysprosium (Dy, atomic number 66), holmium (Ho, atomic number 67), ebium (Er, atomic number 68), thulium (Tm, atomic number 69), ytterbium (Yb, atomic number 70) and lutetium (Lu, atomic number 71).

The principal economic sources of LREE are the minerals bastnasite and monazite. In most rare earth deposits the first four REEs — La, Ce, Pr, and Nd — constitute 80 to 99% of the total.

Deposits of bastnasite in China and the United States represent the largest percentage of the world’s rare earth economic resources.

The second largest percentage of the world’s LREE rare earth economic resources is monazite. Monazite contains less La, more Nd and some HREE, usually with elevated levels of thorium compared to bastnasite.

Ion-adsorbed REEs in clays from South China provide the bulk of HREE to the market.

Practically all light REEs are extracted from bastnasite and monazite, while the heavy REE comes from xenotime and ionic clays. The process of extracting REEs from these four minerals has not changed in over two decades. When you review their minerals chemical compositions you will see they are not complex. The more complex, the harder it is to extract what you want and get the ultra-high-purity oxides, metals, alloys and powders required.

Mineralogy is mineral composition, metallurgy the process of extraction. Complicated mineralogy can mean complex, expensive, power-intensive, time-consuming metallurgy.

Mining REEs is fairly straightforward but separating and extracting a single REE takes a great deal of time, effort and expertise.

- Rare earth ore: the ore is ground up using crushers and rotating grinding mills, magnetic separation (bastnasite and monazite are highly magnetic, they can be separated from non-magnetic impurities in the ore through repeated electromagnetic separation) and flotation gives you the lowest-value sellable product in the rare earth supply chain: the concentrated ore. The milling equipment – crushers, grinding mills, flotation devices, and electrostatic separators — all have to be configured in a way that suits the type of ore being mined. No two ores respond the same way.

- Concentrated ore: chemically extract the mixed rare earths from the concentrated ore (cons) by chemical processing. The cons have to undergo chemical treatment to allow further separation and upgrading of the REEs. This process, called cracking, includes techniques like roasting, salt or caustic fusion, high-temperature sulfidation, and acid leaching which allow the REEs within a concentrate to be dissolved. This separates the mixed rare earths from any other metals that may be present in the ore. The result will be still-mixed-together rare earths.

- Rare earth oxide (REO): the major value in REE processing lies in the production of high-purity REOs and metals — but it isn’t easy. A REE refinery uses ion exchange and/or multi-stage solvent extraction technology to separate and purify the REEs. Solvent-extraction processes involve re-immersing processed ore into different chemical solutions in order to separate individual elements. The elements are so close to each other in terms of atomic weight that each of these processes involve multiple stages to complete the separation process. In some cases it requires several hundred tanks of different solutions to separate one rare earth element. HREEs are the hardest, most time consuming to separate.

- The composition of REOs can also vary greatly. They can and often are designed to meet the specifications laid out by the end product users — a REO that suits one manufacturer’s needs may not suit another’s.

Military & civilian applications

Investing News Network quotes Mark Smith, CEO of Niocorp Developments, who emphasized the far-reaching impact of rare earths export curbs on US defense technologies.

“This is a precision strike by China against Pentagon supply chains that enable our most powerful weapons and defense systems,” Smith said in a press release. “These aren’t just metals — they’re bottleneck elements, and without them, much of the Pentagon’s advanced hardware risks slipping from superiority to obsolescence.”

Take dysprosium as an example. For an electric motor to function at a high temperature, it typically uses neodymium magnets doped with dysprosium. As noted by Clean Technica,

No dysprosium, no thermal stability. No thermal stability, no functioning motor in your F-35 or your Mustang Mach-E. China controls essentially the entire supply of dysprosium, and no, there is no magical mine in Wyoming or Quebec waiting in the wings. If dysprosium doesn’t come out of China, it doesn’t come out at all. It’s the spinal cord of electrification, and right now China’s holding the vertebrae.

Terbium is another rare-earth element vital to high-efficiency motors like those used in electric vehicles and wind turbines. Its military applications include night-vision goggles and sonar. Like dysprosium, terbium comes almost exclusively from China. There is no viable substitute.

