Champion Bear’s summer drill programs

- Home

- Articles

- Uncategorized

- Champion Bear’s summer drill programs

2020.05.29

Gold prices tracked higher Thursday on fresh safe haven demand, and first-quarter GDP data suggesting the American economy last quarter was in worse shape than previously thought.

The Commerce Department reported gross domestic product, the broadest measure of economic health, fell 5% in Q1, an even bigger decline than the 4.8% estimated a month ago.

Gold saw a new round of safe-haven buying as tensions between the United States and China ratcheted up. On Thursday the Chinese government ratified what it calls a “national security law”, that ostensibly quells pro-democracy protests and tightens its grip on Hong Kong. The two biggest economies were already at each other’s throats over their handling of the coronavirus, when the US Secretary of State said Wednesday that Hong Kong was no longer autonomous from China, implying the US may revoke Hong Kong’s favorable trading status. That would have major implications on US companies doing business in the former British colony. Meanwhile the US House of Representatives passed a bill on Wednesday that would sanction minority groups in China, specifically aimed at Chinese government repression of Muslim Uyghurs.

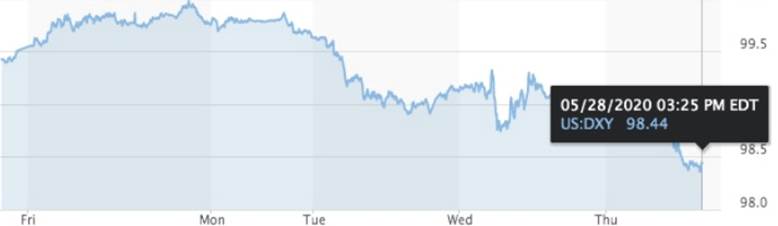

Bullion was also helped by a lower dollar, which has been trading down all week. Despite the US 10-year Treasury yield ticking higher on Thursday to 0.167%, real yields (yield minus inflation) are still negative, which is always positive for gold.

U.S. Dollar Index

At the close of trading in New York, spot gold was up $10 an ounce to $1,719.70, and gold futures for August delivery gained $5 to $1,731.80/oz. Since dipping sharply in mid-March, gold has soared $242, or 16%. April 14th’s $1,756 close was the best performance since September, 2011, when the precious metal blasted past $1,900 for the first time in history.

Gold’s gains show no signs of relenting. Market watchers are expecting a terrible second-quarter to put a double-digit dent in GDP growth, and drag down other key metrics. According to CNBC,

Economists believe the lockdowns that shut wide swaths of the economy and triggered the layoffs of millions of workers will send the GDP sinking at an annual rate of 40% in the current quarter. That would be the biggest quarterly decline on records that go back to 1947. It would be four times the size of the previous decline set back in 1958.

We all know that gold loves a crisis and hates tranquility. Economy re-openings that result in boomerang covid cases, and that fail to inspire business and consumer confidence, will add to gold and silver’s luster.

Although gold is still 10% below all-time highs in US dollars, the World Gold Council expects it will to continue to do well, given the need for extreme monetary easing and the risk of inflation posed by stimulus programs being rolled out worldwide to fight covid-19:

“With the Fed taking interest rates to zero for the foreseeable future, gold could do well as it tends to outperform during easing cycles. Additionally, multi-trillion dollar fiscal stimulus policies to combat the economic impact of covid-19 could prove inflationary – a development that could support gold prices in the long run,” the WGC said.

This view was backed Wednesday by U.S. Bank Asset Management Group, which presented a report saying that prospects for an economic recovery will take awhile and that Federal Reserve officials will remain accommodative.

“The potential for future inflation resulting from central-bank money printing should keep gold prices supported,” they said.

Another important factor assisting gold prices right now is debt.

In an earlier article we showed the close relationship between debt-to-GDP ratios and gold. As the crisis continues to restrict business operations, and people from getting out from their homes and spending money in the economy again, GDP will continue to stagnate.

This week the Atlanta Fed projected economic growth during the second quarter to contract 41.9%.

That’s the first part of a rising debt-to-GDP ratio – a fall in GDP. The second part is an increase in debt.

As of May 20, the Federal Reserve balance sheet hit a record $7.09 trillion.

Seen as a proxy for the amount of debt monetization undertaken by the central bank, the balance sheet from September 2019 to present rose by $3.2 trillion. The fact that it increased this much in only 8 months, compared to the 11 years it took to reach $3.7 trillion following the 2008-09 financial crisis, is truly shocking.