Without dysprosium and terbium, says Clean Technica, “your EV motor gets downgraded to a clunky, less efficient design that eats more power and delivers less range.”

“Without tellurium, First Solar’s cadmium-telluride panels — the pride of U.S. solar manufacturing — become unbuildable. Without yttrium, the turbine blades in offshore wind projects suffer from higher fatigue and shorter life spans.”

Gadolinium is used in solid-state lasers, computer memory chips, high-temperature refractories and cryogenic refrigerants used in improving high-temperature characteristics of iron, chromium, and related alloys.

Samarium is used in missile guidance systems, stealth technology and F-35 fighter jets.

The biggest uses of scandium are in aluminum-scandium alloys used in the aerospace industry and solid-oxide fuel cells used for powering satellites and space capsules. Currently, Japan, China and the Philippines are the chief suppliers of scandium to the US. (The Globe and Mail)

According to Tom’s Hardware,scandium is widely used for RF front-end modules found in smartphones, Wi-Fi modules, and base stations, whereas dysprosium is used for HDD heads and electric vehicles.

Yttrium is used in high-temperature jet engine coatings, high-frequency radar system and precision lasers. Clean Technica provides color commentary on this rare-earth metal, and the implications of doing without it and the other REEs on China’s hit list:

Yttrium is what makes YAG lasers possible, and it’s also what allows thermal barrier coatings on turbine blades to keep your aircraft engines from melting mid-flight. No YAG lasers, no laser target designators, LASIK, engraving, or spectroscopy. If your military likes flying, it likes yttrium. If you like affordable flights, you like yttrium too. And guess who has a near-monopoly on refining it? Hint: it’s not Australia, and it’s not Estonia. It’s China. Again.

The impacts ripple far beyond a few exotic gadgets or weapon systems. The defense sector is first in line, with guided munitions that rely on terbium-enhanced actuators, infrared imaging that needs tellurium, and stealth aircraft that won’t stay in the air without yttria-stabilized turbine blades. It’s not just about whether you can build the next missile. It’s whether your next missile flies straight, hits what it’s supposed to, and doesn’t fall apart from heat stress. Precision without materials is just expensive scrap metal. Those thick U.S. military budgets for the technology it depends on for overwhelming offensive superiority are going to be sitting around unspent.

Rare earths as multipliers

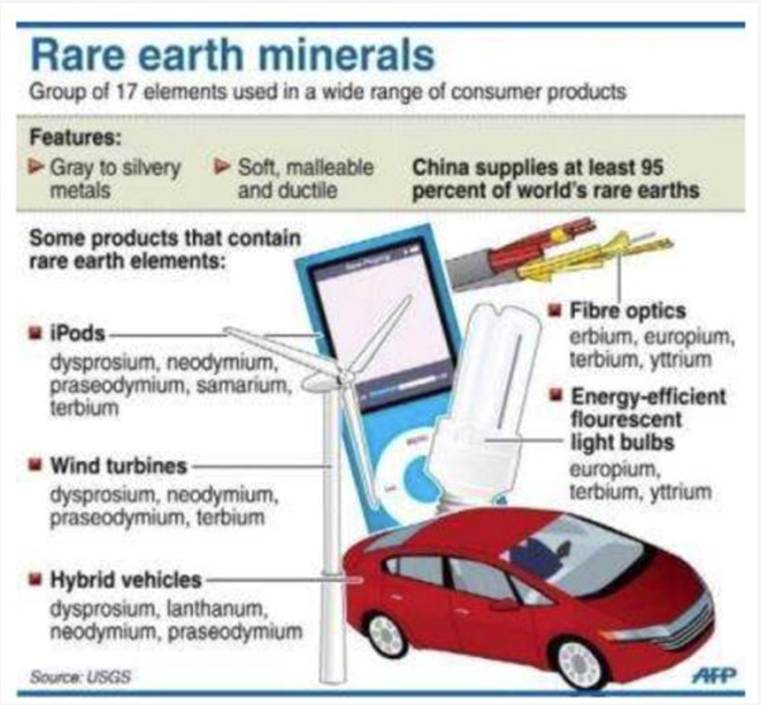

Rare earths are great multipliers; they are used in making everything from computer monitors and permanent magnets to lasers, guidance control systems and jet engines.