US government stimulus spending is also going through the roof, which adds to the debt pile. The fiscal deficit in April, which is always positive, was minus $738 billion. The Heroes Act, a new economic proposal passed by the Democrat-led House of Representatives and currently before the GOP-controlled Senate, would grant another $1,200 per person along with a raft of other relief measures, totaling $3 trillion. This is on top of the $2 trillion stimulus package passed in March.

The Committee for a Responsible Federal Budget projects current debt to exceed 106% of GDP by 2023 – the highest since World War II.

The longer stimulus measures continue, along with a creeping expansion of the Fed’s balance sheet and negative real interest rates (interest rates minus inflation) which are always bullish for gold, we see no reason to doubt that gold will keep climbing, possibly even testing the $1,900 highs reached in September 2011.

A perfect storm for gold would be if plans by US states to open their economies fail. In this scenario all the bullish factors for gold are in play, including low interest rates, quantitative easing, debt, slowing GDP, declines in manufacturing and retail spending. Peak gold also plays into this picture. With gold mining already on the decline due to a lack of new discoveries and depleted reserves, we have output reductions happening from coronavirus restrictions and in some cases indefinite closures.

On the other hand, if re-openings succeed, gold would suffer but the welcome turnaround would be great for base metals, platinum group elements, and silver for all its uses as an industrial metal.

An extremely large infrastructure program by leading industrial nations such as the United States, which needs to spend around $2 trillion to close its “infrastructure gap”, could help to reverse negative global economic growth.

President Trump has talked about reviving a $2 trillion plan for improving the country’s roads, bridges, water systems and broadband Internet.

The Chinese have been touting their own form of blacktop politics as a way of restoring the economy, particularly manufacturing which has been crushed by coronavirus.

Beijing is eyeing a $570 billion infrastructure build-out, not unlike its stimulus package of 2008, to get the economy back on track. Thirteen major cities including Beijing, Shanghai and Fujian province have released major infrastructure projects for 2020.

This week the European Commission released a €1.85 trillion recovery plan focusing on “EU Green Deal” initiatives aimed at reaching the eurozone’s net emissions by 2050 target.

Between 60 and 80 billion euros is directed at boosting EV sales and building out charging networks. €10 billion is earmarked for renewable energy projects, and €30 billion will go towards technologies to cut emissions in hard-to-decarbonize sectors such as steel and cement.

The IMF and the International Energy Agency (IEA) have both said that macroeconomic economic recovery should be done with climate change in mind.

At AOTH, we agree a significant part of a global infrastructure build-out should be “green”. This means a lot more energy metals will need to be mined, including lithium, nickel, cobalt and manganese for EV batteries; copper for electric vehicle wiring and renewable energy projects; and rare earths for permanent magnets that go into EV motors and wind turbines.

Electric vehicles contain about four times as much copper as regular vehicles.

A report by Roskill forecasts total copper consumption will exceed 43 million tonnes by 2035, driven by population and GDP growth, urbanization and electricity demand. Electric vehicles and associated charging infrastructure may contribute between 3.1 and 4 million tonnes of net growth by 2035, according to Roskill.

With each residential charger using about 2 kg of copper, that’s 42 million tonnes, or double the current amount of copper mined in one year.

Over the next few years copper supply is expected to be weak in relation to strong demand, with few new copper projects in the pipeline.

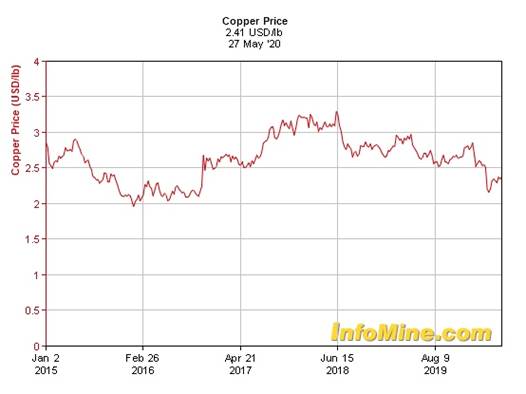

Although the copper price has slumped recently, hit by demand destruction owning to coronavirus lockdowns, spot copper is still comfortably above $2.00/lb, and nowhere near the 5-year low of $1.97 reached in early 2016.

Ideally, we could move right away to electric cars, buses and trains, but that is neither practical nor realistic. At a conservative 40% market penetration of EVs to total vehicles by 2050, we found @ 83 kg of copper per EV, the electric vehicle market would need 39,654,080 tonnes of copper, or 2.2X 2018 global production.

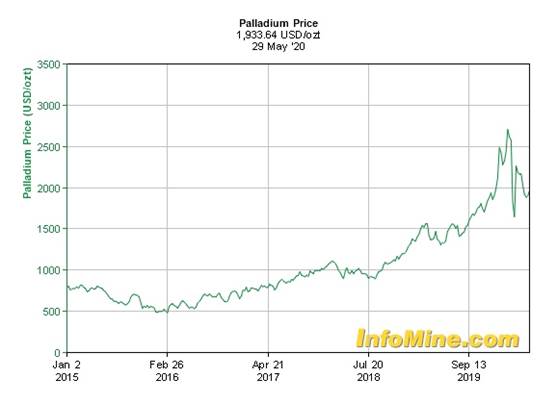

Clearly, we need something to serve as a bridge to widespread electrification, and the answer is, hybrids and palladium.

We are talking here about hybrid electric vehicles (HEVs) and plug-in hybrid vehicles (PHEVs). Because a hybrid is a mix between a gas vehicle and a battery electric vehicle, it requires a catalytic converter to reduce its air emissions. Autocatalysts are a combination of platinum group element (PGE) metals but for gas-powered vehicles the dominant PGE is palladium.

While palladium prices have suffered lately due to a global slump in car sales because of covid-19, they are beginning to test $1,900 an ounce levels, and are still more than twice sister PGE platinum, which currently trades at $832/oz.

Platinum group elements are included among a list of mineral commodities the United States considers critical to its economic and national security.

This means the PGE sector will likely be the recipient of research and development, information-sharing and government funding to ensure that North American PGE production does not fall behind its competitors.

Exploration companies are realizing that this is a good place to be.

Champion Bear Resources (TSX-V:CBA)

Champion Bear Resources (TSX-V:CBA) has the metals to benefit from either an economic recovery from the covid crisis (copper, PGEs) or a continued slump (precious metals – gold, silver).

At Eagle Rock in Ontario, Champion Bear has the good fortune to have held onto this very rare, very prospective Cu-PGE-PM reef-like deposit that contains not only palladium, the darling metal in terms of price gains in each of the past two years, but platinum and copper – both of which are recognized as “green” metals.

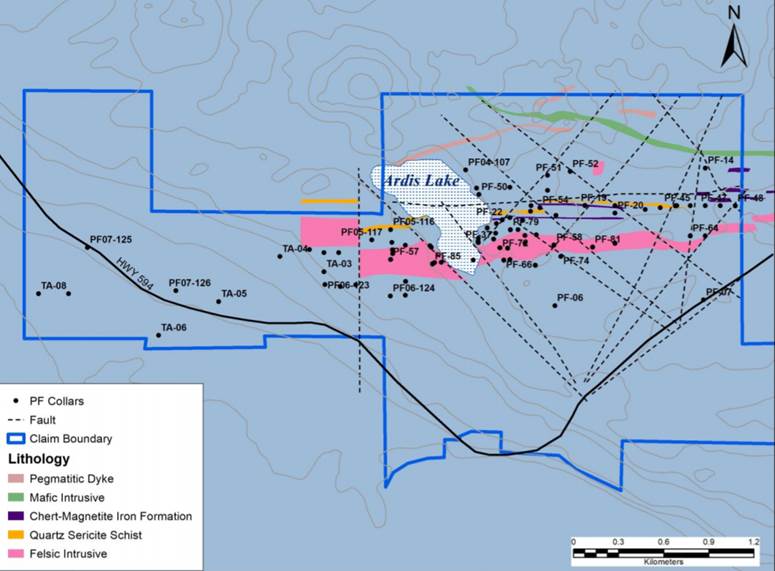

Plomp Farm, located 20 kilometers west of Dryden, ON, is a shear-hosted gold system occurring in two main blocks – Plomp Farm East and Plomp Farm West. The West block hosts the Plomp Farm Main Zone where mineralization occurs within a broad corridor of gold enrichment associated with pyrite and elevated silver and base metals (copper, zinc, molybdenum and barium) concentrations. Previous diamond drilling intersected a 36-meter-wide zone containing 1 to 3% pyrite, chalcopyrite, sphalerite, and gold mineralization.

The company is gearing up for a small but important drill program at Plomp Farm, scheduled to begin mid-July. The 9-hole program is essentially an information-gathering exercise that will add to an already extensive database of drill core at the property, which Champion Bear acquired back in the mid-1990s after discovering a second gold occurrence (the first discovery was made by Fred Plomp, now a CBA director and large shareholder).