The “multiplier effect” on rare earth elements refers to the significant impact their use has across various industries, particularly in clean energy technologies, electronics and defense, leading to a ripple effect of economic activity. (Google AI Overview)

Three examples.

The global dysprosium market was valued at $5.59 billion in 2023 and is projected to reach $8.82 billion by 2032, driven by increasing demand in sectors like electric vehicles and wind turbines.

The global wind turbine market was roughly USD$98.6 billion in 2020, and is forecast to reach $144B by 2027. At a CAGR of 5.6%, this would put the value at $116.1B in 2023. Dysprosium has a multiplier effect of 20.7 for wind turbines.

In 2023 the global electric vehicle market was valued at USD$500 billion. Dysprosium’s multiplier for EVs is 89.5.

Remember, dysprosium is required for electric motors to operate at high temperatures.

The global scandium market was estimated at $591.5 million in 2024. One of the biggest uses of scandium is in aluminum-scandium alloys used is in the aerospace industry. The global aerospace market was valued at around $346 billion, giving scandium a multiplier of 584.

The tungsten market was valued at USD$4.75 billion in 2023. Tungsten is used to make ammunition. The global ammunition market, which includes bullets and other types of ammunition, was valued at around USD$28.10 billion in 2023, giving tungsten a multiplier of 5.9.

Need for diversification of supplies

Without rare earths mined and processed in China, America would be unable to manufacture military hardware. Civilian uses of rare earths would also be put in jeopardy. This includes rare earth elements incorporated into electric vehicle motors, computer chips, fiber-optic cables, flat-screen televisions, wind power turbines and nuclear power, just to name a few uses.

Often there is no substitute and no other supply source is available other than China.

When Biden was president, he invoked the Defense Production Act to encourage domestic production of critical minerals. Battery materials such as lithium, nickel, graphite, cobalt and manganese were added to the list of items covered under the act — a 1950s law that former President Harry Truman enlisted to ramp up steel production for the Korean War — to help companies access $750 million in funds.

Trump used the law in his first term to spur mask production during the coronavirus pandemic.

Now, Trump is again tapping the Defense Production Act, this time as part of an effort to provide financing, loans and other investment support to domestically process critical minerals and rare earth elements, according to a White House official, via Bloomberg.

Funding will be provided through the US International Development Finance Corporation, working with the Department of Defense.

An executive order signed on Thursday, March 20th by the president invokes emergency powers to boost the ability of the US to produce critical minerals. The idea is to facilitate domestic natural resource extraction to make the country less reliant on foreign imports.

The Globe and Mail notes that for some of the rare earths targeted by the new Chinese restrictions, Canada could become a key supplier. Rio Tinto produces some scandium at its titanium plant in Quebec, for example.

Torngat Metals is developing the Strange Lake deposit in northern Quebec which contains dysprosium and terbium.

While the US used to rely on China for about 23% of its germanium needs, Canada now supplies roughly the same amount. Canadian miner Teck Resources produces germanium as a by-product from the zinc it mines at its Red Dog mine in Alaska. The germanium is then refined into germanium dioxide at Teck’s Trail, BC smelter. Germanium, while not a rare earth, is a critical metal used in fibre optics, infrared night vision systems and solar panels.

How the tariffs are harming US critical mineral supply chains

The charts below shows the breakdown of critical minerals production by country. Note that the United States is not a leading miner of any of the metals.

The Trump administration is using the Defense Production Act to provide financing, loans and other investment support to domestically process critical minerals and rare earth elements. This is all well and good, but the United States has also slapped tariffs on the nations that provide it with critical minerals. As noted by Techpolicy.press,

Recent actions taken by the Trump administration to strengthen critical mineral supply chains include substantial tariffs and tariff threats on goods from traditionally allied countries such as Australia, Canada, and Mexico, as well as a new executive order on strengthening domestic mineral production. The tariffs introduced on April 2, 2025, include, but are not limited to, a 104% tariff rate on China, 10% on Brazil, 10% on Argentina, 10% on Peru, and 10% on Australia — just to highlight a handful of the major importers of critical minerals to the US.