A 250m-long strike is thought to run underneath a shallow pond. However, no drilling has been done yet to confirm that theory. CBA plans to drill 6 holes underneath the pond as part of the upcoming summer work program.

The Phase 1 exploration budget is $1.24 million. Nine holes totaling 3,115 meters is estimated to take just over a month.

Drilling under the pond should be relatively quick and easy. The holes are already collared and it’s just a matter of orienting the drills in a different direction and angle to reach the untested ground. A series of “off azimuth” holes can be completed from the shoreline to drill under the lake at a depth of approximately 150m.

If all goes well, assays results should be available by September, allowing the company to compile a maiden resource estimate by October. The geological modeling for a pit-constrained resource has already been done; plugging in the results of the new holes should be relatively straightforward.

Interestingly old occurs in two styles of mineralization on the Plomb Farm Project; Vein type mineralization and the Quartz Sericite Schist zone (varying thickness of a few metres to 10s of metres). Champion Bear has accumulated a large bank of historical drilling data from which to compile a resource estimate. But the data was never properly analyzed and needs to be catalogued and updated to current gold market conditions. This is a great opportunity to assay, and re-assay, thousands of meters of drill core that was originally assayed only for high-grade material – high grade quartz veins. There is a very good possibility that resampling this core, with the idea of a lower-grade open pit in mind, could significantly build ounces.

The idea is to delineate a pit-constrained resource and to build a mine that can be put into production relatively quickly, then access the deeper material later. There are indications of better grades at depth.

CBA is in an enviable position as far as the property’s mining infrastructure. A provincial highway provides direct access and there is major power to the property and a water well. A modern steel, insulated and heated, building has room separations to prevent sample contamination, and a $100,000 computerized diamond core saw. A long history of mineral exploration in the region contributes to a well-skilled workforce. Labor can be drawn from nearby Dryden – which also has an airport with daily connections to Thunder Bay and Winnipeg.

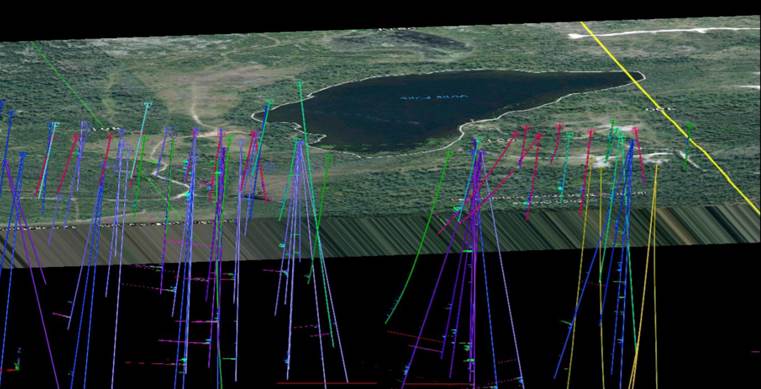

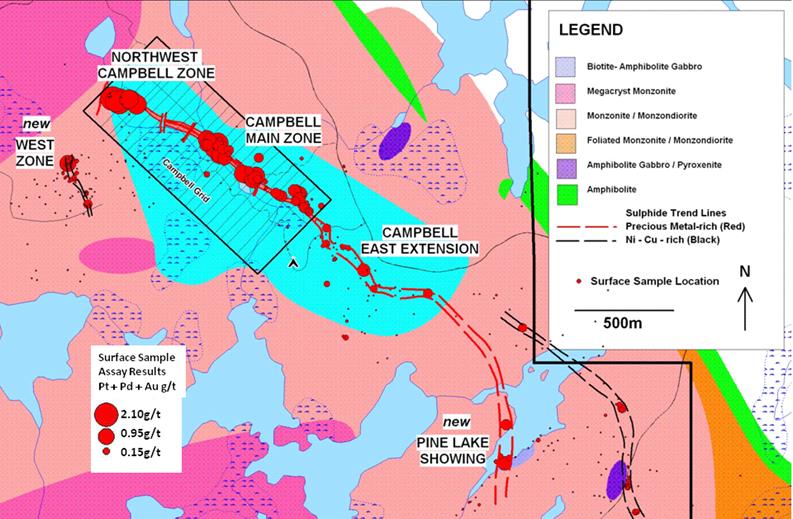

After Champion Bear drills Plomp Farm the plan is to drill Eagle Rock. The reef type Cu-Pt-Pd-Au project hosts a number of sulfide showings including the Campbell Zone, which Champion Bear describes as “a continuous, predictable, PGE reef-type horizon exposed at surface over more than one kilometer.”

The 60 x 20 km property sits on top of a large intrusion called Entwine Lake, host to several sulfide showings including the Campbell Cu-PGE-PM Zone, first explored by now-defunct Noranda in 1969.

Recently Champion Bear acquired an option on mining claims located on the south side of the intrusion, near Kenora, ON. The new exploration area contains a number of historic mine pits and channel sampling digs that have never been drilled off. The presence of surface mineralization and a significant geophysical signature indicates this southern portion of the project bears a strong resemblance to the Campbell Zone.

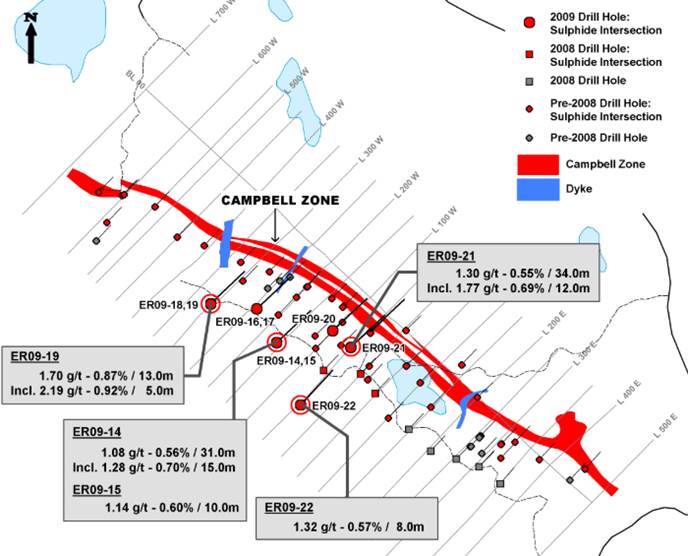

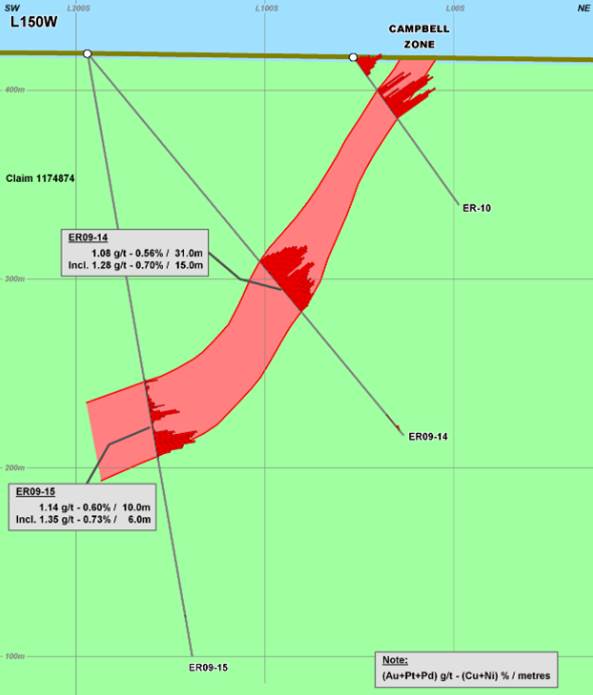

Seventy holes punched into Campbell defined the zone up to a depth of 200 meters, at an average width of 8m. Drilling expanded the sulfide mineralization along strike to the northwest and down-dip. The zone is open in all directions.

With mineralization starting at surface, the company considers Campbell open-pittable, and will continue drilling it to define the nature and extent of the zone.

A 1,600m drill program, completed in early 2019, encountered platinum group elements in every one of the nine holes.

Champion Bear has been compiling geophysical survey data, historical drill logs and other geological information, as it moves towards a maiden resource estimate at Eagle Rock.

The upcoming drill program is expected to include new targets identified by the recent data compilation.

All in all it should be an exciting year for Champion Bear and I’m looking forward to a strong summer news flow from two very interesting properties with loads of upside.

Champion Bear

TSX.V:CBA

Cdn$0.27, 2020.05.29

Shares Outstanding 56,319,996m

Market cap Cdn$15.2m

CBA website

Richard (Rick) Mills

subscribe to my free newsletter

aheadoftheherd.com

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Champion Bear (TSX.V:CBA), CBA is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.