In February Trump imposed 25% tariffs on most goods imported from Canada into the US and placed a 10 per cent tariff on energy and resources, including uranium and certain critical minerals. 25% tariffs were also placed on Canadian steel and aluminum.

Tariffs are meant to protect existing industries. It makes no sense to be tariffing industries that America doesn’t have, i.e., critical minerals.

Moreover, it is unlikely that current tariffs will be successful in shifting critical minerals supply chains to US soil. According to Techpolicy.press, Instead, these policies broadly impose costs on EVs and many other technologies without actually creating market incentives for manufacturers and suppliers to invest in domestic supply chains.

The importance of processing

Domestic exploration is often touted as the solution to breaking China’s hold on rare earths and other critical minerals like tungsten and graphite. But as noted in a recent opinion piece, mining alone won’t lead to critical minerals independence without processing.

The gist of the op-ed by Erik Groves, corporate strategy and In-house counsel at Morgan Companies, is that the primary focus of our public policies should be on building and expanding domestic smelting and processing capability.

This is because constructing smelting and refining facilities involves greater capital investment, more extensive permitting processes, and longer development timelines than constructing a mine. A processing plant can take years—if not a decades—to get up and running. By contrast, there is already a bounty of known domestic deposits of critical minerals waiting to be developed…

What the United States, and many other nations, truly lack is the modern infrastructure to transform these raw materials into finished products.

Without robust domestic processing capacity, the US—even if it discovers the richest orebodies in the world—would still have to rely on its rivals to convert these ores into usable materials. For example, China, while already a world-leading producer of REEs, also controls approximately 85% of the REE processing capacity worldwide. This means that, even if it makes a significant rare earth discovery, America will find it difficult to turn that into the finished products needed to build electric vehicles or wind turbines without outside help.

The Globe and Mail article notes that Canada has made some inroads on the processing side, with the Saskatchewan Research Council operating a plant in Saskatoon that can process neodymium, praseodymium and samarium. The SRC hopes to supply the US military with rare earth end products.

In the US, rare earth processing plants are being built in Fort Worth, Texas (MP Materials) and Stillwater, Oklahoma (USA Rare Earth), with a facility for heavy rare earth processing also planned at the Mountain Pass mine in California.

Conclusion

There are two facts about rare earths that can’t be disputed. First, for many military and civilian applications, manufacturing end uses are not possible without the rare-earth inputs.

Second, despite tiny markets compared to other metals, such as copper, nickel and iron ore, rare earths are huge multipliers. Putting rare earths into the materials required, say to make jet fighters, multiplies their market value from the millions on their own, to the hundreds of billions. The aerospace industry, for example is valued at $346 billion.

China’s export restrictions on rare earths and other critical minerals are creating widespread uncertainty across the US military, the clean-tech sector, and the global semiconductor ecosystem, which now spans from smartphones, to PCs, self-driving vehicles, and sophisticated defense systems.

Clean Technica notes the prices for these materials have already surged, and downstream costs are beginning to appear in everything from automotive supply chains to defense budgets.

Techpolicy.press finds that, with the various tariffs levied on Canadian critical minerals (10%), a proposed copper tariff of 25%, and the tariff on Chinese critical minerals (minerals such as indium, gallium and bismuth are already subject to a 25% duty; certain critical minerals are excluded from reciprocal tariffs), there will be a 27% increase in minerals costs per vehicle, upping the cost of the car by $500.

The final word goes to Clean Technica, which states:

Six months ago staunch allies like Canada and Australia would have loved to help, although they couldn’t replace China overnight. But the same tariffs that led to China’s new licenses for critical minerals are hitting the former allies Trump is treating like enemies.

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

1 Comment

Leave a Reply Cancel reply

You must be logged in to post a comment.

#rareearthsarehugemultipliers